LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Multichain — A Deep Dive

All You Need to Know About Multichain — The Ultimate Router for Web 3.0

Multichain is a cross-chain router protocol with a goal to become the ultimate router for Web3.0. It is an infrastructure developed for on-chain asset interoperability through arbitrary cross-chain interactions.

In this article, we will cover the following:

Multichain: An Overview

Multichain’s Bridge Design and How It Works

Transaction Validation Mechanism

Security

Risks

Supported Chains and Assets

Team

Community

Let’s dive in!

Multichain: An Overview

Multichain was initially launched as Anyswap on 20 July 2020. It was one of the first projects that focused on interoperability. Built to cater to dApp developers who wanted to make communication between different blockchains possible, Multichain has become almost universally applicable as an interoperable layer. After the rebranding to Multichain, the protocol now focuses on providing a reliable infrastructure for arbitrary cross-chain interactions. Moreover, being four times faster and offering better UX than Anyswap, Multichain aims to become the ultimate router for Web3.

Multichain boasts the following features:

Cross-chain router protocol — As Multichain focuses on providing key infrastructure for arbitrary cross-chain interactions, it offers a Cross-Chain Router Protocol (CRP) that is second to none. Not only is Multichain’s CRP advanced in terms of technology, but it also enables great functionality as it supports cross-chain interoperability of tokens, NFTs, and general data across multiple blockchains.

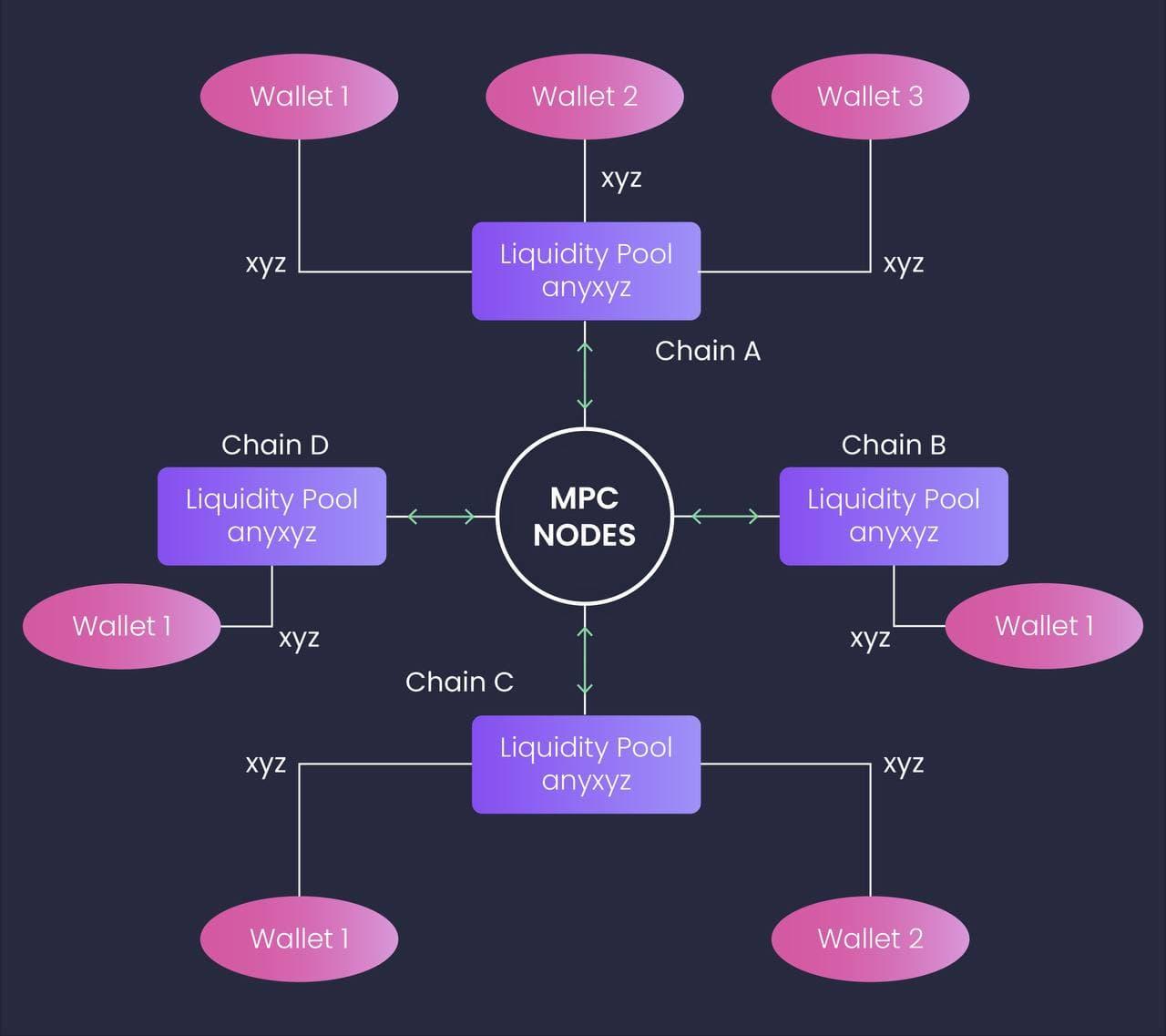

SMPC network — Multichain has a network of nodes that together make the Secure Multi Party Computation (SMPC) network. These nodes are responsible for collectively signing transactions. SMPC network is a vital part of the Multichain network and is run by various organizations, institutions, and individuals who are committed and incentivized to do perform their role properly.

Open-source — Multichain is an open-source protocol and thus is free to use by anyone. The team believes it is essential for them to open-source in order to achieve decentralization of the protocol.

Unparalleled connectivity — Users can bridge over 1600+ tokens across 30+ blockchains including EVM-compatible chains as well parachains, chains like Bitcoin, and Cosmos-based chains.

High speed and low-cost transactions — With its unique MPC design, Multichain can enable quick cross-chain swaps at low costs.

No-slippage swaps — Generally, AMMs have a slippage cost for any type of transfer which adds to the total transfer cost. Multichain, however, offers 1:1 swaps which allow users to execute swaps and cross-chain transfers with 0 slippage costs, eliminating the hidden costs typically associated with AMMs.

Given its features, Multichain offers the following services:

Cross-chain bridge — Multichain uses a lock and mint mechanism to bridge assets from one chain to another. Crypto assets are locked up on the source chain in Multichain’s MPC smart contracts and the same amount of wrapped assets are minted on the destination chain. Example: If a user wants to bridge 1 ETH from Ethereum Mainnet to Fantom, Multichain will lock 1 ETH on the Ethereum Mainnet using its MPC smart contracts and mint 1 wrapped ETH or wETH on Fantom.

Multichain router — Multichain offers a router that facilitates seamless cross-chain transfers. It essentially makes the transactions easier and reduces the cost. The router offers tremendous functionality to the Multichain network as it allows users to swap both native assets and bridge assets that have been created by a third-party bridge. Moreover, the router is also compatible working with bridged assets smart contracts where Multichain is required to mint assets on-chain.

Cross-chain contract calls — Multichain offers cross-chain contract calls known as anyCall. These are smart contract functions that can be used by dApps to make contract calls across chains.

Bridge for NFTs — Multichain is one of the few interoperability solutions that offers a bridge for NFTs, both ERC721 and ERC1155. It also has a router for NFTs.

Multichain’s cross-chain bridge and router are unique in their own ways and enable users to facilitate seamless, low-cost, and quick cross-chain transactions. However, this is a functionality that is offered by most bridges in the ecosystem. With their NFT cross-chain bridge and anyCall solutions for arbitrary cross-chain contract calls, however, Multichain is able to offer services that not all bridges in the ecosystem can provide.

Additionally, the anyCall solution will enable Multichain to offer more services such as multi-chain lending, yield aggregation, and cross-chain decentralized exchange. This will further enhance Multichain’s position as a key player in the ecosystem.

Multichain’s Bridge Design and How It Works

A cross-chain transfer via Multichain can go through in two ways:

A two-way cross-chain bridge that works between two blockchains only.

A multi-way cross-chain router that works across chains, for more than two blockchains.

Let’s take a closer look at how cross-chain transfers work in both these cases.

Cross-Chain Bridge

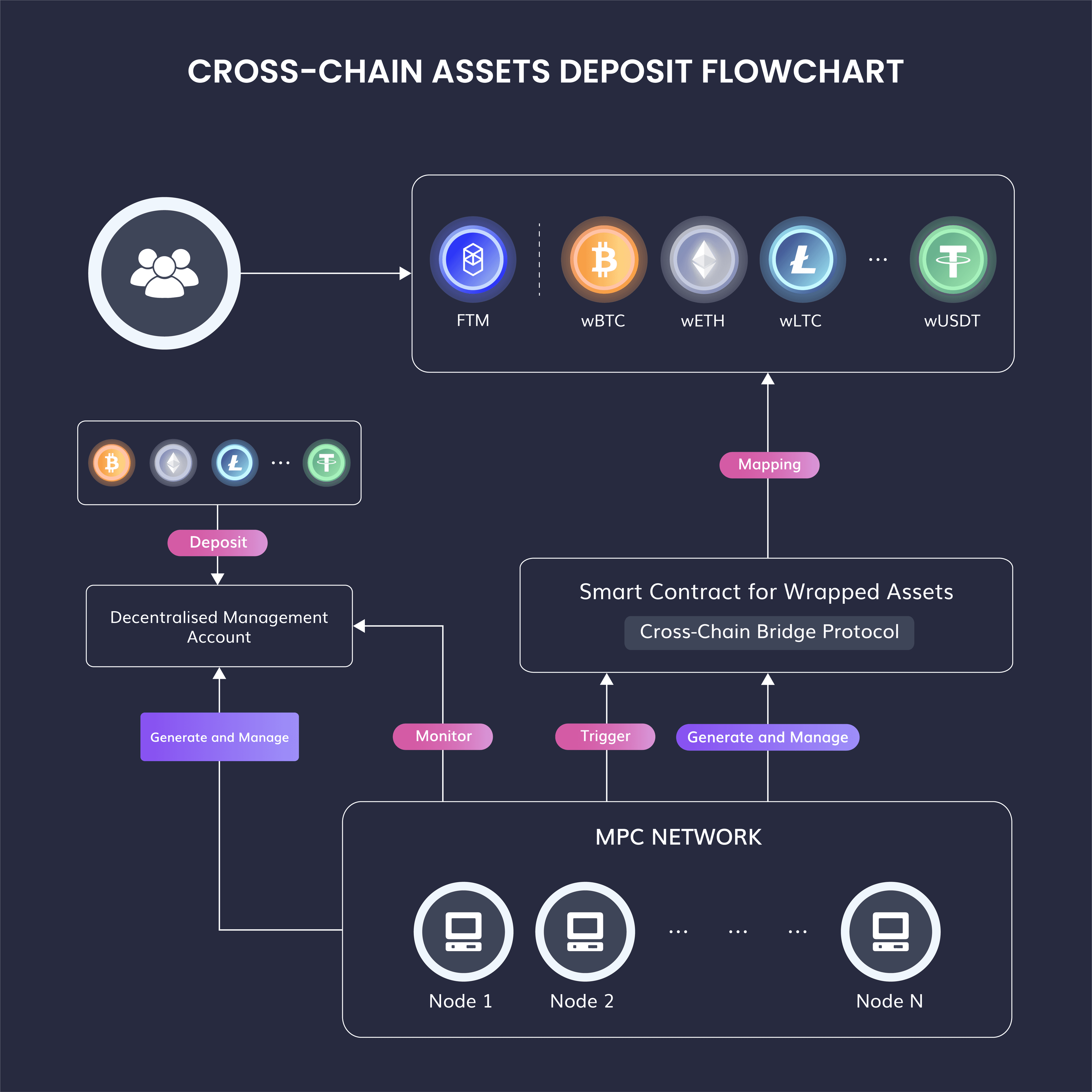

Multichain uses specialized bridges to connect two blockchains. These bridges enable two-way asset transfers between two blockchains only. Multichain’s SMPC network plays an integral role in the cross-chain bridge. Multichain uses a lock and mint mechanism to enable cross-chain transfers. Here’s how it works:

Users deposit assets on with key details of the swap such as source chain (from), destination chain (to), and amount to be transferred.

The deposited assets are sent to a Decentralized Management Account which is essentially a special SMPC wallet address monitored by Multichain’s MPC network. The assets are locked securely there.

After the assets are deposited in the SMPC wallet address, the MPC network triggers a smart contract on the destination chain, which mints token 1:1 with respect to the asset held in the Decentralized Management Account.

The smart contract then maps the minted assets, which are then sent to the user’s wallet on the destination chain.

Example — A user sends 2 ETH (amount transferred) from Ethereum Mainnet (source chain) to Fantom (destination chain). Here’s how the cross-chain transaction will work out in Multichain’s bridge:

The 2 ETH gets deposited in the Decentralized Management Account, where it is locked

The MPC network triggers the smart contract for wrapped assets

The smart contract mints 2 wrapped ETH or wETH on Fantom and sends it to the user’s address

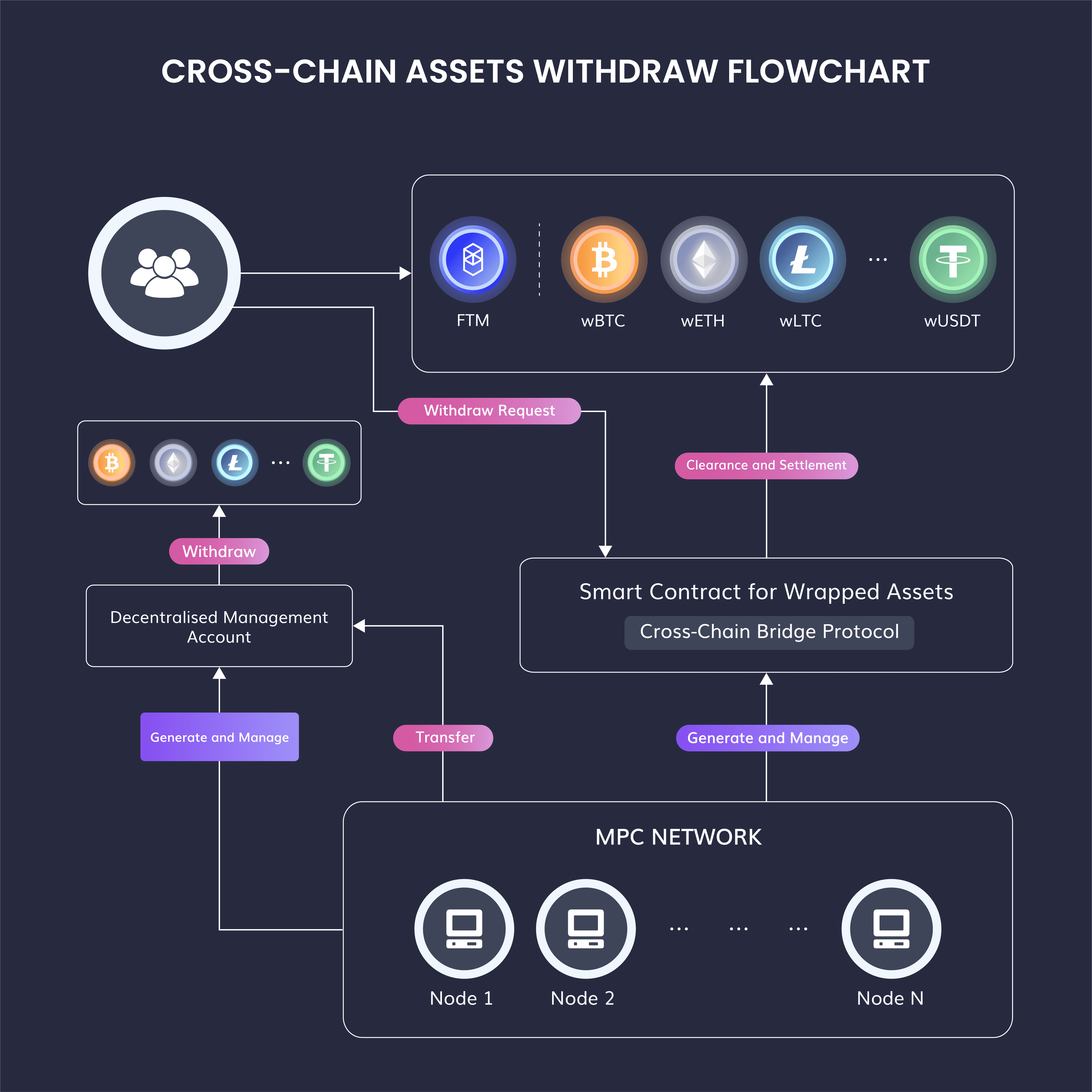

The reverse process where a user sends the wrapped asset from the destination chain back to the source chain is also possible. Such a transaction is called redeeming. Here, the wrapped asset is burned, and the assets locked in the smart contract are released on the source chain.

Continuing the same example — The user now wants to send the 2 wrapped ETH or wETH from Fantom back to Ethereum Mainnet (note: the amount transferred will be slightly less than 2 wETH because of gas fees). Here’s how the cross-chain transaction will work out in Multichain’s bridge:

The 2 wETH is burned on Fantom

The assets in the Decentralized Management Account are released by the smart contract

The 2 ETH is sent to the user’s wallet on Ethereum Mainnet

In Multichain’s cross-chain bridge mechanism, the SMPC network plays an integral role. Some of their key functions in Multichain’s bridge design include:

The SMPC network is responsible for controlling the Decentralized Management Account.

Generating the Decentralized Management Account when a new bridge between two blockchains is created. This is the address where the users’ deposited assets are sent.

Connecting to a new smart contract on the destination chain for Wrapped Assets when a new bridge between two blockchains is created. This contract is used to mint tokens on the destination chain and burns them in case of redeeming.

Cross-Chain Router

The Multichain router is essentially a multiple-way bridge that allows assets to be transferred between more than 2 blockchains. How the cross-chain router works depends on which asset is being bridged. Based on the type of asset, here’s how the Multichain router enables cross-chain transfers.

1. Native Assets

Native assets are tokens that originate on a chain. Example — Both USDT and USDC are ERC-20 tokens, native to the Ethereum blockchain. In such cases, it is not possible to mint native assets on a different blockchain. Like in the example of a cross-chain transfer of ETH from Ethereum Mainnet to Fantom, it is not feasible for Multichain to mint native ETH on Fantom to enable the transfer, and thus they have to use a wrapped version.

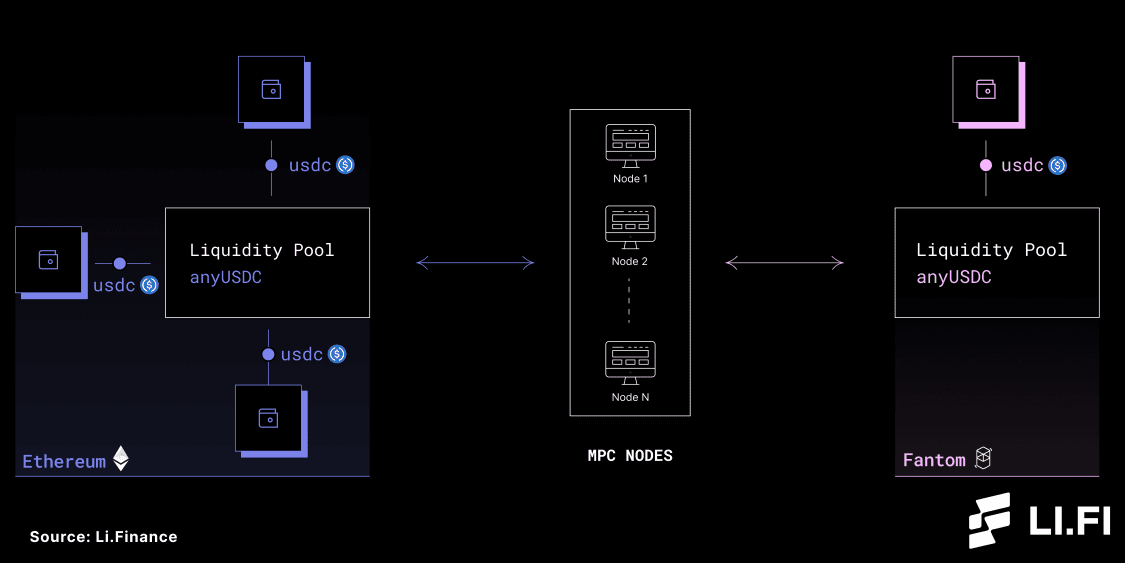

To enable the transfer of native assets cross-chain, Multichain uses liquidity pools. This mechanism is used by many other popular bridges like Connext, Hop, and cBridge, all of which are integrated with LI.FI.

Here’s how cross-chain transfers of native assets work in the Multichain network using liquidity pools:

Liquidity pools of native tokens are created on different blockchains. To do so, native tokens are added to the pool by Multichain or any other project or liquidity providers.

Once added to the liquidity pools, these tokens become available to the users for cross-chain transfers.

To learn more about how liquidity pools used by cross-chain bridges like Multichain work, check out this [article on liquidity pools.](https://medium.com/tixlorg/cross-chain-bridge-how-do-liquidity-pools-work-4c64dfeae77b#:~:text=The Cross-Chain Bridge uses,providers of DEXs are facing.)

This mechanism works when there is enough liquidity in the liquidity pools at the time of the cross-chain transfer. But what happens if there is not enough liquidity? To counter the problem of lack of liquidity, Multichain uses the concept of creating anyXYZ tokens. These are tokens that can be minted by the Multichain chain and are not native to the blockchains. To understand how cross-chain transfers using anyXYZ tokens work, let’s take an example:

A user wants to bridge 100 USDC from Ethereum Mainnet to Fantom using the Multichain Router. Multichain mints 100 anyUSDC on Fantom that represent the amount of USDC the user should have received. If there is enough liquidity, then the anyUSDC is automatically swapped for USDC and anyUSDC gets burned. However, if sufficient liquidity is not there, the user is left with the 100 anyUSDC (called 'Your Pool Share') which then need to be manually converted to USDC by ‘removing’ them when sufficient USDC becomes available again.

In the backend, here’s what happens when the user transfers 100 USDC (XYZ) from Ethereum Mainnet (chain A) to Fantom (chain B):

The 100 USDC is added to the pool on Ethereum

100 anyXYZ are minted on Ethereum

The SMPC network detects these events and triggers the smart contract to mint 100 anyUSDC on Fantom, burning the same on Ethereum

If the number of USDC on Fantom is more than the anyUSDC created, then the USDC gets sent to the user’s wallet on Fantom and anyUSDC is burned on Fantom. However, if the number of USDC is less than anyUSDC, then the user is left with their anyUSDC which represents their share of the pool and can be later redeemed for USDC by ‘removing’ them when there is enough liquidity.

The example above shows how the Multichain router mechanism works with liquidity pools when two chains are involved. Here’s how things will work out when there are more than 2 chains.

Multichain Router with Native Assets

2. Bridged Assets

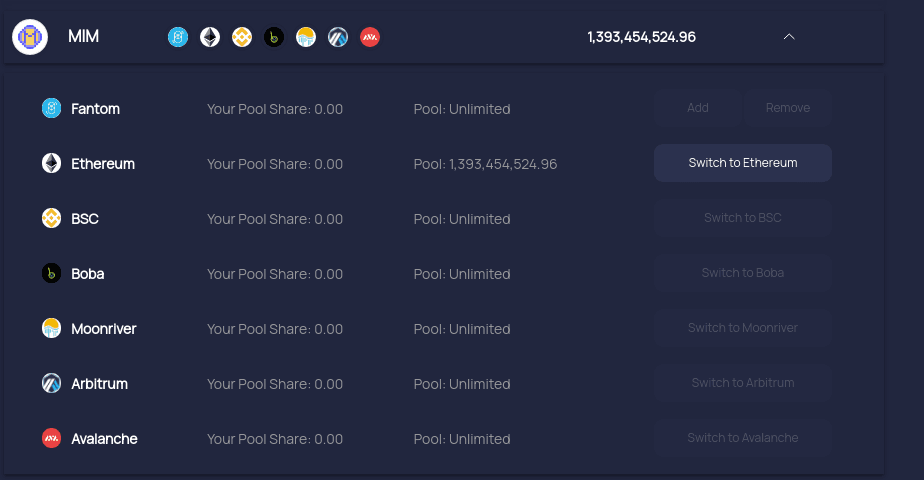

Bridges assets are the assets which are created using AnyswapV5ERC20.sol or its modified version. When it comes to bridges assets, the concept of liquidity pools is not required anymore. This is because Multichain controls the assets’ supply on the chain where the smart contract is present. This makes the pool size ‘unlimited’ as Multichain can simply mint more tokens if more liquidity is needed for a cross-chain transfer.

Thus, in cases where bridged assets are being transferred, Multichain only needs to ensure that a liquidity pool of that particular assets is available on the chain where it was originally minted. Example — MIM or Magic Internet Money which is a token that is created on Ethereum as a collateralized asset but is connected to multiple blockchains via bridges in the Router using AnyswapV5ERC20.

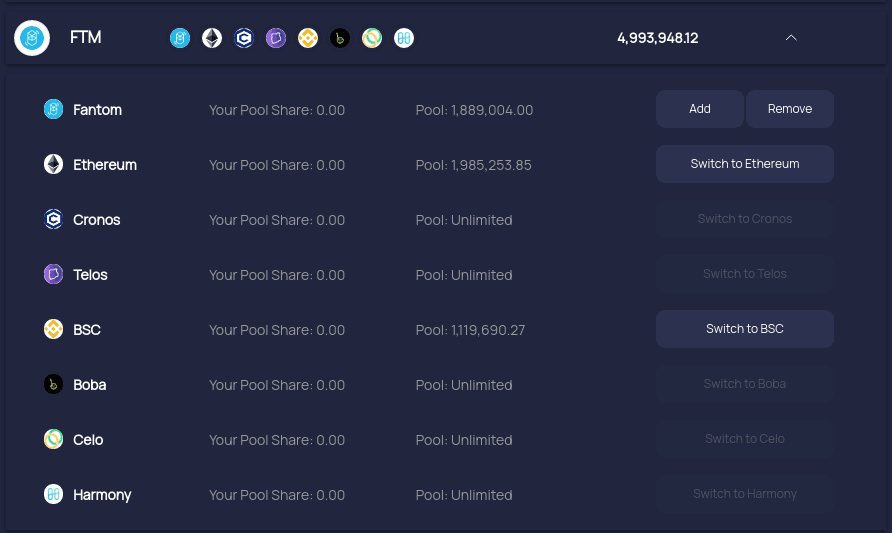

3. Hybrid Assets — Mix of Native and Bridged Assets

In a few cases, Multchain needs to combine native assets with bridged assets that are controlled by AnyswapV5ERC20.sol. This typically happens when a project wants to add token support on additional chains through the Multichain Router but has either has a limited supply of the token or already uses a third-party bridge’s asset on a different chain. Thus, to add support to new chains, Multichain has to mint anyXYZ tokens. As a result, while the existing token supply is native, but the new tokens minted for extra chains is ‘Bridged’.

Example — For FTM, The Multichain Router uses native FTM on Ethereum, Binance Smart Chain and Fantom Opera, but Bridged assets on Cronos, Telos, Boba, Celo and Harmony.

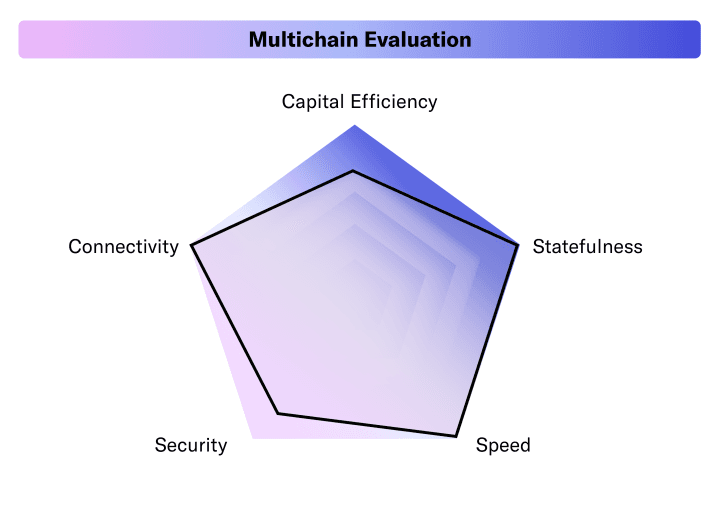

Based on this knowledge of Multichain’s bridge design and architecture, we can evaluate it as follows:

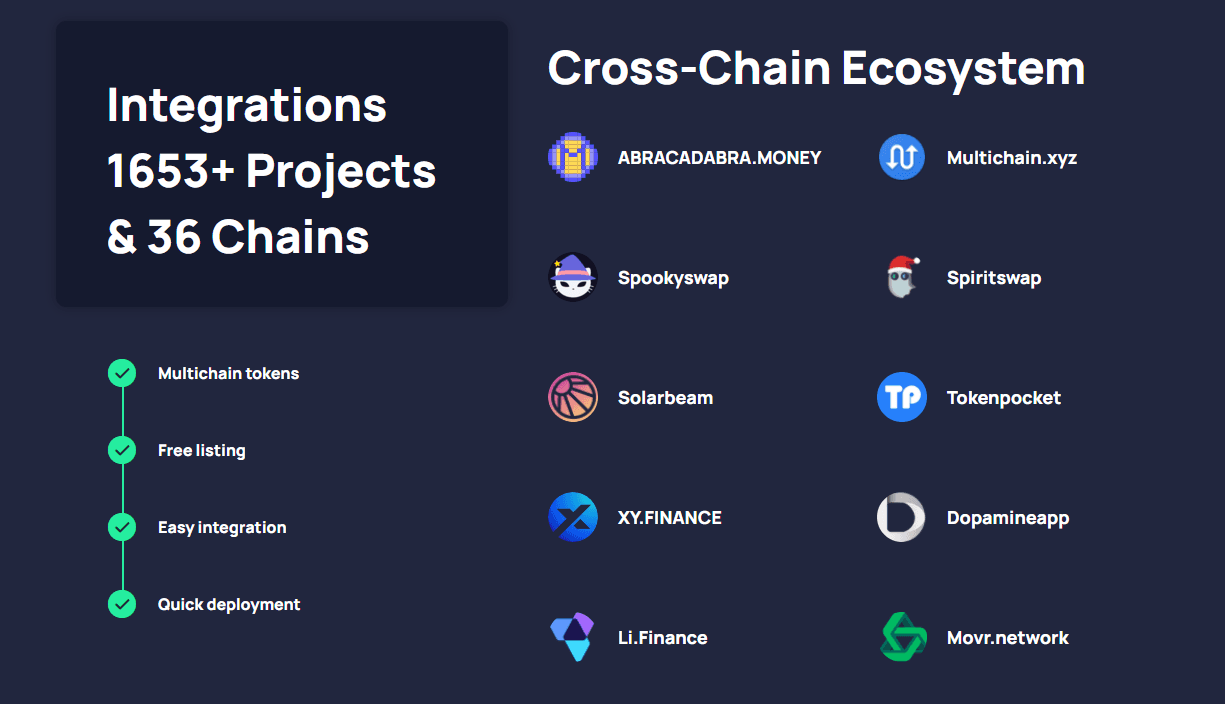

Connectivity — Multichain excels with connectivity as it has different mechanisms for bridging different types of assets and connectin chains which allows it to connect multiple blockchains. Currently, Multichain supports 1600+ assets over 30 blockchains.

Statefulness — Multichain's design offers high statefulness as it gives users the ability to transfer specific assets and trigger cross-chain contract calls on different chains.

Security — Multichain's connectivity and statefulness come at the cost of security as the users have to trust Multichain’s network of nodes for the security of the funds. However, to enhance the network’s security, the Multichain team has taken several measures such as constant monitoring of on-chain bridge activity to ensure the safest environment for cross-chain swaps. Moreover, the team believes that simplicity = security and thus has taken measures such as simplifying smart contracts and avoiding their use when not necessary, ensuring the simplicity of the bridge architecture.

Speed — Typically, there is a trade-off between security and speed and Multichain's case is no different. As Multichain uses the SMPC network for validating transactions, it is able to facilitate quick and low-cost cross-chain transactions.

Capital Efficiency — While Multichain’s bridge design and architecture have significant capital efficiency, it has bottlenecks when it comes to scaling as more capital will be required to secure the network in proportion to the economic throughput being generated.

Transaction Validation Mechanism

To validate cross-chain transactions, Multichain uses the SMPC network that monitors the Decentralized Management Account where all deposited assets are stored. After confirming the receipt of assets in the special SMPC wallet address, Multichain’s MPC network triggers a smart contract on the destination chain.

Security

To ensure the security of the network, Multichain has adopted the following security model:

Audits — Before any chain goes live on Multichain, they are

by TrailOfBits, PeckShield, and Slow Mist. In addition, Multichain is building an “academic alliance” with global cryptography experts in order for the protocol to stay up-to-date.

SMPC Network — Transactions on Multichain are verified using the SMPC network. This is a method where a single private key is subdivided and encrypted across several nodes, making it impossible for bad actors to access or reveal the private key by reverse-engineering transactions. Mulitchain’s SMPC network is distributed and consists of its own nodes, along with several independently operated nodes, executing a predetermined amount of signatures per transaction to approve cross-chain movements of assets.

Bounty Program — Multichain offers a robust Bug Bounty Program (BPP) for good-faith actors who identify, report, and/or fix any vulnerabilities found on its platform. According to documentation, Multichain will provide bounties between $500-$1,000,000 in direct proportion to the severity of vulnerabilities. This program has already been put into action twice, with white-hat hackers coming away with

and.

Security Fund — Bridges are a novel technology and are still in the nascent stages of development. In the case of unanticipated hacks and problems, Multichain has established a security fund to preserve the network's functionality and financial security.

Open-Source Code — Multichain’s infrastructure is based on a system called the “cross-chain router protocol” (CRP), which allows for the general management of multi-chain assets. The source code, development, and maintenance of the infrastructure can be found on Multichain’s Github.

Incentives

Risks

Bridges are in their nascent stages of development and come with their unique risks. Multichain is no different and interacting with it has the following risks:

Malicious attack from Multichain’s

Nodes — Anyone can become a Multichain node and join the SMPC network, and, at the moment, have done so. It is possible for nodes to collude to assemble a private key, however, as the number of nodes increases, the likelihood of conclusion becomes highly unlikely. Furthermore, Multichain has been around for years and has not experienced node collusion – despite a high level of TVL and daily volume. However, this does leave users to somewhat rely on the reputation of node operators.

Possible Vulnerabilities in the Network — In January of 2022, two critical vulnerabilities with the Multichain liquidity pool contract and router contract were reported by security firm. It was later confirmed that the vulnerabilities affected eight tokens, including wETH, wBNB, MATIC, AVAX, MFI, wSPP, TLOS, and IOTEX. The vulnerability of the liquidity pool was fixed soon after it was reported, and Multichain to revoke approvals for the affected router contracts. It's important to note that all assets on Multicain's V2 Bridge and V3 Router were safe despite these vulnerabilities. Moreover, the Multichain team to prevent this from happening again.

Technology Risks — Given the complexity of bridge operations, there is always a technology risk when using cross-chain bridges Multichain. Technology risks like software failure, buggy code, human error, spam, and malicious attacks can possibly disrupt Multichain's operations.

Smart Contract Risks — While Multichain's code has been audited by TrailOfBits, PeckShield, and Slow Mist, there is still a possibility of mistakes in the code. Thus, there is a counter-party risk involved wrt smart contracts.

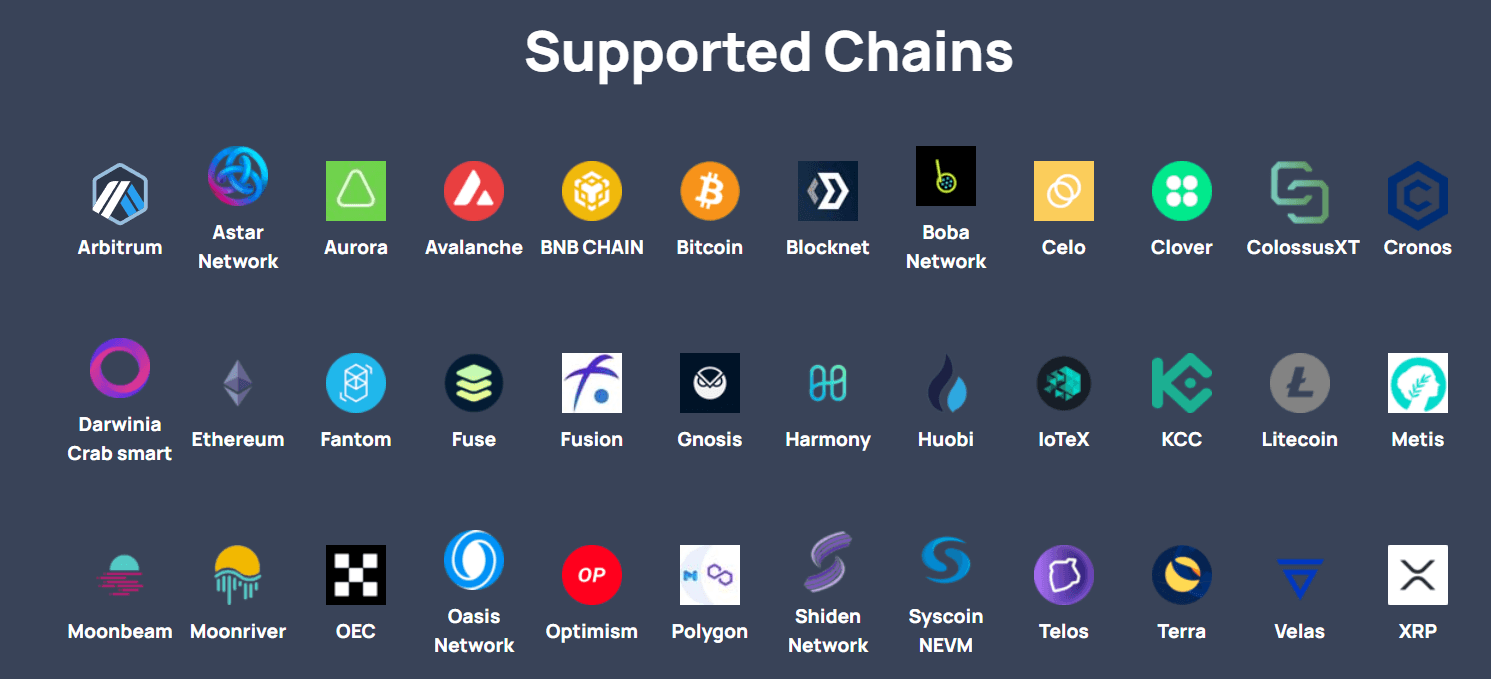

Supported Chains & Assets

Currently, Multichain supports over 1600+ crypto assets across the following blockchains:

Source: Multichain

Team

Zhaojun Co-Founder & CEO

Community

You can stay updated about Multichain and its community through the following:

Closing Thoughts

Multichain offers one of the best bridging solutions in the ecosystem. This is because of the following reasons:

Multichain is one of the few cross-chain solutions that extends support beyond EVM-compatible chains to Parachains (Polkadot, Moonbeam), Cosmos-based chains (Terra), and Litecoin.

In its growing ecosystem, Multichain now supports 30+ chains and has a sustained daily volume of more than

along with $5 billion + in Total Value Locked (TVL). Despite the availability of

in the ecosystem, these stats highlight Multichain’s popularity and show it is one of the most widely used bridging solutions.

Given Multichain’s impressive bridge design, connectivity, and popularity among users and dApp developers alike, integrating it into LI.FI was an easy decision. We believe the vision and values of both teams are aligned towards creating a highly interoperable multi-chain ecosystem. We look forward to working closely with the Multichain team to build key infrastructure for the multi-chain future.

FAQ: Multichain — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.