LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

The State of Interop for 2026

The Year Interop Becomes Crypto

In crypto, some ideas begin as slogans, mature into narratives, and eventually harden into structural truths. Interoperability has now reached the final stage. What started as an industry prediction, “the future is multi-chain”, has become the lived reality of users, institutions, builders, and chains across the ecosystem. The thesis is now the default.

2026 is the year interoperability stops being something “we know is important” and becomes the very basis on which crypto functions. Which begs the question: how do we define interoperability in 2026?

Interoperability is the ability for value, state, and intent to move seamlessly across independent blockchains. It is what allows composability to operate at scale in crypto, enabling coordination across otherwise separate ecosystems. For users, interoperability compresses a multi-chain ecosystem into a single, interconnected mental model of using crypto as a whole.

Key takeaways:

Interop adoption only moves one way: up and to the right.

The interop category has now reached maturity. Distribution is the name of the game.

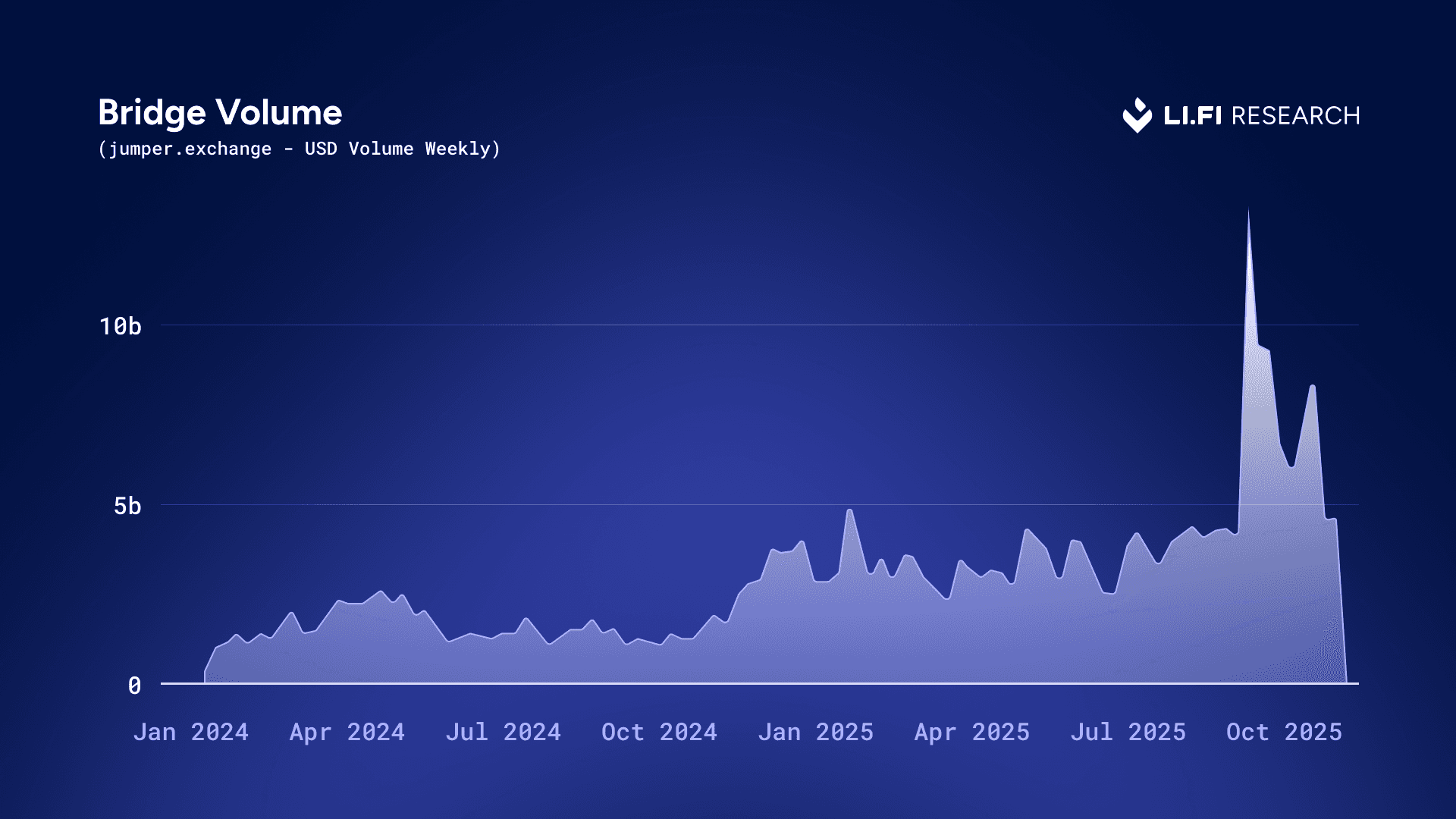

Cross-chain volume has grown exponentially in recent years, surging from a few billion to hitting over $10B in peak weeks over the past year. It’s up 100x since 2022.

No interop, no distribution. Interop must be treated as day-one infrastructure for every new chain and issuer. Those who do capture outsized gains.

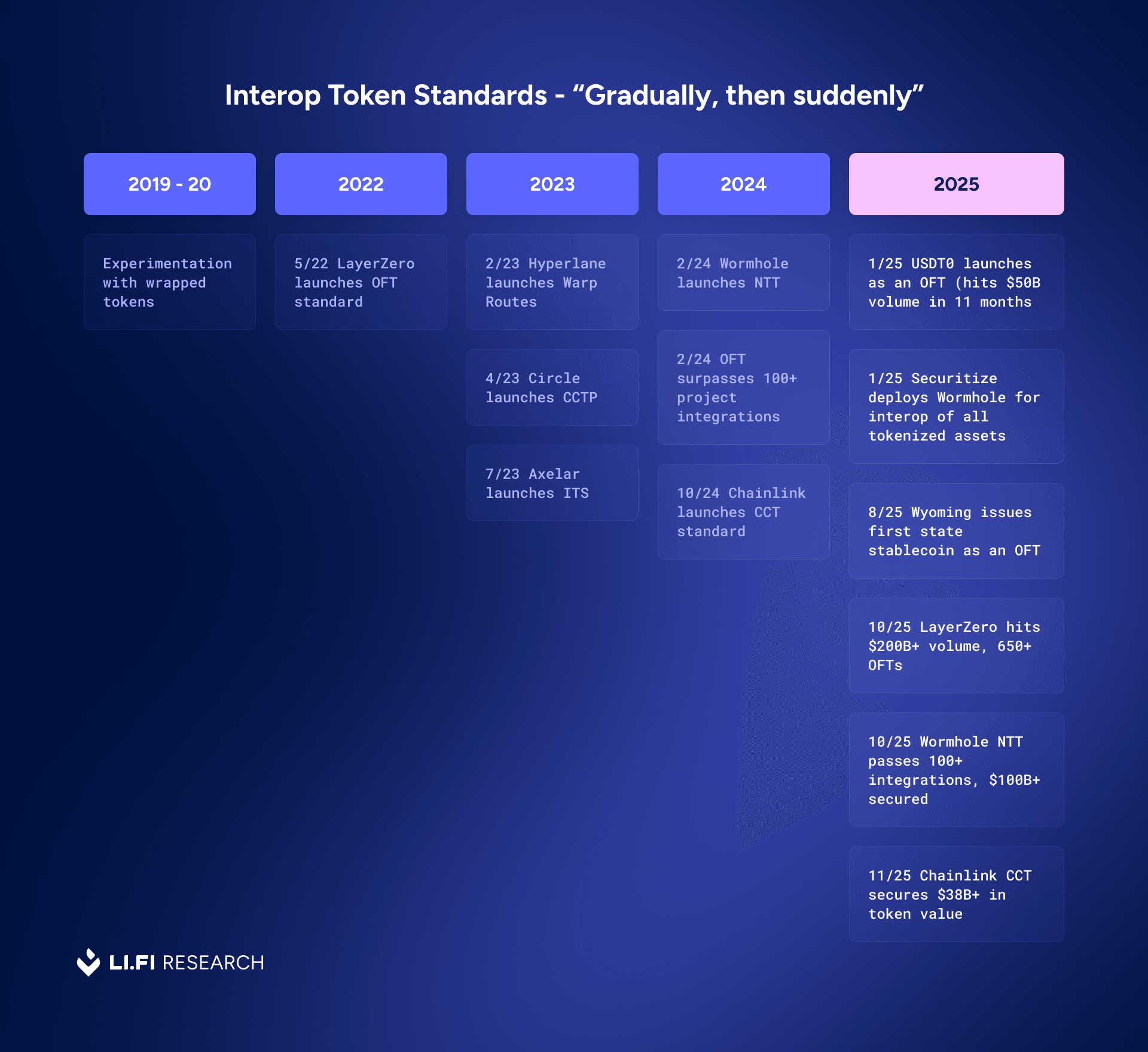

Interop token standards are the biggest PMF breakthrough. They are embedded at the root of the stablecoin and tokenization supercycle.

Interop teams are expanding horizontally. Swaps are standard, “Earn” products are emerging.

Intents now dominate retail bridging, but nothing beats mint-and-burn with interop token standards or native bridges for size – they’re the success story of bridging that’s flying under the radar.

Prelude: Multi-Chain Behavior is Now the Default, Volumes are Up Only

In LI.FI’s earliest days in 2021, our rallying cry was simple: the future is multi-chain. At the time, that view was far from consensus. Crypto was still in a formative phase; activity was overwhelmingly concentrated on Ethereum, which dominated nearly every meaningful metric and captured close to 90% of the market’s mindshare and usage.

As is common in young industries, early dominance invited competition. In 2021, alt-L1s like BSC, Tron, and Terra, alongside Polygon and later Solana, Avalanche, and Fantom, began to erode the assumption of a single-chain world. Different environments offered different trade-offs, and the market got its first glimpse of what a multi-chain reality could look like.

In 2022, the reality became more apparent. Ethereum’s rollup roadmap materialized with Arbitrum and Optimism, reframing chains as connected systems rather than isolated ecosystems. Bridging became a first-class user activity through early “Odyssey”-style campaigns, positioning bridges as the primary entry point for users and capital. This marked the shift from theorizing about a multi-chain future to experiencing it in practice.

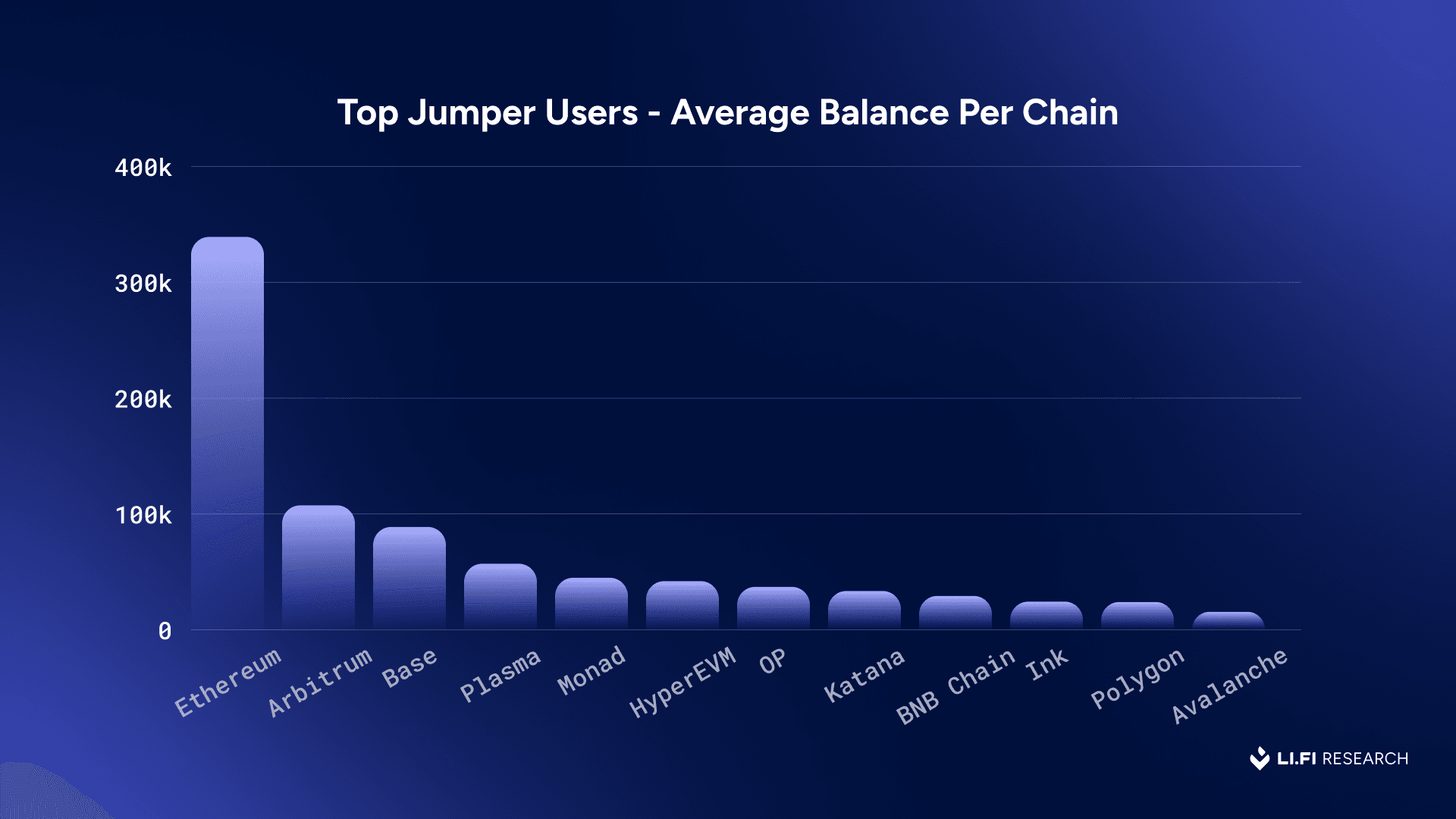

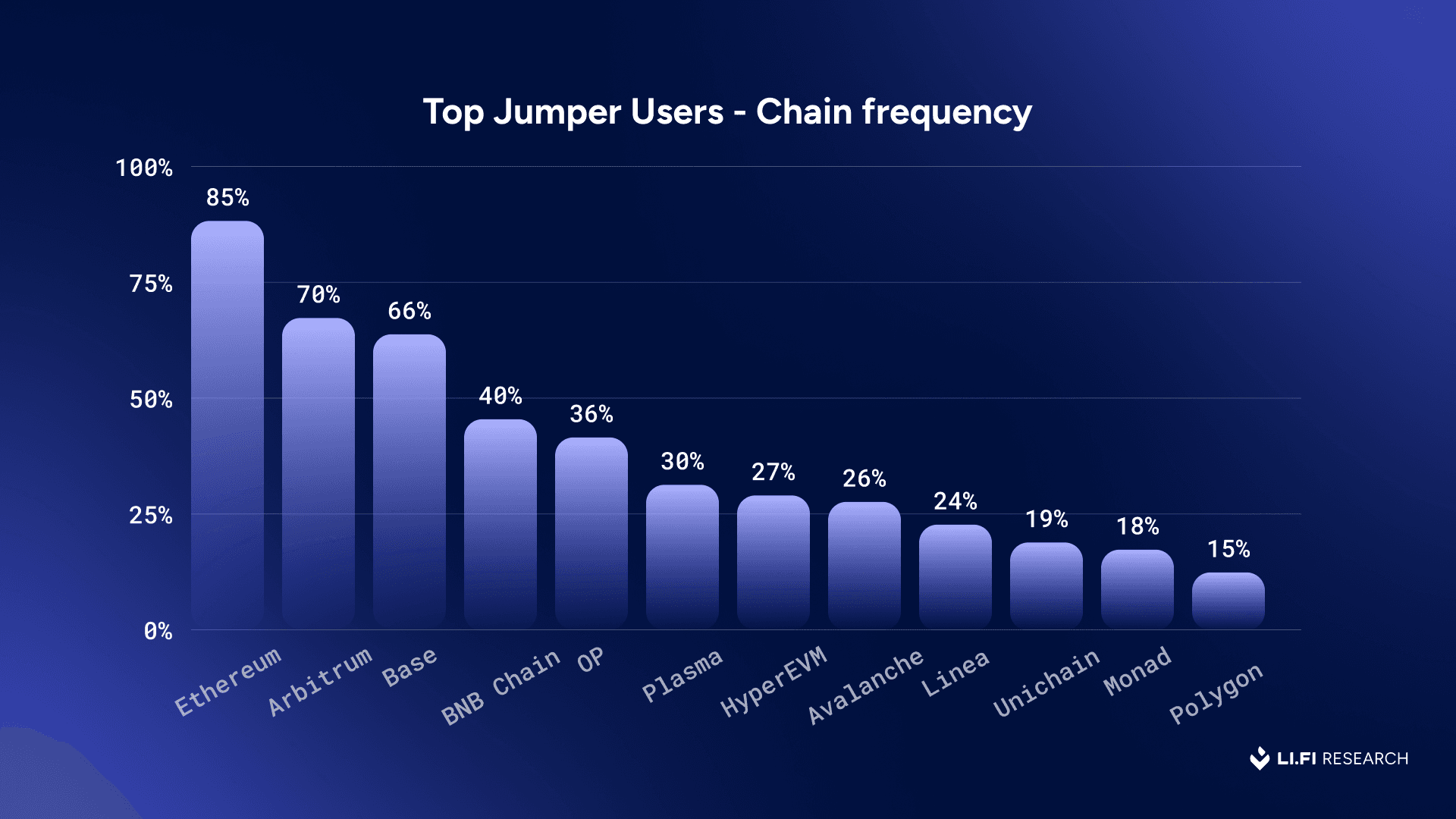

Fast forward to 2026: while many users still have a “home” chain (most often Ethereum, especially among whales) their onchain footprint and behaviour shows that they are natively multi-chain – moving capital across ecosystems based on risk and opportunity rather than loyalty. One data point captures this shift: the average Coinbase Wallet DeFi user interacts with ~2.3 chains and holds ~5.4 tokens, a useful proxy for how multi-chain-native users have become.

Over the past few years, crypto has settled into a familiar market rhythm of moving in clear narrative-driven cycles. Think AI x Crypto season on Solana, or the “Chinese memecoin” speculation on BNB Chain, each season pulls liquidity across chains which sees an aggressive rotation of capital across the ecosystem.

As a result, users have grown accustomed to bridging as a routine part of pursuing opportunity. Bridges tend to see their highest levels of activity during these seasonal surges, as users move funds to whatever venue is hosting the latest wave of experimentation. In this sense, multi-chain behavior has become the norm and every user has funds, and is active on a handful of chains.

Jumper Data, by Octave

Jumper Data, by Octave

The consequence of this evolution is that cross-chain volume has grown exponentially in recent years, surging from a few billion to hitting over $10 billion in peak weeks over the past year. It’s up 100x since 2022.

Bridge Market Metrics dashboard, by Octave

2025: The Year Interop Became Inevitable

If 2025 will be remembered for anything, it will be for a clear shift in what drives crypto forward. Two developments stand out:

We witnessed one of the widest ranges of chain launches in the industry’s history. These spanned crypto-native ecosystems like Initia, Abstract, Story, and Berachain; purpose-built payment chains such as Plasma, Stable, Stripe’s Tempo, and Circle’s Arc; and general-purpose, high-performance platforms like Monad and MegaETH. These launches weren’t driven by hype cycles, but by increasingly well-defined use cases and, in some cases, regulatory clarity.

A flood of stablecoin issuers. Thanks to the GENIUS bill, everyone, from U.S. states like Wyoming to crypto wallets like Phantom and MetaMask to traditional fintech providers is launching a stablecoin, and tons of teams are building stablecoin infrastructure around this trend (orchestration is the word to watch). This is unlocking a wave of real economic activity.

What makes these developments interesting for us is that they all require interoperability.

As crypto becomes more multi-chain, every new chain and issuer is confronted by the same reality: no economy, regardless of scale, can thrive in isolation. Growth requires open trade routes. Liquidity, users, and assets must be able to move freely wherever opportunity exists. Crypto today is a constellation of interconnected economies, each chain its own bazaar of assets and activity. Interoperability is what enables value to flow between them.

This shift has changed how chains launch. Interoperability is no longer an afterthought. New chains that fail to solve interop at launch risk losing their initial momentum entirely. Early capital today is incentive-driven and highly mobile. Without connectivity, liquidity cannot migrate, users cannot participate, and the momentum breaks before activity can meaningfully kickstart.

Jaz Gulati, Founder of Garden Protocol, on the state of interop

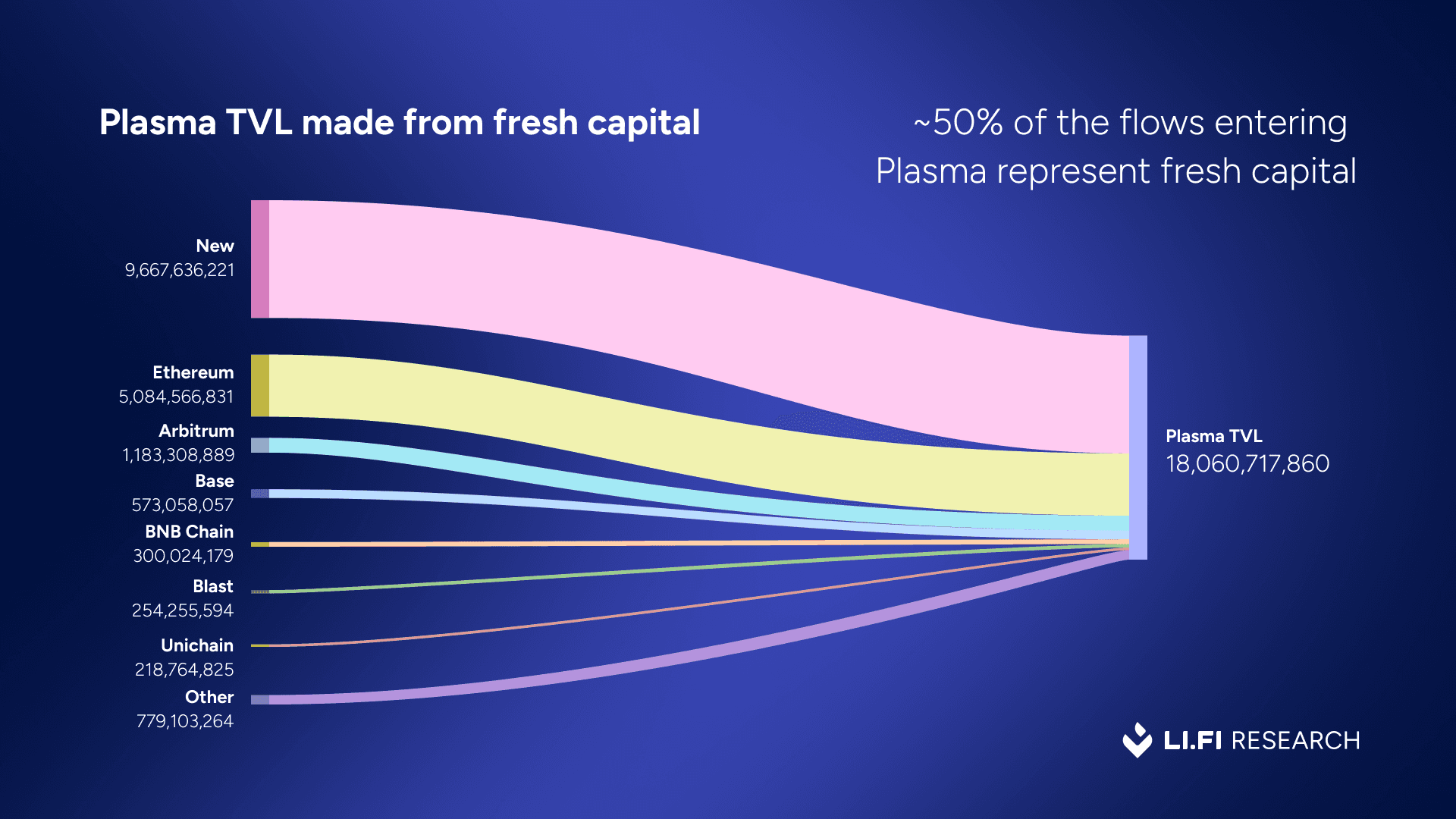

The launches of Berachain, Plasma, and Unichain, in particular, saw fresh wallets being set up, driven primarily by opportunity – capital seeking short-term yield gains across DeFi protocols on these new chains, rather than long-term alignment with a single ecosystem. For instance, when Unichain went live, the median wallet age was 11 months, and the median holding time of top users on the chain was 10 weeks on Unichain.

And this bridged TVL makes up a big chunk of the inflows into a new chain, as well as the capital in the DeFi protocols on that chain. For instance, on Plasma, 75% of bridged TVL is concentrated across four protocols: Aave, Fluid, Pendle, and Euler. 40% is deposited into Aave alone.

Source: https://dune.com/queries/6070166, by Octave

Consequently, we’ve seen launches that not only integrate major bridge providers immediately but also adopt deeper interoperability primitives (more on this in the next section). This is where interoperability has played a key role in determining what a “successful” launch could look like for new chains.

Apart from chains, stablecoins, and asset issuance, more broadly, have become the strongest demonstration of product-market fit for interop protocols.

Launching a stablecoin on a new chain, and doing so efficiently, and at scale, is essential. If stablecoins are to challenge traditional payment and settlement frameworks, they must exist wherever meaningful financial activity occurs. That means not only being available on different chains, but also being natively interoperable between them. The winners in the stablecoin sector are those that recognize this multi-chain reality and design for ubiquity from day one. In practice, interop is distribution, interop is listing. It’s how a stablecoin gets listed, adopted, and used on markets across chains.

Wee Howe Ang, CEO of Tokka Labs, on the state of interop

In 2025, any high-quality project issuing a token of value, whether a native asset, a stablecoin, or a tokenized instrument, is increasingly choosing to issue on interop rails. That pattern has repeated throughout the year.

All of this points to a broader change:

Users have internalized the multi-chain reality.

New chains launch with interoperability solved from day one.

Stablecoins and tokenized assets are being built on interop rails.

Interop infra providers now move billions in volume daily.

What this means:

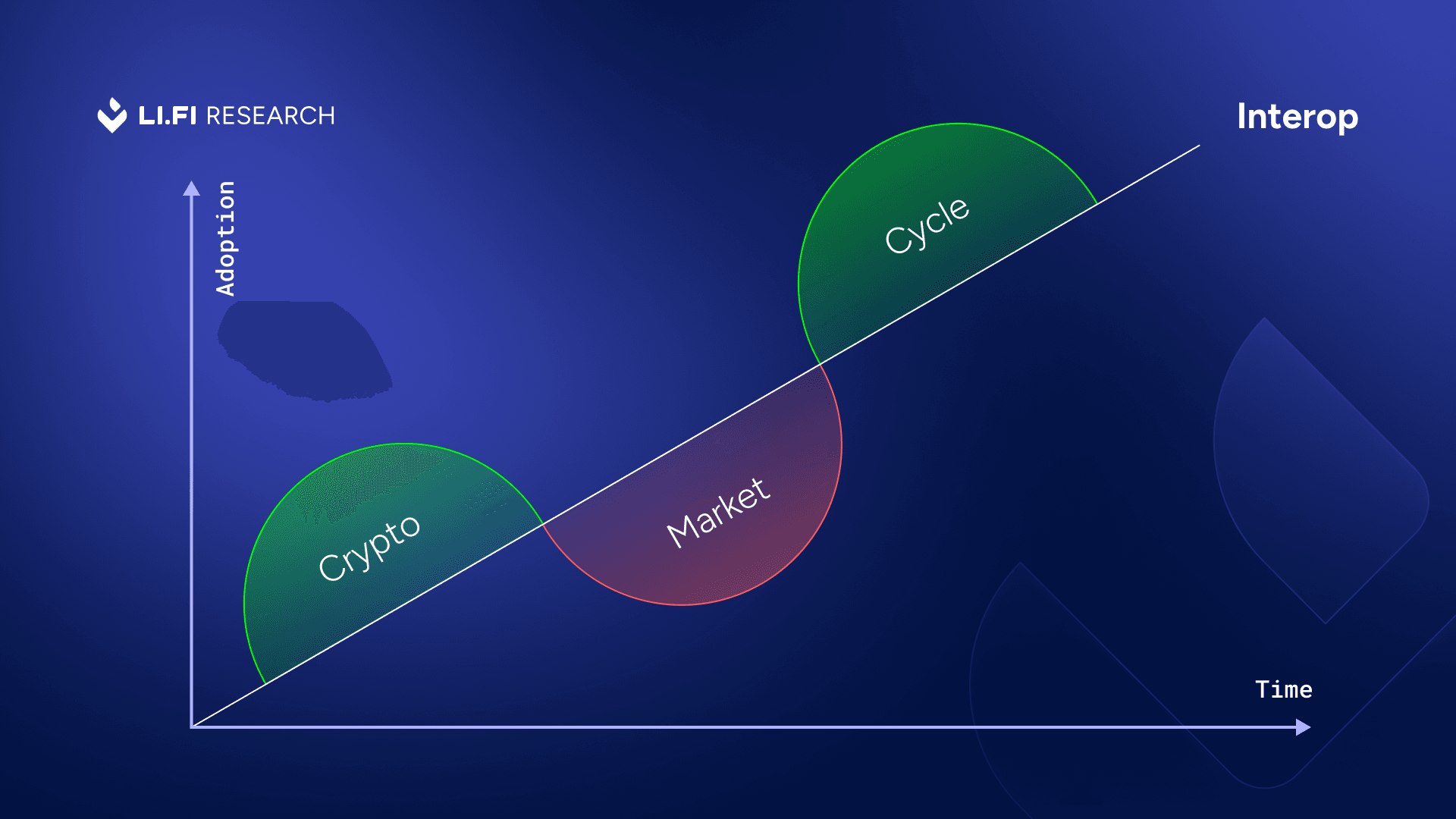

Some industry sectors ebb and flow with market cycles. Interop does not. It is tied to structural forces of crypto like liquidity mobility, market formation, asset issuance, and the economics of connectivity. These are fundamental. They persist through bull markets, bear markets, and periods of disinterest. And so we find ourselves in a position of clarity, that interop is inevitable and its adoption is only going in one direction in the long term, up and to the right.

Interop is inevitable.

Now that we’ve taken care of the bigger picture stuff, how interop fits into the crypto landscape, let’s dig a little deeper and see how the interop landscape is shaping up.

Let’s dive in!

The Great Consolidation – Value is Accruing at the Edges

Every industry goes through the same arc. In the early phase, value is diffuse: many teams coexist, differentiation is weak, and adoption is driven more by timing than by excellence. Simply showing up early is often enough to attract users, capital, and mindshare.

Interop has followed this pattern for years. As the multi-chain world expanded, almost any interop solution saw usage. When the market itself is growing rapidly, temporary participation can be mistaken as product-market fit.

That phase is now over.

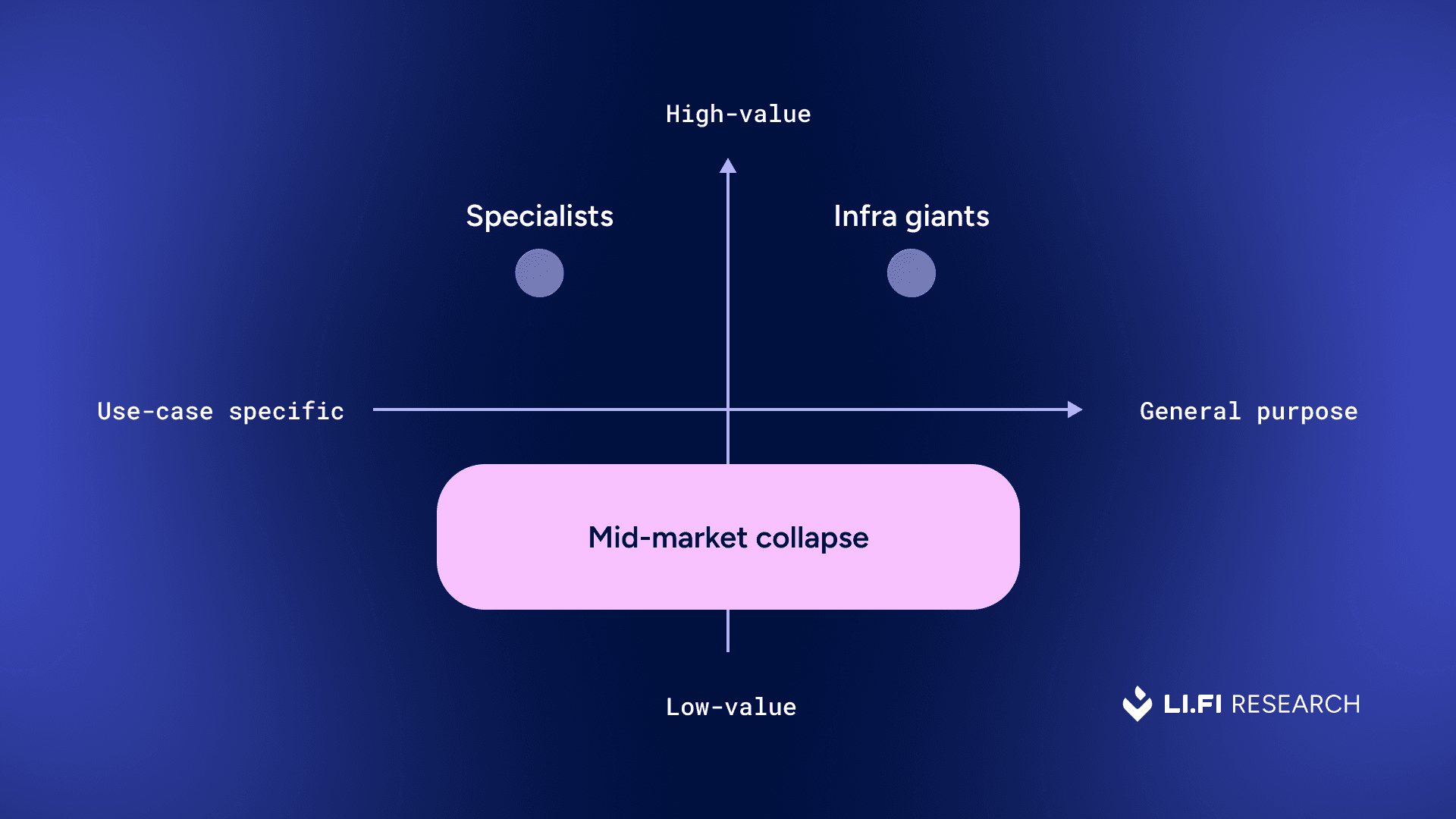

Interop has crossed into maturity, and with maturity comes consolidation. When a category stabilizes, value no longer pools in the middle. It concentrates at the edges, where products either solve a problem exceptionally well or operate at a scale that makes them unavoidable. The center collapses because “good enough” stops being good enough.

Bo Du, Co-Founder of Polymer Labs, on the state of interop

This is what “value accruing at the edges” means in practice:

Users gravitate toward the best possible solution for a specific job.

Developers default to infrastructure with proven distribution and reliability.

Interop today is a textbook example of this dynamic – value is accruing at two extremes.

The interop barbell

On one end are the specialists. Teams that pursue a narrow problem with almost single-minded intensity. They don’t try to serve everyone. They aim to matter deeply to someone. These are the “kings of the jungle” winning by doing one thing really well.

Consider the intent-based bridging space, where speed and cost trump nearly everything else. The teams that committed to this, particularly Relay and Gas.zip among them, are doing well today because they’re hyper focused on solving one problem. They saw that users wanted cheap, fast swaps across chains, and they built exactly that.

Source: @tomkysar

This is why specialists win at one end of the barbell. In the early stages, you can’t be everything at once. Interop teams that focus narrowly on delivering the cheapest routes, fastest execution, and the broadest chain coverage are simply responding to how the market actually behaves. They optimize for one use case, and do it better than anyone else. Eco’s focus on stablecoin transfers, Near Intents targeting underexplored routes, and Polymer’s renewed emphasis on proofs all show how specialization at the edge translates into early adoption.

Ryne Saxe, CEO of Eco, on the state of interop

And it’s worth noting: scaling a system across dozens of chains is far harder than it sounds. Anyone who has tried to build a bridge, or even a basic application, in a multi-chain environment will tell you it’s anything but trivial. Now this might not be the most decentralized approach, or the most philosophically elegant solution, but they are the most useful given today’s market reality. That’s not a criticism. Scaling reliable infrastructure across dozens of chains is brutally hard, and every serious crypto system starts with training wheels. Even today’s most respected L2s began centralized, prioritizing usage and distribution before hardening decentralization. The same arc will play out here. As demand matures, specialists will open and decentralize where it matters.

On the other end sit the infrastructure giants. Generalized platforms with distribution, network effects, and the mindshare that make them default choices for developers. These teams once occupied a position similar to today’s specialists, but they’ve crossed the chasm of adoption. Having built widely used products, they are now consolidating their footholds while simultaneously expanding into new, aligned verticals. LayerZero’s OVault, Wormhole Labs’ Sunrise, and LI.FI’s Zaps are cases in point.

Once a team proves it can execute at scale, the market grants it permission to build more, and many will. We have an example like this in interop itself. Chainlink, for example, is a winner from the Oracle category, but today they have an interop product in CCIP and CCT standard, which is seeing adoption and usage because of their trust in the market as well as the ability to deliver a high-quality product that works at scale.

Moreover, it’s increasingly clear that interop infra providers are becoming ecosystems in their own right. They support growing catalogs of applications that depend on them for everything from core application logic and token issuance to liquidity routing and bespoke cross-chain use cases. In some cases, they now rival top L1 and L2 ecosystems in terms of application count and developer activity.

This points to a flippening that’s going under the radar. If you look at the number of teams building on and with interop providers, the figures today resemble those of top-tier chains. Interop infra providers should no longer be seen as plumbing, but instead as a platform or launchpad for building apps – the same way we’ve looked at chains historically. Interestingly, chains are becoming increasingly specialized, a la Hyperliquid, and in more ways than one the very concept of a “general-purpose chain” is collapsing.

The trouble lies in the middle. This is the most precarious position and the one everyone would want to avoid. Projects that are neither razor-focused nor broadly adopted find themselves in a strategic limbo. They’re too vague to dominate a category, too small to build true infrastructure, and too slow to outrun the specialists. These teams are highly exposed to shifts in narratives, funding cycles, and competitive pressure.

As a result, many won’t survive independently. They may pivot in search of greener pastures, shut down during bear markets, or, more desirably, get acquired by larger players seeking their technology or talent. The recent acquisition of Interop Labs’ team and IP by Circle is a clear example.

The interop category is now in its “adult phase”

This isn’t a permanent ranking of winners and losers. Markets move, competitive positions shift, and what works today may not work tomorrow. A specialized player with momentum today can drift into the middle if its wedge becomes obsolete. A dominant infrastructure provider can be outflanked by a new primitive or a more compelling approach. No seat at the table is guaranteed.

But it’s clear that the interop market has polarized: specialization and generalization now capture the value, while the middle gets squeezed. “Good enough” is no longer good enough. And as in every market that transitions from early stages to maturity, we’re beginning to see which teams built for what's hot in that cycle and which teams are going to stick around longer.

Intents Are Cool but Mint-and-Burn with Token Standards Rise is Going Under the Radar

Intents have cracked the code on the retail bridging experience: fast, cheap transfers that feel like they just work.

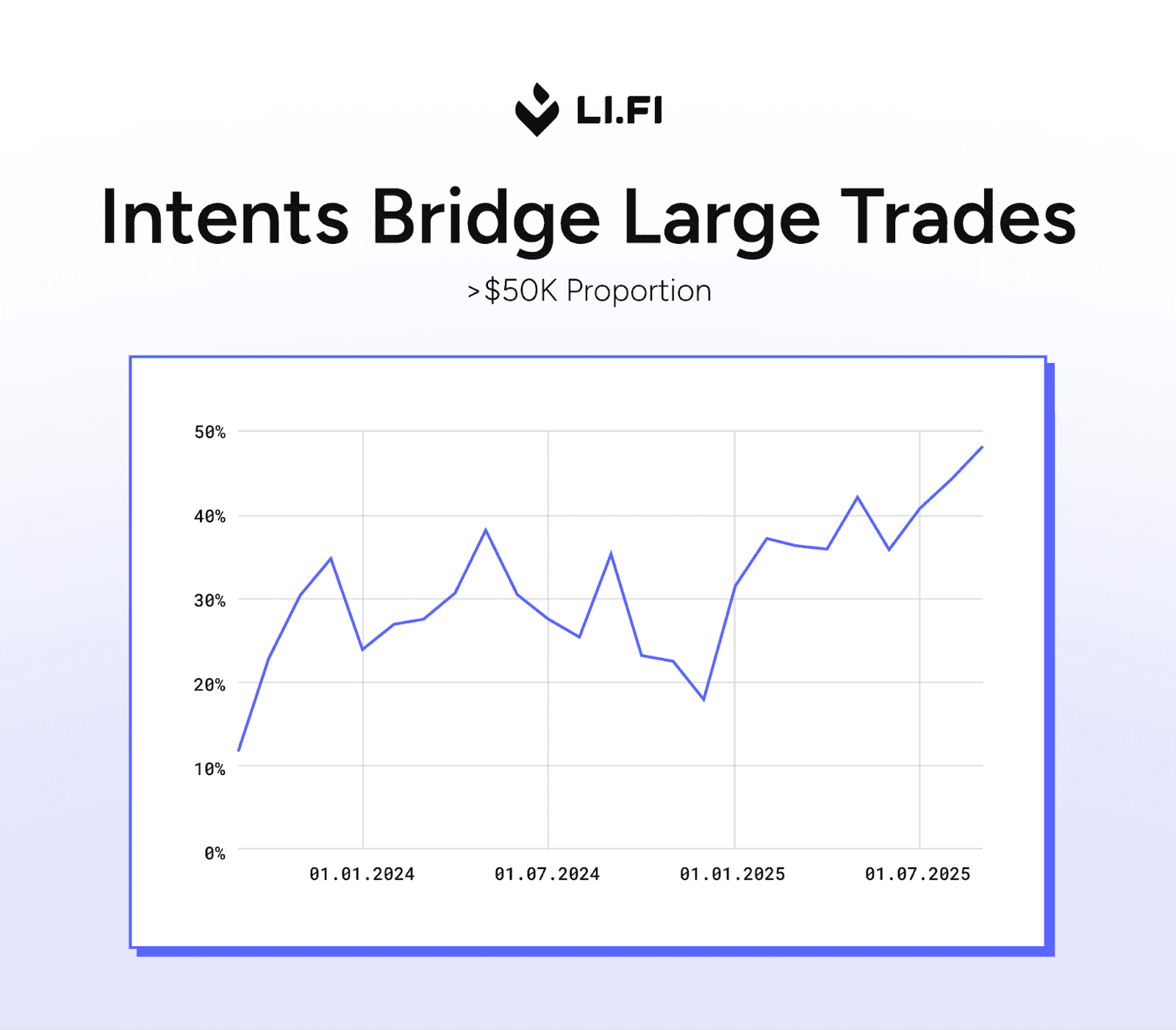

And with time, intent-based solutions are getting better and better. What began as a solution optimized for speed and cost is now handling increasingly large orders, with tight spreads and minimal slippage. And as a result, they’re winning more orderflow on aggregators and more orderflow generally as users see the effectiveness of these solutions. Data also shows that these systems are winning large orders too, often $50,000 or more.

Read more: 4 Trends That Explain Bridging Right Now

But while everybody is already familiar with the beauty of intents and how they simplify taking actions onchain, very few people are paying attention to the quiet resurgence of mint-and-burn bridging solutions that are asset-specific and powered by interop token standards.

Here’s how I like to think about intents vs token standards: If Intents are the sports car, mint-and-burn is the container ship, boring, maybe, but responsible for moving the actual tonnage of global trade.

This distinction becomes clearer the more you examine what’s happening onchain. Consider one transaction:

$549.99M in USDT0 moved from Ethereum to Plasma for a fee of just $2.20, the largest transfer ever processed over LayerZero. Put differently, the cost of capital on that move was ~0.0000004%. That number is almost funny. You don’t beat this. Not in crypto. Not in traditional finance. This is capital efficiency in its purest form, and it helps explain why USDT0 moved over $50B in its first 11 months and now rivals USDC across DeFi.

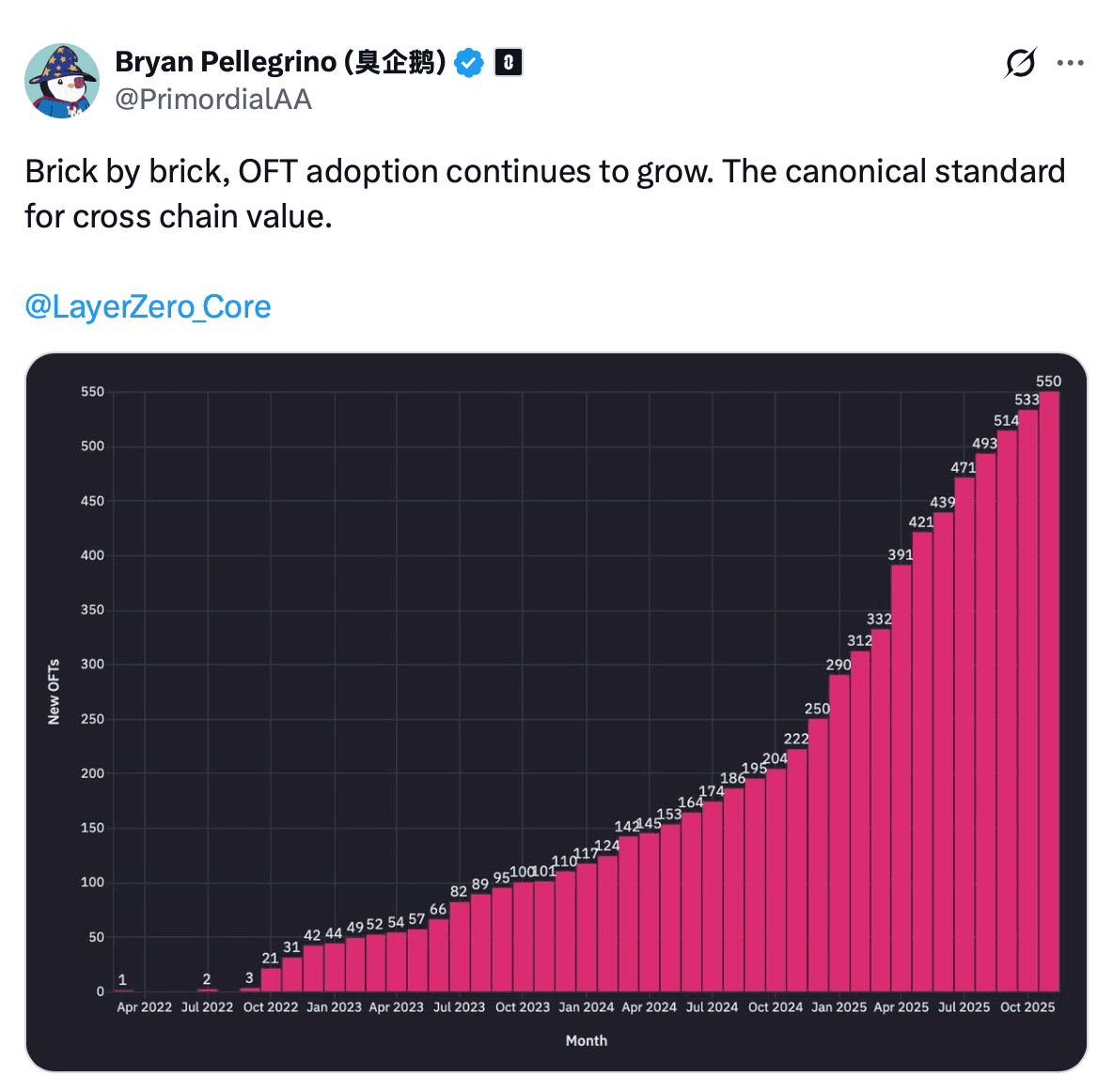

The advantages of mint-and-burn architectures for large transfers have been understood for years. When the task is moving size, no other model has matched it. And over the past year, the flow confirms this: large transactions have increasingly migrated to mint-and-burn rails simply because they are the most cost-efficient way to move capital. Even intent solvers rely on them heavily for rebalancing. The growth curves of Stargate (with OFTs and Hydra), CCTP for USDC, and USDT0 make the point for us.

Stargate itself is an illustrative case. While its competitive position on aggregators has weakened, where speed and fee-based competition is most intense, it continues to clear billions in weekly volume through its own interface. The reason is very simple: OFTs move size, and institutions and whales follow the rails that move size best.

For most of the wider ecosystem beyond people in interop, the adoption of interop token standards seems to be flying under the radar. As mentioned above, stablecoins, and more broadly, asset issuance, is where interop protocols find themselves in the thick of the action finding the most traction and locked-in PMF. This is tightly linked to crypto’s core bull case: tokenising everything. And it’s important to point out that everything is being tokenised on interop rails.

The scale puts this into perspective. Interop token standards today secure well over $250 billion in asset value, rivaling, and in some cases surpassing, the value secured on many chains.

Zoom out. Source: @PrimordialAA

Another underappreciated shift is the changing role of “native” bridges. Historically, chains relied heavily on native lock-and-mint designs to move their assets, primitive versions of what mint-and-burn solutions do today. But as more chains issue their native assets directly through interop token standards, they’re effectively creating omnichain “native bridges” with all the benefits of mint-and-burn and none of the old constraints. We’re watching a structural transition in how assets launch, move, and settle across ecosystems. For example, both Plasma’s launch and Monad’s launch had interoperability providers at their core, LayerZero and Wormhole respectively, embedded at every layer: from powering the native bridge frontend, to enabling connectivity with the broader ecosystem, to minting assets on the chain via token standards.

The next phase for interop token standards will be their integration into cross-chain settlement flows, or netting. As more assets adopt these standards (a trend already well underway), settlement becomes cheaper, faster, and effectively 1:1 across multiple chains. Over time, we can expect these standards, and the tokens issued on them, to play an increasingly central role in crypto’s clearing infrastructure. It’s not hard to imagine a future in which any asset issued on the same token standard or tokenization rails can be settled seamlessly, 1:1.

Tanay Jain, Researcher at PropellerHeads, on the state of interop

Intents and mint-and-burn, both approaches will only get better from here. Intents with tighter spreads and bigger inventories for solvers. Mint-and-burn with more structural unlocks like faster finality times for blockchains.

Horizontal Expansion… From Swaps to Earn?

In the early days of interop, things were simple. There were bridges, and there were DEXs. DEX aggregators had already carved out a niche: same-chain swaps. If you wanted to exchange one token into another, they were the obvious tool.

Then, as crypto became multi-chain and bridging became something everyone had to do, bridge aggregators appeared. But they did something subtle and important: they didn’t just aggregate bridges. They aggregated DEXs too. So instead of just offering price comparison between bridges for the best rates to move an asset from one chain to another (let’s say ETH on Ethereum to ETH on Arbitrum), they also allowed exchanging the asset on one chain for a different one on another (like ETH on Ethereum to USDC on Arbitrum), and this came to be known as a cross-chain swap.

What’s funny is that most of us didn’t think much about the swap part. It felt incidental, a detail. You needed to go cross-chain, so of course you’d need to swap something along the way. The actual swapping felt like someone else’s job. That’s what DEX aggregators were for.

But as the number of chains exploded, something broke. DEX aggregators never managed to scale effectively due to the technical challenges in meeting the sprawl of chains. On the other hand, expanding to new chains is the bread and butter of interop, and thus “bridge aggregators” and other interop teams scale to 100s of chains efficiently.

Today, if you count the number of chains supported by interop teams, you get numbers in the 50–100+ range. For DEXs and DEX aggregators, you get single digits, maybe twenty. You can see the scaling problem in how the DEX landscape shapes up in every ecosystem – new, native DEXs always tend to dominate their own ecosystems (like Pancakeswap on BNB chain, Pump on Solana, Aerodrome on Base, LFJ on Avalanche) and they’re always able to beat the vanilla aggregator that tries to be everywhere.

“Swap functionality” quietly became one of the strongest features of bridge aggregators by aggregating native solutions across ecosystems, tackling cross-chain swaps that require both bridges and DEXs.

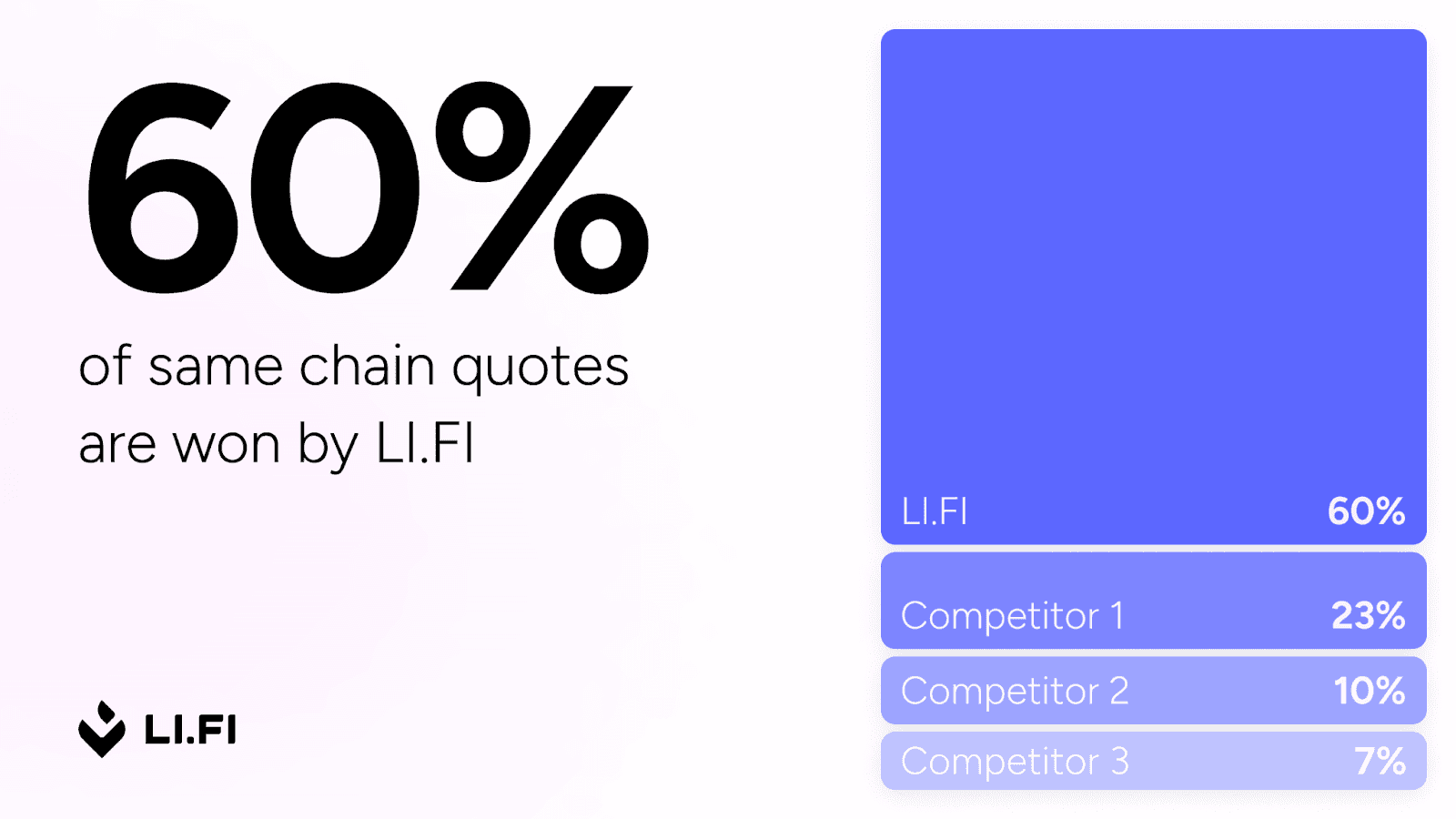

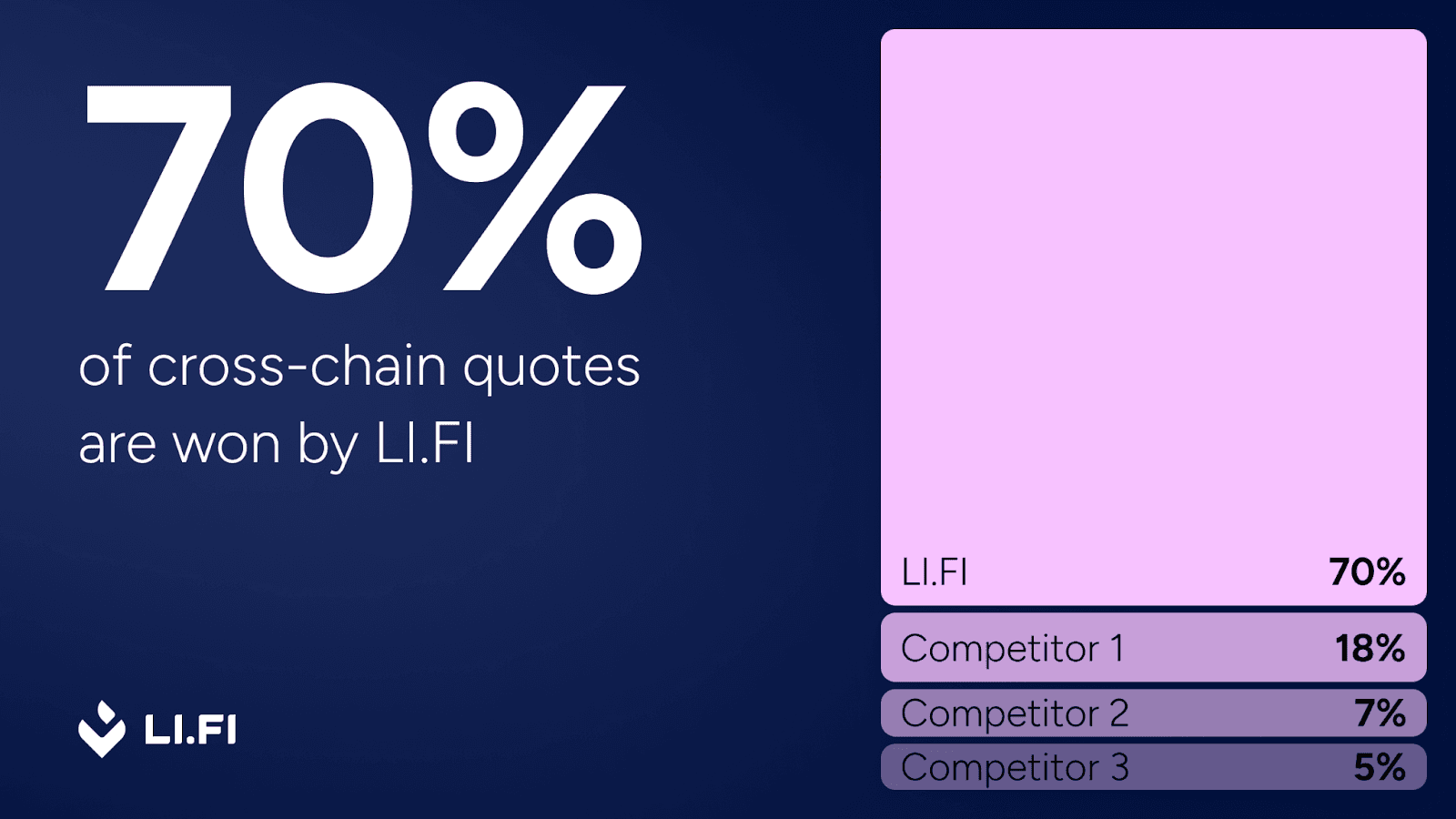

LI.FI, for example, integrates 20+ bridges and 20+ DEX and DEX-aggregators across 60+ chains. That’s a structural advantage. If you’re plugged into everything, you become the best swap engine. As a result, we’ve found out that LI.FI consistently outperforms competitors across both cross-chain transfers and same-chain swaps, winning the majority of direct comparisons across chains, tokens, and trade sizes.

LI.FI vs Other players for same-chain swaps

LI.FI vs Other players for cross-chain swaps

This puts “bridge aggregators” in a strong position to dominate the swap market itself. And you’re seeing the results already: LI.FI has been able to build distribution and get integrated for same-chain swaps across many major wallets and across apps on different chains.

And this swap expansion is not limited to aggregators, look at bridges like Mayan and Relay, they offer same chain swaps as well. And for every major supported route and token pair, they offer highly competitive rates. Moreover, other ‘bridging’ providers are also launching their own swap solutions. Like Stargate launched Fast Swaps recently, Across launched a Swap API.

This is horizontal expansion in its purest form: interop teams growing sideways into adjacent markets simply because they’re already the best equipped to handle the hard parts. Once you’ve built the machinery to operate across chains, every additional DeFi primitive becomes easier for you than for the incumbents.

Alex Mueller, Product & Research at Sprinter, on the state of interop

You can see how stark the difference is whenever a new chain launches. Look at Monad. Every bridge provider was live on Day 1. Only a handful of DEXs and DEX aggregators were. And LI.FI had them all aggregated immediately. Speed, flexibility, and breadth are the natural advantages of interop teams.

The horizontal expansion has started with swaps, but it won't stop there, and we’ll see interop teams tapping into more DeFi primitives. One of the first ones is the “Earn” category, i.e., offering yield bearing products by tapping into existing lending protocols in the ecosystem like Aave and Morpho, among others. Wormhole Portal recently added Earn. Jumper is preparing an Earn product as well, offering the best yields across 60+ chains.

Swaps were the opening. Earn products, and everything after, may be the continuation. Over time, with good execution, interop teams will start taking market share not just in swaps but in every category adjacent to them. They’re simply better adapted to a world where crypto isn’t one chain but dozens.

Tid Bits and Open Questions

In the earlier sections, we covered the major trends in interop already taking shape. Here, I want to briefly spotlight a few developments that are still early but worth paying attention to.

Intents Design Is Still Missing Wider Application

When intents first entered the industry’s imagination, arguably catalyzed by Paradigm’s article on intent-based architectures and their risks, the community rallied around the idea. The pitch was powerful: a declarative paradigm where users simply express what they want, and third-party agents (solvers) figure out the optimal path to execute it.

We immediately reached for analogies: Uber-like requests, outcome-oriented UX, agents doing the heavy lifting. A wave of projects emerged promising this future. Some building DSLs, others building generalized infra. Yet, most of these systems still haven’t reached production. The promise remains mostly theoretical.

In the meantime, intents have found real product–market fit in swapping and bridging, with early traction emerging in lending. But the path to broader applicability may finally be coming into view, and one promising direction is modular, open intent infrastructure like the Open Intents Framework (OIF) spearheaded by the Ethereum Foundation (and built by LI.FI, OpenZeppelin, and others).

Frameworks like OIF could meaningfully expand the reach of intents by giving developers (both apps and chains) a way to customize intent flows for their specific use cases, rather than being forced into today’s one-size-fits-all solutions or having to figure out everything, from setting up a solver network to the settlement logic, on their own. All of which makes intents hard to adopt.

Open, modular, permissionless frameworks like the OIF change this dynamic entirely. They allow teams to:

Build with intents more easily, since the tooling is standardized and accessible.

Choose the components that fit their needs, instead of being locked into a single protocol’s assumptions.

Deploy their own intent infrastructure, without needing buy-in or permission from incumbent intent networks.

This is how we move from intents being limited to swaps and bridging, to intents becoming a design pattern for many categories: application-specific intent flows, customizable logic, and purpose-built execution paths.

Solver Margins are Getting Squeezed

At this point it shouldn’t surprise anyone: running a solver that can actually win meaningful orderflow on a competitive intent-based protocol is an expensive business. A production-grade setup costs $13–26k a month before a single trade is won. Unless a solver captures real flow, the economics work against it from day one.

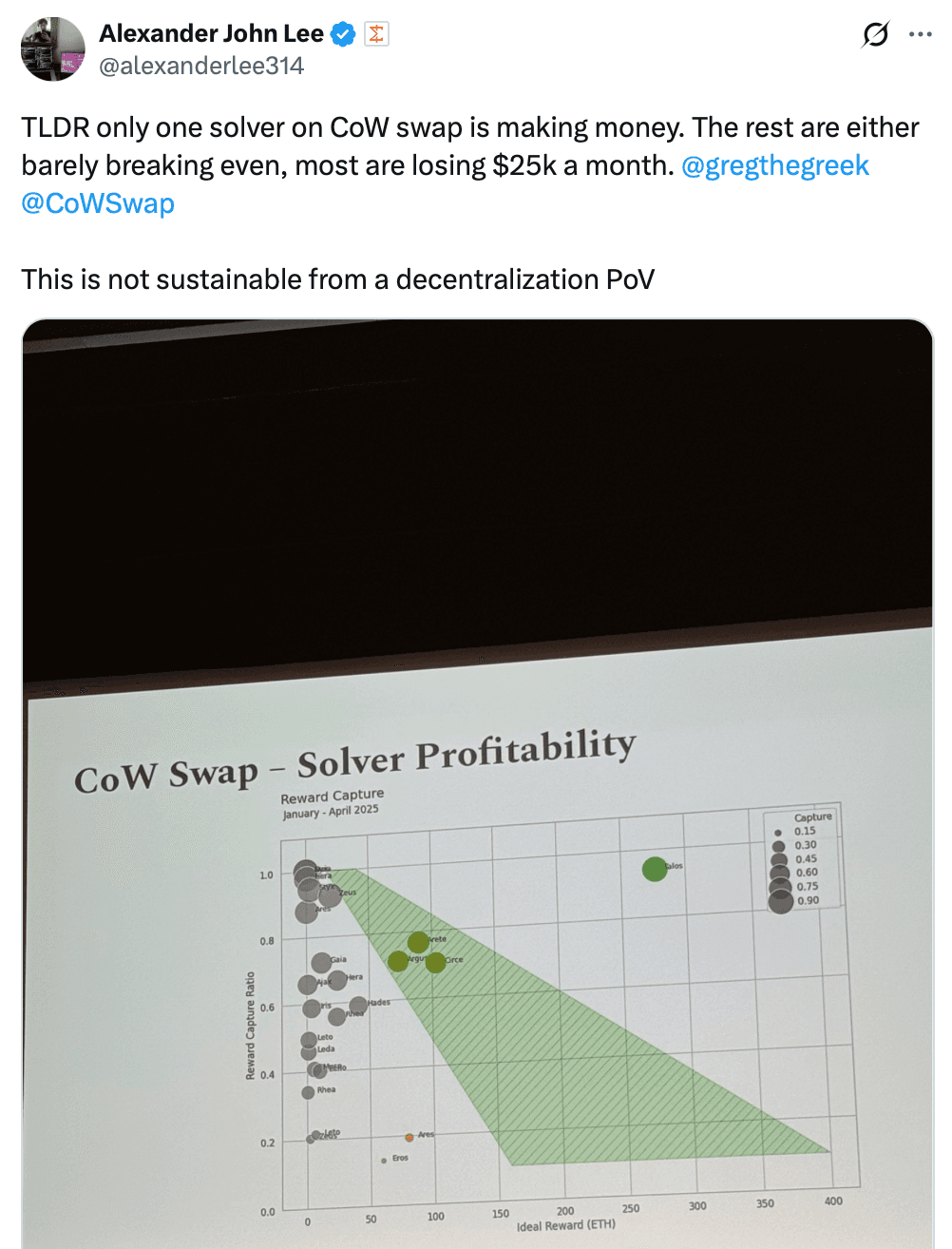

Winner-takes-all-dynamics across solvers. Source: @alexanderlee314

There’s a romantic notion of “indie” solvers built in someone’s basement, but in practice, especially in bridging, we haven’t seen it. The solvers that matter are run like companies: VC-funded teams, well-resourced groups, or the protocol’s own affiliated operators. That’s who wins volume.

The data only confirms what intuition suggests: margins are getting squeezed.

Volume is concentrated – a small handful of solvers handle most activity and capture most rewards. The rest get what’s left, which is rarely enough to cover fixed costs. For instance, Sprinter’s analysis shows that out of dozens of active solvers, only a minority end up profitable. The “survival zone” is narrow, and many sit at or below break-even. This suggests that the solver ecosystem is a strong “top-heavy” landscape where many solvers exist, but most are squeezed, either by not getting volume or by not winning enough auctions.

Advantage comes from access, not just engineering – today, what separates winners isn’t who writes the best code, it’s who has private liquidity, deep capital, or privileged orderflow. Structural advantages crowd out technical skill, leaving smaller solvers with shrinking margins. Many are having to resort to side businesses like arbitrage, MEV, privatized flow, because solving alone doesn’t pay enough.

The bottom line: costs are fixed, revenues are concentrated, and structural advantages dominate. In an environment like this, it’s no surprise that margins for most solvers are steadily disappearing.

Apriori, Researcher at Anoma, on the state of interop

Hyperliquid

Every year crowns a new liquidity hub. Last year it was Solana. This year it was Hyperliquid. Activity on the chain was intense, which naturally meant users needed to move capital in and out of Hyperliquid on a regular basis. This created consistent cross-chain volume to and from Hyperliquid throughout the year.

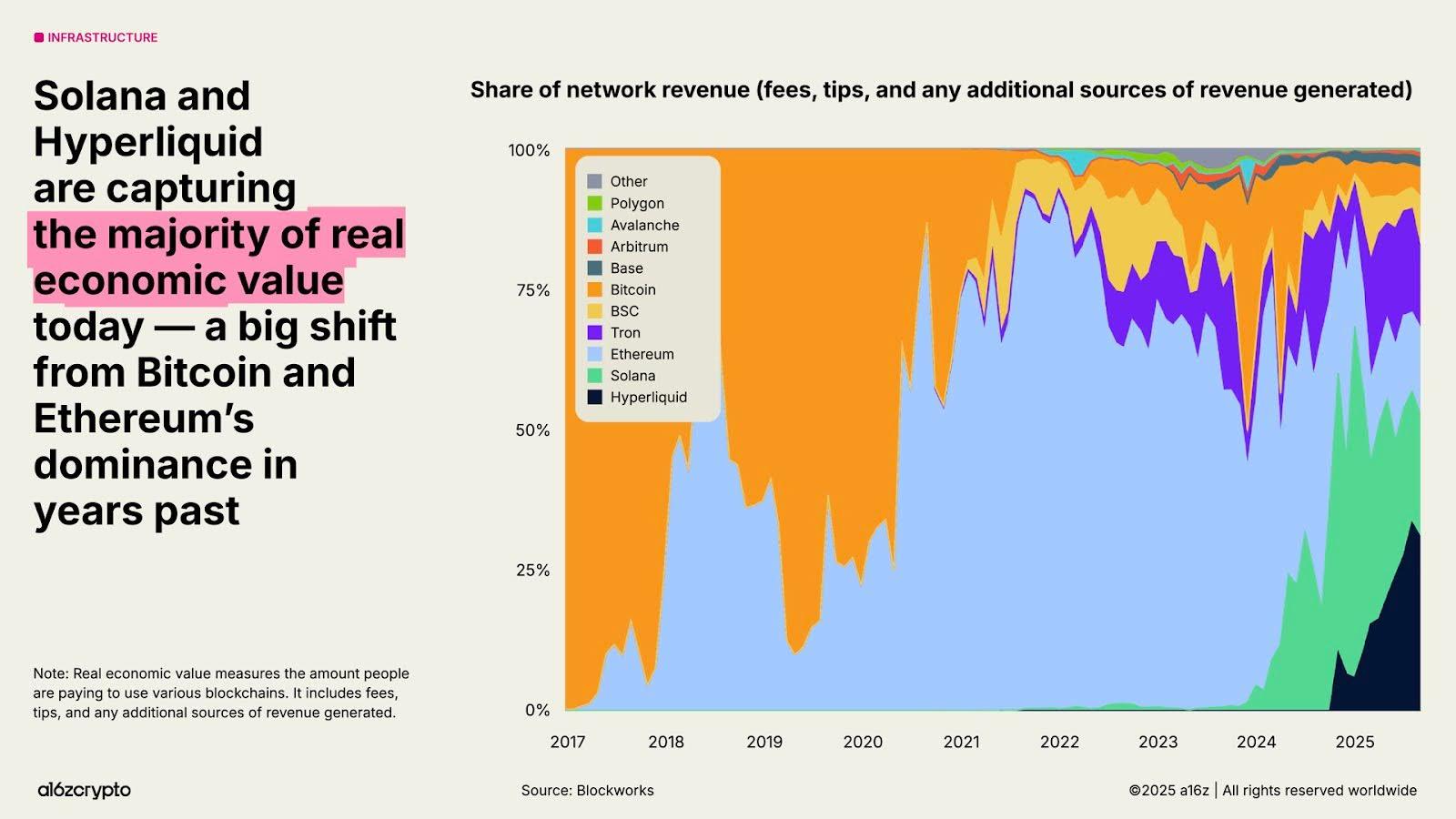

“Hyperliquid and Solana account for 53% of revenue-generating economic activity today, a significant departure from the dominance of Bitcoin and Ethereum in previous years."

Source: a16z state of crypto 2025

As a result, virtually every interop protocol prioritized building connectivity with Hyperliquid. Many went further, layering value-added services on top of basic chain support to ensure smooth, reliable fund flows. The goal was clear: become the go-to option for users moving assets in and out of Hyperliquid efficiently and dependably.

This pattern isn’t unique to Hyperliquid. Every now and then, a chain emerges with significant activity, creating a clear opportunity for interop protocols. Previously it was Solana; last year, Hyperliquid. Next year, it could be another ecosystem. The market opportunity to capture usage and expand share is always present, from providing the rails for users to move funds to chains to building the tokenisation layer for asset issuers to move assets across chains, there’s an opportunity for interop providers everywhere.

Cluster Specific Interop is Solved… or Is It?

Over the past year, a clear pattern has emerged: major ecosystems have stopped pretending blockchains exist in isolation. Instead, they’re building tightly coupled clusters of chains, effectively special economic zones that share liquidity, users, and infrastructure. We see this in:

Optimism and the Superchain

ZKsync and the Elastic Chain

Polygon and the AggLayer

Arbitrum and Orbit chains

For these ecosystems, interop is just infrastructure. Each is assembling a full-stack offering to attract institutions and developers to build chains and apps on top of their infra. In this picture, interoperability becomes the connective layer, ensuring liquidity, users, and applications can move freely across the cluster without friction.

This is why many ecosystems are now building their own in-house interop rails and focusing on a push for institutional interop. The intent is that institutions shouldn’t have to worry about moving liquidity between chains within the same shared economic zone.

Noah Pravecek, Director of Interop Product at zkSync, on the state of interop

But internal connectivity only solves half the problem. No ecosystem is an island. Capital doesn’t stop at the edges of a Superchain, an Elastic Chain, or an AggLayer. Users don’t either. Every ecosystem also needs connectivity beyond its walls, to the rest of crypto. This is where third-party interop providers show their importance.

Take Polygon’s AggLayer as an example. It serves as a cross-chain settlement layer that links liquidity and users across any chain in the Polygon AggLayer ecosystem. Their integration of LI.FI is a case in point. AggLayer handles intra-ecosystem interoperability, while LI.FI provides liquidity rails to chains outside the Polygon economic zone. This dual approach, native rails for internal flows, third-party rails for external ones, is becoming the norm.

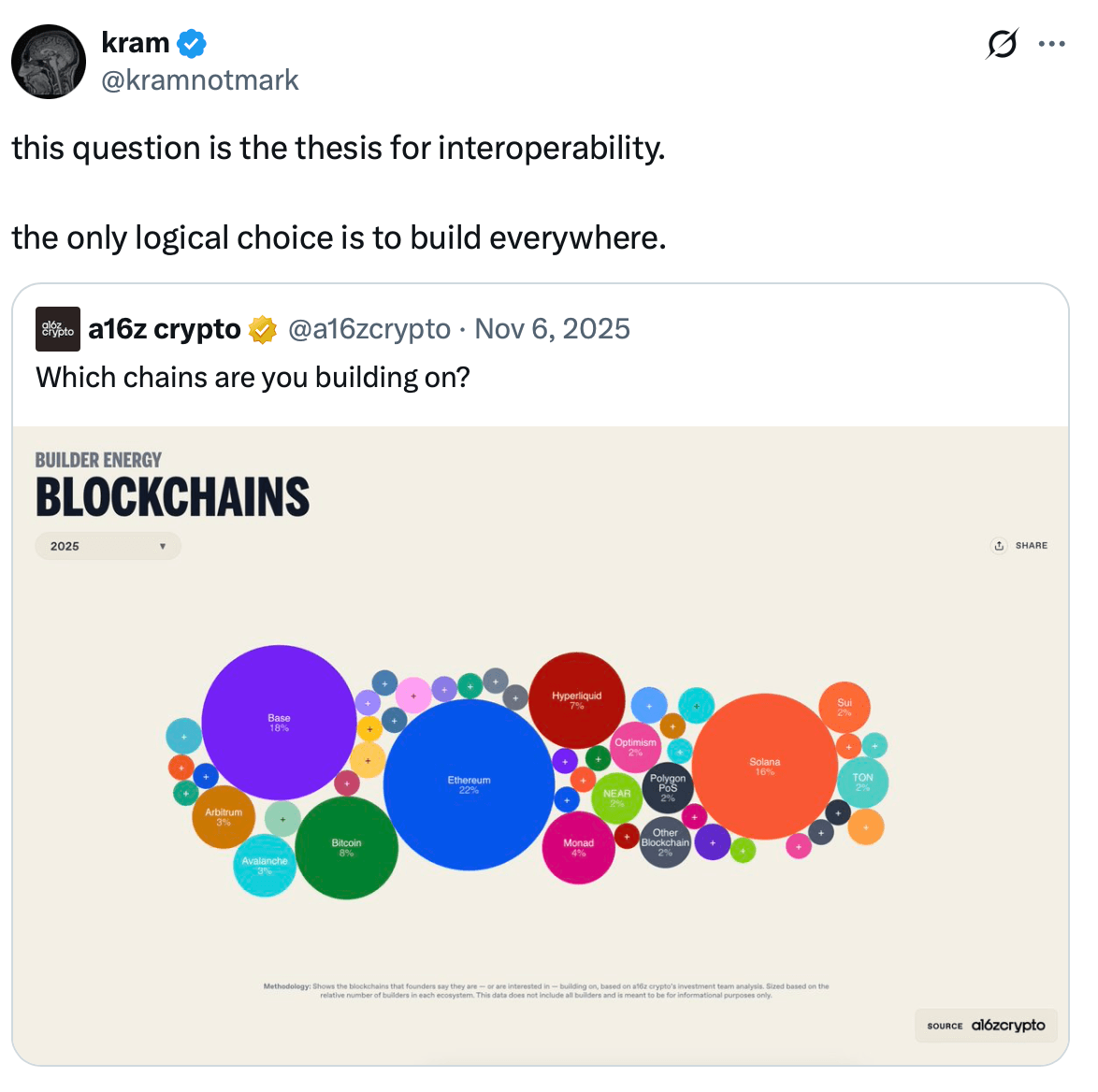

For a user and developer, the question should never be x chain or y chain – it should always be both x and y because that’s how you can make the most of the opportunities that crypto has to offer, and interoperability enables that.

Source: @kramnotmark

The Future… Any Action onchain?

If there’s one thing the last few years have made clear, it’s that cross-chain interoperability at the infrastructure layer is largely a solved problem. The major generalized interop providers now connect to every meaningful chain, bringing with them full suites of tooling, token standards, messaging, and generalized execution. For app builders and asset issuers, this means most chains are already within reach by default.

On the liquidity side, the picture is similar. The markets that matter are all connected through one protocol or another. Where there’s demand, there’s infrastructure offering access. Aggregators then sit on top of this mesh, stitching these liquidity sources into unified marketplaces for users and developers. In short, the infra layer is no longer the bottleneck.

Interop itself will never be “finished”. New chains and new environments will always emerge. But the core markets are connected, and the path to integrating the rest is well-understood.

What’s becoming more interesting is what happens above the infra layer, and how we can abstract the complexity further for users to make crypto usable and fit for mass adoption – interop has a big role to play here.

Anna Yuan, Founder of Perena, on the state of interop

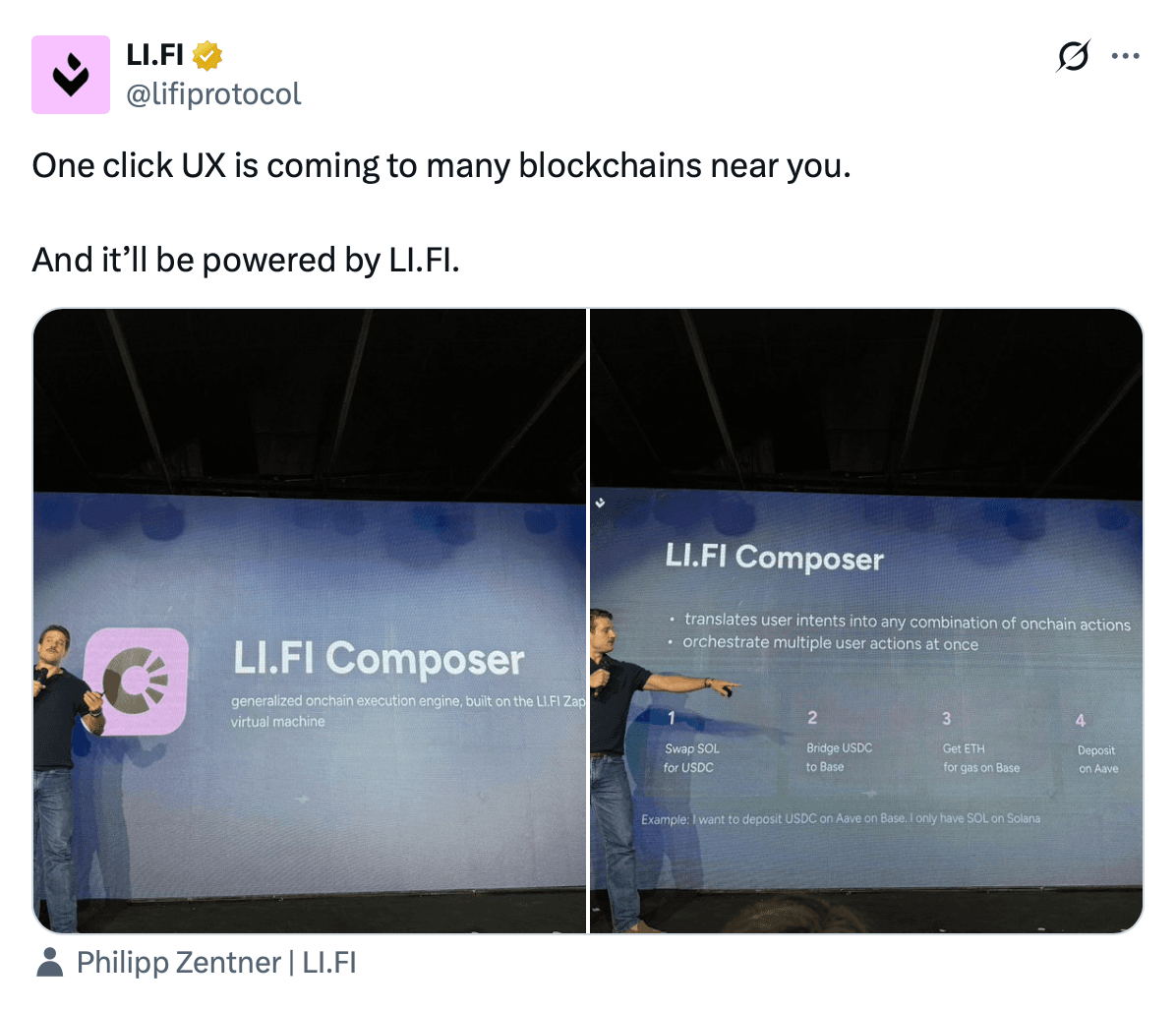

Interop has already expanded far beyond cross-chain use-cases. We’re now seeing solutions that compose and abstract all of this connectivity into smooth, application-level experiences. Resource locks, zaps, generalized intents, these are steps toward a world where any onchain action can be executed in a single click. The future is closer than it appears, and interop providers will be central in making it real.

Source: @lifiprotocol

Ecosystem-specific efforts follow the same arc: Ethereum’s Interop Layer (EIL), and similar vertical stacks for cluster-specific interop are all working toward that same outcome: 1-click for any action on any chain.

What’s Next

Interop has been progressing in the background, both in technological maturity and real adoption. It followed a pattern: slow, steady, and then, we look up and realize the world has quietly changed. Today, every serious project, from the blue chips of earlier cycles to the newest entrants, has adopted one or the other interop provider, in some way, shape, or form. They've all converged to the same conclusion: you can’t build in crypto without building across chains.

We already see complex applications operating across tens of chains, asset issuance scaling to hundreds, and liquidity moving seamlessly across them all. This is the reality of today’s crypto ecosystem, powered by interop protocols.

And the next wave is already visible: vaults that unify credit across chains, RWAs that can be accessed from any chain, and generalized intents that coordinate multiple complex actions in a single flow. This is the next frontier of interop.

Katia Banina, CEO of Bebop, on the state of interop

2025 will be remembered as the year interop accelerated, and the year it was effectively solved. 2026 will be the year it becomes crypto’s core thesis. And the years that follow will be defined by what builders choose to do with this new foundation. The logic is simple: without interop, crypto fails. It’s the substrate on which everything else rests.

This is the era interop has been building toward. Now it begins.

FAQ: The State of Interop for 2026

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.