Connecting Internet Capital Markets Across Chains – Powered by LI.FI

Solana has always been an ecosystem that exists for users, by users, and owned by users.

A new opportunity for the average person looking to truly own their value.

Builders and users alike have flocked to Solana since its inception in 2021, drawn to the chain’s core advantages: cheap transactions, high-throughput, and simple-to-use experiences that feel like the internet should. These pillars support the accessibility of internet capital markets.

Thanks to Solana, we now have access to any asset, any market, anywhere, all at the fingertips of anyone.

However, the crypto ecosystem today is structurally multi-chain. It has thousands of markets, for digital assets, stocks, RWAs, NFTs, credit, perps, prediction markets, all spread across many different ecosystems. Consequently, liquidity and users are spread across the different pockets of the landscape.

What if you could just build on Solana, but have access to users and liquidity spread across all these markets?

That’s where LI.FI comes in. LI.FI is the token orchestration layer connecting the internet capital markets. Thousands of markets across chains are now linked, powered by LI.FI.

In this piece, we’ll break down how teams are building the future of internet capital markets on Solana, and launching liquid, with connectivity to all the markets in crypto, powered by LI.FI.

What Are Internet Capital Markets, And Why Do They Matter?

The Solana Foundation describes “internet capital markets” as a place where anyone can tokenise equities and debt, create their own stablecoins and real-world assets, and access the most liquid markets in DeFi.

This is adjacent to traditional finance today, which is increasingly digital, global, and consumer-driven thanks to the internet.

But the incumbent traditional finance systems we have fragment value across:

Borders

Institutions

Platforms

Walled gardens

The opportunity of crypto has always been to dissolve those barriers.

Solana makes the potential a reality. It doesn’t just bring markets onchain, it behaves like one: open, fast, and built for anyone to plug into instantly.

That is the foundation of internet capital markets with Solana:

Markets that operate at internet speed

Available to anyone with an internet connection

Unconstrained by geography

Accessible liquidity from anywhere in the world

Open 24/7

Simple, intuitive, and cheap

But for the crypto vision to work at scale, it needs to accept the reality – that markets will be fragmented across chains. Hence, we need connectivity. Deeply integrated, agnostic rails that ensure users and liquidity can arrive from anywhere.

And that’s exactly what LI.FI unlocks.

The Most Comprehensive Liquidity Stack for Solana

LI.FI is the token orchestration layer that enables Solana applications to connect with internet capital markets and users across chains by default.

With LI.FI’s API, SDK, and widget, builders plug into liquidity from across chains and protocols and bring it directly into their Solana apps.

Here’s what that unlocks:

Bridge assets from any chain into Solana

Enable same-chain swaps on Solana – LI.FI acts as a meta-aggregator of top liquidity sources on Solana, like Jupiter, DFlow, and Titan.

Combine bridging and swapping to enable cross-chain swaps into Solana.

Enable users to deposit into any pool, combining multiple steps into one composed action – all in a single click.

With one integration, all apps gain access to any asset, from any chain, delivered directly into their product with the best available swap path, and a UX that just works.

No more juggling multiple providers, integrations, or service fees at every step. LI.FI’s core value proposition is to abstract that hassle and complexity away, giving teams a single integration for all your liquidity needs on Solana.

Bridge. Swap. Deposit across DeFi on Solana. Powered by LI.FI.

This lets Solana builders focus on what they do best: creating fast, meaningful, consumer-grade experiences.

Apps become “Solana apps” with access to “global markets”, all at the same time.

This is what internet capital markets demand: frictionless entry, instant liquidity, and chainless UX.

Linking Internet Capital Markets

Internet capital markets are not a single market, there are numerous: stablecoins, collectables, RWAs, stocks, lending/yield, and exchanges.

Each market’s effect compounds when connected, and LI.FI is the orchestration layer linking them together.

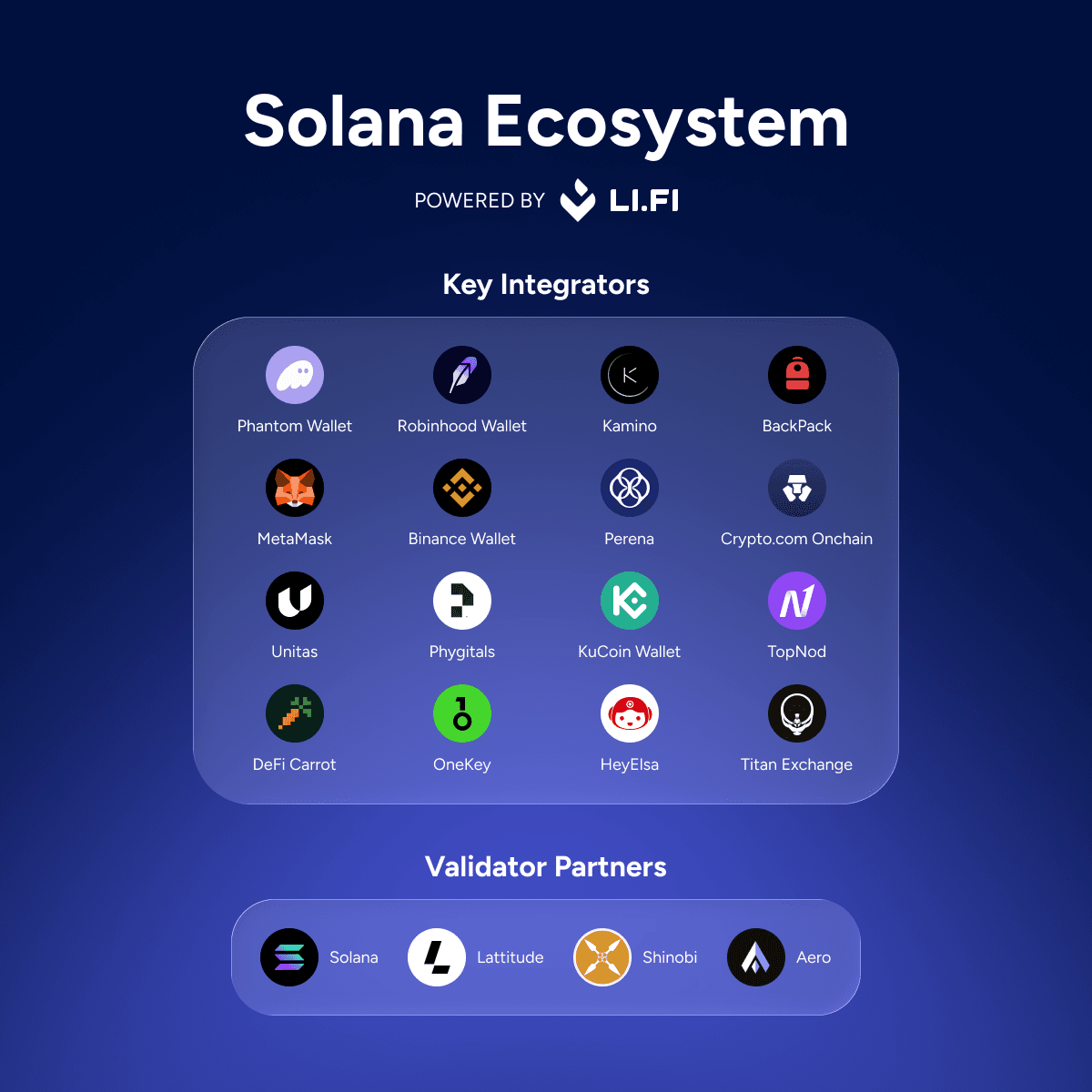

Below is a list of teams using LI.FI on Solana, across different types of internet capital markets.

Wallets

With LI.FI, industry-leading wallets like Phantom, MetaMask, Backpack, Robinhood Wallet and OneKey let users swap and bridge assets on Solana directly inside the wallet.

In-wallet swaps offer a seamless experience as users get the convenience of doing everything without ever leaving their wallet.

Source: LI.FI on X

Stablecoins

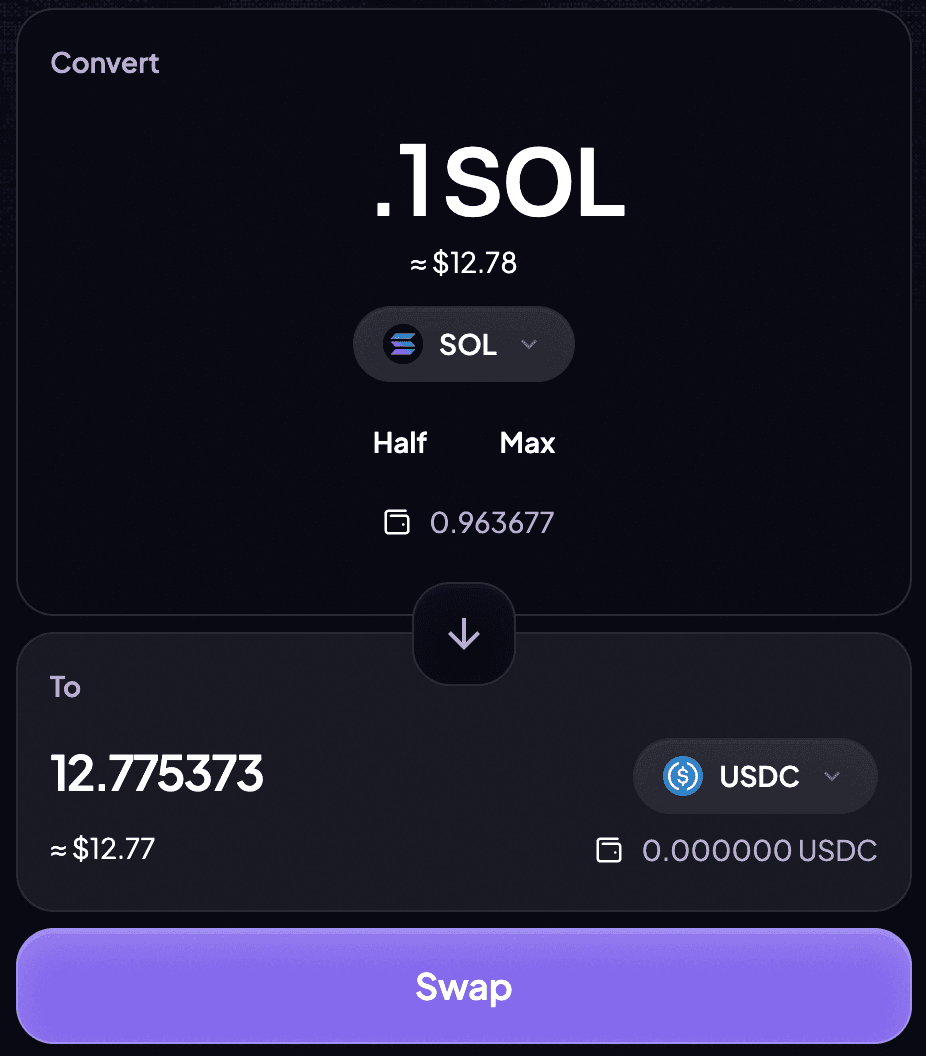

1. Perena – Since September 2025, LI.FI has been powering onboarding for Perena’s stablecoin, USD*, enabling users to enter Solana’s stablecoin rails with whatever assets they hold. This helps users access Perena as a stablebank for the internet economy, where they can mint, redeem, and earn on USD* through a frictionless online experience.

Source: Perena Convert

2. Unitas – Unitas’ integration of LI.FI helps people in nations with volatile currencies use their money as they normally would, secured by USD liquidity.

Exchanges

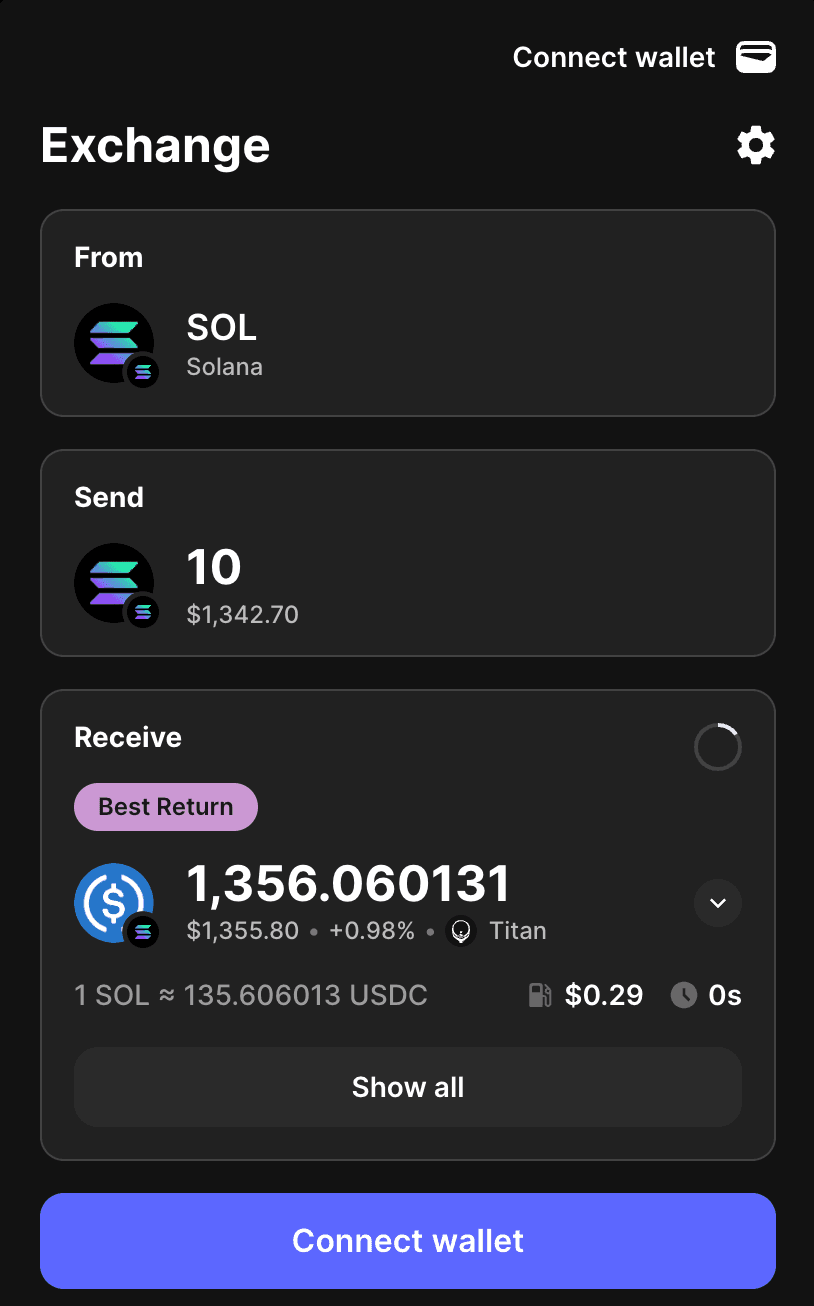

Global exchanges are some of the most trusted and influential to date, onboarding millions of users. LI.FI powers swaps and bridging on Solana for popular platforms like Crypto.com and Titan Exchange.

Tokenised Stocks & RWAs

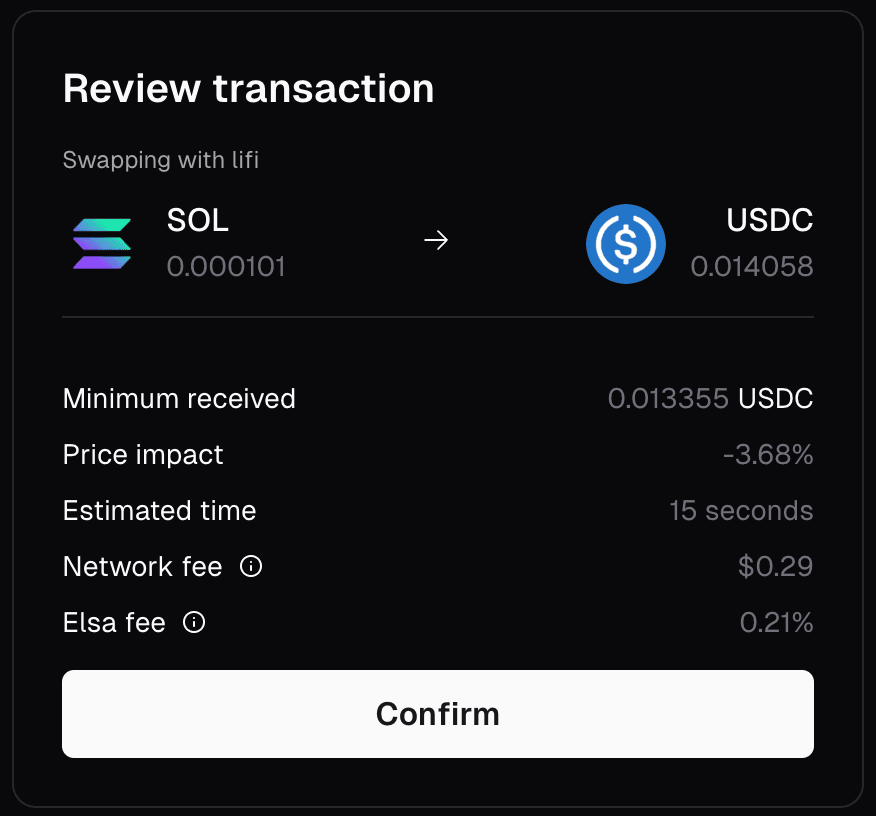

HeyElsa lets users utilize an AI-agent to move directly from their existing portfolios, regardless of chain, into tokenised equity exposure on Solana in a single step.

As RWAs expand, LI.FI ensures capital doesn’t bottleneck at the borders between chains, giving Solana-based tokenised assets unrestricted access to global liquidity.

Source: HeyElsa App

Lending

Kamino and DeFi Carrot use LI.FI to bring users directly into lending markets to earn yield on the strategies they choose. This helps to ensure Solana’s markets for yield aren’t just open, but accessible by users everywhere.

Collectables

The phygital market on Solana thrives on accessibility: collectors from any ecosystem can mint, redeem, or trade instantly.

By integrating LI.FI, Phygitals can onboard users directly into its collectible marketplaces using assets from anywhere. This is a perfect instance of internet capital markets powering global collectables that move as fast as culture itself.

Source: Phygitals Deposit Widget

Trusted by Solana’s Validator Ecosystem

LI.FI doesn’t just power swaps across the applications built on Solana; it contributes directly to the resilience of the network itself.

The LI.FI Validator is supported by key partners across the ecosystem, including:

There’s currently over 50,000 SOL staked with the LI.FI Validator, helping to secure the very infrastructure that powers Solana’s internet capital markets.

Source: StakeWiz

Build on Solana, Reach Every Market.

The breadth of apps and services is growing exponentially on Solana. LI.FI connects the liquidity, assets, and users across the entire crypto ecosystem directly into Solana apps automatically.

One integration. Every market.

Powered by LI.FI.

Read our docs to learn more: Why LI.FI & What is LI.FI

FAQ: Connecting Internet Capital Markets Across Chains – Powered by LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.