Explore Harmony By Swapping With LI.FI

LI.FI Interoperability Expands To Harmony

Harmony is a layer 1 blockchain. It launched in 2018 and became operational as an EVM compatible chain in 2019. It can be used as a layer 2 solution too, but most transactions take place on its base layer.

Harmony began with an initial private seed round in May 2018, raising around $18 million from companies like AU21 Capital. In the following year, Harmony conducted an initial exchange offering (IEO) via Binance, raising another $5 million. Since then, Harmony has exploded to become a top 20 chain by total-value-locked (TVL).

Harmony leverages random state sharding and an effective proof-of-stake (EPOS) consensus algorithm to secure its chain.

Interestingly, Harmony was the first sharding-based layer 1 system to go online, allowing the problems of network congestion, speed, and throughput to be tackled by splitting the blockchain into different shards. To conceptualize this, sharding can be compared to moving from a one-lane highway to a five-lane highway. Increasing the number of lanes lets more users/cars access the highway/blockchain in a faster and cheaper manner.

Sharding, however, does come with a trade-off: aka the “tolling” system. To continue with the highway-based mental model, the tolling station would be the validators, and the cars would be transactions passing through the station for inclusion in a block. With one lane, there is only one tolling station on a highway, making it extremely difficult for a bad actor to bribe or overrun a single station, as the security of the highway (police in real life, validators in the mental model) will be completely focused on protecting the one station.

However, with five tolling stations, the chances of bribing (controlling enough validators to operate an entire shard) one of the five lanes is higher than with one, which opens up the highway (aka Harmony in this example) to the threat of 1/5 of transactions/cars being malicious or faulty.

To counter the threat of any single shard being controlled, Harmony has deployed a system called effective proof of stake (EPOS), which removes the danger of single parties with large amounts of tokens controlling the majority of nodes by having because each shard included in the block requires 250 validators — and after each block is mined, a new random set of 250 validators will be responsible for any given shard. This prevents a subset of nodes from dominating any specific shard, leading to the effective use of EPOS and sharding, delivering users low transaction costs and transaction finality of 1–2 seconds.

Graphic provided by Harmony in its documentation!

As a chain, Harmony had just under $200,000 in total value locked in early March 2021. However, projects have gained plenty of traction since then and now have roughly $300 million locked in over 54 dApps.

Furthermore, in September, Harmony announced a fund of $300 million worth of grants to various aspects of the ecosystem, like DAOs, bounties, and partnerships.

This article discusses Harmony and sheds light on some of the most popular dApps in its ecosystem — which can be utilized after bridging assets via LI.FI.

Let’s dive in!

Exploring the Harmony Ecosystem

The Harmony ecosystem is perfect for the retail user, as its design offers extremely fast transaction speeds at low costs to the user. Let’s take a look at the many dApps available on Harmony that you can use by swapping with LI.FI today.

Harmony Ecosystem

DeFi Kingdoms

Any deep dive into Harmony would be incomplete without detailing DeFi Kingdoms (DK), a viral P2E game bundling DeFi primitives into a UX reminiscent of Runescape and Clash of Clans.

DK transforms the standard DeFi experience into a game. Instead of the usual standard DEX screen, with a basic swap interface and liquidity provision button, DK completely gamifies this process into a video game-like experience for users. For example, the Harmony ecosystem token required to play can be purchased in the DK marketplace, yield farming opportunities are found in the DK gardens, and staking the native DK token, $JEWEL, can be done in the bank.

Image courtesy of DeFi Kingdoms’ documentation!

Furthermore, DK is built with NFTs top of mind, as heroes and real estate are both tokenized via NFTs.

DK heroes have various rarities and characters, affecting how often they can go on quests or summon new heroes. Heroes can be purchased in the tavern and are used to complete quests, which can potentially earn rewards for gamers that are exchangeable for any token available in the marketplace, including stablecoins (this is the P2E aspect). According to their documentation, DK also has extensive plans for land plot NFTs. The first plots of land were released in January 2022. DK promises there will be more to come on that front.

Notably, DK has expanded outside of Harmony and now has a gaming experience called Crystalvale available on an Avalanche subnet called DFK Chain.

(Of course, LI.FI can help users bridge assets to Harmony and Avalanche to play DK).

Decentralized Exchanges (DEXs)

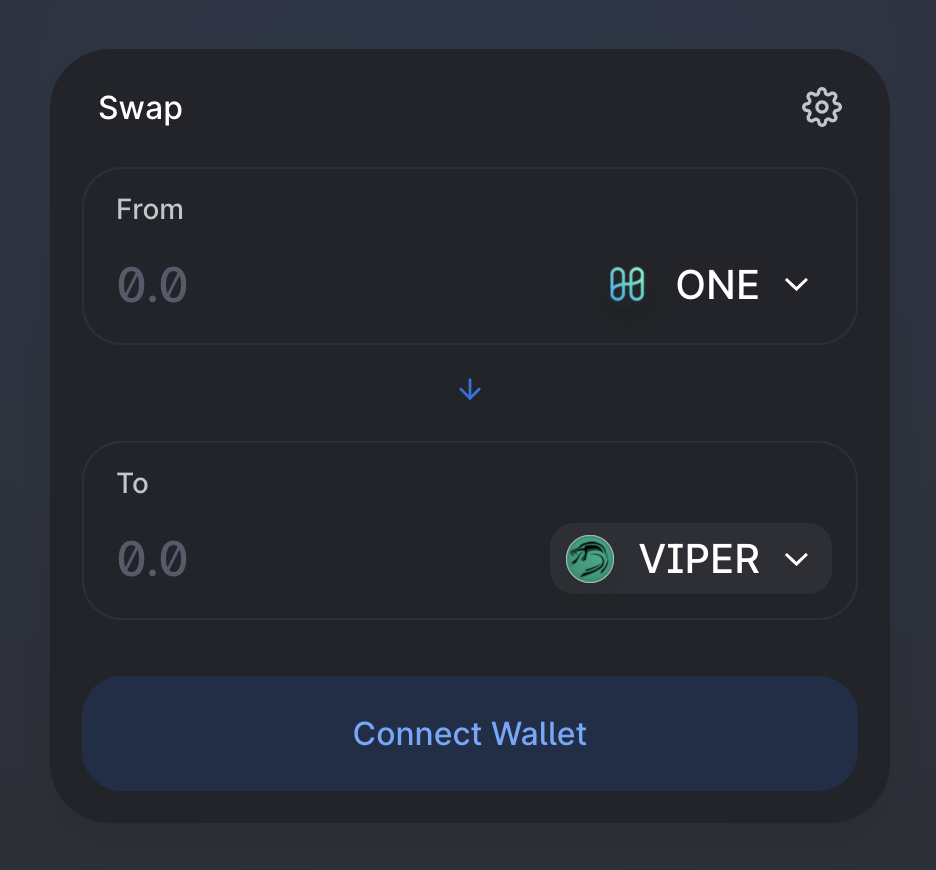

The primary DEX on Harmony is DeFi Kingdoms. Additionally, there are two other native DEXs with over $5 million in TVL on Harmony: ViperSwap, which launched in March of 2021, and FoxSwap, a DEX that shares some characteristics with Olympus DAO.

ViperSwap UIEthereum native DEXs such as Sushiswap and Curve also have markets available on Harmony, which provides users with more mainstream avenues to perform transactions, such as earning $SUSHI rewards instead of $JEWEL, which is a more risk-averse strategy for making yield.Additionally, Curve provides users with the classic 3pool consisting of DAI, USDC, and USDT.

LI.FI wants to enable access to all of these markets while helping dApps on Harmony maximize their UX.

Lending Protocols

Tranquil Finance is the leading money market protocol on Harmony and the largest dApp by TVL on the chain. Tranquil allows participants to leverage not only $ONE (the native token of Harmony) and wrapped blue-chip tokens, but also staked $ONE — meaning users can lever up their exposure to $ONE. Since late December, the protocol has experienced rapid growth in TVL, which has increased from $30m to $85m as of writing time.

Image courtesy of Tranquil Finance’s Twitter page.

In addition to Tranquil, Aave V3 is also available on Harmony and currently has about $13 million in total value locked into the lending protocol.

LI.FI is an incredibly user-friendly cross-chain bridge aggregator. By supporting any-to-any swaps, LI.FI users can easily access lending markets like Tranquil and Aave on Harmony.

Additional Harmony dApps

This section is about the fantastic dApps running on Harmony that haven’t been mentioned above.

Harmony Logo

Here’s a list of some of the most widely used Harmony dApps:

Mars Colony — play-to-earn game allowing gamers to settle on Mars.

Hermes DeFi — a trader-focused DEX and overall DeFi platform built on Harmony.

StakeDAO — a staking platform that facilitates $30 million+ in staking on Harmony and hundreds of millions of dollars on other chains.

Hundred Finance — a multi-chain lending protocol that utilizes Chainlink.

Euphoria Money — an algorithmic reserve currency protocol launched by Venom DAO.

WAGMI DAO — a multichain DEX that first launched on Harmony as an Olympus fork but has since expanded to other chains.

To see a list of all the ambitious projects integrating on Harmony, check them out here!

How Can Users Explore Harmony?

LI.FI has already integrated the best bridges in the ecosystem, including cBridge and Multichain, enabling users to move their assets to and from the Harmony network. As a cross-chain bridge and DEX aggregator, LI.FI can facilitate any-2-any swaps — meaning Harmony users can swap any token from the plethora of chains we support to any token available on Harmony. LI.FI will route the transaction through a multitude of DEXs and bridges to find the most efficient, cost-effective route from chain to chain, and, with just a few clicks, a user can approve the transaction.

To learn more about Harmony, check out:

Conclusion

The future is multi-chain and LI.FI always strives for more interoperability. We aim to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Harmony in the LI.FI family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

Get Started With LI.FI Today

LI.FI is the most advanced bridge aggregation protocol on the market. Our smart contracts have been audited twice (Code4rena — March ’22, Quantstamp — April ’22), and our team consists of 25 people fully dedicated to the cross-chain space. LI.FI has aggregated 9 bridges across 15 EVM compatible chains, along with all available DEX aggregators & DEXs on those chains, into a single solution.

Special features: whitelisting, blacklisting, and a “prefer” function allowing integration partners to customize the suite of bridges that they utilize to their liking (e.g., if the project only trusts trust-minimized bridges like Connext & Hop). Here is a list of LI.FI supported chains, bridges, and DEXs.

Our widget and SDK are the ultimate cross-chain money legos for dApps to build on top of or plug into themselves.

We’ve integrated multiple fallback bridges+DEXs so that you don’t have to

We maintain bridges+DEXs so that you don’t have to

We choose the best bridges based on our research so that you don’t have to (positioning ourselves neutral)

For further examples of how LI.FI works, please refer to:

Alps Finance — SDK integration

Transferto.xyz — LI.FI B2C interface

Cross-Chain Klima Staking — Custom built cross-chain staking product for Klima

(Special thank you to Jonas Bahceli for writing this post.)

FAQ: Explore Harmony By Swapping With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.