LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Ionic Integrates LI.FI to Enable Seamless Cross-Chain Swaps

TL;DR – LI.FI is powering cross-chain swaps inside Ionic

We’re excited to announce that Ionic, a money market for yield-bearing assets on the OP Superchain, has integrated LI.FI! The integration enables users to execute seamless cross-chain and same-chain swaps across 20+ leading chains and L2s, including Ethereum, Scroll, Arbitrum, Linea, Polygon, Base, BSC, and more!

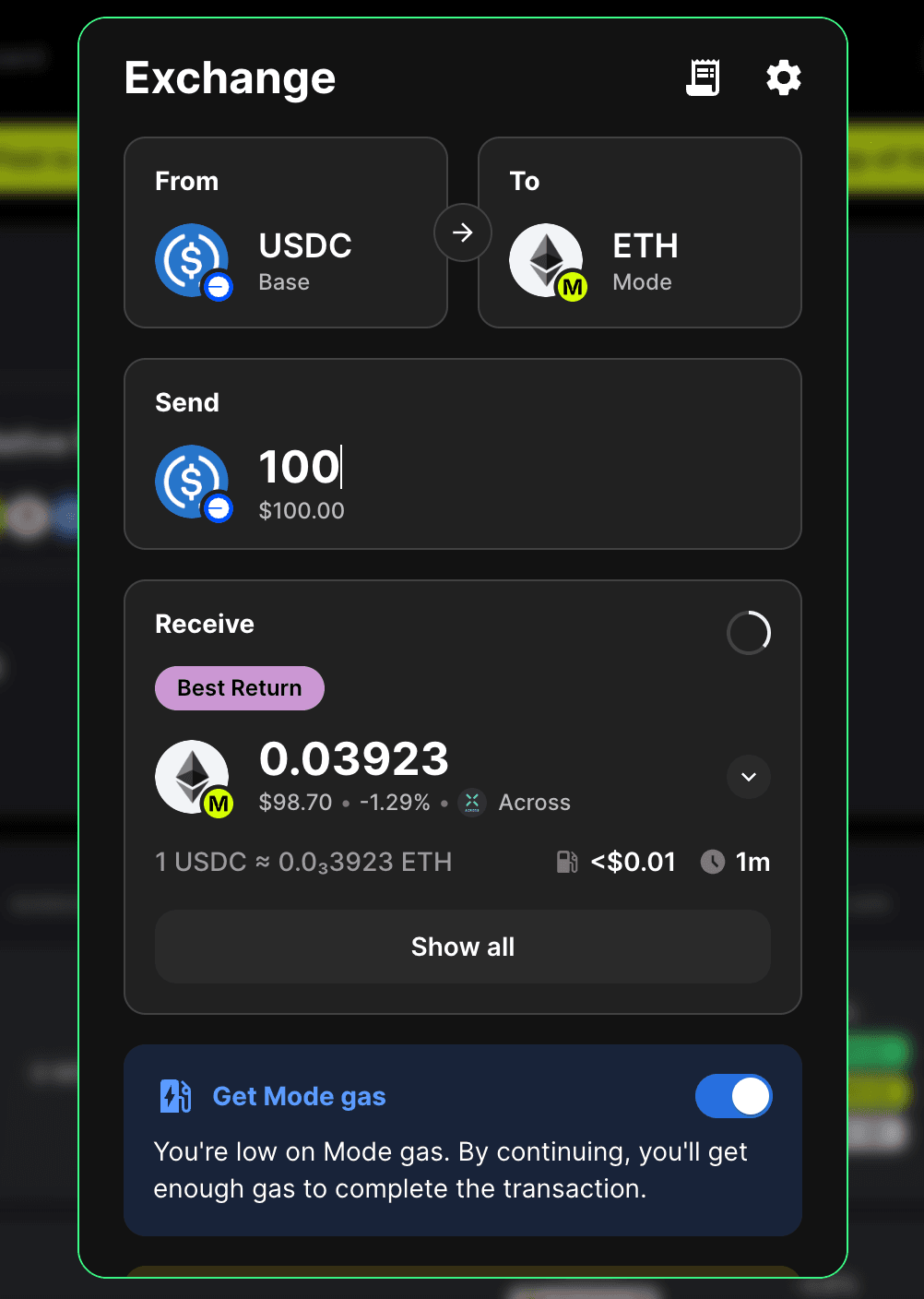

For example, a user can go from USDC on Base to ETH on Mode or any other combination of tokens/chains without leaving Ionic’'s platform.

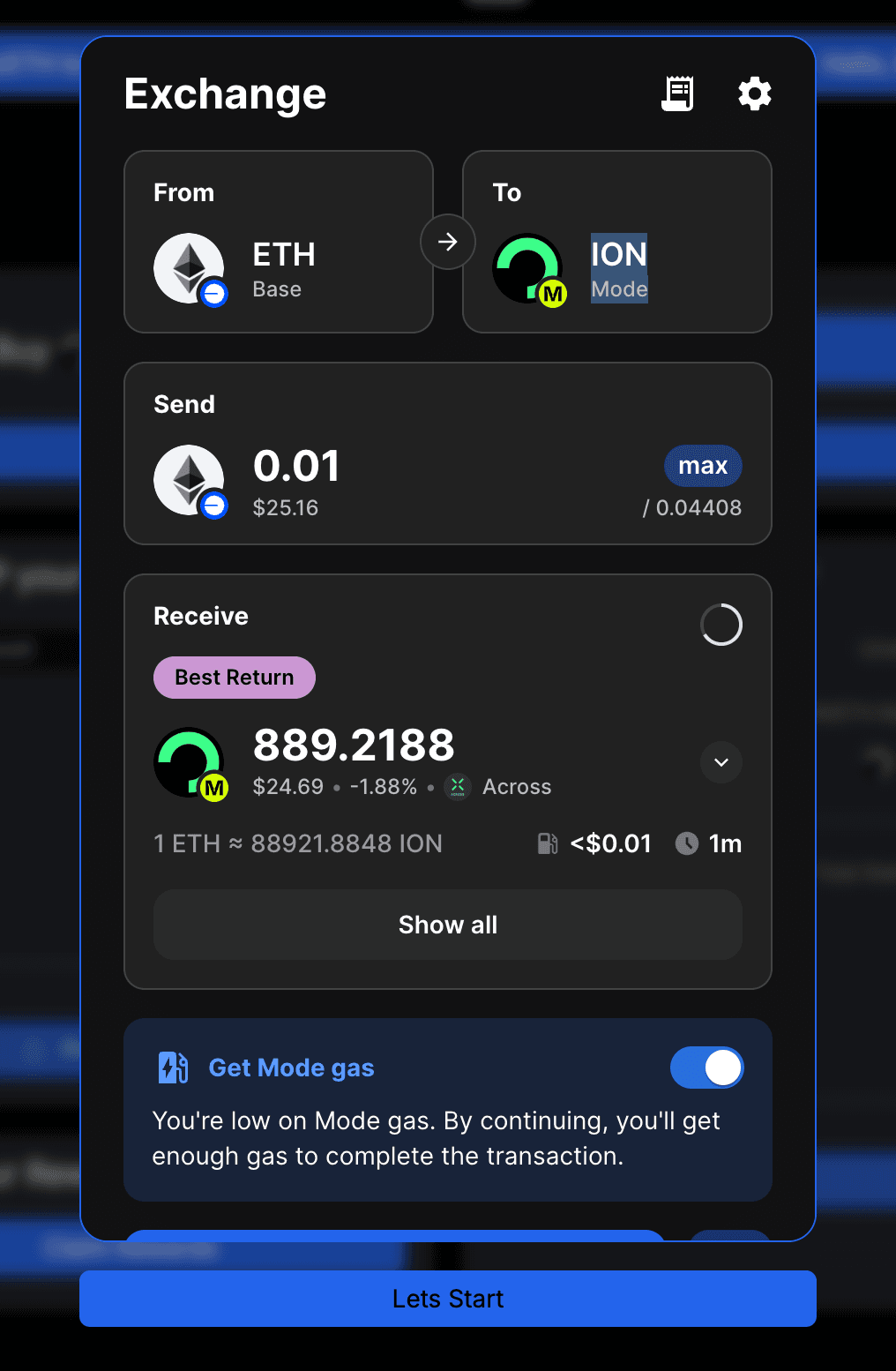

Furthermore, if users want to stake their native token (ION), they can swap it inside the platform.

In the background LI.FI does the heavy lifting by searching through its 18 integrated bridges (Across, Stargate v2, THORChain, Symbiosis, Circle CCTP, Allbridge, and more) to find the best available route to move funds between Arbitrum and Base. In the example above, we’re being routed through Across.

Additionally, LI.FI has integrated 35 DEXs, DEX aggregators, and Solvers (Uniswap, 1inch, 0x, Sushiswap, Enso, + others) to ensure users get the best swap rates on their assets.

We’re thrilled to partner with Ionic to make the cross-chain universe simple for anyone to use. Try out cross-chain swaps on Ionic here.

What Is Ionic?

Ionic is a decentralized non-custodial money market protocol, supported by a comprehensive security monitoring failsafe system.

Ionic gives users complete control over their funds by providing best interest rates across the Superchain with Dynamic interest rates powered by Adrastia.

With a meticulously designed tokenomics model, Ionic aims for robust and long-lasting growth, cultivating exemplary conduct among all DeFi participants for the collective benefit of every stakeholder.

Key Features:

Unrivalled asset support: Biggest variety of supported assets on Mode Network, expanding across the Superchain to include LRTs, LSTs, and all of the major tokens available on any network, with the ability to easily add new asset classes as new protocols onboard onto the OP Stack.

Looping: One-click looping to open a leverage position on the desired assets.

veTokenomics: a veION token model sits at the center of its multichain infrastructure, ensuring optimal capital utilization in every pool.

To learn more about Ionic, check out their:

What Is LI.FI?

LI.FI is a middleware solution connecting 25 EVM chains and Solana via 18 bridges, 25 DEXs, 8 DEX aggregators, 3 Solver networks (and growing).

LI.FI’s product portfolio features sophisticated white-label B2B solutions that not only allow same-/cross-chain swapping capabilities but also grant arbitrary contract calls for the implementation of advanced cross-chain strategies such as yield aggregation, LP-zapping, NFT purchasing, and many more. We believe Web3 needs to be made available not only for the next billion users but also for the next million developers to build on it.

Our SDK is the ultimate cross-chain money lego for dApps to build on top of or plug into themselves.

We've integrated multiple fallback bridges + DEXs so that you don't have to

We maintain bridges + DEXs so that you don't have to

We choose the best bridges based on our research so that you don't have to (positioning ourselves neutral)

FAQ: Ionic Integrates LI.FI to Enable Seamless Cross-Chain Swaps

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.