LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

LI.FI: The Cross-Chain Money Lego

(*read this like it’s scrolling text at the beginning of a Star Wars movie*)

What started with simple peer-to-peer transactions on Bitcoin has transformed into an alternative financial system full of codified economic products — aka “money legos.” These products, such as lending protocols, algorithmic stablecoins, and decentralized exchanges, now span an ever-growing list of smart contract networks, including; Ethereum, Solana, Avalanche, BNB Chain, Polygon, Optimism, Arbitrum, and more.

As money legos go across chains, we need a piece that can bring it all together. That piece of the puzzle is LI.FI, the cross-chain money lego. This article discusses cross-chain money legos and how LI.FI, a new breed of money lego, offers a solution to the complexities of building in a cross-chain ecosystem.

Advanced Bridge & DEX Aggregation

What are Money Legos?

The best DeFi protocols are…

programmable: refers to money being controlled via smart contracts.

composable: describes how multiple systems can be combined to create entirely new systems.

interoperable: allows for information to be sent from one system to another.

In essence, the best DeFi protocols are like “money legos” — meaning they can be stacked together to create something new… something seemingly greater than the sum of their parts.

As CoinDesk put it all the way back in 2020:

“Money Lego are tech stacks that allow different applications to fit (or be shoved) into other projects. For example, you can deposit ether (ETH) into MakerDAO, receive the stablecoin dai (DAI) and then lend it on Compound to a trader in order to earn the network’s governance token COMP.”

A 2014 photo from a Vitalik Buterin presentation on Ethereum.

Cross-Chain Money Legos — a UX Nightmare

With the growth of money legos across the web3 ecosystem, DeFi has become fragmented. The core issue is that blockchains are siloed and cannot communicate with each other. Blockchains — and the nodes/validators which secure them — are constructed to follow their own rules, governance mechanisms, and communication structures. Therefore, money legos might be programmable, composable, and interoperable within their own chain, but not with others.

This is a user experience nightmare. Cross-chain transactions that sound simple actually require 4–5 steps because cross-chain money legos are not programmable, composable, and interoperable with each other.

boomers in the wild trying to bridge assets

For example, let’s say I have $50 in USDC on Polygon and want to purchase an NFT on TreasureDAO, a marketplace on Arbitrum. Moving my USDC from Polygon to Arbitrum would take four steps:

First, I must find a bridge to transfer my USDC across chains.

Secondly, I have to be sure that I have enough MATIC/aETH to pay for gas fees on both ends of my transaction to actually bridge the USDC to Arbitrum.

Third, once on my destination chain, I have to convert USDC to $MAGIC — the native token of TreasureDAO.

Fourth, when I finally have $MAGIC, I can purchase an NFT.

In this example, each interaction with a “money lego” required a user decision. I had to 1) choose a bridge, 2) check my gas levels and execute the bridging transaction, 3) swap USDC for MAGIC using a DEX, and 4) purchase an NFT via a marketplace.

In short, users are forced to make a ton of tough decisions because NFT marketplaces (and other dApps) on Arbitrum are not inherently programmable, composable, or interoperable with wallets on Polygon.

And this is a simple example. The frustration of leveraging cross-chain money legos extends far beyond having USDC on Polygon and trying to purchase an NFT on Arbitrum.

Here are a few other examples that show the difficulty of money legos going multi-chain:

it is not possible to purchase an NFT on OpenSea with Bitcoin

you cannot transfer Orca LP tokens (a Solana lender) to Aave on Polygon

there isn’t a way to bridge tokens from another chain directly onto Uniswap

In essence, a cross-chain world nearly shatters the concept of money legos. As laid out above, the cross-chain user experience is bad — it involves far too many clicks, open tabs, and tough decisions.

Herein lies the problem with money legos. As currently constructed, cross-chain money legos are poorly stacked and leveraged. DeFi is not a finished lego model (like the Millennium Falcon below) as it appears on the box. Rather, it’s a messy bin full of brightly colored and exciting-looking lego pieces with no particular shape.

The DeFi Dream

The DeFi Reality

So Here’s Where We’re At

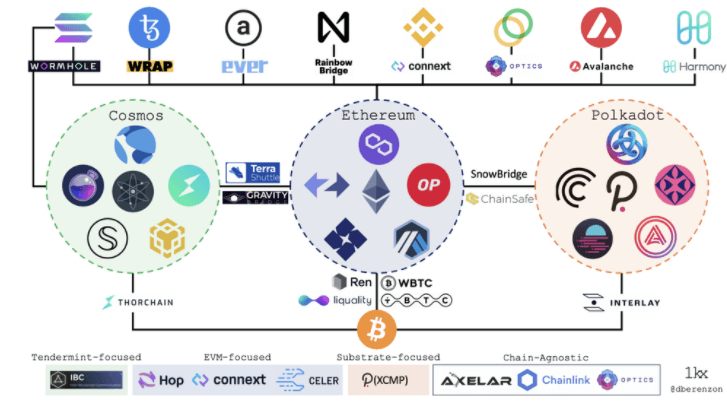

Nobody can predict the future. However, the future of “crypto” looks like it will be multi-chain. Blockchain networks are already carving out their specific niches:

Ethereum = DeFi and NFT security

Bitcoin = the ultimate monetary network

Solana = high-frequency trading

Optimism/Arbitrum = Ethereum rollups

Avalanche = cheap smart contract transactions

Polygon = layer 2 Ethereum solution

Flow = mainstream NFT adoption

Binance Chain = gaming

Shoutout to @dberenzon for this beautiful chart! (if someone wants to make a new one, hit us up!)

Therefore, with the current state of crypto as a “multi-chain” ecosystem, creating “cross-chain” infrastructure is imperative.

Side note: The difference between “multi-chain” and “cross-chain” protocols is slight but important.

multi-chain = users can find a dApp or token on multiple networks

cross-chain = users can interact with a contract, dApp, token, etc., across multiple chains in one user-interface

Programmability, composability, and interoperability are no longer enough to fully leverage money legos in a cross-chain world. Users need to be able to bridge, trade, leverage, borrow, sell, and utilize assets across multiple chains in one click without having to think about the who/what/when/where/why of how the assets are moved.

Thus, two new characteristics need to be added to the definition of “money legos” in order to account for the new cross-chain environment: aggregation and abstraction.

Aggregate the technology and abstract it away from the user so a single button can bundle 8–10 different swaps, bridges, DEXs, etc., into something that seems like one click to the user. In other words, take multi-chain solutions and transform them into cross-chain infrastructure.

Aggregation

TL;DR → aggregation is another way to promote the ethos of decentralization for users, along with it being a safe way to build dApps, as it forces users and developers to rely on a wide variety of solutions rather than a single point of failure (though it could be argued that the aggregator itself then becomes the SPoF).

The whole point of crypto is to remove the middleman and never rely on a single point of failure. But how can money legos decentralize themselves? The answer revolves around aggregation — the act of bringing together multiple money legos into one user interface.

Aggregation decentralizes money legos because it gives the end-user a fair choice in what services to choose. This is very important in a cross-chain environment, as the security of DEXs, bridges, and other money legos can wildly oscillate.

When a user wants to swap a token, the user should be able to choose from a multitude of DEXs and select the most efficient route, depending on their preference. Or, when a user wants to stake a token in return for APY, they should see every single APY available for that particular token in one interface and be able to select which lending platform to use. Furthermore, in the case of a black swan event (hack, major token volatility, etc.), aggregation gives users multiple avenues to navigate the situation.

From a developer’s point of view, it is perilous for a dApp or developer to rely on a single point of failure for bridged assets — as the bridging space is just in its infancy, and hacks are still somewhat commonplace.

Abstraction

TL;DR → For the normal user, crypto must be made simple — which means money legos need to be stacked in a way that reduces complex decision-making.

For “money legos” to be deemed successful, it should be impossible for users to ascertain how money legos are put together. The beauty of the final lego structure should be so seamless, so fluid, that users would never suspect that it was actually multiple legos to begin with. In other words, users should not be able to “see how the sausage is made.

”Money legos need to have beautiful interfaces that alleviate: 1) clicks, 2) decisions, and 3) transaction costs from the end-user. The end game is for money legos to wrap other money legos, like DEXs, bridges, liquidity providers, stablecoins, etc., into a single UX.

Furthermore, money legos should fit seamlessly into dApps so that developers can easily leverage (or stack) DeFi primitives into new, innovative use-cases.

Abstraction in a cross-chain environment is crucial if we want the DeFi space to grow from degen crypto natives to normal users. Additionally, abstraction allows developers to continue building more complex, innovative products.

LI.FI Is a New Breed of Money Lego

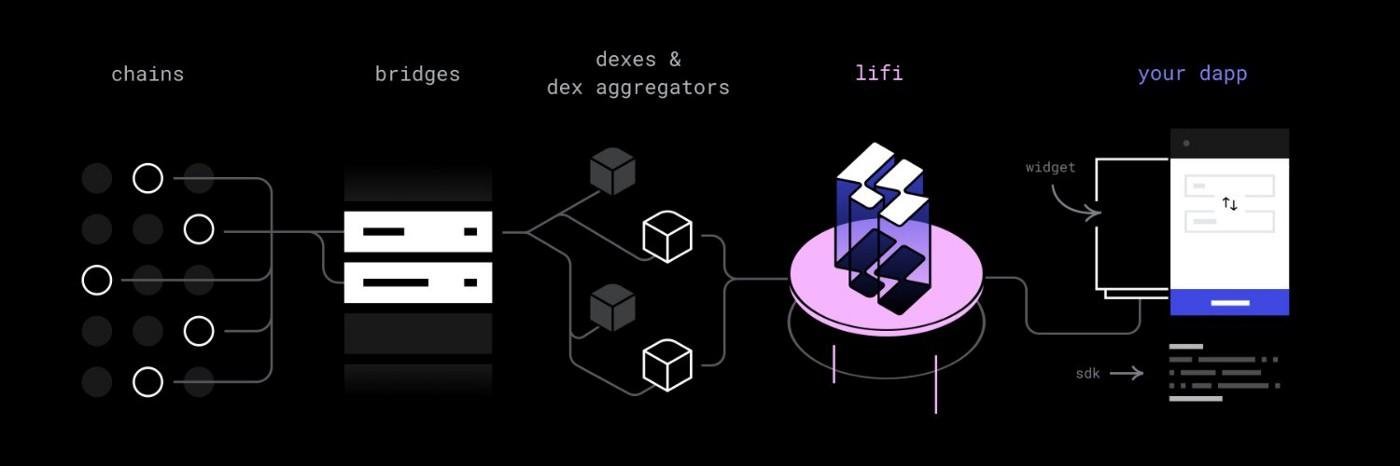

LI.FI is a cross-chain bridge aggregation protocol. LI.FI aggregates DEXs and bridges and abstracts away decisions that would normally need to be made by the user via LI.FI’s smart contract — which always chooses the best bridge/DEX for the cheapest, quickest, and most secure swap route.

In essence, LI.FI is the money lego of money legos. We have built a product that combines the power of 20 DEXs, 10+ bridges (and counting), and 17+ smart contract blockchains into a single UX.

this is what LI.FI does

In English, this means LI.FI has done all the hard work for users and developers. We have…

integrated multiple DEXs into one interface.

bundled together several bridges into the same interface.

built a set of smart contracts that finds the most efficient way to swap and bridge tokens in one click, in addition to giving users/devs their choice of routing.

How LI.FI Helps Improve the Cross-Chain Space

LI.FI is a cross-chain user and developer experience upgrade. Let’s look at three ways LI.FI solves issues in the multi-chain world:

DeFi Protocols

Problem –DeFi Dashboards, lending protocols, yield farms, etc., that are present on new chains create a need to do cross-chain swaps, but their users have to wander the ecosystem to satisfy this need. Many multi-chain DeFi protocols offer support for multiple chains but do not allow users to swap assets across chains directly on the platform. Additionally, some users come across a new interesting dApp on a chain they don’t have funds in and struggle to get their funds there — causing significant friction in user onboarding as users have to research and find bridges to that chain to start using the dApp.

Solution –dApps can now integrate LI.FI SDK/widget (for free!) that allows users to swap and bridge assets directly to a new chain WITHOUT leaving the dApp.

Example: Alchemix, DeFi Saver, Perpetual Protocol

DeFi Saver x LI.FI integration

NFT Marketplaces

Problem — NFTs attract new users to crypto every day. Many new cryptopians do not understand the difference between blockchains or cryptocurrencies — they just want to buy an NFT with the crypto they purchased on a centralized exchange.

Solution — LI.FI’s SDK/widget makes bridging/swapping assets very simple for new users, as it facilitates multiple transactions into one user interface. Hopefully, at some point in the future, our SDK will be used by an NFT marketplace to allow users to pay in ANY token for an NFT.

Essentially, LI.FI aggregates money legos and abstracts them away from the user, thereby facilitating cross-chain transactions in a way that 1) is more secure than relying on a single bridge or DEX and 2) makes it easy for a user to purchase an NFT with any token.

Wallets

Problem — Multi-chain wallets want to let their users swap assets cross-chain without having to go outside its UI to either 1) a centralized exchange or 2) a cross-chain bridge. Furthermore, wallets want to support as many chains as possible with the least amount of upkeep.

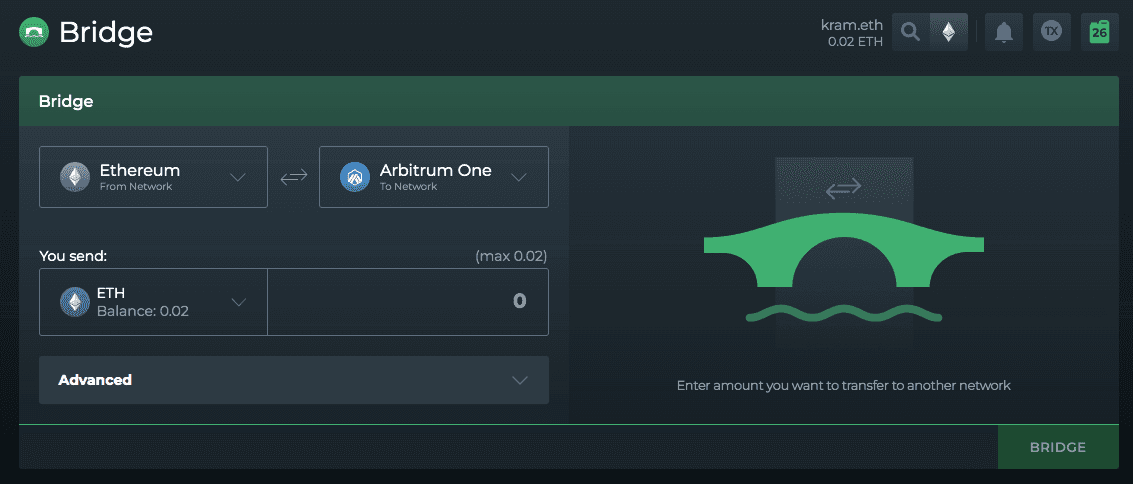

Solution — LI.FI helps wallets by providing an SDK that wallets can integrate into their mobile/browser extension wallet to swap assets across chains seamlessly without worrying about integrating and maintaining multiple bridges — we take care of that for them.

The New Breed of Money Lego

To summarize the above… LI.FI is pioneering a new breed of money lego.

DeFi OGs were built as single-chain money legos — bringing with them programmability, composability, and interoperability. However, in a multi-chain world, both aggregation and abstraction are necessary for money legos to live up to the lofty expectations of 1) decentralization and 2) good user experience.

LI.FI believes that aggregation and abstraction are fundamental principles to unlocking the potential of the multi-chain crypto world by making it fully cross-chain.

To do so, we have constructed a data mesh of cross-chain liquidity sources: cross-chain liquidity networks, bridges, DEXs, bridges, and lending protocols. As a bridge and DEX aggregator, LI.FI can route any asset on any chain to the desired asset on the desired chain, thus providing a remarkable UX to their users.

And we have done this by keeping the user-experience top of mind. All of this is available on an API/Contract level which comes as an SDK, API solution, and widget for other developers to plug directly into their products. There is no need for users to leave your dApps anymore.

LI.FI is a cross-chain money lego facilitating cross-chain transactions that any dApp can integrate into their platform in less than a week (and they can do it for free). With LI.FI, crypto assets will no longer be confined to their native chain. Instead, crypto assets will be set free across the multichain ecosystem.

In our opinion, our products are a no–brainer for integration by any wallet, DeFi protocol, or NFT marketplace. Furthermore, we believe that our bridge and DEX aggregation product can provide a foundation for a near-infinite amount of development and specialized use-cases.

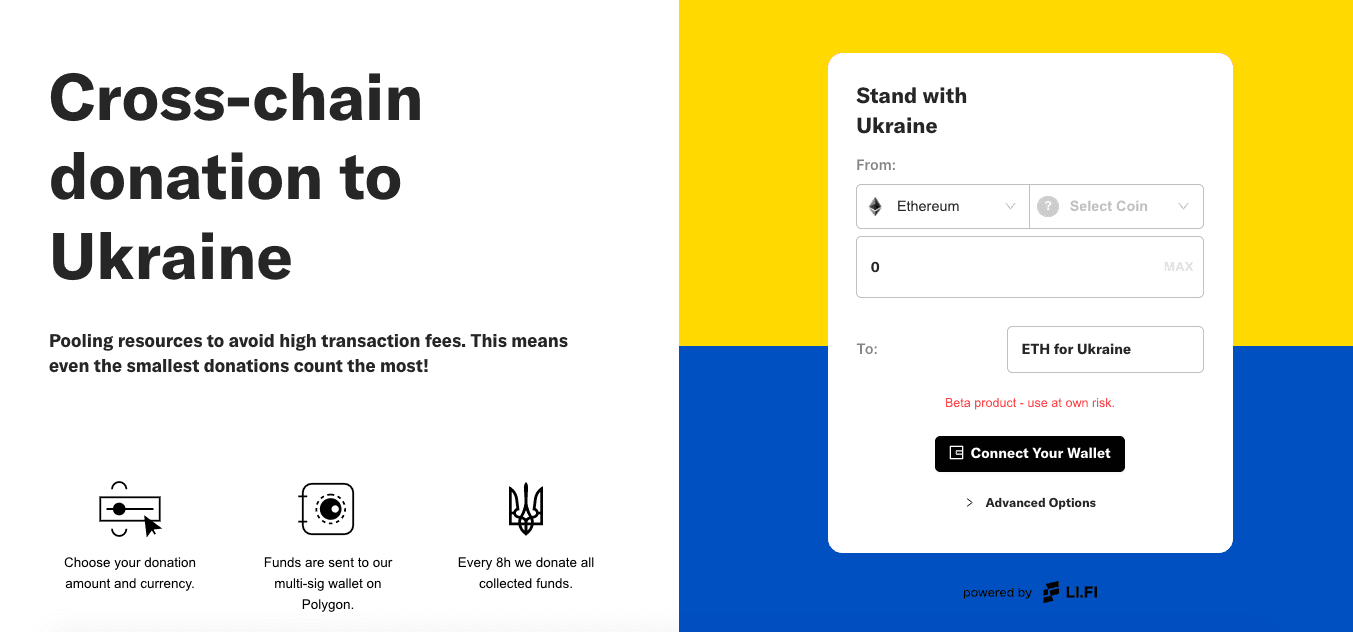

For example, using our own product, we recently built out an any-token-any-chain token route for people to donate funds to Ukraine.

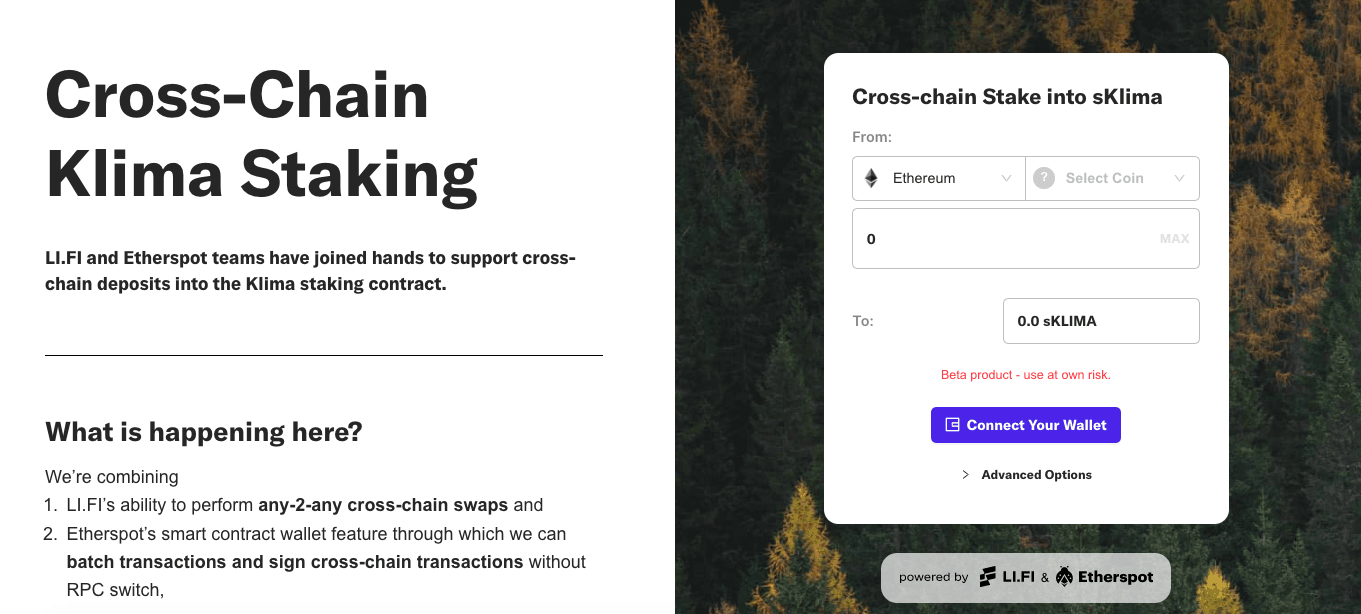

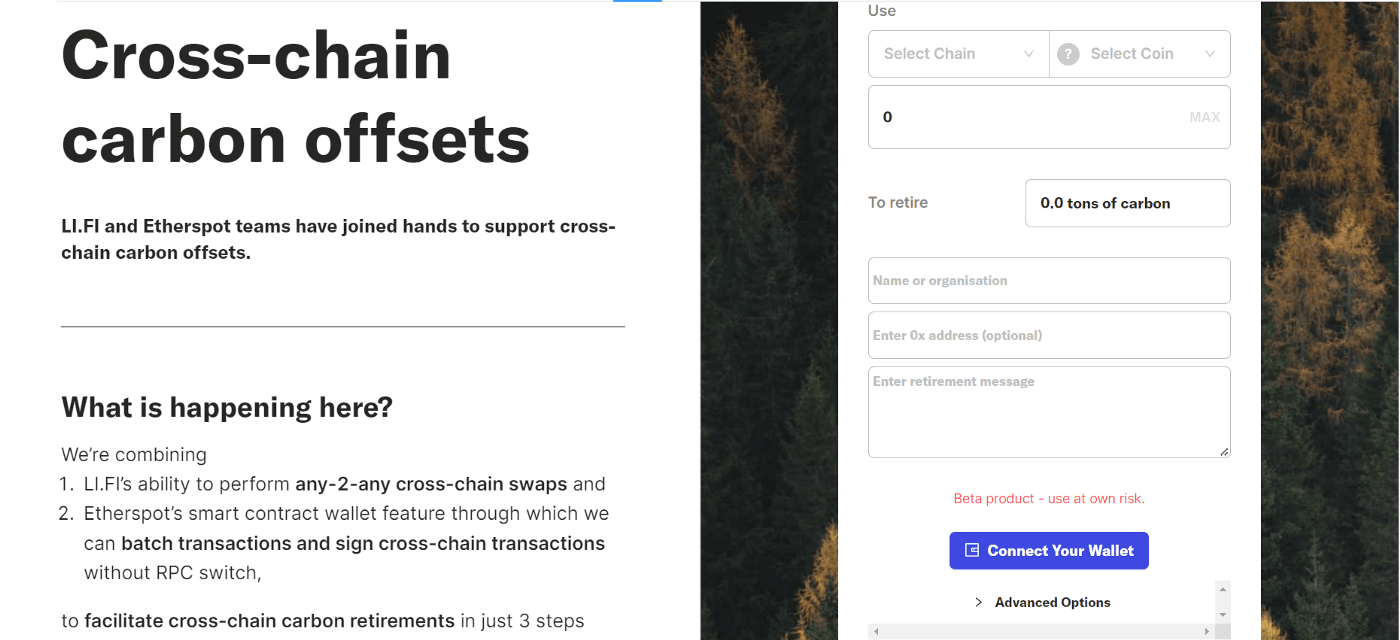

Additionally, in partnership with Etherspot, we launched a single UI that allows for cross-chain staking into KlimaDAO.

On top of that, together with Etherspot, we released another paradigm shift for cross-chain transactions!

Facilitating cross-chain carbon offsets via KlimaDAO — in a UI that takes 3 clicks.

Conclusion

LI.FI is the most advanced bridge aggregation protocol on the market and we want to continue working with dApps to build cool cross-chain products. Furthermore, we are continuing to streamline our product to create the best-looking, smoothest cross-chain swapping interface via transferto.xyz.

Our smart contracts have been audited twice (Code4rena — March ’22, Quantstamp — April ‘22), and our team consists of 25 people fully dedicated to the cross-chain space. LI.FI has aggregated 9 bridges across 15 EVM compatible chains, along with all available DEX aggregators & DEXs, on those chains into a single solution.

Special features: whitelisting, blacklisting, and a “prefer” function allows integration partners to customize the suite of bridges they utilize to their liking (e.g., if the project only trusts trust-minimized bridges like Connext & Hop).

List of supported chains, bridges, DEXs

As mentioned above (a lot), our tech is the ultimate cross-chain money legos for dApps to build on top of or plug into themselves.

We’ve integrated multiple fallback bridges+DEXs so that you don’t have to

We maintain bridges+DEXs so that you don’t have to

We choose the best bridges based on our research so that you don’t have to (positioning ourselves neutral)

For further examples of LI.FI integrations, please refer to:

Alchemix — SDK integration

DeFi Saver — SDK integration

Transferto.xyz — LI.FI B2C interface

Cross-Chain Klima Staking — Custom-built cross-chain staking product for Klima

Cross-Chain Carbon Offsets — Custom-built cross-chain carbon offsetting for Klima

FAQ: LI.FI: The Cross-Chain Money Lego

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.