The Evolution of Native Bridges

Native bridges are key infrastructure in the crypto industry. Much of the development and capital influx across different blockchain ecosystems happens because of native bridges.

This article discusses what native bridges are, why they are essential and how blockchain ecosystems can improve their user onboarding experience.TL;DR — Native bridges alone are not sufficient to enable the secure and cost-efficient transfer of assets to and from a vibrant blockchain ecosystem. This is why LI.FI, a bridge and DEX aggregator, is a key piece of infrastructure for any blockchain to consider integrating.

Let’s dive in!

What are Native Bridges?

Native bridges are built to connect two blockchain ecosystems and, more specifically, bootstrap liquidity on a particular blockchain by making it easier for users to bridge from another blockchain. Given most of the liquidity is present on Ethereum, most native bridges are designed to connect a blockchain with Ethereum. Oftentimes, Native Bridges and their front-ends are hosted by the foundation or group of developers that launched the chain.

If we consider Haseeb Qureshi’s mental model for blockchains — which describes blockchains as cities — we will find that native bridges are like national highways that act like roads connecting all major cities. For instance, if Ethereum is New York City and Avalanche is Chicago, Avalanche Bridge (AB) is the Nationation Highway connecting both cities.

Avalanche Bridge is the National Highway connecting two major cities, Avalanche and Ethereum

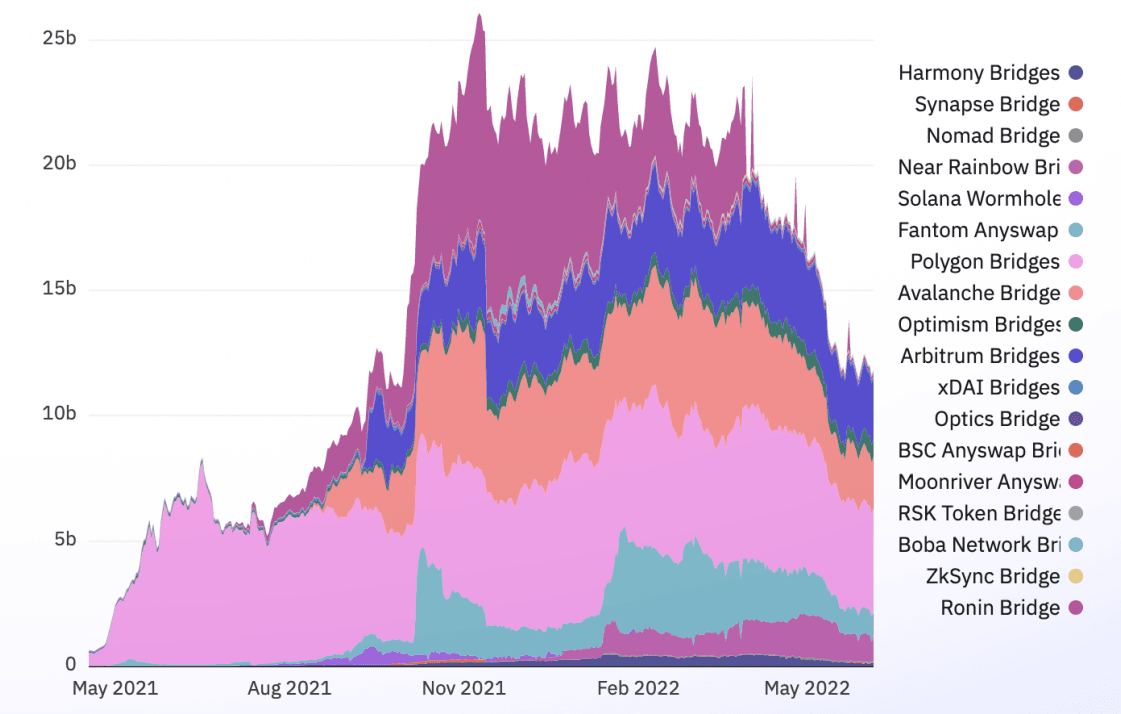

Most native bridges are built to make it convenient for users to bridge assets from Ethereum to their ecosystem. Additionally, they offer incentives such as low costs. For instance, Avalanche Bridge airdrops a small portion of AVAX to the users when they bridge $75 or more from Ethereum. As a result, we’ve seen a large amount of capital being bridged away from Ethereum to other ecosystems via native bridges.

Bridge Away from Ethereum — Ethereum Bridges Total Value Locked in Billions

How do Native Bridges Work?

Native bridges are typically limited to two chains and support basic bridging functions (specifically token movements) between these blockchains. Since they’re built to facilitate simple operations, these bridges are easy and quick to build.

The main function of a native bridge is to support locking and unlocking tokens on the source chain and minting tokens on the destination chain. They use the lock and mint mechanism when funds are deposited and the burn and unlock mechanism when funds are withdrawn.

Let’s consider a native bridge connecting Ethereum to a blockchain X. Here’s how bridging will work:

Deposit Transaction — From Ethereum to Blockchain X

Deposit — A user can deposit their funds into the bridge address.

Lock — The bridge locks the asset on Ethereum (source chain)

Mint — The bridge mints a representation of the assets on X (destination chain)

Let’s understand this with an analogy.

You’re traveling in your car from City A to City B, which is connected by a bridge. On your way to City B, you can leave your car in a warehouse in City A and receive an identical car in City B.

Lock and Mint Mechanism of Native Bridges

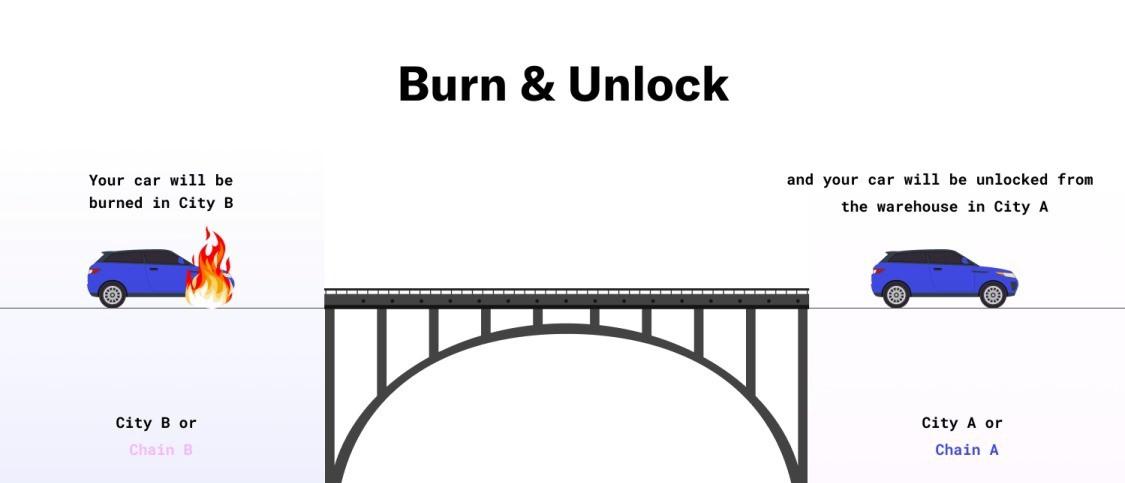

Withdrawal Transaction — From Blockchain X to Ethereum

Withdraw — A user can request to withdraw their funds from the bridge.

Burn — The bridge burns the assets on blockchain X (source chain)

Unlock — The bridge unlocks the initially locked assets during deposit transactions on Ethereum (destination chain)

Going back to the analogy, consider you’re traveling back from City B to City A. To return to City A, your identical car in city B needs to be burned. Then, your original car in City A is unlocked from the warehouse.

Burn and Unlock Mechanism of Native Bridges

Examples of Native Bridges

Most blockchains ecosystems today have a native bridge connecting them to Ethereum. By creating an easy route between Ethereum (the ecosystem with the most total-value locked), native bridges enable blockchains to attract much-needed liquidity and play an integral role in bootstrapping an ecosystem. Furthermore, since oftentimes the initial chain developer also launched and hosts the native bridge, therein lies a reputational aspect of security to the chain (ex: Ava Labs is incentivized to securely validate Avalanche Bridge).

Let’s look at some of these native bridges and how they work:

Polygon — Plasma and PoS Bridge

Polygon has two native bridges to move assets from Ethereum to Polygon. The first one is called the Plasma Bridge, and the second is known as the Proof of Stake (PoS) Bridge. The two bridges are different in what features they prioritize. The Plasma Bridge optimizes for decentralization, whereas the PoS Bridge optimizes for speed.

Plasma Bridge — It provides increased security because the Plasma exit mechanism leverages Ethereum’s security to ensure the safety of funds on Polygon. However, this comes at the cost of speed associated with withdrawals from Polygon back to Ethereum, as there is a 7-day withdrawal period when moving from Polygon to Ethereum via the Plasma Bridge. As a result, the bridge offers enhanced security and decentralization but has limitations regarding flexibility and withdrawal time.

Proof of Stake (PoS) Bridge — PoS Bridge was built as an alternative to overcome the rigidity of the Plasma Bridge. It uses an external set of validators for its security. It trades off decentralization and security for speed and flexibility. It provides PoS security and faster withdrawals (20 mins to 3 hours) with one checkpoint interval.

Avalanche — Avalanche Bridge (AB)

Ava Labs launched Avalanche Bridge (AB) in July 2021. It offers users a quick and easy way to bridge assets between Ethereum and Avalanche. It trades off security and decentralization for speed and low costs, utilizing an externally verified system that uses wardens to move assets affordably and efficiently. These wardens are run by Avascan, BwareLabs, Halborn, and Ava Labs and play an integral role in the functionality of Avalanche Bridge by actively watching for and relaying cross-chain information to an Intel SGX enclave or private code base, which handles the deposits and withdrawals of funds.

Optimistic Rollups — Arbitrum and Optimism

Optimistic rollups like Arbitrum and Optimism leverage their ability to communicate between Ethereum Mainnet (L1) to transfer any form of Ethereum asset between L1 and L2 trustlessly. For both rollups, assets are deposited into a bridge contract on L1, and an equal amount of assets are minted on L2. The process of depositing assets is quick and seamless. However, the withdrawal period is slow as it works around the Optimistic rollup security model, which requires users to wait for the end of the challenge period (7-days) before they can redeem the assets on L1.

Optimistic rollups have a challenge period of 7 days to balance security and usability. During this period, any published transaction is considered ‘pending’ and can be challenged with a fraud proof by validators. This enhances the security of the system but limits the speed of withdrawals because, during the challenge period, messages sent from L2 to L1 cannot be relayed. Therefore, users are forced to wait for this challenge period to elapse to receive their assets on L1.

The Current State of Native Bridges

From the examples of native bridges above, we can see some common traits of native bridges:

The Good

Lock-mint-burn — They use the lock and mint mechanism for deposits and the burn and unlock mechanism for withdrawals.

Connectivity with Ethereum — They connect to Ethereum as it is the ecosystem where most of the TVL in crypto is present.

Low costs — They are cost-effective when moving away from Ethereum. Native bridges even offer incentives such as gas airdrops (Avalanche Bridge gives AVAX tokens for deposits >$75) for bridging away from Ethereum.

The Bad

Externally verified — Most of them rely on an external set of validators that are typically run by the team behind the blockchain. Users rely on the reputation of the team when using native bridges.

Slow withdrawals — Withdrawals are slow and often take 7 days for blockchains like Polygon, Arbitrum, and Optimism because of the challenge period.

Connectivity only with Ethereum — Native bridges are limited in their connectivity and are often only connected to Ethereum. They are not easily scalable to other ecosystems.

Native Bridges are Not Enough

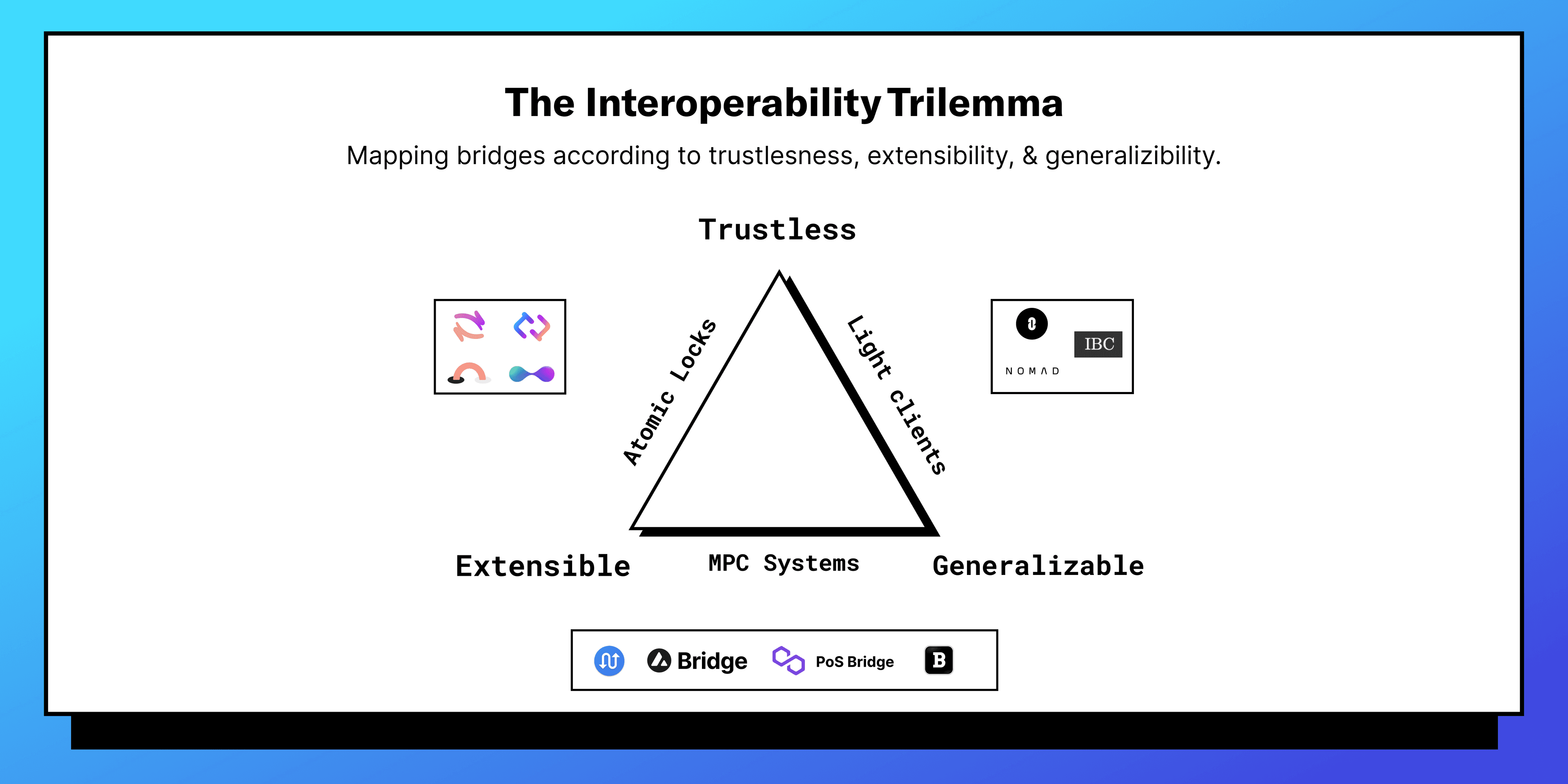

Native bridges have been primarily built to make the process of depositing assets into a blockchain ecosystem easy, quick, and cost-effective. But, they are limited in what they can offer as they are typically only connected to Ethereum. Moreover, they have other restrictions — such as the 7-day challenge period for withdrawals.However, with the proliferation of third-party bridges in the ecosystem, there now exist many bridging solutions that can offer an alternative to native bridges. These bridges are not limited by similar restrictions and can offer many benefits to the users and make it easier for them to move assets between ecosystems. This is because third-party bridges can play around with the properties of building bridges as stated in the interoperability trilemma.

The design space for building bridges

So, how can blockchain ecosystems with their own native bridges make the most of these third-party bridges?

EXAMPLE

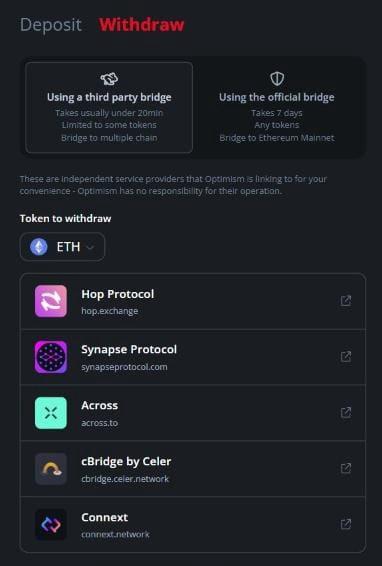

Optimism built a solution by aggregating several third-party bridges into one UI.

To enable seamless movement between Optimism and other major blockchain ecosystems like Ethereum, Polygon, BNB Chain, Arbitrum, and Gnosis Chain, they aggregated bridges such as Hop, Synapse, cBridge, Connext, and Across.

Optimism’s UI for Withdrawal with Third-Party Bridges

While this solves the problem of faster withdrawals and gives users more options than just the native bridge, one must ask, is this the most efficient solution? Perhaps not.

Here are some concerns and limitations of this approach:

Directs traffic away — It takes the users away from Optimism’s interface to a third-party website and forces them to figure out how to use the bridge. Using bridges can be complicated even for advanced users; beginners might find it overwhelming.

Inconvenience — It increases the steps required for a user to start exploring the ecosystem. Also, it is an inconvenience on the developer side to host the front end and add more third-party bridges as they launch.

Forces users to make too many decisions — It increases the scope for users to make mistakes as they now have to figure out how to use different bridge UIs.

Lack of evaluation metrics — Users still need to select a bridge among the different available options. This is not straightforward given bridges make various design trade-offs regarding speed, security, and cost.

Limited assets — Single bridges do not support all assets and are generally limited to stablecoins and blue chips like ETH.

No feature to swap — Bridges are limited in their functionality and cannot offer swap and bridge service simultaneously in one transaction for the users. To offer such a feature, you need DEX connectivity (aka liquidity).

To summarize, while hosting a front-end with multiple third-party bridging options gives users a bit more flexibility in regards to their bridging experience, it is still a somewhat cumbersome, time-consuming process for most users.

We believe that LI.FI, which has aggregated a variety of third-party bridges and native bridges into a single protocol, is the best solution for blockchain foundations to onboard users to their chain outside of only hosting their native bridge.

Building a Better Experience with LI.FI

Let’s take a look at why LI.FI, an advanced bridge and DEX aggregation protocol, is a solution blockchains currently using only native bridges for connectivity to the wider ecosystem must consider:

Simplified UI — Projects can simply integrate the LI.FI SDK and offer bridging along with other functionalities to the users, without them ever leaving their interface to bridge or swap assets.

Bridge options — We’ve integrated the best bridges and inherited their strengths. This allows us to compare different routes and choose the best one. Moreover, we have also integrated native bridges, and thus it’s always possible to use the official bridge. Furthermore, Since we have integrated multiple bridges, we can offer different fallback options. This is important because bridges are in their nascent stages of development and often experience downtime.

Smart routing — Our algorithm considers several factors such as security, costs, connectivity, speed, etc., to determine the most efficient route for a user’s transaction. This simplifies the bridging experience for the user as they no longer have to decide which bridge to use.

DEX connectivity — LI.FI has also integrated most major DEXs and DEX aggregators on different chains. This allows us to offer swap-bridge functionality. As a result, a user can swap from any token on any chain into the required token on another chain.

Less overhead — Integrating bridges and maintaining the integration always to support the latest update of the bridge is a resource-intensive task. LI.FI is a B2B-focused enterprise solution that takes care of this overhead and enables projects to focus on their core competencies.

Special features — LI.FI also offers special features to projects such as whitelisting, blacklisting, and a “prefer” function that allows integration partners to customize the suite of bridges they utilize to their liking (e.g., if the project only wants trust-minimized bridges like Connext & Hop). Blockchain foundations can have the native bridge be the “preferred” route for assets to go through before falling back to other third-party solutions.

A solution like LI.FI offers the perfect alternative that overcomes the limitations of Optimism’s approach:

Abstracts the complexity away from the user — Blockchain ecosystems should integrate different bridges into one UI instead of making users go to another interface to bridge assets. This will make life easier for users as they can now bridge funds without leaving the interface.

Helps users pick the most efficient route — Different bridges have different trade-offs. It isn’t easy to compare several third-party bridge providers in terms of important factors such as security, costs, speed, convenience, etc. Instead of leaving the user to make this critical decision alone, projects should find a solution to pick the best route.

Gives users more options and features — Bridges only support a limited number of assets like ETH and stablecoins. Instead, projects should work on a solution that supports bridging any asset from any chain. Additionally, a feature for swapping and bridging from any asset into the required asset reduces the overhead on the user to use bridges and DEXs externally.

While we are certainly biased, we believe that our one-stop interface for swaps and bridges is the most optimal way to onboard users onto new chains.

About LI.FI

LI.FI is a cross-chain bridge aggregation protocol with DEX connectivity. Our vision is to create a middle layer between DeFi infrastructure and the application layer to facilitate the development of applications in a multi-chain world.With LI.FI, it’s very easy to be cross-chain from day one and onboard users who are coming from other chains, or extend your existing product with cross-chain capabilities: e.g., cross-chain swaps or cross-chain yield strategies.For further examples of how LI.FI works, check out:

Alchemix — SDK integration

DeFi Saver — SDK Integration

Alps Finance — SDK integration

Cross-Chain Klima Staking — Custom-built cross-chain staking product for Klima

FAQ: The Evolution of Native Bridges

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.