LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Why Are We Tokenizing Real World Assets?

Understanding RWAs and tracking their adoption in crypto

Introduction

An asset is anything that can generate income or retain its value over time. But why do we differentiate between assets as "Real World" assets and digital assets?

Initially, this distinction may seem trivial. However, the financial landscape has evolved from traditional brick-and-mortar businesses to multi-division companies operating entirely digitally.

In this new landscape, there’s a merging point where the best of both worlds meet—real-world assets like real estate or stocks are being tokenized and converted into digital assets. These tokenized assets can be traded globally, creating a new category known as Real World Assets (RWAs) in crypto.

Let's unpack this up-and-coming vertical of tokenized real-world assets in crypto, their implications on the financial system, and what it means for the average Joe.

History: From Digital Goods to Digital Assets

How did we get here? Why did we start differentiating between RWAs and Digital Assets? After all, isn't any asset that's stored digitally a digital asset?

The term "digital assets" evolved from the early days of the internet, where one could sell or trade digital files—whether they were sounds, images, or software—online.

These pieces of software were essential in pioneering the digital age, but, unsurprisingly, they weren't considered assets. Instead, they were viewed as pieces of code a person owns, or a database entry that entitles a person to a particular claim.

However, they played an important role in making people feel like they owned a particular item digitally, which was the first step toward a much-needed mindset shift.

As the world moved towards a more digital-first environment, regulations and terminologies had to catch up.

With time, any yield-bearing or value-realizing piece of document on a computer was considered a digital asset; everything else was a digital good that was just issued by the company that sold it.

Okay, sure, but "What does cryptocurrency have to do with this?," you may ask.

Well, once the world felt like it had caught up with digital assets, a whitepaper released on October 31, 2008, permanently changed the way people viewed digital assets.

The concept of a digital currency, Bitcoin, that existed on a trustless and permissionless ledger, captured the world's imagination. This currency could be stored on a blockchain where nobody except yourself (or whoever has the keys to your wallet) could make transactions, and its implications for real-world change spread like wildfire.

Bitcoin's arrival marked the birth of a truly digital asset, one that was not just a file or a database entry, but something with tangible value and potential for real-world impact—a digital asset not beholden to any government's laws and regulations, not made or issued by any identifiable person, and belonging to a network owned by no single individual.

This was the fundamental idea that galvanized everyone who felt betrayed by the corrupt financial system. It inspired a movement, leading to a surge in development and innovation around Bitcoin.

World’s first Bitcoin conference

Since then, the digital asset landscape has expanded with several significant innovations.

Smart contracts, dApps (Decentralized Applications), Decentralized Finance (DeFi), and NFTs (Non-Fungible Tokens) have each played a role in reinforcing the distinction between physical and digital assets.

Tokenizing RWAs and Bringing them Onchain

Now that we understand the difference between Real World Assets and Digital Assets, let’s take a slight detour to explore the DeFi frontier.

DeFi is one of the main reasons for the existence of blockchains. It represents a step toward creating a fully autonomous financial system by eliminating intermediaries, offering permissionless alternatives to banks, exchanges, and brokers.

With the growth and massive adoption of DeFi protocols, the idea of a self-governing and independent financial system is something that excites many.

Where RWAs come into the picture is in addressing the gaps these DeFi protocols cannot fill.

You see, these protocols are not a cure-all for the financial system's problems. They are susceptible to hacks, getting gamed and shutdowns. The added negative behaviour of most users in a permissionless system, which encourages a destroy-or-be-destroyed mentality, doesn’t help either.

What if you found a way to get a highly trusted, government approved, low risk security that is guaranteed(*) to pay out to offset the degeneracy that most people that participate in?

Sounds almost too good to be true, no? If government bonds get you this excited then, you my friend, are in the right place.

What if they took all the positives of a trusted and valued system and put it onchain? Sure, it doesn’t make it as sexy as a fully self-governing, autonomous system, but it would definitely address quite a few problems the space faces.

And as per research on RWAs published by Galaxy, it looks like it’s the crypto native users that are interacting the most with onchain RWAs, as opposed to traditional investors.

Take a government bond or a hundred and put it onchain as a token where users who hold this are entitled to claim the returns the bonds generate.

Why stop at bonds? You can tokenize stocks and even corporate bills. Why not tokenize a house and either sell the claim for any yield the estate generates or better yet, sell the house. Why stop at a house, a Lamborghini is pretty well trusted, as long as someone is incentivized to verify the authenticity of the vehicle, it can be sold. With this line of logic, almost anything can be sold.

This is what Real World Asset Tokenization is all about:

Taking a well-trusted and recognized asset from the real world, putting it onchain by issuing a token backed by the asset you want to tokenize (a process very creatively called tokenization), and allowing people to trade it. If someone wants to claim it, they can follow the rules of the protocol and the jurisdiction of the asset to transfer it to their name in the real world.

The Impact of Tokenizing RWAs

All this might seem like technical bike-shedding to most people. Why would this even need to exist as it doesn't directly solve any problems? The tokenization of RWAs may not have any direct implications to the average person, but what it does to the overall system is nothing short of paradigm shift.

Removal of the middle-man – Selling assets on a global scale, no matter the kind, is always a cumbersome process because of the requirement to talk to several different entities before you can even start your desired process. With RWA protocols, this makes trading the assets much easier. Sure you may have to face some bureaucracy while claiming these assets in the real world, but the proposed system is light years ahead of the system which forces individuals to face several challenges just to participate in the global market.

Improved market dynamics - A great heuristic by Ryan Beckerman is the evolution of trading towards markets with very low friction. Information and liquidity restrictions are the least when you are trading on a trustless, permissionless system which encourages people to move to a system that provides them with maximum value. The tokenization of RWAs is just the next step we'll be taking towards creating a friction-free marketplace.

Anything for anything marketplace - DeFi Matrix – Balaji Srinivasan, co-founder of Coin Center and a proponent of decentralization, introduced the concept of a DeFi matrix. This framework would enable users to trade any asset for any other asset. Imagine trading a house in Brazil for two luxury cars in Tokyo, which in turn could be traded for stock in a Canadian company—all while sitting in Australia. The suggested matrix pairs every asset against each other, not too dissimilar to how Uniswap works, where best routes for the asset are programmatically found and trades done automatically. This proposal would be the pinnacle of what a decentralized financial system would allow you to do.

RWA Adoption in Crypto

Are you sold on the idea? Good. Larry Fink of BlackRock thinks the same.

The space has been developing at quite a rapid rate with people from all kinds of backgrounds trying to break the barriers to a global financial system. There are a ton of protocols and projects that are waiting to be tried out. These RWA protocols range from fixed income Instruments like bonds and bills to tokenizing actual land in the physical world.

Here are a few that are worthy of your attention.

Traditional Finance Instruments

Tokenization of Financial Instruments has been one of the driving points of why RWA is important. It provides a much easier time accessing these instruments than what exists currently, which in-turn provides more liquidity to the same instrument allowing for institutions to raise a globally competitive amount of capital.

Some noteworthy projects in this segment include:

Stablecoins – The issuing of 1:1 tokens for every dollar held in a reserve is what the Stablecoin business is all about. It helps users trade with some form of stability as the volatility of native digital currencies makes it very difficult to trade. Circle and Tether, the largest players in the market have made it very easy for users to trade with less friction.

Mirror Finance – First attempt at bringing tokenized stocks onchain. The project failed because of a poor implementation of the algorithmic stablecoin that eventually led to the demise of the whole network, but was a great first time venture in a very early market.

Backed – A protocol that has been slowly tokenizing the most popular assets in the US like the Core S&P 500, High Yield Corporate bonds, etc.

Maple Finance – Onchain lending to institutions and accredited investors allowing these companies to have access to liquidity at a rate that suits their needs. With over $3 Billion in loans issued, Maple aims to be the premier loan provider to institutions looking to trade on chain.

ONDO Finance – Provides onchain access to institutional grade assets that allows people across the world to access yield from the US markets.

Tangible Assets

RealT – A marketplace for investing in tokenized homes and using fractional ownership to allow users to claim a part of income the property generates.

Mattereum – Enables tokenization of almost every asset and a system that's very compliant with the government. It is run by Vinay Gupta, an OG in the cryptography space who has been working on Mattereum for the last 8 years.

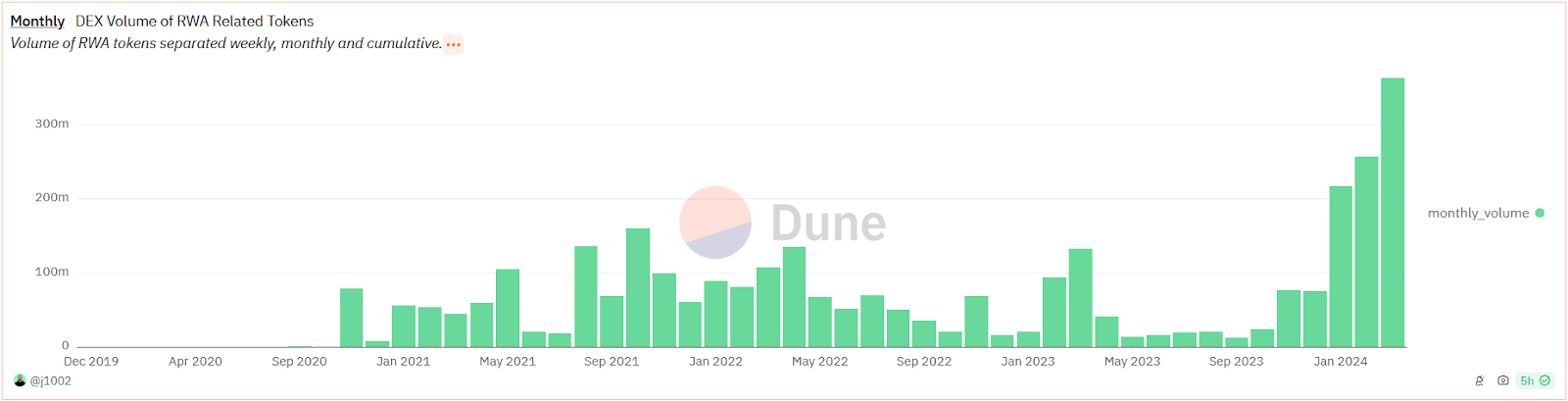

Volume of RWA tokens is on the rise. Source: DEX Volume of RWA Related Tokens

The next significant advancement of RWAs appears to be the facilitation of trading traditionally illiquid or "sticky" assets.

The tokenization, coordination and last mile execution being handled by these companies make it conceivable for people to trade real estate, commodities, physical art and luxury Items like watches and cars. This space is still quite new and ripe for innovation, but early signs show a lot of promise.

Digital Asset Adoption in the Real World

If the process of bringing an asset to onchain is called tokenization, the opposite, as counter-intuitive as it sounds, can be called the crypto-fication of assets.

This may seem illogical, why would people try to make a real world asset out of cryptocurrencies? But institutional bureaucracy is a by-product of being a legal entity, and since the government's pace is almost always slower than private entities, some of them take it into their own hands to get the ball rolling.

This is a totally different perspective from the previous section as it is entities in the real world that are trying to bring digital assets to the traditional finance systems and in some way meeting the digital space halfway. Here are some noteworthy headlines:

Bitcoin ETFs – On January 10th 2024, the SEC approved the listing of 11 Bitcoin Spot ETFs that has now opened the way for more digital assets to be offered to traditional funds, offering them ways to mitigate risk by holding a variety of digital native assets.

Central Bank Digital Currency (CBDCs) - Quite a few governments are toying with the idea of issuing CBDCs as a way of keeping their currencies relevant in the online era of trustlessness. The Federal Reserve at St. Louis regularly publishes their findings and have been quite positive about the developments in the crypto space. The CBDC may actually increase blockchain activity as the most difficult task has always been on-ramping and this may just solve the problem.

Is this actually helpful to the space? Yes and no.

It is helpful because of how much potential exposure the average person now has to crypto, they can use well trusted institutions to lawfully hold some crypto in their portfolio eliminating some risk of holding foreign exchange in their accounts.

On the other hand, it’s not very helpful as this doesn’t address the frustrating bureaucracy, lack of liquidity and market isolation traditional finance generally brings to the system.

It is, however, very exciting to see the world acknowledge the crypto space in their own dilatory ways.

This isn’t an endorsement to any of the ETFs or actions taken by these entities (or any entity mentioned here) but to remove the doubt you may have about the legitimacy of the space. It’s not just the “crypto bros” working on this, it’s everyone who wants to build a fairer financial system.

Where Does that Bring Us?

Somewhere in the middle, if a guess had to be wagered.

A lukewarm response, but the space seems to be developing in a way that is trying to bring the best of both worlds.

A well regulated marketplace that uses all the best features of a decentralized financial system might actually be the answer for a lot of people. We’re seeing the tokenization of real world assets and the traditional form of digital assets, it is clear that “both sides” want to create the same thing.

Crypto maximalists might see this as a bad thing but the truth is a lot of people still don’t, and likely won’t, understand finance or crypto. Abstracting away all the nitty-gritty details can actually increase the adoption rate and that can only happen when people can be relieved of the burden by trusting their governments to have their backs when things go wrong.

Is it all sunshine and rainbows?

Of course not. Blockchains and tokens have their own fair share of problems. Transactions are immutable and very costly, double-whamming people who are new to the space, Oracles - entities incentivized to pull data onchain - see their fair share of issues, All of these entities in the RWA space still require government checks and can fall back to the same problems as the centralized entities.

What it is, is an important first step to address the inefficiencies and using the technology we have at hand to make an age-old process much faster.

While the space is still quite chaotic, groups are actively taking measures to keep the space as clutter free as possible. We’re still quite early in the S-Curve, not just for RWA protocols, but for crypto in general. So all we can do is watch for these improvements and incorporate them into our flow, making it feel incrementally better in the short term but exponentially better in the long term.

How RWA Protocols Are Using LI.FI

The existence of multiple chains, rollups and side chains may make it hard for users to transfer value (RWAs) as their tokens might be on a different chain while the applications they want to use are on a different one. It's actually this very problem that led to the creation of bridges improving the connectivity of the system and making it more composable.

All applications in the future need to abstract away all of the unnecessary complications and allow users to just focus on what they want to achieve while allowing for power users to optimize processes to their liking, and luckily, such abstraction is possible with LI.FI.

LI.FI is a multi-chain trading API for financial institutions, fintechs and DeFi projects. LI.FI's technology empowers RWA projects to streamline asset purchases for their users.

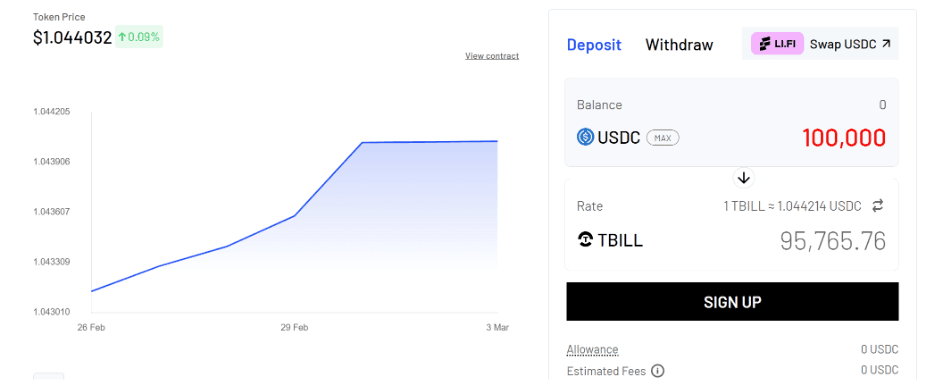

Take OpenEden, an RWA project that has integrated LI.FI to facilitate the minting of T-Bills, enabling users to generate on-chain yields from various assets.

With the integration, OpenEden users can swap directly into USDC on Ethereum & Arbitrum from 15+ chains and L2s and then mint TBILLs. For instance, a user could exchange MATIC on Polygon for USDC on Arbitrum—or any other token/chain combination—and proceed to mint TBILLs, exemplifying the seamless interoperability that LI.FI brings to the table.

Minting TBILLs with LI.FI on OpenEden

FAQ: Why Are We Tokenizing Real World Assets?

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.