Crypto’s Distribution Playbook: Or, the DeFi Mullet

And Interop: the Mullet Under the Mullet

Every few years crypto gets its moment in the spotlight. For most of its life, those moments followed a predictable four year cycle: prices shot up, usually too far, people piled in, most got burned, and a few stayed. That’s how crypto grew, by booms and busts that left behind true believers.

Institutions seemed like they were part of the same game. They bought Bitcoin for their balance sheets, launched ETFs, or let clients trade it. Each time, people called it a turning point. But institutional adoption was usually a top, not a beginning. “Institutions are here” became a meme. They never brought the next billion users, because they never really embraced crypto. They just nibbled.

But this time is different, because institutions aren’t just experimenting anymore. They need crypto. For the first time, it’s in their best interest to go all in.

It’s ironic, because crypto started as a big “fuck you” to institutions. The whole point was to build outside the system. And yet, ever since I’ve been in crypto, there’s been this hunger for recognition from the very incumbents it was meant to replace. Where does that urge come from? Probably from the realization that replacing the entire financial system is unrealistic. It’s built on decades of trust, and for better or worse, most people still believe it works for them.

So the more realistic goal isn’t replacing it. It’s red-pilling it. Getting institutions to slowly shed their old ways; ways that are opaque, inefficient, and out of step with a global, hyper-connected, internet-native world.

Until now that seemed like wishful thinking. But this cycle, the change isn’t coming from startups at the edge. It’s coming from the top.

The U.S. government has started to sing the same songs crypto has been singing for years. If the dollar is to remain the world’s reserve currency, every lever has to be pulled. One of the biggest is crypto. Onchain, dollar-pegged stablecoins like USDT and USDC already dominate. Instead of resisting that, Washington is leaning in. Stablecoins have gone from curiosity to policy tool, and under Trump they’ve become a centerpiece of economic strategy.

The GENIUS Act now requires stablecoin issuers to buy U.S. Treasuries, creating an entirely new class of buyers to finance America’s debt. Why does this matter? Because buying Treasuries isn’t just “funding the government,” it’s the foundation of the entire financial system. U.S. debt is considered the safest asset in the world. For governments, steady demand for Treasuries keeps interest rates low and the dollar strong. For institutions, Treasuries provide a predictable yield backed by the full faith of the U.S. government - arguably, in recent history, the most reliable borrower on earth.

That’s the opportunity. Stablecoin issuers get a scalable, liquid, yield-bearing asset to back their tokens. Institutions get to participate in a market that’s both safe and enormous. And the U.S. government gets a new pipeline of capital to fund spending without pushing rates higher. At this point, it has become a national strategy.

And the incentives here are enormous. Big banks, sitting on trillions in customer deposits, now have a reason to convert those reserves into stablecoins, because they’re simply more efficient. Arthur Hayes estimates over $10 trillion in new buying power for U.S. government debt.

Where does that liquidity go? Not all of it stays parked in Treasuries. Some of it leaks out into risk assets, into crypto. Which creates a loop: stablecoins grow, Treasuries get funded, liquidity flows outward, crypto rallies, stablecoins grow again.

And for that reason, for the first time, institutions aren’t just nibbling. They’re locked in.

That’s why this time might actually be the turning point. Not because crypto convinced the world to defect from institutions. But because institutions are starting to defect to crypto.

We’ve never had a setup like this: governments are warming, institutions are leaning in, regulations are clear, the infrastructure works, and interop is solved. So how do teams in crypto seize the opportunity now that we have an opening we’ve been waiting for all along? The answer is the DeFi mullet.

The DeFi Mullet

Every new technology that succeeds does so by hiding its complexity. The internet was like that. In the early days, it wasn’t simple at all. You needed dial-up modems, obscure commands, and a lot of patience for slow connections. Even in the 90s and 2000s, getting online meant expensive PCs, clunky browsers, and internet cafés. Or if you’re from a third world country like me, all these things were still a luxury up until the early 2010s. Clearly, for almost three decades, the internet was useful, but far from universal, simply because of a distribution problem.

Then came smartphones. Suddenly, the internet wasn’t something you went to, it was something you carried. From BlackBerrys with qwerty keypads and indestructible Nokias to iPhones and Androids that responded to the lightest touch, the web was now always on, always available. That shift didn’t just remove barriers to the internet, it created demand for it. Billions of people who never thought they needed the web suddenly couldn’t live without it. Without smartphones, the internet might never have scaled beyond the early millions.

Similarly, AI had its smartphone moment a few years ago with ChatGPT. Before it, AI largely lived in research papers, GitHub repos, and APIs that only developers touched. Then came a simple chatbox everyone could use, and suddenly, generative AI was in the hands of millions, who began using it daily for everything from writing emails to coding. That was AI’s mainstream moment: a sudden leap from a niche tool to a global phenomenon.

Two data points tell the whole story:

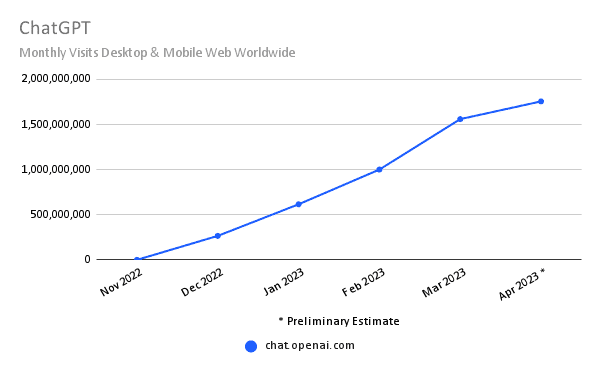

1. The first shows its historic user adoption. ChatGPT reached 100 million monthly active users in just two months after its launch in late 2022, a milestone that took TikTok about nine months and Instagram over two years to achieve.

2. The second shows the "why": its viral accessibility and capabilities drove an explosion in engagement. Web traffic to OpenAI's website surged from 152.7 million visits in November 2022 to 1.6 billion by March 2023, a more than 10x increase in just four months.

Source: similarweb Blog

Crypto is waiting for its version of that moment. The technology works. The infrastructure is here. But distribution is missing. The internet needed smartphones. AI needed ChatGPT. Crypto needs its own interface shift.

You can’t expect billions to use a DEX or manage self-custody. My parents never will. But if their bank app suddenly offered stablecoin payments or crypto yields, they’d try it. That’s the reality if our ambitions are to onboard billions.

I like to call it the Grandma Test. Crypto hasn’t passed it yet. You can’t hand your grandma a DeFi interface and expect her to navigate wallets, gas fees, or slippage. But if PayPal offers her the same onchain yield under the hood, she just sees “5% savings account” and clicks.

That’s the mullet: fintech in the front, DeFi in the back. Smartphones did it for the internet. ChatGPT did it for AI. The mullet can do it for crypto.

To the user, it’s their bank, or PayPal, or Coinbase offering a loan or a yield product. Underneath, the transaction is happening onchain, powered by censorship resistant protocols. They don’t see the complexity, and they don’t need to.

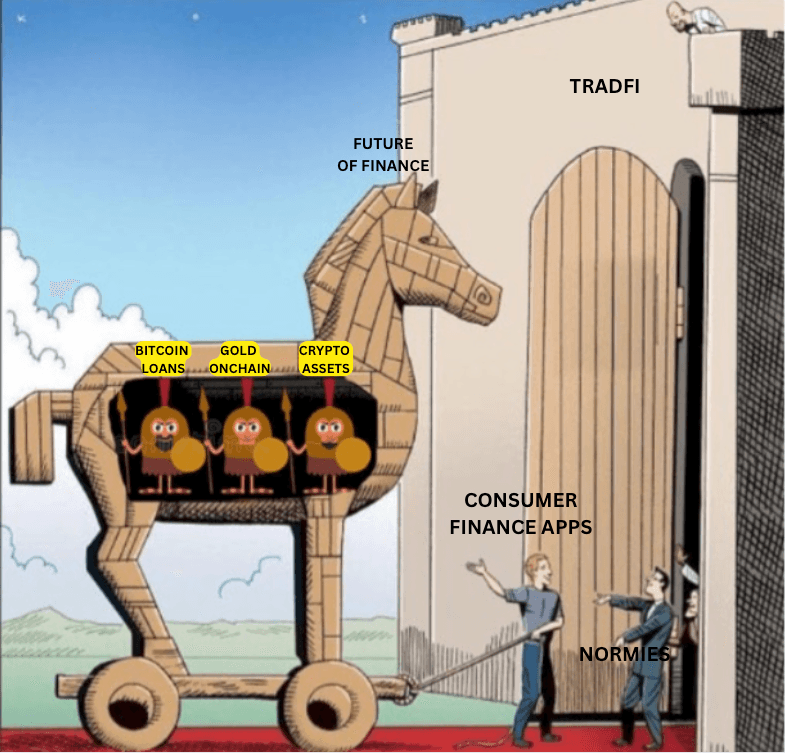

The Horse in the TradFi Castle

The DeFi mullet isn’t a theory anymore. It’s a Trojan horse, and it’s already inside the castle.

The best example so far is Coinbase x Morpho. From the user’s perspective it looks like a standard Coinbase feature: a clean button to take a Bitcoin-backed loan. But behind that button, the loan is coming from Morpho’s onchain lending market. The user doesn’t see DeFi. They just see “loan.”

That’s a big shift from how crypto has worked until now. Until now, we’ve expected the users to be onboarded to crypto and figure out our ways of the world – wallets, chains, gas, bridges, decentralized exchanges. We’ve taken the approach that the product is great and the yield is high and self custody is important, so the users who understand this will come to us and make the most of DeFi!! This is cool and while I’m all for self custody and staying true to crypto’s cypherpunk ethos, it’s naive to expect everyone in the world to do so as well. Saying “we don’t want those users anyway” sounds principled, but really it’s just narrow. It’s like leaving money on the table because you refuse to change the packaging.

The DeFi mullet flips the script and puts us on the right track to meet the users where they are. On exchanges, on bank portals, on consumer fintech apps. It gives them the same product that we’ve been offering all along–lending, swaps, yields–but it just hides the details they don’t even care about and removes all the friction that we expected them to go through to be onboarded to crypto.

In Coinbase x Morpho’s case for instance, what’s left is the essential action: lock up Bitcoin, get dollars. Everything else has been pushed to the background, where it belongs.

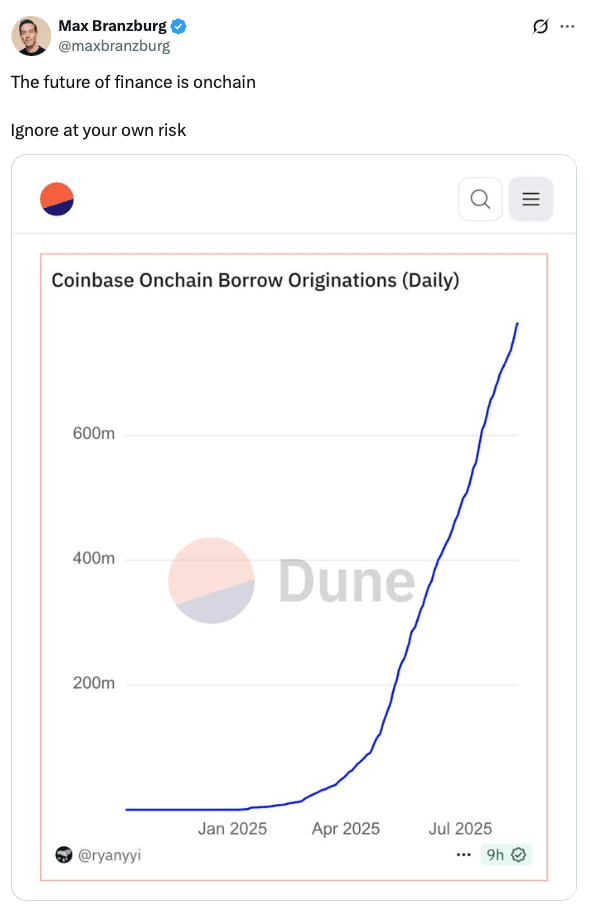

And the early numbers show that the mullet works.

Proof of ‘up and to the right’ technology. Source: @maxbranzburg on X

This is how crypto scales: by meeting people where they are. The list is growing:

Kraken x Ink x Aave – institutional chain with retail distribution, onchain DeFi loans.

Coinbase x Velodrome – onchain liquidity, consumer interface.

ZeroHash x Mastercard x Chainlink – crypto with a credit card, powered by oracles + DEXs.

SharpLinkGaming x Ethereum – Nasdaq treasuries tapping DeFi yields through Digital Asset Tokens (DATs).

If the DeFi mullet works, the next billion people will use DeFi without ever knowing it.

Skeptics dismiss the mullet as “just a narrative.” But that’s what makes it powerful. Narratives are how people grasp new technology. “Bitcoin as a store of value” was a narrative too. No one in Wall Street cares about the Bitcoin network, the blockchain; they just want to buy BTC, the asset and hold it as a hedge against inflation and a store of value. The mullet works the same way: it compresses an idea that would otherwise have too many details to explain.

Moreover, the mullet is a new way to build and distribute products. It’s one thing to build for the average DeFi user who knows the intricacies of crypto and wants to see the details behind everything. But most people outside crypto don’t care about any of that. They just want the result: dollars, yield, credit, tokens.

The mullet gives founders, investors, and regulators a way to see adoption: you don’t need to drag billions of users into DeFi, you just sneak DeFi into the apps they already use.

And the timing couldn’t be more perfect:

TradFi used to nibble at crypto anymore. A pilot here, a partnership there, just enough to signal interest without real commitment. What’s happening now is different. TradFi is biting and the cautious flirtation with crypto has been replaced by a full-scale strategic embrace. Institutions like Robinhood, Stripe, Coinbase, Circle, are building chains, acquiring companies, and turning crypto into part of their core stack. Old guard asset managers like Franklin Templeton, BlackRock, with trillions of dollars in AUM are putting their core money markets onchain. It’s clear that these TradFi giants are now putting real money, strategy, and distribution behind their crypto offerings. And to put the cherry on top, Even the SEC’s Project Crypto reads like a door opening for all of finance to come onchain.

For banks and fintechs, the mullet makes obvious sense. Building DeFi rails in-house would be time-consuming and expensive, as it would require building out full-fledged teams with the experience and know-how of crypto markets and technology. Every year they spend building rails themselves is a year lost to competitors who just plug into what already exists. In fast markets, time is the biggest cost. It’s cheaper, faster, and more astute to embrace the DeFi mullet. By using DeFi protocols, they skip the R&D cycle entirely and go straight to distribution.

Moreover, It’s not enough to just say ‘institutions should use what we’ve built.’ That’s like telling someone in 1995 to build their business on the internet because TCP/IP is “ready.” Technology being ready doesn’t guarantee adoption. DeFi teams have to meet institutions halfway. That doesn’t mean giving up decentralization or self-custody. It means packaging the things we’ve already built so institutions can actually use them.

Institutions care about three things above all:

Compliance – They can’t touch anything that puts them at odds with regulators. If DeFi teams don’t build clean interfaces for KYC, reporting, and risk management, institutions simply won’t integrate.

Reliability – A protocol may work for degens who refresh Discord when something breaks, but an institution needs guarantees, uptime SLAs, pen tests, and clear escalation paths. Wrappers, SDKs, and service agreements aren’t exciting to crypto builders, but they’re what make an institution comfortable.

If you zoom out, most of the obstacles aren’t about the protocols themselves, they’re about the last mile. This may sound like boring grunt work to some DeFi users and builders, but it’s time to suck up the pride and build what’s needed to take crypto to the masses.

Everyone knows about the DeFi mullet. But what about the interop mullet? As you may already know, interop is solved. We have the tools. Which means fintech companies and institutions to move onchain and make the most of what crypto’s internet capital markets have to offer.

The DeFi Mullet is about abstracting the application layer of crypto (hiding Morpho behind a Coinbase button). The Interop Mullet is about abstracting the infrastructure layer (hiding the bridges, chains, and DEXs that LI.FI uses to execute a transaction or the stablecoin issuance technology that interop protocols and their proprietary token standards unlock). It's the mullet under the mullet.

Interop: The Mullet Under the Mullet

It's easy to look at the DeFi Mullet and think we’ve found the solution to crypto's adoption problem. This is true, but it's like saying the solution to traffic is to make cars more comfortable. Sure making cars more comfortable might help with the road rage and frustration for drivers stuck in traffic, but the actual problem lies a layer deeper than the cars: it’s the roads.

The beauty of the crypto ecosystem is that it isn’t a single, unified, internet of value; instead it’s hundreds of chains built by opinionated builders who believe they have a unique way of building scalable blockchains. The beauty lies in the eyes of the beholder. What I’m describing here as beauty is infact the fragmentation curse of crypto that makes it slightly hard to use by the masses. But that’s where interop comes in, and this is why the interop mullet, the abstraction of the underlying technology, is so important.

Not only that, the interop mullet, just like the DeFi mullet, is a key enabler of faster go-to-market for institutions who want to launch crypto products. Two potent examples:

Stablecoin issuance – everyone wants to issue a stablecoin now. Crypto companies, fintechs, banks, even local jurisdictions. In 2025, it feels more like a question of when and not if. With nation states like the U.S putting their foot on the gas to accelerate crypto adoption to enable their local currencies to move via crypto rails, everyone’s in a hurry to join the stablecoin gold rush. In today’s crypto landscape, the best way, and if you ask me, the only legitimate way to launch a stablecoin that’s future-proof is via interop token standards. These token standards dramatically accelerate the go-to-market time for issuing stablecoins and at the same time, significantly reduce the technological and operational overhead of taking up such an initiative – all the while, the issuers get to retain control over token contracts, security guarantees, and collect fees. It’s a win-win for everyone involved.

Swaps (same chain, cross-chain, bridging) – the one thing that’s never gone away in crypto is people wanting to buy assets. Whatever else changes, that demand remains. Which means there’s always been a steady need for companies (exchanges, wallets, onramps, custodians) to let people swap assets, either for themselves or for their users. And it turns out, historically, the swap feature has consistently been one of the easiest ways for these companies to make money outside their core product. The simplest way to add swaps today is to integrate LI.FI. Yes, I’m biased. But LI.FI is the only system that can actually route trades in crypto across all the countless fragmented pools on hundreds of chains. For companies the value is obvious: you ship faster with one API, while LI.FI does the hard part – finding liquidity, comparing prices, and executing the trade in the most efficient way.

Closing Thoughts

For a long time, the hard problems in crypto were about technology. Scaling, consensus, interoperability. The smartest people worked on those problems, and for the most part, they’ve solved them. The infrastructure now works.

The hard problem has shifted. It's no longer about building the engine; it's about building the car people actually want to drive. The mullet is the design for that car.

Delusional optimism of building a better world has gotten crypto to a $4 trillion dollar economy. For the next leg, it'll be the pragmatism that wins. The mullet embodies that pragmatism. It's the admission that the old financial world has the one thing crypto needs: distribution. And it's the most direct path to getting the crypto in the hands of everyone. The builders who understand this are the ones who will build the future.

FAQ: Crypto’s Distribution Playbook: Or, the DeFi Mullet

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.