LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

The Intent Value Chain

Co-authored by Jim and Arjun, inspired by the MEV Supply Chain.

Crypto has changed a lot in the past few years. People used to have to interact with blockchains directly – facing significant technical hurdles and clunky interfaces, lots of ways to mess things up. It wasn’t fun, unless you happened to like debugging transactions.

Intents first appeared simply as a way to make things easier – letting users focus on what they wanted to do rather than how to do it. But as the crypto landscape exploded in the number of chains in the last two years, intents transformed from a helpful feature into critical infrastructure. With users now scattered across numerous different networks, intent-based interactions have become the most practical fix we have for the short to mid-term to deliver a seamless experience across this fragmented landscape.

This necessity has sparked the rise of specialized players like solvers that handle the heavy lifting of fulfilling users’ intents. Instead of managing complexity themselves, users simply express what they want - "swap these tokens at the best price" - and an ecosystem of participants work together to make it happen.

Today, we’re introducing a new framework to think about this new paradigm: The Intent Value Chain.

Introducing The Intent Value Chain

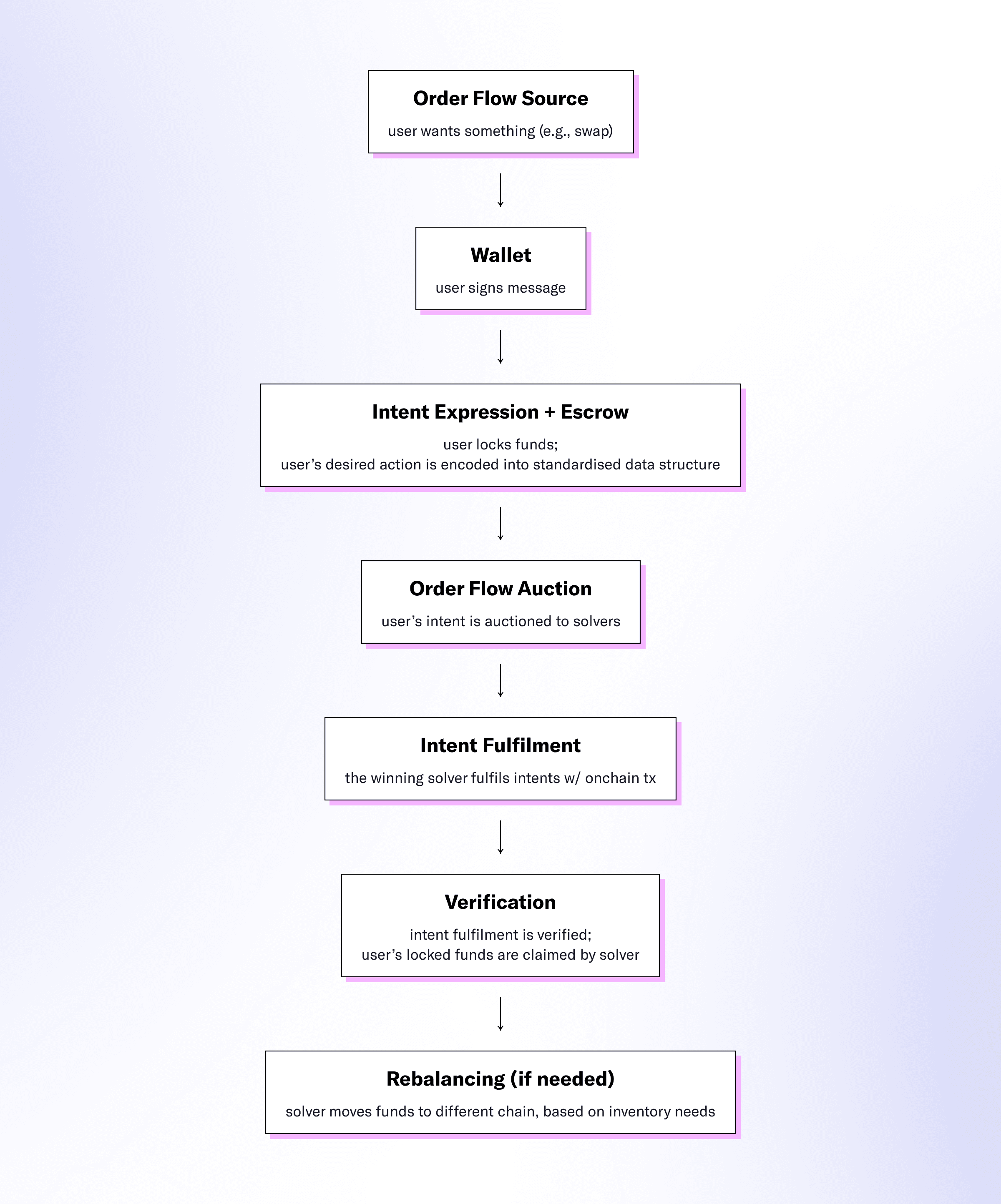

The Intent Value Chain shows how simple user desires flow through a series of infrastructure layers to become finalised, onchain transactions. We’ll break down each stage of this value chain, revealing the key players, emerging standards, and value capture opportunities in the eyes of the lifecycle of an intent.

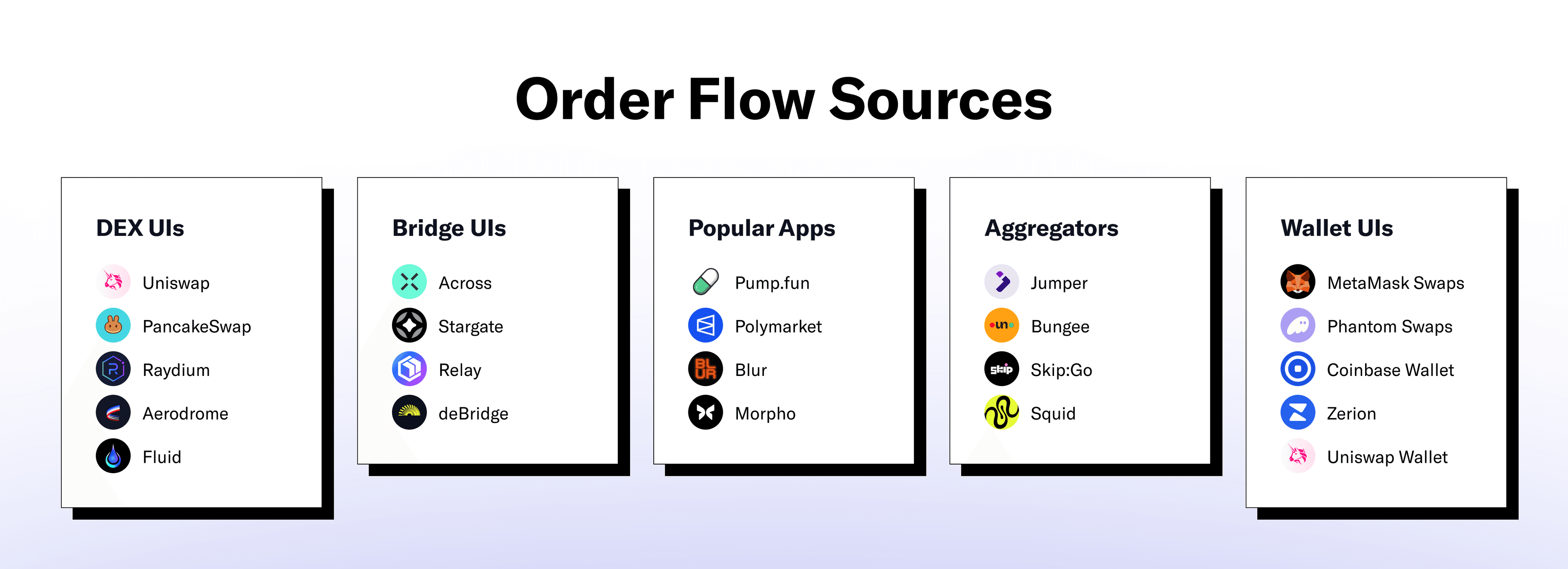

Order Flow Sources

Order flow in crypto (and outside of it) starts with the websites and apps where people go to do things onchain; they serve as the first touchpoints in the value chain, where users desire to do something, and thus initiate their transactions.

When you want to swap tokens, you might visit a DEX like Uniswap or PancakeSwap. If you're looking to move assets between different blockchains, you'd use bridge UIs like Across or Stargate. For those seeking the best rates across multiple services, aggregator platforms like Jumper scan numerous options at once.

Even wallets are one of the biggest sources of order flow these days. They’ve transformed from basic key storage services to full-on transaction hubs. MetaMask and Phantom now let users initiate complex transactions. Users can now swap, bridge, and more (typically enabled by a third-party provider like LI.FI), all directly from their wallet interfaces. A wallet UI functions as a source of order flow, even though it's also part of the broader wallet infrastructure – it might appear as a simple widget, exist within an internet explorer like Coinbase, or operate as a full-featured website like Zerion.

These interfaces compete to be your entry point into crypto. The ones with the best experience, lowest fees, or most functionality attract the most users – and thus the most order flow. Capturing this initial interaction is incredibly valuable as it gives them sticky customer relationships and the ability to monetise order flow through fees or MEV via Application Specific Sequencing (see the Fat Application Thesis for more on this).

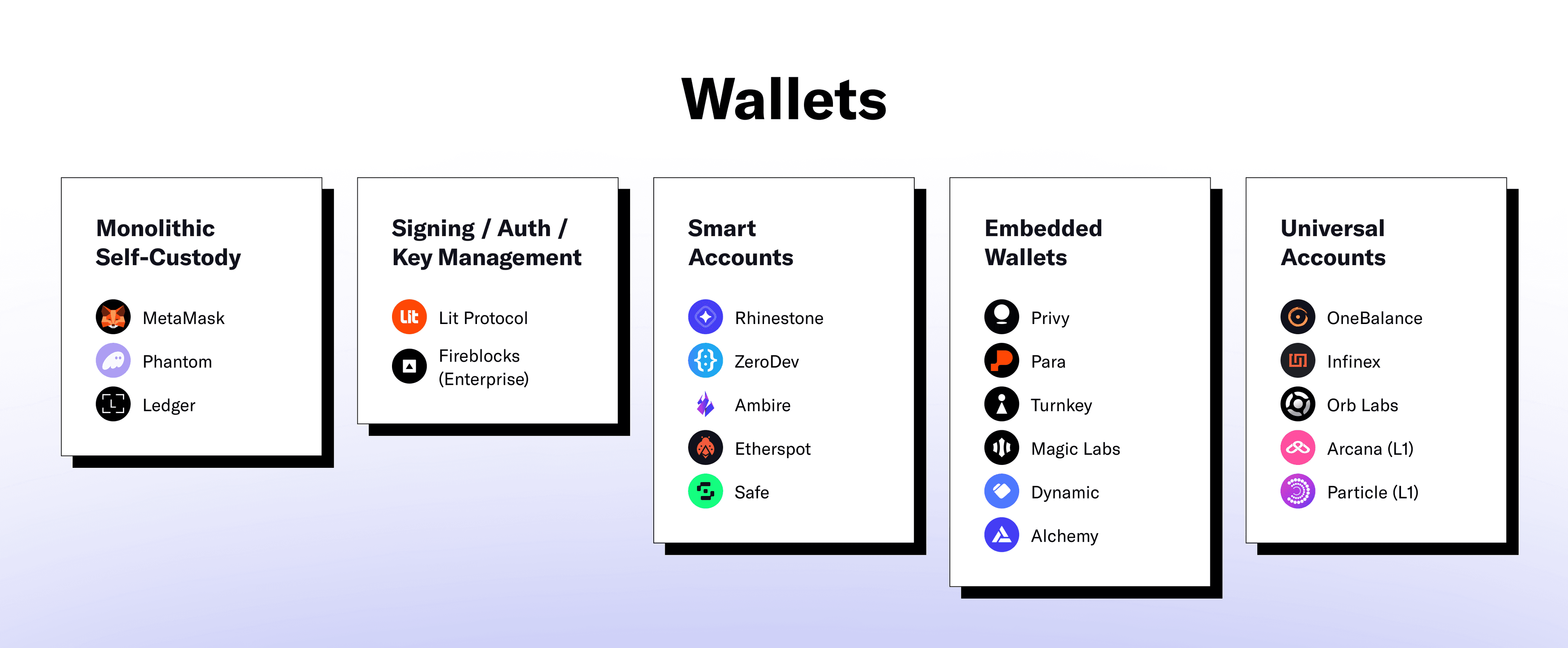

Wallets

Once a user has decided they want to do something onchain, they will need to interact with their wallet to authorise the use of their funds.

Wallets in the blockchain ecosystem have evolved well beyond simple key storage into sophisticated multi-component systems. They typically consist of three essential elements working together to enable user interaction with blockchains: a UI, signing/key management (i.e., the private key), and the actual account (i.e., the address on the blockchain).

The most obvious wallet category is monolithic self-custody solutions like MetaMask, Phantom and Ledger, which handle all three components in one package. These are the OG traditional wallets that have dominated the market by providing a straightforward way for users to hold their assets and sign transactions.

Over the past few years, we’ve seen the modularisation of the wallet stack. The signing, authentication and key management layer is the crucial security component, with specialized solutions like Lit Protocol and Fireblocks focusing exclusively on using advanced cryptography to securely authorise transactions on behalf of customers. These services manage the private keys that prove ownership and authorize transactions, operating as offchain entities with the authority to perform actions on behalf of users’ accounts.

Smart accounts, like those offered by Rhinestone, ZeroDev and Safe, are programmable onchain primitives that can hold assets and maintain transaction history. Unlike traditional accounts, these wallets are smart contracts that can be customised with advanced logic and security features, providing users with enhanced control over their funds.

Embedded wallets, like Privy, Para and Turnkey, combine signing and account functionality into comprehensive “wallet-as-a-service (WaaS)” solutions that other businesses can integrate into their applications. These offerings serve as both a technical SDK and as UI widgets, lowering the barrier for any business to offer wallet solutions to their users.

Universal accounts, such as OneBalance, Infinex and Particle, are the most ambitious emergent category in the wallet space – attempting to aggregate balances across different chains through “balance abstraction”. These solutions try to solve the fragmentation of user assets across multiple blockchains, offering a consolidated view and simplified management of users’ funds.

Intent Expression + Escrow

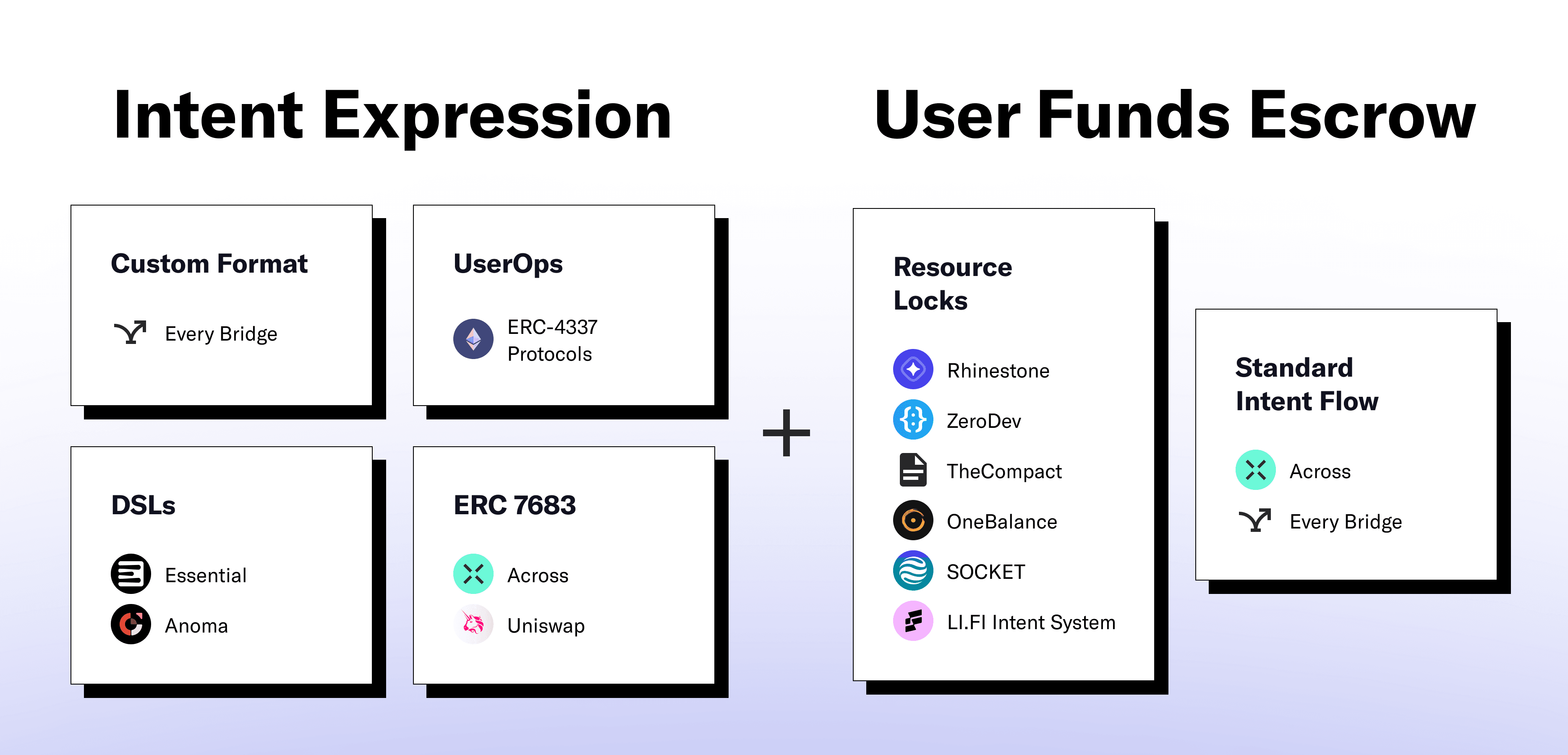

After signing a transaction or a message with their wallet, users effectively communicate what they want to accomplish on the blockchain – this is an intent expression. Rather than manually constructing transactions across multiple chains, users simply indicate their desired outcome on one chain (e.g., bridging tokens) and wait for it to happen on another chain.

When expressing an intent, the user's instruction gets encoded into a data format that can be interpreted by the specified chain(s). While some initiatives like ERC-7683 or domain-specific languages like Anoma attempt to standardise these formats, most protocols currently implement their own custom formats for representing user intents. This lack of standardisation creates challenges in having a unified view of intents.

The standardisation of intent formats is still a work in progress, but any kind of standardization always helps adoption. The more things converge around a few widely-used standards, the easier it gets — both for solvers, who won’t have to support a dozen different formats, and for users, who’ll be able to get more generalised intents executed. It’s one of those things that feels like a bottleneck until it’s solved, and then it just fades into the background as infrastructure.

Alongside expressing their intent, users must commit their funds into a secure escrow mechanism – essentially locking their assets into a smart contract. This locked capital creates a "credit balance" that guarantees payment to whichever solver successfully fulfills the intent. The relationship mirrors how credit cards work with bank accounts: the locked funds serve as collateral while the intent specifies what the user wants to purchase.

This combination of intent expression and fund locking sets the stage for the next step of the Intent Value Chain. By clearly defining what they want and securing the necessary funds, users enable an entire marketplace of specialised solvers to compete for the opportunity to fulfil their transaction in the most optimal way.

Order Flow Auctions

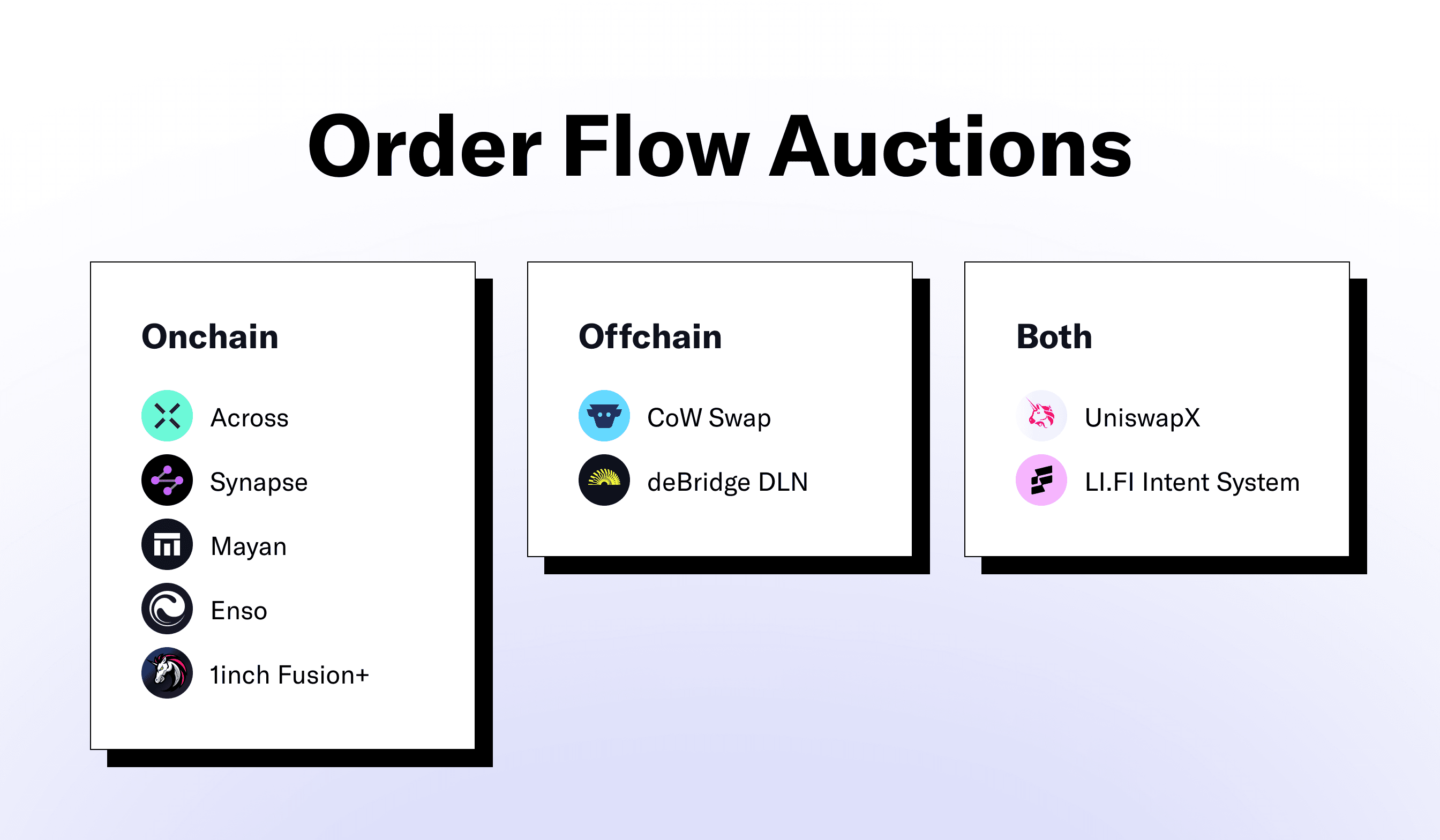

Once an intent has been expressed and funds locked, the next critical stage in the blockchain transaction journey is the Order Flow Auction (OFA). This marketplace determines which solver will handle a user's intent by creating competitive bidding for the right to execute.

When intents enter an auction venue, they become available to a network of solvers who analyse each opportunity. These solvers run sophisticated algorithms to calculate the potential profitability of fulfilling specific intents – considering factors like gas costs, market conditions, and their own operational inventory. Based on these calculations, solvers submit bids for the exclusive right to execute the intent onchain.

Currently, the auction landscape remains highly fragmented, with every protocol implementing its own unique auction mechanism. Some protocols operate completely offchain auctions to minimise gas costs (e.g., deBridge), while others conduct auctions directly onchain for greater transparency and trustlessness (e.g., Across, Mayan). Despite the potential efficiency benefits, there are no widely-adopted shared auction protocols yet – each venue operates as its own isolated marketplace.

These auctions employ various price discovery methods tailored to different transaction types. Some use Dutch auctions where prices decrease until a solver accepts, others implement First-Come-First-Served (FCFS) models for time-sensitive transactions, and some employ more complex sealed-bid approaches. Each auction venue is an operational overhead for a solver to submit competitive bids – factoring in auction mechanism, auction location, auction cadence, and more. Additionally, failed bids in auctions can be a big drain on profitability, adding further costs and inefficiencies to the process.

The lack of standardisation on the auction mechanism and venue leads to a higher barrier of entry for solvers and thus fragmentation in solver participation. In the near future, we anticipate auction standardisation and overall more cross-chain orderflow that will allow for more competition between solvers and ultimately will drive better execution prices for users.

Intent Fulfilment

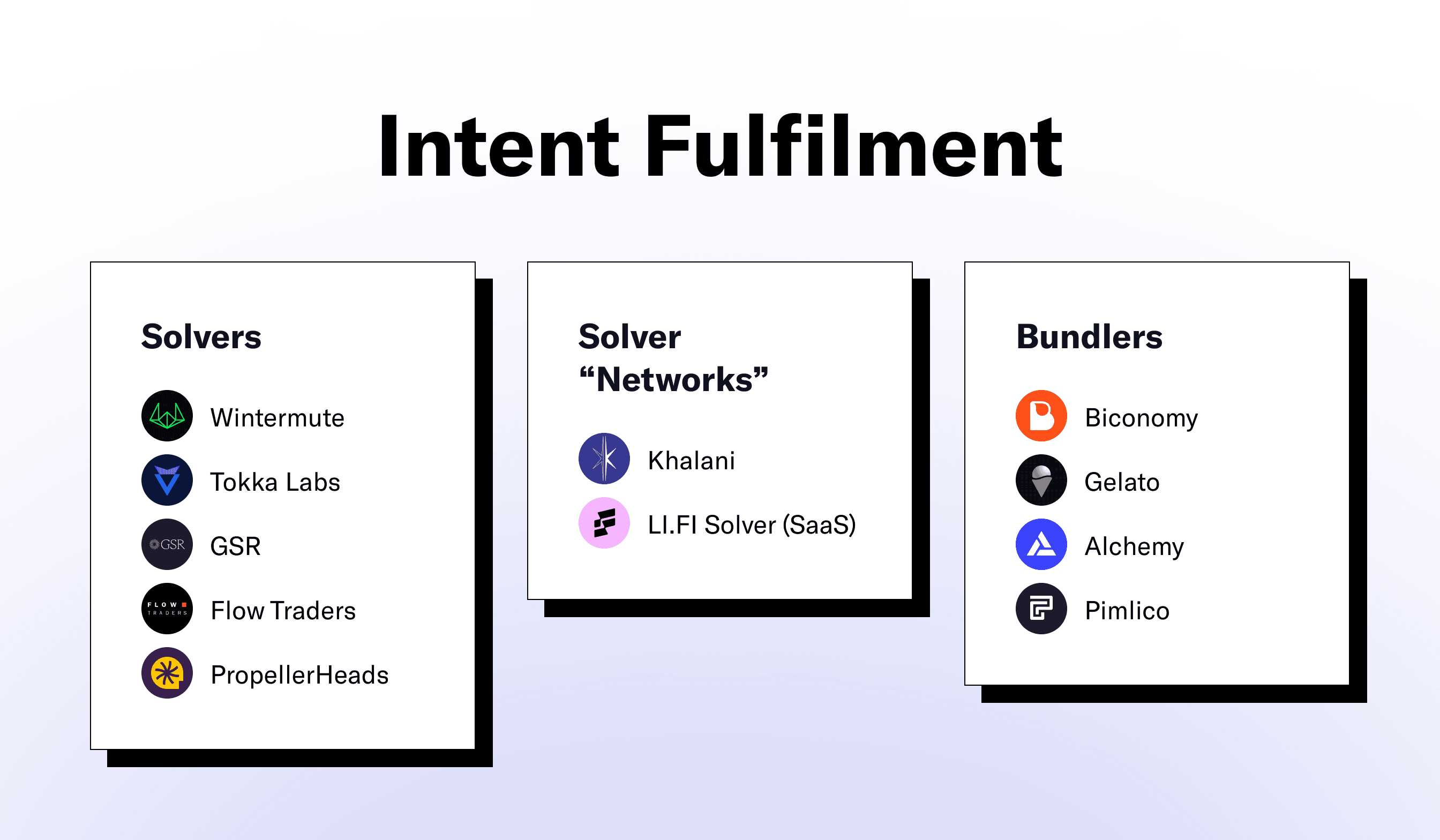

When a solver secures the winning bid in an order flow auction, they earn the exclusive right to execute the user's intent onchain. At this stage, the solver takes on the responsibility of constructing the actual transaction or bundle of transactions needed to achieve the user's desired outcome.

Solvers effectively operate as specialised transaction constructors – taking the user's high-level intent and translating it into exact blockchain instructions. They must determine the optimal execution path, which might involve complex routing across multiple protocols or even multiple chains to achieve the best results for the user.

Solvers typically front capital to users, effectively providing quick loans to execute intents on the users’ behalf. A solver might temporarily commit their own funds to complete a token swap or bridge transaction, only receiving reimbursement and a service fee after the intent is verified as successfully completed. Additionally, solvers cover the gas fees required for executing transactions on destination chains. All these costs are baked into their auction bids to make sure they maintain profitability.

Although solving is a highly profitable business when done correctly at scale, it requires significant capital and has a high barrier to entry. As a result, despite the appearance of a competitive marketplace – in practice – a handful of well-capitalised solvers handle the vast majority of order flow across the entire cross-chain ecosystem (e.g., Wintermute, Tokka or protocol run solvers like Risk Labs for Across and the Reservoir team for Relay).

This kind of centralization introduces risks. A single point of failure can take down the whole system. Less competition means worse prices. It also opens the door to market manipulation. And beyond that, it puts limits on what assets can be traded, how much, and how fast and how many trades a solver can execute.

As a response to this centralisation, we're now witnessing the emergence of solver networks that coordinate multiple specialised solvers to fulfill complex intents. Services like Khalani create frameworks for different solvers to collaborate on transaction bundles, potentially improving execution efficiency for particularly complex cross-chain operations.

LI.FI also announced the first "solver-as-a-service" platform last month. By providing solver infrastructure as a service, this platform enables other teams like new chains to offer intent fulfilment without having to build the entire solver technology stack from scratch. This approach could significantly lower the barrier to entry for new solver businesses, potentially increasing competition in the auction marketplace and improving execution prices for users.

Verification (Unlocking of Funds)

After successfully fulfilling a user's intent on the blockchain, the solver needs to claim their compensation for services rendered.

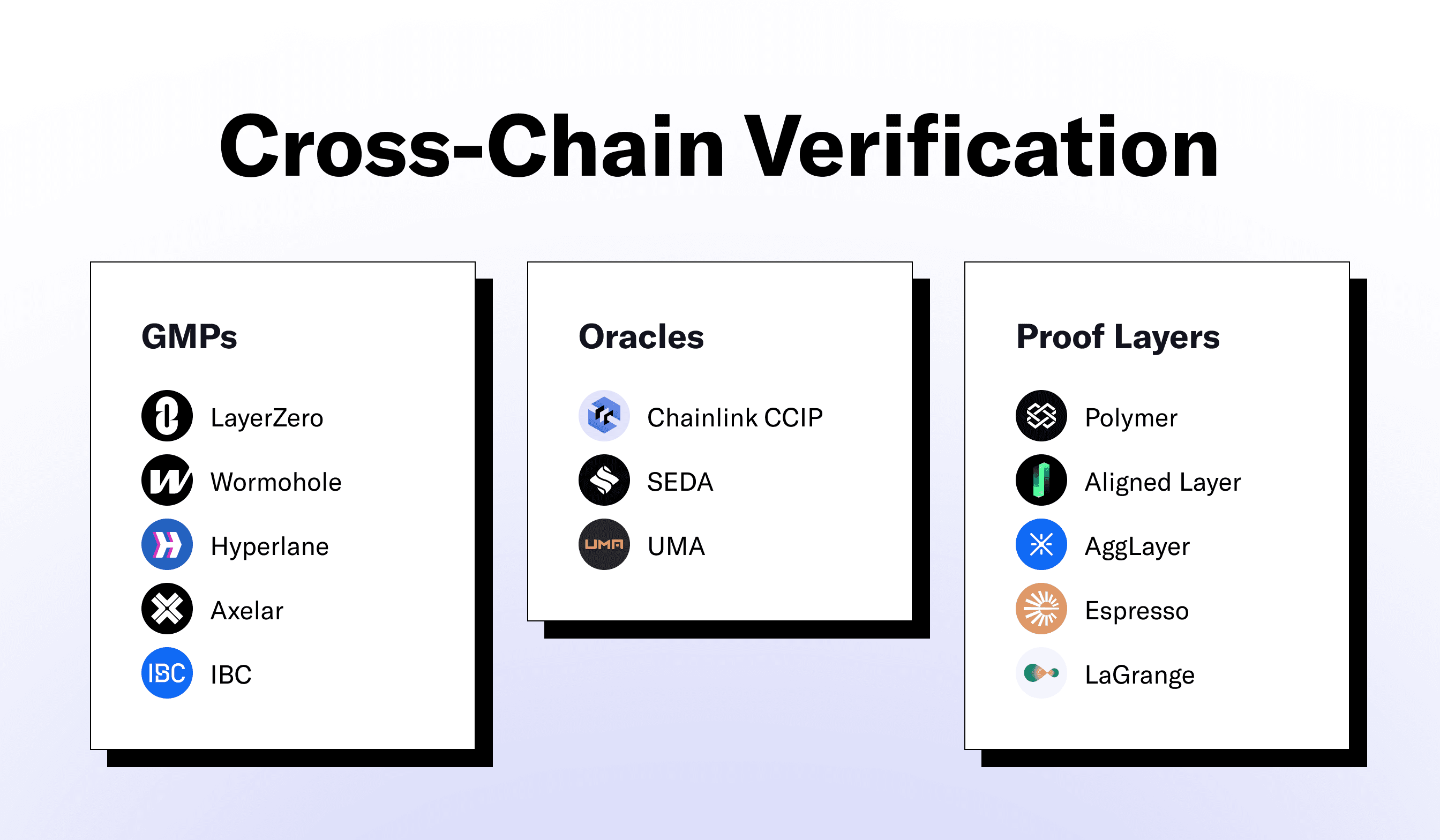

To unlock the user's escrowed funds, the solver must provide cryptographic proof that the requested blockchain state transition has actually occurred. This typically involves submitting evidence to a verification contract on the origin chain (i.e., where the users’ funds are escrowed) showing that the transaction was properly executed and the user's desired end-state was achieved. This step also comes with a non-negligible cost – solvers incur gas fees to submit the proof and some computational effort to generate it.

These proofs can come in various forms – each with different trust assumptions and security tradeoffs. A cross-chain message from LayerZero, Wormhole, Hyperlane, IBC or Axelar can be used. A light client update or a ZK proof of a light client update can be used. Different protocols implement different verification approaches based on their security requirements, chain coverage, cost, and speed.

The verification process serves as a crucial trust mechanism in the Intent Value Chain. This verification stage ensures that solvers are only paid when they've accurately delivered the promised outcome. Without reliable verification, users would have no guarantee that their intents were properly executed, and the entire intent-based model wouldn’t work.

Once the verification contract confirms that the user's intent has been properly fulfilled, it releases the escrowed funds to the solver. This payment covers the solver's fronted capital, gas fees paid during execution, and a service fee representing their profit margin. This final settlement, sometimes referred to as "settlement" in protocols like Across, completes the core intent lifecycle!

Rebalancing

After fulfilling numerous intents, solvers often find their assets scattered across multiple chains. This fragmentation of capital creates operational overhead that requires hands-on, active management through rebalancing.

When a solver executes cross-chain intents for users, they naturally build up token positions on various origin chains where the users escrowed their original funds. Over time, this distribution may not align with where the solver needs capital for upcoming transactions. Rebalancing involves moving these scattered funds back to specific chains where they expect to need liquidity for future intent fulfillment.

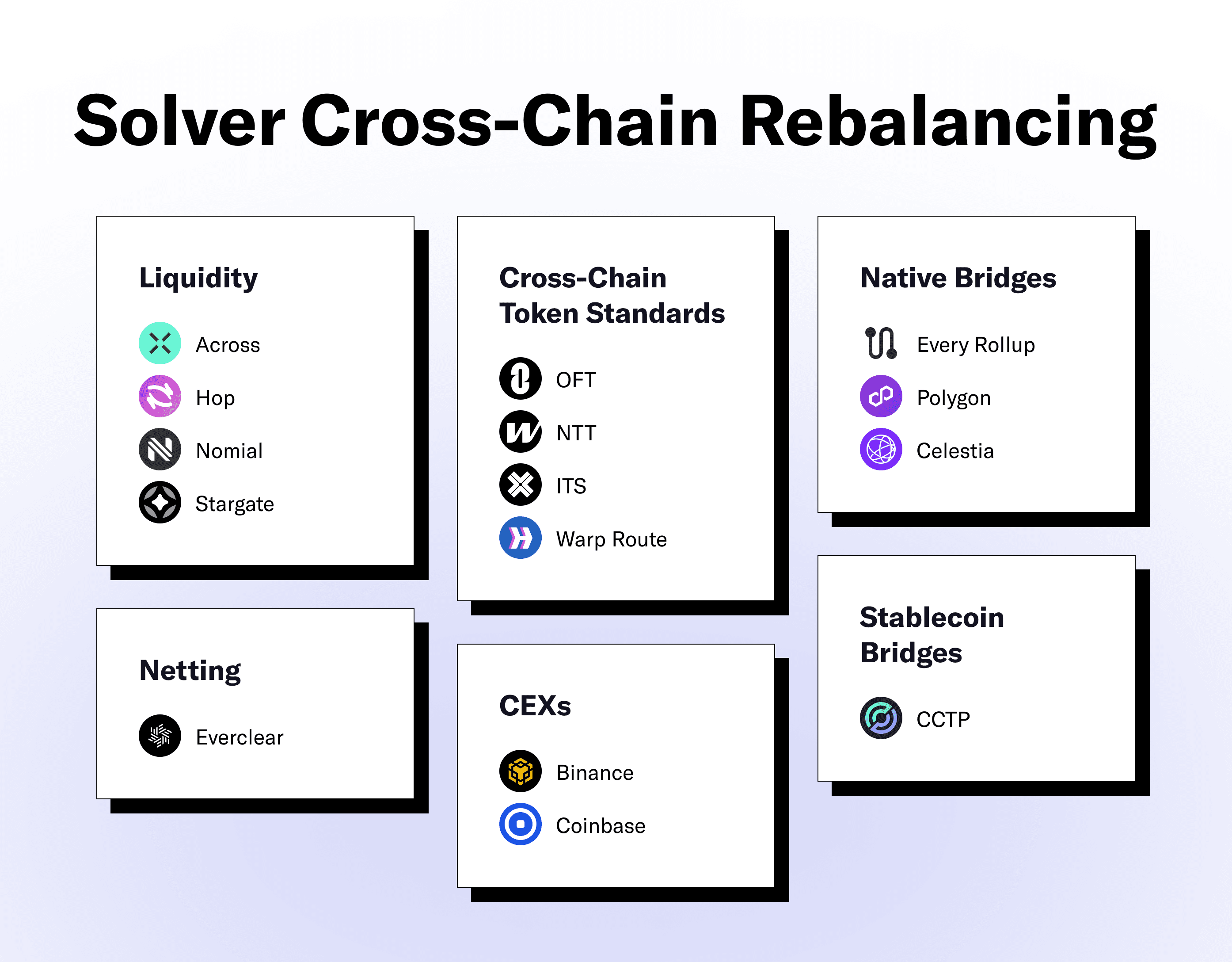

Luckily, solvers have many options to rebalance their funds. They can use native rollup bridges like Arbitrum to provide direct deposits/withdraws to and from Ethereum. They can also use stablecoin bridges like CCTP if they just need to move stablecoins like USDC, or rely on a good ole CEX.

Lately, interop token standards like OFT, NTT, ITS, warp tokens, among others, are becoming a common choice for solvers to transfer large amounts of capital across chains. Their burn-and-mint mechanism enables zero-slippage transfers, making them a capital efficient solution for rebalancing. While these transfers currently don’t incur underlying fees in most cases, they do come with latency due to source chain finality, which may factor into the decision-making process.

Solvers can also use a liquidity protocol like Across, Hop, or Stargate to bridge their funds to different chains (for a fee, of course). Or, just use Jumper.

Additionally, new solutions like netting by Everclear leverage coincidence of wants and competing in/outbound token flows to “net out” can be useful for solvers to easily and cheaply move inventory of different tokens.

Moreover, there’s different fee considerations attached to every option which eats into profitability margin, so solvers will have to choose carefully which option to use and when to rebalance. Also, these options may not support every chain that a solver wants to be on.

Effective rebalancing strategy represents a significant competitive advantage for solvers. Those with more efficient rebalancing operations can maintain higher capital efficiency, reducing rebalancing costs and enabling them to make more competitive bids in auctions. Larger, better-capitalized solvers typically have advantages in this area, as they can maintain adequate inventory across more chains without frequent rebalancing. And this competitive advantage grows larger and larger as the crypto ecosystem grows more complex with more chains.

In Conclusion

The Intent Value Chain evolved as a response to crypto’s growing complexity, creating an ecosystem of projects where user desires are translated into onchain actions through a series of specialised infrastructure layers. What began as a user experience improvement has transformed into essential infrastructure for navigating crypto’s increasingly technically complex multi-chain landscape.

One of the biggest challenges in the current Intent Value Chain is what people call "solver centralization." But it's more subtle than that. It's not just that a few solvers handle most of the intent fulfillment across chains. It's that many of those solvers are team-run. Today, a huge chunk of orderflow goes through solvers maintained by the same people building the protocols. That kind of tight coupling between infra and orderflow creates a bottleneck.

Now, some would argue that a marketplace where 3 to 5 solvers handle the majority of traffic is still fairly competitive. And they’re right, in the abstract. If those solvers were independent, interchangeable, and easily replaceable, we might be okay. But they’re not. The capital, technical know-how, and operational lift required to become a solver means most new players don’t even try. So what looks like healthy competition on the surface is actually a pretty rigid structure underneath.

However, emerging initiatives like solver-as-a-service platforms and collaborative solver networks are working to democratise participation by providing shared infrastructure and pooled liquidity.

In the Intent Dystopia, value from the Intent Value Chain accrues predominantly to a handful of centralised entities. Right now, we face a future where a few dominant solvers integrate vertically across the value chain, creating insurmountable barriers to entry and extracting maximum value from users. This "Intent MegaCorp" scenario results in less competitive pricing, reduced innovation, and ultimately a contradiction of blockchain's core promise of decentralisation.

The Intent Utopia presents an alternative where open standards, shared infrastructure, and democratised solver participation create vibrant competition at each stage of the value chain. In this future, intent expression formats become standardised, auction marketplaces operate with full transparency, and solver participation barriers are dramatically reduced. As these standards mature, we'll likely see greater visibility into intent order flow and more transparent auction participation. As a result, users benefit from optimal execution across chains, while value flows back to users through better prices, reduced latency, enhanced security, and more reliability.

In order to achieve Intent Utopia, we need more solutions like the Open Intents Framework and LI.FI Intent System, comprehensive, full-stack intent frameworks that address fragmentation at every part of the Intent Value Chain. With such solutions, the barrier to entry for solving lowers dramatically. By creating common standards and interfaces at each stage, it allows for a new generation of solvers to participate in the Intent Value Chain.

The future of the Intent Value Chain will likely be shaped by this tension between centralising economic forces and the ethos of crypto decentralisation. As this ecosystem continues to evolve, its trajectory toward utopia or dystopia remains unwritten. The choices made by developers, investors, and users today — which protocols to support, which standards to adopt, which solvers to trust — will collectively determine whether the Intent Value Chain fulfills blockchain's decentralisation promise or merely recreates traditional financial hierarchies with new technology. The question remains: which future will you help build?

Thanks to Zain, Angus, Kram, Nam, Hart, Paul, Spencer, Ankit and several others for feedback, constructive pushback, and related discussions.

FAQ: The Intent Value Chain

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.