Faster, Cheaper, More Efficient, Borderless: Crypto is the Best Money Technology Ever Invented and This Essay Shows You Why

Omnichain Fungible Tokens (OFTs) vs Traditional Rails and Bridges: A Comparative Analysis

Co-authored by Arjun Chand (LI.FI) and Mark Murdock (LayerZero)

Introduction

Blockchains are proving to be better money technology, imbuing the atom of the internet (data packets) with the ethos of Satoshi (ownership). Crypto, a bucket term for the industry of blockchains, is a fundamental shift in how data, and therefore value, is moved across the world. What previously necessitated governments, banks, lawyers, and a whole slew of intermediaries is now being replaced by codified law propagated forth via game theoretical software. Immutable, permissionless, and censorship-resistant protocols now underpin assets, rather than the mutable, permissioned, and censored rails currently used by humanity (mostly via governments and banks) to coordinate value at scale.

Crypto is already changing the world via value transfer: better money technology. What started with Peer to Peer (p2p) money with Bitcoin, escalated to Business to Business (b2b) finance with Ethereum, and is now transitioning into the Economy to Economy internet with crypto – the bucket term for what happens when blockchain becomes a plurality.

At each level step, value transfer got better, adding a new blockchain-enabled superpower. With Bitcoin, money became sovereign – self custody. With Ethereum, finance became automated – smart contracts. With crypto, intranets became internets – interop.

This essay is an attempt to explain why crypto is the best technology humans have ever invented for moving value. To show why, we're going to compare three ways people transfer value: traditional rails, bridging rails, and messaging rails. Each one tells us something about what’s possible. But only one of them feels like the future fully realized.

Faster, cheaper, more efficient value transfer is the core upgrade analyzed here, as money starts racing across the world via traditional rails to bridging rails to messaging rails. However, as a a second order effect, the story becomes about crypto introducing better money technology, full stop, wherein the many industrial layers of intermediaries wound up around dollars (SWIFT, ACH, Western Union, etc) can be flattened into a single rail (OFT) that can move any type of asset at the speed of finality of a blockchain. This is when disintermediation really sets in, as the tools for any type of value transfer – retail or institutional, intra or inter border – can be solved by the same tool, rather than having to route around permissions set by an outdated financial system hindered by dated machinery, bureaucratic red tape, and humans in general.

That’s the real difference. Traditional payment systems were built for a world with borders. Crypto wasn’t. Stablecoins, or any asset you hold, backed by native interoperability through standards like OFT, gives people the ability to move value across the globe with no middlemen and no questions asked. They create a new default: borderless, permissionless value transfer for anyone with internet.

This article provides a comparative analysis of three distinct mechanisms for moving value across networks:

Traditional Finance Rails – The established, regulated systems forming the backbone of conventional finance, including SWIFT for cross-border messaging, ACH for U.S. domestic transfers, and FedWire for U.S. real-time gross settlement, and the Western Union.

Bridges – Crypto-native protocols (e.g., Stargate, Across) that facilitate cross-chain asset exchange using pools of assets or solvers.

Omnichain Fungible Tokens (OFTs) – A newer multi-chain token standard, pioneered by LayerZero, where the token contract itself is extended to enable native burning and minting across multiple chains via secure messaging, maintaining a unified asset identity.

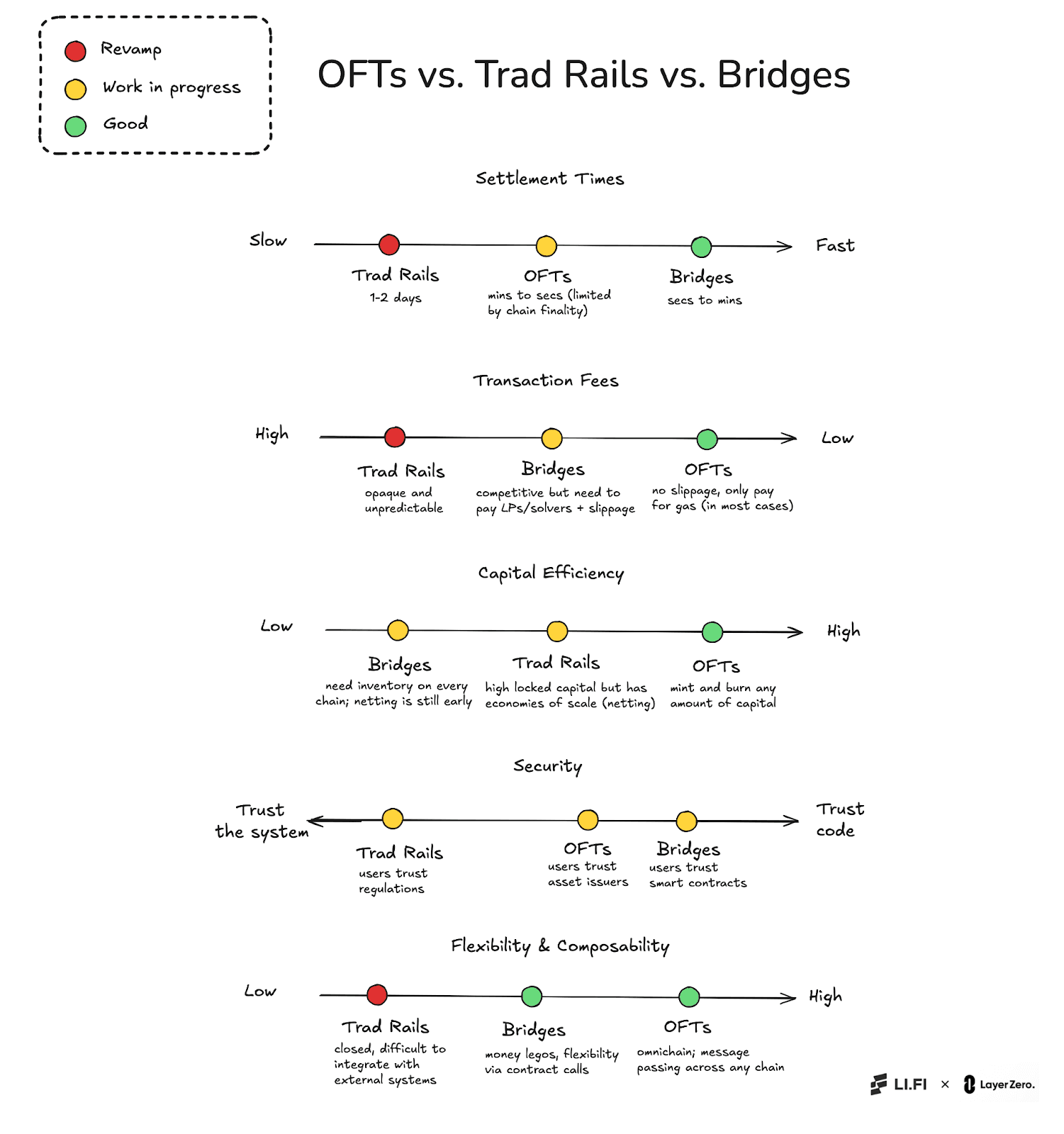

The evaluation focuses on performance and risk criteria: settlement times, transaction fees, capital efficiency, security, flexibility/composability.

Key Takeaways

Traditional firms calculate time in minutes and days due to systems designed for analog communication and borders. While dependable and quite literally institutionalized, they are constrained by slow settlement speeds, high costs, operational limitations tied to business hours, and inherent inflexibility with modern digital systems.

Liquidity bridges provide significantly faster settlement and lower costs for retail-sized transfers compared to traditional finance but suffer from capital inefficiency due to fragmented liquidity pools across chains. They also provide users with benefits of blockchain, such as self custody on the destination chain, transparency in terms of how trades are executed (usually), open hours (being that these are smart contracts).

OFTs emerge as a zero slippage asset transfer option that is both faster and more capital efficient than any other form of money technology ever invented. By enabling native asset transfers through a burn-and-mint mechanism coordinated by a messaging layer, OFTs aim to deliver fast settlement and cost-effective transactions. Crucially, they achieve high capital efficiency by maintaining a unified token supply across chains, eliminating both LP pool fragmentation and the asset fragmentation common with wrapped tokens.

Real-world adoption signals, such as the selection of LayerZero by the State of Wyoming for its WYST stablecoin and the launch of USDT0, suggest growing confidence in the OFT Standard as a token issuance technology. This is separate from a bare look at OFT as value transfer technology, but still interesting.

The article concludes that OFTs represent a notable level step for value transfer technology, potentially collapsing the traditional trade-offs between speed, cost, security, and efficiency, and paving the way for more seamless institutional and retail omnichain finance.

Here's a snapshot comparing different value transfer mechanisms:

Let’s dive in!

Deep Dive — Traditional Finance Rails (SWIFT, ACH, FedWire, Western Union)

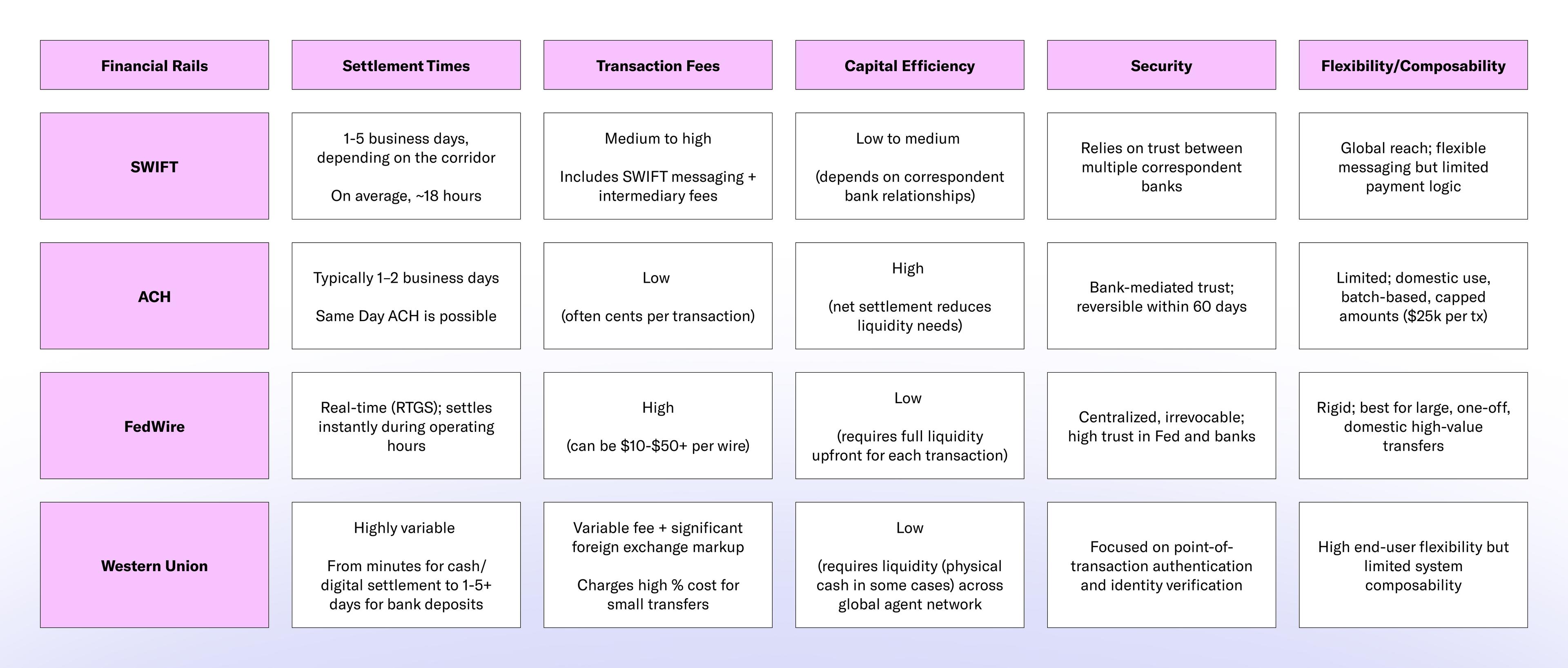

Traditional finance is a term as empty as crypto, meaning vaguely “anything that moves via non blockchain rails.” For this essay, we will analyze four of the most famous traditional financial rails: SWIFT, ACH, FedWire, and Western Union. This is not comprehensive, but the goal is to give a smattering of examples for the options major companies, along with end users, have to send money inside the economy with the largest GDP (US) as well as cross-border.

These traditional finance rails like SWIFT, ACH, FedWire and Western Union are the incumbent infrastructure for global and domestic payments, processing trillions of dollars daily within the regulated financial system.

Designed decades ago, they prioritize institutional trust and settlement finality but operate with inherent constraints shaped by pre-blockchain technological limitations and banking conventions.

Settlement Times

SWIFT – End-to-end settlement typically takes 1-2 business days on average. The SWIFT Global Payments Innovation (GPI) initiative has improved speeds, with 90% of GPI payments reportedly reaching the destination bank within an hour. However, this metric doesn't guarantee immediate access for the end beneficiary, as delays can still occur due to intermediary bank processing, time zone differences, local clearing system hours, and compliance checks. Extreme cases, particularly involving less developed corridors or complex compliance reviews, can extend settlement to several days or even weeks. Critically, SWIFT operates within the constraints of the traditional banking system, meaning processing is typically limited to business days and hours, unlike the 24/7 nature of blockchain networks.

ACH (Automated Clearing House) – This U.S. domestic system operates via batch processing. While traditionally settling next-day or in two business days, enhancements like Same Day ACH allow for settlement within hours for transactions up to $1 million. Worst-case scenarios (e.g. transfers spanning weekends, manual compliance reviews) can push settlement to several days. However, there’s a $25,000 cap per transaction.

FedWire Funds Service – As the Federal Reserve's Real-Time Gross Settlement (RTGS) system, FedWire offers near-instant final settlement (seconds to minutes) for high-value U.S. domestic payments. However, its major limitation is its operating schedule, confined to specific hours on business days. Transactions initiated outside these hours must wait until the next opening.

Western Union – Settlement times vary widely depending on the service and destination. Its fastest offering, “Money in Minutes”, enables near-instant cash pickup at agent locations. Mobile wallet transfers also typically settle within minutes. In contrast, direct-to-bank transfers range from a few hours to up to five business days internationally, with extreme cases (e.g., "slow-to-pay" countries) taking up to three weeks. This variability stems from funding/delivery methods, destination infrastructure, regulatory checks, and local banking hours.

Transaction Fees

Outgoing Wire – Traditional fees are relatively high for retail users. Wire transfers often cost $25–$50 per transaction for individuals – whether sending $500 or $5,000 – making small transfers expensive (a $100 transfer via SWIFT might incur a $30 fee, a 30% cost).

Incoming Wire – Typically carry a fee as well (median ~$15). International SWIFT wires may incur additional correspondent banking fees or FX conversion spreads, with total costs often $40+ for retail clients.

ACH – By contrast, ACH transfers are extremely cheap (on the order of $0.001–$0.50 internally for banks) and usually free or very low cost to retail customers; they are 5–7× cheaper than SWIFT on average.

FedWire – Fees for banks are low (fractions of a dollar), but banks commonly charge users around $25 for a domestic wire. Institutional users can negotiate lower fees or bundle wires into account services. In summary, traditional rails often have flat fees that are negligible for large values (e.g. $30 on $1M is 0.003%) but prohibitively high for low-value payments.

Western Union – WU's transaction fees are highly variable and often opaque, driven by both explicit transfer fees and implicit FX markups. Transfer fees range from <$1 for online bank-funded transfers to >$30 for card-funded or agent-initiated transactions. In addition, WU applies a significant exchange rate markup (often 2-4%+), which can constitute the majority of the total cost, especially for small transfers. For example, sending $999 to India from Vancouver would cost ~$19 with Western Union.

Capital Efficiency

SWIFT – SWIFT relies on a maze of correspondent banks, each holding money for the others in what are called Nostro and Vostro accounts. To make this system function, banks have to pre-fund these accounts with large sums of money (Ripple estimated this figure to be $5 trillion back in 2018). This ties up capital that could’ve been put to work elsewhere. This is also challenging for banks to figure out how to best allocate resources across corridors such that they’re used efficiently based on demand. Moreover, as transactions can take days to settle, the capital stays in the system for much longer than required.

FedWire and ACH – Domestic systems like Fedwire and ACH operate under the purview of central bank settlement (via Federal Reserve accounts), which improves capital efficiency within national borders. Fedwire, for example, settles each transaction individually in real-time gross settlement, requiring full pre-funding and therefore lower capital efficiency on a per-transfer basis. ACH, on the other hand, uses net settlement at the end of each business day, allowing banks to process large volumes of transactions with minimal intraday liquidity — a more capital-efficient model domestically, albeit slower and less suited for time-sensitive transfers.However, none of these systems provide a native solution to cross-border liquidity fragmentation. Banks must still maintain significant liquidity buffers, and funds can’t be reallocated across jurisdictions in real time.

Western Union – WU’s capital efficiency is constrained by the demands of its global cash-based agent network. WU must maintain pre-funded liquidity across agents and banking partners, often in the form of physical cash. This model ties up significant working capital and introduces forecasting, security, and logistical challenges. However, WU's digital services mitigate some of these capital efficiency woes.

In sum, traditional rails require significant liquidity buffers at financial institutions and can’t instantly reallocate liquidity across jurisdictions, limiting scalability and efficiency.

Security

Traditional networks are considered highly secure in operation – transactions are authenticated through banking systems and regulatory frameworks:

Institutional Trust and Regulatory Oversight – While the core messaging networks like SWIFT are generally considered secure at the protocol level, the primary risks lie in operational security at participating institutions, fraud, compliance failures (AML/KYC), human error, and counterparty risk. And this is where government and international agencies play a central role in monitoring and enforcing compliance in these systems. For instance, in systems like ACH and FedWire, the government is playing an active role with the U.S. Federal Reserve acting as an operator, supervisor, and policymaker as it’s part of its mandate to provide the nation with a "safe, flexible, and stable monetary and financial system". Moreover, in systems like the ACH, consumers have strong regulatory protection. If you're a consumer and someone pulls money from your account without permission, you've got up to 60 days to report it, and you’ll almost always get your money back. But if you’re a business, it’s a different story. The system assumes they’re sophisticated and If someone steals from them, they must usually notify the bank within 24 - 48 hours.

Centralization Risks – Users must trust intermediary banks and the system operators. Funds can be frozen, seized by authorities, or transactions blocked due to regulatory or political reasons, introducing censorship risk. Bank failures also pose a risk to user funds held within the system. Notably, technical exploits of the network are rare – e.g. there have been isolated SWIFT-related cyber incidents (such as the 2016 Bangladesh Bank hack for $101M), but these resulted from compromised bank credentials rather than protocol flaws.

Flexibility & Composability

Traditional financial rails are built with flexibility, offering an array of products and services: bank accounts, debit cards, credit cards, and even physical cash. They give you reach too, letting you send money across borders. But at the end of the day, they’re still closed systems. They’re bound by banking hours, subject to logistical delays and constrained by regulations.

When it comes to composability, traditional rails have a pretty limited view of the term. You might get an API that lets you integrate payments into a website or app. But that’s the farthest composability can go in the traditional finance world. It’s almost a joke in the inner circles of crypto if traditional systems use the term in that context.

Most of these systems cannot be used for programmatic use. To even compare the composability of traditional systems to blockchain systems would feel like comparing a horse-drawn cart to a Ferrari.

However, one of the more surprising developments lately is how traditional banking infrastructure is beginning to plug into interoperability protocols. At first, these seemed like separate worlds. But now, the lines are blurring — core banking tech is starting to treat blockchains as useful extensions.

Deep Dive — Liquidity-Based Bridges (Intents and Pools)

Bridges are solutions built to unify fragmented liquidity across chains, enabling users to move from chain A to chain B by interfacing with a third party that either holds or has access to a lot of an asset and can fill an order on the destination chain in exchange for a fee.

There are mainly two types of designs that are popular for value transfer today:

Intent-based bridges – users express their desired outcome (an "intent") – for example, "I want X amount of ETH on Arbitrum, and I currently have it on Base". Third-party actors, often called solvers, compete to fulfill this intent as quickly and cheaply as possible, typically by fronting the funds on the destination chain. The user receives their funds almost instantly, while the solver is reimbursed later through a separate settlement process that verifies the intent was fulfilled. Examples include Across, Relay, Mayan.

Pool-based bridges – these operate by maintaining pools of specific assets on each supported chain. Here, users deposit an asset into the pool on the source chain, and the bridge protocol facilitates a withdrawal of the same asset type from the pool on the destination chain, typically charging a fee to compensate the liquidity providers who supply the assets to the pools. Examples include Stargate, Thorchain, Symbiosis.

In reality, these are the same thing, with slight variations in where the capital is held (onchain or offchain), along with different barriers to entry (it is much harder to solve than LP) . The premise is that there is capital attached to a set of smart contracts and when a user wants to move from chain A to chain B that capital is used to fill the order quickly and securely for a small fee.

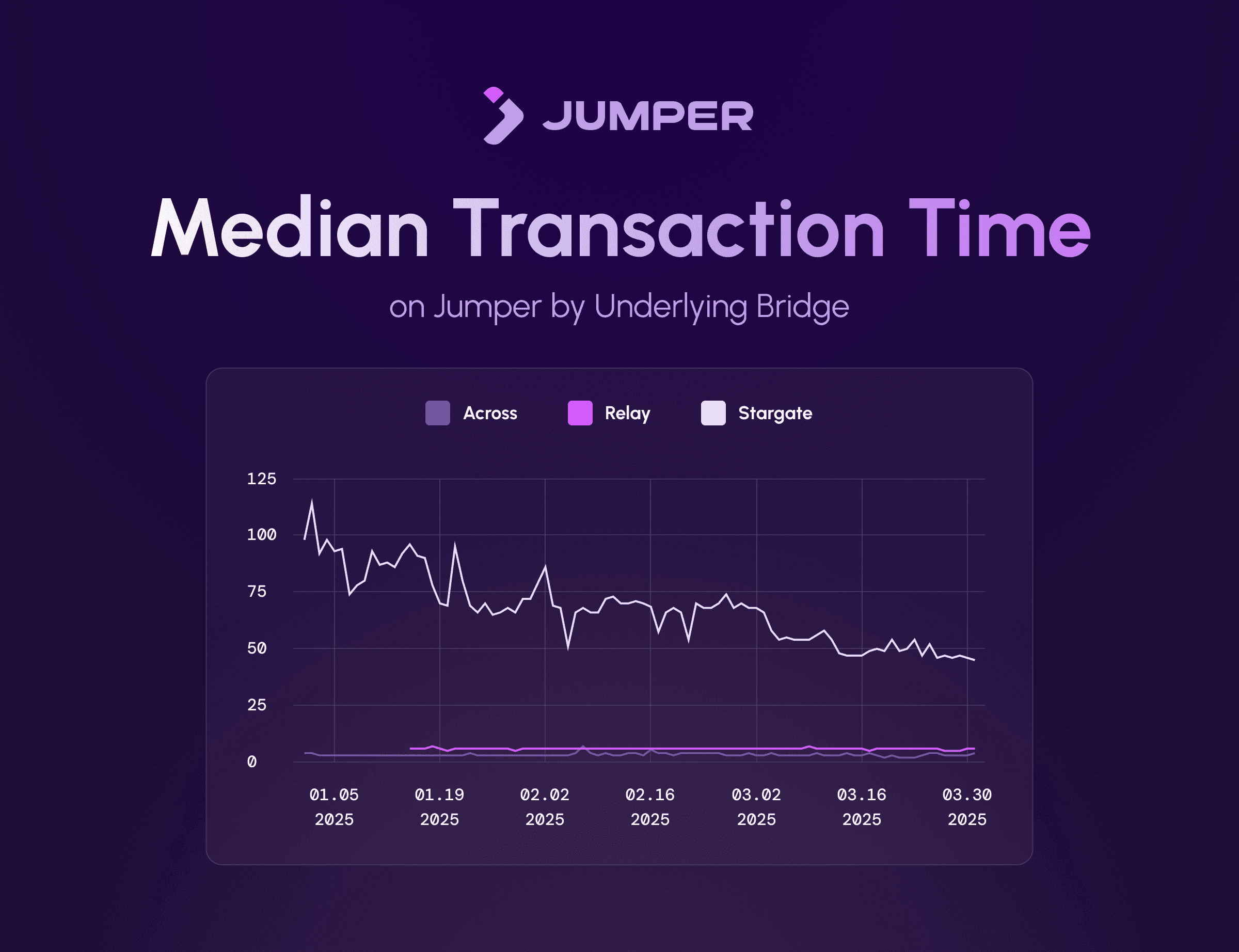

Settlement Times

Liquidity-based bridges, especially intent-based ones, offer dramatically faster settlement compared to traditional cross-border rails. Transfers usually finalize within seconds to minutes. Intent-based systems aim for near-instant fulfillment from the user's perspective, as solvers front the funds for a fee in return for taking on finality risk of a chain reorg.

The transfer times have gone down drastically over the past two years with the introduction of intent-based bridges and the maturity of pool-based bridges, as can be seen in the data below:

Note: Median tx size is $107 for Stargate, $31 for Across and $21 for Relay.

This is dramatically faster than traditional cross-border transfers. However, there is a dependency on source chain finality – if a user bridges from a slow chain or during congestion, the wait could be relatively long (e.g. bridging from Ethereum may require more than ~12 block confirmations, ~3 minutes) in both types of bridges.

In most cases, though, bridges settle within a single block confirmation on the destination after source transaction finality, effectively close to near-real-time for end-users. Worst-case delays occur if liquidity is insufficient – a transfer might queue until more liquidity arrives or a relayer intervenes, but such scenarios are rare on well-capitalized routes.

Despite these dependencies, liquidity-based bridges represent a significant improvement, enabling near-real-time cross-chain transfers for many use cases compared to the multi-day standard of traditional international payments.

Overall, compared to the glacial pace of traditional cross-border transfers, liquidity-based bridges feel much faster. What used to take days now takes seconds — or minutes, if you're unlucky.

Transaction Fees

Users typically incur different types of costs when using liquidity-based bridges:

Capital Fee – A fee charged by the bridge. In pool-based models, this often compensates LPs. In intent-based models, this fee compensates the solvers who compete to fill the user's order.

Network Gas Fees – Users must pay standard blockchain transaction fees on both the source chain (for the deposit/intent submission) and potentially the destination chain (for withdrawal/claim, though often abstracted away). These fees vary significantly based on network congestion and the specific chains involved.

Slippage – An implicit cost can occur in liquidity bridges if a large transfer impacts the pool balance / solver’s inventory, resulting in a worse exchange rate (which happens in a similar fashion in Forex rails).

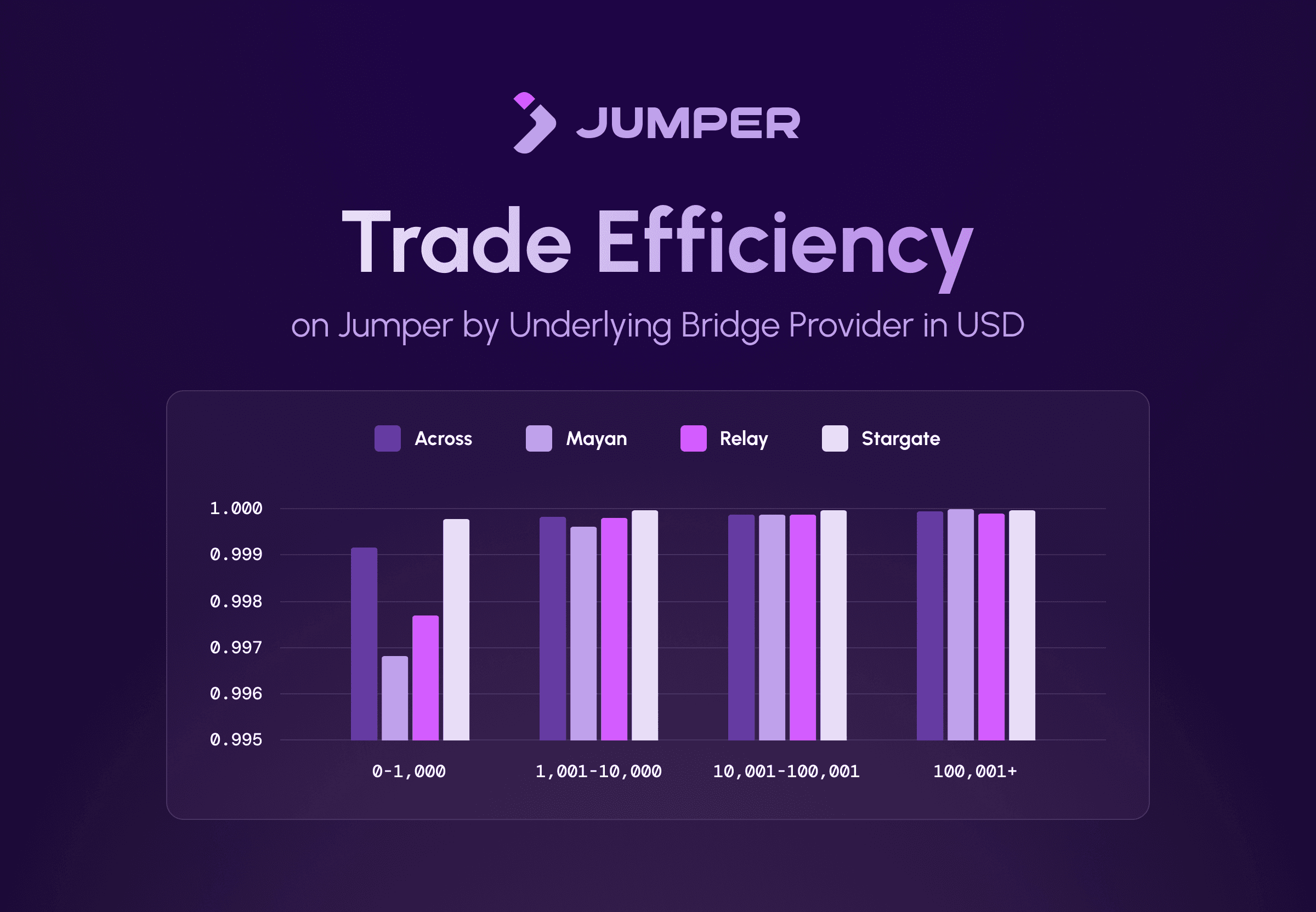

If you're moving small amounts (up to a thousand dollars), you'll notice that the fees in liquidity bridges eat up a bigger chunk of your money. Liquidity bridges tend to charge more in basis points for retail-sized transfers than they do for larger ones. You can see this in the chart below, which compares trade efficiency across different bridges on Jumper. Trade efficiency, by the way, is just the ratio of what you get out to what you put in, measured in USD and excluding gas costs. It's a simple way to see how much value gets lost in the process.

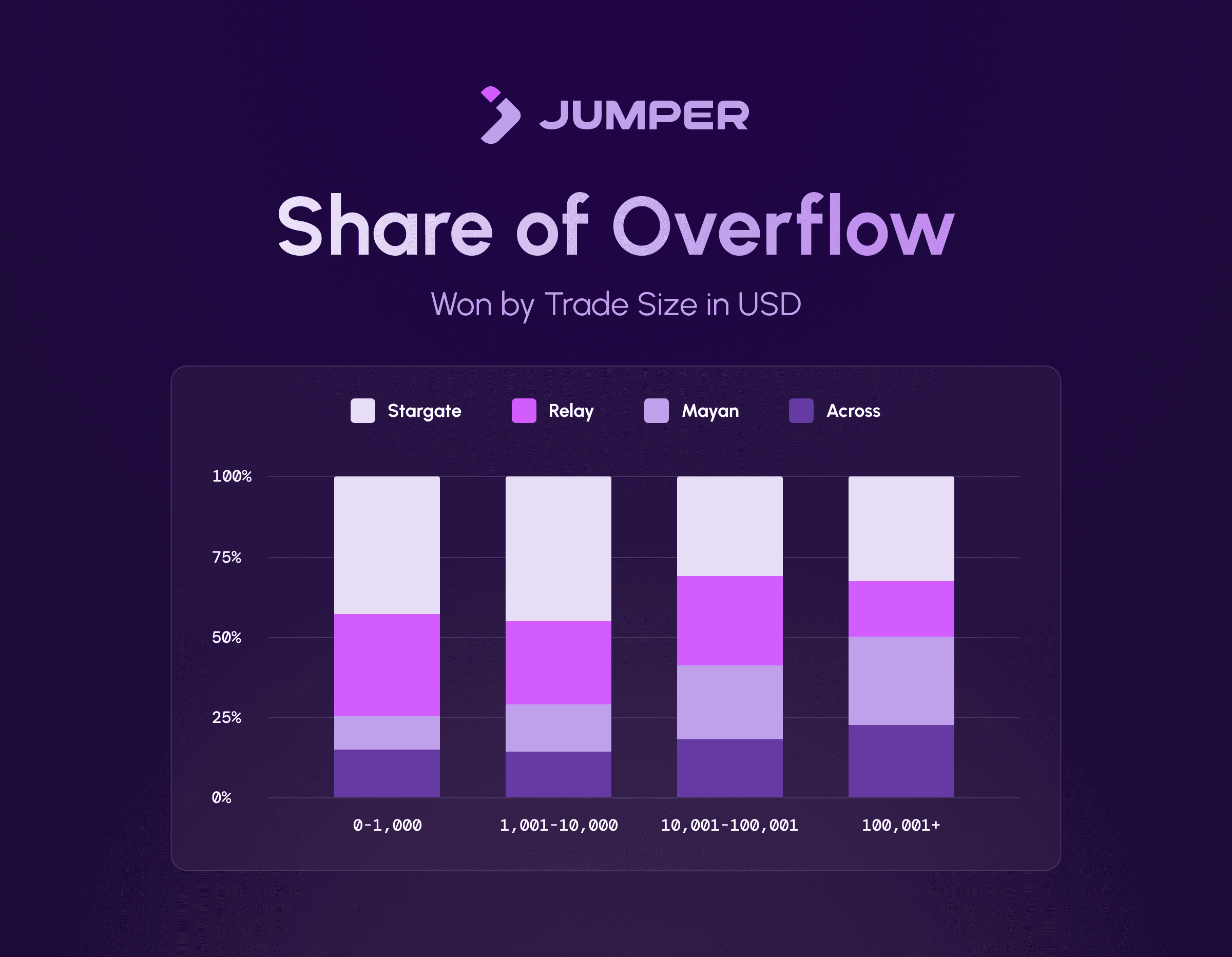

However, these systems are designed with dynamic fees so they can optimize trade efficiency and offer better rates to users as overall the north star for every bridge is to win more orderflow. And it works. You can see it in the data — bridges that offer better trade efficiency tend to capture a larger share of orderflow across different trade sizes.

Overall, if you compare them to traditional payment rails, liquidity-based bridges are usually a much better deal for small to mid-sized transfers. We're talking a few bucks, versus the $30–$50 you’d pay for an international wire.

When the numbers get big, the difference between traditional rails like SWIFT and liquidity bridges isn’t far off. Move a million dollars through a liquidity bridge, and the fee might be anywhere from $5 to $5000, compared to around $30 through SWIFT, so roughly the same.

The real difference, however, is the liquidity in the system. Traditional rails are backed by deep pools of capital, built up over decades. That’s why they can move large amounts without blinking. Liquidity bridges aren’t there yet. With the exception of Stargate, there are almost no systems that can reliably move over seven figures on a regular basis. Not because the tech can’t do it, but because the liquidity just isn’t there.

Capital Efficiency

A core drawback of liquidity bridges is capital inefficiency – they require locked liquidity or inventory on every chain. This is different in capital inefficiency than traditional systems, which are insufficient due to settlement times, whereas these systems are inefficient due to capital costs.

Liquidity providers or solvers must stake/hold large amounts of each asset on each supported chain to facilitate instant swaps. This pre-funded liquidity is analogous to Nostro accounts in traditional finance: it ties up capital that could be used elsewhere.

Fundamentally, liquidity bridges trade capital efficiency for faster settlement which results in the following problems:

Scaling costs – If a bridge connects N chains, each asset might need significant reserves on all N networks. This model does not scale linearly without a lot of capital – adding a new chain requires seeding a new pool or expanding a hub pool or in the case of intent-based bridges, requires solvers to add new assets to their balance sheet or the bridge to attract new solvers on the new chain. There are designs to improve capital use (Stargate, for example, uses a unified “omnichain” pool model for stablecoins), but fundamentally, liquidity must be present wherever users want to enter or exit. Moreover, if one route experiences heavy demand, liquidity can become imbalanced, requiring rebalancing or arbitrage.

Capital Costs – Stargate has to pay for LP through token issuance (not anymore, but did for most of its existence), so does Across with ACX tokens

Slippage and liquidity depth – a shallow pool leads to higher slippage and may even reject large transfers. In contrast, deeper liquidity yields better prices but at the cost of more idle capital.

LP/Solver risks – LPs in bridges are also exposed to impermanent loss if volatile assets are bridged via pools, though stablecoin-only bridges mitigate this. On the other hand, solvers in intent-based bridges are exposed to the price volatility of the assets they’re holding in their balance sheets.

Security

While non-custodial in nature (no single entity controls all user funds), liquidity bridges concentrate risk in their smart contracts and the underlying verification mechanism:

Smart Contract Vulnerabilities – The complex code governing liquidity pools, cross-chain messaging or oracle, and transaction validation becomes a prime target for attackers. Bugs in this code can lead to the draining of LP/solver funds. Historical examples like early Thorchain exploits demonstrate this risk.

Protocol Logic Flaws – Both LPs and solvers are vulnerable to bugs and design mistakes in liquidity bridges. These can lead to real losses. Sometimes it's auction logic that breaks, sometimes it’s the verification mechanism. Solvers, in particular, have taken hits in early intent systems, where the rules are still relatively new and the edge cases are still being figured out.

Hot Wallet Risk – LPs and solvers typically rely on hot wallets to move quickly across chains, but that makes them easy targets. These wallets are always online, often hold large amounts, and a single compromise (a leaked key or phishing attack) can wipe them out. There have been several examples of such wallet compromises, both small and big, and this continues to be a major security threat for solver/LP funds.

Flexibility & Composability

In crypto, composability is everything. Liquidity bridges are a great example as they come with SDKs or APIs, so developers can plug them directly into apps and aggregators. LI.FI, for example, is an onchain liquidity API that aggregates 20+ bridges. Instead of relying on one, it routes through all of them to find the best rate. That’s possible because bridges are composable; they’re built to work with other tools in the ecosystem.

Some bridges go even further in terms of functionality. They also have the ability to pass call data across chains in the form of contract calls which gives them the ability to execute more complex multi-step logic like ‘bridge x funds from Chain A to Chain B and then deposit them into a Vault’.

Still, from a developer perspective, liquidity bridges are extra pieces to integrate and monitor. They are not a native capability of blockchains, but external services. There’s also operational complexity: liquidity must be managed and user experience can suffer if a bridge is out of liquidity or under maintenance. All these things are tackled by using an aggregator like LI.FI that takes care of the maintenance overhead for developers but allows them to tap into the liquidity and functionality of bridges.

Omnichain Fungible Tokens (OFTs) – The LayerZero Model

Omnichain Fungible Tokens (OFTs) represent a fundamentally different approach to value transfer. Instead of relying on intermediary liquidity pools or creating wrapped IOUs, the OFT Standard allows an asset issuer to extend a token contract (like an ERC-20) itself, making the token itself natively aware of and transferable across multiple blockchains. The core mechanism involves burning tokens on the source chain, sending a message via the LayerZero protocol, and then minting the exact same number of tokens on the destination chain (no slippage) using the token's contract there.

This results in a single, canonical token with a unified total supply that exists across all supported chains simultaneously, merely changing its location (chain). LayerZero acts as the underlying messaging layer, using a configurable system of Decentralized Verifier Networks (DVNs) and onchain Executors selected by asset issuers themselves to ensure secure and reliable message passing between chains.

The OFT Standard enables anyone to tokenize an asset the chains they want while implementing the security standards they specifically trust. Where Circle launched CCTP, a solution to deploy and move USDC across any chain, LayerZero’s OFT Standard is a framework that any asset issuer can use to deploy its own version of what is essentially CCTP.

Settlement Times

OFT transfers are designed for fast settlement that can scale to instantaneous as the speed of a blockchain increases, as they are only, limited by the finality of the underlying blockchains they connect:

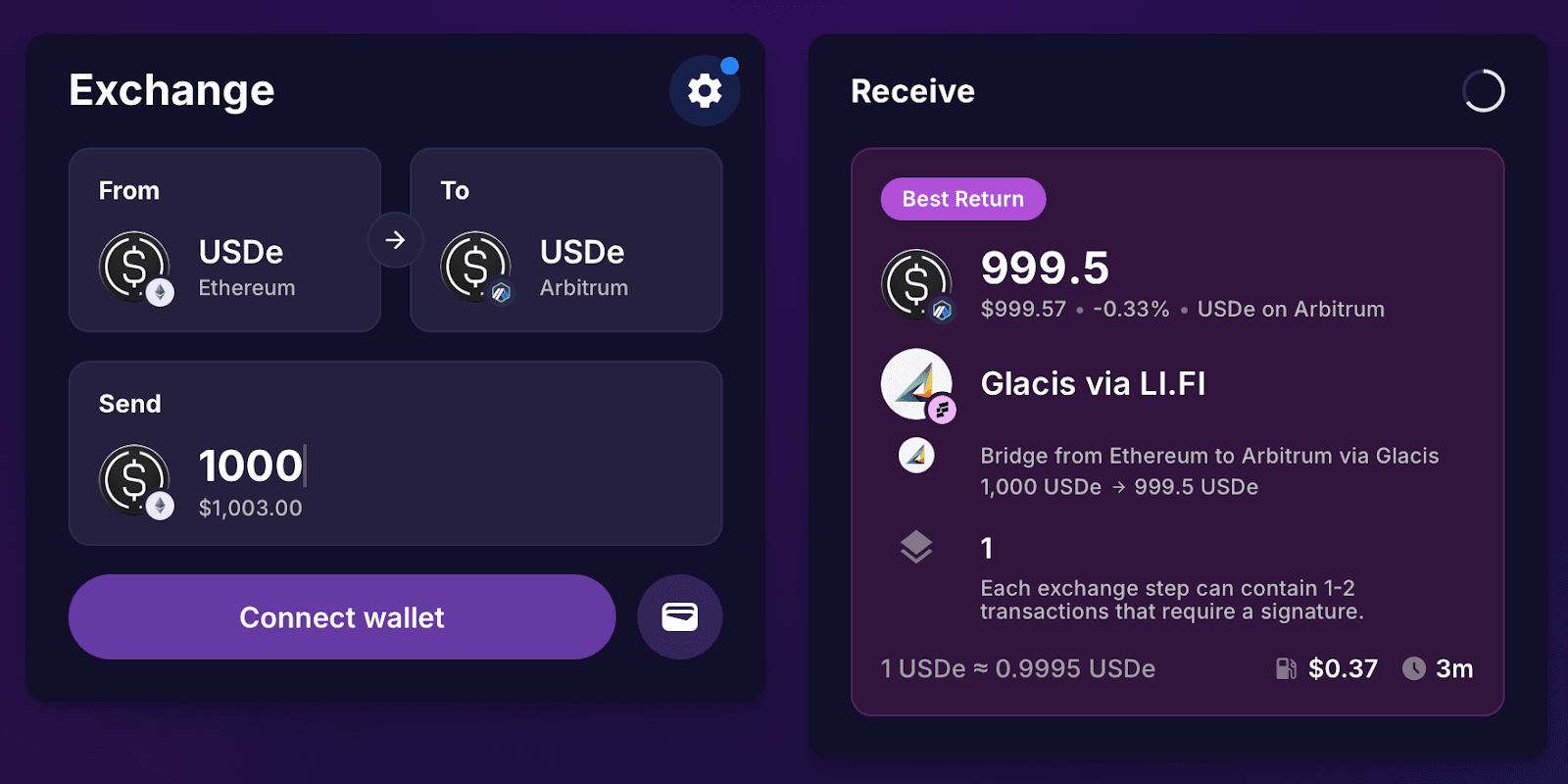

Speed – The process involves a burn transaction on the source chain, message relay via LayerZero, and a mint transaction on the destination chain. The total time is effectively one block confirmation time and finality on source chain + message relay latency + one block confirmation time on destination chain. LayerZero's messaging latency is typically measured in seconds. Therefore, end-to-end OFT transfers often complete in under a minute, especially between fast L2s (e.g., Arbitrum to Polygon). Even involving slower L1s like Ethereum, settlement usually occurs within minutes after the source chain transaction achieves the required confirmations (see image below for USDe transfer, which is an OFT). Notably, these block confirmations are set on a per asset issuer basis. The OFT Standard is just a framework for asset issuance, all parameters are decided by the implementation layer. For instance, a very risk-averse asset, perhaps something like USDY by Ondo, might choose a high block-finality number. A risk-on issuer might have something like 1 block confirmation from every chain except for Polygon (5 blocks), due to reorg risk. The real future, however, is probably what we’re seeing with CCTP V2, wherein speed is faster than finality, with the asset issuer fronting capital.

OFT transfer from Ethereum to Arbitrum in less than 3 minutes. Source: Jumper

Reliable experience – The settlement speed of OFT transfers is not dependent on the availability of liquidity in bridge pools, making it more consistent and predictable than liquidity bridges, especially for large transfers. In the worst case scenario, potential latency could arise from network congestion delaying message relay or if an application configures a very high number of block confirmations on the source chain for security reasons. Even in these scenarios, settlement is expected to be in the order of minutes, not hours or days.

Transaction Fees

The OFT model aims for a cost-effective fee structure by eliminating intermediaries:

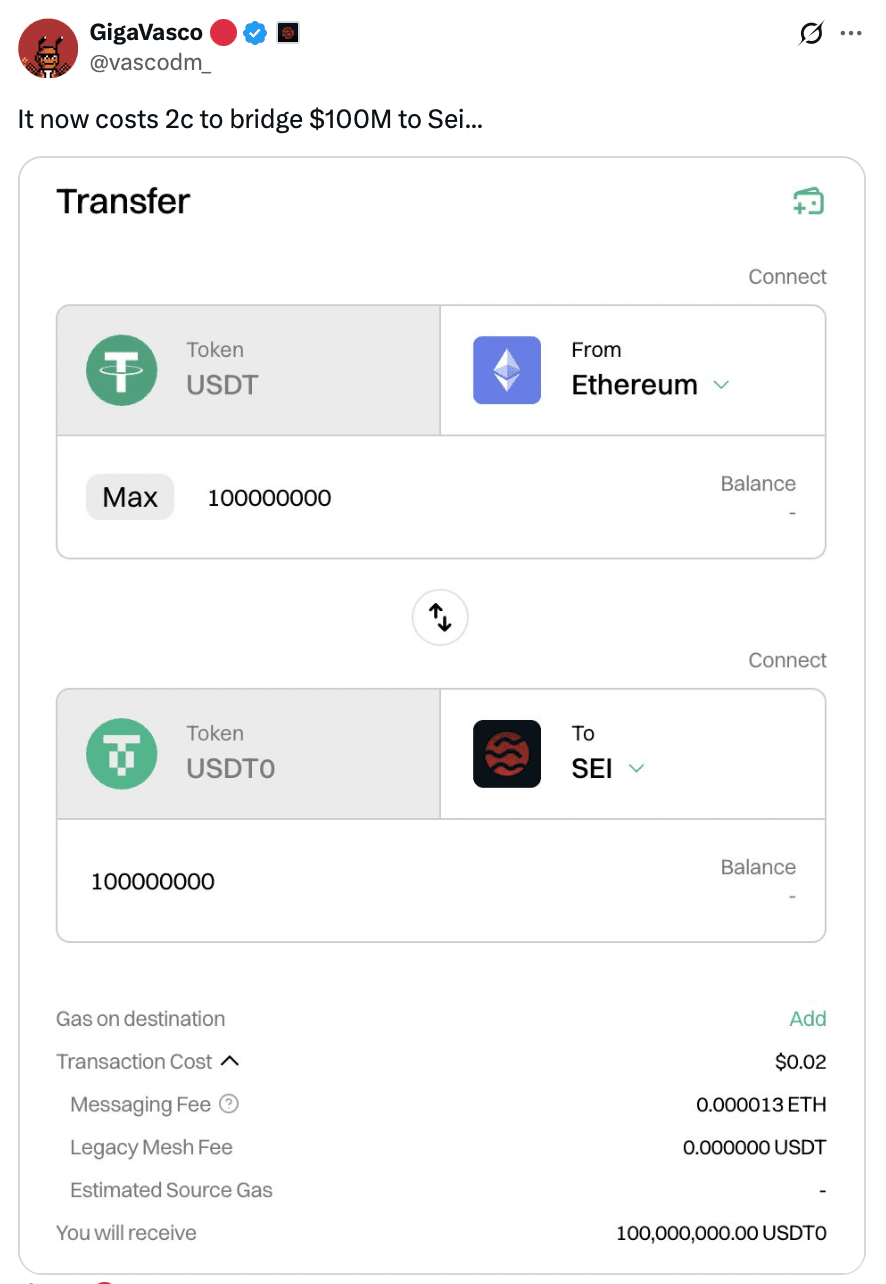

Costs – The cost primarily consists of standard blockchain transaction fees (gas) for the burn operation on the source chain and the mint operation on the destination chain. Additionally, a small messaging fee to pay the executor/DVN (often this is bundled into the same gas payment). In other words, sending an OFT is like doing a normal token transfer on Chain A and a token mint on Chain B. If those operations cost, say, $1 worth of gas on each chain, that’s the total cost. Crucially, the cost does not depend on the amount being transferred – sending $100 or $100,000,000 of an OFT costs roughly the same in gas. For example, when someone sends any amount of USDT0 to another chain, this will take place without any slippage and at a minimal cost of a few cents to cover the gas costs, which – a tiny fraction (<<0.01%) of the amount.

Source: @vascodm_ on X.

Retail users benefit similarly: sending $100 of an OFT might cost a few dollars in gas (depending on the chain), comparable to or even less than an ACH fee, and with almost instant settlement.

No Intermediary Fees – Crucially, there are no percentage-based fees paid to liquidity providers, as no LPs are involved. There is also no slippage associated with liquidity pools. Projects issuing OFTs have the option to charge a custom fee if they want (for example, a tiny protocol fee on each transfer), but this is optional and can be set to zero. Moreover, there’s a protocol fee switch for LayerZero that’s controlled by ZRO holders. This is currently disabled but tokenholders can vote to switch it on and potentially charge a fee per OFT transfer. That said, again, everything is owned by the asset issuer. While OFT Standard comes with no fees out of the box, perhaps assets will implement a fee directly into the contract going forward. This is interesting, in that with stables, which are somewhat commoditized, this probably will not happen. However, for non-stable assets, like memecoins for example, they can add a fee and the end user would likely still pay it.

The bottom line: OFTs dramatically reduce variable costs. No double-spending of liquidity or percentage tolls – just pay for the compute work done on each chain. This makes OFTs the most cost-efficient mechanism especially as transfer values increase (the cost becomes negligible in percentage terms). It aligns with how the internet transmits data (cost is agnostic to the content’s value).

Capital Efficiency

OFTs are designed for maximum capital efficiency by collapsing the need for external liquidity. The token’s total supply is unified across all chains – it is minted and burned but never duplicated. This means all liquidity is essentially one pool (the token itself) that can dynamically flow to where it’s needed. There is no requirement for pre-funded pools on each network and no wrapped tokens. This has profound implications for efficiency and scalability:

Unified supply – Projects no longer need to split their token liquidity among chains; a single market (with arbitrage) maintains the price across chains.

Scalability in chain expansion – When adding a new chain deployment, you do not have to seed it with a large inventory of tokens. The approach is linearly scalable to many chains. If a token issuer wants their token on 100 chains, they deploy the OFT contract on each and that’s it. They don’t have to lock 100x worth of liquidity or manage 100 different connectors; the messaging layer connects them all. This design paves the way for scalable liquidity across numerous chains without fragmentation. Also gives flexibility to launch on a small subset of chains and then expand from there. Or go big and restrict.

OFTs effectively eliminate slippage in transfers – since you are not swapping assets, you get the same amount out as you put in (minus perhaps a negligible protocol fee if one is configured). There is no concept of pool imbalance because there is no pool, just the token’s supply accounting which is being changed across chains as tokens get minted (+) and burned (-).

No asset fragmentation – Unlike lock-and-mint bridges that can lead to multiple incompatible wrapped versions of an asset on a destination chain, an OFT maintains its single, canonical identity and contract address across all chains. This model also sidesteps issues like multiple versions of the same asset – all chains see the same token. Notably, the absence of wrapped assets also removes the massive attack surface of custodial honeypots, tying into security benefits discussed next.

In essence, OFTs are as liquidity-efficient as the underlying token can possibly be. The only collateral needed is the token itself, and it’s always doing useful work – when it’s on Chain A, it’s available there; when moved to Chain B, it’s available there, never duplicated or sidelined).

Security

The security of OFT transfers relies on the security guarantees of the underlying LayerZero messaging protocol and the specific configuration chosen by the token issuers:

LayerZero Security Model – LayerZero V2 employs a modular security architecture. Message validation is performed by independent DVNs and message execution is handled by an Executor. No single party’s signature is sufficient. This separation of duties means an attacker would need to compromise multiple independent parties to forge a message. Core LayerZero contracts are immutable.

Configurable security – Token issuers using LayerZero choose and configure their desired DVNs and required confirmation thresholds. For example, a project might require validation from 2 out of 3 chosen DVNs before a message is considered valid or set a delay of x block confirmations for finality, etc. This flexibility allows the security to be as robust as desired – e.g. an issuer could even incorporate a native chain’s light client as a verifier for maximal trustlessness.

Ownership of contracts – With an OFT, the token issuer retains ownership and control of the token contracts on each chain – not the LayerZero protocol or any bridge operator. This is a critical distinction: it means there is no central honeypot contract holding reserves (unlike a lock-mint bridge), and no liquidity pool contract holding user funds (unlike a liquidity bridge).

Trust Assumptions – Users and applications trust that the chosen set of DVNs will operate honestly and independently (i.e., a sufficient number will not collude to validate malicious messages) and that the Executor will reliably deliver validated messages. Potential risks include:

Collusion among the specific DVNs selected by token issuers.

Bugs within the immutable core LayerZero contracts (though heavily audited 6 times and there’s an open bounty of $15 million).

Vulnerabilities or misconfigurations in the token’s own OFT implementation (the token contract itself or its LayerZero configuration).

Compromise of the token owner's keys used to manage the OFT configuration (if not locked).

Flexibility & Composability

OFTs offer maximum composability and flexibility: the token becomes native on every chain, and cross-chain interactions are elevated to a first-class citizen. This creates the foundation for omnichain dApps — applications that span multiple networks effortlessly, something past solutions, bogged down by fragmentation, couldn’t pull off.

The standard effectively introduces "universal semantics" to tokens across chains. The token behaves identically everywhere — same name, same supply, same functionality — just living on multiple networks. This makes multi-chain development and user experience significantly simpler:

For users, 1 TokenX (OFT) on Chain A is 1 TokenX on Chain B. There’s no need to swap versions or get confused. If TokenX is listed on an exchange on Chain B, users can deposit their TokenX from Chain A directly. It’s the same asset, so no new listings or wrapped versions are needed.

For developers, OFTs offer a standardized interface. LayerZero’s libraries make it easy to create an OFT by deploying a contract on each chain and linking them. With LayerZero’s endpoint SDK, developers can send messages, making cross-chain transfer integration as seamless as interacting with any token contract.

For token issuers, governance and control remain flexible. The issuer has full control over which chains are supported and can expand to new chains at any time, simply by deploying a new contract and updating remote addresses. Security settings can also evolve over time — LayerZero’s design allows updates to the security stack as new technologies (validium, zk proofs, etc.) emerge.

Conclusion, Future Outlook and Real World Adoption

When people talk about moving money across the world or across chains in crypto, they usually talk about trade-offs. You can have speed, but you lose security. You can have security, but it’ll cost you time and money. Or you can try for both and end up with a complicated system that does neither efficiently.

OFTs collapse traditional trade-offs of value transfer.

They approach the security guarantees of traditional financial rails, yet avoid its typical inefficiencies — namely, slow settlement times and high cost. Compared to liquidity bridges, they offer competitive speed, constrained primarily by the finality times of individual chains. Most notably, they achieve significantly greater capital efficiency, eliminating the need to lock large reserves in pools or rely on deep market maker inventories.

An OFT transfer doesn’t rely on any single intermediary or pool of funds; it relies only on the source and destination blockchains and a decentralized network of verifiers. This means there is no single point to exploit and no capital inefficiency tax. The unified token model ensures that an OFT is the same asset everywhere, allowing markets to stay aligned and liquid across chains.

For a product manager at a bank or fintech, the implications are significant. Adopting OFT-based infrastructure could enable features like instant cross-exchange transfers of stablecoins, multi-chain liquidity management, and on-demand settlement that current systems (whether traditional or crypto bridges) struggle to provide without incurring major costs or risks. Essentially, OFTs fulfill the long-sought ideal of “move money at the speed of information” – similar to how the internet moves data. Every other system forced a trade-off between speed, cost, and trust:

If you want speed and low cost (crypto transfers), you trust bridge smart contracts and LPs / market makers to show up with the capital required.

If you want security and trust (bank wires), you tolerate high costs or slow delivery.

If you want low cost at scale (traditional wires for large sums), you give up speed and openness.

OFTs break this triangle: speed, cost, and trust can finally go hand-in-hand.

Like email did for communication, OFTs enable value to move at the speed of information. They don’t force you to choose between speed, cost, and trust. They make that choice obsolete.

We can strongly say that OFTs, and more broadly, multi-chain token standards enabled by interoperability protocols, represent a tectonic shift in how value moves across the world.

This is one of the main reasons we’re seeing OFT adoption accelerating.

Source: Accelerate Asia Stablecoins with Interoperability, Four Pillars

A notable example is Wyoming’s WYST project. The State has selected LayerZero as the official infrastructure for its upcoming Wyoming Stable Token — a fully backed, state-issued stablecoin. In testing, WYST has already been issued on Ethereum, Solana, and Avalanche testnets, moving seamlessly between them via the OFT standard.

By using the OFT standard, Wyoming retains custody of the reserves backing the token (cash and U.S. Treasuries) while allowing the token itself to move freely across chains. This approach preserves both control and flexibility. More importantly, it sets a precedent. A U.S. state embracing blockchain to issue a public-purpose stablecoin marks a significant milestone — one that underscores the maturity of the tech. It’s a vote of confidence from a risk-averse institution in the security and reliability of OFTs for mission-critical use cases.

If major stablecoins become OFTs, it means a user could hold a dollar stablecoin and use it natively in any app on any chain, or even move it from a public chain to a bank’s private ledger and back, with minimal friction. This kind of universal interoperability unlocks use cases: truly global remittances that auto-settle through the cheapest chain at the time, or multi-chain commerce where payments find the most efficient path (similar to internet routing).

Over the next decade, as regulatory clarity improves, we might see consortia of banks creating omnichain settlement networks – essentially doing what SWIFT does, but through blockchain and messaging hubs like LayerZero. These networks would not replace domestic RTGS systems but rather bridge them, providing real-time cross-system settlement. It’s plausible that the term “omnichain” will become synonymous with how all digital assets operate, just as “internet” became synonymous with interconnected networks. The trade-offs that once forced fragmentation (like separate liquidity pools and wrapped tokens for each chain) will fade away, replaced by tokens that are born interoperable.

In conclusion, the rise of Omnichain Fungible Tokens signals a future where value transfer is unified across platforms – a dollar is a dollar, whether it’s on Ethereum, an internal bank ledger, or a state’s blockchain – and it can hop between them in seconds with total safety. This will spur innovation in finance similar to how standard internet protocols spurred innovation in information exchange. Organizations that embrace this paradigm early, as Wyoming has, will help shape the next generation of financial infrastructure.

LI.FI: All Interop Out of the Box

LI.FI now supports the Omnichain Fungible Token (OFT) standard by LayerZero. That means any token issued as an OFT is now instantly routable through LI.FI.

This is a meaningful upgrade to our routing engine — not just another bridge, but an entirely new transfer primitive. OFTs use a native burn-and-mint mechanism, allowing assets to move across chains with zero slippage, no size limits, and at the speed of source chain finality.

Why does this matter? Because it opens up a new class of tokens supported and use cases offered. Whales and solvers, for example, no longer have to worry about liquidity limitations or wrapped assets as with OFTs, they can manage large, cross-chain positions easily and reliably.

One more way to transfer assets, one more way to unify liquidity across chains, one step closer to solving interop.

Thanks to Zain for the feedback and Octave for the Jumper data that helped shape this article.

FAQ: Faster, Cheaper, More Efficient, Borderless: Crypto is the Best Money Technology Ever Invented and This Essay Shows You Why

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.