LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Explore Arbitrum By Swapping Cross-Chain With LI.FI

LI.FI interoperability expands to Arbitrum

Home to a diverse range of protocols, Arbitrum is one of the most popular Ethereum scaling solutions. Li.Finance has been supporting cross-chain swaps to Arbitrum One since October 2021, enabling users to enjoy Arbitrum’s low transaction fees and thriving ecosystem.

This article talks about Arbitrum and throws light on some of the most popular dApps in its ecosystem.

Let’s dive in!

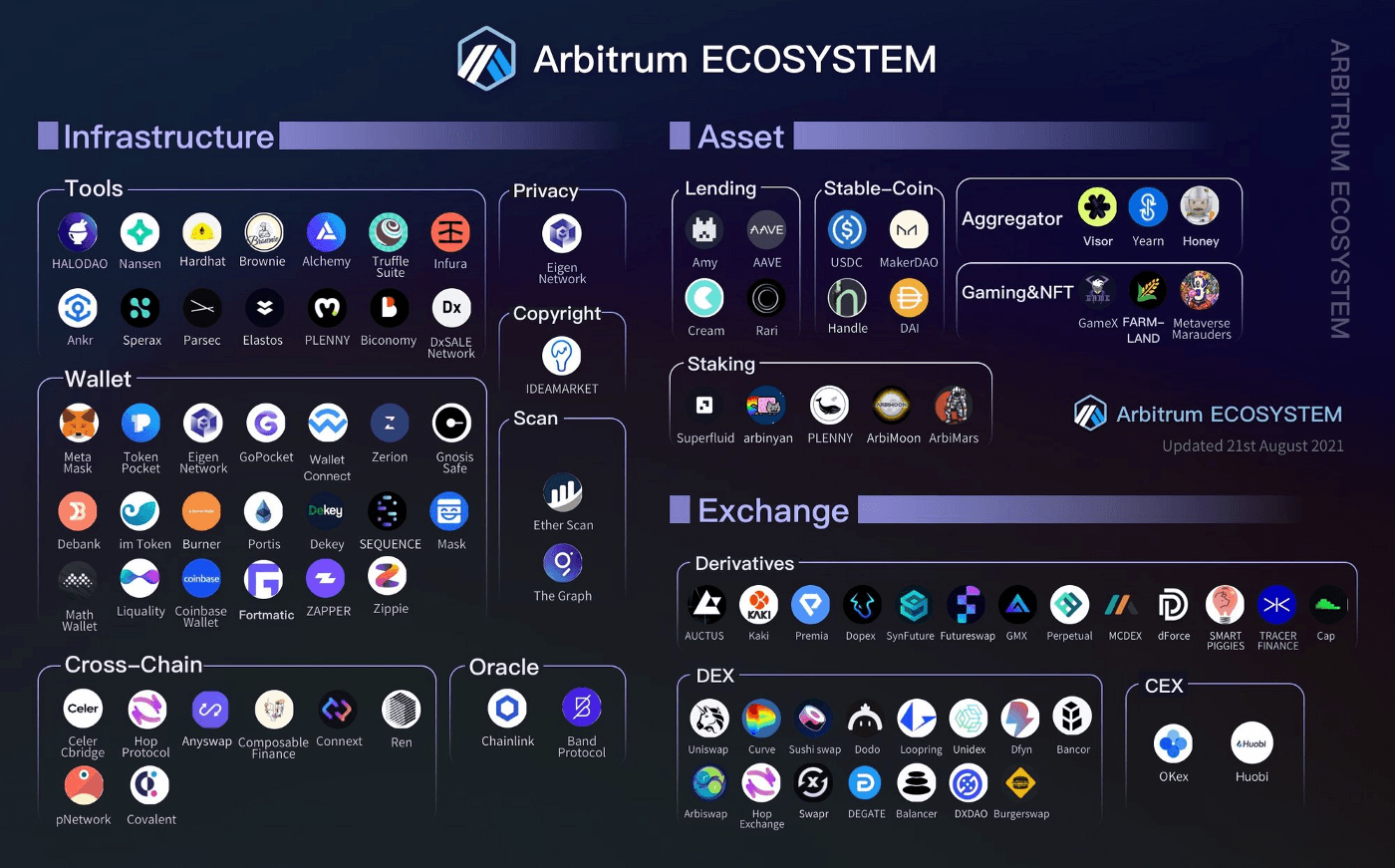

Source: @arbitrum

Exploring The Arbitrum Ecosystem

While Offchain Labs launched the mainnet beta of Arbitrum one to developers in May 2021, it publically launched on August 31st, 2021. Since its launch, Arbitrum’s ecosystem has been growing rapidly and boasts a great mix of native protocols and multi-chain giants that account for 27.79% of the TVL on Arbitrum.

Source: Eigen Network

Here’s an overview of the most popular dApps on Arbitrum that you can use by swapping via Li.Finance:

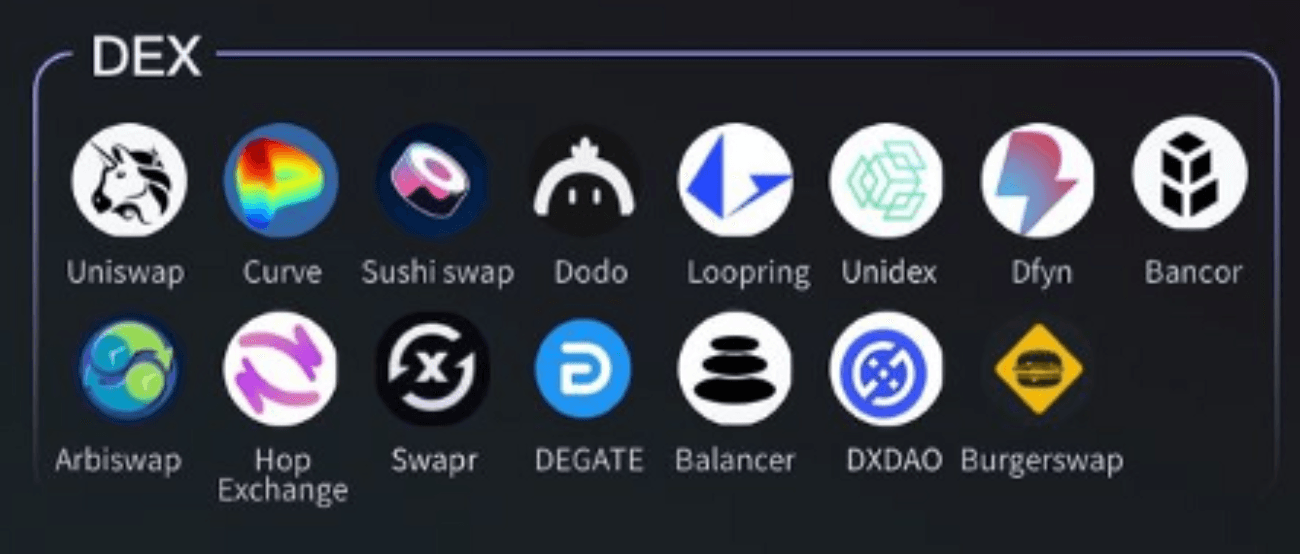

Decentralized Exchanges (DEXs)

Arbitrum is home to 3 of the most popular DeFi protocols Uniswap, SushiSwap, and Curve. While these protocols started on the Ethereum network, they have since broadened their reach to other networks, reflecting the growing reality of a multichain future. The primary function of DEXs is to allow users to swap between tokens. While Curve focuses on stablecoin swaps, Uniswap and SushiSwap offer a broader range of tokens for users to trade. Once again, users can provide liquidity on these protocols to generate yields on their assets.

DEXs on Arbitrum

Lending Platforms

No ecosystem would be complete without the presence of lending platforms. These protocols allow users to generate yield on their assets by depositing them. More aggressive traders can also borrow against their deposits to make bets on a different token. For example, suppose a trader expects the price of token X to increase but still wants to maintain exposure to ETH. In that case, they can deposit ETH on Abracadabra, borrow funds (denominated in Magic Internet Money) from the protocol, and purchase token X using the borrowed funds. Some of the most popular lending platforms on Arbitrum include Hundred Finance, Rari, Cream, Amy.Finance, and Abracadabra.

Gaming & NFT

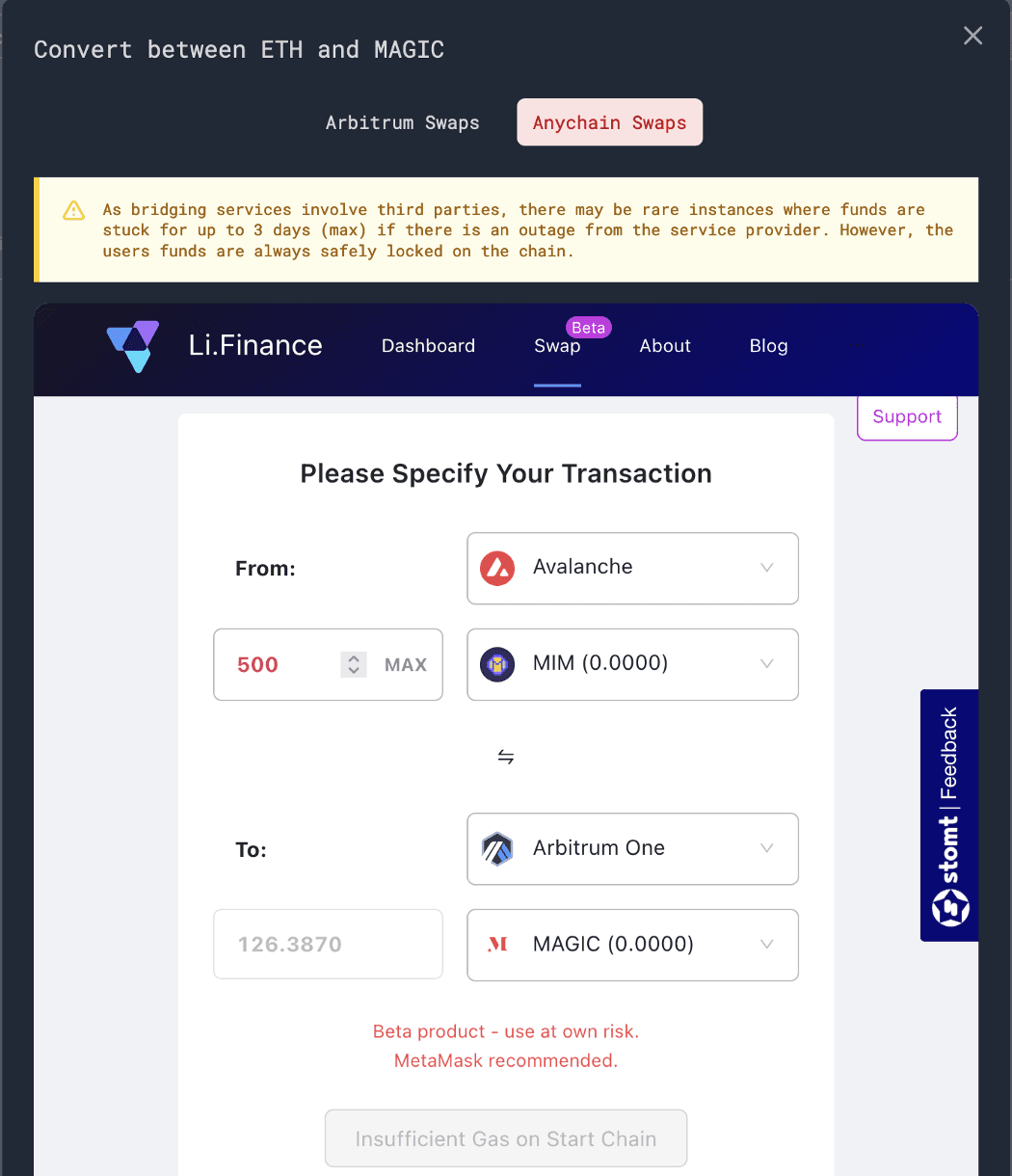

NFTs and GameFi exploded in 2021, and it thus comes as no surprise that Arbitrum will have its share of Gaming and NFT projects. TreasureDAO is one of the biggest Metaverses and NFT marketplaces on Arbitrum. Treasure started as an NFT project on Ethereum, which they later migrated to Arbitrum to build their own metaverse on L2 Ethereum.Treasure’s NFT marketplace is where you can buy Treasures, Legions, and other NFTs like Smol Brains, one of the most successful NFT projects on Arbitrum with over $35M (or 13M+ $MAGIC) in traded volume. Their NFT marketplace is set to launch more NFT projects like Olympus Odyssey, Imperium, LIFE, etc.

Note: TreasureDAO recently integrated our cross-chain swap widget. Users can now swap their funds from any asset on any chain to their native token $MAGIC on Arbitrum One and explore the TreasureVerse.

Cross-chain swap on Treasure Marketplace powered by Li.Finance

Native Arbitrum dApps

This section is about the amazing dApps built natively on Arbitrum but haven’t been mentioned above. Here’s a list of some of the most widely used native Arbitrum dApps:

DOPEX — DOPEX is a maximum liquidity and minimal exposure options protocol.

GMX — GMX is a decentralized perpetual exchange that allows trade BTC, ETH, AVAX, and other top cryptocurrencies with up to 30x leverage directly from your wallet

Umami Finance — Umami is the premier market-maker and liquidity network natively built on Arbitrum.

Cap Finance — CAP is a free decentralized perpetual exchange that allows users to trade crypto perpetuals with 0% fees.

Premia Finance — Premia is a decentralized options protocol that provides fully-featured peer-to-pool trading and capital efficiency to DeFi options.

To learn about more Arbitrum native dApps, we highly encourage you to check out the amazing thread by @ExaltedFoks, which gives readers an inside scoop on the dApps and has some fire memes.

@ExaltedFoks on Twitter

So, how can users explore the Arbitrum ecosystem?

By using cross-chain bridges individually or using a bridge aggregator like Li.Finance that integrates the best bridges in the ecosystem and allows users to move their assets onto and from the Arbitrum network.

To learn more about Arbitrum, check out:

The future is multi-chain and we strive for more interoperability. Our aim is to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Arbitrum in the Li.Fi family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore Arbitrum By Swapping Cross-Chain With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.