Explore Optimism By Swapping With LI.FI

LI.FI Interoperability Expands To Optimism

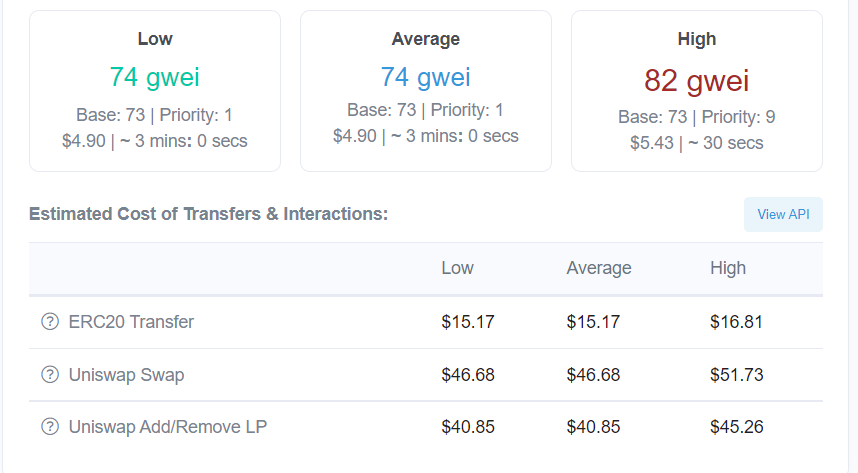

Optimism is a layer 2 scaling solution for Ethereum. More specifically, it is an Optimistic Rollup layer 2 solution that enables users to enjoy the decentralization of Ethereum but at lower costs and lightning speed. On top of lower gas fees, Optimistic Rollups can do many transactions off-chain while maintaining the L1 security guaranteed by Ethereum. Thus, Optimism helps scale Ethereum by running off-chain computation while putting all transaction data on-chain, significantly increasing transactions per second with gas fees being around 100x cheaper than Ethereum mainnet.

Current ETH gas fees

While the project was initially scheduled to launch in March 2021, it got delayed until July 2021. The Optimism team felt that the ecosystem was not robust enough for the launch. Thus, in the initial stages, the team worked with a whitelist of projects, and in December 2021, they decided to remove the whitelist and release the fully permissionless mainnet. At LI.FI, we’re proud to say that we’ve been supporting cross-chain swaps to Optimism from the get-go, i.e., December 2021.

This article talks about Optimism and sheds light on some of the most popular dApps in its ecosystem.

Let’s dive in!

Source: Optimism Ecosystem

About Optimistic Rollups

ORs (Optimistic Rollups) are a type of layer 2 architecture that runs on top of Ethereum’s base layer. This allows smart contracts to be performed at scale while leveraging the security of the underlying layer, i.e., Ethereum. These structures are similar to Plasma, except instead of running Plasma, they run an EVM-compatible Virtual Machine called OVM (Optimistic Virtual Machine), which allows ORs to execute whatever Ethereum can.

The solution’s name, Optimistic Rollups, comes from how it works. ‘Optimistic’ is used since aggregators simply publish the bare minimum information required with no evidence, presuming that the aggregators do not conduct fraud and only provide proof in the event of fraud. Because transactions are committed to the main chain in bundles, the term ‘rollups’ is employed (that is, they are rolled up)

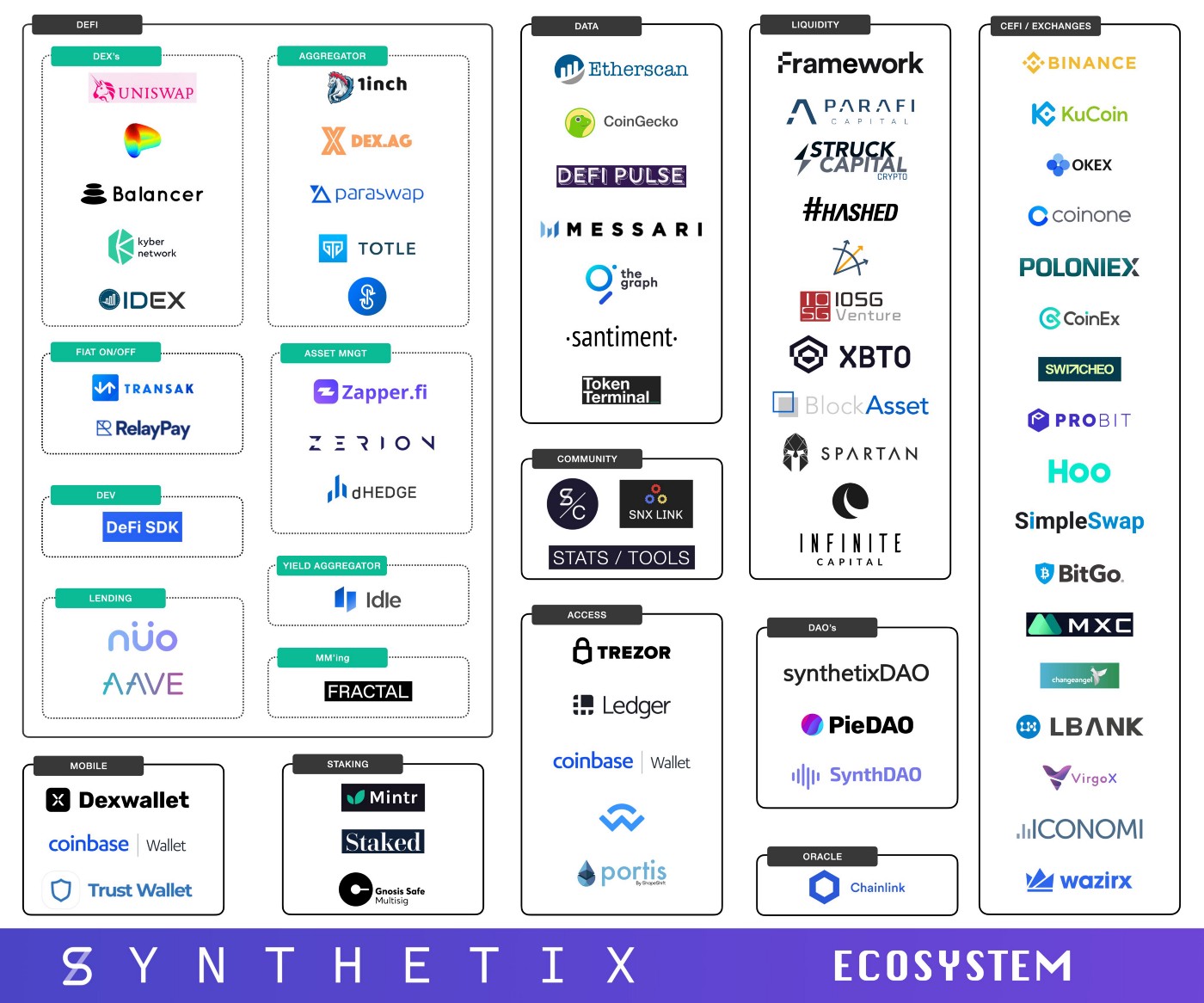

Optimism Ecosystem Overview

Since its launch in Dec ’21, Optimism has amassed a whopping $300mil in Total Value Locked (TVL). With many more dApps launching on Optimism soon, it’s only a matter of time before Optimism hits the $1B TVL mark.

Here’s an overview of the most popular dApps on Optimism that you can use by swapping via LI.FI:

The Big Three

Synthetix is by far the most dominant protocol on Optimism in terms of total value locked. At the time of writing, it accounts for more than 50% of TVL on Optimism. As the name suggests, Synthetix is a protocol that facilitates the creation of synthetic assets and thus gives users a way to gain exposure to assets without owning them. As long as reliable price feeds are available, synthetic assets can be created, allowing users to gain exposure to assets that do not exist on-chain. For example, the sDefi token that tracks the Defi Index. Inverse synths also exist on Synthetix. They allow users to receive short exposure to underlying positions or hedge against them. Some would even argue that Synthetix should be an L1 of its own, given the number of dApps in its ecosystem.

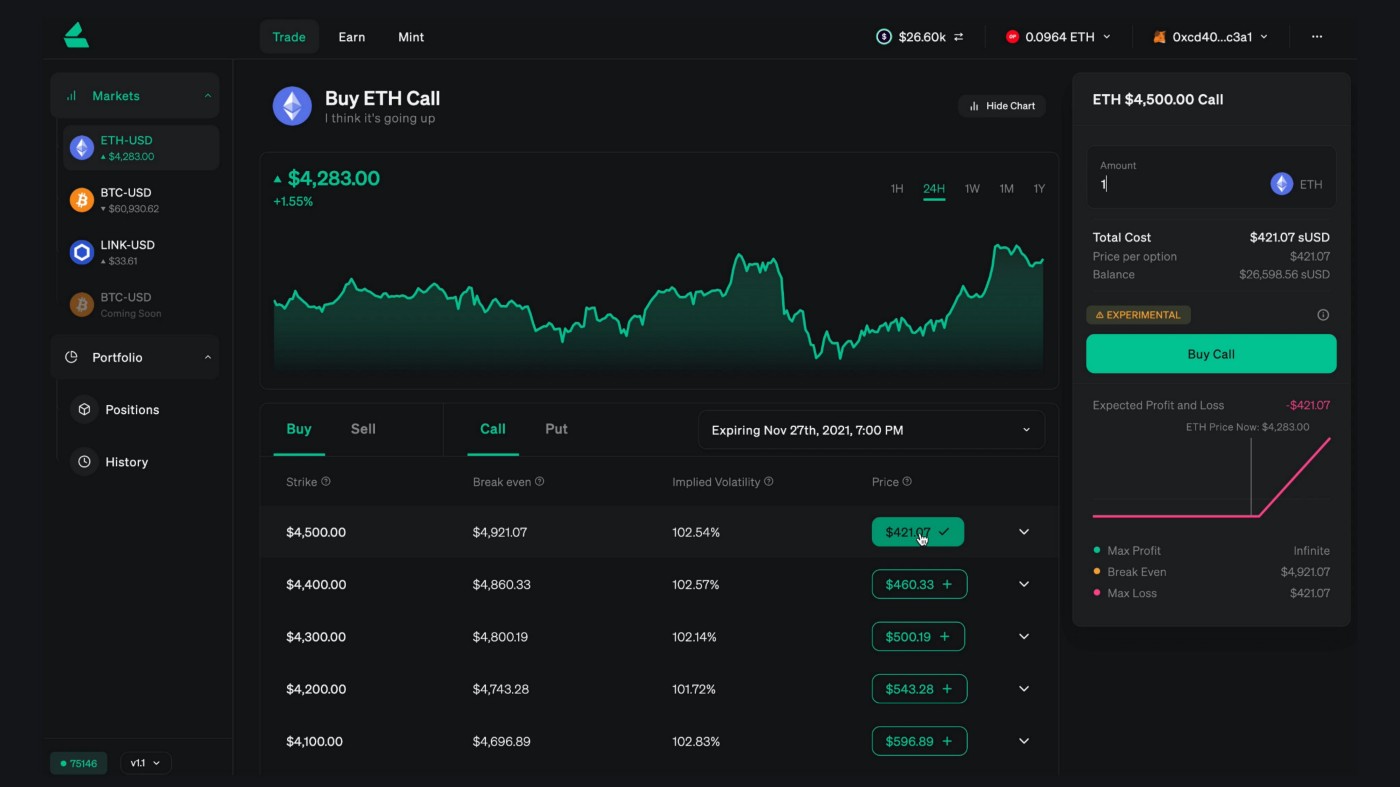

Lyra is an options automated market maker that allows traders to sell or buy options. In traditional finance, options play a critical part. This is no different in the crypto ecosystem, allowing traders to obtain leverage, manage risk, and craft their desired payout structure. However, on-chain options haven’t exactly taken off due to several teething issues, including impermanent losses, improper hedging, and low liquidity. By being native to the Optimism network, Lyra aims to tackle these challenges by running computationally intensive calculations, which would be very gas-intensive on L1 environments. For example, to protect liquidity providers against price movements, Lyra automatically shorts or longs the underlying assets using the Synthetix protocol

Uniswap is the largest Decentralized Exchange (DEX) on the Optimism network. While Uniswap started on the Ethereum network, they have since broadened their reach to other networks, reflecting the growing reality of a multichain future. The primary function of DEXs is to allow users to swap between tokens. They also allow users to provide liquidity on these protocols to generate yields on their assets.

Optimism Native dApps

Kwenta is one of the most widely used Optimism native dApp. It is a derivatives exchange that allows users to trade synth assets from Synthetix with infinite liquidity and zero slippage. This is made possible due to the innovative liquidity model of Synthetix. What is particularly interesting about Kwenta’s model is it removes several limitations imposed by centralized exchanges. This includes enabling trading against a smart contract (as opposed to a counterparty) and removing limitations on trading pairs (since any synth can be traded for another pair). Most importantly, Kwenta is permissionless and non-custodial, thus building on the ethos of Web3.

Source: Kwenta

NFTs

NFTs exploded in 2021, and thus it comes as no surprise that Optimism has a fair share of NFT projects. One of the up-and-coming NFT projects on Optimism would be Quixotic. If unpredictable or expensive gas fees on Ethereum mainnet have made it impossible for you to begin your NFT investing journey, then Quixotic may just be for you. Despite only recently launching in December 2021, the platform has already garnered close to 100ETH in trading volume!

Source: Quixotic

Other notable NFT projects on Optimism include OptiPunks, Dope Wars, Optimistic Bunnies, Optimistic Loogies, tofuNFT, and oe40s.

So, how can users explore the Optimism ecosystem?

By using cross-chain bridges individually or using a bridge aggregator like LI.FI that integrates the best bridges in the ecosystem and allows users to move their assets onto and from the Optimism network.

To learn more about Optimism, check out:

The future is multi-chain and we strive for more interoperability. Our aim is to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Optimism in the Li.Fi family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore Optimism By Swapping With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.