Bridge Insurance: The Ultimate Safety Net for Bridging

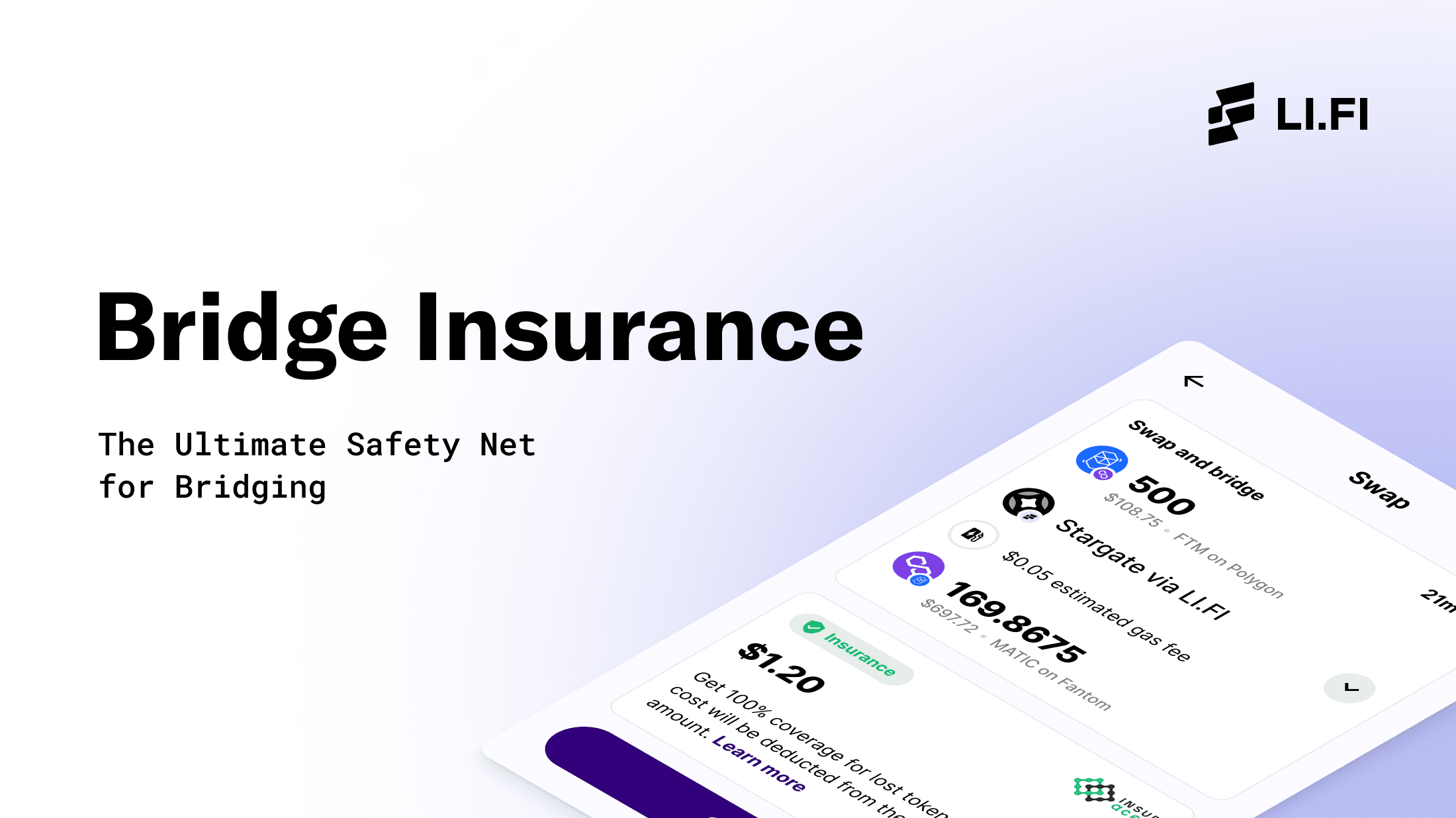

LI.FI and InsurAce have joined forces to introduce Bridge Insurance, crypto’s first production-ready product designed to safeguard users against the risks associated with bridging transactions.

In collaboration with InsurAce, LI.FI is launching Bridge Insurance, a powerful tool that allows us to bridge the gap between security and convenience.

Bridge Insurance addresses the risks associated with using cross-chain bridges by providing 100% protection for users against the risks of losing funds while using these platforms.

In other words, it is time to say hello to stress-free bridging!

The Details

The Bridge Insurance fee will be a small fraction of a user’s bridge amount, typically between 0.1-0.5% depending on the underwriter’s risk profile. To purchase Bridge Insurance for your transaction, simply flip the Bridge Insurance switch on Jumper and press ‘Start Swap’ after you have filled in your transaction details.

Thanks to LI.FI’s ability to bundle smart contract calls with bridging transactions, this flow should feel like a normal Jumper transaction!

Once you’ve started the swap, you’ll be provided a link to your insurance coverage for the duration of your transaction on InsurAce.

And that’s it! User transactions can now be 100% insured against bridges being hacked.

The Future of Bridging Is Insured

Although cross-chain bridges have been a significant technological advancement and are crucial in enabling connectivity between blockchains, they are complex systems with many moving parts. Despite their utility, ensuring the security of these systems is an ongoing challenge. As a result, users are worried another bridge hack could be just around the corner, leading to stressful experiences.

At LI.FI, our mission is to make the bridging experience as seamless and stress-free as possible for our users. The possibility of losing funds during one of these transactions is a significant concern, and we aim to alleviate such worries by providing a sense of security to users.

With the addition of Bridge Insurance, we hope to make bridging a stress-free experience.

Our partner, the esteemed InsurAce, manages pooled capital to guarantee bridge transactions through Jumper. In the event of a bridge hack, InsurAce will confirm the loss of funds locked inside the bridge, and users can submit a claim for their lost funds.

We're proud to be at the forefront of this initiative, making bridging more secure and hassle-free than ever before.

We will continue working with InsurAce to expand our insurance coverage and provide you with even more peace of mind when interacting with cross-chain bridges.

About InsurAce

InsurAce.io, a decentralized global risk cover protocol, offers mutual protection for digital assets against risks such as hacking, smart contract bugs, and stablecoin de-pegging. The platform features two membership-governed mutual pools and uses the $INSUR token for membership rights. With smart contracts issuing covers and a seamless user experience, the need for intermediaries is eliminated. The platform's unique selling points include Low Fee Portfolio Cover, a Wide Product Range, SCR Mining, and Reliable Transparent Payouts.

About LI.FI

LI.FI is a multi-chain liquidity and data gateway that provides access to nearly 20 blockchains, enabling the moving of assets and sharing of data by aggregating infrastructure solutions including cross-chain bridges, relevant data sources, and decentralized exchanges, which allows for seamless interoperability for platforms and users. Based in Berlin, LI.FI was founded by a team of DeFi experts and has quickly grown to become the leading liquidity aggregator in the blockchain space.

FAQ: Bridge Insurance: The Ultimate Safety Net for Bridging

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.