LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

4 Trends That Explain Bridging Right Now

The interop ecosystem is moving into a new phase. The early years of bridges was all about experimentation; lots of new players, lots of designs. Then came iteration. Now the focus has shifted to distribution. The unspoken truth of technology is that superior tech alone isn’t enough to win, you only win when people actually use it. This truth is not lost on teams in interop, especially as adoption starts to follow the later stages of the S-curve.

Intents. AMMs. Token standards. Fees. These have been the big debates. Debates are fine for sparking competition and shaping narratives, but results matter more. With more data now, we can see more clearly which approaches are working and how the interop landscape is shaping up.

Note: All data used in this analysis comes from LI.FI and Jumper. As aggregators of multiple liquidity sources, LI.FI provides one of the best vantage points for observing competitive dynamics across bridging solutions.

For every order, LI.FI’s API queries all integrated solutions (whether intents, AMMs, or mint-and-burn models) and returns their quotes. These are presented to the user as a menu, with the top recommendation based on either the best rate or the fastest execution time, depending on the user’s preference.

Big thanks to Octave (Data Lead, Jumper) who worked on all the data behind this piece.

With that out of the way, let’s dive in!

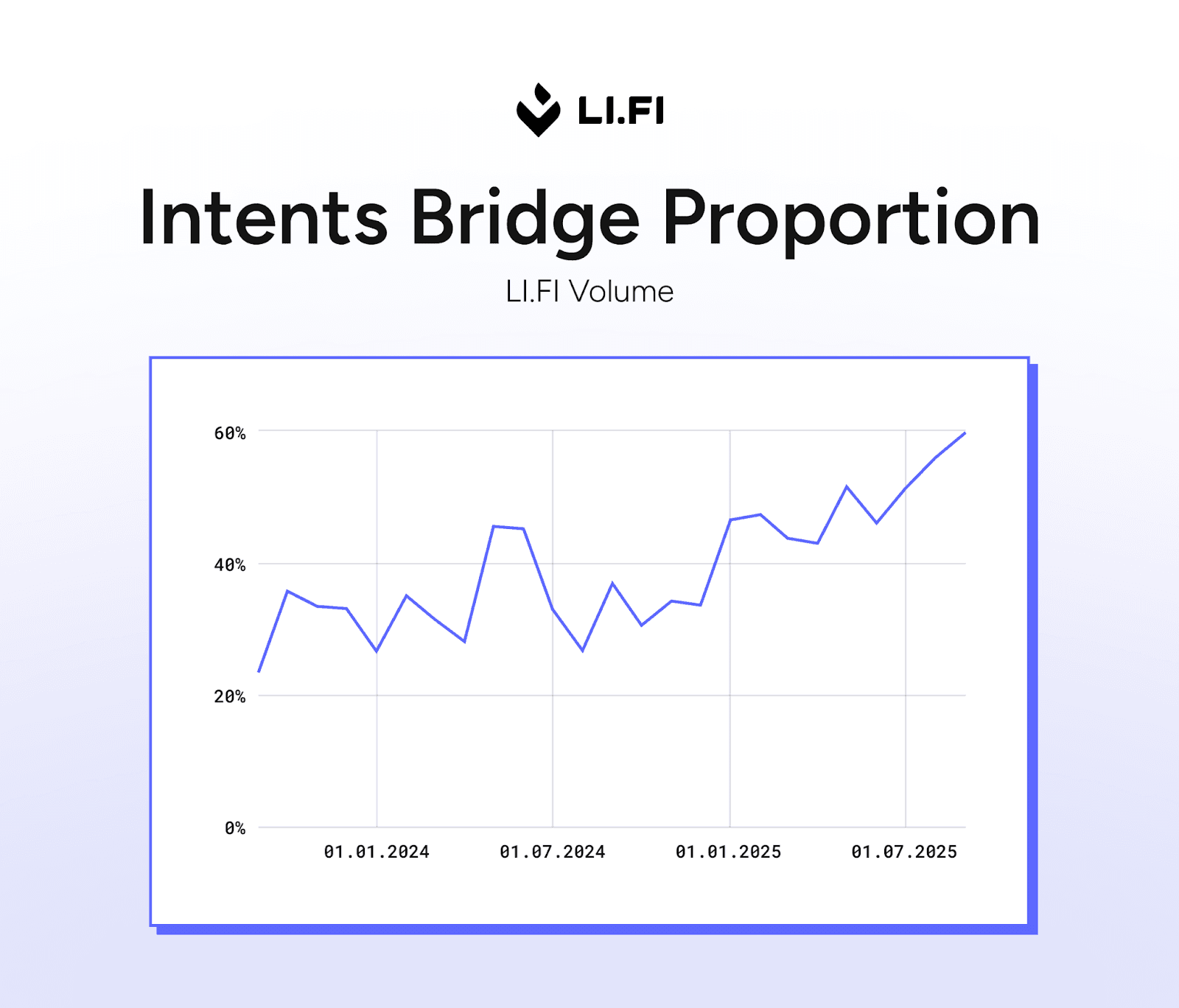

#1 Intents Are Creeping Up the Volume Charts

Part of the rise in intents is simply mathematical. With more intent-based solutions in the market, order flow has started tilting their way. Across, Relay, Mayan, Gas.Zip, Stargate’s Fast Swaps, and soon LI.FI’s own solver network, the train has left the station, and it’s only picking up speed.

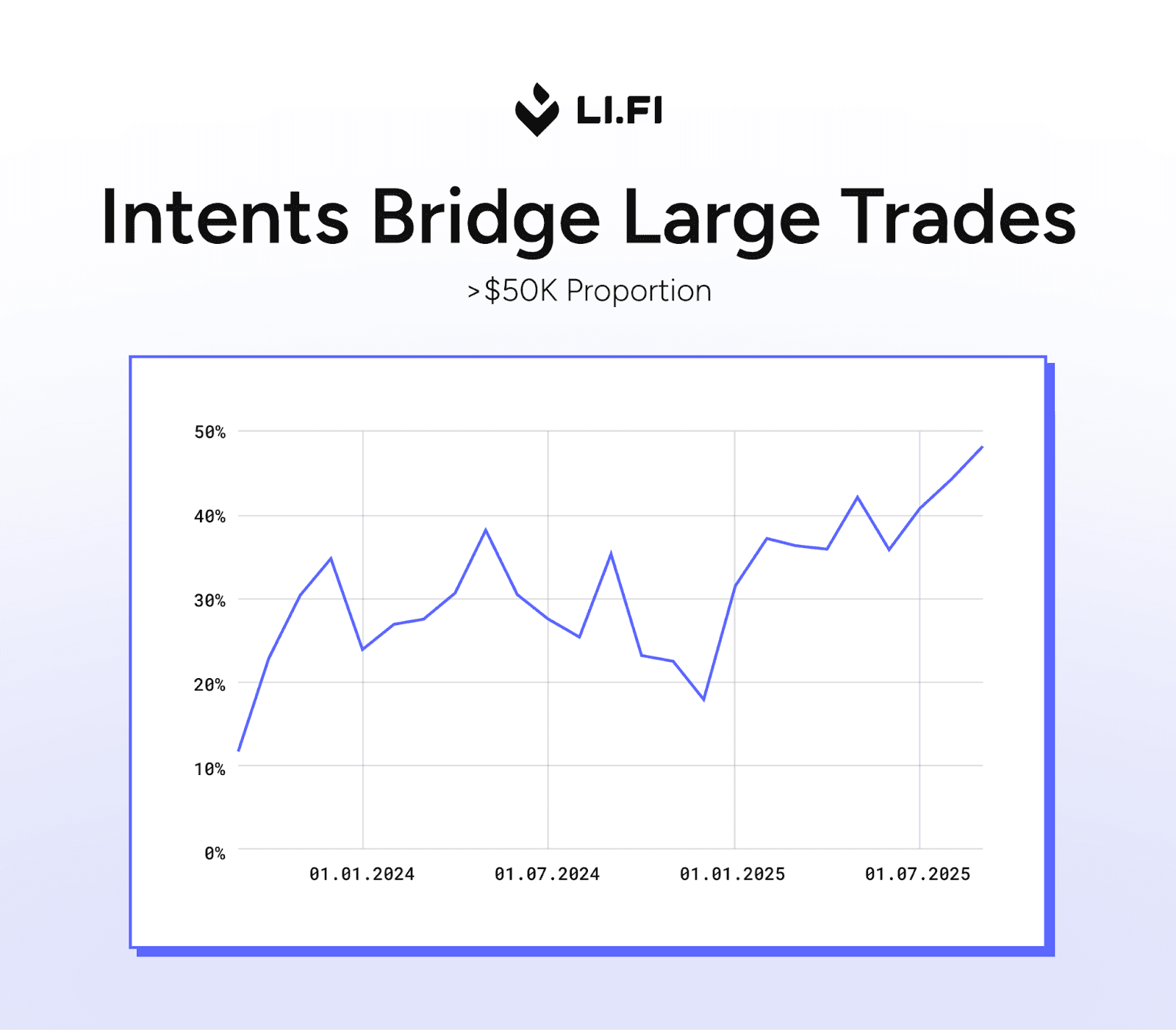

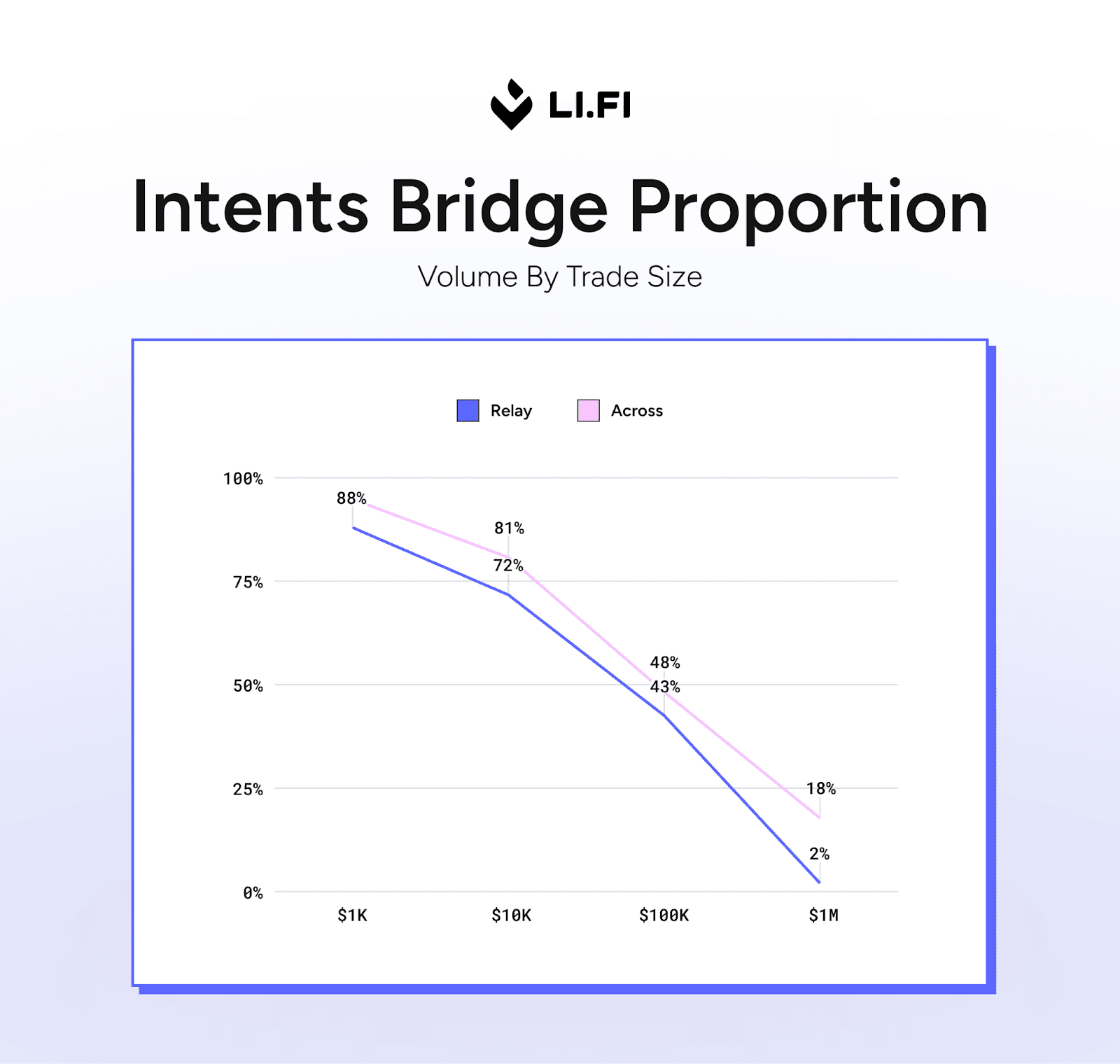

What’s more interesting is that intent-based solutions have also started winning large size orders. At first, intents were categorized as retail rails - cheap, fast transfers of $50-$1000. That view is now outdated. Data shows these systems are winning large orders too, often $50,000 or more.

The reasons for this are manifold, some are more clear and logical than others. Solvers now run with deeper inventories. Relay’s solver, for example, runs with about ~$20M in inventory, far more than a year ago. Plus, solvers have gotten better at rebalancing. Mint-and-burn bridges (like CCTP and USDT0) and Everclear play a role, but so does smarter use of data, which ensures capital is parked on the right chains at the right time. The result is greater capital efficiency, and with it, the ability to capture not just more orders, but larger ones.

But, if you look more closely, there are also softer factors that across teams and their north star metrics. For instance, not all solvers are purely profit-seeking in the short term. Some run operations at a loss to capture market share, data, or orderflow they can monetize in other ways. Moreover, strategies shift by route. On high-volume paths, like stablecoin transfers between Arbitrum and Base, solvers may undercut each other to win flow. On obscure routes, they can charge fat spreads. And the sophisticated, savvy solvers make money from positive slippage that others miss.

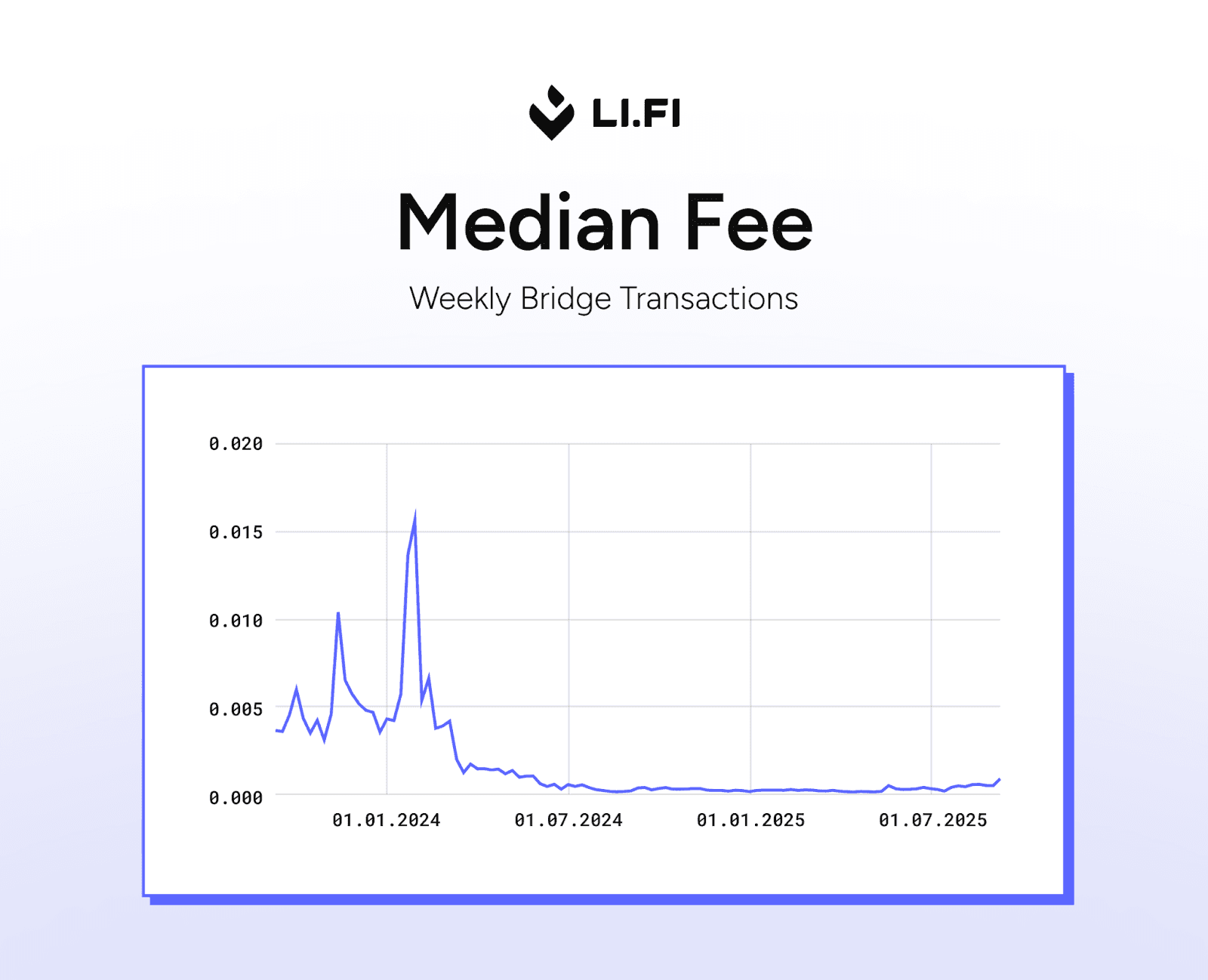

#2 Fees (and Margins) Are Going To Zero

In most industries, competition works like gravity and pulls margins down over time. Bridges are no exception. Nothing signals a maturing category more clearly than the steady erosion of fees. The winners, as always, are the users, who get cheaper, faster, and better service.

Today, we have a strong set of bridges, each jockeying for distribution. One bridge undercuts another by a few basis points, or matches the rate while shaving seconds off transaction time, and the orderflow follows (especially true in an aggregator setting). Intent-based designs, especially lightweight single-solver models like Relay and Gas.Zip, are accelerating this race to the bottom by combining speed with ultra low cost.

That leaves little room to monetize. A team that insists on higher margins risks losing the flow entirely. The practical response has been to shift monetization elsewhere - on frontends, or through B2B distribution models where price is less visible.

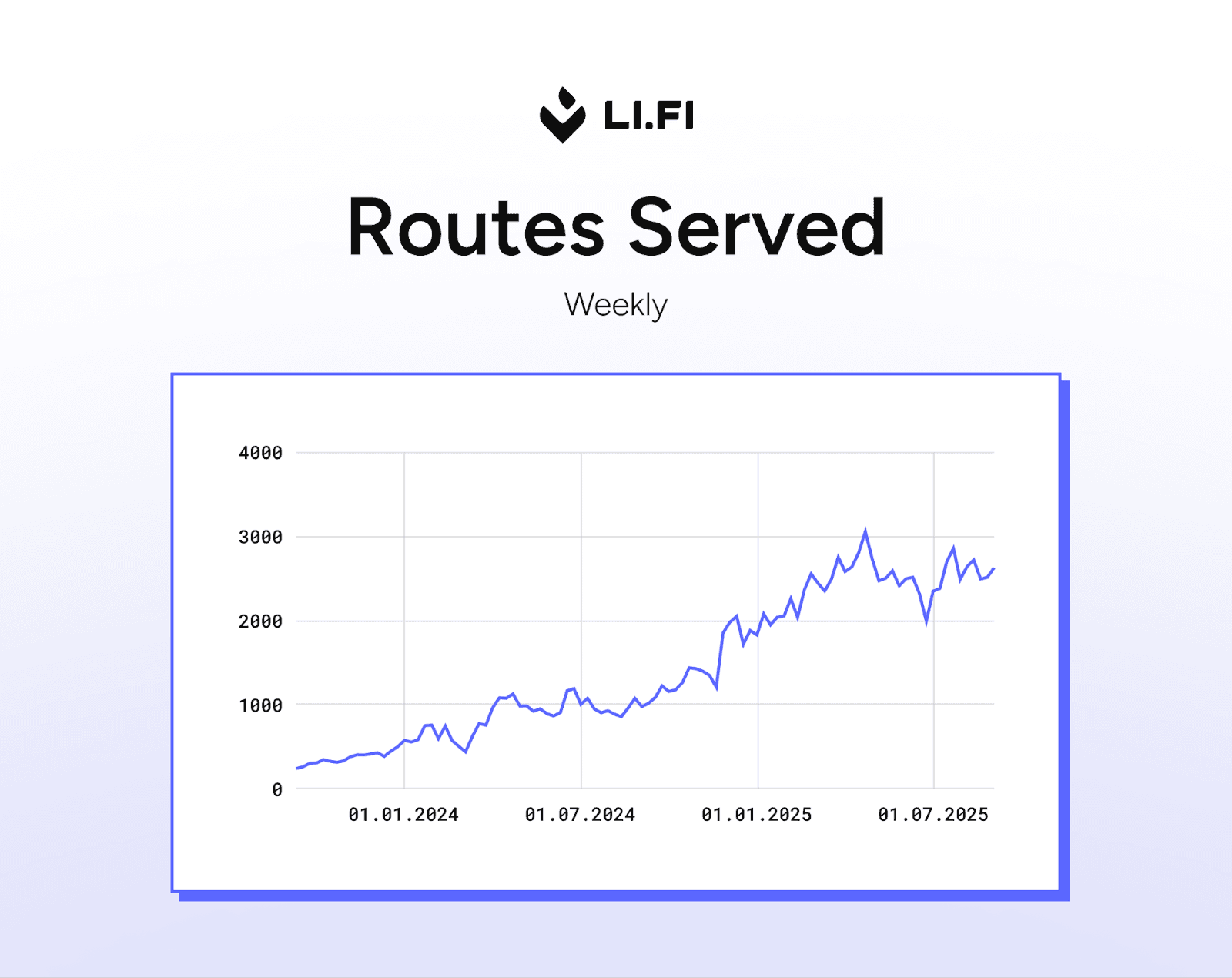

There are, however, exceptions. On more exotic chains, where competition is thin, users are less price-sensitive. They are often just relieved that a reliable bridge exists at all. Bridges willing to do the extra work of integrating these smaller ecosystems can still capture some fees. It’s no surprise, then, that we’ve seen a slight uptick in revenues on those routes and a big increase in routes served overall.

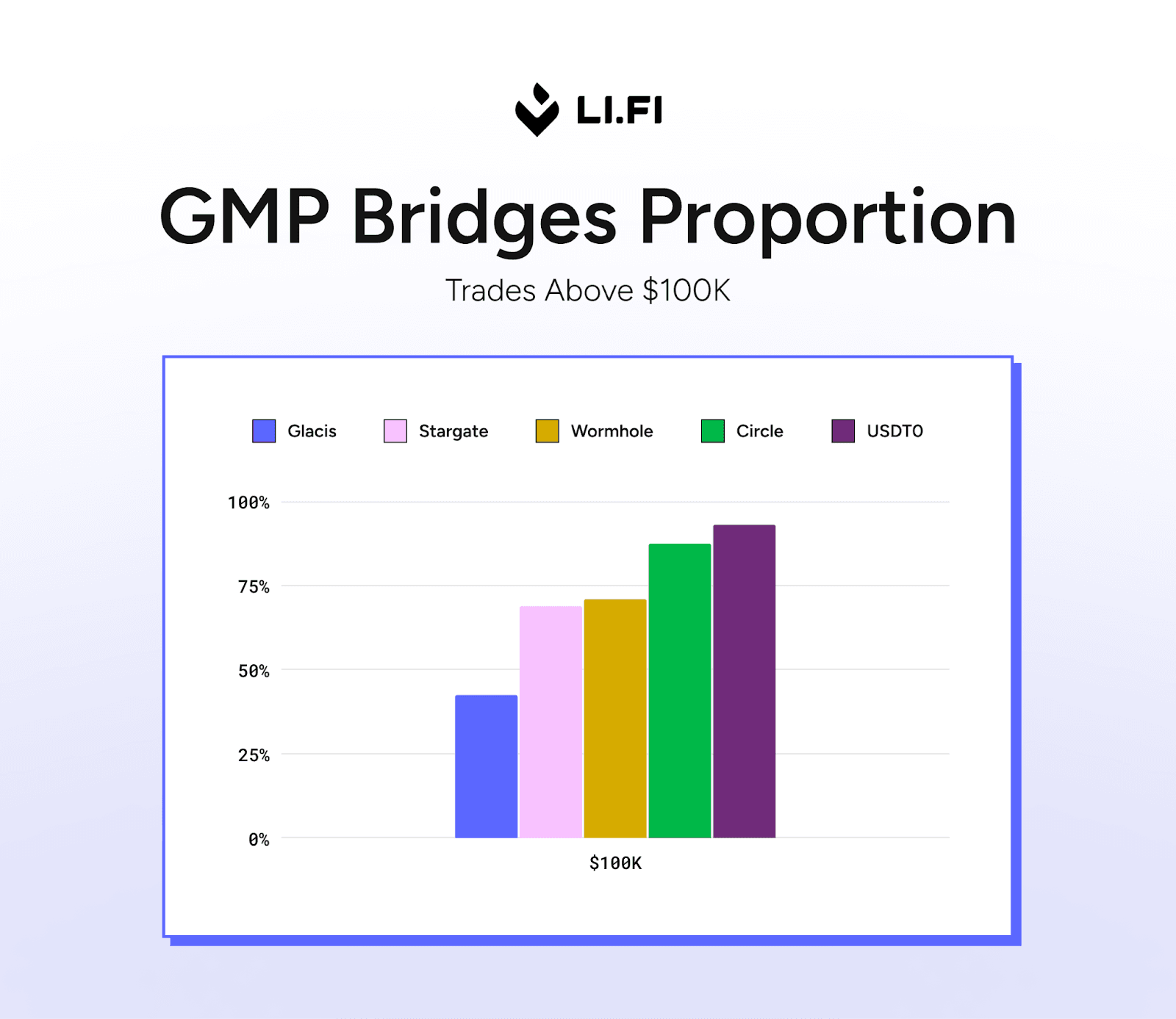

#3 Mint-and-Burn: The Best Way to Move Size Across Chains

In bridging, the advantages of mint-and-burn technology have long been understood. When the task is moving large sums of capital, no approach has proven superior. The mechanics are simple: burn the asset on the source chain, mint the same amount on the destination chain. The result is cheap (requiring little more than gas fees) and capital-efficient (no need for liquidity pools).

Historically, this design was limited to native bridges, Ethereum to an L2, for example. That gave us the benefits of efficiency and security, but only within a narrow scope: two chains at a time. The next step was obvious: keep the good, discard the bad. That’s where interop token standards come in. By building mint-and-burn into the issuance layer itself, assets can now be:

1) Multi-chain - minted and burned on any chain supported by the interop provider.

2) Easier to expand - issuers can add chains and unlock new markets with far less friction.

Over the past year, we’ve seen a surge in large transactions flowing through these mint-and-burn solutions. The reasons are practical: they’re the most cost-efficient option available. And the demand isn’t just from retail users, solvers in intent-based systems rely on them heavily for rebalancing. The growth of Stargate (with OFTs and Hydra), CCTP for USDC and USDT0 tells the whole story. Among interop protocols providing the rails for omnichain asset issuance, LayerZero has pulled ahead undeniably with the adoption of its OFT standard.

If not for mint-and-burn, intent-based bridges might already dominate outright. But intents are limited by the capital solvers can actually hold. Mint-and-burn bridges don’t have that problem, they draw straight from the token's supply, the real source of liquidity. That gives them a built-in advantage, especially on large orders. The bigger the ticket, the wider the gap, as intents start winning lesser orders comparatively. As a result, the market today is more balanced, with different designs competing on their respective strengths.

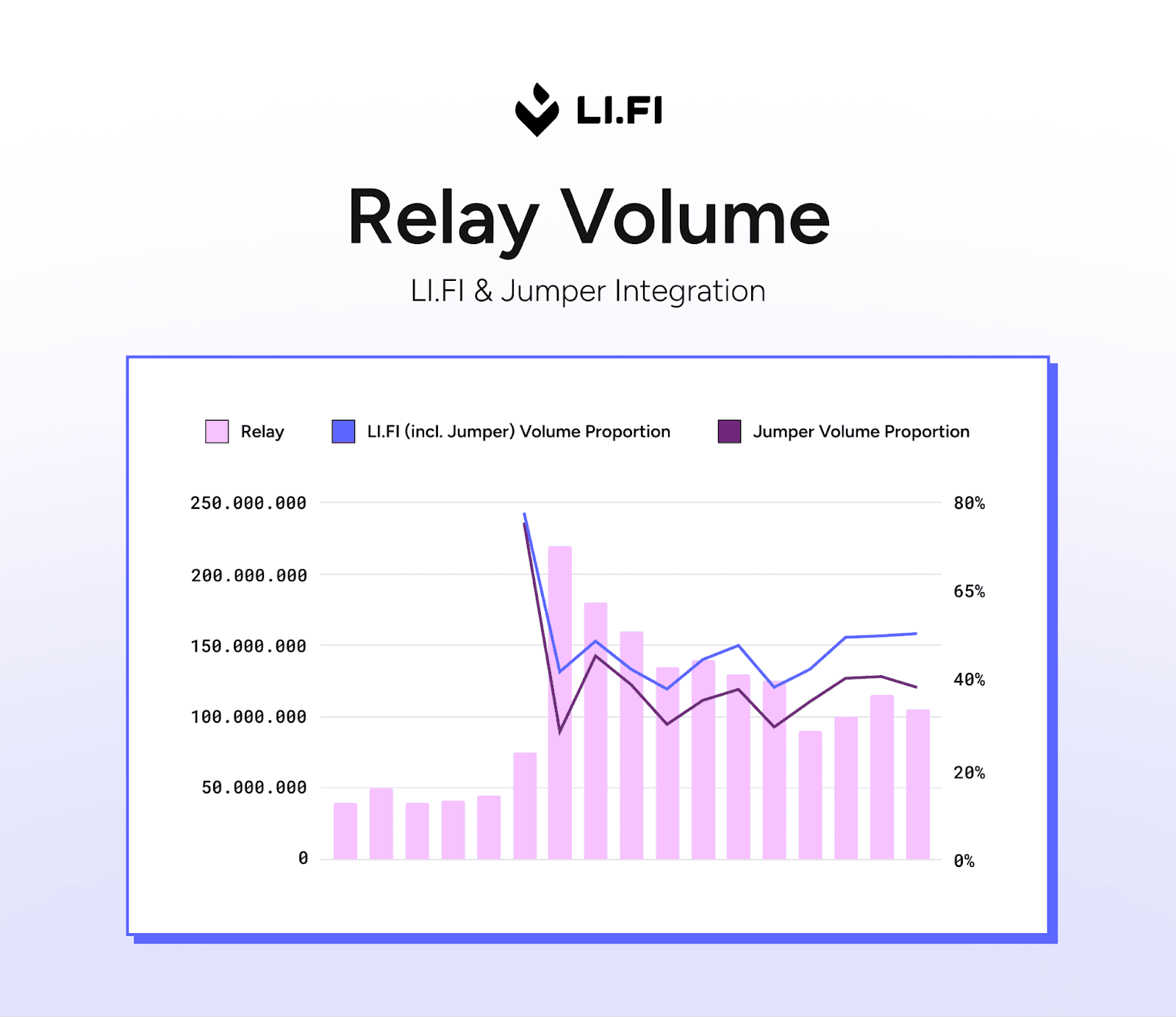

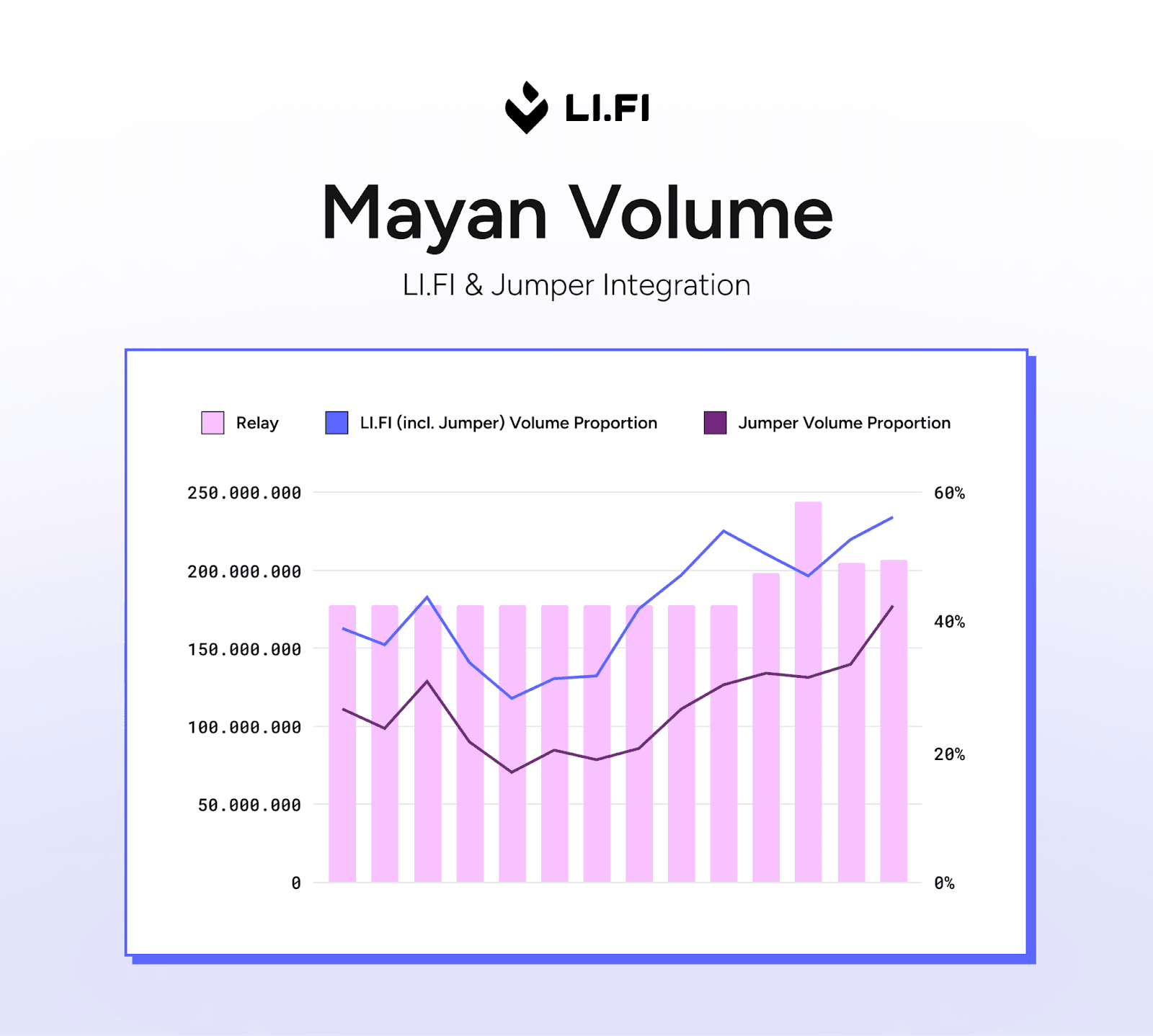

#4 Aggregators Are a Key Source of Orderflow for Intents

Aggregators play a critical role in the ecosystem. They give users the best routes by weighing two simple but decisive factors: price and speed. Intents excel on both, which explains why they’re capturing more orderflow today. But what often gets overlooked is that intent-based bridges lean heavily on aggregators to reach those users in the first place.

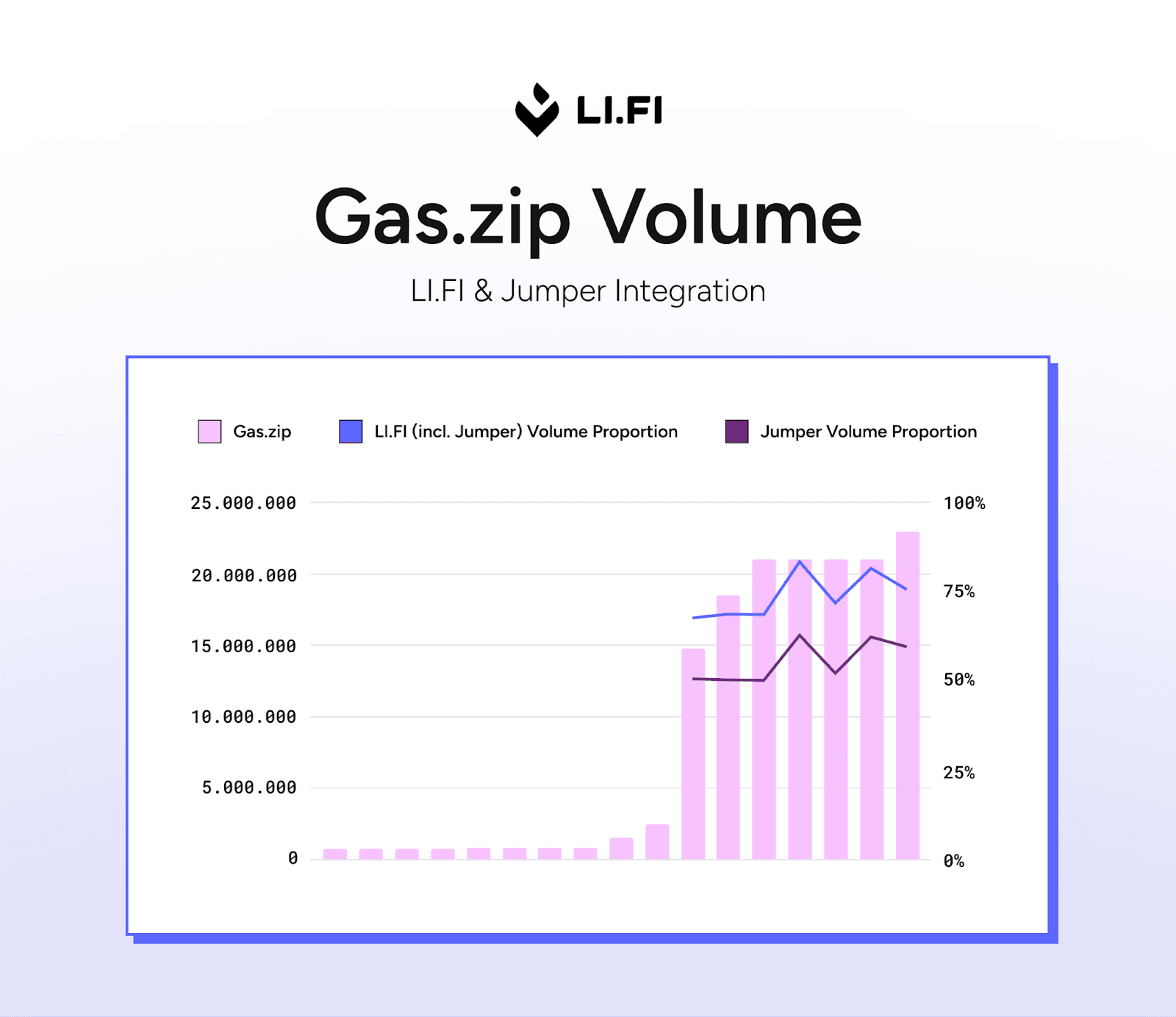

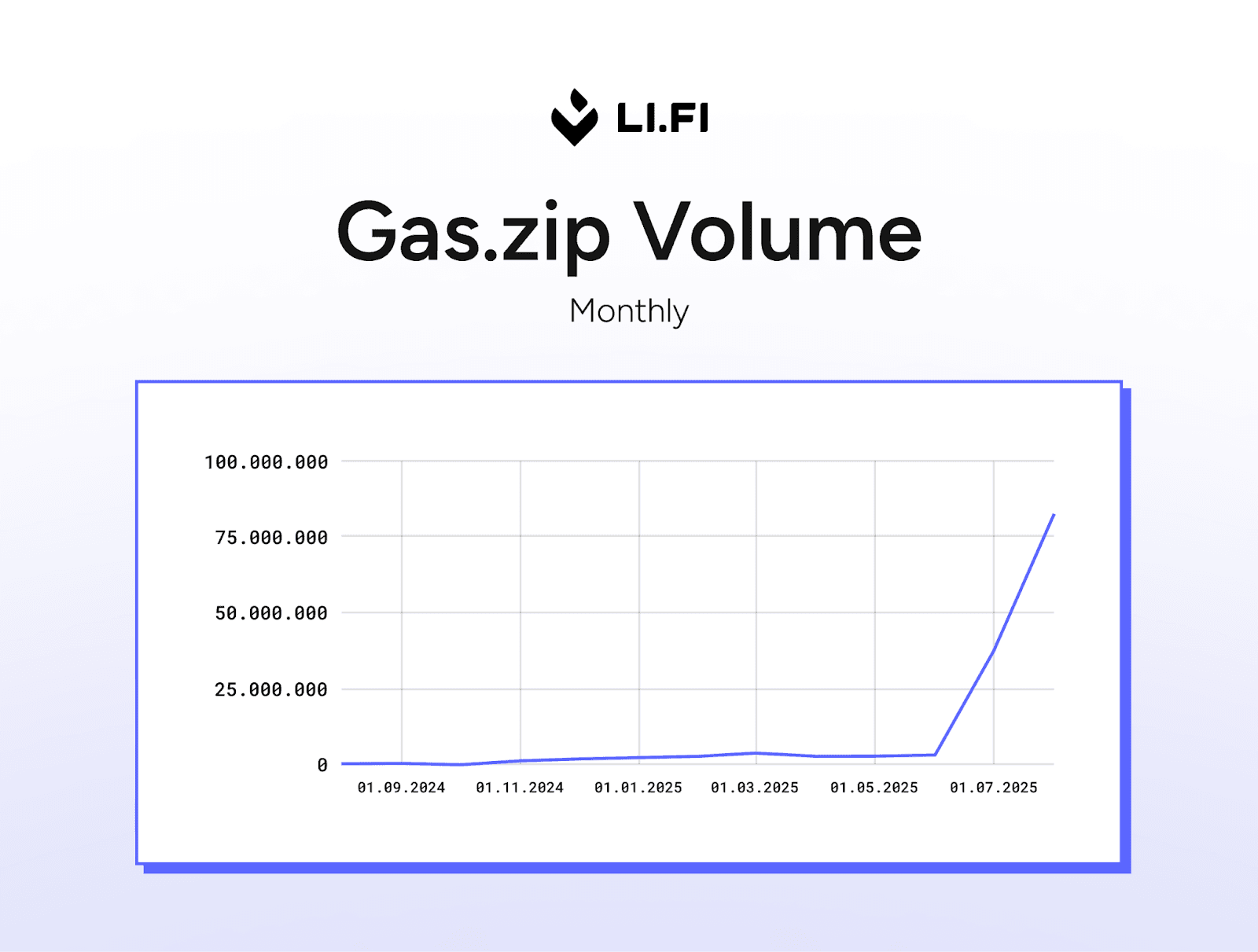

This dynamic has been consistent over time. First it was Across that captured a meaningful share of LI.FI’s orderflow, then competition from Relay and Mayan shifted the balance, and most recently Gas.Zip has been winning share on certain routes. The competitive picture may keep shifting, but the constant is this: bridges depend on aggregators to get distribution.

The good news is that volumes are rising overall. Over time, aggregators have become deeply entrenched in the wider ecosystem – they’re embedded in wallets, apps, and countless frontends. That position allows them to capture significant cross-chain orderflow at the source, and then route and spread it across multiple bridges for execution. In doing so, aggregators have become a key distribution layer for the entire interop stack. As a result, even as orderflow get shared by more bridges, they’re all seeing volume grow through aggregator channels.

Nothing illustrates this better than the surge in Gas.Zip’s volume after its LI.FI integration, which instantly gave it distribution across partners like Jumper and leading wallets.

FAQ: 4 Trends That Explain Bridging Right Now

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.