LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Intro to Stargate V2

What can we expect from Stargate’s latest upgrade?

Stargate V1 was launched in March 2022 and quickly made headlines. Within days of its launch, billions were deposited into its liquidity pools, and Alameda Research sniped all the STG tokens in the public auction. Since then, Stargate has become one of the leading bridges in the ecosystem, boasting over $36 billion in volume and $20 million in fees.

Skeptics might argue that LayerZero's airdrop farming played a role in these figures. It would be unfair to say that Stargate’s success is solely due to the airdrop hype. Among all those metrics, there’s some real use, and we can all agree that Stargate offers one of the better bridges in the ecosystem — the ~17% of LI.FI’s total volume it has captured shows its effectiveness as a bridging solution.

But, it’s been a long time since Stargate V1 was launched. Two years in crypto is like a decade in traditional markets. Stargate needs an upgrade, and V2 promises to make it cheaper and more scalable to more chains.

This article will discuss why Stargate V2 is necessary, its new features to improve upon V1’s limitations, and how V2 could allow Stargate to maintain its position among the top bridges for years to come.

Let’s dive in!

The Need for Stargate V2

The multi-chain ecosystem has changed significantly since Stargate V1's launch over two years ago. Initially, the multi-chain concept was just unfolding, but now we're allegedly looking at a future with thousands of chains.

Let’s take a look at some of these major changes in the multi-chain landscape that form the foundation of many of Stargate V2’s design decisions and features:

1. Increasing number of chains with significant traction — The number of chains that an average user interacts with regularly has grown, and that number is only increasing. To put things into perspective, when Stargate launched in March 2022, about $7B was locked across L2s. Now, that number is nearly $39B, with several L2s holding over $1B. Moreover, Layer 1 networks such as Solana are processing billions in daily volume, while emerging Layer 3 networks like Degen Chain are also gaining traction.

2. Proliferation of wrapped assets — Stargate V1 was hyper-focused on native assets, predicting they would experience widespread expansion as new chains emerge. However, this prediction did not materialize as expected. The expansion of major stablecoins such as USDC and USDT across various chains has lagged behind the rapid deployment of new chains. Due to the slow availability of native assets, chains have turned to using wrapped versions of these assets to serve as their canonical assets.

3. Cheaper and faster competition — While Stargate offers competitive bridging rates, its high gas fees increase the overall cost for users. This makes Stargate pricier than other bridges and affects the volume it captures through aggregators.

The total output amount via Stargate is lower than the competition because of high gas costs. Source: Jumper

High gas costs on Stargate are due to:

a) The Delta Algorithm – This algorithm pre-assigns credits to pools on different chains, ensuring instant guaranteed finality. However, managing these credits onchain is gas-intensive.

b) LayerZero’s messaging costs – Each Stargate transaction requires a cross-chain message via LayerZero, adding to the overall cost of the transfer.

Stargate must address these challenges and V2 introduces new features to make this possible. Let’s take a closer look at some of the most important features.

What’s New in Stargate V2?

With a focus on cost reductions, expansion to more chains, and capital efficiency in mind, here’s what’s new in Stargate V2:

Hydra: Bridging-as-a-Service for More Chains

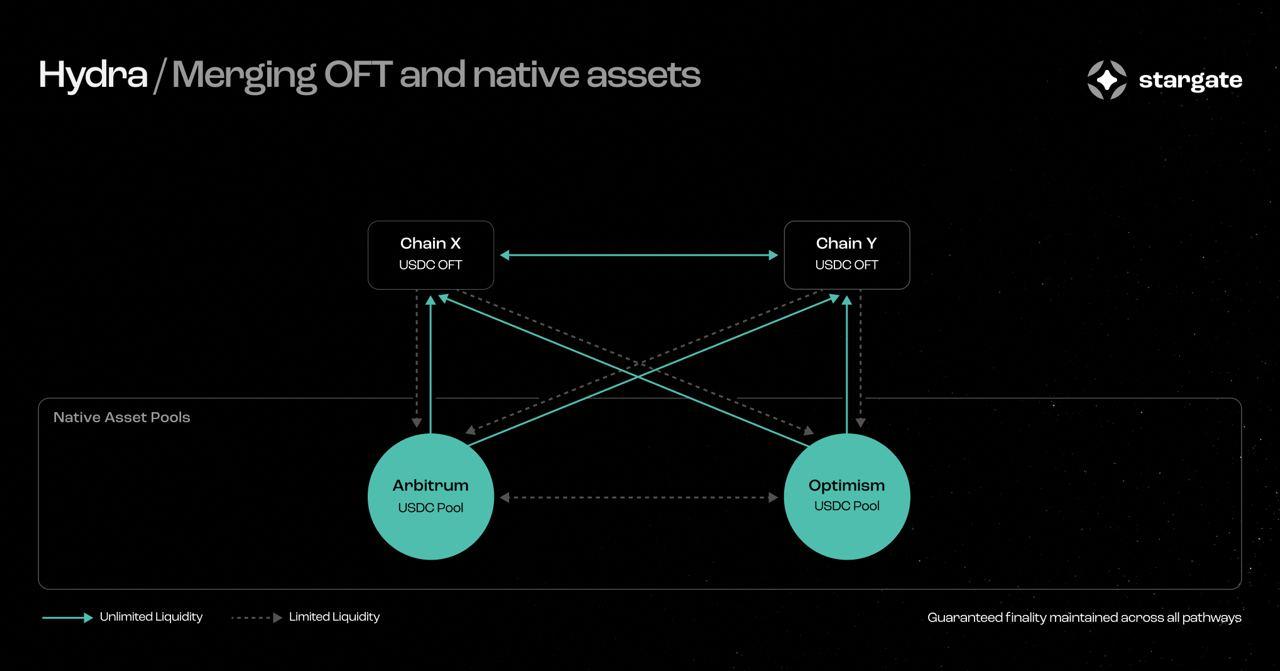

Hydra is Stargate's response to the evolving needs of the multi-chain world. It's a Bridging-as-a-Service (BaaS) solution that enables new chains to integrate with Stargate using Hydra-wrapped assets, based on the Omnichain Fungible Token (OFT) Standard.

This integration is a win-win for Stargate and the Hydra-enabled chain:

Hydra chains gain connectivity with Stargate's extensive chain network, allowing for asset bridging from established chains like Arbitrum or other Hydra-compatible chains. This is a huge benefit for new chains as they no longer require pools to be deployed on each new chain they want to establish connectivity.

This also makes life easier for Stargate users – the need to manually select compatible chains for bridging is eliminated, as they can now bridge assets from any supported chain to Hydra chains.

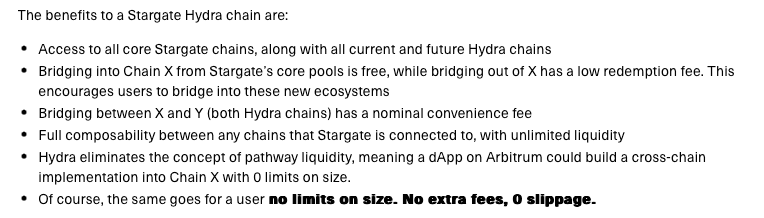

Other benefits to Hydra chains include:

Source: Stargate V2 Proposal

For Stargate, Hydra makes it more capital efficient by introducing Protocol Locked Liquidity (PLL) which leverages the OFT standard at its core.

When a chain adopts Hydra, it mints canonical assets via the OFT standard. This involves locking assets on a Stargate core chain from which they are bridged.

For example, when bridging USDC from Arbitrum to a Hydra-chain, the USDC gets locked in Stargate’s contracts. Simultaneously, an equivalent amount of USDC (which is an OFT) is minted on the Hydra-chain.

This action locks the user’s original USDC in Stargate’s contracts, where they will remain until the user returns to Arbitrum or another Stargate core chain. But in the meantime, these assets contribute to Stargate’s Protocol Locked Liquidity. This allows Stargate to boost the credits in its account system and optimize liquidity flows within Stargate’s ecosystem of chains.

The neat part is the dynamic network effects that amplify as more chains adopt Hydra, increasing internal credits and generating additional protocol locked liquidity, creating a powerful flywheel effect.

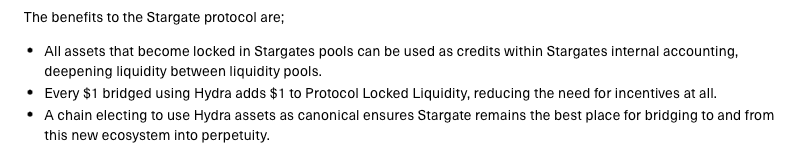

Other benefits to Stargate include:

Source: Stargate V2 Proposal

Transaction Batching for Cost Reductions

A portion of Stargate’s current transaction cost includes LayerZero’s message fee. Critics have often noted the inefficiency and expense of sending a message for each cross-chain transfer.

To tackle this issue, Stargate V2 introduces transaction batching through LayerZero V2, enabling the batching of multiple transactions into a single LayerZero message.

This batching feature aims to lower cross-chain transaction costs by allowing users to share the burden of gas and messaging fees. In essence, users can pool their transactions, and instead of each paying the full fees, they share the cost.

The Stargate V2 proposal likens transaction batching to purchasing a "bus ticket" for transactions. Each "bus" represents a batch with a set capacity for transactions, and it departs when full or when expedited by a user's payment.

Primo’s at the wheel?

Opting for the "bus" means users benefit from reduced fees, even if the batch isn't full. However, users can also choose to maximize cost savings by waiting for the batch to fill up completely – this introduces a cost vs speed trade-off for the users. To ensure a smooth user experience and minimize wait times, a regularly scheduled bus service will also be implemented for various routes within the bus feature.

For users seeking immediate transaction processing, the "taxi" option is available – more costly than the bus but still more affordable than Stargate V1. The taxi offers immediate departure and finality on the destination chain.

AI Planning Module for Capital Efficiency

Unlike Stargate V1, which had a static credit accounting mechanism, Stargate V2 introduces the AI Planning Module (AIPM) — an off-chain entity designed to dynamically manage the distribution of credits and fees within the Stargate protocol to optimize liquidity, slippage, and transaction costs.

Key differences between the static credit accounting system of V1 and AIPM in V2 include:

However, it must be noted that the AIPM is a trusted and whitelisted entity initially operated by the Stargate Foundation for the DAO. In the worst case scenario, issues with the AIPM and the entity running it would lead to latency issues for Stargate. This is because the AIPM is granted only specific permissions to modify the credit system, ensuring its operations are restricted to credit management without the risk of affecting user funds directly as it cannot interact with the token and the messaging layer of Stargate.

Bull vs. Bear Case for Stargate V2

Here's an analysis of what could go right (bull case) and the potential hurdles (bear case) that Stargate V2 might face:

Bull Case

Widespread adoption of Hydra — Should Stargate's Bridging-as-a-Service model gain substantial traction with new chains, the resulting network effects could be massive. Such adoption would not only facilitate Stargate's expansion across a multitude of chains but also position it as the go-to bridging platform for these chains due to the use of Hydra-wrapped assets (OFTs) as canonical assets in these ecosystems. Moreover, as Hydra's usage grows, so will the protocol-locked liquidity within Stargate. This will create a self-sustaining flywheel that will boost Stargate’s liquidity depth organically, eliminating the need for external incentives (like STG emissions).

Cost reductions make Stargate the top recommended route on aggregators — As aggregators like LI.FI become more prevalent in the market and direct more order flow through interfaces like Jumper and B2B integrations, Stargate's reduced transaction costs could give it a competitive edge. Cheaper transactions on Stargate could enable it to outcompete quotes from other bridges and win more orderflow via aggregators.

Bear Case

Limited adoption of Hydra — The race to become the go-to bridge provider for chains is highly competitive, with countless bridges vying to win deals. If other bridging protocols offer comparable or superior services, Hydra's adoption may fall short. However, I believe Hydra's promise of instant global connectivity with all Stargate-integrated chains is going to be an attractive option for new chains.

Secondly, Hydra’s success depends on the assumption that the ecosystem will continue to see a proliferation of new chains. If the number of new, successful chains does not meet expectations, the need for Hydra diminishes.

Additionally, if issuers of major native assets like USDC (Circle) and USDT (Tether) get more active with their chain expansion efforts, the demand for Hydra-wrapped assets could wane. This would render the service less critical.

However, it’s important to note that Hydra Hydra USDC complies with Circle’s Bridged USDC Standard. This allows Stargate to potentially transfer the status of native USDC on a Hydra-integrated chain to Circle, should they decide to extend their services to that chain. This arrangement could create a beneficial dynamic where Hydra USDC serves as an indicator of adoption, helping Circle determine whether a chain warrants their native support. At present, this type of synergistic relationship between Hydra assets and stablecoins is only feasible with USDC, as other assets like USDT do not have similar standards.

Competition from intent-based bridges — The market is showing a growing preference for intent-based bridges like Across, which enable fast and cheap bridging. Although Stargate V2 aims to reduce costs, it may not necessarily increase transaction speed. This could be potentially problematic especially in the context of aggregators where Across and Stargate are currently competing closely for order flow. Across's edge in both speed and cost on numerous routes may position it to outperform on aggregators, potentially diminishing Stargate's share.

Closing Thoughts

The upcoming launch of Stargate V2 marks an important moment for the bridging landscape. In my view, the standout feature of Stargate V2 is Hydra. Its potential to create unparalleled network effects is significant, as Hydra-wrapped assets could become the canonical assets on integrated chains, providing Stargate with a substantial edge over other bridges. I’m intrigued to see the rate of adoption of Hydra in the coming months.

What’s your favourite feature of Stargate V2? Do you believe Stargate will maintain its position as a leading bridge in the ecosystem? Share your thoughts in the comments!

FAQ: Intro to Stargate V2

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.