LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Under the Hood of Intent-Based Bridges

Should you use intent-based bridges? A guide to the pros and cons.

The bridging landscape has come a long way in the last three years, with each new design improving scalability and capital efficiency. Intent-based bridges are the latest type, introduced for their improved UX and faster speed.

As the name suggests, they work based on user intent. Let's break down what intent-based bridges are and how they work.

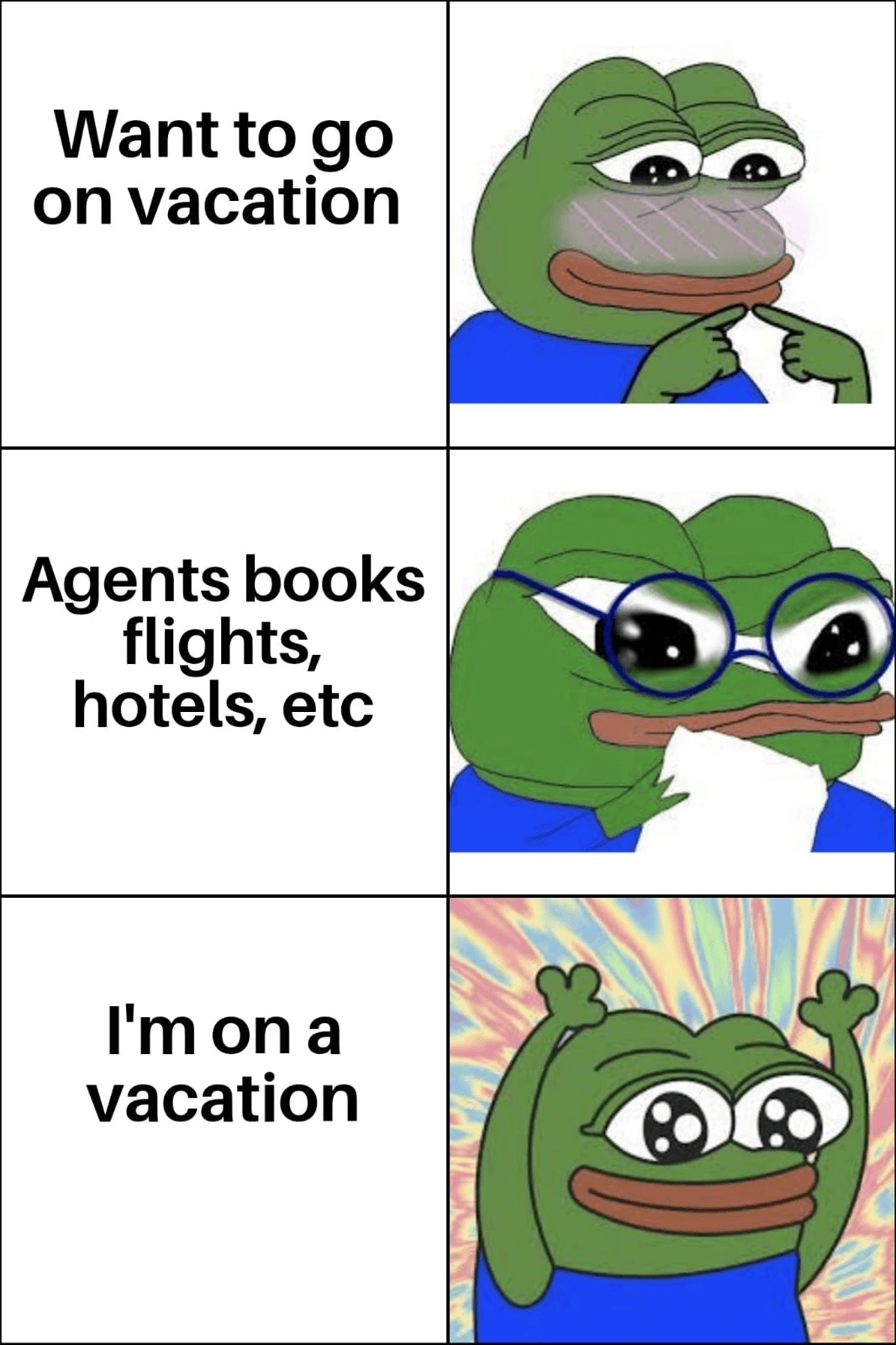

Intent-Based Architectures

Intents are like making a simple request. Imagine you decide you want to go on a trip. You tell a travel agent your desired destination and dates (your intent), and they handle the rest, arranging flights, hotels, and activities (the fill).

Any intent-based architecture can be broken into these key elements:

Intent: The user's action that starts the process, like asking for a book.

Solver: The entity that completes the user's request. Different terms, like relayers, fillers, or agents, might be used for similar roles.

Fill: The solver's task of fulfilling the user's request. The term ‘fill’ is particularly used in the context of intent-based bridges to explain the solver’s task of ‘filling’ users, aka fronting the desired assets on the destination chain.

Settlement: The final step is where the completion is verified and the user's request is officially fulfilled.

With that in mind, let’s understand how this design works with bridges.

Working of Intent-Based Bridges

The intent-based bridge process begins when a user initiates an action, creating an intent message that outlines the desired outcome. This triggers several steps to fulfill the user's request.

Here is a step-by-step explanation of what happens:

The user initiates the intent.

Funds are sent to an on-chain escrow.

Solvers bid to fulfill the intent through an auction.

The winning solver is selected and given a timeframe to perform the swap.

The solver fronts the liquidity on the destination chain.

The solver provides proof of completion through an oracle.

The bridge releases the user’s funds from the source chain and send them to the solver.

Let’s understand this with an example:

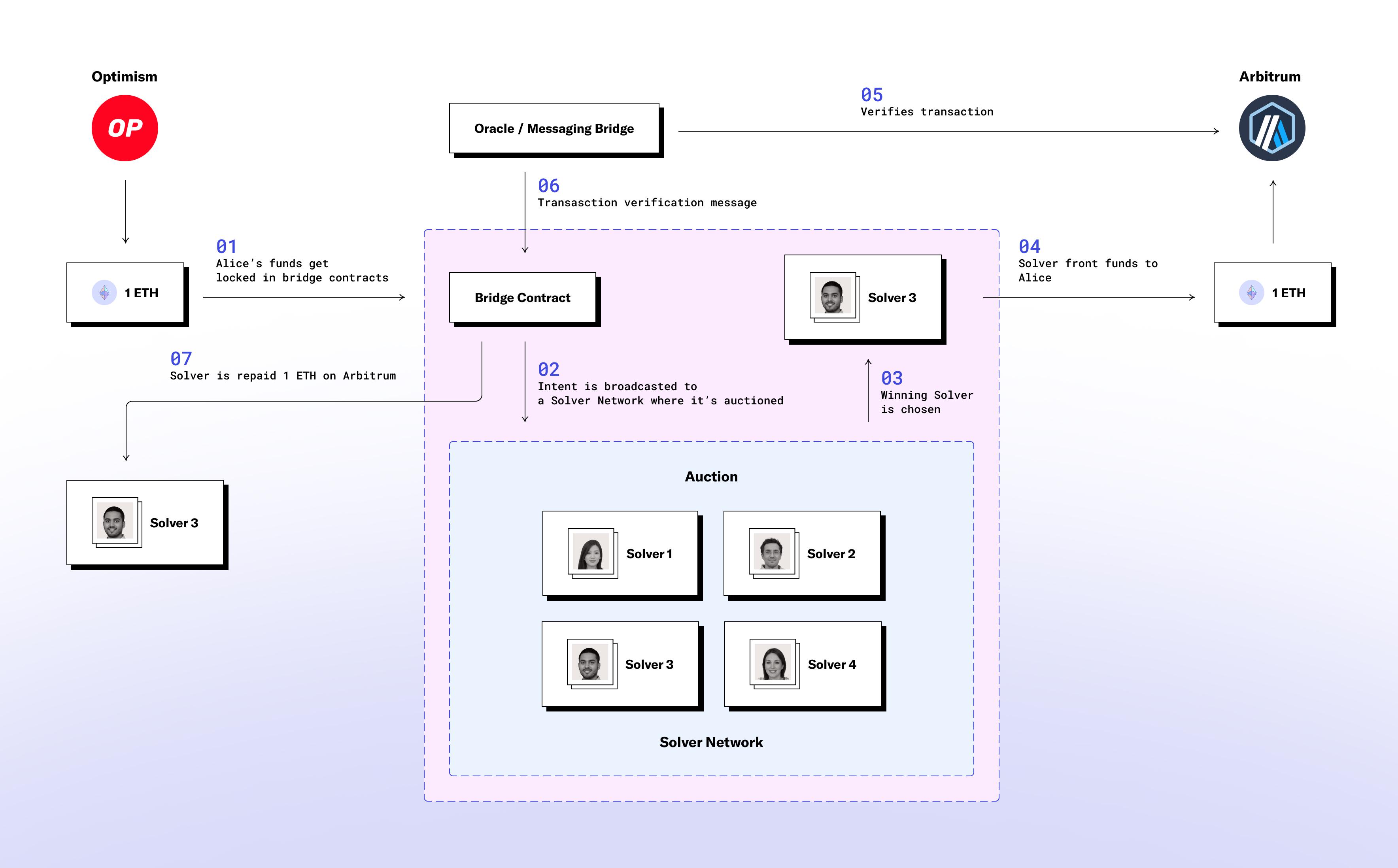

Alice wants to send 1 Eth from Optimism to Arbitrum.

Working of Intent-Based Bridges

Here, the components are as follows:

Bridge Contract: Responsible for maintaining an escrow for user funds on the source chain, aggregating transactions, and releasing funds to the solvers.

Oracle/Messaging Bridge: This verifies the transaction on the destination chain.

Solver Network: A network of solvers that participate in auctions to fulfill user intents.

One important aspect to note is that once a user initiates a transaction, they can't cancel it. This design choice is made to prevent timing attacks. For example, if a user could cancel the transaction right after the solver completes it, they could potentially steal the solver's funds.

Auction Dynamics in Intent-Based Bridges

Any intent-based bridge will fundamentally operate in the same way as above, but how it executes auctions for solvers is a key differentiator. The auction dynamics for each bridge vary, with different auction types for different actions.

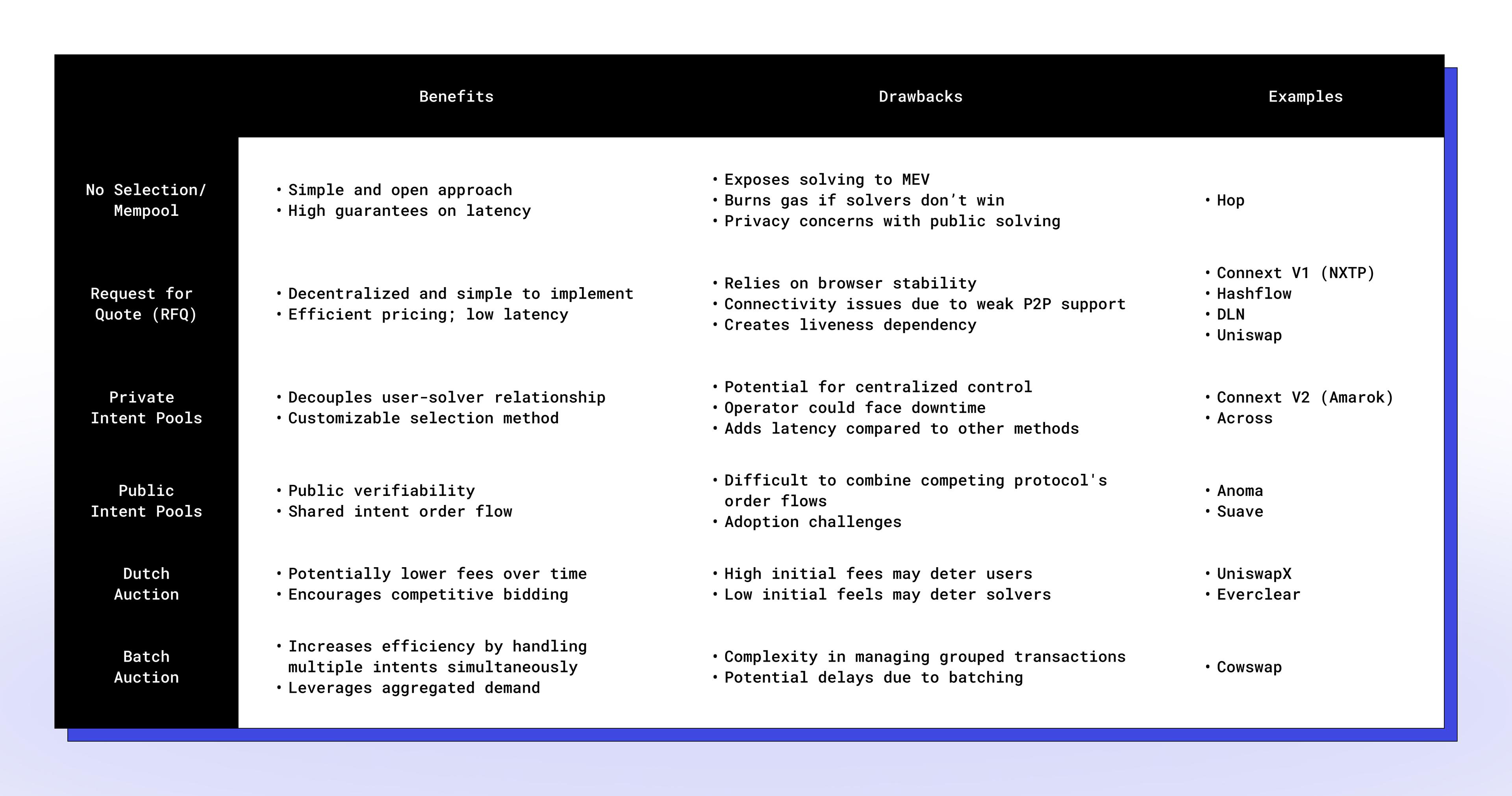

Here are the types of auctions solvers participate in:

No Selection/Mempool: Solvers race to fulfill the intent.

Request for Quote (RFC): Solvers provide offchain quotes, and users pick the best one.

Private Intent Pools: The bridge runs a permissioned auction for a select few solvers.

Public Intent Pools: The bridge runs a permissionless auction open to all solvers.

Dutch Auction: Starts with higher fees, and the price decreases as solvers bid.

Batch Auction: Grouping multiple intents together for a combined auction.

There are benefits and tradeoffs of each auction type:

The table above extends the differentiation framed by the team at Everclear.

Discussing the Edge Cases in Intent-Based Bridges

The intent-based design of the bridges simplifies cross-chain actions, but there are some instances where transactions might not go through. Here's how different bridges handle these situations:

No solver bids for an intent: Across uses its own solver to fill the intent, and if it isn’t profitable, the intent expires after a set time. On the other hand, Everclear increases the fee and holds a new auction.

Solver fails to execute the intent: If the intent expires, the funds are returned to the user.

Intent expires: If the winning solver fails to execute the transfer within the allotted time, the intent is reopened to other solvers who can claim the task and the associated fees.

Also, different bridges have different options for paying solvers. For example:

Everclear: Solvers are paid only on the source chain.

Across: Solvers can receive settlements on any supported chain for a small fee.

One last thing to note is that currently, each protocol is developing its own solver network. These networks are isolated, and there is a proposal for a standard to unify the solver networks called ERC 7683 put forward by Across and Uniswap.

We will cover more about the solver network and ERC 7683 in an upcoming piece. As of now, the primary challenge that anyone faces with creating an intent-based bridge (or infrastructure) is creating and maintaining a solver network.

Benefits and Drawbacks of Intent-Based Bridges

Intent-based bridges offer several advantages, making them a compelling option for cross-chain actions:

Fast and Cost-Effective Execution: These bridges are designed to execute transactions within a specific timeframe and predefined fees, making them efficient for users as they don’t have to wait for long durations.

Simplicity: The design lowers costs and speeds up transactions by minimizing onchain interactions and using off-chain liquidity. Competitive bidding among solvers ensures efficient, low-fee transactions with faster execution.

Reduced User Risks: The design minimizes finality risks for users by offloading them on solvers.

Some key drawbacks of intent-based bridges are:

Risk of Centralization: A few solvers dominating the order flow can lead to potential risks like censorship, single points of failure, and poor execution.

High Barrier to Entry: Becoming a solver requires substantial liquidity (due to staking requirements in some intent-based protocols and the fixed costs) and technical infrastructure, making it challenging for new entrants.

Single Bidder Problem: In some protocols where there’s a lack of solvers, it’s seen that there’s only one bidder, leading to no bidding contest. Orders are frequently fulfilled without competitive bidding, which in turn impacts the rates offered to the users as the benefits of an auction aren’t realised.

Closing Thoughts

Intent-based bridges offer a promising and simplified system for cross-chain transactions, but they also come with some challenges. One concern is that a few key solvers could dominate the entire auction. However, efforts are underway to create standards and lower the barrier for anyone to become a solver.

The proposal of ERC-7683 as a unified solver layer aims to address this by standardizing the process. This standardization will simplify operations within the Ethereum ecosystem, but it will be interesting to see how bridges manage solver auction dynamics and infrastructure on other L1s like Solana.

With that said, if ERC-7638 is implemented, then the efficiency of any intent-based bridge will be determined by its auction dynamics, similar to how Layer 1’s differentiate themselves based on their consensus mechanisms. It will be interesting to see how the space evolves and adopts the intents design across multiple applications, including bridges.

We've already discussed the major trade-offs with intent-based bridges in this post. But overall, the design adoption looks positive, and we at LI.FI are looking closely at how this design will perform in the long term.

FAQ: Under the Hood of Intent-Based Bridges

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.