The Multichain Future And LI.FI

How LI.FI Can Be The Solution To The Challenges Of A Multi-Chain Ecosystem

The Multichain Future And LI.FI

The cryptocurrency and blockchain ecosystem has experienced exponential growth. However, due to the rapid growth of the industry, we appear to have reached a crossroads. With the growth of the industry, we’ve seen the rise of several Layer 1 solutions like Solana, Avalanche, and Terra to name a few. While the growth of the industry and an increased number of blockchain solutions are excellent for the space, they pose unique challenges as we move towards a multi-chain future.

Let’s take a look at some of the issues associated with the multi-chain future and how LI.FI can be the solution!

The Real Problem and the Bridging Problem

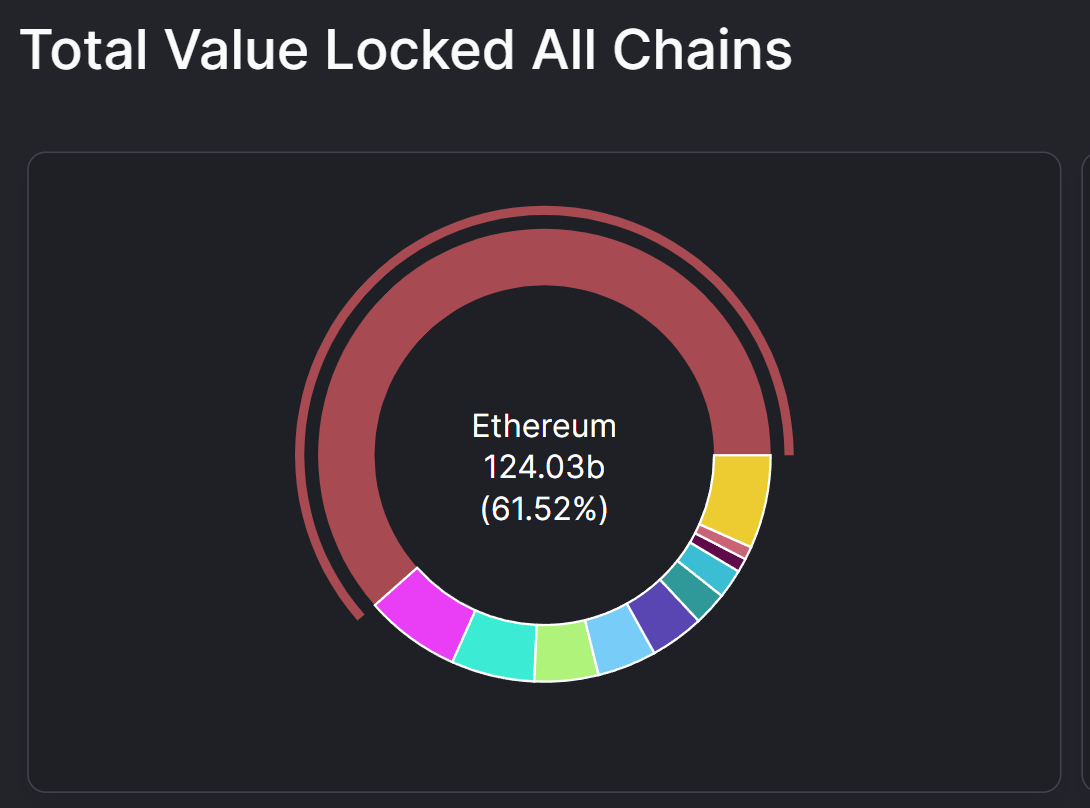

With the DeFi summer of 2020, the NFT bull run that we experienced earlier this year, the craze around Play-To-Earn games and the Metaverse currently, if there is something to learn, it’s the fact that when it comes to blockchains, there’s a lot of design space to play with. This has further been confirmed with the rise of Layer 1s and Ethereum scaling solutions. Thus, even with any power law, there is good reason to believe that there will be several in-demand blockchains around in the future. This is further highlighted by the graphic below, which reflects that while Ethereum still dominates all chains in terms of TVL, other chains have started gaining significant traction.

However, as the blockchain ecosystem becomes increasingly multi-chain, the liquidity gets fragmented. While the influx of capital into the ecosystem has been abundant, it is distributed among the different blockchain ecosystems and their dApps. Moreover, the issue of fragmented liquidity is faced by the users as well. From a user’s perspective, the ecosystems lack fluidity as different blockchains exist in isolation. Thus, users end up having liquidity on multiple chains. Such a market structure highlights the need for interoperability between the different blockchains in existence.

The blockchain ecosystem boasts of many excellent developers that have identified this issue. As a solution to the interoperability problem, bridges have been introduced. Currently, there are over 75 different bridge projects that are working to connect the fragmented ecosystem. However, the bridging ecosystem faces its own set of challenges, which include:

Bridges are immature - The bridge ecosystem is in its nascent stages of development. As a result, no bridge has yet lasted the test of time. Thus, while most bridges offer great security on paper and have performed well till now, one cannot say with utmost guarantee that user funds are never at risk.

Lack of liquidity - For bridges to scale, they need liquidity. However, as mentioned above, the ecosystem has over 75 bridging solutions which compete with each other for liquidity. Thus, even though bridges implement solutions like integrating different blockchains, it’s possible that liquidity pools might not have enough liquidity to fulfill particular swaps. As a result, many bridges are capital inefficient.

Long Assessments for selecting bridges - Each bridge is designed differently and thus has different strengths and weaknesses. When analyzing a bridge, there are many factors to consider: speed, costs, security, capital efficiency, trust assumptions, and statefulness. Moreover, based on the technical approach, each bridge has its own limitations. As a result, projects have to spend weeks or months doing research when assessing a bridge for implementation. Even then, it’s not hard to make a decision on which bridge to use.

Connectivity issues - As each bridge only connects to specific blockchains, projects typically have to implement more than one bridge to offer a comprehensive solution.

Implementing multiple bridges is costly - While one bridge is simply not enough, implementing multiple bridges is risky and has a maintenance-heavy dependency, making it a costly option. This is mainly because the bridging ecosystem is in its nascent stage of development and is rapidly evolving. As a result, bridges have to go through continuous updates and sometimes even revamp their entire approach.

Now that we understand the bridging problem, let’s look at the solutions offered by Li.Finance:

Bridge Aggregation - By implementing our bridge aggregation protocol, projects can get access to all of the bridges instead of being limited to a specific bridge. This will enable them to offer their users more choices and will help them find the fastest and most cost-efficient route for their bridging activities.

A bridge/swap widget - To help projects abstract the complicated process and research entirely for the user, we implement a bridge/swap widget in the front-end. This is an in-app widget that enables users to come from different chains and simply swap from any asset into the one used on the dApp.

Configuration for drawer mode of our widget view with a floating action button

This brings us to another vital component of the multi-chain ecosystem; bridges and bridge aggregation. Let’s take a closer look at what that is all about.

Bridges And Bridge Aggregation

In the article titled, ‘Blockchain Bridges: Building Networks of Cryptonetworks’ Dmitriy Berenzon from 1Kx, classifies bridges into the following categories:

Asset-Specific - These bridges are used to exclusively provide users access to a specific asset from a foreign chain. For example, Wrapped BTC or wBTC.

Chain-Specific - Such bridges are typically used for locking and unlocking tokens on the source and subsequently minting wrapped assets on the destination chain. For example, Polygon’s POS bridge.

Application-Specific - These bridges are built by specific applications to gain access to two or more blockchains for exclusive use within the application. For example, Compound Chain’s Compound Cash.

Generalized - These are bridges that allow the transfer of information across numerous blockchains. For example, Inter-Blockchain Communication Protocol (IBC).

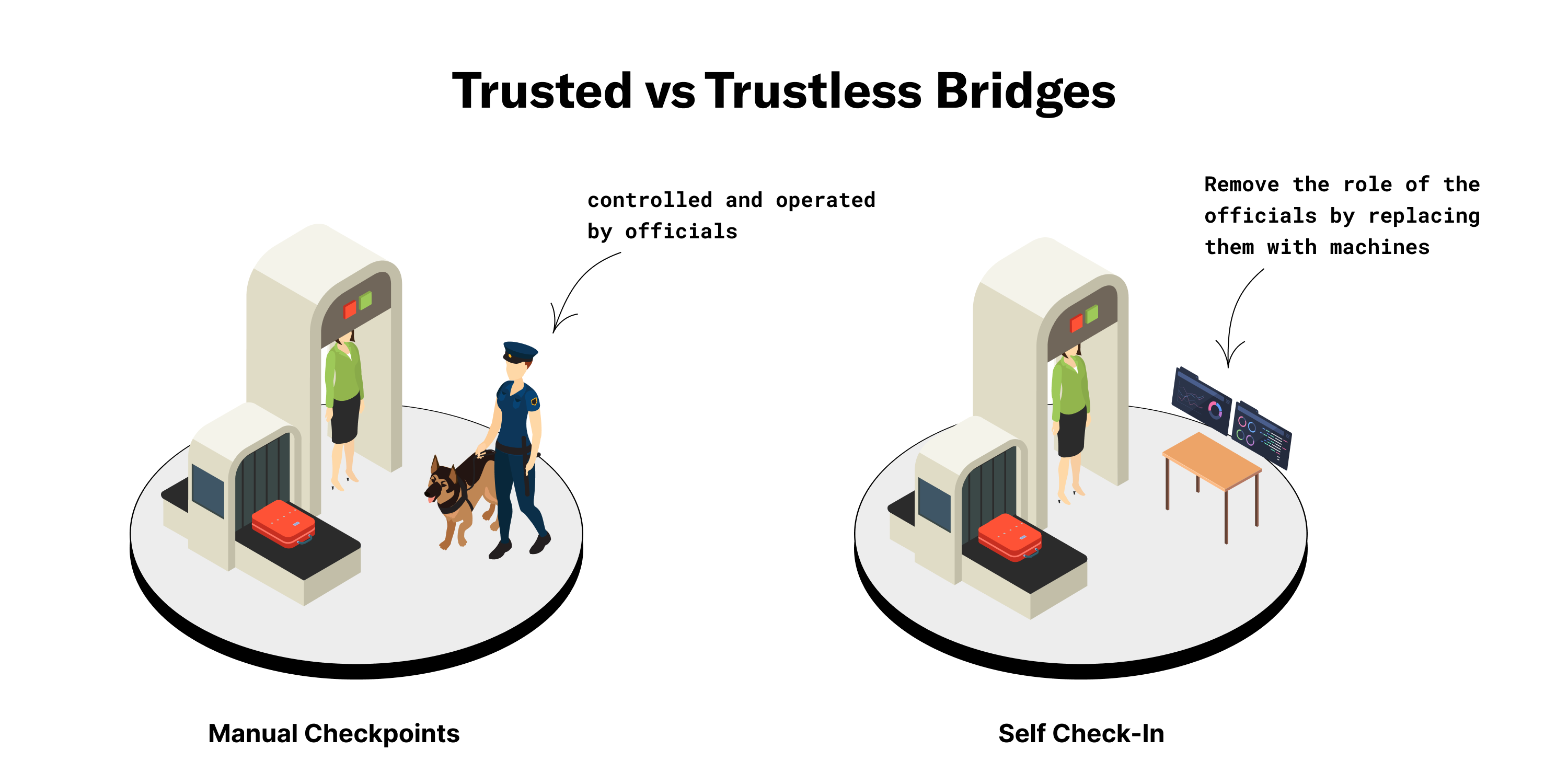

In Dmitriy’s article, he also talks about 3 types of bridge designs. These designs are categorized based on the cross-chain transaction validation mechanism. They are:

External validators and Federations

Light clients and Relays

Liquidity Networks

We won’t go into detail about these 3 bridge design categories here and highly encourage you to check out the stellar research work done by Dmitriy. Our main point of focus here is that there are many different types of bridges, and even bridges that fall into the same category can further be differentiated based on design and features. As a result, there are too many bridge options, and each bridge has its own strengths and weaknesses.

As we mentioned above, integrating all the bridges is not viable because of the complexities and costs involved. So, what’s the solution here? Bridge Aggregation.

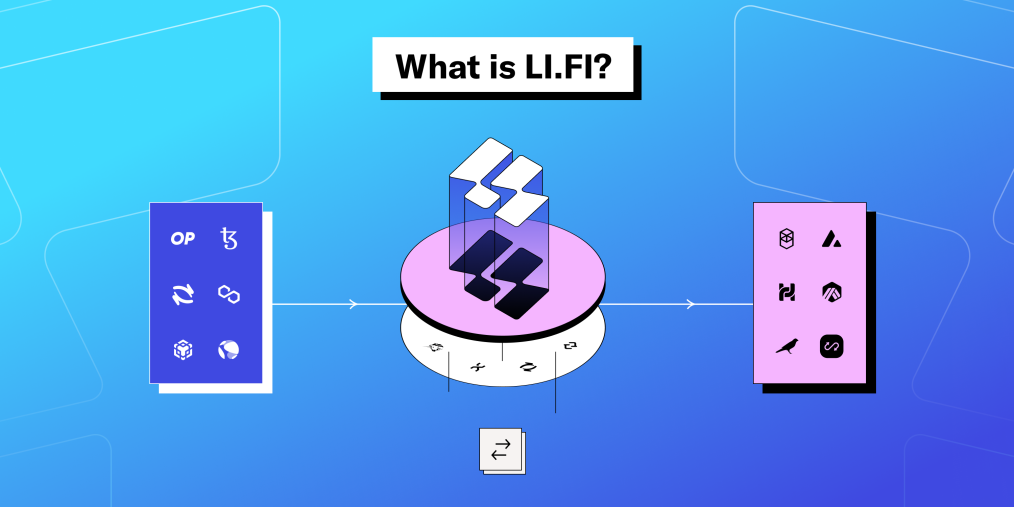

A bridge aggregation protocol enables projects to access all the bridges instead of implementing multiple individual bridges. And who can offer such a solution? LI.FI.

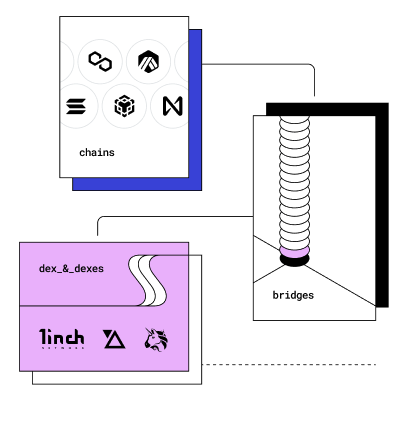

Bridge & DEX Aggregation Out Of The Box

At LI.FI, we align the bridge communication standards, qualitative aspects like trust assumptions and attack vectors, and quantitative factors such as speed, reliability, and fees. By incorporating this information into a routing algorithm, we can determine the best cross-chain route for the users. Our goal is to aggregate the most important bridges as well as the cross-chain liquidity networks. We aim to connect them to DEXs and aggregators as this will allow seamless cross-chain any-2-any swaps. Let’s take a look at the concept of any-2-any swap in more detail.

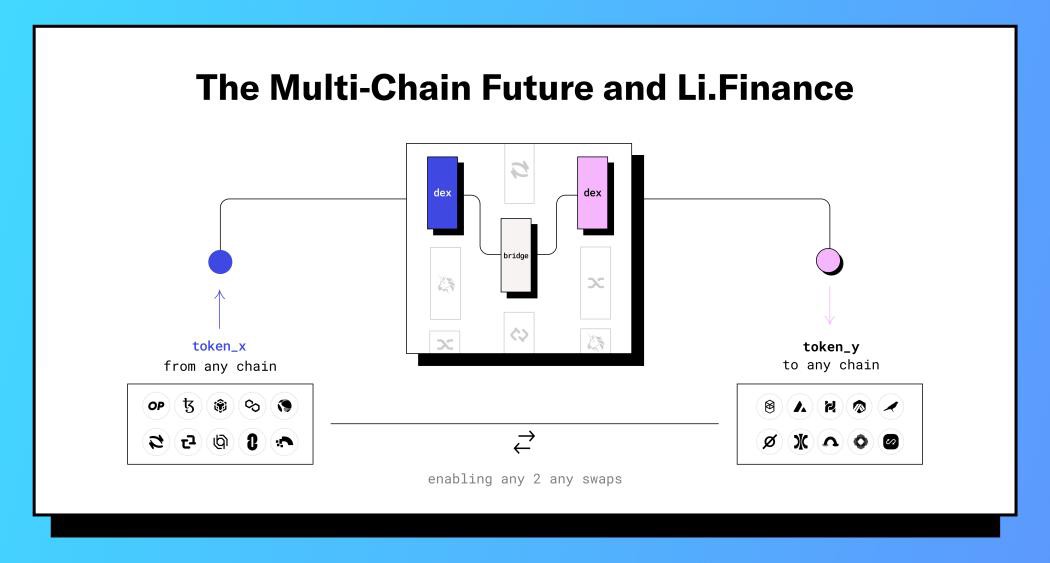

Any-2-Any Swap

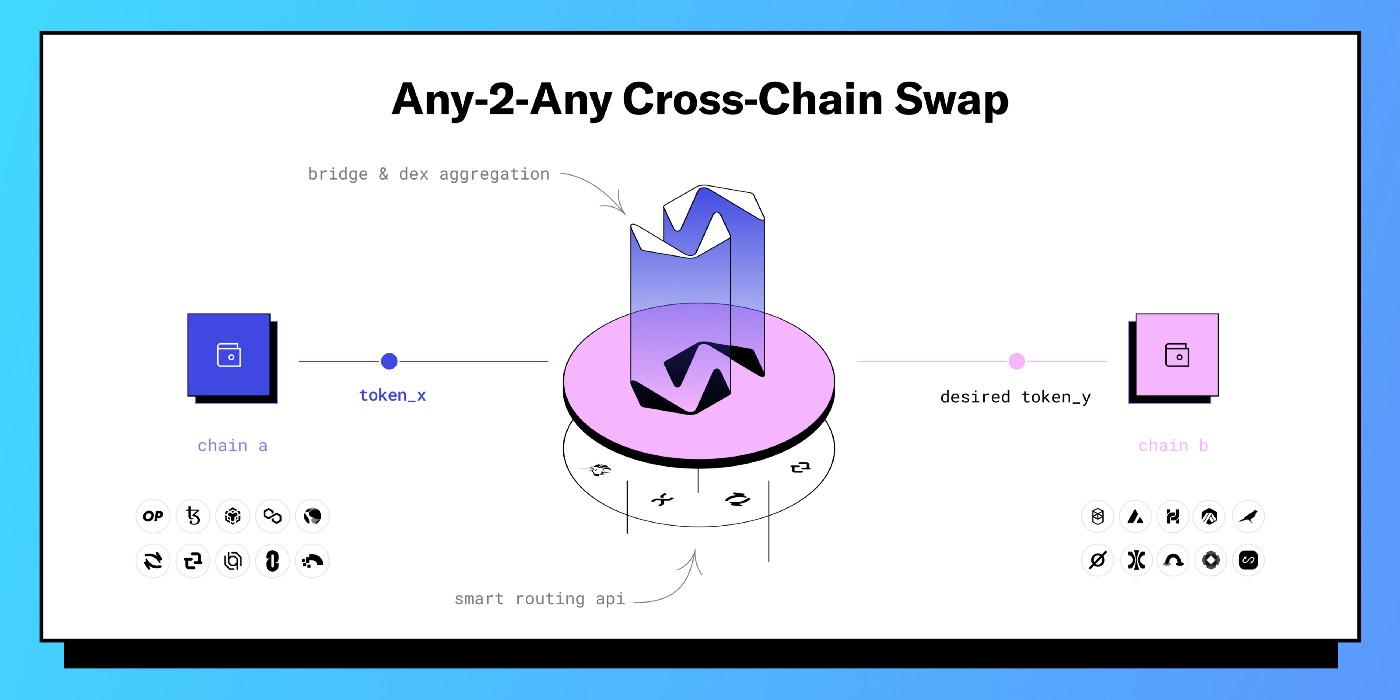

Bridge aggregation is an excellent solution for the bridging problem. Unfortunately, it is limited to stablecoins and thus offers limited functionality. However, one can solve this problem by integrating DEXs and connecting them to bridges. Doing so will allow users to conduct any-2-any swaps. Moreover, most bridges have liquidity issues that one can solve by implementing DEXs and DEX aggregators.

At LI.FI, we connect to all DEXs and DEX aggregators. As a result, our solution allows complex any-2-any swaps. As we’re providing both on-chain and cross-chain swaps, LI.FI is the only solution your product needs to ensure liquidity for swaps.

Any-2-Any Cross-Chain Swap Thus, by implementing our bridge/swap widget in your front-end, you can enable your users to come from different chains and conduct any-2-any swaps, i.e., swap from any asset into the one used by your dApp. This will make your protocol bridge-independent and accessible immediately for everyone. Moreover, it will also help you retain users on your dApp as they will not have to go to different bridge protocols in order to get the required assets.

Trigger our swapping interface from any button. Let your users buy into your dApp the way you want.

We aim to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We have already integrated some of the most important bridges in the ecosystem and will continue to be compatible with all types of bridging solutions in the future.

More than 50% of the current bridge-builders have invested in the LI.FI project, and we’re connecting them with DEXs to solve their liquidity challenge. If you’re a bridge or a protocol looking to integrate a bridging solution, come talk to us and let’s work together!

FAQ: The Multichain Future And LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.