Why Multi-Chain, Why Now.

Understanding Crypto's Multi-Chain Reality

Introduction

The crypto industry has evolved rapidly since 2021 (when LI.FI launched), with the multi-chain thesis becoming increasingly evident in real-time.

This article is written to compare and contrast why and how developers and/or users should utilize different types of chains being built, including EVM chains, smart contract networks built on zk tech, application specific blockchains, and non-EVM blockchains.

Before we dive in, let’s take a look at how the crypto industry has changed since 2021.

Where We Were, Where We Are

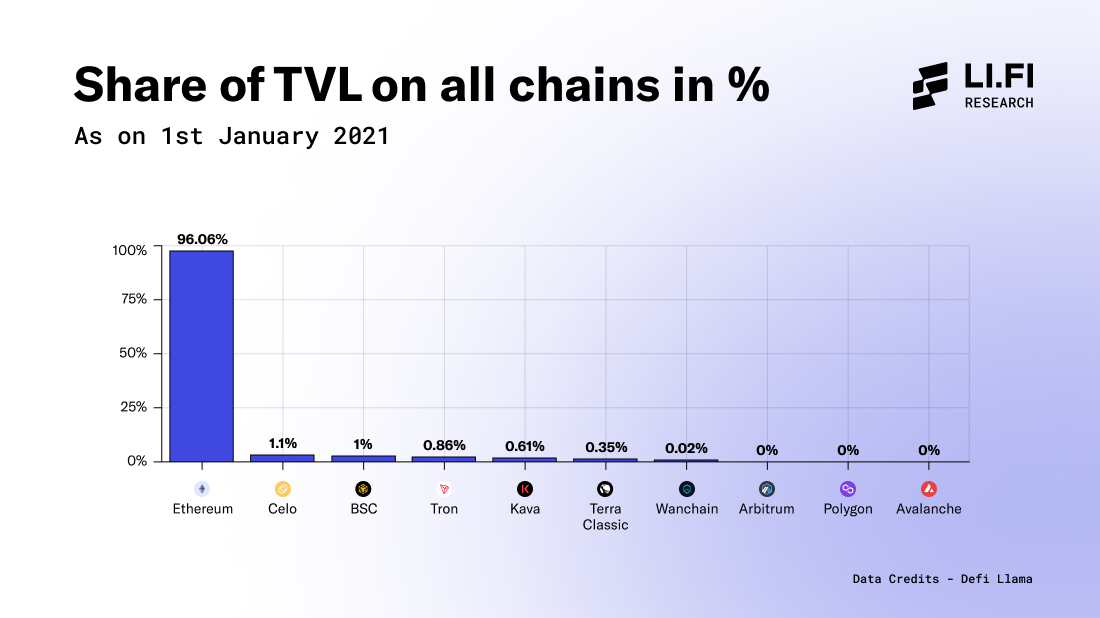

In 2021, most of the capital in crypto (~96.06%) was locked into Ethereum’s DeFi ecosystem. Few incentives existed to draw users to dApps on other blockchains due to limited scope and innovation…

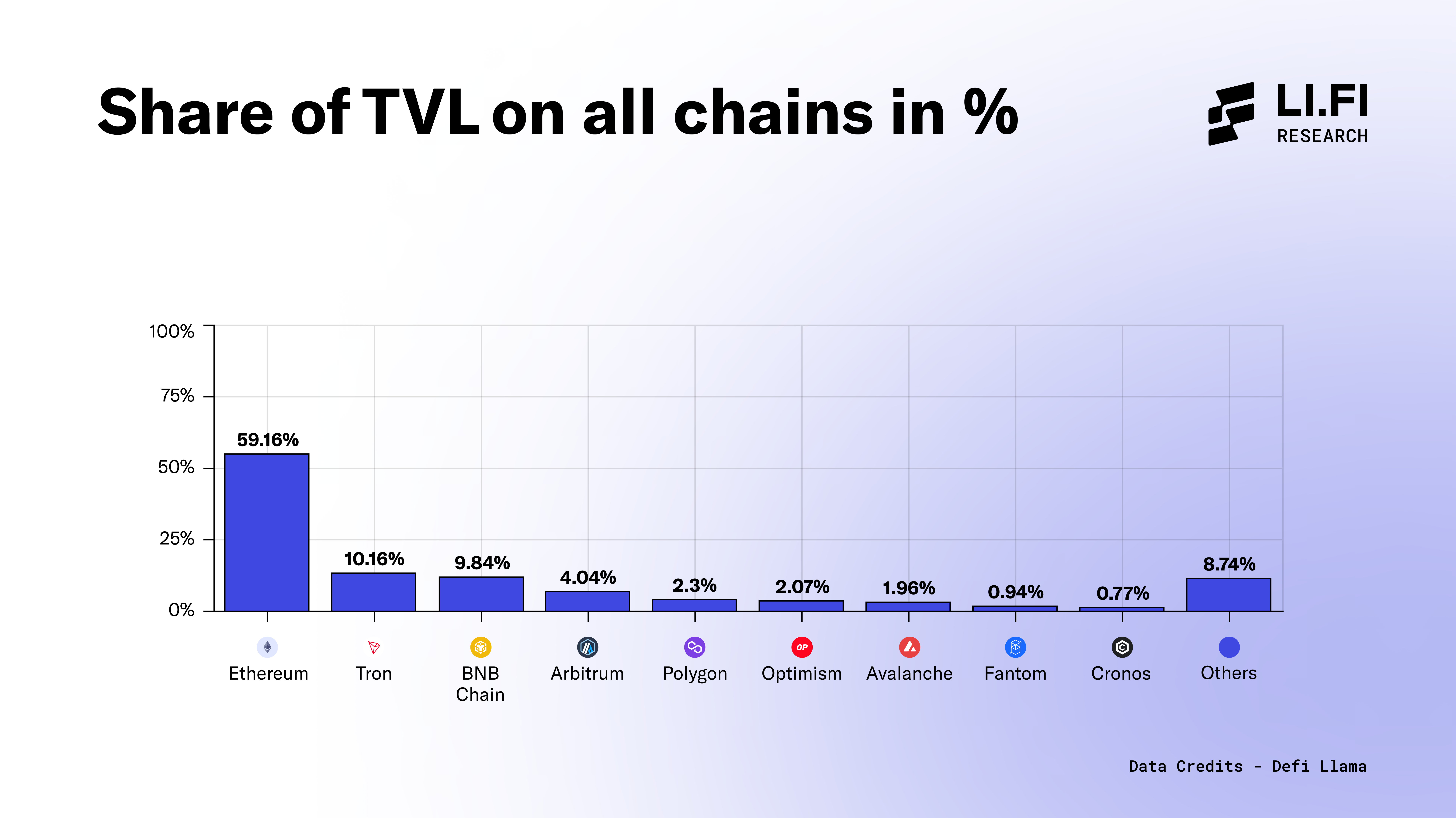

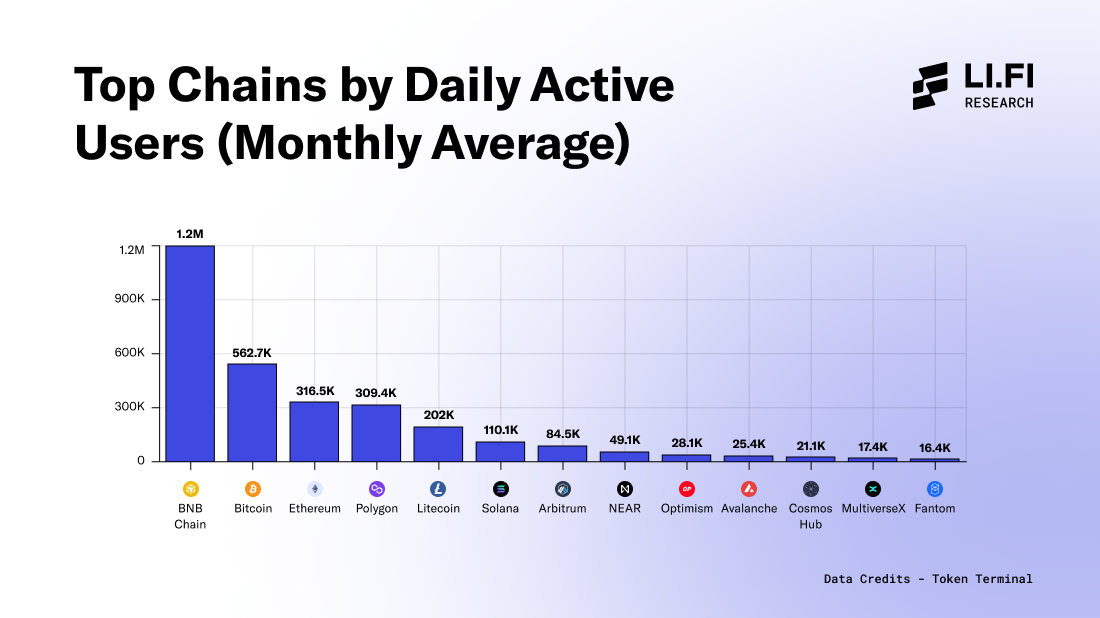

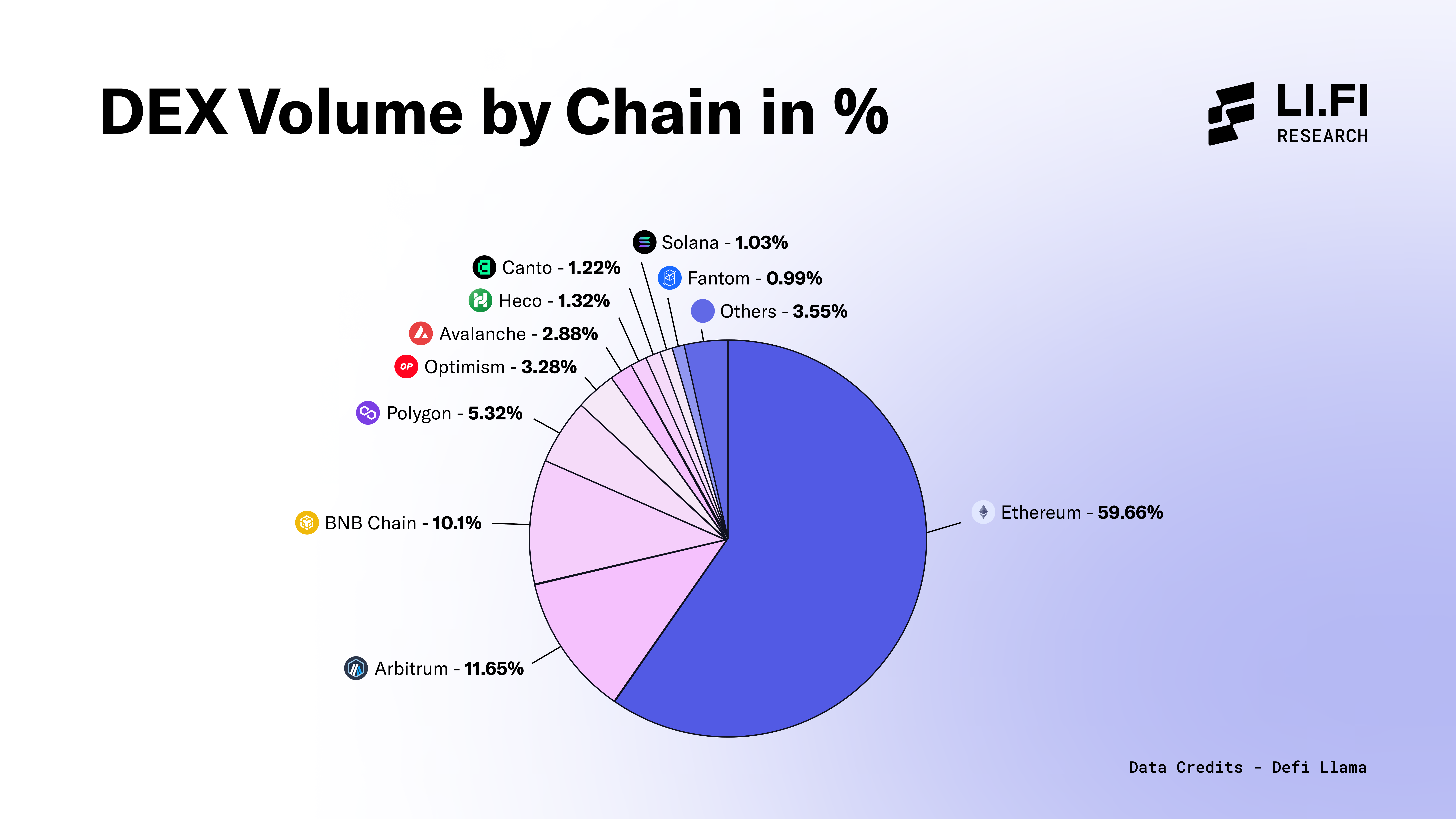

In 2023, the story is substantially different. To show the growth of the industry, here’s a snapshot of chain usage in 2023:

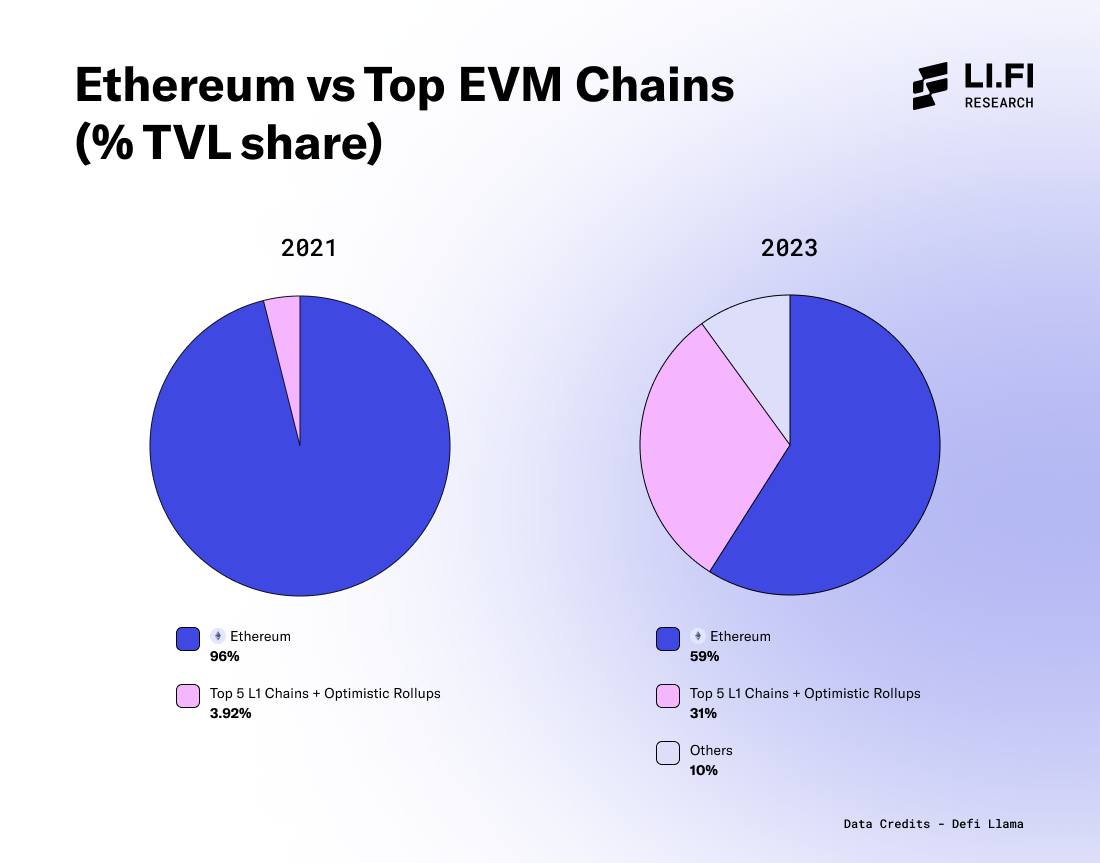

Ethereum is still king but its TVL share fell from ~96% in 2021 to ~59% at the time of writing. (It went down below 50% for the first time in history on April 2, 2022, as Terra Classic’s ecosystem grew.)

Alt-L1 EVM chains like Polygon, Avalanche, Fantom, Tron, and BNB Chain, among others, were virtually nonexistent in 2021. In 2023, these five chains alone attract nearly 25% of the TVL in DeFi.

Rollups (blockchains that bundle transactions and settle on Ethereum) own approximately 6% of the TVL in DeFi.

Ethereum, large L1 EVM chains, and rollups make up 90% of all TVL in crypto. TVL on Solana, Cosmos chains, Bitcoin, Polkadot parachains, and Cardano contribute to the majority of the remaining TVL.

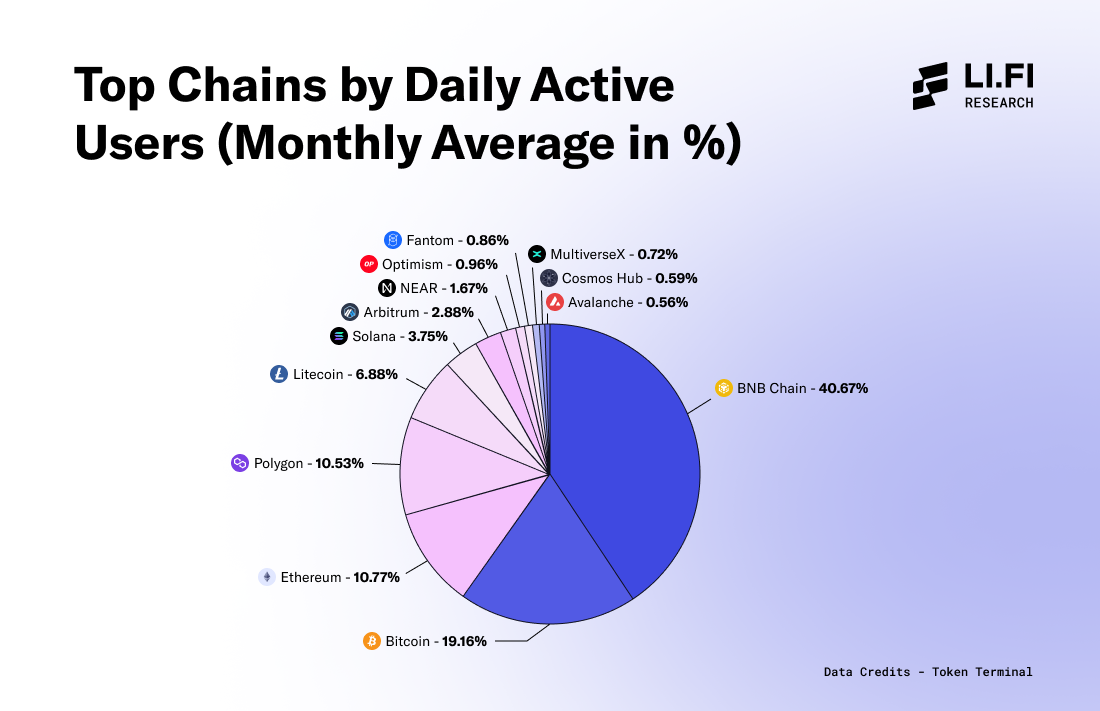

The daily active users metric shows that Ethereum and Bitcoin are still widely used despite expensive and slow transactions. However, the theory that cost drives user behaviour is also playing out as highly scalable chains have become far more prominent, with BNB Chain and Polygon accounting for just over half of all daily active users in crypto.

Ethereum, BNB Chain, Polygon, Arbitrum, and Optimism account for approximately 90% of DEX volume in crypto. This highlights that users are actively executing on-chain trades.

As the data shows, Ethereum is still the most popular chain, with the majority of DeFi activity still happening on Mainnet, a rollup, or an EVM chain. This highlights that crypto is already multi-chain thanks to EVM compatibility. Additionally, on top of the spread of DeFi outside of mainnet Ethereum to L1 forks and L2s, there has been a surge in builders announcing zero-knowledge powered blockchains and scalable appchains, which we will cover in depth below. Ecosystems building outside of the Ethereum community like Cosmos, Solana, and (hello Taproot) Bitcoin have also seen meaningful usage.

Our research, which we will dive into below, makes us believe that the future will only hold more chains.

Let’s now analyze the different types of ecosystems that are available to users and developers, starting with the EVM ecosystem and then moving out to zk-tech, appchains, and non-EVM hubs.

The EVM Ecosystem

Ethereum Virtual Machine compatible blockchains (EVM chains) are currently winning the race for users and developers and hold almost 90% of the value locked into DeFi.

The reasons for the popularity of EVM chains are simple, though not impregnable (as we will discuss later):

Interoperability — EVM chains execute transactions using the same rules as Ethereum and applications built on top of EVM chains are written in the same language (Solidity) as Ethereum, so it’s relatively easy to port dApps from one chain to another.

Development resources and network effects — EVM chains have the most number of active developers across crypto. This comes down to the immense activity and capital on these chains attracting devs, users, and, more importantly, the large and battle-tested repo of dev tooling (libraries, good documentation, support) that makes development on EVM chains easier and more effective since developers and users don’t need to diverge from their current experience flows.

Connectivity — Most bridges only support EVM chains and, as a result, there’s more efficiency in capital flows between these chains.

Let’s dive into the EVM space, specifically breaking apart the ecosystem into L1 EVM Chains and Rollups.

L1 EVM Chains

Ethereum

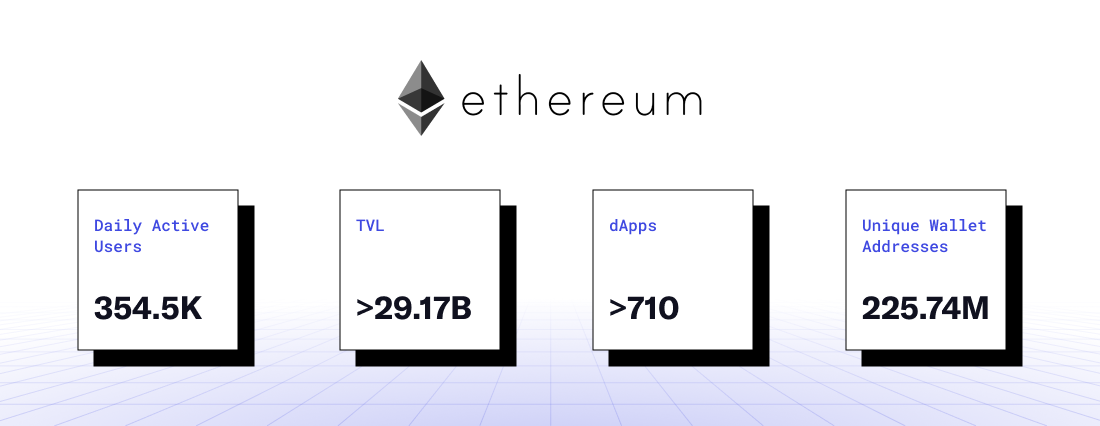

59%, or $29.17B, of the assets in DeFi are currently locked on Ethereum. At the peak of the bull run in November 2021 when $ETH was trading at ~$4.7k, Ethereum DeFi TVL was over $106B.

Ethereum in many ways is the home of DeFi. Over 710 dApps, including blue-chips projects like MakerDAO, AAVE, Lido, Uniswap, Instadapp, among others, are constantly innovating and onboarding users into crypto on Ethereum.

Ethereum is one of the longest running blockchains in the industry (live since 30 July 2015).

Ethereum is highly trusted by many users in crypto and it has over 354.5k daily active users (monthly average over 180D as per Token Terminal).

Ethereum has over 225.74M unique wallet addresses.

BNB Chain

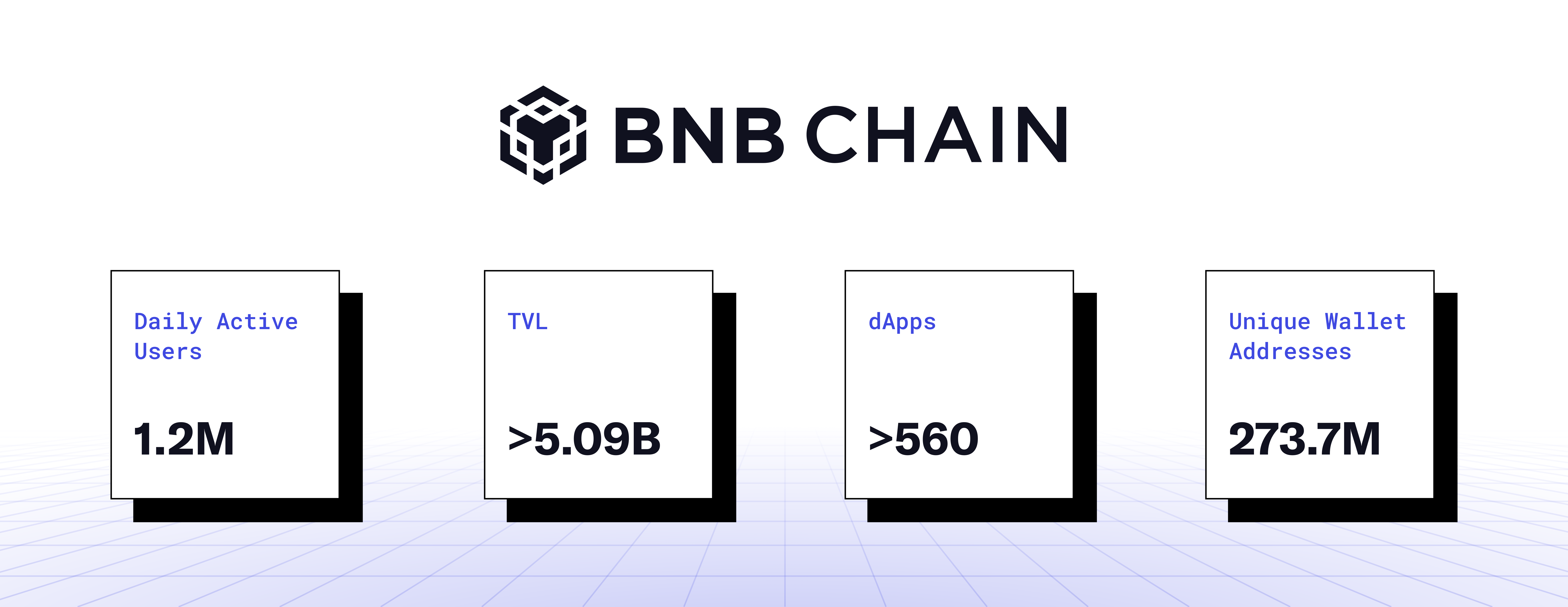

BNB Chain has over 1.2M daily active users (monthly average over 180D as per Token Terminal, which is significantly more than Ethereum’s 354.5k users).

The TVL on BNB Chain currently stands at $5.09B, though it was >$20B at peak.

BNB Chain has over 273.7M unique wallet addresses.

Over 560 dApps like PancakeSwap, Venus, Alpaca Finance, and Thena, have deployed on BNB Chain.

BNB Chain enjoys strong network effects via Binance Exchange, one of the biggest centralized exchanges in the world, which offers additional benefits for dApps like access to Binance’s user base and liquidity.

Uniswap V3 recently launched on BNB Chain in order to benefit from BNB Chain’s DeFi ecosystem.

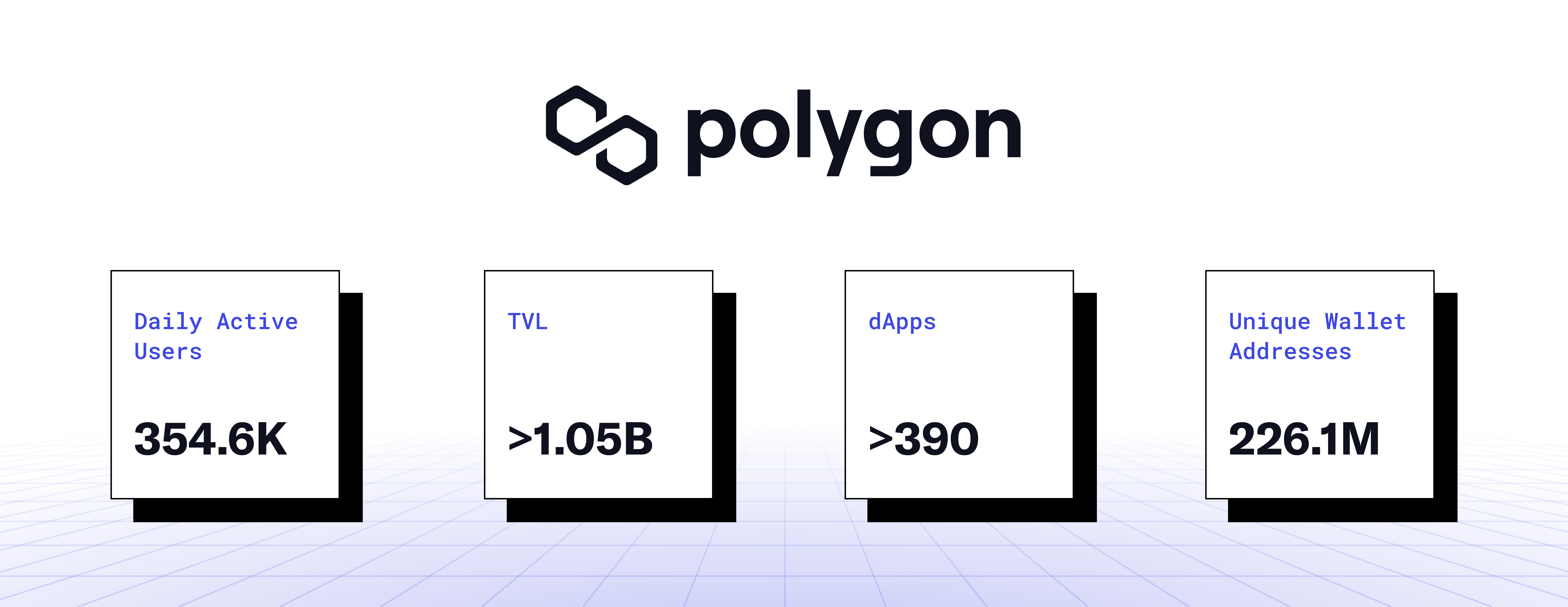

Polygon

Polygon has over 354.6k daily active users (monthly average over 180D, as per Token Terminal).

Polygon has over 226.1M unique wallet addresses.

Over 390 dApps like Aave, Quickswap, Klima DAO, and Gains Network are constantly innovating and onboarding new users and capital to Polygon.

While the TVL on Polygon has reduced recently, it still stands at over $1.05B (>$9B at peak).

Polygon has attracted significant attention from the Web2 world through partnerships with global brands like Starbucks, Adidas, Meta, Strip, Disney, etc.

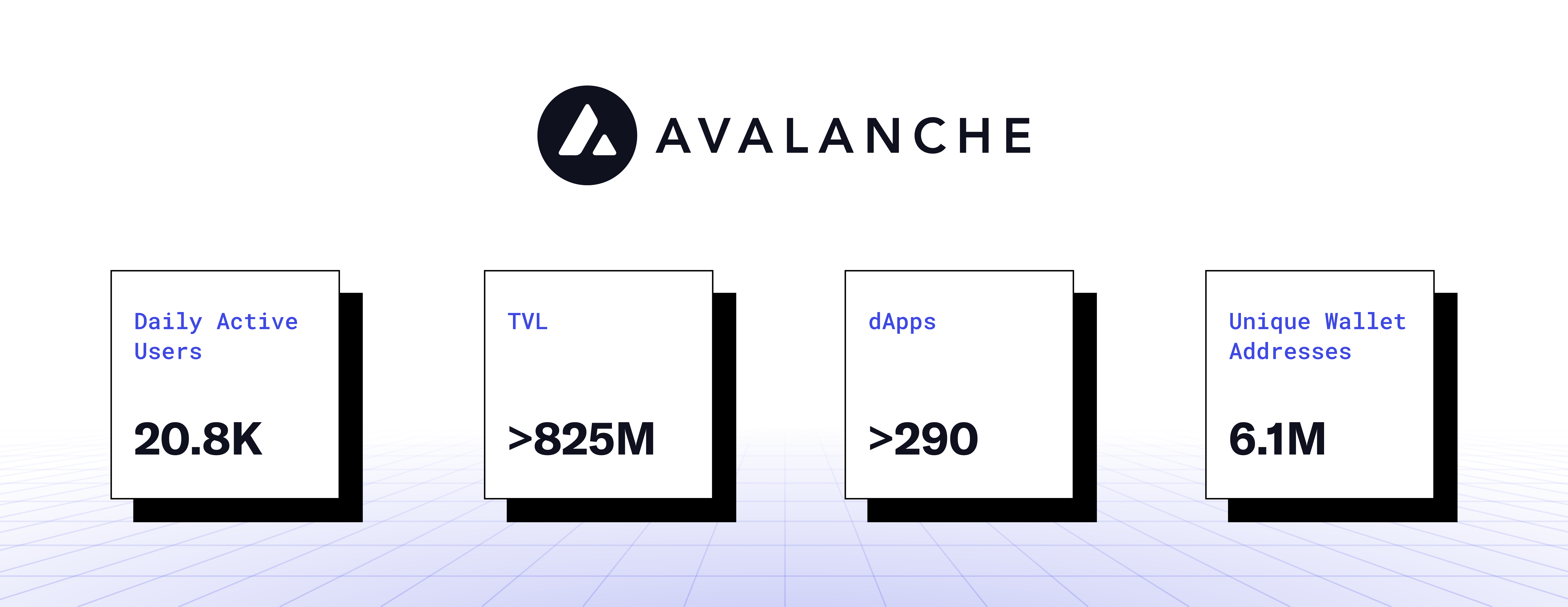

Avalanche

Avalanche has approximately 20.8k daily active users (monthly average over 180D, as per Token Terminal).

Avalanche has over $828M TVL in its DeFi ecosystem.

Over 290 dApps like Benqi, Trader Joe, and Pangolin are constantly innovating and onboarding new users and capital to Avalanche.

Avalanche has over 6.1M unique wallet addresses.

Avalanche puts a strong focus on developer adoption and has a growing ecosystem of Subnets (~22).

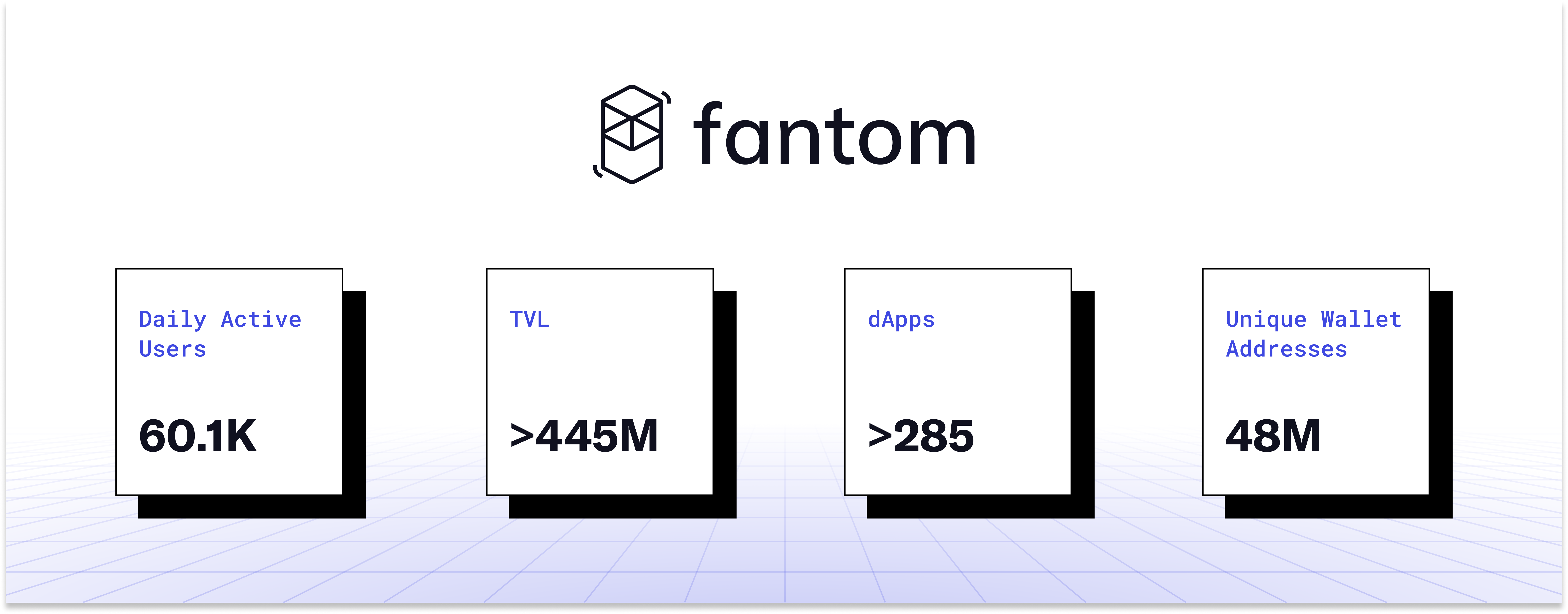

Fantom

Fantom has approximately 60.1k daily active users (monthly average over 180D, as per Token Terminal).

Fantom has over $448.55M TVL in its DeFi ecosystem.

Over 285 dApps like SpookySwap, Beethoven, and Geist Finance are constantly innovating and onboarding new users and capital to Fantom.

Fantom has over 48M unique wallet addresses.

Fantom’s ecosystem receives strong support from the Fantom foundation in the form of grants, technical support, and other resources.

Optimistic Rollups

Rollups were the story of 2022 (L222), with Optimism and Arbitrum both growing from new chains in 2021 to top 10 chains by TVL in 2023.

The core case for Optimistic Rollups is that they allow for batched transactions (aka high throughput, low fee txs) outside of Ethereum mainnet while still relying on Ethereum’s security for settlement.

Here are some helpful statistics for the growth of the Optimistic Rollup environment:

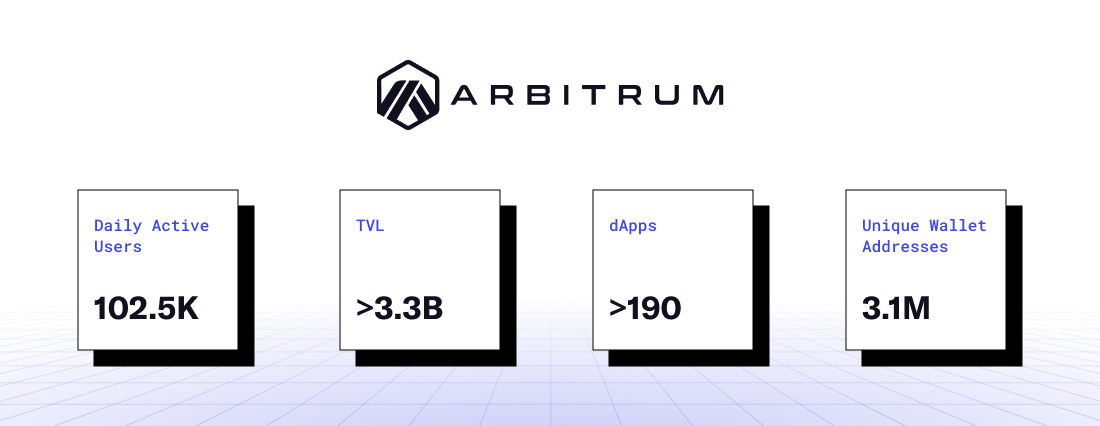

Arbitrum

On Feb 21, 2023, Arbitrum became the first rollup to surpass Ethereum Mainnet in daily activity.

The TVL on Arbitrum has grown rapidly and is currently at a peak in terms of ETH value at 2.15M ETH (~$3.3B) (Source: L2Beat).

Arbitrum has over 102.5k daily active users (monthly average over 180D, as per Token Terminal).

Over 190 dApps like GMX (derivatives platform with >$500M TVL), Radiant (lending platform with >$120M TVL), ZyberSwap, Camelot, Vela Exchange, Jones DAO, among others, are constantly innovating and onboarding new users and capital to Arbitrum.

If you thought the stats above were impressive, here’s how Arbitrum’s stats shape-up post the $ARB airdrop:

On March 23, 2023, Arbitrum surpassed Ethereum by 2.5 times with 2.73M transactions on the network compared to Ethereum’s 1.08M. On that day, Arbitrum accounted for 66% of the total activity on all L2s.

Arbitrum had 611k active addresses on the day of the airdrop (the previous record was held by Optimism with 53k addresses).

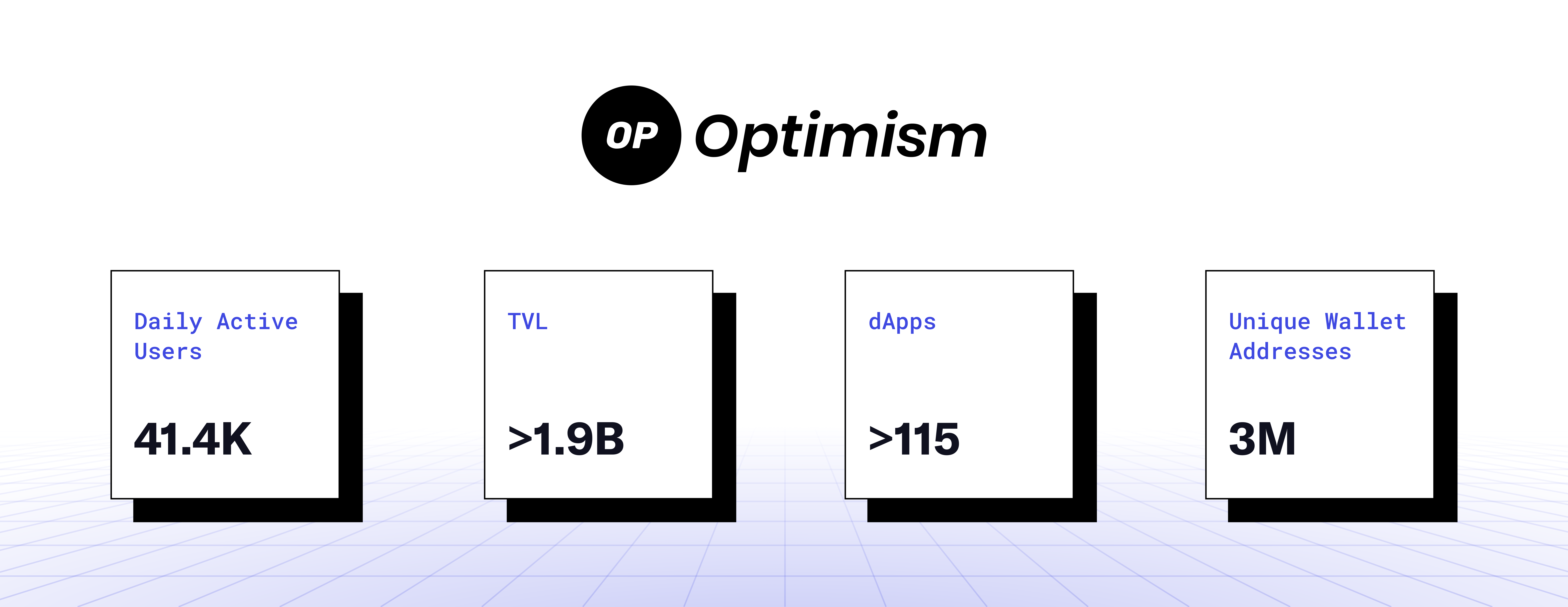

Optimism

The TVL on Optimism is currently 1.2M ETH (~$1.9B), up approximately 700% YOY (Source: L2Beat).

Optimism has over 41.4k daily active users (monthly average over 180D, as per Token Terminal).

Optimism hosts over 3M unique wallet addresses.

Over 110 dApps like Velodrome (DEX with >$300M TVL), Synthetix, Lyra, Pika Protocol, among others, are innovating and attracting new users and capital to Optimism.

Projects like Coinbase are building Superchains on the OP Stack.

There are several other rollups like Metis, Boba, Arbitrum Nova, but these chains are yet to see significant traction and make up less than 2% of Rollup TVL combined.

The ZK Ecosystem

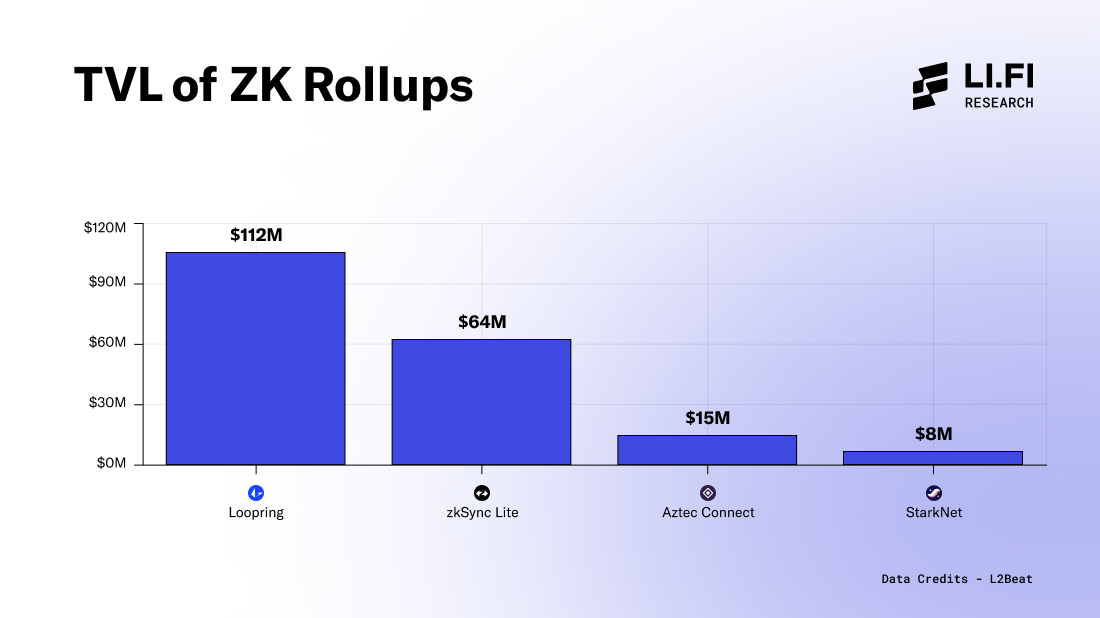

There is a swath of zero-knowledge powered blockchains gaining traction at a rapid pace. These math-based blockchains allow dApps to scale faster and offer benefits in terms of enhanced security and low transaction costs. Some of the most promising zk rollups include:

Loopring

zkSync Lite

Aztec Connect

StarkNet

While there is active development on all of these zk-rollups (with dApps building on each of them), certain constraints limit broad adoption:

Lack of EVM connectivity — The EVM was not originally designed to support zero knowledge proofs. As a result, it’s difficult to build seamless and secure connectivity between zk rollups and the EVM ecosystem. Thus, one cannot simply migrate an existing dApp from one of the EVM chains to zk-rollups.

Limited functionality — dApps building on zk-rollups are limited to simple swaps and payments (because math is hard and it’s difficult to bake complex functionality into zk-based chains at the moment). Moreover, it’s difficult to build general purpose dApps on zk-rollups since developers cannot leverage EVM friendly tools and have to rely on specialized toolkits that are often built by the zk-rollup teams themselves.

However, advances in zero-knowledge technology now make it possible to build zero knowledge EVM chains that provide the same benefits of zk-rollups and are also compatible with the robust native Ethereum infrastructure that developers are already familiar with.

A host of blockchains like zkSync Era, Polygon Hermez zkEVM, Scroll, Consensys zkEVM are set to launch soon with the idea to combine the power of zk tech and EVM dev tooling. These projects are currently in testnet phase and have already seen many dApps deployed on them — with several key infrastructure projects like bridges and data providers committing to support them on Mainnet launch, which is expected in 2023 for all these projects.

The Application Specific Rollup Ecosystem (The Rollups as a Service Narrative on Ethereum)

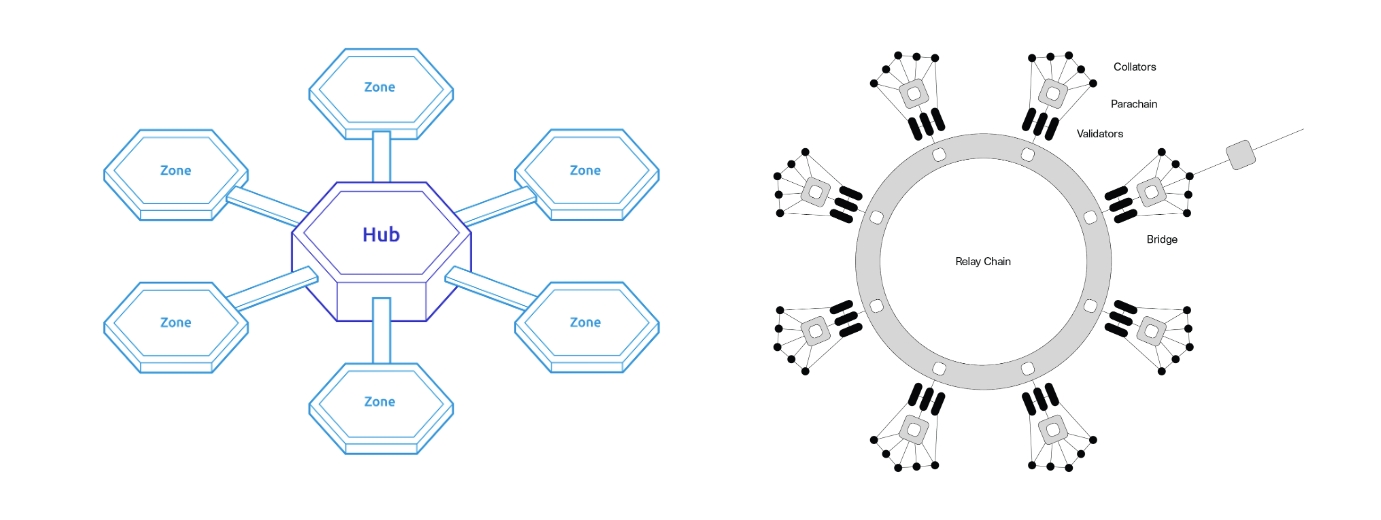

Ethereum’s rollup-centric roadmap is conceptually similar to the ‘hub and spoke’ model adopted by non-EVM ecosystems like Cosmos and Polkadot — the only difference is the layer at which the multi-chain structure unfolds for scaling. (Essentially, Cosmos and Polkadot scale in a horizontal design.)

Ethereum will scale a bit differently though. Ethereum’s scaling vision is multi-layered and adopts a vertical design. It builds around Ethereum Mainnet (Layer 1) as the Hub and scales by handling transactions off-chain on Layer 2s that are later settled on the L1. This allows us to build application specific rollups or RollApps that leverage the security of L2s (which leverage the security of the L1).

RollApps are essentially L3s that are hyper scalable and can be customized to serve a specific purpose. L3s are to L2s what L2s are to L1s. (L3:L2 :: L2:L1). Utilising an L1 as the Hub for security and communication (as the settlement layer), these RollApps (spokes) can be customized for better performance by using modular architecture — which separates the functions of a blockchain via decoupling the data and execution layers of a network while relying on a Hub for settlement (security).

This is where Ethereum’s vision of scalability aligns with that of Cosmos and Polkadot. The major difference is the fact that multi-application specific blockchain thesis is unfolding at the Layer 2 and Layer 3 level for Ethereum, instead of the base layer on Polkadot and Cosmos.

We’re seeing rapid development in offering “Rollups as a service.” Some of the most notable projects in this niche include Eclipse, Sovereign Labs, Artesi, Dymension, AltLayer, Stackr, Slush, and Optimism’s OP Stack.

The main reason behind launching RollApps is the convenience for dApps to not compete with others for blockspace on the same network. By doing so, dApps don’t need to worry about their operations being affected by the performance of another dApp on the same network.

In addition to Ethereum-centric RollApps, there are RollApp-like structures being built on top of EVM chains. These structures can function very similarly to RollApps. For example, Avalanche Subnets give developers the ability to spin up a customized blockchain experience with very little effort. Other structures, which are even less tested, are built to separate execution and settlement layers of blockchains. Celestia, Eigenlayer, and Arweave, among others, would count as this type of second example.

On Application-Specific Blockchains

Application-specific blockchains or in this case, RollApps, offer many benefits in the form of enhanced performance, customizability, and value capture. Thus, applications that have achieved product market fit and serve a large user-base will likely seek to launch their own blockchains in the future (the Starbucks loyalty program and Nike’s NFT marketplaceare something to keep an eye on as potential RollApps).

It’s likely that these chains will be connected by a variety of bridges and thus for any dApp, it becomes paramount to be well-connected with all the different chains in this multi-chain market structure to benefit from the users and capital that all of them attract.

Beyond EVM — The Ecosystems of Cosmos, Solana & Bitcoin

The multi-chain landscape is shaping into one that’s separated into different zones. For example, we can say that the EVM ecosystem is a zone that has a set of chains with the same dev tooling, are highly interoperable with each other, see high overlap of value/users between them, and, thus, have tremendous network effects.

Similar zones of compatibility exist with unique chains and ecosystems like Cosmos, Solana, and Bitcoin, among others. While we see high activity within these zones, the activity between zones is limited. This is largely due to:

Lack of awareness and familiarity — most users generally begin their journey in crypto on Ethereum or other EVM chains. This might be because MetaMask is everyone’s first wallet in crypto (and MM is currently only compatible with EVM chains). Similarly, developers typically learn solidity when experimenting with crypto. As a result, many users/developers are often unaware of the benefits offered by chains beyond the EVM ecosystem or simply do not have a strong enough reason to bridge their funds to these chains. Moreover, many developers and users are familiar with Ethereum and the EVM ecosystem at large, as it has been around longer and has a larger community. Going beyond EVM chains involves a learning curve for most and that is often a big deterrent for them to try out chains across other zones.

Interoperability challenges — While these zones are typically designed to facilitate interoperability between different chains within the zones, there’s a lack of connectivity with other zones due to the limited bridging infrastructure. For instance, connectivity between Cosmos and EVM chains largely depends on Axelar whereas the same can be said for Wormhole in the case of connectivity between Solana and EVM chains.

The above graphic highlights that bridging in large volumes is more relevant within zones (across chains in the same zone, i.e., EVM <> EVM) and is limited across zones (between chains in different zones, i.e., EVM <> Cosmos). However, as bridges become more robust in the future, this trend will likely change and the flow of value across zones should become more popular.

In this section, let’s zoom into different zones like Cosmos, Solana, and Bitcoin and analyze some growth stats for these zones.

Cosmos

Proof of Growth

There is currently 206.7M ATOM, worth ~$2.6B, staked on the CosmosHub across 175 validators. The economic security of the CosmosHub has increased steadily and with the present staked capital, it would cost ~$860M (⅓ threshold) to halt the chain. The cost to reorg the chain is ~$1.73B (⅔ threshold).

The Cosmos app-chain thesis is taking shape with over 270 applications and services building on Cosmos that offer a wide range of use cases including DeFi, gaming, NFTs, and more. Most notably, dYdX, the popular decentralized derivative exchange that was initially built on StarkWare, decided to launch a standalone blockchain called dYdX Chain on Cosmos further validating the thesis.

According to DefiLlama, over ~1.03B in total value is locked across 20+ Cosmos chains, with major contributions from 4 chains namely Cronos (35.49%, $368.48M), Kava (24.9%, $258.51M), Osmosis (17.43%, $180.97M), and Canto (10.67%, $110.78M).

The Cosmos ecosystem has a growing community of developers, users, and stakeholders. According to Token Terminal, Cosmos Hub has over 17.8k daily active users (as per Token Terminal) and 152 monthly average active developers in the past 180 days.

The number of active chains interconnected over IBC has grown steadily to 56 active chains. In 2022, there was over $30.3B in IBC enabled cross-chain transfers.

The Missing Money Legos

The stablecoin conundrum — Stablecoins are critical components of any DeFi ecosystem and, at the moment, the Cosmos ecosystem lacks a widely adopted stablecoin. While there are some stablecoins that have been developed specifically for the Cosmos ecosystem, such as Kava’s USDX stablecoin, these have yet to achieve the same level of adoption and liquidity as more established stablecoins on other blockchains like USDT and USDC in the EVM zone.

— To this end, Circle announced that it will be creating a “generic asset issuance chain” secured by Cosmos validators to issue USDC on Cosmos in 2023.

Lack of EVM connectivity — While the Cosmos ecosystem is designed to offer interoperability between chains within its network through IBC, there are limited options for connectivity with other chains. This makes it difficult for projects to build on Cosmos and attract users from other ecosystems.

— Bridging infrastructure providers like Axelar and token bridges built on top of them like Satellite and Squid have a critical role to play in connecting Cosmos chains to EVM chains. These solutions make it easier for users to move funds between chains and for dApp developers to either build on different chains (through Axelar’s message passing functionalities) or open up connectivity with them to onboard users and attract capital (through Squid’s token bridging mechanism).

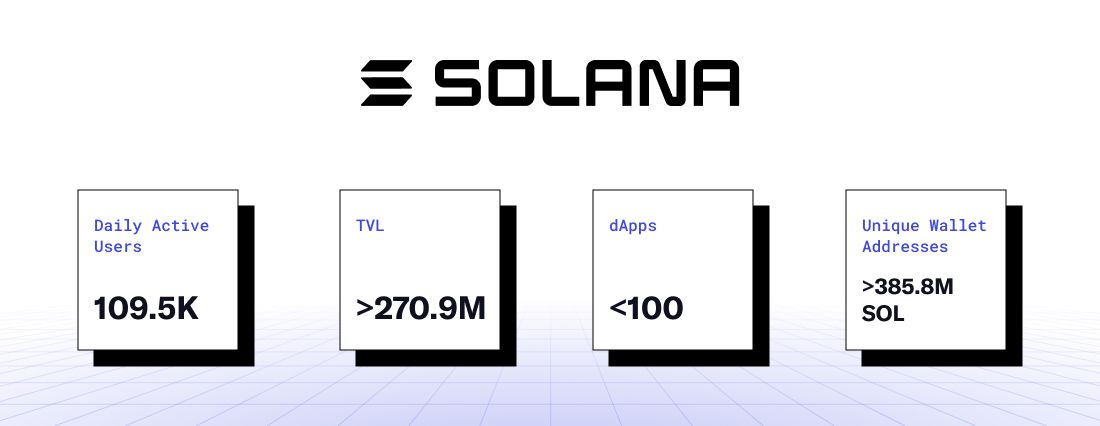

Solana

Proof of Growth

Solana has over 109.5k daily active users (monthly average over 180D, as per Token Terminal) and has processed nearly 157.3B transactions till date.

Solana has seen a significant increase in the number of validators on its network. As of March 25, 2023, there are over 1,700 validators on the Solana network. However, there are still concerns about the Superminority number, i.e., the number of validators that together control over 33% of the total stake — In its current state, 31 validators can theoretically collude to censor and/or halt the Solana network.

Solana has a vibrant NFT ecosystem and community with several hundred collections calling it home — including unique blue-chip collections like Degenerate Ape Academy, SolPunks, Degods, and Famous Fox, among others.

Despite facing a series of challenges such as the FTX collapse, multiple network downtimes, and the Wormhole $320M hack, the Solana community has remained resilient and continued to drive innovation (as seen in developments such as Solana Mobile).

The Missing Money Legos

Lack of blue-chip DeFi projects — The TVL on Solana’s DeFi ecosystem hit $1B in April 2021 and grew to a peak of $10B in November 2021. Since then, Solana’s TVL has reduced drastically and currently stands at $270.9M.

— The low TVL on Solana likely has a lot to do with crypto being in the depths of a bear market — but it must be said that Solana has been impacted by competition from growing L2s like Arbitrum and Optimism. Moreover, there’s a lack of growth catalysts in Solana’s DeFi ecosystem, with only 99 dApps currently deployed on the network — out of which only Marinade Finance is able to attract more than $100M in TVL (Marinade Finance TVL is $131.65M, which is approximately 48.59% of Solana’s entire TVL).

Solana’s low TVL at the moment does not reflect its long-term potential as we’ve seen in the past that the network can attract significant amounts of capital and user interest. Thus, there’s reason to believe that Solana’s DeFi ecosystem will see a revival over the next few years.

Multiple steps required to get the desired tokens on Solana after bridging from EVM chains — Solana’s native token ($SOL) is not native on other chains. When users bridge from EVM chains to Solana, they generally bridge stablecoins like USDC and DAI. As a result, when users come to Solana via bridges like Wormhole, a majority of users immediately go swap into their desired tokens on Jupiter Exchange (56% of all actions after bridging to Solana are related to swapping). While this flow of bridging and swapping being two separate actions gets the job done, it’s certainly not the ideal flow, especially for new users bridging to Solana.

— Bridge and DEX aggregation platforms (like Jumper.Exchange) plan to add Solana in Q2 2023 which will allow users to access multiple bridges like Allbridge and Wormhole for bridging to Solana and allow for swapping into desired assets using DEXs on Solana in a single transaction.

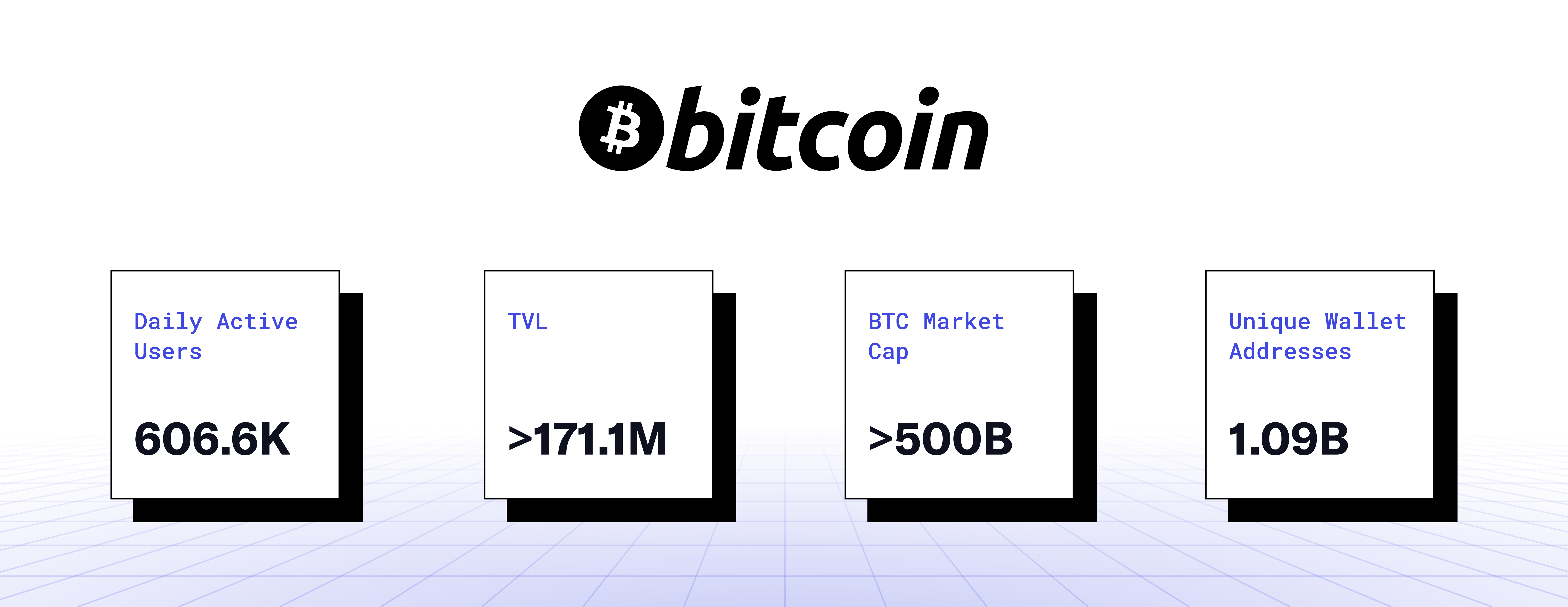

Bitcoin

Proof of Growth

According to CoinMarketCap, Bitcoin is still dominant compared to any other crypto asset. At a ~$500,000,000 market capitalization, BTC accounts for 46.1% of the entire industry’s value.

Over 1.09B unique wallet addresses have interacted with the Bitcoin blockchain.

Lightning Network capacity, the cumulative amount of BTC across all Lightning Network channels, is at an all time high. The L2 to Bitcoin has over 5,000 BTC locked into the network, which is worth roughly $150M at current prices.

Ordinals, an NFT community project on Bitcoin, accounts for between .1% of miner revenue since December 2022, according to data compiled by Joel John. Notably, on peak interest days for Ordinals, miner revenue from the NFT project has reached 1%. While perhaps appearing insignificant, the fact that Bitcoin is seeing any uptick in interest outside of the digital gold thesis is worth looking into.

Bitcoin is now the home to multiple scaling solutions. In addition to Lightning Network, teams at Rootstock, Liquid Network, and Stacks are building smart contract capabilities in close association with Bitcoin.

Multiple security statistics are at an all time high for Bitcoin, including Bitcoin Average Difficulty and Bitcoin Network Hash Rate.

The Missing Money Legos

Smart contracts are hard — Bitcoin has smart contracts, but they are not Turing-complete: meaning any programming on Bitcoin is limited. As mentioned above, teams at Rootstock and Liquid are attempting to add DeFi native smart contracts to Bitcoin, but they are more akin to L2s than development on the native Bitcoin chain.

The stablecoin conundrum — Much like with Cosmos, the Bitcoin ecosystem lacks a widely adopted stablecoin. Some of the scaling solutions on Bitcoin have attempted to create stablecoins. On Rootstock alone there are three BTC-backed stables, including DOC, RDOC, and XUSD. Additionally, BitMEX founder Arthur Hayes recently proposed NakaDollar (NUSD), a stablecoin backed by BTC and BTC derivatives. However, it must be noted that these stablecoins are not to be used on the actual Bitcoin Network — they are just stablecoins for other networks backed by native BTC.

Lack of EVM connectivity — Bitcoin is its own silo. For now, the best way to use Bitcoin on EVM chains is wrapping it via BitGo, which is a centralized solution that goes against the core premise for why Bitcoin was invented in the first place. Other chains like Solana and Cosmos also have Bitcoin, but it has to exist in some sort of wrapped form — be it BitGo or some sort of bridge infrastructure. That being said, ThorChain does offer the ability for users to swap natively from ETH to BTC.

On Non-EVM Chains

We believe the case for dApps to deploy on these chains is slightly weaker compared to EVM chains given the dev resources it would take. However, there is still compelling evidence for dApps to consider establishing connectivity with these chains through bridging providers or aggregators. Additionally, these chains have all the right things in place to experience significant growth and development in the future, making it an attractive option for dApps to expand to them early and position themselves to benefit from growth.

Closing Thoughts

The stats and narratives above, which outline the reality of a multi-chain crypto ecosystem, make deploying dApps on multiple chains not just a prudent move but a strategic imperative for teams. Deploying on multiple chains or providing the infrastructure to onboard users from any chain will allow dApps to:

— tap into wider user bases

— access different liquidity sources

— gain exposure to new markets

It also reduces the risk of dApps becoming irrelevant in case of a market shift — i.e. a particular blockchain may become less popular over time or, even worse, the entire protocol could collapse (s/o Terra).

In summary, with the market structure rapidly evolving into a multi-chain landscape, dApps need to adapt and innovate quickly. Deploying on multiple chains is a powerful way to achieve this, providing them with limitless opportunities.

Go Multi-Chain With LI.FI

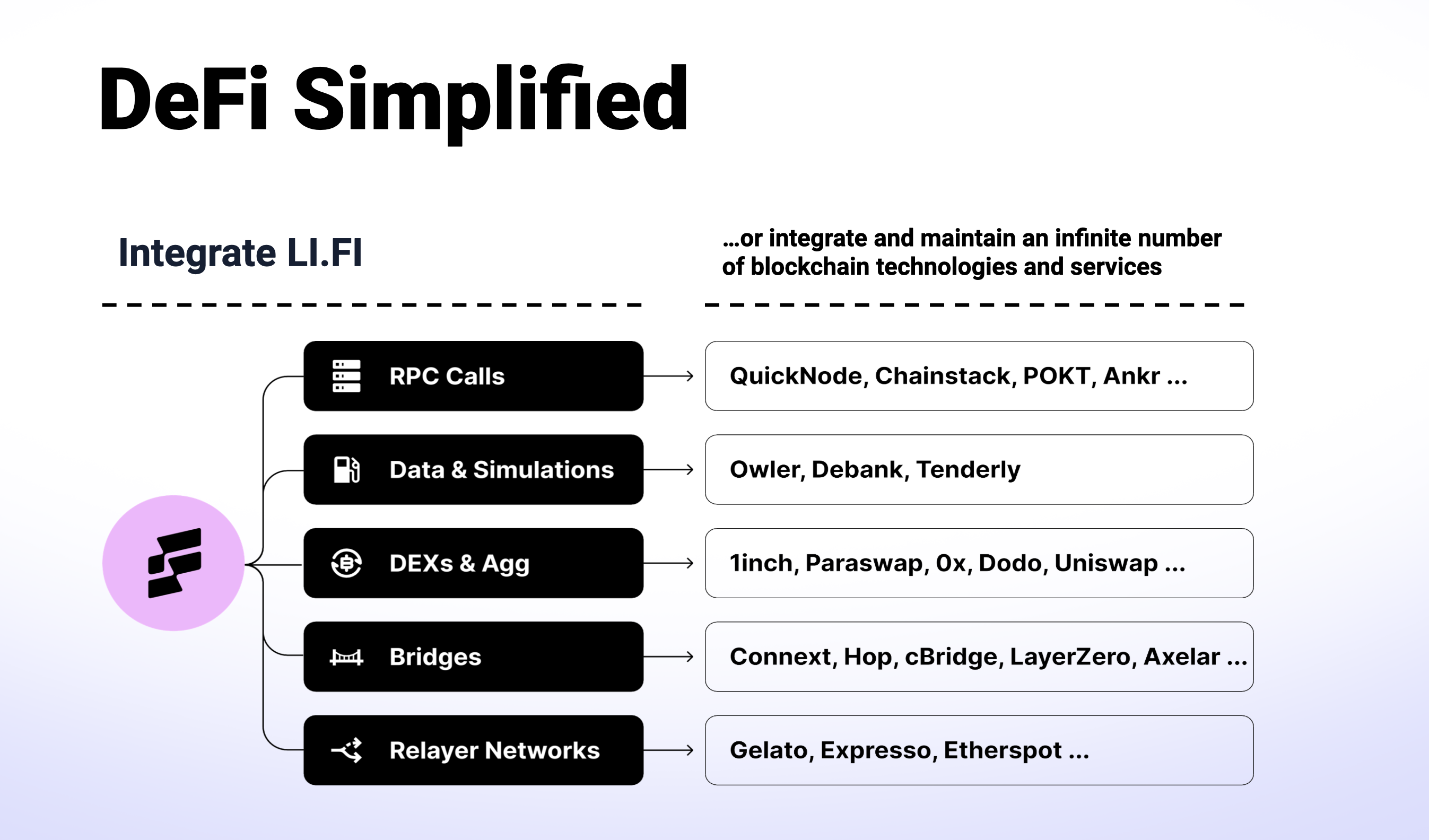

There has been significant advancement in the development of cross-chain technology that makes the move across blockchains seamless for dApps. For instance, multi-chain DeFi middleware solutions like LI.FI offers a product that abstracts away cross-chain infrastructure by providing a tech stack to cater to every need:

Want to stay on one chain but onboard users and attract liquidity from several chains? Integrate the widget with prebuilt UI components and style it to match your web app design within a few hours.

Want complete control over the x-chain experience you offer? Integrate the SDK or use the API.

The ecosystem is rapidly evolving; new chains and bridges launch every other week. Using a multi-chain middleware solution that aggregates and abstracts away critical DeFi infrastructure and services across blockchain ecosystems is a viable option. Such solutions enable dApps to outsource the research and development costs of integrating and maintaining bridges and staying on top of the trends in crypto. As a result, bridge aggregators can significantly reduce the technical overhead and the knowledge barrier for any multi-chain go-to-market strategy, making them an easy choice to power any multi-chain strategy.

Huge thanks to Mark Murdock for brainstorming and co-writing this research article. This article would not have been possible without his editing skills. 😄

Stats taken from:

Daily active users — Token terminal

TVL data for Optimistic Rollups and zk chains — L2Beat

TVL data for other chains — DeFi Llama

Other dashboards used — Nansen, Dune, chain-specific block explorers.

FAQ: Why Multi-Chain, Why Now.

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Join the official Discord Server

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on Twitter & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.