Rivo Integrates LI.FI to Enable Cross-Chain Swaps

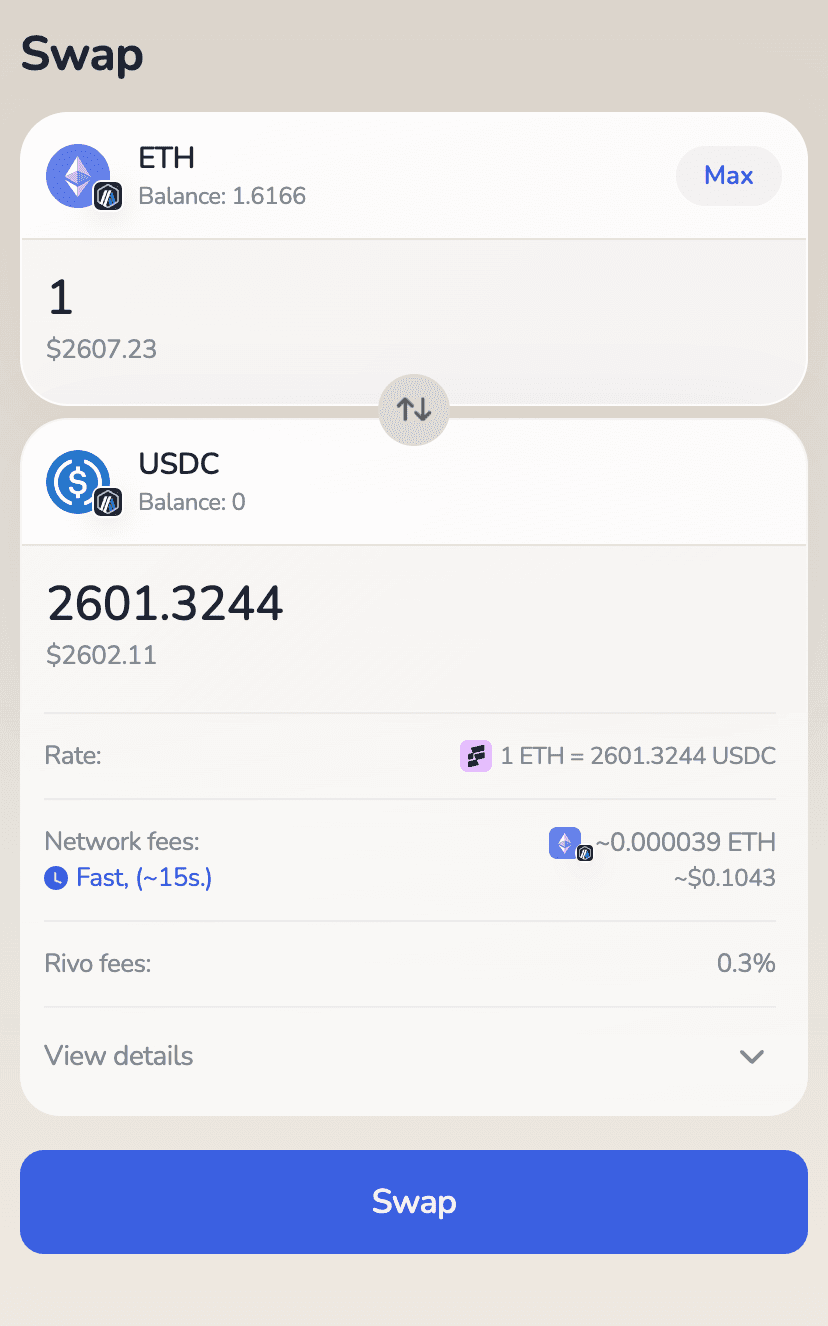

TL;DR – LI.FI is powering cross-chain and same-chain swaps inside Rivo.

We’re excited to announce that Rivo, a revolutionary one-click investment platform, has integrated LI.FI! This integration allows Rivo users to seamlessly perform cross-chain and same-chain swaps across 25+ leading chains and L2s, including Ethereum, Base, Arbitrum, Binance Smart Chain, and more.

By leveraging LI.FI’s advanced aggregation stack of 32 DEXs, DEX aggregators, and Solvers (Uniswap, 1inch, 0x, Odos, Enso, + others) the user is guaranteed to find the best price to swap their assets.

Additionally, LI.FI’s 18 integrated bridges, such as Across, Stargate v2, THORChain, Symbiosis, Circle CCTP, and Allbridge ensure the seamless flow of funds across various chains.

We’re thrilled to partner with Rivo to make the cross-chain universe simple for anyone to use. Try out same chain and cross-chain swaps on Rivo here

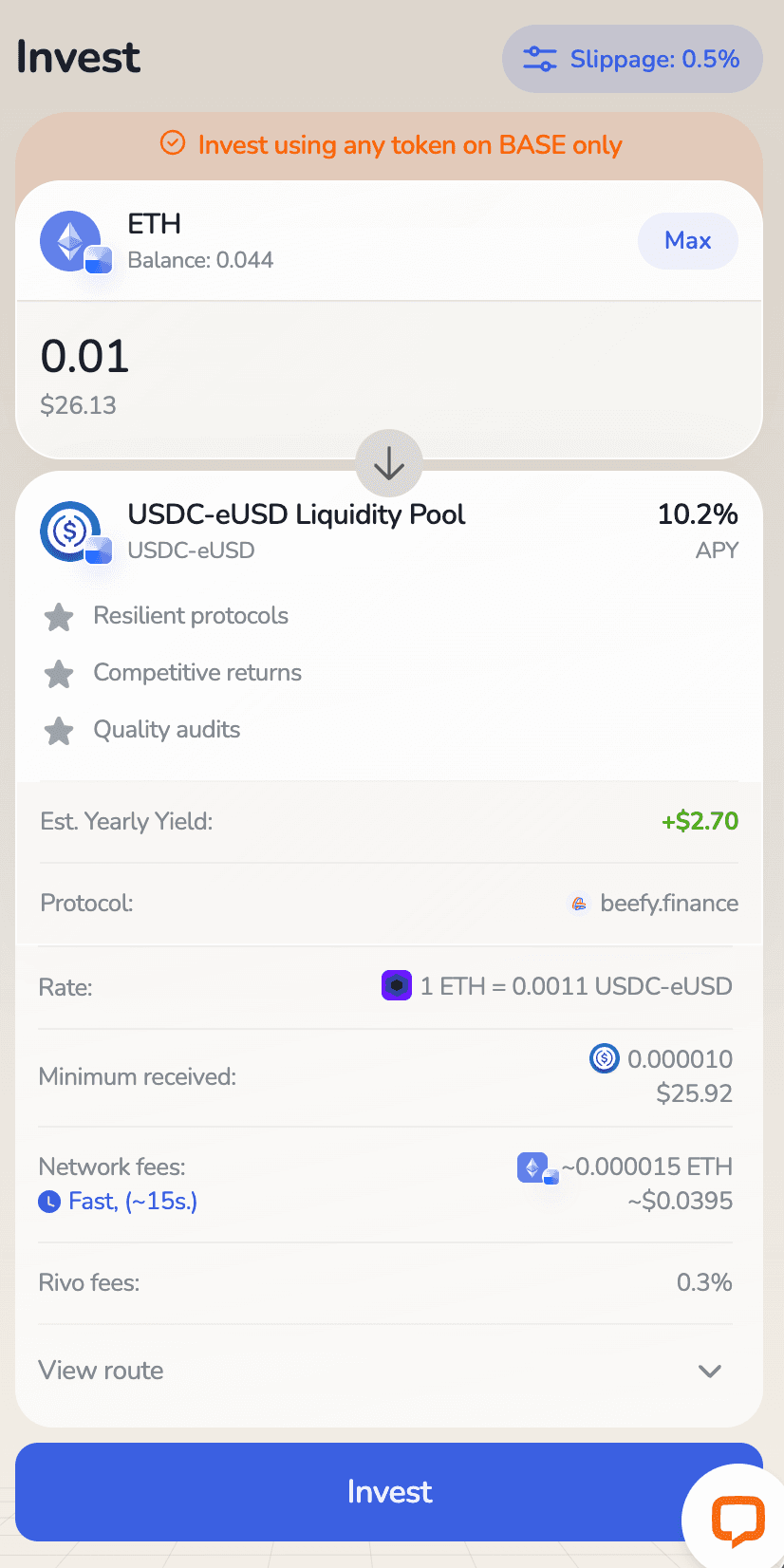

Additionally, users can also leverage LI.FI when depositing into Rivo Strategies here

With Li.FI integration, users can zap any ERC-20 token (like USDT) directly from the Ethereum mainnet or any other supported network into Base DeFi protocols in a single transaction on Rivo. ZAP acts as a shortcut for providing liquidity or performing cross-chain swaps. It eliminates the lengthy process of manual bridging.

Here's how it works:

Imagine you have USDT on Ethereum and want to provide liquidity for the AERO-ETH pair. Li.FI seamlessly handles the entire process:

1. Swap on Ethereum: Li.FI first sends your USDT to a DEX aggregator on Ethereum to swap it for ETH.

2. Bridge to Base: The ETH is then swapped for WETH (wrapped ETH) on Base through the Across cross-chain bridge.

3. Swap to AERO: Once the tokens arrive on Base, Li.FI swaps your WETH to AERO.

4. Deposit to Aerodrome: Finally, the protocol deposits your AERO and WETH into Aerodrome, completing the liquidity provision.

Thanks to automation, this entire process happens in just one transaction, saving you time and effort.

What Is Rivo?

Rivo is a revolutionary one-click investment platform that simplifies DeFi. By integrating with major blockchains like Ethereum, Avalanche, Optimism, Base, Arbitrum, and BNB Chain, Rivo offers a seamless experience for users to swap, invest, and generate competitive yields. Through its intuitive interface and educational resources, Rivo empowers users to make smart investment decisions based on their expected returns and risk tolerance.

Rivo's standout products include the Yield Marketplace, which presents a carefully curated selection of 20+ trending DeFi strategies, and the Yield Indexes developed by Rivo experts that provide diversified portfolios of DeFi tokens and strategies. With its innovative features like one-click investments, advanced portfolio tracking, risk scoring, and AI-powered portfolio building, Rivo is poised to become a leading platform for retail users entering the DeFi space.

To learn more about Rivo check out their:

What Is LI.FI?

LI.FI is a middleware solution connecting 27 EVM chains and Solana via 18 bridges, 22 DEXs, 8 DEX aggregators, 2 Solver networks (and growing).

LI.FI’s product portfolio features sophisticated white-label B2B solutions that not only allow same-/cross-chain swapping capabilities but also grant arbitrary contract calls for the implementation of advanced cross-chain strategies such as yield aggregation, LP-zapping, NFT purchasing, and many more. We believe Web3 needs to be made available not only for the next billion users but also for the next million developers to build on it.

Our SDK is the ultimate cross-chain money lego for dApps to build on top of or plug into themselves.

We've integrated multiple fallback bridges + DEXs so that you don't have to

We maintain bridges + DEXs so that you don't have to

We choose the best bridges based on our research so that you don't have to (positioning ourselves neutral)

For some examples of how LI.FI works. Check out:

MetaMask Bridges - API Integration

Superfluid - Widget Integration

Alchemix - SDK Integration

FAQ: Rivo Integrates LI.FI to Enable Cross-Chain Swaps

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.