LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

The Untold Trade-Offs in Intent-Based Bridges

Intent-based bridges are cheap and fast, but what are the trade-offs?

Prelude

Bridges are the money Legos making up the multi-chain ecosystem, providing the infrastructure for value to move across chains. Through some combination of airdrop mania, user demand for low fees, and developer demand for blockspace, bridges have become an indispensable part of the DeFi experience. It is imperative for these bridges to build robust protocols that can stand the test of time by striking a balance between decreasing cost/speed while staying true to the attributes that matter in crypto: decentralization, permissionless-ness, and censorship resistance.

Until now, discussions around the security of bridges have predominantly centered on the validator sets of messaging bridges. However, with the increasing popularity of intent-based bridges, it’s important to broaden the scope of these security conversations to intent-based systems.

Connext, Across, and DLN were early adopters of what's now known as intent-based design. The term "intents" wasn't widely used until UniswapX entered the scene and popularized it.

UniswapX's whitepaper explained their method for cross-chain transfers, which was similar to the earlier bridges but with a new twist: they called the user's signed orders “intents”, and it stuck. Soon enough, the intents terminology was picked up by bridges. This led to the coining of a new term in the industry: "intent-based bridges”.

Following this trend, bridges such as SynapseRFQ and Squid (for their Boost feature) have embraced this design. Users are increasingly recognizing the benefits of fast execution speeds and quick UX such bridges offer. Consequently, there's a lot of talk about intent-based bridges, with many seeing them as the future of bridging.

This article provides a data-driven examination of order flow fulfilment in two popular intent-based bridges: Across (V2) and DLN, and some of the trade-offs and potential bottlenecks in their current implementations.

For uniformity (and sanity), we will use the term 'agents' to describe third-party entities that satisfy intents. In different intent protocols, these agents are known as solvers, resolvers, searchers, fillers, takers, relayers, etc.

Let’s dive in!

Understanding Intent-Based Bridges

Intent-based bridges are designed for fast and cheap execution of cross-chain orders. To do so, they introduce third-party agents who play a crucial role in the bridge’s operations:

These agents deliver users the desired assets on the destination chain.

Agents front capital from their own pockets (aka inventory) to provide users with the desired assets.

Users receive funds instantly, but agents risk experiencing delays or losses in repayment given the finality risks (also known as reorg risk).

Agents charge a fee for their services and for assuming these risks. One can think about this as a short term loan by the agents, for which users pay a convenience fee as it gives them fast execution.

Depending on the bridge's design, agents may receive repayment in various tokens across different chains.

Due to the design, these agents have to rebalance frequently and maintain liquidity across chains. As the number of supported chains and assets increases, the complexity compounds exponentially for agents, making it difficult for intent-based bridges to scale.

For the purpose of this study, we will focus on order flow fulfilment in Across V2 and DLN. To support our discussion, we will analyze data from Anera Labs' dashboard, “Illuminating the Cross-chain Intents Landscape.” This data was gathered over the week from January 26, 2024, to February 2, 2024.

The key takeaways from our analysis reveal that:

A select few agents win nearly all of the order flow.

The agent that wins the most order flow is often run by the team behind the protocol.

There’s a lack of competition amongst agents for each order. A significant percentage of auctions involve only one bidder, meaning that there’s no bidding contest.

There’s evident centralization risk among intent-based bridges at the agent level, posing risks related to liveness, censorship resistance, and poor execution of order flow.

Let’s take a closer look into specific concerns:

Risk of Agent Centralization

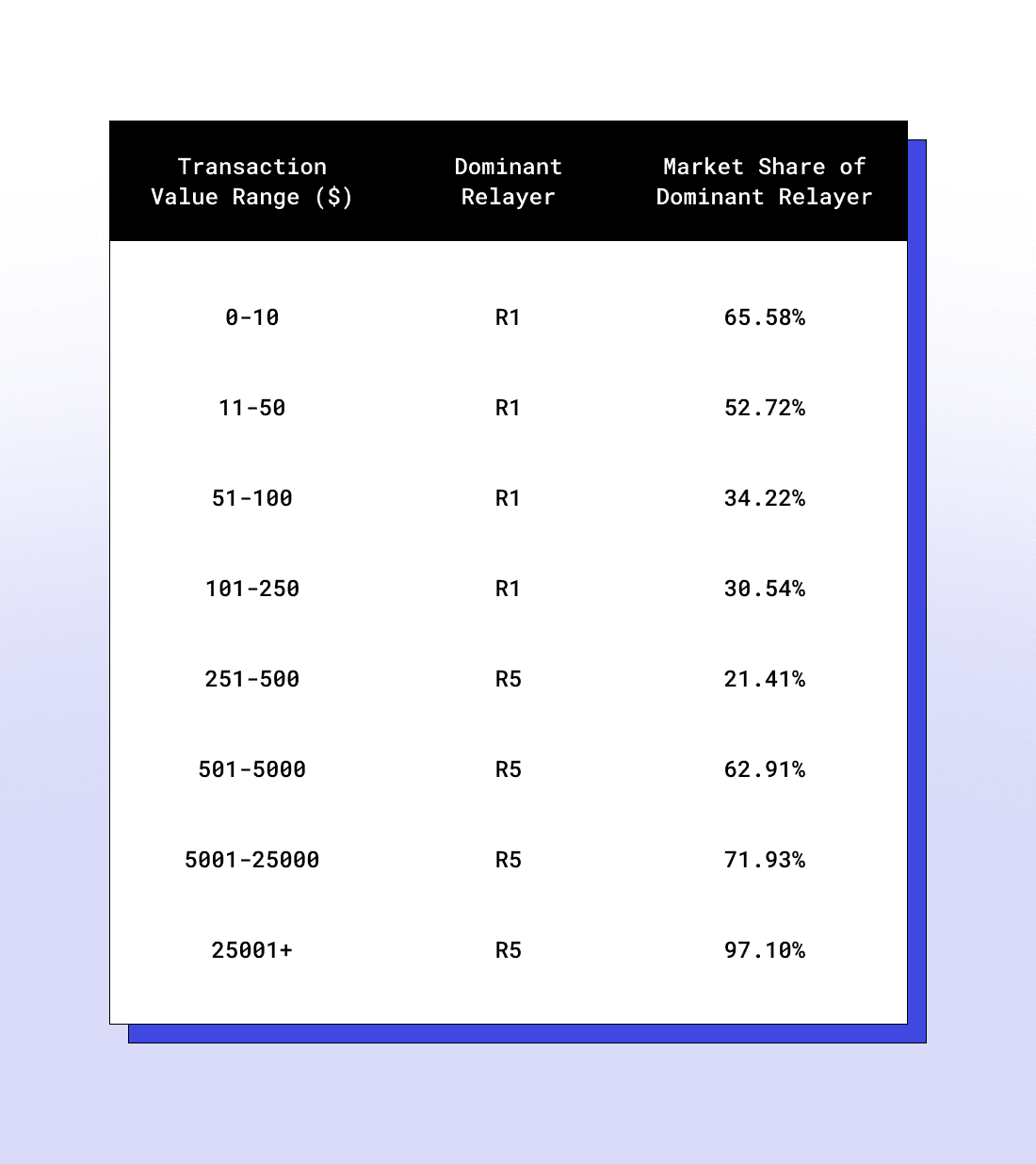

Across has 22 agents and DLN has 26 agents bidding for order flow in their system. A closer look reveals that: only a few of these agents are winning almost all of the order flow.

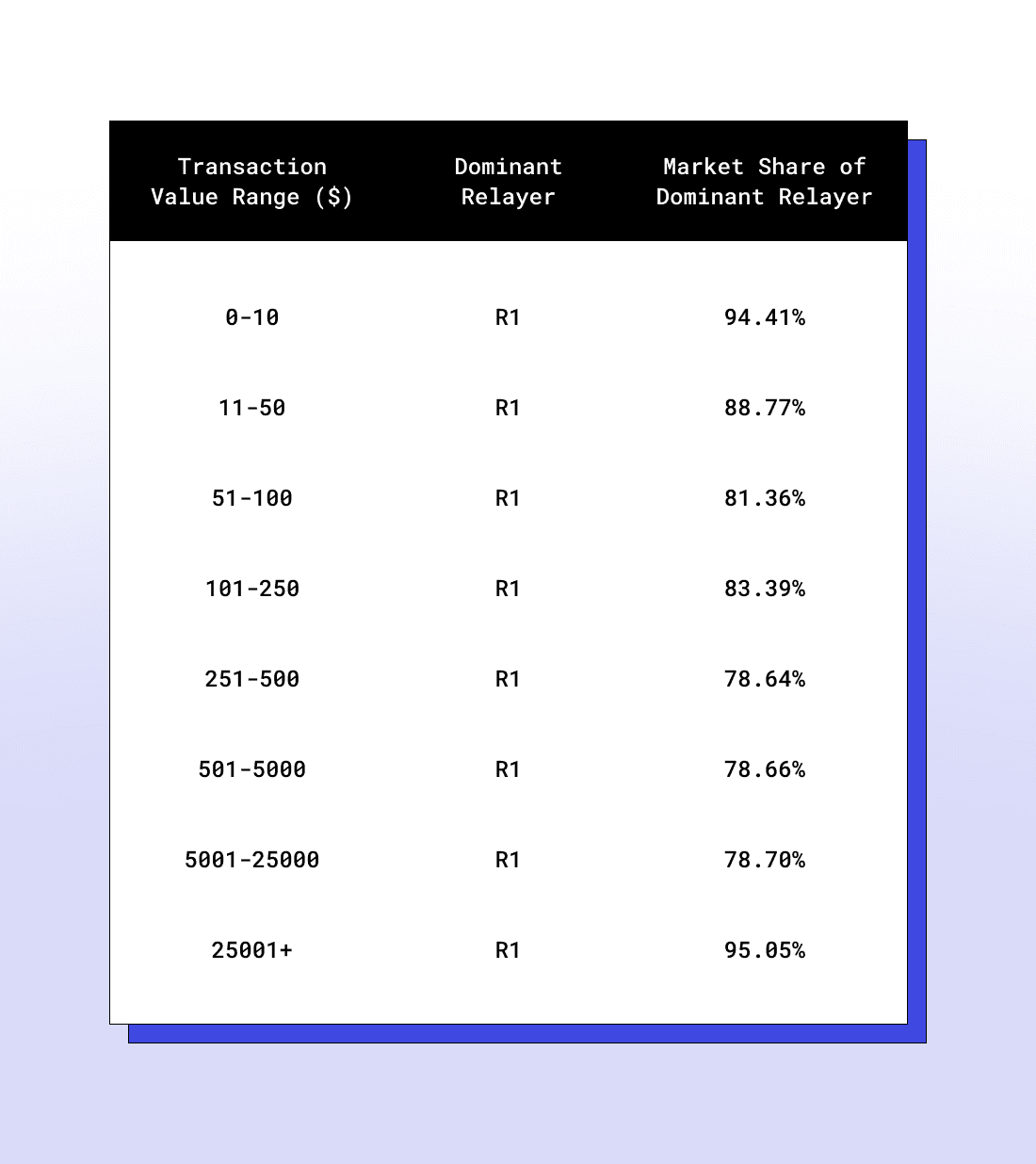

In Across, a single agent often wins the majority of orders over $500. This market share dominance (market share = volume an agent wins in the transaction value range) is even more pronounced for orders exceeding $25,000, where one agent wins over 97% of the volume (more on who this entity is later).

However, it must be noted that for smaller transactions, up to $250, Across maintains a more competitive system, though one agent still dominates broadly in this range as well, but its dominance is limited to a small share of the order flow.

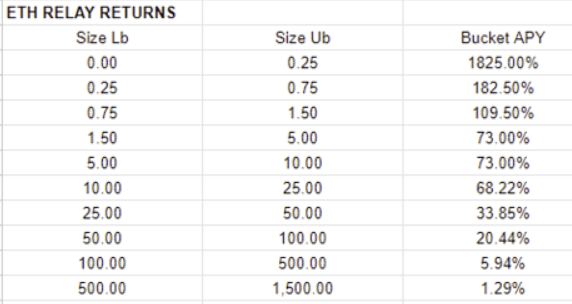

There’s more competition among agents in Across for smaller transfers because they’re highly profitable and there’s more margin for the agents. This is because bids for small transfers are less affected by fluctuations in gas prices. Gas fees constitute a larger proportion of the total cost for small transfers, so when agents accurately account for gas price volatility in their quoted fees, they can ensure consistent profitability.

Consequently, as more agents become aware of the potential gains on offer in Across, they’re incentivized to onboard on the platform and compete for these transactions.

DLN, on the other hand, shows a more extreme case of centralization, with one agent overwhelmingly dominating across all order ranges. The agent wins close to 80% of the order flow in all the ranges. For orders above $25,000, the same agent captures over 95% of the order flow.

Principal — Agent Problem: Risk of Reliance on Protocol-Run Agents

Running an agent is not easy. As discussed in the research paper titled “An Analysis of Intent-Based Markets”, there are several barriers for entities to setup agents and compete in intent-based systems:

It requires substantial capital and sophisticated tools to manage and rebalance inventory across multiple chains. For instance, Synapse Labs has an ongoing proposal to take a $5 million loan from the Syanpse DAO to deploy an agent in SynapseRFQ.

Agents might have to incur congestion costs, if the auctions are highly competitive and require the agents to spend time and resources to find the necessary liquidity to complete transactions (all this even before they know if they will win the chance to fill the order).

Agents have to figure out a labyrinth of legal considerations, ensuring all activities adhere to the regulations. This requires extensive legal work, which can be both costly and time consuming. Some of the most effective agents are run by trading firms (like Wintermute), because they have access to the capital required to run such an operation at scale. However, establishing a trading firm presents significant challenges due to the complex and often unclear legal and compliance landscape that varies by jurisdiction.

These challenges are so daunting that for many, the effort is not justified by the potential profits. Consequently, protocol teams often end up operating the primary agents themselves, as their success is directly tied to the protocol's performance.

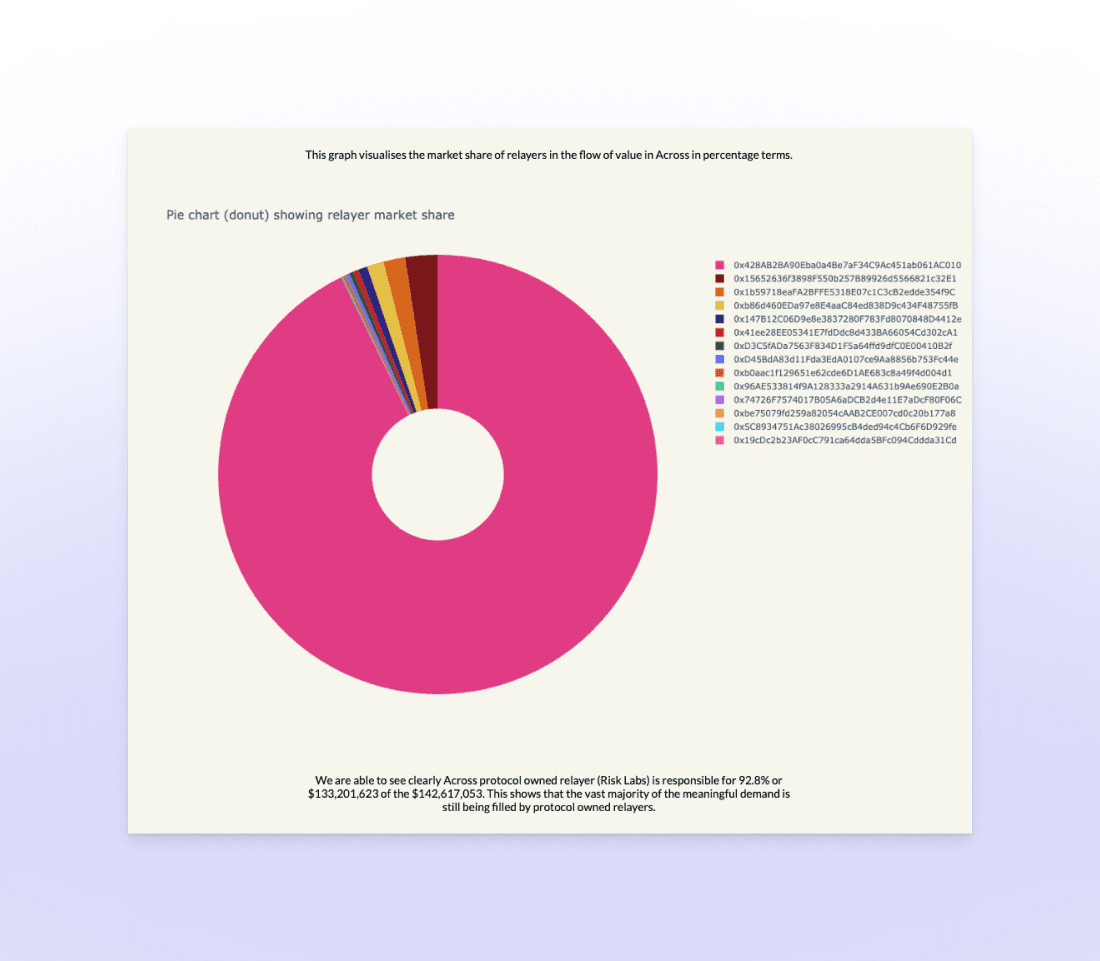

Our research indicates that in Across, an agent run by Risk Labs (the team behind Across and UMA) is responsible for filling a staggering 92.8% of the total order flow on the platform (during this period). This concentration of activity within a single agent underscores the central role Risk Labs plays in the current operational framework of Across V2.

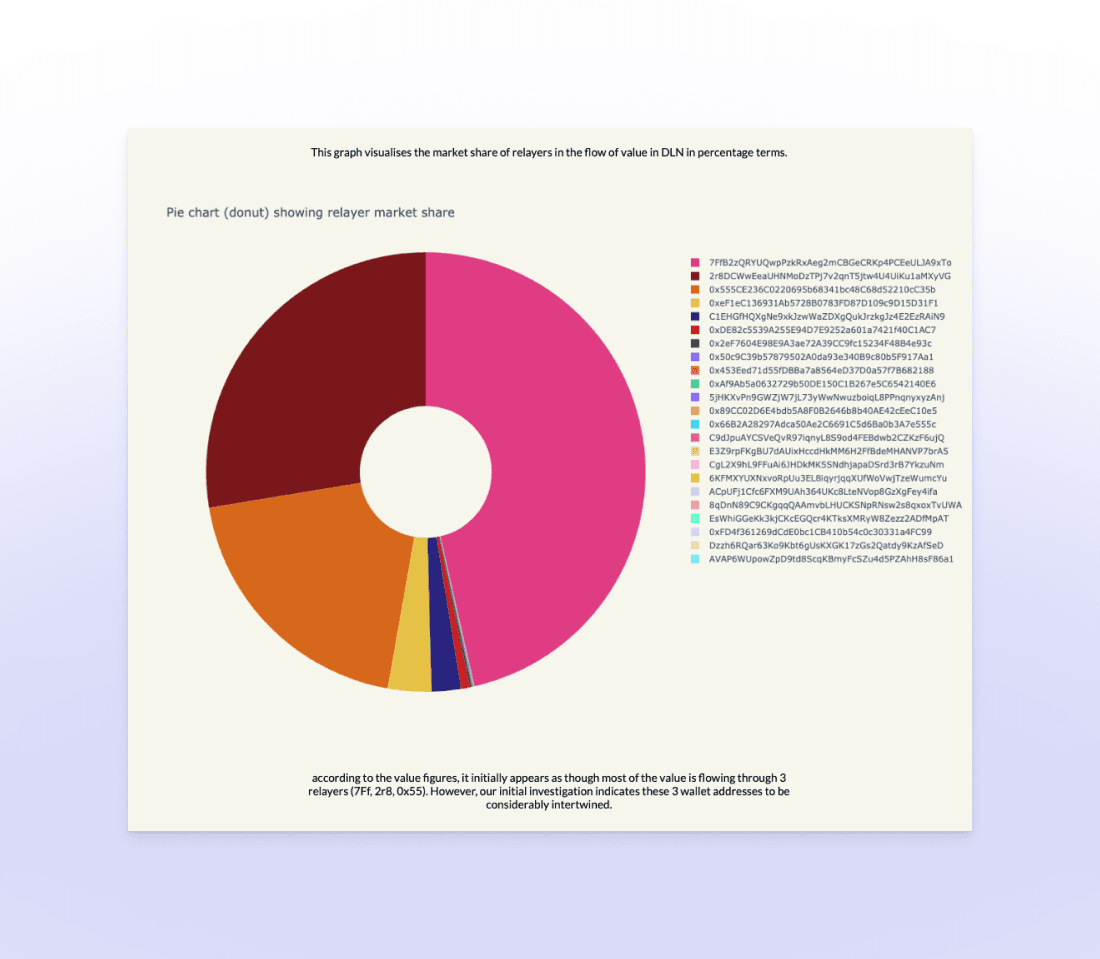

In the case of DLN, three agents handle most of the order flow. Transaction patterns and agent behaviour indicate that these agents are closely connected and are likely operated by the DLN team, which exacerbates the concerns.

This situation, where protocols rely heavily on their own infrastructure, is far from ideal. It introduces centralization risks, including censorship, single points of failure, and the potential for rent extraction, as mentioned above.

It must be noted that this is a common problem across marketplaces of any type; a classic challenge known as the "chicken-and-egg" problem.

Protocol teams are obligated to operate the early agents to ensure there’s a reliable and functioning service from day one. By doing so, they help to establish trust and reliability in the system, which in turn attracts more users and agents (network effects), gradually leading to a self-sustaining marketplace.

It's important to acknowledge that these intent-based bridge systems are still in their early days. We must recognize that this is a normal part of the growth process for any new system and that it takes time for a market to develop organically. But, it’s crucial to acknowledge this issue. Doing so ensures that teams work towards reducing self-reliance and take the necessary steps to onboard more agents.

Importantly, more agents have onboarded to intent-based bridges over the last year and this increase in competition is a positive sign. This has been aided by team’s investing in providing comprehensive instruction guides that make it easy for entities to set up agents. For instance, Across offers a technical guide for running a relayer.

As these bridges attract more order flow, and there are more profit opportunities for agents, we can expect to see a greater number of agents will join the fray. However, more work needs to be done on mechanism designs that incentivizes new agents to join and be competitive.

Risks of Concentrated Control in Intent-Based Bridges

The agent centralization and reliance on protocol-run agents leads to concentration of order flow fulfillment by a handful of agents. This concentration poses the following risks, among others:

Liveness risks – with a single agent or a small group of agents winning most of the order flow, there's no backup in place if they encounter technical issues, leading to potential service disruptions. Operational issues with these agents could lead to poor execution for users, affecting not only the bridges themselves but also dependent apps such as bridge aggregation platforms like Jumper.

Regulatory concerns – a system with a few controlling agents could be more susceptible to regulatory action, which could disrupt operations and affect users.

Censorship concerns – control over order fulfillment could lead to censorship if dominant agents decide to, or are forced to for any reason, block or prioritize transactions based on their own criteria or external pressures.

Market manipulation risks – Dominant agents could potentially manipulate the market by setting unfavourable rates or delaying transactions, exploiting their control over the order flow, or frontrunning users’ orders. However, in the example of Across and DLN, this is unlikely as the dominant agents are run by the protocol teams themselves, and it’s in their interest to give users the best execution possible.

Agent exclusivity risk – In intent-based bridges like Across V3 and UniswapX, agents are granted exclusive rights to fulfill an order after winning an auction. The risk with such systems is that the agent may choose not to execute the order, especially if market conditions change unfavorably (a bigger issue when the markets are across different chains). This can lead to a high rate of unfilled orders, and gives the agent the power to censor or forgeo orders, posing a risk to the reliability and efficiency of the system. This problem is further exacerbated by the lack of competition among agents in intent-based bridges. When there are fewer agents participating in the auction, the winning agent faces less pressure to fulfill orders. With less competition, the winning agent might feel more secure in their dominant position and may therefore be more inclined to forego order fulfillment if it becomes less profitable for them. In a more competitive environment, agents are incentivized to fulfill their commitments to maintain their reputation and to ensure they can continue to win future auctions. If they fail to fulfill orders, they risk losing their competitive edge as users and the platform may prefer more reliable agents.

Addressing these concerns is crucial to ensure the resilience, competitiveness, and trustworthiness of intent-based bridges. Ideally, as these platforms mature and onboard more agents, the distribution of order flow will improve.

Platforms like Cowswap showcase the possibility of a competitive intent-based system, with at least 17 agents contending for orders. Although 17 agents might not sound like a lot, it's the way orders are distributed among them that demonstrates the competitiveness of Cowswap's auction system. This success is attributed to careful mechanism design, which includes well-structured rewards for agents and checks in place to deter actions that affect the execution of user orders, such as imposing penalties on agents who commit to but fail to complete an order.

Simple napkin maths indicates that the leading agent in Cowswap has secured around 30% of the order flow. The race for second place is close, with two agents each handling nearly 16.67%. The fourth agent has an 11% share, while the fifth and sixth agents each have 5%, followed by several others with smaller percentages. Notably, none of the top agents are run by the platform's own team.

This distribution indicates that each agent actively vies for orders, ensuring that the auction environment remains dynamic and competitive. It makes Cowswap a benchmark for any intent-based system.

Concerns over Lack of Competition for Order Flow

The last concern is intrinsically linked to the previous points, underscoring the lack of competitive dynamics among agents on these platforms. A large percentage of the orders on these platforms are fulfilled without competition among the agents.

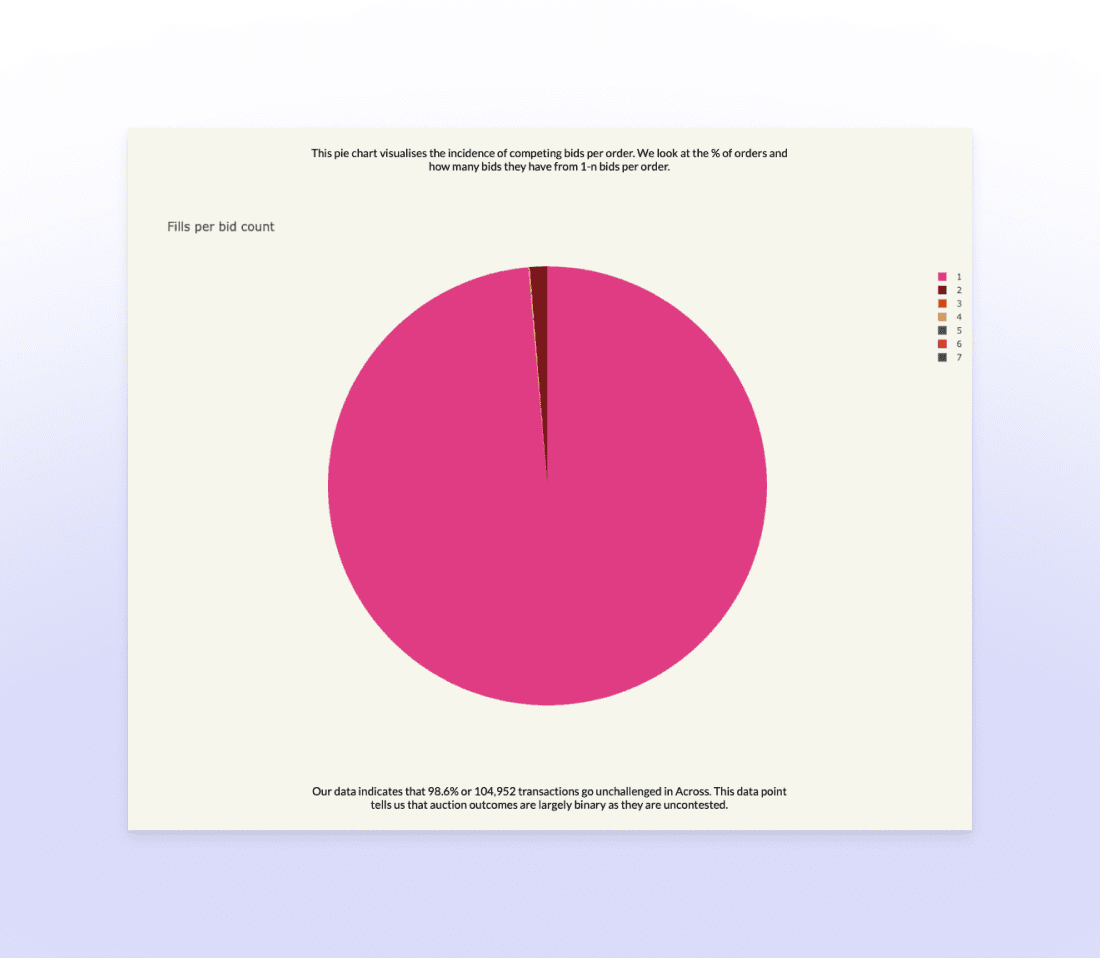

Our analysis shows that 98.6%, or 104,952 transactions, face no competition in Across. This suggests that auction outcomes for who wins the order flow are typically predetermined, as they are not contested.

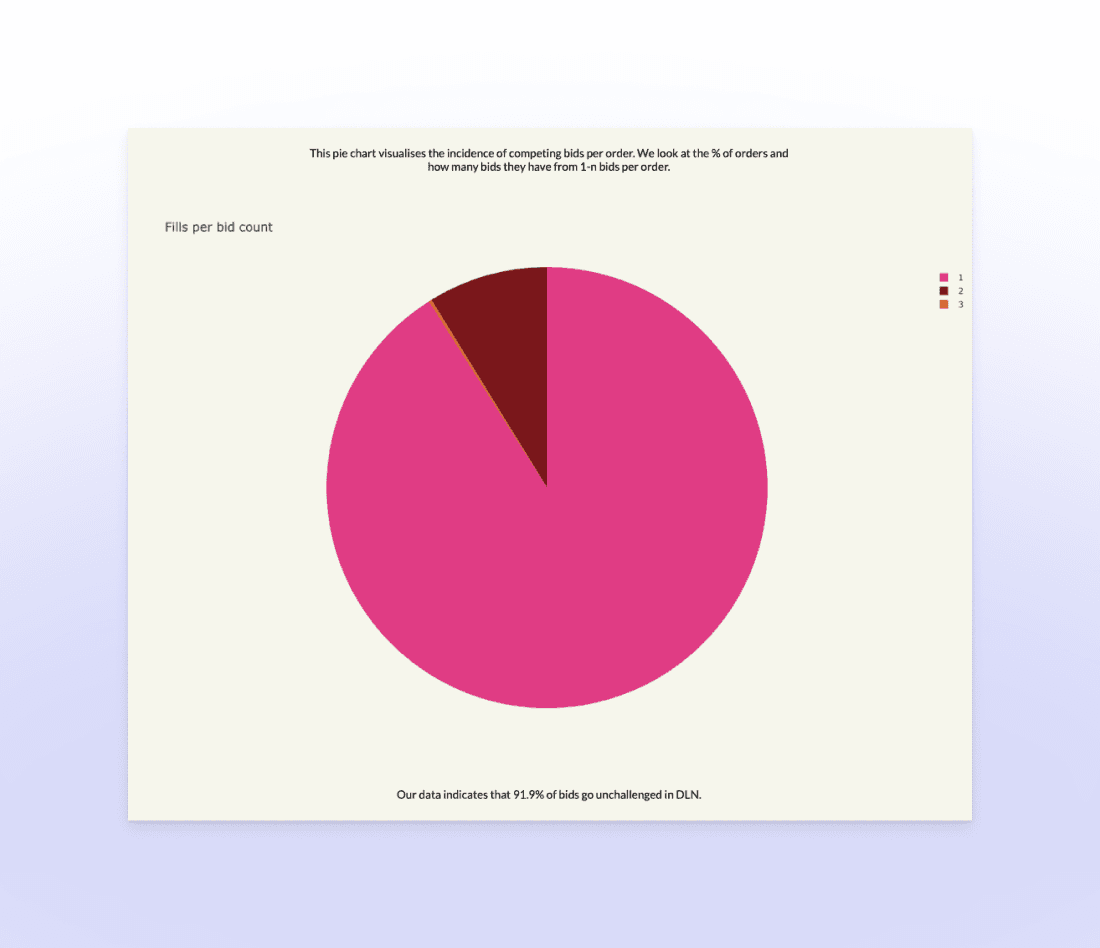

For DLN, the data reveals that 91.9% of bids are unopposed, highlighting the concerns of lack of competition.

The lack of competition in bids means that users do not reap the benefits of an auction system, such as optimal pricing and fast execution – somewhat defeating the purpose of introducing the auction in the first place. Consequently, users may not benefit from the optimal execution price they would typically enjoy in a more competitive marketplace. Instead, they are reliant on the rates provided by the sole agent available at the time.

Additionally, speed is a key benchmark for these systems, with auctions designed to favour agents who are quicker in fulfilling orders. For instance, in a first-come, first-served auction, agents race to be the earliest to fulfill an order. This makes it challenging for intent-based systems to offer both fast execution and also the best price. Example – In DLN, agents rely on a webhook to receive order flow data. This makes it possible for deBridge to selectively send data to certain agents before others, giving them an unfair advantage to win the auction. [Source: DLN auction opennesses on intent.markets]

Moreover, the speed-based nature of these auctions also gives an advantage to those agents in the same geographic region as the intent-pool, as they can access orders marginally faster, even if by mere milliseconds, which can be significant.

This is due to the added latency in network communication (signal propagation time, speed at which data packets move) across the world and is not something that the protocol can change. Importantly, it introduces a risk of geographic centralization to the system and is also perhaps one of the reasons why protocol-run agents are dominant in these systems.

Lack of Competition Might Not Mean Worse Prices

Recent findings from the “An Analysis of Intent-Based Markets” paper challenge the assumption that more competition in auctions yields the best prices for the users. It proposes that an oligopoly might actually lead to more favorable outcomes. This is because agents are trying to buy the same assets, pulling liquidity from the same sources in the external market which can drive up their cost and as a result the users might not get the best prices – a somewhat paradoxical situation.

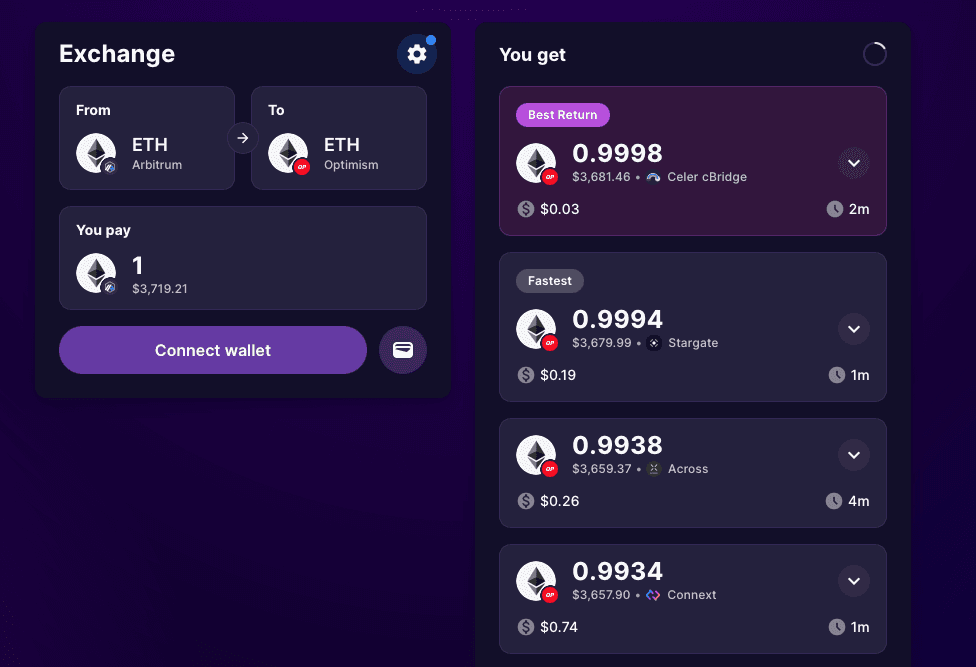

The findings from the paper indicate that price quotes and speed of intent-based bridges will vary based on factors such as the number of agents, their liquidity sources, and auction parameters. This differentiation underscores the relevance of aggregators like LI.FI that can parse through quotes not only from intent-based bridges but also from those with different designs (such as Stargate and cBridge with liquidity pools, or CCTP with burn and mint), ensuring that users get the best execution available in the market.

Open Questions

Although intent-based bridges are gaining popularity, there remain numerous unresolved questions regarding their long-term development:

What are the implications of sacrificing liveness guarantees in favor of increased speed and reduced costs? Is it an acceptable trade-off?

How do intent-based bridges scale to thousands of chains while maintaining a high degree of decentralization and competitive agent participation?

To what extent does the number of entities running agents on intent-based bridges affect their competitiveness and decentralization?

Should the intent-based bridge’s security and liveness be decoupled from the underlying oracle / messaging bridge it uses?

Across uses UMA’s oracle, with both the oracle and Across being developed by Risk Labs.

DLN uses deBridge messaging bridge,which is also a product of the team behind DLN.

UniswapX and Connext are neutral and impartial to which oracle / messaging bridge is used as they don't have their own solution. They use the most robust solution for a particular chain, like native bridges when available. (note: cross-chain UniswapX is not live yet).

Who should be allowed to be an agent in an intent-based bridge? Should the role be permissionless or permissioned?

What strategies could be implemented to incentivize a greater number of entities to assume the role of agents within intent-based bridges?

Should there be transparent dashboards to monitor agent competition and performance across intent-based bridges, similar to the systems used for tracking validator performance in messaging bridges?

The industry must engage in collaborative dialogue and research to address these open questions. The decisions made today will have far-reaching consequences for the scalability, security, and decentralization of bridges.

Closing Thoughts

Intent-based bridges are an exciting innovation in the bridging landscape. They offer an unmatched user experience which is fast and saves users a lot of time. However, it’s important to consider the trade-offs we’re making to achieve these benefits. While speed and high returns are attractive features, they should not come at the cost of decentralization and censorship resistance (in most use cases).

The current landscape of intent-based bridges reveals a lack of competition, with order flow predominantly controlled by a limited number of agents. Running an agent is costly and resource intensive, creating barriers to entry for new participants. However, if intent-based bridges are indeed the future of bridging, we need to think of ways to make it easier for agents of all sizes to plug into different order flow competitions and make these bridges more competitive.

Furthermore, there’s a pressing need for research into how intent-based bridges can scale. In a world with thousands of rollups, the complexity of managing token inventories across them also increases, potentially making it unprofitable for many agents. Moreover, the growing number of chains also amplifies the difficulty and effort in setting up infras to support them and monitor cross-chain transfers. These challenges could inadvertently push protocols to take on this role, leading to centralization and introducing latency risks. Addressing these issues is crucial for the sustainable growth and decentralization of intent-based bridges.

At LI.FI, we’re all for experimentation with bridge designs and believe intent-based bridges bring a fresh perspective on building bridges. They are an exciting option that’s raising the standard for the speed of execution of cross-chain transfers. Currently, not only do we support intent-based bridges like Across in our tech stack, we’ve also integrated agents directly to ensure users can benefit from this innovation.

This analysis is offered as constructive feedback rather than criticism. Intent-based bridge design has its merits but this study serves as a reminder to build robust systems that do not rely on a handful of actors.

As we conclude this section, it's with a sense of optimism and commitment that we look forward to building the future of bridging with our trusted partners. The path ahead is filled with opportunities to innovate and improve, and we are excited to contribute to the development of a more open, efficient, and decentralized bridging infrastructure.

Acknowledgements: This is a collaborative effort co-authored by LI.FI and Anera Labs. Special mention to the Anera Labs team for filtering the data on intent-based bridges, which serves as the foundation of this analysis.

Many thanks to Vishwa (Anera), Kram (LayerZero), Sam (Hourglass), Nick (Across), Kevin (Khalani), Mike (Brink), Taker, Sandman, for the discussions on the topic and feedback on the article.

If you wish to get involved in the discussions around intent-based bridges or intent-based research in general, consider contributing to intent.markets, a public good kickstarted by the Anera Labs team.

FAQ: The Untold Trade-Offs in Intent-Based Bridges

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.