Explore Polygon By Swapping With LI.FI

LI.FI Interoperability Expands To Polygon

Polygon PoS is an Ethereum Layer 2 scalability solution that executes more transactions at faster speeds and lower gas fees than the Ethereum mainnet.

Polygon also has an SDK that enables developers to create their own interoperable Ethereum-compatible sidechains or Layer 2 chains. Polygon’s goal is to be an “Internet of Blockchains” for Ethereum, in competition with products such as Polkadot, Cosmos, and Avalanche.

This article talks about Polygon and throws light on some of the most popular dApps in its ecosystem.

Let’s dive in!

Exploring The Polygon Ecosystem

Matic Network originally launched as an Ethereum sidechain in October 2017, but rebranded to Polygon in February 2021. Since then, Polygon’s TVL has exploded to $4.34 billion, driven by DeFi, Gaming, and NFT dApps.

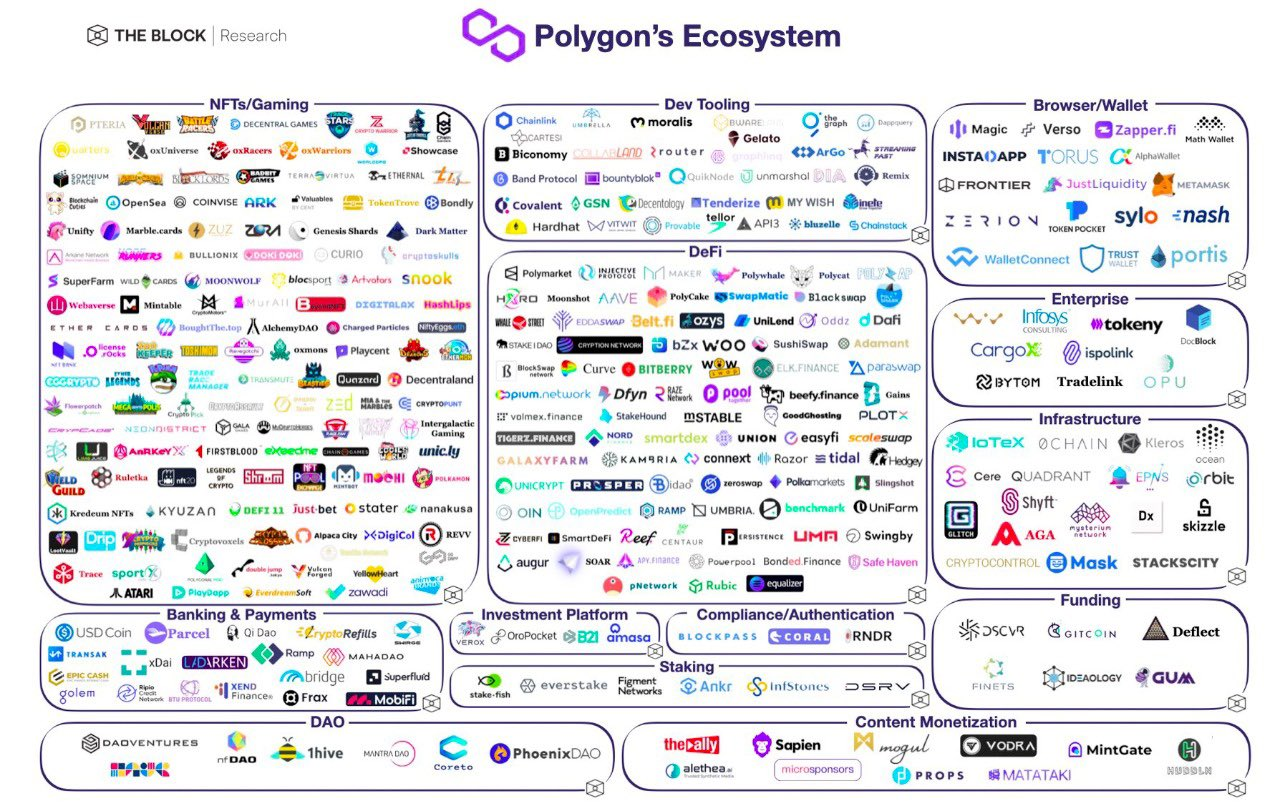

Here’s an overview of the most popular dApps on Polygon that you can use by swapping via LI.FI:

Source: The Block Research

Decentralized Exchanges (DEXs)

Polygon hosts some of the most popular DEXs in the crypto space, including Uniswap, Sushiswap, and 1inch. DEXs allow users to swap tokens without giving up control of their assets to a centralized intermediary, and often use complex algorithms to optimize for gas fees and exchange rates. Polygon’s PoS chain and SDK are appealing to major exchanges because they facilitate faster transactions at lower gas rates.

Lending Platforms

Polygon’s popularity has also led to some of the biggest crypto lending platforms being built on its network, such as AAVE, which boasts a TVL of over $11 billion. DeFi lending platforms allow users to provide liquidity for borrowers without centralized intermediaries ever taking ownership of their assets. Because smart contracts govern decentralized liquidity protocols, network speeds are paramount, and Polygon is beloved by protocols like EasyFi and CREAM for its high transaction speeds.

Source: The Cryptonomist

Gaming & NFT’s

NFT’s and Gaming had a huge year in 2021, so it only makes sense that Polygon has been integrated by the biggest players in both spaces.

Videogame giant Atari has partnered with Polygon to bring their Atari Token and Atari NFT’s to Layer 2 Ethereum. Furthermore, they have announced plans to launch an Atari NFT minter that will allow Atari token holders to mint NFT’s. Polygon is also supported by major NFT platform Opensea, and by metaverse gaming platform Decentraland.

Native dApps

You should also know about Polygon’s native dApps, which are dApps whose smart contracts are directly built on Polygon’s chain, or that support native assets from Polygon PoS. LI.FImakes it super simple to move your capital from any of the supported chains to Polygon. Here are some of the biggest standouts:

Quickswap — A Layer 2 decentralized exchange that promises near-zero gas fees thanks to Polygon.

Polycat Finance — A yield farming platform that empowers new farms to draw in early investors with innovative tools like Initial Farm Offerings

.

OpenOcean — An aggregator of centralized as well as decentralized exchanges, which supports Polygon native assets.

Decentral Games — A play-to-earn poker gaming platform that incentivizes users to earn their ICE token by playing their game daily.

Refinable — A platform for trading gaming NFT’s across multiple chains, including native support for Polygon NFT’s.

To learn more about Polygon’s native dApps, and other dApps supporting the Polygon network, check out their official dApp list.

So, how can users explore the Polygon ecosystem?

By using cross-chain bridges individually or using a bridge aggregator like LI.FI that integrates the best bridges in the ecosystem and allows users to move their assets onto and from the Polygon network.

To learn more about Polygon, check out:

The future is multi-chain and we strive for more interoperability. We aim to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Polygon in the Li.Fi family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore Polygon By Swapping With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.