LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Explore Avalanche By Swapping with LI.FI

LI.FI Interoperability Expands To Avalanche

Avalanche is a platform for deploying dApps and blockchains in a unified interoperable ecosystem. Avalanche’s consensus mechanism offers high-speed transaction finality without sacrificing decentralization, and the network’s Ethereum compatibility allows developers to port their Solidity smart contracts over rapidly and painlessly.

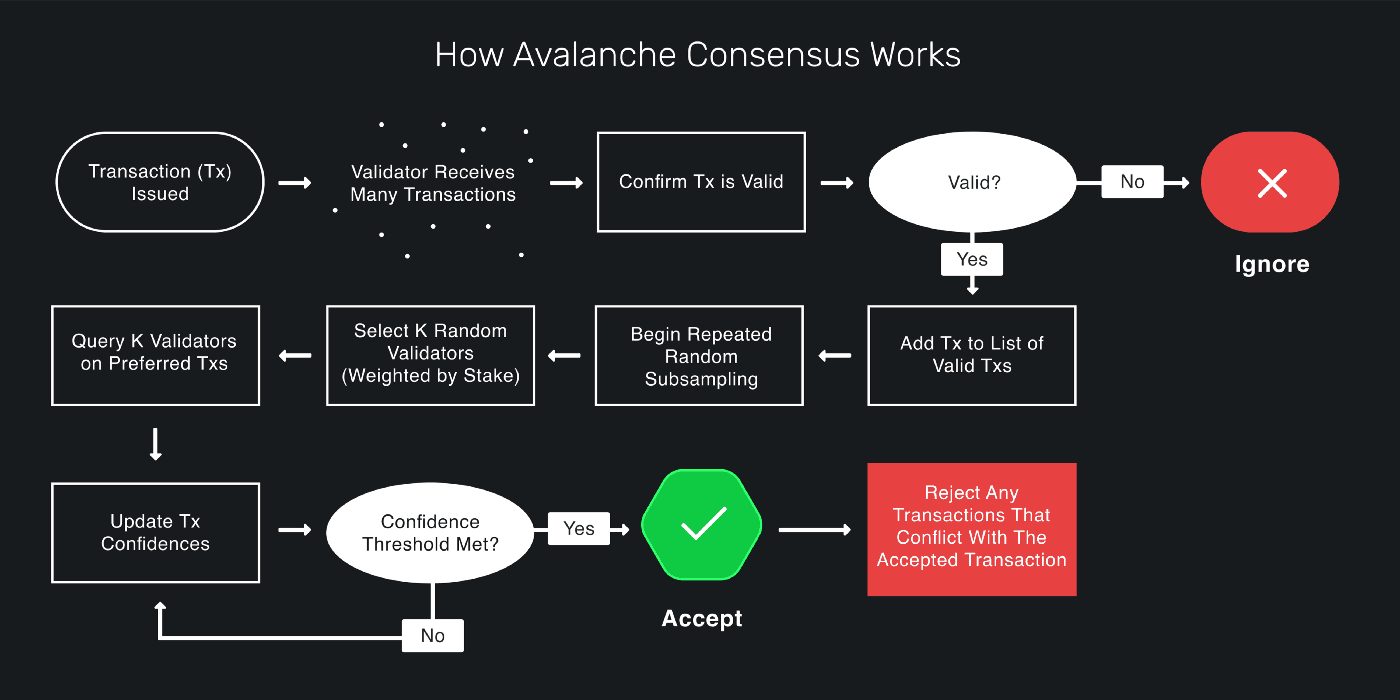

As described in their whitepaper, Avalanche’s consensus protocol uses sub-sampling to speed up the validation process. Validators ask a random subset of other validators whether they think a given transaction should be accepted or rejected, and repeat the process until a sufficiently large portion of the queried validators reply the same way (accept or reject) for multiple consecutive rounds of sampling.

Source: Avalanche Docs

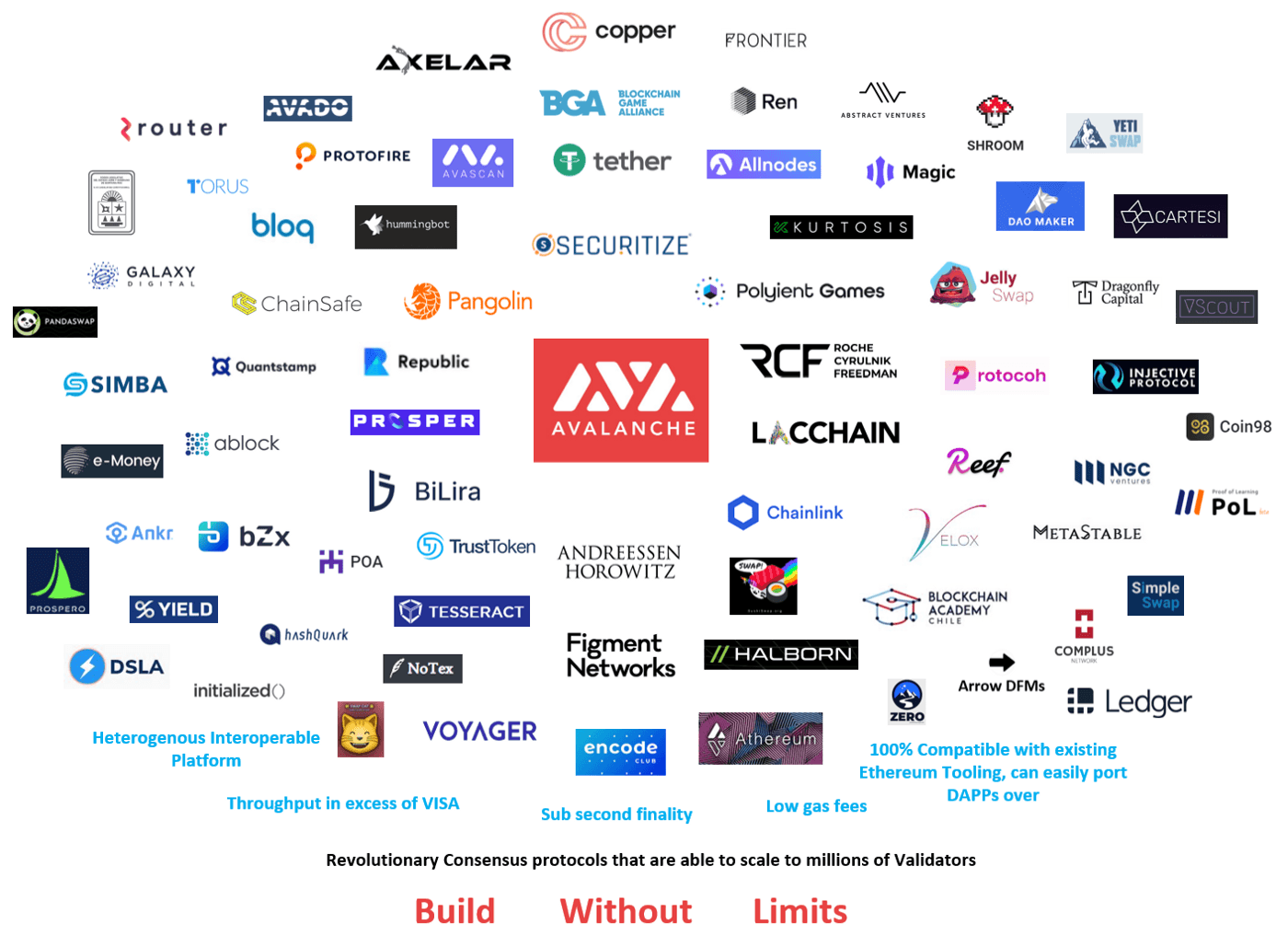

This protocol enables rapid transaction without requiring a high degree of centralization of the validator network, which has proven extremely attractive to the crypto world. Major organizations have hopped on the opportunity to integrate with the network, which has caused its TVL to shoot to an astounding $10 billion. Both DeFi and traditional financial institutions have joined in, from AAVE to Mastercard, and the list of new partnerships will only continue to grow.

This article talks about Avalanche and throws light on some of the most popular dApps in Avalanche’s ecosystem.

Let’s dive in!

Source: SEQ on Medium

Exploring the Avalanche Ecosystem

Ava Labs launched Avalanche mainnet in September of 2020 as a high-speed Ethereum competitor, and since then have raised hundreds of millions in token sales, and launched funds to supercharge the growth of their dApp ecosystem.

Here’s an overview of the most popular Avalanche dApps that you can use by swapping with LI.FI:

Source: Binance Academy

Decentralized Exchanges (DEXs)

One of the biggest moves Avalanche made was announcing its Rush program, which offered financial incentives to DeFi protocols deploying on its network. The first DEX to take advantage of this free-flowing cash was Curve Finance, which was gifted $7 million in AVAX tokens to reward users who took advantage of its AMM functionality on the Avalanche network.

Another major win was Sushiswap, which deployed on Avalanche earlier in 2021 following the creation of the Avalanche-Ethereum Bridge. This was during a time of tremendous growth in DeFi for Avalanche, when DEX aggregators like Rubic and Paraswap were joining in, and a Chainlink partnership was also underway.

We at LI.FI believe swapping assets into this ecosystem shouldn’t be limited to those who own assets or use wallets supported by the DEXs currently integrating Avalanche, which is why we’ve built an SDK that enables any-2-any swaps of EVM-compatible crypto assets to Avalanche and other major networks. Check out our docs to get a swap onto the Avalanche network today.

Source: Avalanche on Medium

Gaming & NFTs

Even NFTs have a place in DeFi, and Avalanche made sure to tap into this field by partnering with Polyient Games. Polyient and Avalanche began building a decentralized exchange for NFT’s in the summer of 2020, and the project promises peer-to-peer decentralized gaming and art-related NFT swaps for its users.

More recognized NFT projects have also integrated with Avalanche, including NFT minting tool, Unifty, as well as NFT market and wallet provider, Venly. These integrations rounded out an ecosystem that now enables the minting, trading, selling, and farming of NFT’s on the Avalanche network, and more partnerships are being worked on every day.

Engaging in this market will be a huge win for NFT artists and collectors alike, as Avalanche’s unique consensus mechanism keeps its transaction costs far below those of popular competitors like Ethereum.

Source: Crypto Slate

Lending Protocols

Another major win for Avalanche when they launched their Rush initiative was their integration with AAVE, the popular lending protocol. Rewards were dispersed to lenders and borrowers on the Avalanche deployment of AAVE, encouraging economic activity within the ecosystem.

A month later, in November 2021, NEXO became the next big lending platform to add support for Avalanche via the network’s native AVAX token. That December, Nereus, a newer face in the DeFi landscape, enabled cross-chain lending for the Avalanche ecosystem.

As Avalanche continues incentivizing new DeFi initiatives on its network, accessing that liquidity will only look more enticing over time. DApp developers who integrate LI.FI can already tap into Avalanche’s growing, well-funded lending ecosystem right now, enabling any-2-any cross-chain swaps with a few lines of code, or by integrating our widget into their user interfaces.

Native Avalanche dApps

This section is about the amazing dApps built natively on Avalanche that haven’t been mentioned above. Here’s a list of some of the most widely used native Avalanche dApps:

BenQi — Built natively on Avalanche, BenQi is a DeFi liquidity market protocol with a focus on approachability, ease of use, and low fees.

Trader Joe — This trading platform combines DEX services with DeFi lending to offer leveraged trading opportunities to the Avalanche ecosystem. Trader Joe enables trading, farming, staking, and borrowing tokens.

Teddy Cash — Teddy Cash is a decentralized borrowing protocol with interest-free loans on the Avalanche network. Loans can be over-collateralised up to 150%.

Avalaunch — Avalaunch is the first decentralized fund-raising platform for projects launching on the Avalanche protocol. Their site serves as the starting point for many new ventures in the Avalanche ecosystem.

There’s a nearly endless list of ambitious projects integrating Avalanche, and you can check them out on Avalanche’s official projects and dApps page.

So, how can users explore the Avalanche ecosystem?

By using cross-chain bridges individually or using a bridge aggregator like LI.FI that integrates the best bridges in the ecosystem and allows users to move their assets onto and from the Avalanche network.

To learn more about Avalanche, check out:

The future is multi-chain and we strive for more interoperability. Our aim is to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Avalanche in the LI.FI family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore Avalanche By Swapping with LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.