LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Seashell Integrates LI.FI

TL;DR – LI.FI Is Powering Cross-Chain Swaps Inside Seashell

We’re excited to announce that Seashell, a smart portal for community-owned vaults to make DeFi easier for everyone, is using LI.FI to power xChain contract calls! What does this mean for users? A simple user experience that abstracts away the complexities of depositing into the Blueberry Vaults on Arbitrum.

What is Seashell?

Starting on Arbitrum’s Layer-2 chain, Seashell aims to create a simple user experience that seamlessly automates your DeFi routines and puts your tokens to work. One of Seashell’s first front-end integrations is with the Blueberry Vaults, built for both GMX users and stablecoin holders to maximize their rewards on GLP and USDC, respectively.

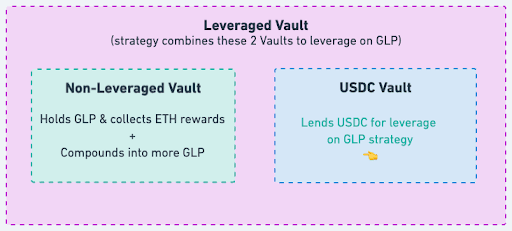

The Blueberry Vaults are a set of three vaults built with the user in mind. They provide distinct DeFi strategies without deposit/withdrawal fees. The Leveraged Vault amplifies GLP reward strategies, the Non-Leveraged Vault automates GLP compounding, and the USDC Vault provides a delta-neutral strategy to make an overcollateralized loan to the Leveraged Vault. These different, yet complementary strategies, allow users to participate in customized DeFi strategies to fit their own profile and needs.

GLP Non-Leveraged Vault increases APR by automatically turning GLP rewards into more GLP. Compounding happens at a dynamic interval to optimize rates. This vault does not utilize leverage. Who is this for? This vault is for those who seek to automate the GLP compounding process without borrowing more capital.

The USDC Vault generates returns by lending out the USDC. The USDC Vault lends to the GLP 3x Leveraged Vault, and there may be additional strategies in the future. The returns are in the form of USDC and calculated from a utilization curve and a percentage of the GLP rewards earned by the leveraged borrowers. Who is this for? This vault is for those who seek a delta neutral method of earning rewards from lending USDC. Here are some features of Seashell and the vaults it currently supports:

Arbitrum-native - Fast transactions with low fees.

No Caps, Maximum Flexibility - No caps on deposit size and funds can be withdrawn at any time.

Capital Efficiency - Specific target leverage ratios and optimized timing of compounds.

No Hidden Fees - No fees are taken from the front-end or smart contracts, unlike many other Vault systems.

Security - Passed the CertiK audit with 0 identified vulnerabilities of medium or greater severity levels.

And most importantly,

Cross-chain swaps - With the integration of LI.FI, users can seamlessly bridge and swap their tokens across 15+ chains in 1-click.

What is LI.FI?

LI.FI is the most advanced bridge and DEX aggregator with smart routing capabilities to find the best route to move any asset on any chain, to another asset on another chain. We have added support for 13 bridges across 15+ EVM-compatible chains, along with all DEX aggregators & DEXs on those chains, into a single solution that is available as an SDK, Widget, or API.

We believe Web3 need to be made available for not only the next million users, but for the next million developers to build on it as well.

Our SDK is the ultimate cross-chain money lego for dApps to build on top of or plug into themselves.

We've integrated multiple fallback bridges + DEXs so that you don't have to

We maintain bridges + DEXs so that you don't have to

We choose the best bridges based on our research so that you don't have to (positioning ourselves neutral)

For some examples of how LI.FI works, check out:

MetaMask Bridges - API Integration

Superfluid - Widget Integration

Alchemix - SDK Integration

Under the hood

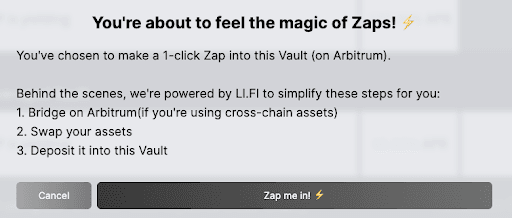

Let’s look at the transaction flow for depositing into the Vaults without LI.FI. First, users would need to bridge funds over to Arbitrum, go to the GMX platform, buy GLP tokens, and then head back to Seashell to deposit GLP into the Blueberry vault.

Now, with the full integration, users can deposit any asset from any chain directly into their desired Vault, and the bridging and swapping are automatic. With just 1-click, everything runs in the background—from finding the best bridge to Arbitrum, to buying GLP, to making the Vault transfer.

The partnership between LI.FI & Seashell achieves a seamless user experience to make DeFi easier for everyone.

To learn more about Seashell check out their:

FAQ: Seashell Integrates LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.