Hop Protocol — A Deep Dive

All You Need To Know About Hop Protocol

Hop Protocol offers a scalable bridge architecture that focuses on connecting the different scaling solutions in the Ethereum layer-2 ecosystem. It provides users a quick and easy way to move crypto assets directly between layer-2s. In this article, we will cover the following:

Hop: An Overview

How It Works

Bridge Design — Architecture

Transaction Validation Mechanism

Security

Incentives

Risks

Supported Chains & Assets

Community

Let’s dive in!

Hop: An Overview

Hop allows tokens to be sent from rollups and their corresponding layer-1 networks to L2 solutions on other blockchains quickly and in a trust-minimized manner. It consists of a scalable rollup-to-rollup general token bridge for Ethereum’s layer-2 ecosystem that enables users to send tokens from one rollup to another. Hop is one of the most widely-used bridging solutions for the Ethereum network and has had over ~47,000 total users thus far.

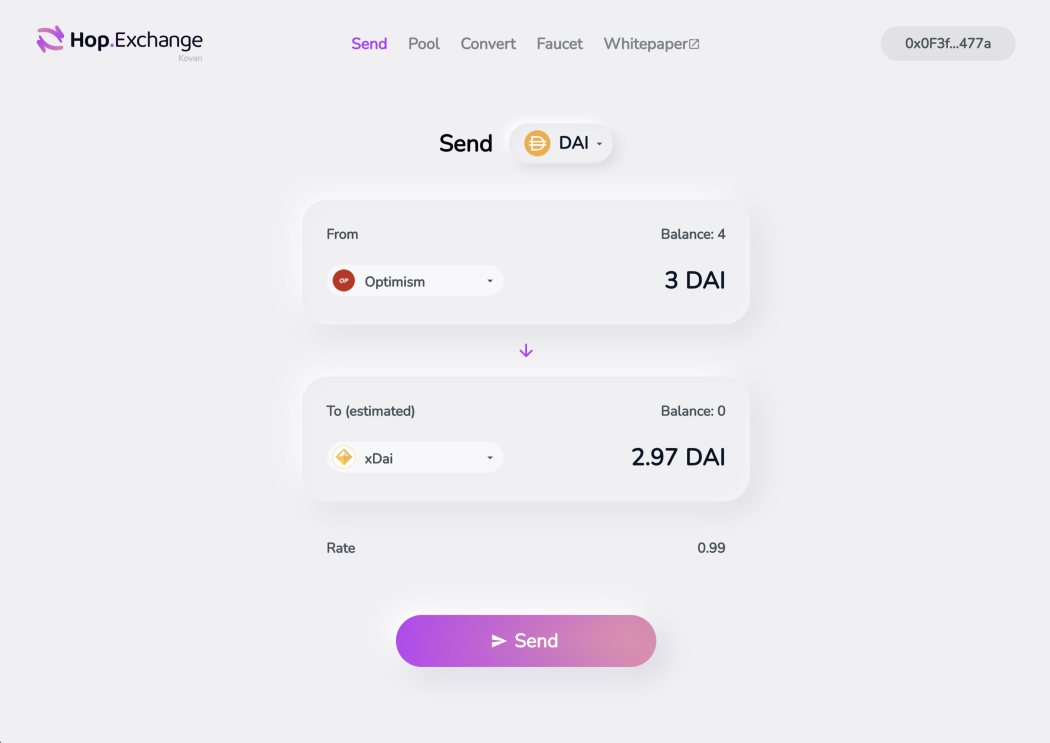

To enable users to transfer their assets from one network to another seamlessly, Hop uses the following mechanisms:

The Creation of “h” Tokens — Hop uses an intermediary asset called an h-token. The h-tokens are cross-network bridge tokens that account for the funds being moved across chains.

The end-user does not have to deal with h-tokens directly. Instead, they must deal with the canonical token (or native token) of the corresponding rollup, e.g., hTokens of DAI and ETH would be hDAI and hETH.

Automated Market Makers — Hop uses AMMs to swap between the h-tokens and their corresponding assets on the layer-2 networks associated with the swap.

This two-pronged approach enables users to swap between two layer-2 canonical tokens like canonical ETH/DAI.

Source: Hop Protocol

Hop helps increase the throughput of the Ethereum network by moving computation and some of the data storage off-chain. It enables users to “hop” between different layer-2 solutions or even withdraw their funds to the Ethereum Mainnet almost instantly and at a fraction of the cost.

Hop: An Overview

How Does Hop Work?

A transfer on Hop involves the following:

A cross-chain Hop Bridge

Hop Bonders

The Automated Market Maker

Moreover, a Hop Transfer includes the following information:

Destination Chain ID - The ID of the rollup or layer-1 destination chain

Recipient - The receiving address on the destination chain

Amount - The quantity of the token being transferred

Additional Information - Additional info may be included in the transfer for convenience. For example, the transfer may indicate a relayer fee to allow a transaction relayer to withdraw the Transfer on behalf of the user at its destination.

The next section will explain some of the key components of Hop architecture and how they are involved in completing a transaction using the Hop protocol.

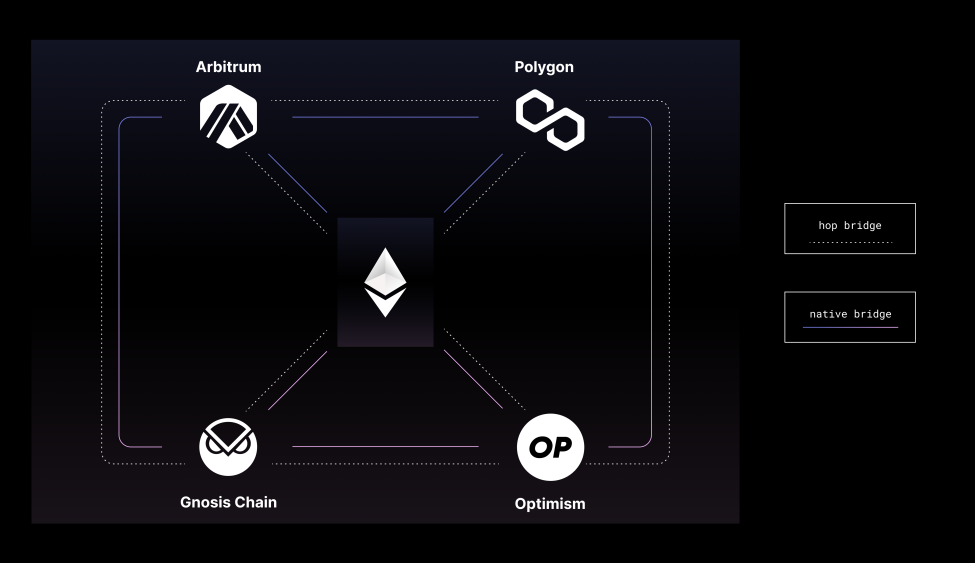

The Hop Bridge

The Hop Bridge is a multi-chain network that connects L2 solutions on different ERC-20 blockchains. For instance, Hop has its own Optimism Bridge, Arbitrum Bridge, and Polygon Bridge.

Why do we need Hop Bridges?

If we use the native token offered by each Layer-2 solution, the transfer will be subject to long exit periods since the assets being moved represent the original asset that only exists on the specific layer-2 solution. For instance, If users want to move ETH to Arbitrum using the native Arbitrum bridge, they will receive a canonical token aka Arbitrum Ethereum, which will be the original representation of ETH on the Arbitrum network. However, as this canonical token only exists on the Arbitrum network, the user will not be able to convert and use it on any other Layer-2 solution instantly.

As a result, if the user then wishes to bridge the token to another L2, the transfer will be subject to long exit periods. For example, if a user wishes to convert their Arbitrum Ether into Optimism Ether, they would have to withdraw their canonical token back to the Ethereum Mainnet, and convert the mainnet ETH to Optimism ETH via the native Optimism bridge. This process is lengthy, and the user will have to wait for seven days for their tokens to unlock.

Converting a layer-2 token into the asset it represents on L1 is expensive and time-consuming.

Instead of utilizing bridges between native tokens to accomplish this task, the Hop architecture supports different “Hop Bridges” for each layer-2 solution. This allows Hop to issue Hop tokens (h-tokens) on each of its supported networks, eliminating the long exit times required by rollups. For instance, if a user wants to transfer 4 ETH from a rollup to Arbitrum using Hop, Hop would create an equivalent amount of hETH on Arbitrum. This enables the user to receive 4 ETH on the destination rollup after the hETH is swapped for native ETH on Arbitrum, and Hop burns the 4 ETH on the original rollup.

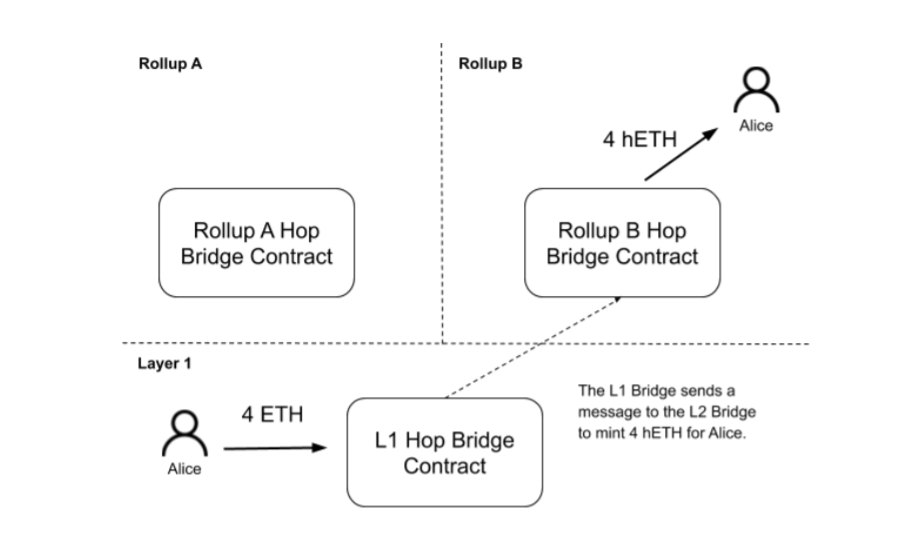

Here’s an example: Alice deposits 4 ETH into the L1 Bridge contract and receives 4 Hop ETH from the L2 Bridge contract.

Source: Hop Exchange Whitepaper

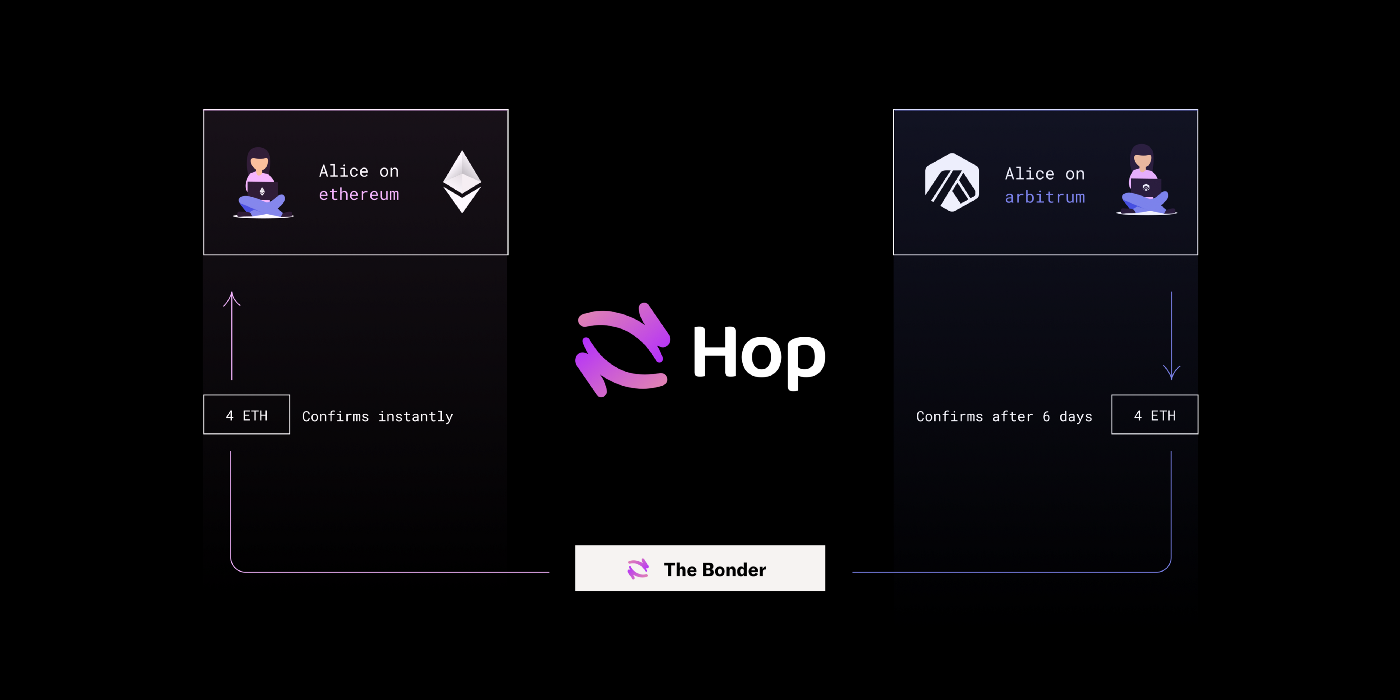

The Bonder Enables Cross-Chain Swaps

Hop uses Bonders In order to facilitate these instant transfers. For a small fee, the Bonder fronts liquidity on the destination chain. This liquidity is returned when the transfer propagates through layer-1 as part of a “Transfer Root” representing a bundle of transactions.

As Bonders run a verifier node on each rollup and possess the functionality to verify transactions as they are being made, they are assured of getting their funds back. Furthermore, given the assurance that they will eventually receive their funds back, the Bonder provides upfront liquidity on the destination chain. Finally, the Bonder's locked funds are restored when the big batch of transactions on the mainnet is eventually confirmed.

The Bonder Enables Instant Cross-Chain Swaps

Thanks to the upfront liquidity provided by Bonders, Hop Tokens can be exchanged swiftly and affordably between all supported networks.

For instance, a user wants to withdraw hETH for ETH. As Bonders run a verifier node, they know in advance that the user has executed this particular withdrawal transaction and will have to be settled soon on the Mainnet. Knowing this, the Bonder sends locked up hETH on the destination chain to the user’s wallet address. As a result, the user receives the funds instantly, and when the transaction batch is settled, the Bonder receives its collateral and a small fee for its services.

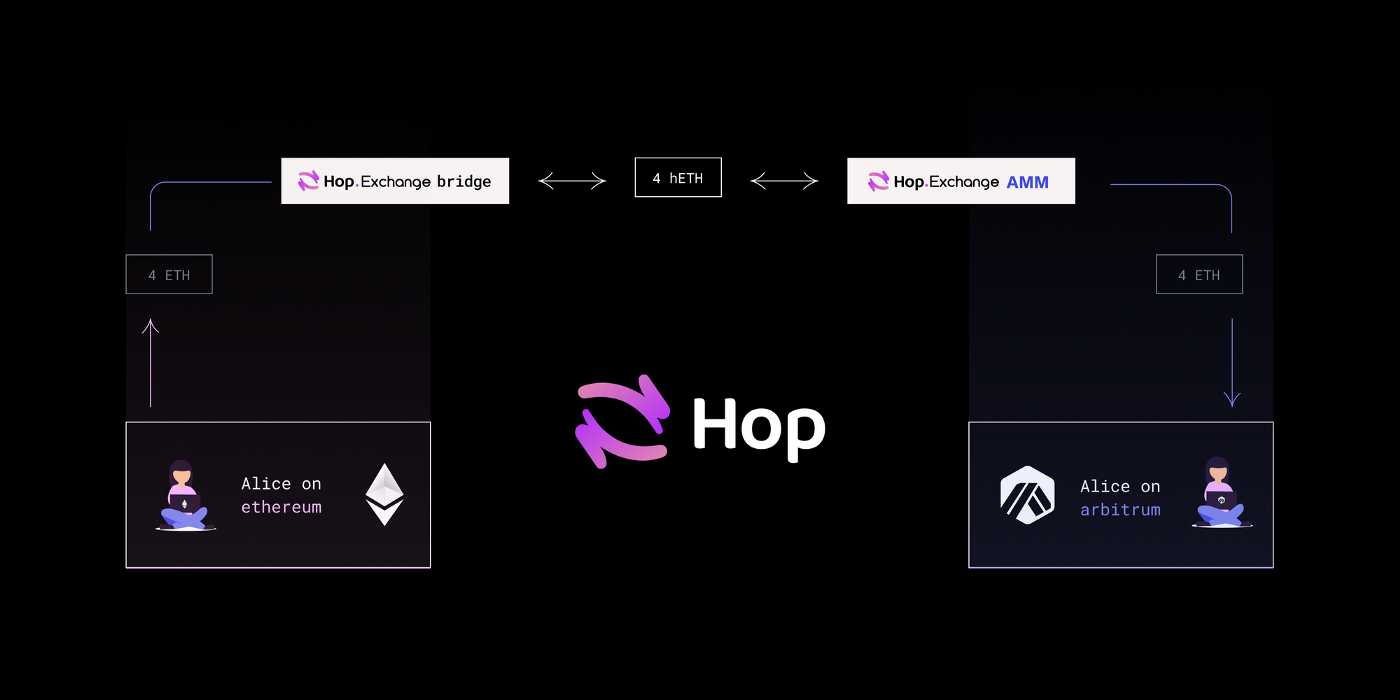

The AMM

Since third parties on different rollups are unlikely to adopt htokens, Hop protocol needs a mechanism to convert the htokens into the original or native tokens of the rollup. To do so, Hop Protocol deploys an Automated Market Maker (AMM), which enables swaps between each Hop Bridge Token and its canonical version. For example, Hop ETH or hETH — Canonical L2 ETH.

For instance, if a user wants to send ETH to Arbitrum from the Ethereum mainnet network, Hop first issues hETH to the user on Arbitrum and using the AMM, it will then swap it against Arbitrum ETH. While this might seem like different steps on different chains, it all looks like one transaction to the end-user.

Hop’s AMM converts the htokens to the original tokens of the rollup

In addition to enabling the swaps, AMMs also offer a pricing mechanism for liquidity on different rollups. Moreover, it acts as an incentivization mechanism for Arbitrageurs as it enables them to rebalance liquidity in response to market movements.

The AMMs have two key users:

Arbitrageurs - An arbitrageur is a user that buys a token on one exchange and sells it on a different exchange for a profit when there is a slippage in the price of a token. Arbitrageurs in Hop shift between “h” tokens and canonical tokens on one Hop rollup AMM and profitably trade the token on a different rollup. Because liquidity is rebalanced between AMMs, the price eventually stabilizes.

Liquidity Providers — Anyone can become an LP in a Hop pool and earn fees as rewards for swaps. There is a very low risk of impermanent loss for a liquidity provider as liquidity on Hop AMM is provided in the form of the same underlying asset (hETH, Arbitrum ETH, etc.) that can essentially be redeemed for the exact same amount from the mainnet,

Bridge Design: Architecture

The Hop Bridge is a general token bridge. General token bridges like Hop are provided by a third party and enable users to bridge ERC-20 tokens in a generic way.

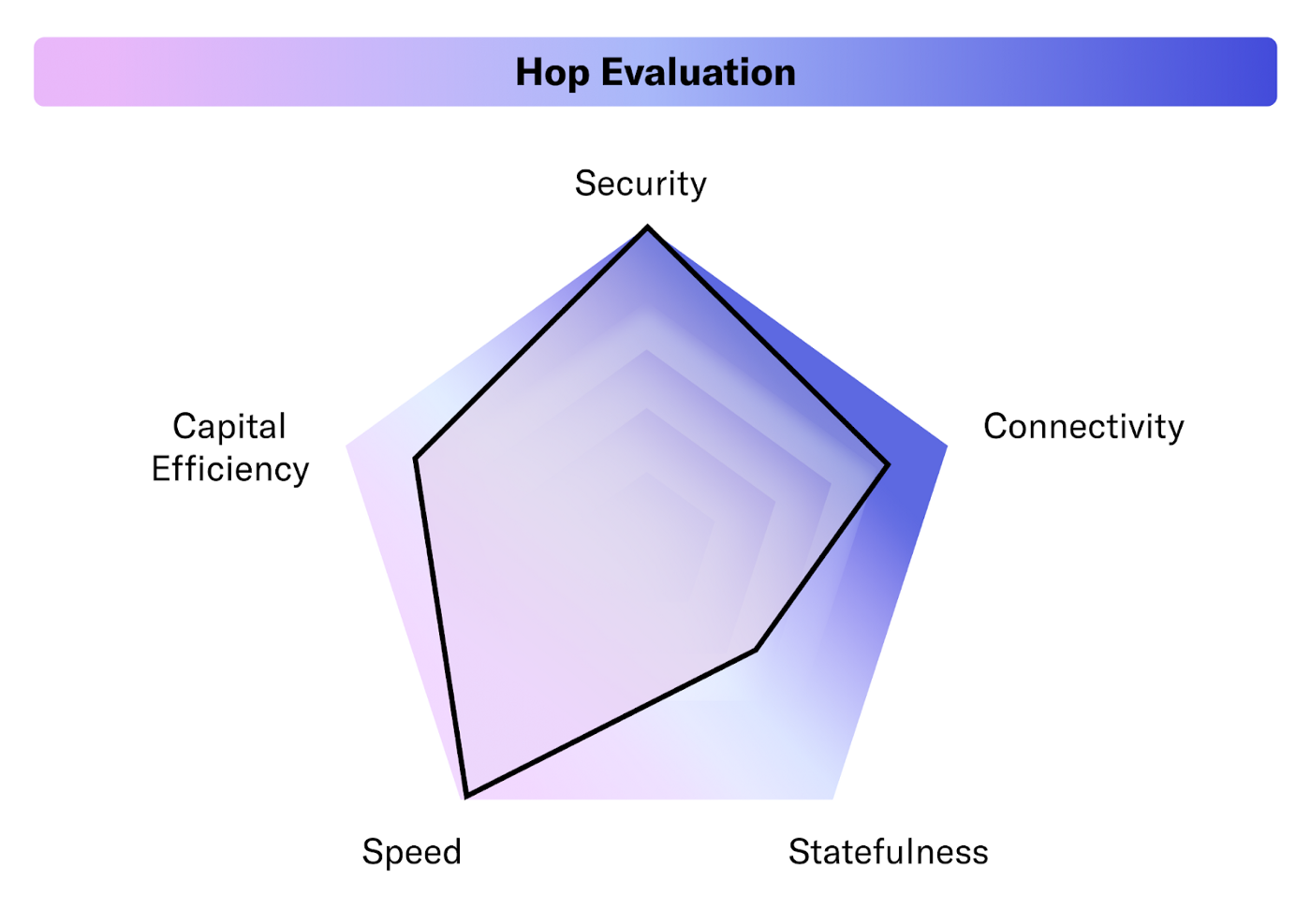

We can evaluate Hop’s architecture and design as follows:

Security — User funds can never be lost or stolen as the security is equal to that of the underlying rollup it supports. The worst-case scenario for the security of funds is when the Bonders go offline. Even then, the users will only face a delay equal to the exit time of the rollup. Hop, however, is not completely trustless because it adds some trust assumptions through their system’s need for a fast arbitrary-messaging-bridge (AMB).

Speed — As Hop uses a two-pronged approach of creating a cross-network token and using AMMs, it is able to execute transactions quickly.

Connectivity — Hop supports a wide range of destination chains, and hence it offers good connectivity. However, it is limited to the Ethereum mainnet and layer 2s.

Capital Efficiency — Hop can enable significant amounts of economic throughput and this is highly capital efficient. Moreover, the transaction costs to transfer assets are also relatively low.

Statefulness — Hop is limited in its ability to transfer specific assets, more complex state, and currently only supports 5 different assets.

Hop Evaluation

Transaction Validation Mechanism

To facilitate and validate transactions, Hop uses Bonders that run a verifier node on each rollup and possess the functionality to verify transactions. Moreover, since the Bonders provide upfront liquidity in exchange for a small fee, Hop tokens are seamlessly exchanged between all supported networks via Hop’s AMM that converts the htokens into the original or native tokens of the rollup.

Security

Given the current architecture, a Hop bridge is only as robust as the weakest supported rollup. Moreover, Solidified and Clean Unicorn have audited Hop’s smart contracts.

Incentives

To provide upfront liquidity on the destination chain, the Bonders receive a small fee for every transaction they help facilitate.

Moreover, the liquidity providers on the Hop AMM receive a small fee from each swap as a reward for contributing passive liquidity to the AMM’s liquidity pool.

Risks

Interacting with the Hop Bridge has the following risks:

Permissioned Bonder Network — As Hop only allows a few whitelisted entities to become a Bonder in the initial phases, Bonders risk not facilitating transactions. However, no Bonder can steal funds or censor transactions.

All Bonders Go Offline — All Bonders going offline is perhaps the worst-case scenario that a user can experience while interacting with Hop. In such a situation, no transfers will be bonded and as a result, will get delayed to the normal exit time of the L2s. However, it’s important to note that even here, the transfer will eventually go through but with a delay.

Smart Contract Risks — While Hop’s smart contracts have been audited by Solidified and

Clean Unicorn, any smart contracts can have bugs.

Technology Risks — Given the nature of Hop’s operations, it is still susceptible to technology risks like software failure, buggy code, human error, spam, and malicious attacks

Systematic Risk — The Hop Bridge’s reliance on rollups for security makes the participants susceptible to systematic risks. Although regular users crossing the Hop bridge are only exposed for a brief period of time, liquidity providers for AMMs and some arbitrageurs are constantly exposed to this risk.

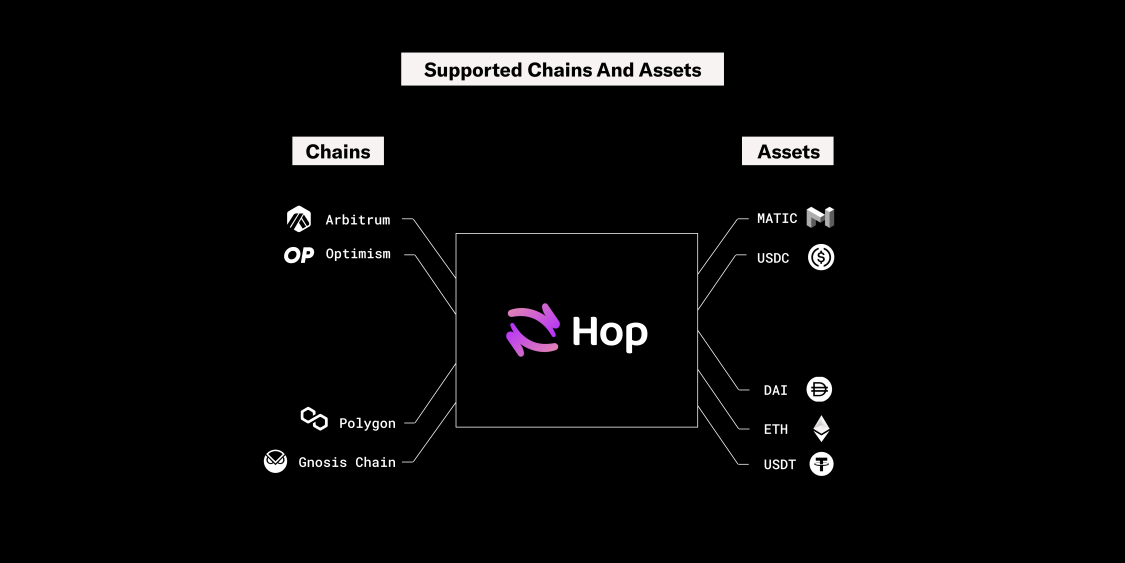

Supported Chains & Assets

Hop supports the following chains:

Hop: Supported Chains and Assets

Team

Hop’s team is dedicated to making the bridging experience between different Ethereum Layer-2s seamless, trustless, and inexpensive. The core team includes:

Chris Whinfrey — Co-Founder

Miguel Mota — Co-Founder

Shane Fontainte — Co-Founder

Lito Coen — Growth

Isaas Kang — Fullstack Dev

Community

You can stay updated with Hop Protocol and its community through the following:

Closing Thoughts

Hop offers one of the best bridging solutions in the ecosystem. This is because of the following reasons:

Hop crossed $1B in transfer volume only 6 months after launching and over $130M in Total Value Locked (TVL) at its peak.

Hop is taking a trust-minimized approach towards building a sustainable bridging solution for the ecosystem.

Hop has an experienced team that believes in developing decentralized products that fit the Ethereum ecosystem’s ethos.

Hop was one of the first bridges that we integrated on LI.FI. We believe that both teams share the vision and are aligned toward creating sustainable and secure products for the ecosystem. We look forward to working closely with the Hop team and collaborating on building key infrastructure for the ecosystem.

FAQ: Hop Protocol — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.