LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

LI.FI 2.0: Expansion

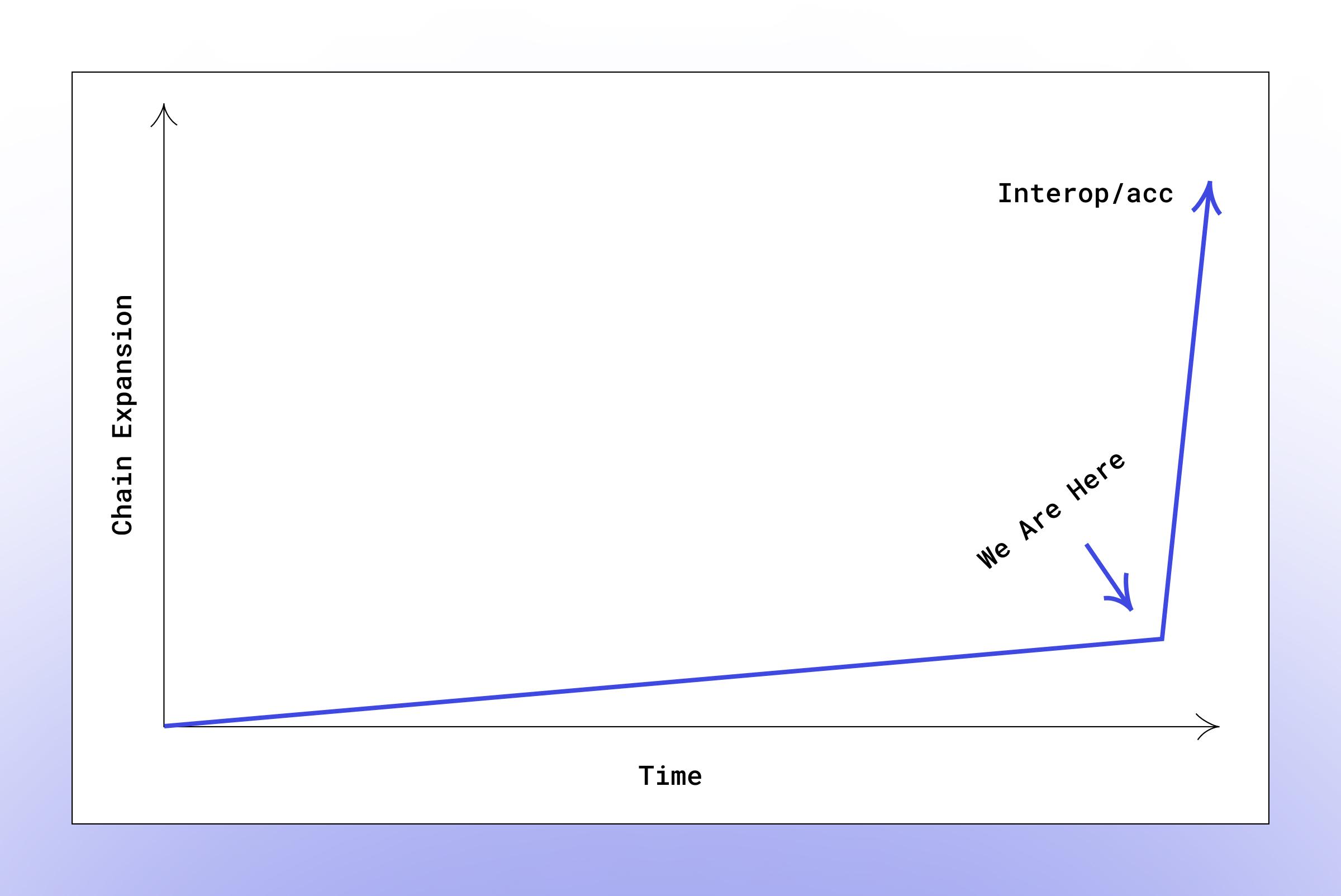

When we started LI.FI in 2021, we had a simple thesis: the future is multi-chain. A few years later, that future is here. New ecosystems, new virtual machines, appchains — it’s all happening.

The pattern so far for chain expansion has been linear. What’s coming next will be exponential.

We’re at the inflection point.

We’re headed for a world with so many chains that without interop protocols, fragmentation will hit levels no ecosystem can sustain. The only question is how fast, and whether we’ll be ready when it does.

The good news is that interop protocols have already set the foundation. Today, we’ve deployed endpoints across hundreds of chains and solved the core problem: letting users move liquidity between the most active chains.

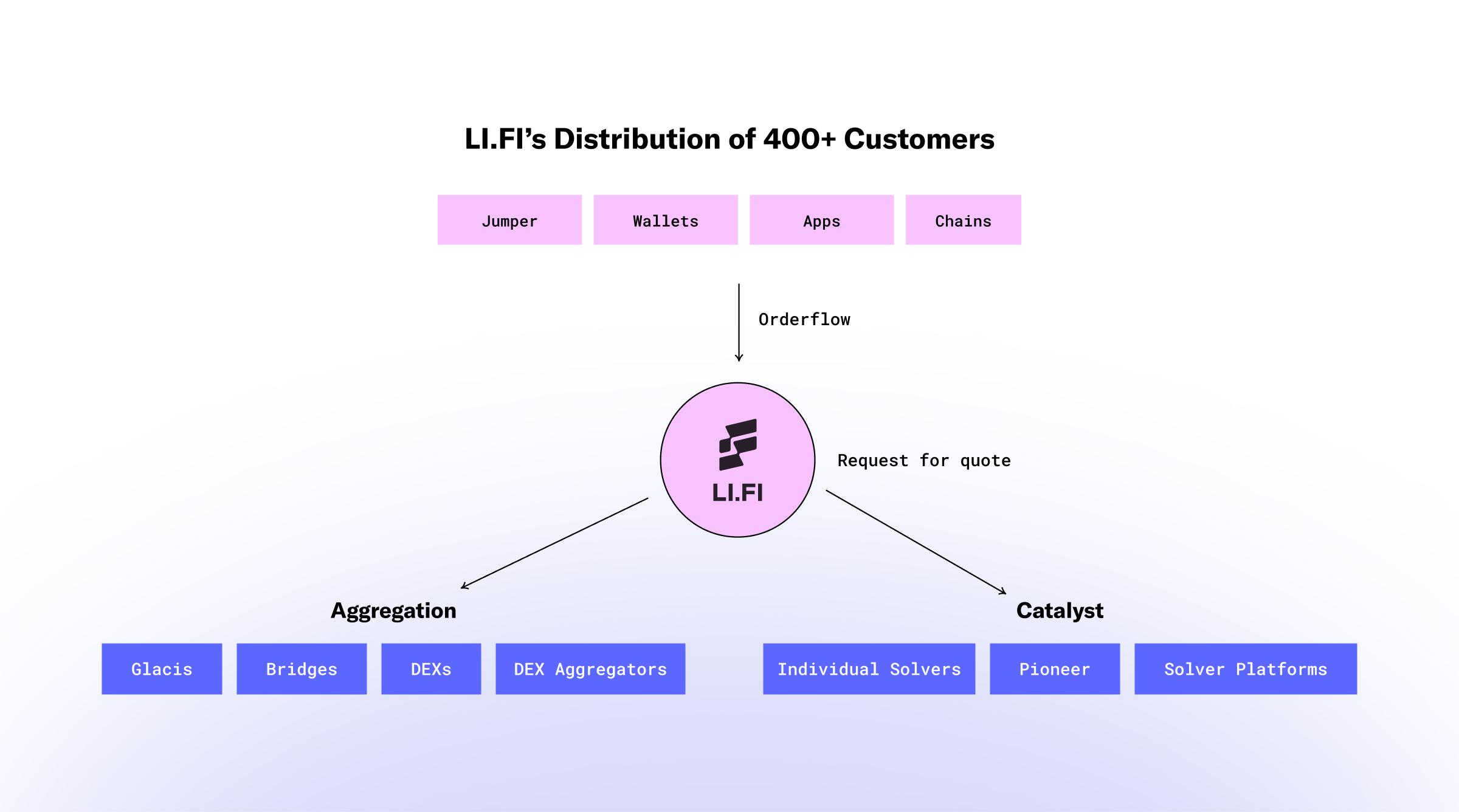

LI.FI connects 30+ chains across VMs and has found product-market fit as the liquidity aggregator for the multi-chain ecosystem. One API to swap and bridge across the chains users care about. We’ve nailed this offering, and the adoption speaks for itself:

400+ customers, many of them enterprise

$20 billion in volume

30+ million transactions

5+ million users served

Every major wallet and app you’ve heard of uses LI.FI under the hood for swaps and bridging.

The Next Chapter

We began with aggregation on EVM chains because that’s where the action was. Then, as the landscape changed and user demand grew, we expanded to Solana and other ecosystems.

That’s our core belief: serving users where they are. Aggregation for all of crypto.

Today, we can proudly say that LI.FI’s aggregation service serves a real market and solves a real need.

But solving a real problem isn’t the end of the story. It’s the beginning. It’s time to take the next step in LI.FI’s evolution.

A few fundamental shifts in the ecosystem are shaping where interop and aggregation needs to go:

1) Everyone's launching a chain.

Each new chain or cluster creates another silo in the broader crypto landscape. Broken incentive structures push teams to build walled gardens or proprietary fixes for interoperability that only deepen fragmentation. These heterogeneous zones need to be made accessible.

The needs of crypto users and the demands on aggregators have evolved:

Aggregators need to support hundreds of chains, spread across heterogeneous zones.

Scaling across VMs is critical.

Speed matters. Early support for new chains is becoming table stakes.

2) Interop token standards are becoming the go-to choice for asset issuance.

Token issuers are no longer just sticking to one chain. There’s liquidity on Ethereum, Solana, and new chains are emerging every day that are potential markets they can tap into.

Expanding a token across chains without fragmentation requires interop token standards. This is the direction the market is headed: every major stablecoin launch recently has adopted interop token standards, while Circle has their own proprietary solution in the form of CCTP for USDC, Tether recently launched USDT0 using LayerZero’s OFT standard for USDT.

To be the best routing engine in crypto, we need to support all of these tokens and the evolving standards they’re built on.

3 a) Intents, where order execution is outsourced to third-party actors (commonly known as solvers), are becoming a core design principle for builders.

Users like quick and easy one-click UX that just works and intents deliver that. Some of the sharpest minds in crypto are building the picks and shovels for this ecosystem. We need to make sure that solvers can compete for LI.FI’s orderflow to ensure the best prices.

3 b) Chain abstraction, powered by intents and resource locks, is an emerging market.

Teams are experimenting with smart accounts, account abstraction, resource locks, and interop. There’s clear promise here, and we need to lead the way, unlocking the next generation of UX.

A shifting ecosystem demands a product that moves with it. How do hundreds of top-level applications keep pace in a space fragmenting faster than ever?

At LI.FI, we’re building the liquidity infrastructure to support thousands of chains and millions of tokens — to unify everything. The future of crypto aggregation starts now.

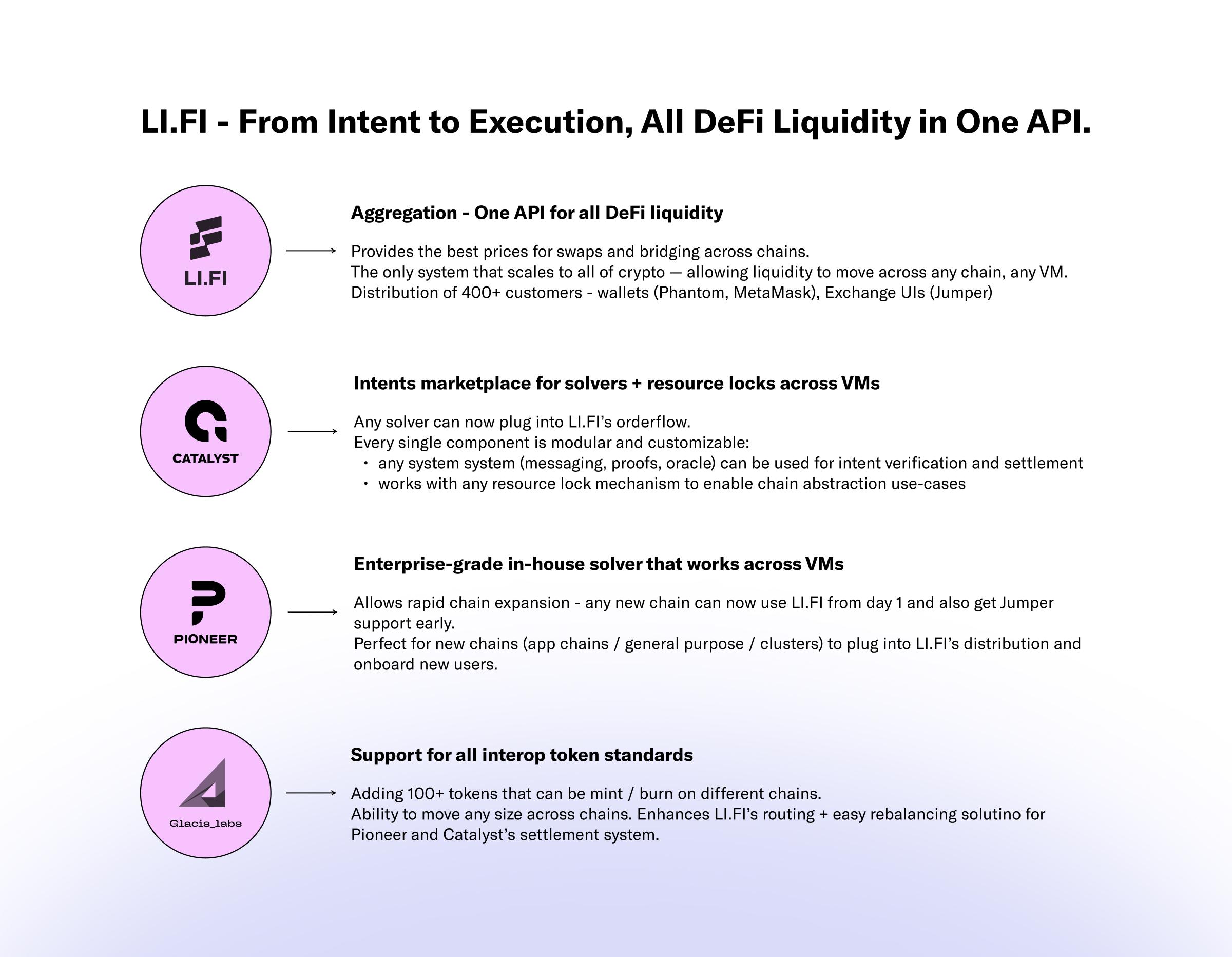

LI.FI – From Intent to Execution: All DeFi Liquidity In One API

Today marks an acceleration event to meet the demands of both today’s ecosystem and the one taking shape for the next decade. We’re thrilled to announce LI.FI’s expansion with the acquisition of Catalyst and an exclusive partnership with Glacis.

In a world with thousands of chains and liquidity sources fragmented across them, smart routing through just our current aggregation model gets harder. As new chains launch and liquidity sources multiply, providing the best prices means endless integrations, constant maintenance and reliance on third parties. These dependencies limit scalability and slow down chain expansion.

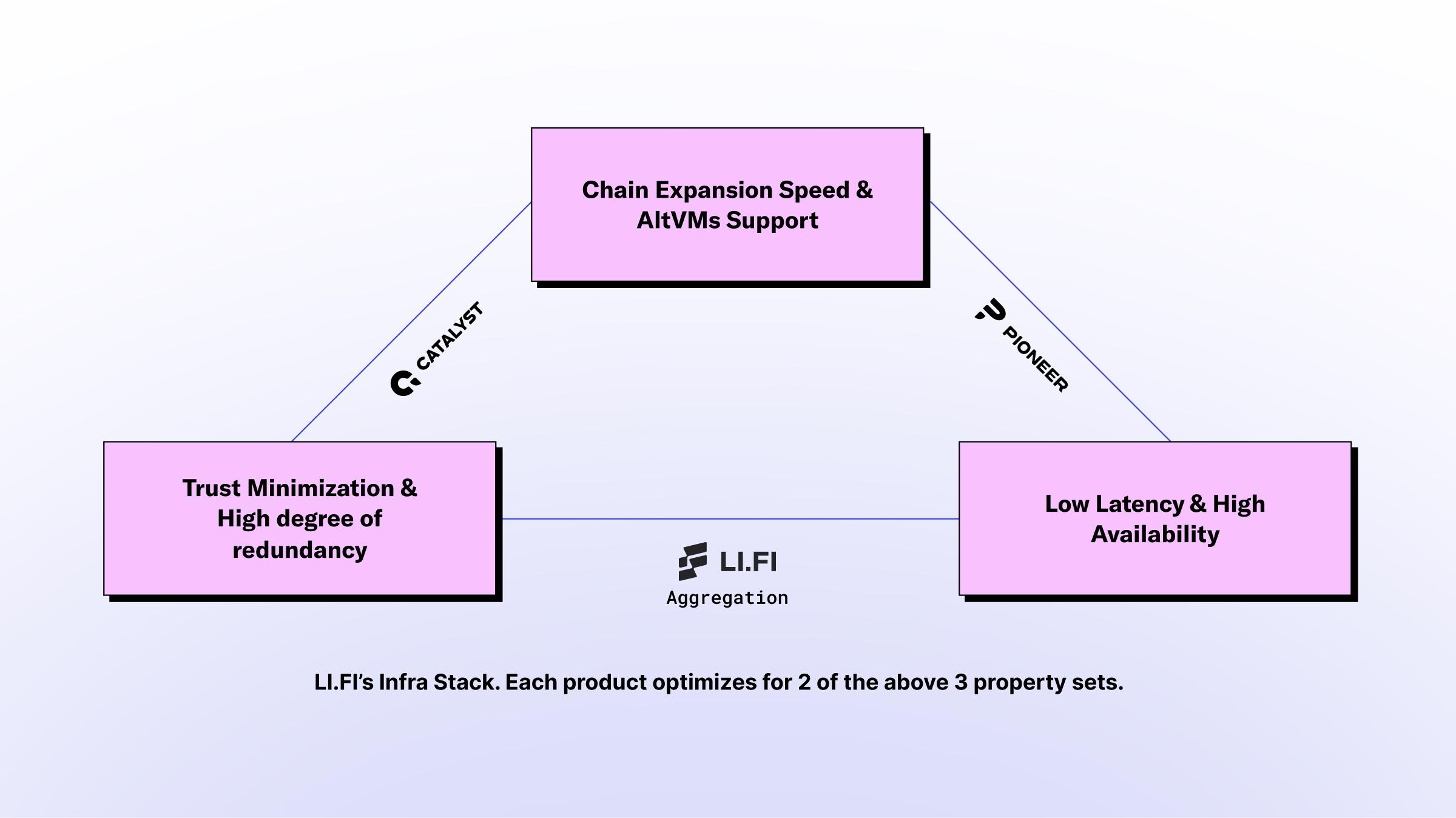

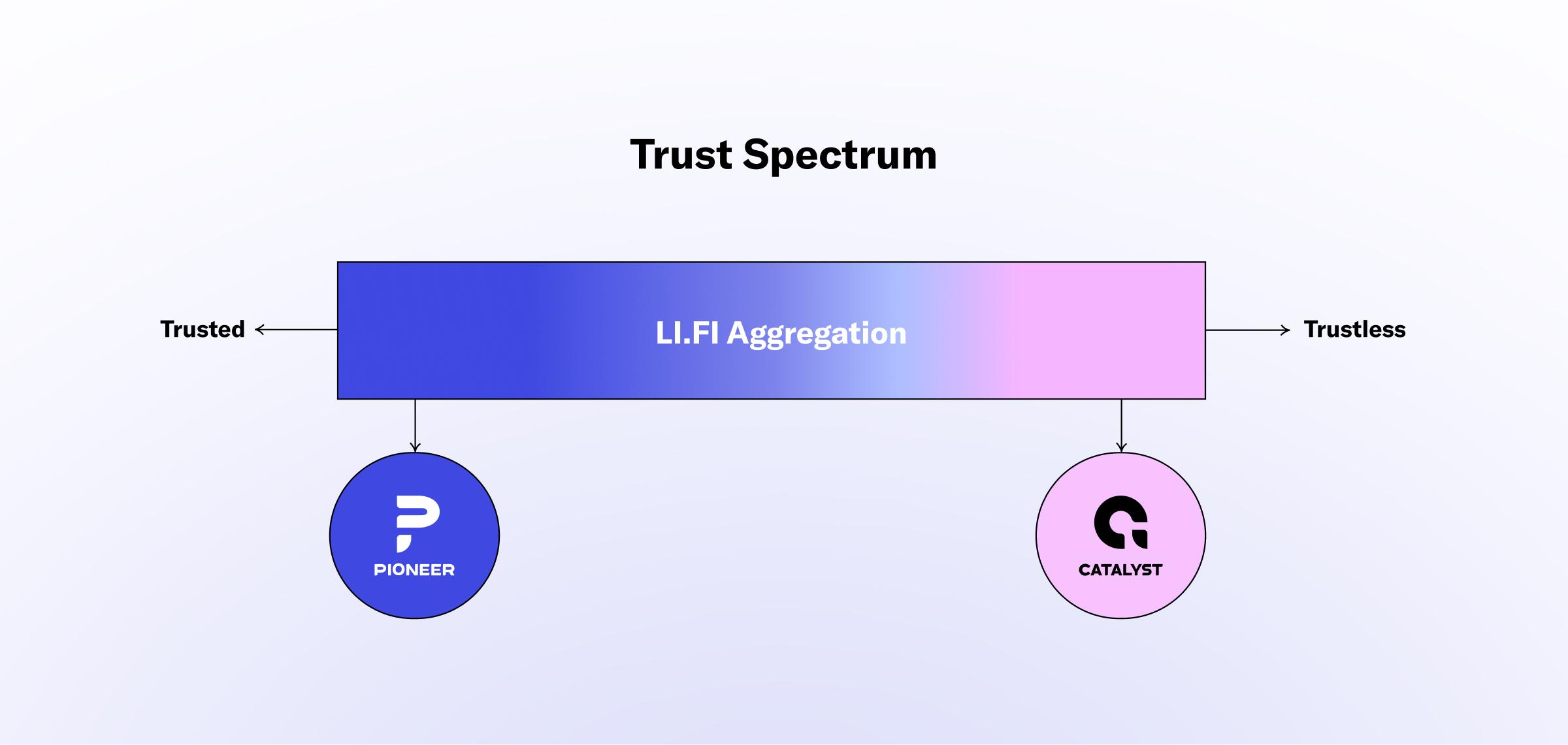

LI.FI 2.0 solves this by combining traditional aggregation with an intents protocol that outsources routing complexity to an open marketplace of solvers.

We’re building aggregation infrastructure that scales to any chain.

Catalyst

An intents protocol that works across any VM and outsources order execution to an open marketplace of solvers.

Catalyst is built on four core principles:

Extensible – Its architecture is highly scalable, enabling frictionless expansion to any chain and VM while maintaining performance efficiency – optimizing for minimized gas costs while enabling near-instant finality for cross-chain actions.

Permissionless – Catalyst is a pure protocol, entirely permissionless. Any solver can execute orders and anyone can run infrastructure that verifies intents. It supports any verification system (messaging, proofs, or oracles), ensuring that it always uses the most efficient solution for intent settlement, free from bias.

Trust minimized – Users only need to trust the protocol used for verification of the intent.

Modular – Every component of the stack is modular. From solvers to oracles, each component can be swapped out independently, giving developers full flexibility.

Catalyst As An Extension To Traditional Aggregation

Catalyst turns LI.FI’s aggregation into a true marketplace where solvers compete against each other and other liquidity sources in LI.FI’s routing to win orderflow.

With Catalyst, solvers can tap directly into LI.FI’s orderflow, enhancing our offering in several key ways:

Access to a wider variety of liquidity – Solvers can tap into any liquidity — on-chain pools, off-chain liquidity like on CEXs and OTC desks, or even their own inventory – in order to give users the best price for their orders.

Best prices – Every order is compared to quotes across sources, making sure solvers are competing with every liquidity source in the aggregation. This ensures that users always get the best prices available.

Gasless swaps – Users can pay gas fees in the input token itself, so they don’t have to worry about keeping gas tokens on every chain they use.

Catalyst improves on existing intent systems in the market by avoiding the classic chicken-and-egg problem that plagues them — attracting solvers requires orderflow, and orderflow only comes if there are solvers (liquidity begets liquidity). With LI.FI’s distribution, we provide the orderflow, naturally incentivizing solvers to fill orders in Catalyst.

Catalyst As The Settlement Layer For Intents

With Catalyst, we are building an intent protocol that is purpose-built for resource locks.

Teams using resource locks in smart accounts to build chain abstracted experiences can plug Catalyst in as a settlement layer. With Catalyst, your products can execute instant, generalized intents on any chain (or VM) in a trust-minimized manner for end users.

Why use Catalyst as the settlement layer?

More solvers, better execution – Catalyst is an open marketplace and any solver can permissionlessly join to execute orders. Multiple solvers compete to fulfill user intents, improving liquidity and order execution quality. And to ensure reliability, we’ve built our own in-house solver (Pioneer) — so orders always get filled.

Flexible settlement with any verification system – Most settlement layers lock you into a specific verification system, usually the one run by their own team. Catalyst doesn’t. With Catalyst, you can choose the verification system that fits your needs best, whether it's storage proofs, interop protocols, or even a centralized server signing messages off-chain.

Quicker settlement times – Catalyst’s settlement architecture enables solvers to be repaid within 30 minutes on average, way faster than the industry norm. That means they need less working capital, which makes everything more efficient.

Rapid chain expansion and cross-VM compatibility – Catalyst is built to scale seamlessly across chains and VMs, making it easy to expand into new ecosystems.

Any auction, any order type – Whatever auction mechanism (RFQ, sealed-bid, etc.) or order type (bridging, gasless orders) you want, if the system can produce a settlement proof, it’ll be supported in Catalyst’s settlement layer.

One integration, all the benefits – Once you’ve integrated Catalyst, you get access to a network of solvers, full chain support, and a settlement layer that works with any verification system. No extra integrations needed.

Chain abstraction is still in its early days. With Catalyst, we’re excited to push it forward — expanding the market, improving the tech, and enabling teams to build crypto UX that feels as effortless as using a remote control. The best is yet to come.

Pioneer

Pioneer is an enterprise-grade in-house solver and fast-bridge that can support any chain (on any VM) in just an hour. This allows us to expand our chain coverage rapidly and work with chains to onboard new users into the ecosystem.

The goal here is simple: bootstrap liquidity between routes and onboard users to a new chain. Long-term, Catalyst takes over.

Once order flow is kickstarted on a route with Pioneer (or in general via LI.FI), Catalyst can turn it into a marketplace where any solver can tap into the orderflow.

Pioneer fills the gap. Catalyst drives us closer to a trust-minimized "intents everywhere" future.

Glacis

Glacis aggregates interop protocols, making it possible to support any interop token standard – OFT (LayerZero), NTT (Wormhole), Warp Token (Hyperlane), ITS (Axelar), CCT (Chainlink), and beyond.

Hundreds of tokens are already being issued on these standards and soon, everything – from stablecoins to canonical tokens of chains to RWAs to memecoins – will follow. Supporting these tokens in our routing is non-negotiable.

That’s where Airlift by Glacis comes in. With Airlift, LI.FI can support any token on any chain, issued on any of the leading interop token standards.

This means:

Better pricing – Lower costs than traditional bridging, thanks to direct mint/burn, which skips liquidity pools and the fees they come with.

Improved routes – You can move any size with these tokens across chains, with zero slippage.

More tokens – Over 100 new tokens available that can be moved across chains effortlessly with mint/burn token bridging, and more new tokens will be added every week.

Interop token standards allow us to move capital across chains with no slippage. This approach offers a highly efficient rebalancing mechanism and we intend to use the direct mint/burn feature to address the rebalancing needs of Pioneer and any solver within Catalyst.

Additionally, Catalyst’s flexibility, supporting any verification system for solver settlement, positions it as the ideal protocol for addressing any solver’s rebalancing needs. We’re excited about using Catalyst as the clearing house for intents, which will unlock significant netting benefits for solvers.

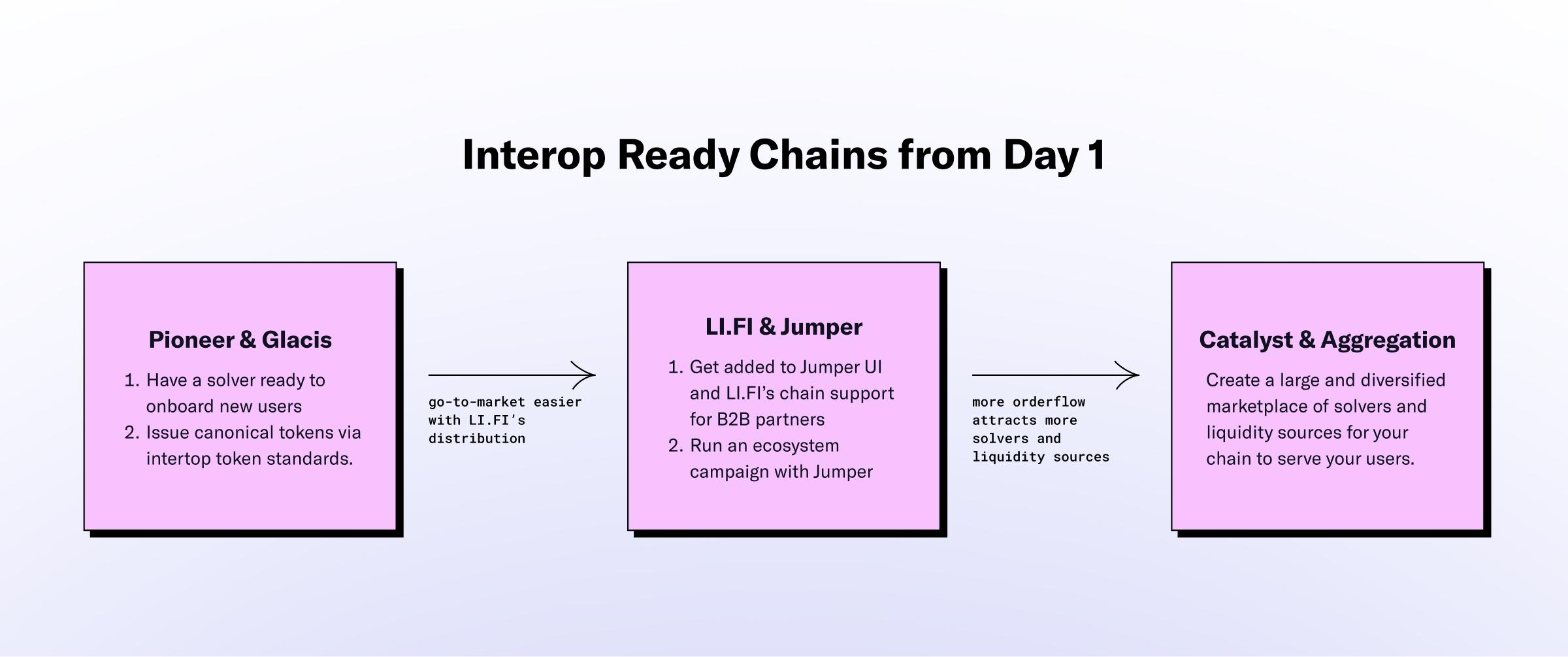

With LI.FI, Chains Can Have Interop Solved From Day 1

One of the biggest opportunities with LI.FI’s new stack is that new chains can have interoperability solved from day one.

Pioneer – Start by spinning up a solver and fast-bridge to handle routes between your new chain (any VM) and others, making user onboarding easy.

Glacis – Easily issue canonical assets using any interop token standard. These tokens will be added to LI.FI’s list of supported tokens and be available to our distribution partners.

Catalyst – As order flow builds, add more solvers to these routes with Catalyst’s intent marketplace, scaling up without the friction. Moreover, you can also build chain abstracted user onboarding UX with Catalyst using resource locks.

LI.FI and Jumper distribution – Pioneer and Catalyst will be directly integrated into LI.FI and Jumper, making it effortless for chains to get added to our routing and be made available to all of our partners and users.

We’re rewriting the playbook for distribution and user acquisition for new chain launches in real time with LI.FI. If you’re launching a new chain, we’re ready to help you bake in interop from day one, so you can onboard users and liquidity effortlessly.

LI.FI 2.0

By bringing in more like-minded people with deep interop expertise, we’re ready to accelerate LI.FI’s growth.

We’re going all in on scalability, reliability, and speed. Catalyst, Pioneer, and Glacis are at the forefront of our expansion efforts, enabling us to scale quickly, work across any VMs, and deliver a more dependable customer experience.

We’re also in the process of rolling out a data-driven, graph-based routing algorithm designed to optimize high availability and minimize latency – ensuring more efficient and reliable execution at scale.

This is LI.FI 2.0. A system that scales with crypto’s expansion. A system designed to solve crypto’s deepest liquidity challenges, at scale, across chains, without friction.

To anyone building in crypto, whether it's a chain, a wallet, or the next killer app, we should talk. At LI.FI, we're building the best abstraction and aggregation solution available on the market that redefines how value moves across chains. So you can build anywhere, access all users and liquidity across DeFi — seamlessly.

FAQ: LI.FI 2.0: Expansion

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.