Explore BNB By Swapping With LI.FI

LI.FI Interoperability Expands To BNB Chain

BNB Chain is a hard fork of the Go Ethereum protocol, created by Binance, in which we can find the BNB Beacon Chain and the BNB Smart Chain (previously BSC). In the Beacon chain, users can find all governance purposes related, allowing staking and voting. At the same time, the Smart Chain is the EVM compatible layer, through which users can interact with dApps.

The BNB Smart Chain runs on a Proof of Staked Authority (PoSA) consensus model. This model leverages aspects from PoS and PoA, whereby users can earn staking rewards by delegating BNB to a given authority validator. Such models rely on a smaller amount of validating nodes, however, these usually are entities with an established reputation. In moving from BSC to BNB chain, the number of validators has also greatly increased, from 21 to 41. These models allow for larger throughput capacity, and they require minimal computational effort.

BNB Chain: Building Beyond

BNB raised $10 million in a Series A funding round by the likes of Sequoia Capital and Black Hole Capital. Binance itself has also made valuable deals by itself, acquiring companies such as Trust Wallet and CoinMarketCap. Through such acquisitions, the company is gathering extremely valuable insight into the interests of everyday users.

BNB Chain eclipses the majority of other chains in a variety of factors. As of early March 2022, there were 321 protocols active on BNB, and the TVL reached $11.95b, the only chains to surpass are Terra and Ethereum. A large number of protocols, matched with extremely low gas fees, have led the chain to have the highest number of active users, at around 1 million daily. Our goal at LI.FI is to make cross-chain communication seamless for every user, so welcoming BNB Chain to the LI.FI family was a priority!

This article talks about BNB and throws light on some of the most popular dApps in BNB’s ecosystem.

Let’s dive in!

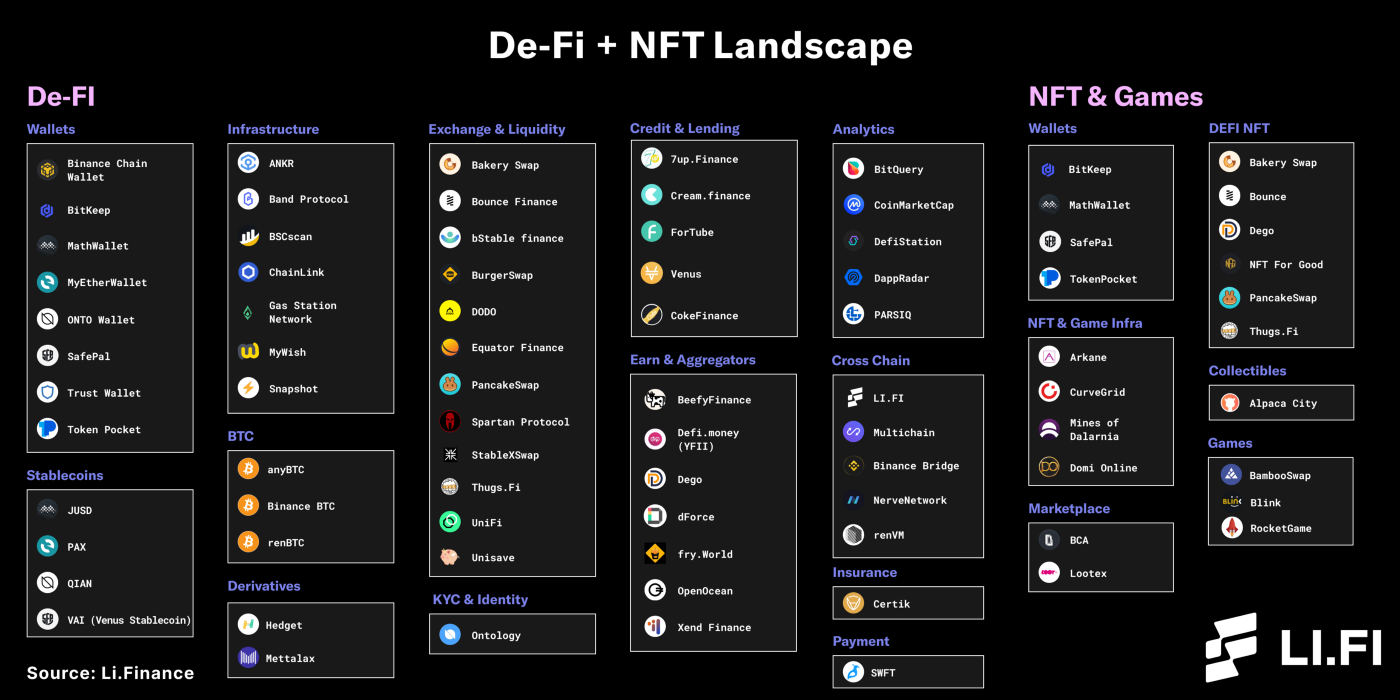

BNB Chain Ecosystem Overview

Exploring the BNB Ecosystem

BNB Chain has been operational since September 2020 and saw a giant leap in TVL in the early stages of 2021. A large contributor to this leap was the amount of liquidity being brought into markets such as Pancakeswap, following outside interest for a variety of tokens, including many dogecoin imitators.

Here’s an overview of the most popular BNB dApps that you can use by swapping with LI.FI:

PancakeSwap DEX

Decentralized Exchanges (DEXs)

The most pivotal dApp residing on the BNB Chain is Pancakeswap. Of the nearly $12b locked on BNB, $4.3b of that alone is provided on the Pancakeswap Dex. This DEX has offered users liquidity into every token one might be searching for on the chain, and besides usual LP-ing, a variety of tokens can be earned in the Syrup pool through staking CAKE. Each week whitelisted projects may bid on their pairs through an auction method, which results in the right to host a 7-day farm on the platform. Prizes may also be won through lottery and trading competitions. PancakeSwap has also opened its own NFT market, allowing users to buy and sell their favorite BNB NFTs without having to look for another marketplace.

DEX Aggregators such as 1inch, also saw the value in extending to the BNB Chain, having done so early 2021. Other options on BNB include DEXs such as MDEX and BiSwap, both launching shortly following the surge of liquidity on Pancakeswap in the spring of 2021.

LI.FI aims to support asset swapping on all major chains, thus integrating a chain the size of BNB was made a paramount task. Anyone that integrates the LI.FI SDK, will allow their users to make any-2-any swaps to DEXs and markets on BNB Chain.

Mines Of Dalarnia NFT Game

Gaming and NFTS

Following the surge in the NFT space in 2021, there has been a rapid shift in interest in types of NFTs. While the initial stage was flooded with “profile picture” NFTS (PFPs), such as Cryptopunks and Bored Apes, in-game collectibles and playable characters have shifted the space to more utility which users can monetize.

Mines of Dalarnia is an example of such. It is an action-adventure game that leverages in-game real estate plots where users can fight monsters and also find resources, while the landowners also benefit from action on their plot. Soon quests and in-game unlockables will be monetizable through the Binance NFT Marketplace, where assets can be traded for the in-game currency DAR.

For players who enjoyed the likes of Runescape or World of Warcraft, similar type MMORPG are also being built atop of BNB chain. One example is Domi Online, and while such games are not fully playable yet, if they can live up to the joy that was brought to so many gamers and add a financial incentive to them, an unthinkable amount of new entrants could join the space.

In order to give gamers a swift and seamless entrance into opportunities as such, LI.FI provides the perfect tool to transfer value from any of the supported chains onto BNB chain.

Venus Protocol

Lending Protocols and Yield Aggregation

Users who enjoy borrowing assets against their tokens, are given the option to do so on Venus. The wrapped versions of established tokens such as BTC and ETH, yield under the 1% mark, while stables offer around 3%, making Venus a competitive platform to other lending markets on other chains. The Venus dashboard also includes a prediction market, where users may bet on a high/low game for the prices of BNB, Venus and BTC.

Alpaca Finance is another lending market, also being present on Fantom, however with the majority of it’s TVL on BNB. Where the real difference in this protocol comes is in the leveraged yield farming. Users have a choice of 58 pools currently, where they can take leverage up to 4x on these pools. While rewards may be boosted, this also comes with a danger of liquidation if price moves too far against the subject, so caution is recommended.

Native BNB dApps

This section is about the amazing dApps built natively on BNB that haven’t been mentioned above. Here’s a list of some of the most widely used native BNB dApps:

Tranchess — Built natively on BNB, Tranchess is a yield-enhancing asset tracker with options for different risk appetites.

Ellipsis — Ellipsis is an authorized curve fork, providing low slippage stable swaps for wrapped BTC tokens and stablecoins.

Binance Launchpad — While Binance Launchpad isn’t a dApp per se, it is a Binance created platform where projects receive advice on how to best launch their token, and from there it can be directly offered to users.

Bakery Swap — Users are given the choice to use other DEXs on BNB, such as

, whereby they can provide liquidity to earn BAKE and also use the NFT marketplace provided by the protocol.

There’s a nearly endless list of ambitious projects integrating BNB, and you can check them out on BNB project overview.

So, how can users explore the BNB ecosystem?

By using cross-chain bridges individually or using a bridge aggregator like LI.FI that integrates the best bridges in the ecosystem and allows users to move their assets onto and from the BNB Chain.To learn more about BNB, check out:

The future is multi-chain and we strive for more interoperability. Our aim is to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have BNB in the LI.FI family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore BNB By Swapping With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.