Stablechains Aren’t New, But They’re Here to Stay

A primer on dedicated stablecoin networks

What are Stablechains?

Stablechains are the future of internet money for merchants and consumer payments. The rise of stablechains enables stablecoin issuers to white glove their services to merchants e.g. compliant, near zero cost transactions with flexible settlement times. For consumers, stablechains mean cheaper transactions, tailored rewards and easy redemption of services from anywhere in the world.

Just as the early internet birthed specialized protocols (SMTP for email, HTTP for the web), crypto is moving from “one chain does everything” to specialized payment chains, with stablechains acting as the settlement layers for internet money. In short, stablechains are the great equaliser for global consumer markets.

Why are stablechains relevant now?

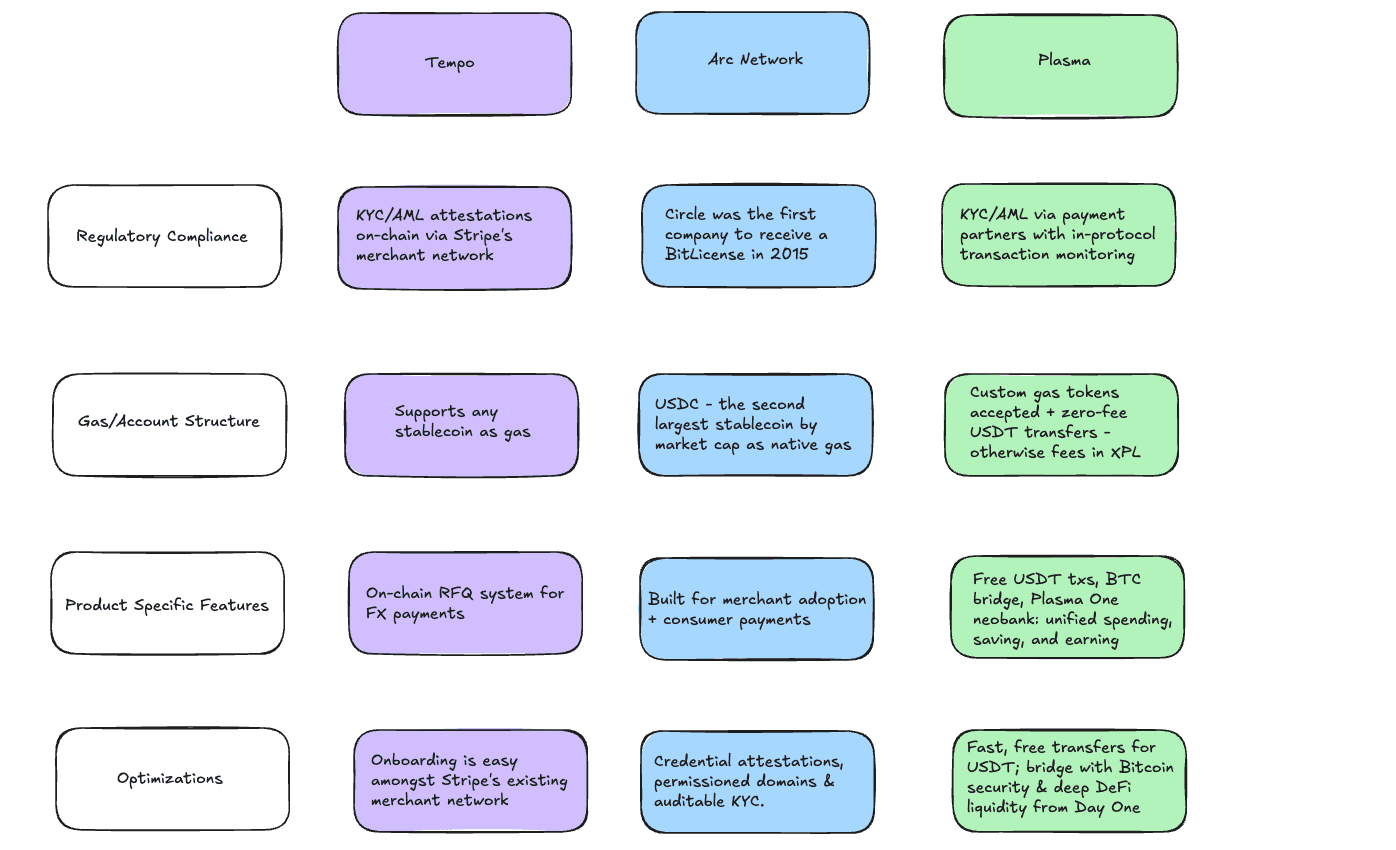

Stablechains have exploded into the public conscience recently with the introduction of Stripe and Paradigm’s new venture: Tempo, Circle’s: Arc Network as well as Plasma and Stable (both backed by different teams, focusing on USDT/Tether-based stablecoins). The pop-ups of these new blockchains have coincided with the expansion of the stablecoin market with the issuance of tokens like cUSD (Cap Money), mUSD (MetaMask), USAT (Tether), USDm (MegaETH), and USDH (Native Markets/Hyperliquid). This is significant because over the last six years we’ve seen $20tn+ in adjusted volume within the stablecoin market alone which means two things:

There is generalized demand that is being serviced by the issuance of more stablecoins

There is more application specific demand that needs to be met

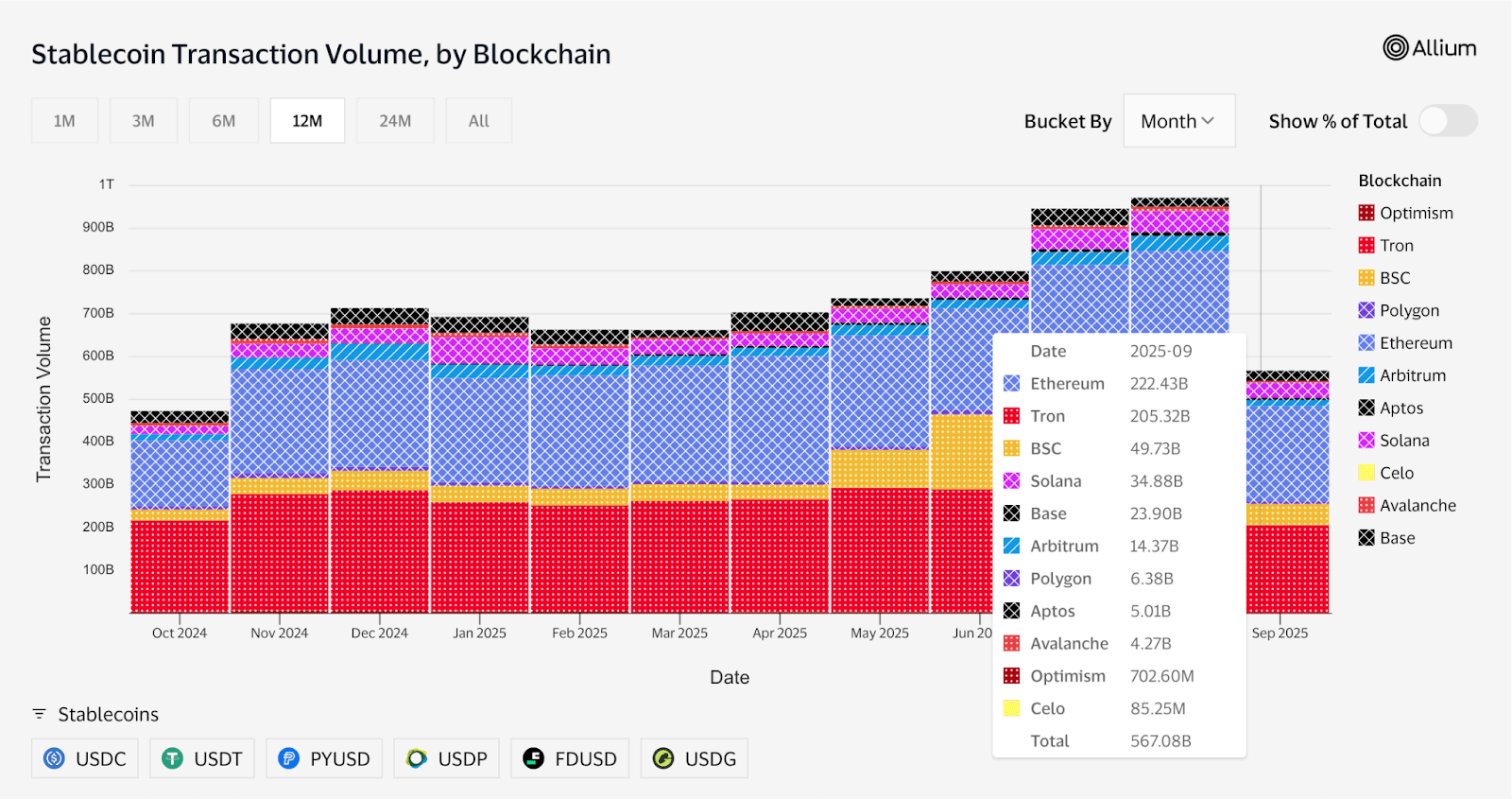

Just within the last 12 months we’ve seen over $40tn of stablecoin volume moved across crypto rails.

Why? Because the world is unstable.

Source: Youssef Haidar, Messari Research

Namely, we’re seeing the following kinds of geopolitical activity:

Conflict and political instability in ‘first world’ and ‘emerging’ countries.

High inflation rates and currency devaluation in regions like Latin America, Central Africa, and East Asia.

Clarity around the status of cryptoassets and stablecoins within legal frameworks at federal, national, and supranational levels.

Stablechains hedge against (or embrace, depending on your perspective) all of this political and social flux by utilizing different strategies and reserves (within the underlying stablecoin used on any chosen stablechain) to maintain a predictable and redeemable value.

Stablecoin activity alone has been huge on Ethereum, and Tron, both known to be decentralized/'secure', and cheap/liquid respectively. We’ve seen hundreds of billions of dollars of stablecoin value settled on Ethereum because institutions believe in the ecosystem due to its high economic security; and on the flipside, we’ve seen consumers flock to Tron in hordes to settle payments in USDT – with Tether making up the supermajority of Tron’s entire volume. Therefore it is undeniable that with so much product-specific demand, bespoke solutions are necessary to reconcile institutional markets with their retail consumers.

Source: Visa, ‘Stablecoin transaction Volume, by Blockchain’.

Stablechains act as specialized execution and settlement environments that provide enterprises and consumers with certain features that cannot be enforced, or are impractical to implement on generalized blockchains such as:

Compliancy checks: Fully onchain, secured, and auditable for KYC/AML, credential attestations, permissioned domains, and asset-specific rules (Stellar SEP-8, XRPL Credentials).

Native gas + fee predictability: Permit stablecoin issuers to use their own token as native gas, this also allows merchants and consumers to anticipate costs for each transaction as the token issued is set to maintain a stable value, so UX is better with this improved reliability e.g. USDC gas on Arc, xDAI gas on Gnosis

Embedded FX: Means foreign exchange risk (transacting between two non-commonly denominated assets like USD/EUR) is heavily mitigated because value doesn’t leak via AMM inefficiencies like liquidity pools or MEV attacks by third party actors e.g. Arc plans an on-chain RFQ engine for foreign exchange; Stellar/XRPL have path payments and native DEXs optimized for fiat pairs.

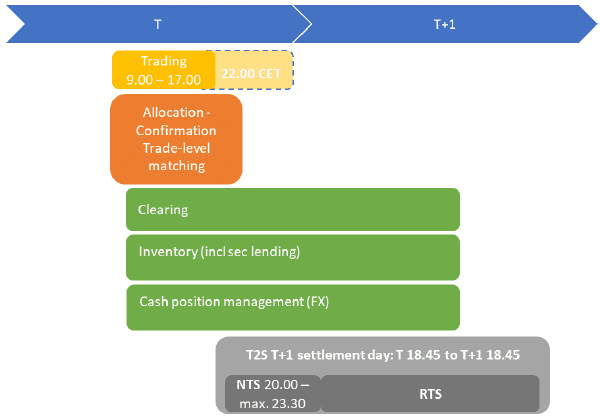

Stablechains are simply a dedicated settlement layer for money that traditional payment systems don’t offer. After all, is any member of the public able to easily, and certifiably audit Visa or Mastercard payments at any time? The answer is no, not second to second, minute to minute or even hour to hour because in traditional finance, settlement does not occur instantaneously - it typically happens under a t+1 framework, obfuscated by each bank’s private systems.

Source: Commission de Surveillance du Secteur Financier (CSSF), ‘T+1 Settlement: Preparing for the future of European financial markets’

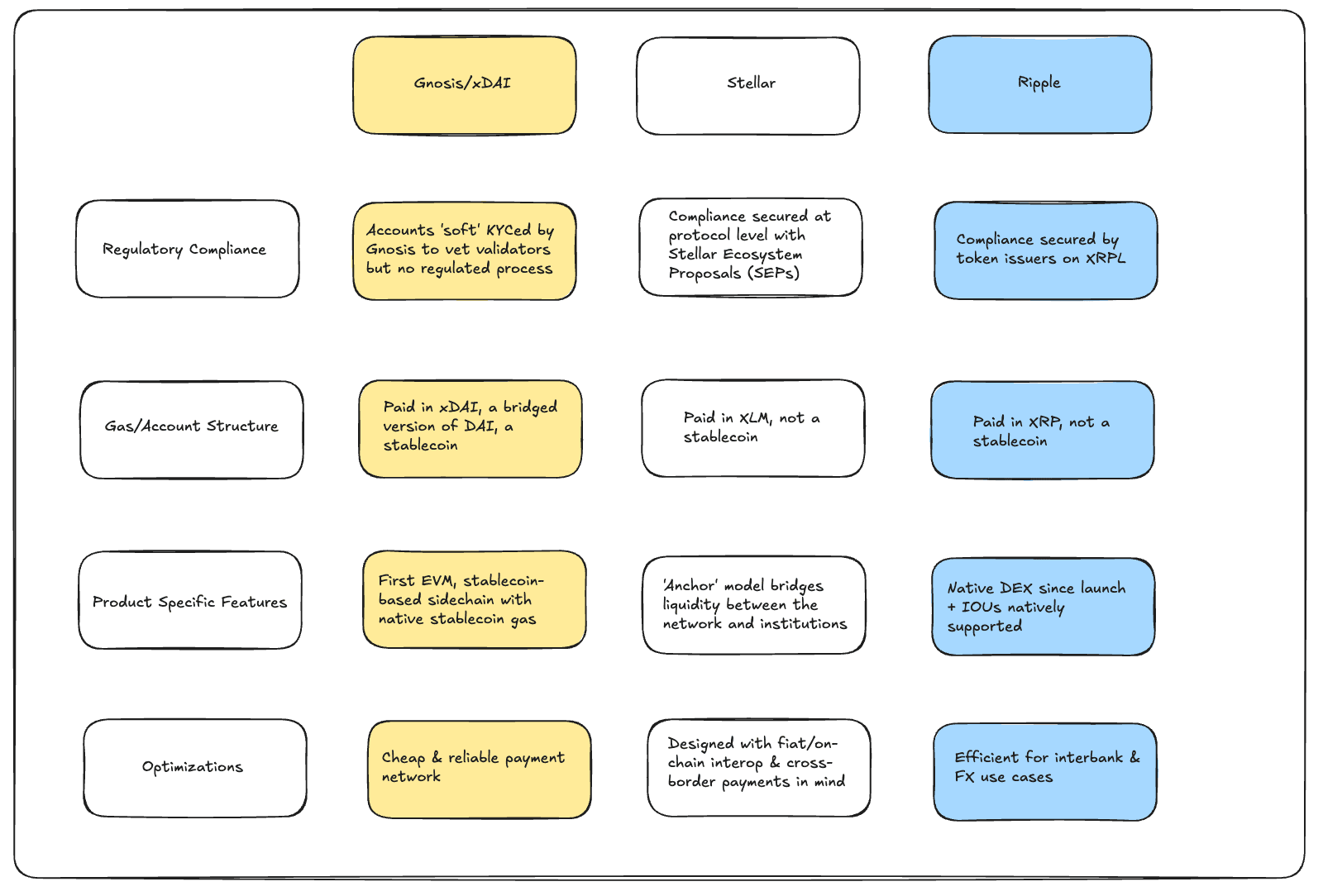

The first wave of stablechains like Stellar, Ripple and Gnosis chain provided some of the defining features of stablechains we see today, however they never gained the popular traction we can observe with stablecoins today - and that’s for a few reasons.

The First Wave: One Small Ripple for Internet Money

The first little ripple of internet money happened around 2012-14 with the launch of Ripple and Stellar, both addressing onchain compliance for payments. This was in the landscape of your Moneros, ZCash, and Bitcoin where most payments were being conducted in the ‘grey market’ or even outright black market.

Grey market coins like Monero, ZCash, and at the time, Bitcoin were seen through a hostile lens by regulators for a few reasons:

No oversight: fully encrypted networks which obfuscated transaction origins and destinations which means that funds moved could be used to settle payments with sanctioned organizations - and there was no way of telling what funds had ‘touched’ sanctioned addresses because it was impossible to tell which addresses to sanction at the time (data was still scarce/very short history of transactions which required a high burden of proof to prove wrongdoing e.g. Ross Ulbricht’s Silk Road).

Money laundering: these cryptocurrencies’ opaqueness were a prime opportunity for anyone tapped into their networks to launder money because the privacy-preserving components often encouraged under-the-table OTC deals where early cryptocurrency investors could buy exposure to these tokens in exchange for their fiat; and by intention or otherwise, these individuals helped others launder their money.

High volatility: even today, liquidity in the cryptocurrency market is often scrutinized by regulators, a decade ago it almost goes without saying that a handful of whales could bleed the market dry whether or not they meant to; and this often resulted in holders of Bitcoin, Monero or ZCash to essentially get liquidated on their token holdings overnight.

People wanted the ability to make payments on-chain, but without the day-to-day volatility of Bitcoin or the opacity of privacy coins like Monero and ZCash. This opened the door for projects such as Stellar, Ripple, and Gnosis/xDAI, which aimed to provide more predictable and usable infrastructure for individuals and institutions alike, but each stablechain or token issuer needs to attract deposits.

The cold-start issue for new stablechain, or stablecoin issuer, is therefore evidently challenging.

Issuers want to attract deposits but can’t do so without incentives

Incentives bring the issuer under greater legal scrutiny + risks having their token labelled a ‘security’

Therefore, issuers may likely choose not offer incentives

Without incentives, issuers struggle to gain traction.

Ripple faced no such cold-start as it was an institutionally funded venture from the beginning, entering the scene in 2012, three years after Bitcoin’s genesis block. Ripple’s ethos was fundamentally different from Bitcoin. Rather than promising censorship-resistance and anonymity, Ripple offered banks and payment providers a compliance-friendly distributed ledger. Ripple embedded features like issued currencies (IOUs), a native decentralized exchange (DEX), and later escrow/payment channels. These allowed institutions to tokenize fiat directly on-ledger and move value with finality in seconds, as opposed to Bitcoin’s hours.

Ripple’s focus on institutional settlement and cross-border transfers made it “revolutionary” at the time. For the first time, a blockchain could serve as a real-time gross settlement system (RTGS) for banks, competing with the Society for Worldwide Interbank Financial Telecommunication’s (SWIFT) settlement times of multiple days. While Bitcoin was a protest against the banking system, Ripple sought to upgrade it.

Two years later in 2014, Stellar was launched as a fork of Ripple’s codebase, but quickly pivoted to its own consensus model — the Stellar Consensus Protocol (SCP). Where Ripple focused on banks, Stellar positioned itself as an open-source public good for payments. It built an “anchor” model that allowed regulated entities to issue fiat-backed tokens while handling KYC/AML off-chain.

For NGOs, fintechs, and remittance providers, Stellar was a lifeline: cheap, fast, and with built-in standards (SEPs) for compliance and interoperability. If Ripple was “Wall Street crypto,” Stellar was “Main Street crypto” — designed for financial inclusion and small-value remittances that legacy systems ignored.

However, Stellar, Ripple and (initially) Gnosis/xDAI did not take off. The main reason for lacklustre uptake is likely that pitches of most of these players were aimed at institutions – who were unprepared and uncomfortable with the prospects of crypto pre-2020 due to legal quagmire – rather than scaling their businesses via retail. On the other hand, Circle and Tether scaled their stablecoin adoption with retail massively between 2015 and 2025, and now effectively own the user journey.

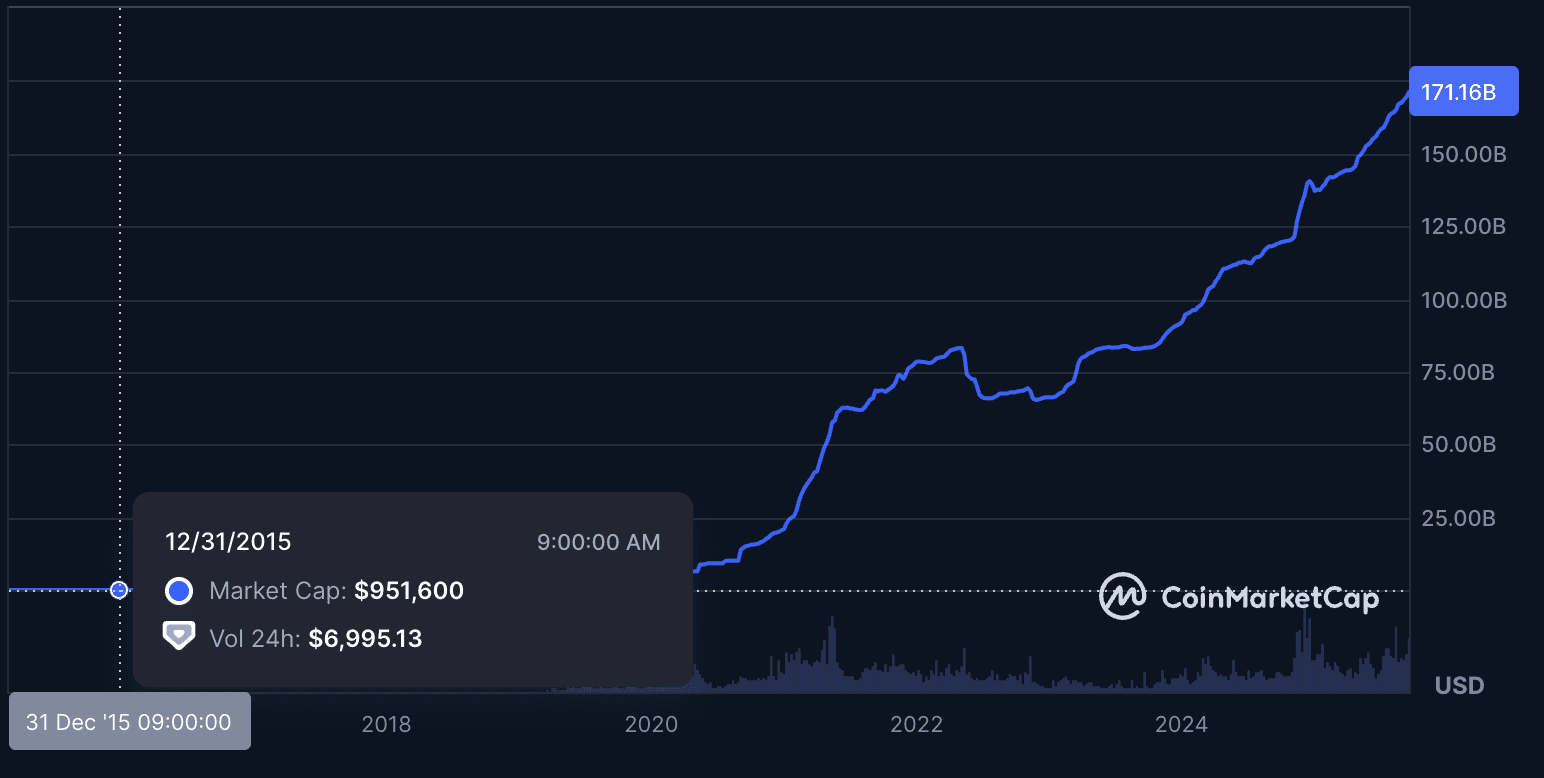

Source: CoinMarketCap, Tether’s Historical market cap

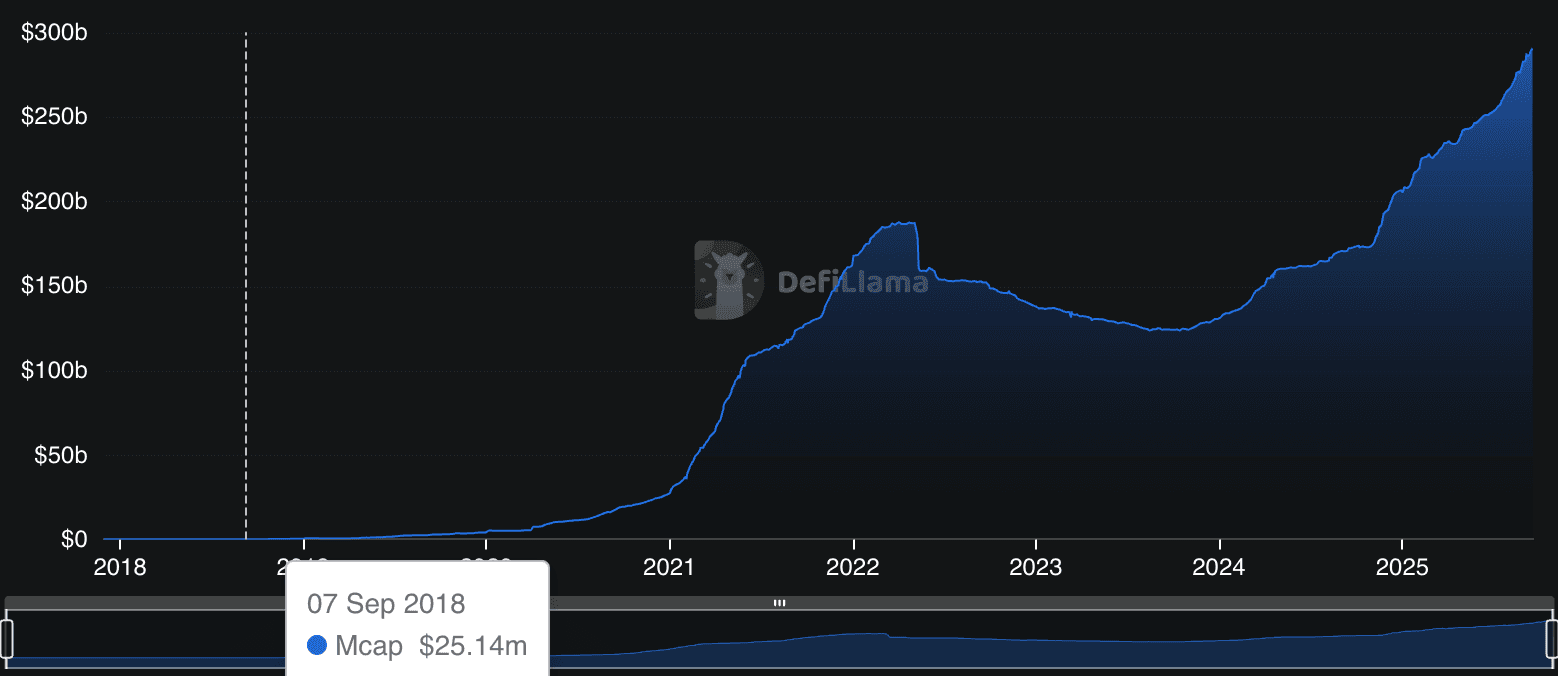

Source: DefiLlama, Total Stablecoin market cap (including USDC & USDT)

A New Arc for Stablecoins

The introduction of Arc Network, Tempo, and Plasma are a turning point in stablecoin history: they are being launched as dedicated Layer-1 blockchains rather than piggybacking on Ethereum or other general-purpose networks.

A dedicated L1 allows stablecoin issuers to hard-code compliance and payments-specific features into the base protocol like credential attestations, stablecoin-native gas, and FX settlement engines. These primitives are impractical to enforce on generalized blockchains, where every application competes for blockspace and governance decisions must serve multiple, often conflicting use cases. By owning the entire stack, Stripe (Tempo) and Circle (Arc) can optimize specifically for payments, giving enterprises predictable costs, compliance guarantees, and a settlement UX that rivals traditional systems. More DeFi centric solutions like Plasma are attempting to compete with this by offering native-onchain liquidity that can be deployed in real world contexts like with recent announcement of Plasma One.

In hindsight, launching new blockchains pre-2020 would have faced an insurmountable cold-start problem. Interoperability rails like secure cross-chain bridges/general messaging protocols (GMPs), standardized APIs, and stablecoin liquidity, simply did not exist at scale. Projects like Ripple, Stellar, and Gnosis/xDAIi solved the problem the only way they could at the time: creating siloed ecosystems or running as sidechains tethered to Ethereum. In 2025, the landscape is starkly different. The advent of GMPs, intents, sophisticated oracle systems and calldata abstraction are all tools that help power any action, and every potential outcome to wash away all the historical friction institutions, consumers, and developers have had to face when building or interacting with crypto rails. All assets, all data, and all actions are now distributed amongst a multi-chain ecosystem.

Stablecoins like USDC & USDT have now gained wide traction and are fare more liquid, cross-chain interoperability protocols have become standardised and battle-tested, and L1s can plug directly into banking, fintech, and merchant rails. This makes it viable for Arc, Tempo and Plasma to launch their own sovereign chains without condemning themselves to isolation.

In short, dedicated L1s give Arc Network, Tempo and Plasma the sovereignty to embed compliance and payment logic natively at the protocol level, while today’s interoperability rails ensure they can still plug seamlessly into the offchain and onchain liquidity securely.

Why Stablechains Are Here to Stay

Stablecoins are already the largest use case in crypto by volume. With trillions transacted in recent years, the demand is undeniable. What’s changing now is that dedicated stablechains are emerging to handle that demand natively, rather than as add-ons to general-purpose blockchains.

Predictable UX mean fees are denominated in stable value, no volatile gas tokens.

Regulatory alignment mean safe, compliant primitives built in, not bolted on.

Institutional backing mean better collaboration and deeper liquidity coming from banks, fintechs, and merchants.

Capital efficiency because there’s no need to rely on AMMs (because the stablechain may be settling all balances through one token) to bootstrap liquidity for FX — no MEV leakage, and settlement in milliseconds.

Early stablechains couldn’t scale to the mass market, because they were limited to the only market their issued stablecoin(s) had – there could be no discovery or ease of transfer for users between stablechains, or even of stablecoins themselves a decade ago. Dedicated solutions exist today to sow these gaps together like LI.FI’s Stablecoin API, which is a dedicated preset that handles stableswap transactions enabling: faster token transfers, and cheaper settlement.

Crypto is now having its’ ‘SWIFT moment’.

Prior to the introduction of SWIFT in the 1970s, transactions were sent over telegram messages (not like the app – physical papers, much slower) and were written in free-form text, so they required manual interpretation. Human operators were needed to interpret and verify these messages, often requiring extra confirmation by contact with the bank of the originating transaction to confirm transactions’ authenticity. Because of the lack of standardization, transactions were painfully slow, susceptible to fraud, and account errors.

With interop solved in crypto, stablechains no longer need to rely on slow, risky bridges or chokepoints for operational failure – today, the right rails, standards and security hygiene is in place to not only ensure that stablechains themselves flourish, but the consumers using them can move their funds quickly, cheaply and securely without ever rescinding control over their assets: the entire ethos of crypto in the first place.

FAQ: Stablechains Aren’t New, But They’re Here to Stay

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.