LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

If You Just Heard About Hyperliquid

A Latecomer’s Guide to Hyperliquid

Hyperliquid is everywhere right now. Mindshare feels higher than ever, which is impressive given how much attention it already commanded over the past year.

The timing of this essay might look deliberate but it isn't. Six months ago at LI.FI, we set out to build the most comprehensive bridging and swapping solution for the Hyperliquid ecosystem. That meant giving one PM, Ali (@0xasrequired), free rein to chase his Hyperliquid bag bias. And, as always happens when someone builds for their own bags, he delivered. Today LI.FI offers the best coverage into Hyperliquid from 50+ EVM chains, Solana, Bitcoin, and Sui – with 5 integrated bridges, 9 dex aggregators, and countless optimizations only possible when you’re deep in the trenches. You can move assets to HyperCore and HyperEVM in 3–6 seconds, with minimal fees. Credit where it’s due. Thank you, king Ali.

But products like ours only exist because Hyperliquid itself did what most projects can’t: create gravity. Billions in liquidity, a user base that actually knows DeFi, a cult-like community, and builders who don’t need grants, they just want HYPE to succeed. You can’t fake that. It only happens when a team makes a long series of hard calls and gets them right.

So the question is I keep coming back – what did Hyperliquid do right that others missed? Many projects have thrown money at users and builders. None of it stuck. Hyperliquid somehow pulled it off.

This essay is my attempt to answer why. It’s written for people outside the Hyperliquid bubble, the ones who just saw it dominate their timeline and are wondering why it has such gravity. You’re late to the party, but zoom out and it’s still early.

My TLDR is that the Binance and BNB comparisons are valid. In fact, that’s the base case now.

To explain why, we’ll start with the attention flywheel, the liquidity moat, and the culture that formed around them. Then we’ll dive into the tech stack and distribution playbook designed to house all of finance.

Let’s dive in!

Attention → Speculation → Allocation

Most people writing about Hyperliquid focus on the liquidity sink. That matters, liquidity is the foundation of everything in crypto. But the better question is how it got there. How did Hyperliquid build millions in perp and spot liquidity, $5B locked in the Arbitrum <> Hyperliquid bridge, and $2.5B+ across the ecosystem?

The answer: before it nailed the liquidity flywheel, it nailed the attention flywheel. And attention is harder. You can’t brute-force it with money. You win it by aligning with what people already want.

Hyperliquid leaned into the points meta early, right as the bull market had everyone hungry for speculation. Their program launched November 1, 2023, and ran exactly one year. It rewarded users for the actions that mattered — trading perps and spot, depositing funds, providing liquidity. The rules were simple, transparent, and hard to game. Both small traders and whales felt it was fair, and unlike other points systems, there was no drama.

But the real magic was timing. Q4 2023 is when the bull market really started, when things started to moon on Solana and users had just tasted their first real windfall with the Jito airdrop. Jito had a points program, a relatively small user base, and a high FDV launch, which meant everyone who qualified got paid – at least five figures, with some hitting six or even seven.

Once people see that kind of money fall from the sky, they chase the next one. Hyperliquid was perfectly positioned to capture that speculative energy – alongside Eigenlayer, the restaking crew, and a wave of high-profile airdrops like Jupiter, LayerZero, zkSync, and Wormhole.

Speculation then became allocation. Once users were in, they stayed. As a result, Hyperliquid’s traction never slowed. The metrics only moved one way – up and to the right, hitting new highs again and again. And funnily enough, their intern made sure to mark every points day (when points would be distributed to the community) tweet with a new ATH announcement. Hyperliquid.

Of course, points only get people in the door. To keep them, you need a product worth using. Hyperliquid delivered. They brought all financial primitives that traders care about, onchain. Everything from perps to spot markets were now onchain on Hyperliquid. Combining these markets with a centralized order book and world-class order matching engine delivered a trading user experience that felt as good as the best centralized exchanges and market depth that allowed users to go in and out of positions without leaving much on the table.

That era built loyalty in different ways. Some people stayed because they liked the product. Others stayed for points and the promise of an airdrop. Both groups kept the flywheel spinning. When I visited the Stargate office in London in late 2024, the only thing anyone wanted to talk about was Hyperliquid and what a single point might be worth.

Hyperliquid also nailed another key piece: giving traders the assets they wanted, exactly when they wanted them. At the height of the bull market, degens want hot tokens to be listed on exchanges, so that they can trade them and participate in the price discovery of the asset.

The streets will tell you how Binance, for all its size and glory, fumbled this badly. Instead of listing the tokens people actually wanted to trade during the AI and memecoin craze, they listed a stream of dubious projects with no product, no team, no credibility. (Remember ACT? I do, I fumbled that one really bad, lol).

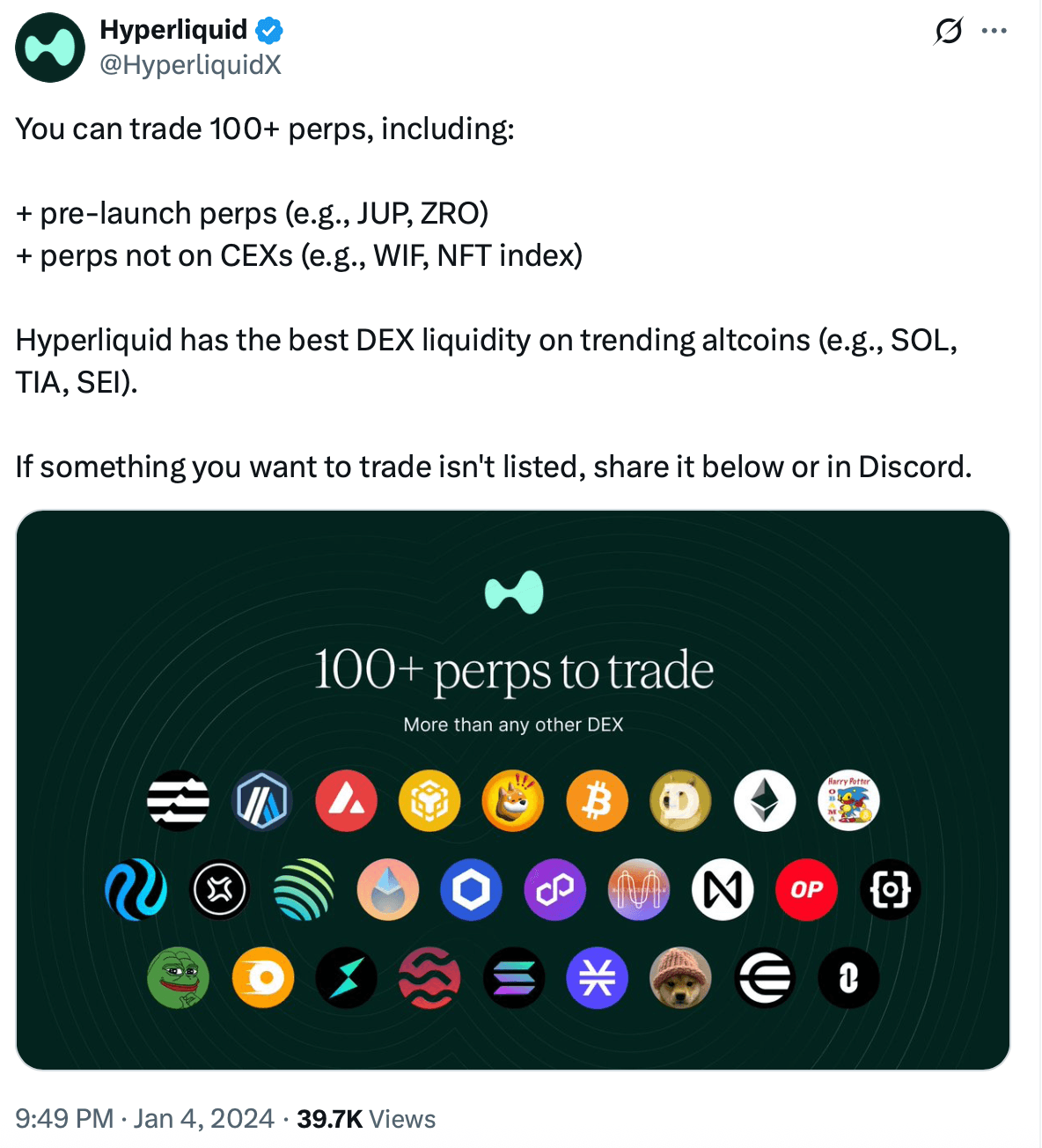

Hyperliquid went the opposite way. Hyperliquid has always been community first, and these are not just words but all their moves actually exemplify this belief. They listed assets instantly, based on community demand, from memecoins to tokens pre-airdrop.

Source: Hyperliquid on X

Over time, it became the default venue to speculate on future airdrops. Want to bet on LayerZero’s valuation before it launched? Hyperliquid had a market for it. This added a second layer of speculation – not just on tokens, but on which teams would deliver good airdrops at what valuations. Hyperliquid turned airdrop launches into pre-airdrop markets where onchain price discovery would happen, exactly how it’s meant to be.

The result of getting all these things right is a loyal user base and a deep, sticky liquidity sink. Liquidity is the gravity of finance. It decides where traders stay, where builders go, and where attention compounds.

But liquidity on its own is just numbers on a screen. What makes it durable is belief. And belief comes from moments that bind people to a product.

Airdrop → Loyalty → HYPE

From the start, people were hooked. The eventual Hyperliquid airdrop in 2024 sealed the deal. For many, it was the kind of windfall that changes your life. Generational wealth binds you to the thing that made it possible. You don’t just remember the protocol that made you money, you remember it like your first big break. It becomes part of your identity.

That’s the part most people skip over. Loyalty isn’t just about liking a product. It’s about what the product did for you. Users will say they love Hyperliquid, and many genuinely do, but their willingness to stay is multiplied when it also made them rich. Consumer psychology 101. We tie products to turning points in our lives. “This product changed my net worth and my life trajectory” is as strong an anchor as you’ll ever get.

The HYPE launch captured this perfectly. Interop lost the ticker (sorry Hyperlane), but everything else was flawless. Distribution was fair, FDV was high enough to deliver life-changing paydays, and price action did the rest, ensuring everyone stuck around.

HYPE is trading at an all-time high, moving into price discovery with clear skies ahead. The last ten days have seen institutions pile into the Hyperliquid ecosystem, going ga-ga over the USDH ticker. Source: Coinmarketcap

The price action of an asset can’t be understated. In crypto, it’s the clearest signal. Every tick is someone’s opinion about the future. When a chart goes up and to the right, it creates belief. Belief creates confidence. Confidence creates loyalty. That’s exactly what happened here.

Look at today’s builders in the Hyperliquid ecosystem. Most were early users. They bought into Jeff and the team’s vision to house all of finance onchain. They’re not just building for themselves, they’re building for the community and for HYPE. Every new product makes the token more productive and usable. The alignment between community, builders, and token is rare, and it’s the core of Hyperliquid’s success.

Some unique projects that embody this alignment and show the variety of markets on Hyperliquid include:

Kinetiq – kHYPE is the first trustless, fully onchain LST. Built with CoreWriter on Hyperliquid, everything, from key management to validator selection to rewards distribution, runs natively onchain. Kinetiq is so deeply embedded in the Hyperliquid DeFi ecosystem that kHYPE is far more than a passive staking token. Today, there are 13+ ways to earn points with kHYPE across the HyperEVM ecosystem, through lending, LPing, YTs, white-labeled vaults, and more.

Felix – The Felix Collateralized Debt Position (CDP) has been one of the main ways HYPE bulls increased their exposure: users deposit HYPE as collateral, and in return, Felix CDP lets them mint a native stablecoin called feUSD. Launched when HYPE was just $11.20, the system has worked out well for all parties, and today feUSD is a key asset within the Hyperliquid ecosystem. The team hasn’t stopped there. They launched Felix Vanilla in collaboration with Morpho, a more traditional borrow/lend product with a wider range of collateral assets. They also introduced USDhl to meet the ecosystem’s growing demand for a fiat-backed stablecoin.

Ventuals – Another project worth highlighting is Ventuals. What makes it unique is that it lets users trade startups before they IPO like OpenAI, SpaceX, Stripe, offering private company perps with up to 10x leverage. You can long your favorite companies or short the ones you think are overhyped. This type of market is popular in traditional finance, but even there it’s messy: pricing is opaque, lot sizes are restrictive, and trade agreements are complicated. The whole process feels anxiety-inducing, it’s kept me from participating myself. Ventuals makes that market cleaner and more accessible, with a simpler way to gain exposure. And because it’s onchain, it isn’t bound by geography, it can list the most in-demand pre-IPO stocks from anywhere.

Beyond these, many other projects, from HyperLend and Liminal to Blueberry, Hyperbeat, and Project X, expand the breadth of the Hyperliquid ecosystem.

Tech and Distribution Flywheel

Hyperliquid began as what looked like just another perps DEX. That fooled me too. If you only noticed it early on, you probably thought of it as a single tree, a healthy one, with thicc deep roots, but still just a tree. What wasn’t obvious then was that the tree was meant to become a forest.

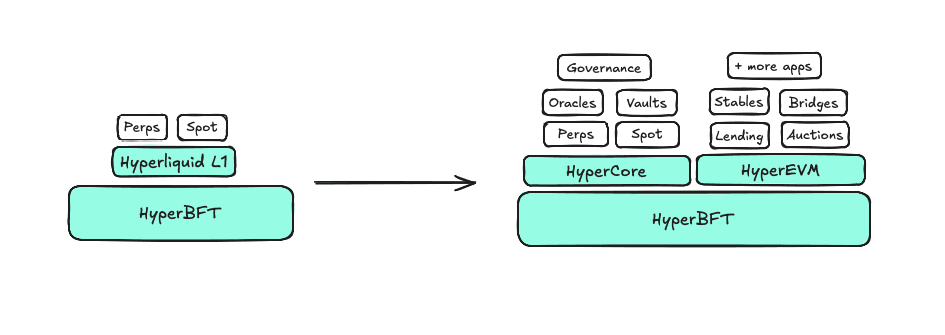

At first, Hyperliquid built an L1 from scratch, mainly to make a scalable perps DEX. Nothing unusual there, we’ve seen that play before. But once it pulled in real users and liquidity, the scope changed. The team and community realized they had the foundations for something bigger. Not just a perps DEX, but infrastructure for all of finance. That’s the path they’re on now.

Let’s plot the journey.

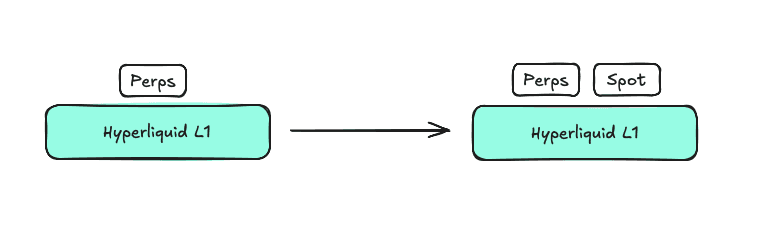

Hyperliquid’s story began in February 2023 with a perps DEX on its own chain, Hyperliquid L1, in closed alpha. The goal was always to build a CEX-like experience, but built onchain and community-first.

To really rival CEXs though, you need spot markets. Hyperliquid added them in April 2024, powered by two upgrades:

HIP-1 created a native token standard, so anyone could launch assets on Hyperliquid.

HIP-2 solved the usual cold-start problem for new markets with automated liquidity.

Now Hyperliquid wasn’t just a perps venue. It was moving toward becoming a full trading platform.

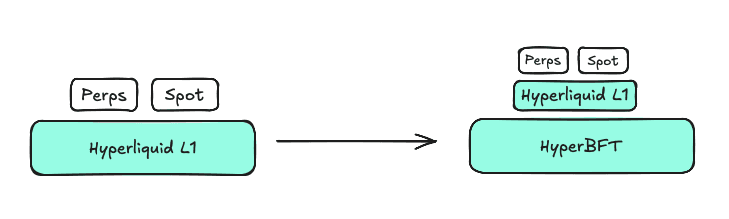

A few months later came a bigger leap. Hyperliquid replaced Tendermint with HyperBFT, its own consensus algorithm written in Rust. Tendermint capped out at ~20k TPS. HyperBFT pushed that 100x higher (though execution bottlenecks cap it closer to 200k orders/second).

Then came HyperEVM. This was the turning point. By adding an EVM chain with atomic composability with Hyperliquid’s markets, the team opened the door to new primitives: lending, auctions, and more novel applications.

The implementation of the move as an EVM blockchain with native connectivity with the Hyperliquid liquidity was also a masterstroke. Builders got familiar EVM tooling, but their contracts plugged directly into Hyperliquid’s CEX-like liquidity. A DeFi project could build, launch, and trade tokens entirely onchain, tied into the same order books moving billions on HyperCore.

At this point, Hyperliquid also clarified naming. The L1 execution engine for perps and spot was now called HyperCore. The new smart contract environment was HyperEVM. Both ran on the same blockchain, with the same validators, consensus, and state. The difference was purpose: HyperCore for trading, HyperEVM for smart contracts.

This sometimes confused users. When bridging in on Jumper, the UI showed two options: HyperCore or HyperEVM. It looked like two destinations. In reality, assets always landed in the same wallet address. The difference was just formatting:

Bridge to HyperCore if you wanted to trade perps or spot markets.

Bridge to HyperEVM if you wanted to use applications in the HyperEVM ecosystem.

It’s like a bank account. You might say “this is for savings” or “this is for checking,” but it’s all the same account underneath. On Hyperliquid, HyperCore and HyperEVM are just two ways of interacting with the same assets.

After the HyperEVM launch is really when you could start seeing that there was something much, much bigger at play here as more cards started to show and you could see the full elephant slowly taking shape.

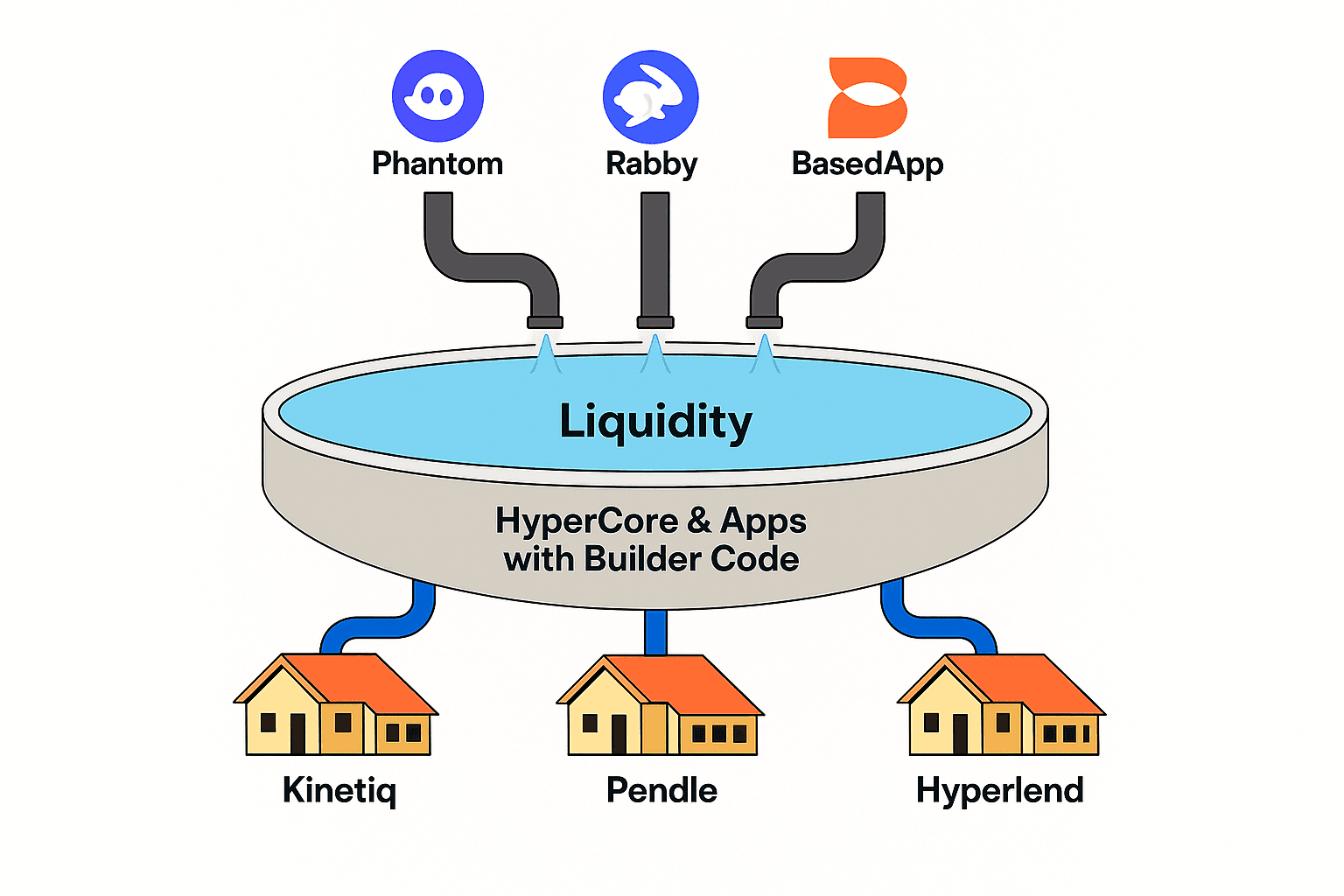

The narrative started changing and Hyperliquid began positioning itself as liquidity infrastructure the way AWS became cloud infrastructure. The model being: give builders access to world-class performance and liquidity, permissionlessly. CEXs have performance but no alignment. General chains have alignment but thin liquidity. Hyperliquid combines both.

The flywheel here is order flow. You need both demand (users trading) and supply (new markets to trade). Hyperliquid’s answer is builder codes and HIP-3.

Builder Codes

Crypto is a distribution game. Whoever owns the frontend owns the users, and once you have users, you tend to expand horizontally. You keep adding financial products to the same interface people already trust.

The product most of these apps add first is perps. It’s obvious why: people love to speculate, and perps are the purest form of speculation. For projects, that means more revenue. For users, it means more ways to trade without leaving the app. The problem is, building a perps exchange is hard. Liquidity is hard to bootstrap, and bad liquidity means high slippage and poor fills. As a result, most attempts flop.

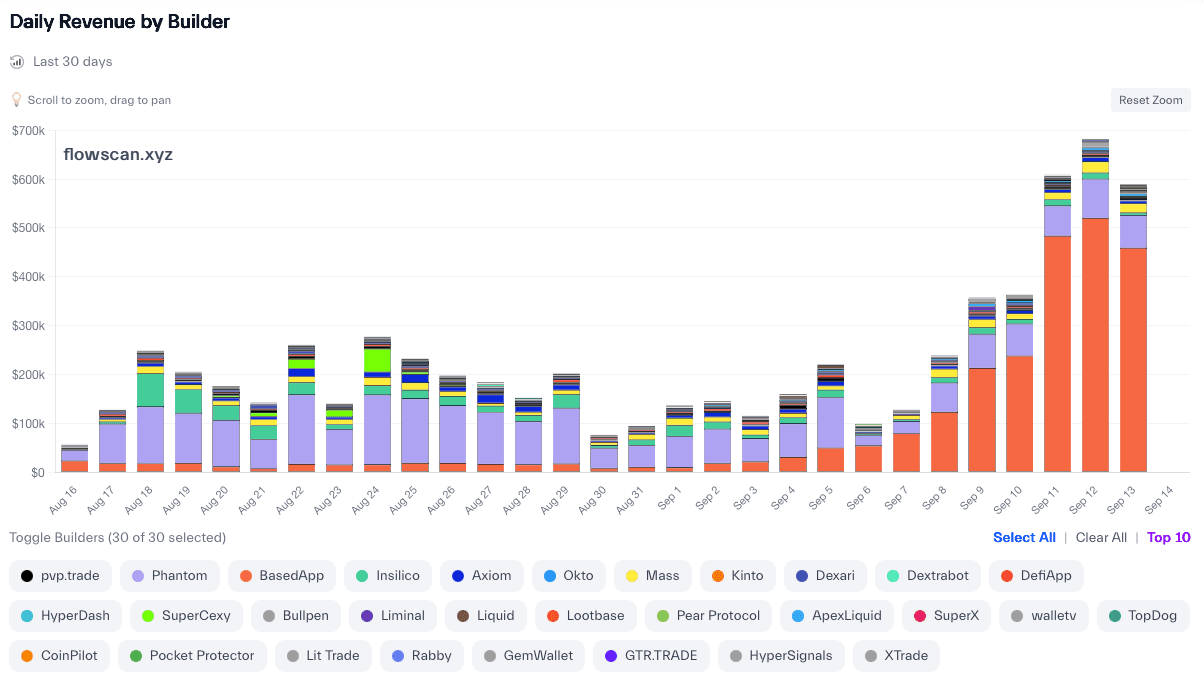

Builder codes solve this. They let apps plug directly into HyperCore’s markets. No need to build or bootstrap liquidity. Just integrate HyperCore perps via builder codes and your app can offer deep perps markets and earn revenue for doing it. Apps monetize their distribution, traders get CEX-level liquidity, and HyperCore gets more order flow. Everyone wins.

Like moths to a flame, teams are rushing to launch perps with builder codes. Two of the most notable are wallets, Phantom and Rabby, both already widely used, now looking to monetize their distribution. (Note: LI.FI’s built a clean deposit flow for these integrations: users can deposit into Hyperliquid perps from any token on any chain in one click. It’s already live on Rabby.)

The results speak for themselves. Projects like pvp.trade ($7.5M), Phantom ($5M), BasedApp ($3.1M), Insilico ($1.6M), and Axiom ($1.3M) have each made millions in revenue from builder codes.

Source: Hyperliquid Builder Codes (Flowscan)

This constant stream of orders, trades, and liquidations from different sources generates a deep and active pool of liquidity on HyperCore, which eventually benefits the whole Hyperliquid ecosystem.

Think of HyperCore as a reservoir. Builder-code apps are pipes filling it with water. Around the reservoir are towns, i.e., the apps on HyperEVM. Instead of digging their own wells and hoping to strike water, they can tap directly into the reservoir. They get instant, abundant liquidity.

For builders, this means no costly, time-consuming bootstrap of liquidity pools. For users, it means tighter spreads, lower slippage, and deeper markets. Everyone benefits from sharing and contributing to a single, deep pool of liquidity. And for the first time, we’re seeing a Central Limit Order Book (CLOB) model go mainstream in DeFi, displacing the AMM design that has dominated most ecosystems until now.

HIP-3

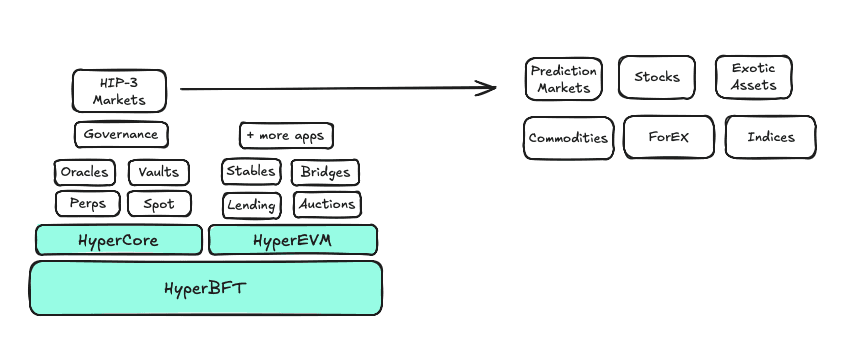

The Hyperliquid community is waiting for HIP-3, and for good reason. It’s the step that opens the door to every kind of perps market on Hyperliquid.

HIP-3 lets anyone permissionlessly create a perps market for any asset. Until now, new perps markets were curated. With HIP-3, the power moves to the community and third-party builders.

Market deployers can claim up to 50% of the fees their market generates. If you create a market people actually trade on, you earn. To keep quality high, deployers must also stake 1M HYPE. That ensures only serious builders take the risk, and ties the health of the markets back to the token.

We can expect all types of markets to come onchain on Hyperliquid with HIP-3. From prediction market perps to indices onchain, everything will be tokenized.

And as often happens on Hyperliquid, new primitives like HIP-3 serve as building blocks for even more unique financial products and services. A good example is Launch by Kinetiq — the first “Exchange-as-a-Service” (EaaS) platform built on HIP-3. It lowers the barrier to launching markets by letting deployers crowd-fund the 1M HYPE stake through Kinetiq’s LST architecture, democratizing access to HIP-3.

HIP-3 is the final boss of Hyperliquid’s vision to house all finance

Closing Thoughts

Big things never look big at the start. They look small, sometimes trivial. Only later do you realize those early moves were the first bricks in a cathedral.

Crypto is designed for this. It’s permissionless, so anyone can add a piece. Because it’s composable, those pieces fit together, like Lego. And when they click, the whole becomes larger than what anyone planned. Flywheels build on flywheels until the system takes on a life of its own.

That’s what happened with Hyperliquid. By building onchain and staying community-first, it created the right incentives for others to plug in. What looked like just another perps DEX became something else: attention → speculation → capital → sticky liquidity → real builders. Each step compounding on the last.

That’s the real moat. Not just liquidity, but the ability to absorb new legos, all aligned with the same incentives, all spinning the same flywheel.

If Hyperliquid keeps running this playbook, it won’t just add more financial primitives. It will make it obvious that crypto and blockchain is where all of finance was always going to end up.

Hyperliquid.

Thank you to @0xDamian0x, @alvinhsia, and @0xasrequired for the feedback on the article.

FAQ: If You Just Heard About Hyperliquid

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.