Pontoon Finance — A Deep Dive

All You Need to Know About Pontoon — The Cross-Chain Liquidity Mirroring Protocol

Pontoon is a one-click liquidity mirroring protocol that aims to solve the fragmentation and composability concerns in the cross-chain ecosystem in a decentralized and trustless manner.

In this article, we will cover the following:

Pontoon: An Overview

Bridge Design — Architecture

How It Works — Transaction Lifecycle

Transaction Validation Mechanism

Security Model

Incentives

Risks

Supported Chains

Team

Community

Let’s dive in!

Pontoon: An Overview

Pontoon Finance is a one-click cross-chain liquidity mirroring protocol. It currently supports the transfer of assets across four chains via its incentivized relayer network and liquidity providers. Pontoon is built to offer a solution to the following cross-chain problems:

Centralized Exchange Dependancy — Despite the development of bridges connecting the crypto ecosystem, the industry is still quite dependent on centralized exchanges to move assets between different blockchains. While centralized exchanges offer a suitable solution to move assets across chains, they are not the ideal solution because they are centralized, non-custodial, and charge additional fees to users.

Liquidity Fragmentation — Liquidity across the crypto ecosystem is not spread evenly; some blockchains and pools attract more liquidity than others. As a result of such liquidity discrepancies, problems like slippage plague DeFi activities (especially when moving across chains).

Non-Composability — DeFi is all about composability and the concept of money legos where developers can build applications on top of another. However, currently, the DeFi applications lack cross-chain composability.

Pontoon offers several features to overcome these challenges, including:

Decentralized Relayer Network — Pontoon’s architecture consists of a Proof of Stake (PoS) relayer network secured by validators running nodes. This relayer network is responsible for making cross-chain transfers. Validators are incentivized to run nodes by collecting fees in $TOON tokens.

Cross-Chain Liquidity Pool — Liquidity Providers (LPs) are incentivized to add liquidity in Pontoon pools to earn rewards in $TOON tokens.

Cross-Chain Bridge — Tokens can be transferred across blockchains via Pontoon’s relayer network. The transfers function in a trustless manner as users don’t lose custody of their funds, and the cross-chain transfers are initiated using smart contracts.

Pontoon’s Features

Bridge Design — Architecture

Pontoon’s architecture evolved from its core focus on solving the cross-chain liquidity fragmentation problem in a decentralized and trust-minimized manner. Pontoon’s architecture includes:

Bridge Contracts — These are the smart contracts deployed on each chain supported by Pontoon. User transactions execute a function on these contracts, which leads to the locking/unlocking of tokens on the source/destination chain.

Relayer Network with Validator Nodes — ontoon’s Proof-of-Stake (PoS) secured relayer network plays a vital role in its functionality. It is the piece of the jigsaw puzzle that connects everything — users, smart contracts, liquidity pools, validator nodes, and utility for $TOON tokens

.

Liquidity Pools — LPs add liquidity to the liquidity pools on Pontoon’s relayer network. This enables quick and easy cross-chain transfers as users can simply swap their assets using liquidity pools on different chains without having to actually bridge assets across chains.

Together, these components form a solid architecture to enable cross-chain transfers via a method called liquidity mirroring. Here, LPs can stake their assets on a chain and unlock the same asset value on another chain, enabling instant cross-chain asset bridging.

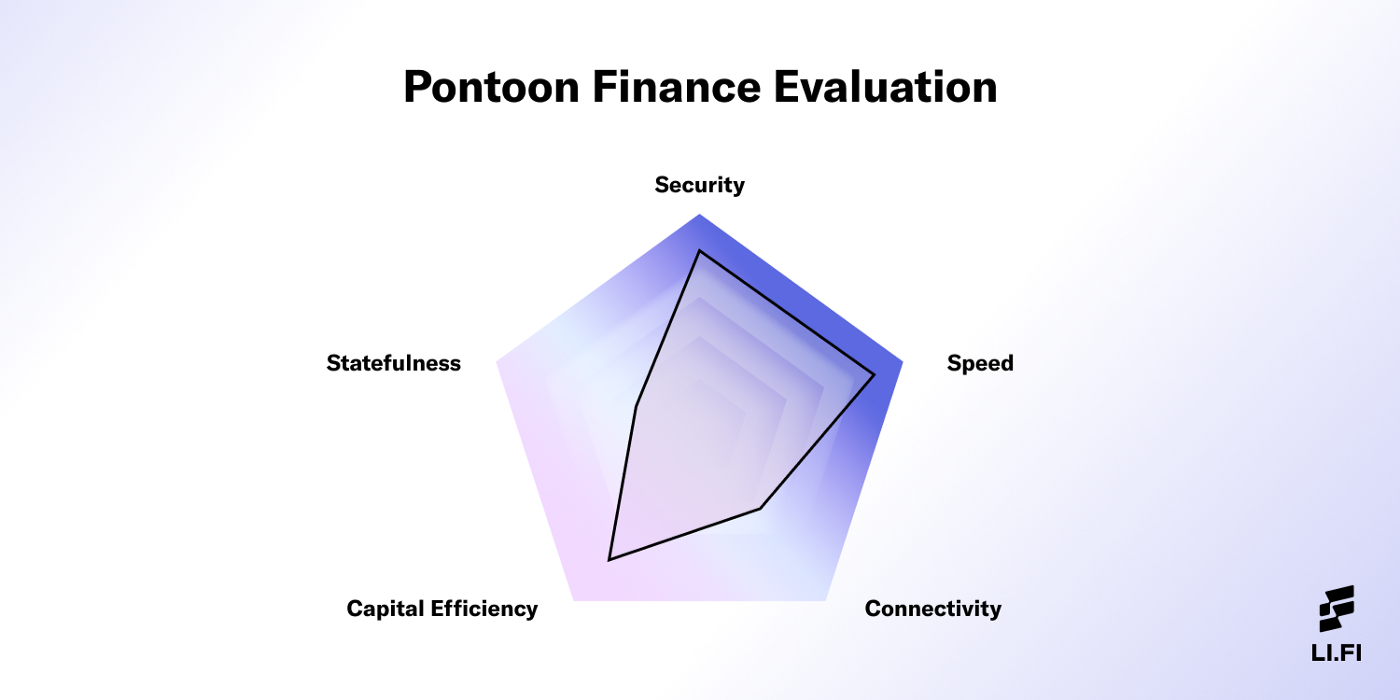

Based on this knowledge of Pontoon’s design and architecture, we can evaluate it as follows:

Security — Pontoon has a trust-minimized design as it uses liquidity pools on two blockchains to execute cross-chain transfers.

Speed — Pontoon can execute transactions quickly as cross-chain transfers occur through the liquidity mirroring mechanism.

Connectivity — Pontoon currently supports four blockchains and plans to add 4 more in the coming weeks. The team plans to add all EVM chains in the future.

Capital Efficiency — Pontoon’s design can be highly capital efficient as it uses liquidity pools. Thus, with a solid rebalancing mechanism in place, Pontoon can support large volumes in a capital-efficient manner.

Statefulness — Liquidity networks like Pontoon typically trade-off statefulness for other qualities. Pontoon is no different and offers limited functionality to pass more complex data/messages across chains.

Note: Liquidity networks like Pontoon will inherently score low on metrics like statefulness as they don’t optimize for it.

How It Works — Transaction Lifecycle

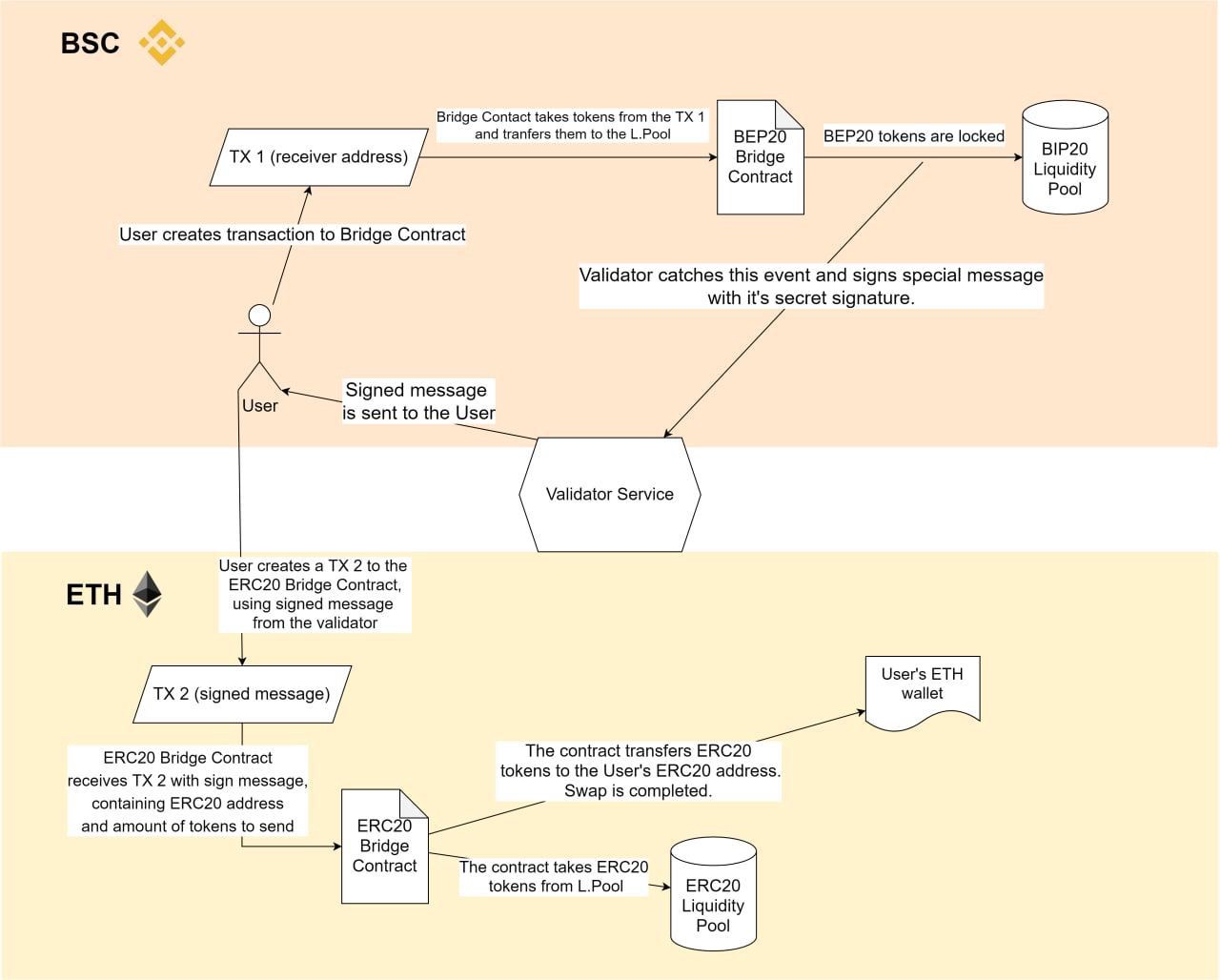

Pontoon offers one-click liquidity mirroring across blockchains. Here’s how a transaction works in the Pontoon architecture:

The user initiates a transaction by inputting relevant information like token, source chain, destination chain, and token amount on the Pontoon bridge UI.

User funds are sent to the receiver address via the Bridge Contract, which then adds (or locks) the tokens to the liquidity pool on the source chain.

Once the validator node sees this event, it signs a special message.

Using the signed message, the Bridge Contract on the destination chain takes funds from the liquidity pool and adds them to the user’s address.

Pontoon Transaction Lifecycle

Example — A user wants to swap 1 ETH (amount transferred) on BNB Chain (source chain) for 1 ETH on Ethereum Mainnet (destination chain). Here’s how the cross-chain transaction will work out in Pontoon’s architecture:

The 1 ETH gets deposited in the liquidity pool on BNB Chain, where it is locked.

The validator nodes in the Pontoon relayer network sign a message that triggers the smart contract on Ethereum Mainnet.

The smart contract takes tokens from the ETH pool on Ethereum Mainnet and transfers them to the user’s address on BNB Chain

Transaction Validation Mechanism

To validate cross-chain transactions, Pontoon uses a decentralized relayer network that relies on validator nodes to monitor transactions. They sign messages that trigger the smart contract on the destination chain to take funds from the liquidity pool and transfer them to the user’s address.

Security Model

To ensure the security of the architecture, Pontoon has taken the following steps:

Decentralized Relayer Network — Pontoon’s relayer network is Proof of Stake secured and allows anyone to become a validator node. These nodes are incentivized with rewards in $TOON, Pontoon’s native token.

Trust-Minimized Design — User funds are never in the custody of the validators. All functions in Pontoon’s designs are executed via smart contracts.

Audits — Pontoon has successfully completed security audits by reputable blockchain security studios like Zokyo, PeckShield, Coinspect, SlowMist, and BlockSec.

Liquidity Network — Pontoon is a cross-chain solution that uses liquidity pools for transfers. Liquidity networks are inherently trust minimized as they do not add new trust assumptions between the blockchains they connect.

Incentives

Pontoon rewards LPs for providing liquidity to the various pools on different chains and validators who run nodes in Pontoon’s relayer network in $TOON tokens.

Risks

Interacting with Pontoon has the following risks:

Technology Risks — Given the nature of the operation, technology risks like software failure, buggy code, human error, spam, and/or malicious attacks can possibly disrupt Pontoon’s operation.

Centralized Relayer Network — Pontoon’s relayer network is open for anyone to join and is on a path towards achieving progressive decentralization. However, in the early stages of the protocol, it’s likely that the team is working closely with a whitelisted set of validator nodes — which poses a risk of the relayer network being centralized.

Smart Contract Risks — While Pontoon has been audited, there is still a possibility of mistakes in the code. Thus, there is a counterparty risk involved concerning Pontoon smart contracts.

Lack of Liquidity — Pontoon’s operations depend on the condition that liquidity pools on all chains have sufficient liquidity at all times. In cases without enough liquidity, cross-chain transfers via Pontoon will fail.

Role of Validator Nodes — The validator nodes play a key role in the Pontoon architecture. In case validators experience downtime, user transactions might get delayed or canceled.

Supported Chains

Pontoon has concluded the testnet recently on four chains — Ethereum, BNB Chain, Polygon, and Avalanche. They plan to launch on Celo, Fantom, Arbitrum, and Optimism in the coming weeks.

Team

Pontoon is an eight-member team spread across the globe. Some key individuals in the Pontoon team include:

Venkatesh Karanalu — CEO

He has over 14+ years of IT experience in DataCentre management and has served major IT players — Wipro, CTS, EMC2(DELL EMC), CapGemini

Mahanthesh Shadakshari — CTO

He has 8+ years of Experience in Software Development and has served at Practo, Qplum, Acko, and Locus.

Divya Jagadeesh — Engineering Lead

She has 10+ years of Experience in Software Development and has served at Himalaya Healthcare, Infosys, L&T, CMI Ltd.

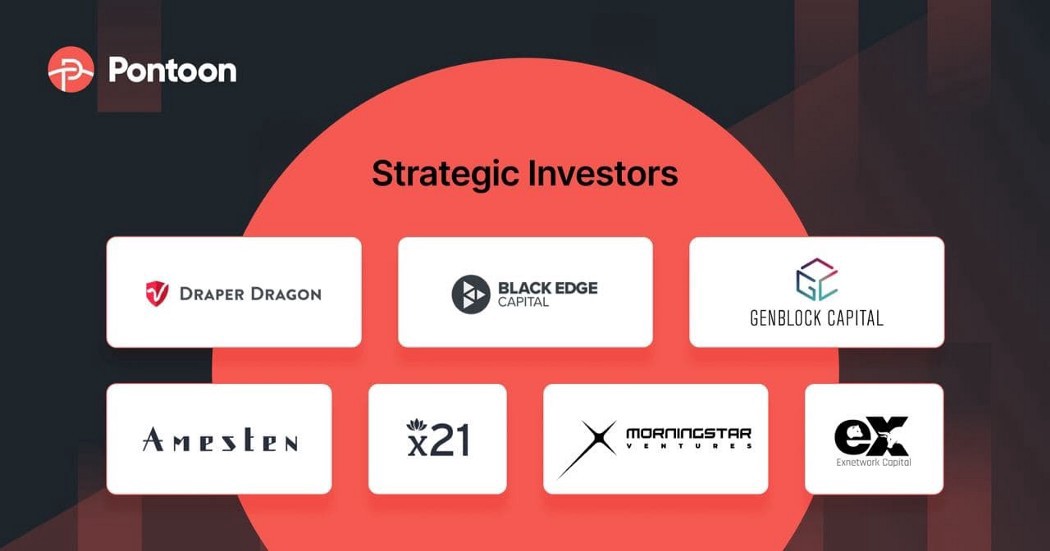

The Pontoon team has raised $3.2 million in funding.

Community

You can stay updated about Pontoon and its community through the following:

Closing Thoughts

Pontoon offers a trust-minimized bridging solution. It introduces the concept of liquidity mirroring and has the architecture to support cross-chain transfers securely and efficiently.

Pontoon is still in its testnet stage. We look forward to seeing its development and working closely with the team to build key infrastructure for the multi-chain ecosystem.

FAQ: Pontoon Finance — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.