LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Circle's Cross-Chain Transfer Protocol (CCTP) — A Deep Dive

All You Need to Know About Circle CCTP

Today, we’re expanding our knowledge hub by learning more about Circle’s Cross-Chain Transfer Protocol (CCTP).

This article examines the design, security, and trust assumptions of CCTP, highlighting its unique features and tradeoffs by thoroughly analysing its architecture.

Here, we will cover the following:

CCTP — An Overview

How It Works — Transaction Lifecycle

Trust Assumptions & Tradeoffs

Supported Networks & Resources

Let’s dive in!

CCTP — An Overview

The Cross-Chain Transfer Protocol (CCTP), developed by Circle, facilitates the seamless movement of native USDC across various blockchains.

CCTP streamlines the transfer of USDC by directly minting and burning tokens on the respective blockchains, eliminating the necessity for bridged token versions.

The Origins of CCTP

Circle's vision for a multi-chain ecosystem is reflected in the deployment of USDC across various chains in recent years. Their dedication to expanding across multiple blockchains stems from the conviction that each chain offers unique opportunities for innovation and diverse user experiences. With the goal of making USDC an omnipresent digital dollar, Circle has endeavoured to anchor USDC's ubiquity throughout the blockchain ecosystem.

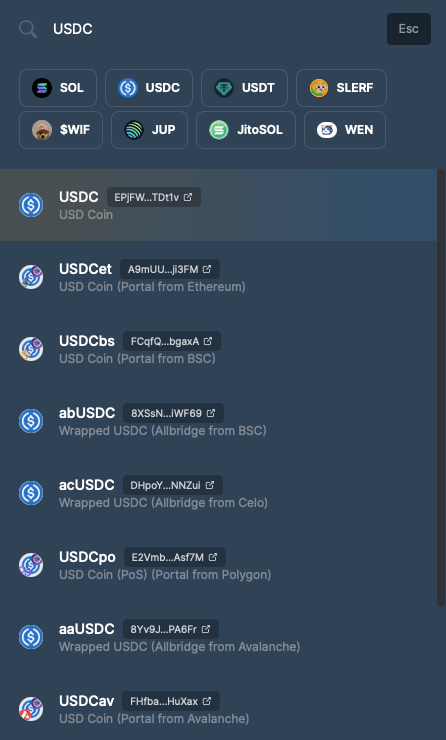

As time has passed, a variety of lock and mint USDC bridging methods have surfaced, leading to the fragmentation of liquidity into multiple wrapped asset forms. Consider that on Solana alone, there exist 11 distinct verified wrapped USDC variants, along with numerous unverified ones. This results in a fragmented liquidity landscape and creates uncertainty for developers about which version to adopt.

Circle recognized a chance to tackle the issues of liquidity fragmentation and removing bridge risk , all while maintaining the fungibility of USDC across different blockchains. The feedback was encouraging, as stakeholders showed readiness to embrace a system that could deliver a fungible USDC and consistent developer experience across multiple chains.

In response, Circle introduced the Cross-Chain Transfer Protocol (CCTP), a permissionless onchain protocol designed for the native transfer of USDC between chains.

Why Do We Need CCTP for USDC?

As mentioned above, CCTP was developed to address key inefficiencies within the multi-chain ecosystem:

Proliferation of wrapped or synthetic versions of stablecoins across chains – The presence of various wrapped USDCs on a single chain can create confusion among users and developers, making it challenging to discern which version is predominantly used in DeFi activities. CCTP introduces a unified standard for USDC, serving as the source of truth for USDC on each supported chain.

The clear need for USDC across various chains and industry buy-in – The existence of wrapped USDC on multiple chains signals a strong customer demand for it on particular chains. Moreover, Circle has previously garnered input from major ecosystem players (as noted by Circle's Joao Reginatto here and dYdX's Antonio Juliano here) revealing a widespread desire to integrate CCTP where available.

Dependence on third-party issuers (lock and mint bridges) across chains – Prior to CCTP, users had to place their trust in third-party bridges to move USDC between chains. Should these issuers face security breaches or operational halts for maintenance, users could suffer significant losses and the stablecoin's reputation might be at stake. For example, a compromised bridge might issue an unchecked amount of wrapped USDC, resulting in considerable user losses and potentially affecting the entire blockchain ecosystem. CCTP removes the need to trust these third-party entities, as users can rely directly on Circle, which is already the case when they hold the stablecoin.

Liquidity pools present inefficiencies – A prevalent method for transferring USDC across chains involves liquidity pool-based bridges. In simplified terms, these bridges encourage liquidity providers (LPs) to deposit substantial amounts of USDC into smart contracts on various chains. Users wishing to bridge USDC pay a fee to these LPs, who then lock and unlock stablecoins from this collective pool on the users' behalf. While LP-based bridges benefit users by providing access to native stablecoins without the need for wrappers, the cost of incentivizing LPs to contribute to the bridge is ultimately borne by the protocol and, consequently, the end-user. Moreover, the volume of stablecoins that can be bridged at any given time is limited by the amount available in a specific pool.

Benefits of Using CCTP to move USDC Across Chains

The advantages of CCTP reflect the challenges it addresses, offering:

Capital efficiency – CCTP allows for the bridging of virtually limitless USDC between chains without the need for liquidity pools or reliance on wrapped tokens, which demand asset locking by LPs and bridge security.

Zero fees – Users can transfer USDC across chains with no extra costs beyond gas fees, as CCTP eliminates the fees typically paid to LPs and third-party bridges.

Fungible assets – CCTP enables users to possess native USDC that is fungible with assets on other chains, avoiding the complexities of wrapped or synthetic versions.

No slippage – CCTP transactions are free from slippage, a common issue with liquidity pool transfers, since there's no asset exchange between LPs and users.

Minimal trust assumptions – CCTP relies on Circle, the stablecoin issuers themselves. Users already place their trust in Circle by using USDC, so extending this trust to cross-chain transactions managed by the issuer is a relatively minor additional assumption.

An Onchain Use-Case – Bridging $50M USDC from Ethereum to Avalanche

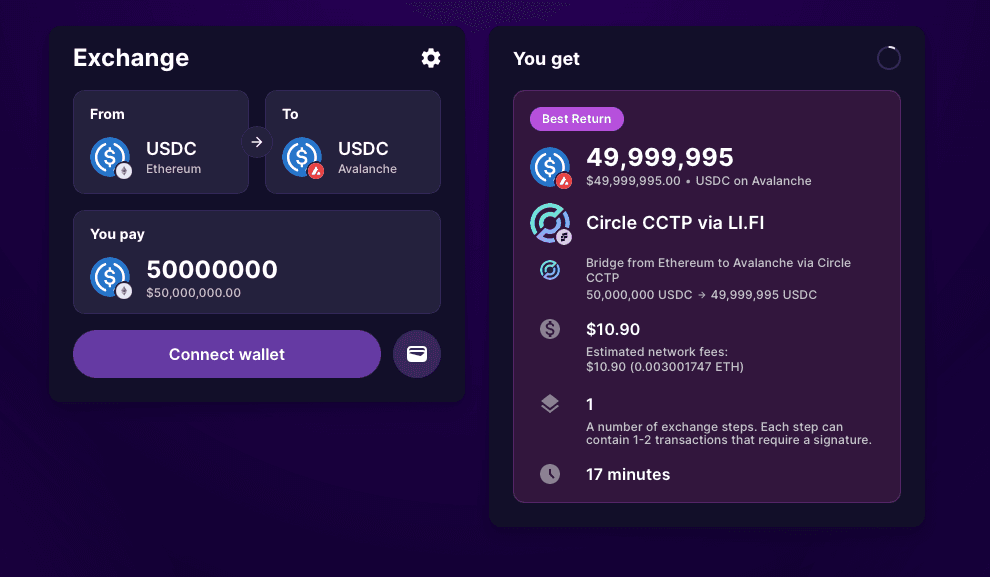

To fully understand the impact of stablecoin bridges, let’s consider a scenario where a dApp aims to transfer $50M USDC from Ethereum to Avalanche.

Using a liquidity-pool based bridge or an intent-based bridge to move $50M USDC from Ethereum to Avalanche is often impractical due to a lack of available liquidity or the absence of an agent with the necessary $50M inventory to satisfy such an intent. This limitation compels a dApp or user to execute several bridging transactions to move the desired sum.

On the other hand, the dApp might try to conduct the $50M USDC transfer via third-party bridges that use wrapped versions, like Axelar's axlUSDC. These bridges typically permit an unrestricted quantity of tokens to be wrapped and transferred to a new chain at any given moment. However, there's a compromise involved: the wrapped token may not necessarily possess liquidity or practical utility upon arriving at the destination chain. This uncertainty renders wrapped USDC options less appealing for executing such substantial transactions.

Conversely, CCTP, which depends on Circle's ability to lock/burn and mint tokens, in theory, provides a streamlined solution for large-scale stablecoin transfers. For example, with CCTP, a dApp could burn $50M USDC on Ethereum and have the equivalent amount minted on Avalanche once Circle verifies the transaction. This method guarantees a direct transfer of USDC between chains, bypassing the need for intermediary actions or intricate wrapping processes.

This scenario unfolds in real-time on aggregation platforms like Jumper, which integrates 15 different bridges, encompassing both liquidity-pool based bridges (such as Stargate) and intent-based bridges (like Across). When it comes to transferring $50M of USDC from Ethereum to Avalanche, CCTP stands out as the only viable route offered.

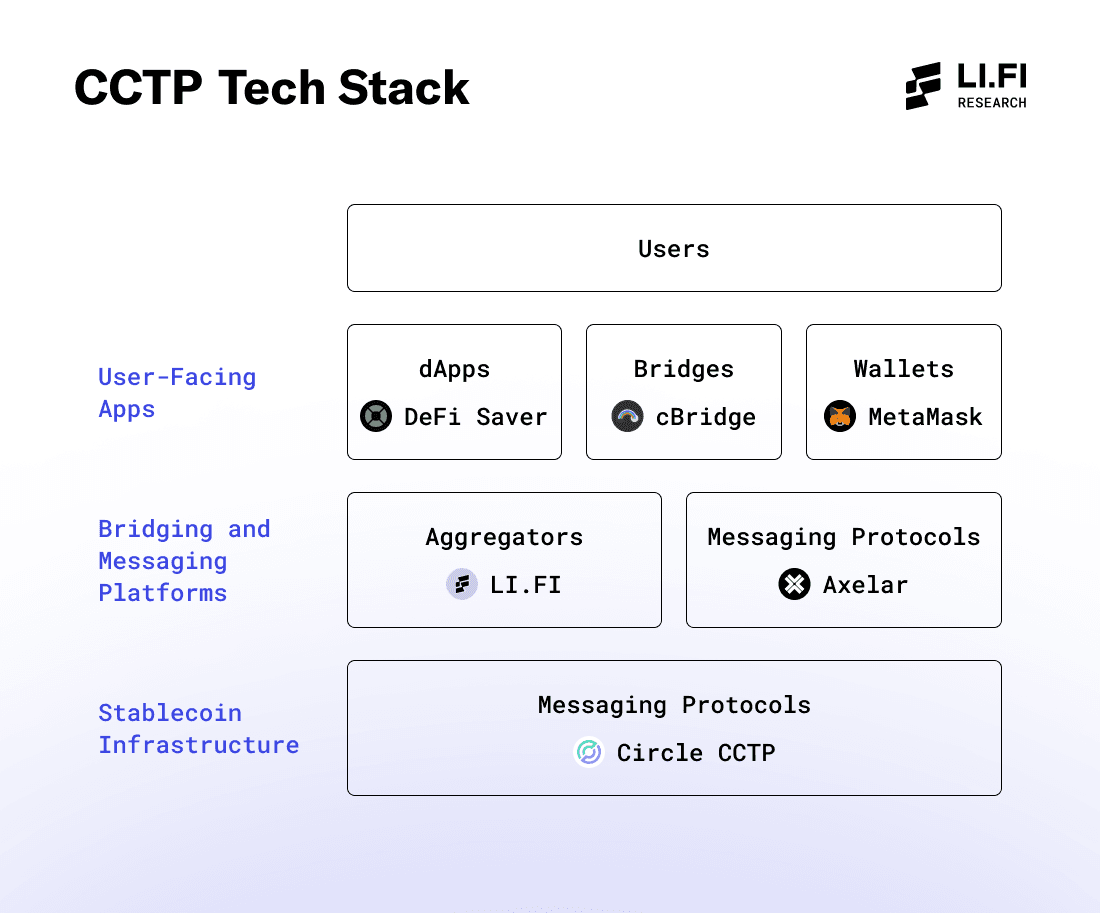

How it Works – Transaction Lifecycle

CCTP serves as foundational infrastructure for dApps, wallets, bridges, and messaging platforms to enhance and build upon. It's not designed for direct interaction by end-users. Rather, Circle has developed CCTP for integration within dApp interfaces, positioning it as a resource for crypto developers to facilitate native USDC transfers on behalf of their users, thereby streamlining the user experience.

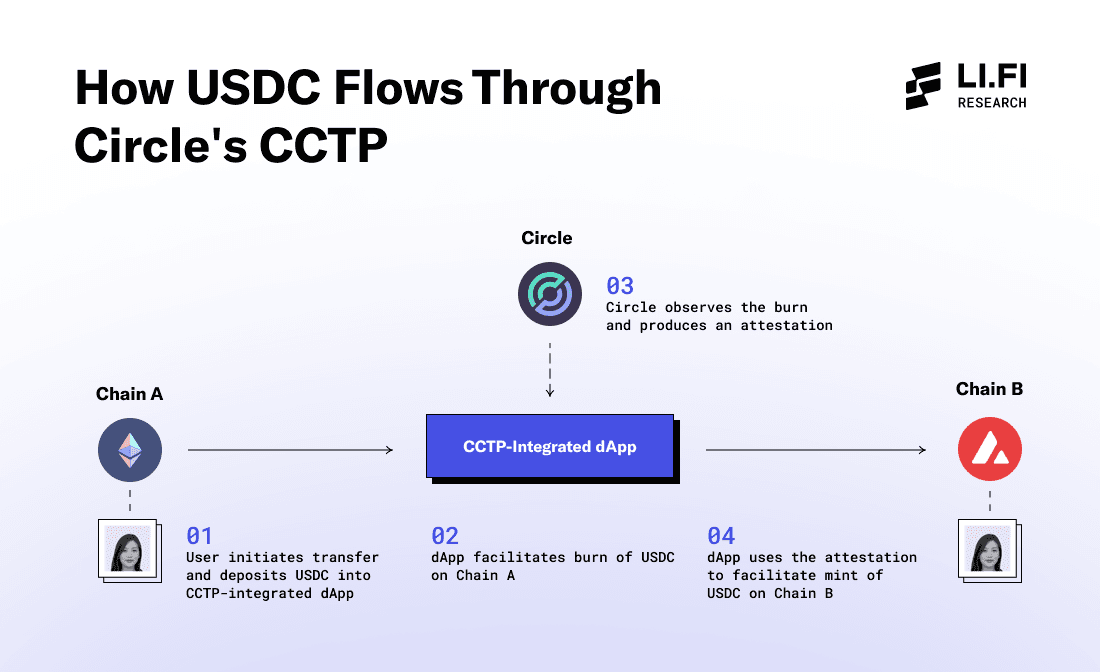

To understand CCTP's functionality, let's dissect the transaction lifecycle into four stages:

Part 1 – Transaction Initiation (on Source Chain)

The user begins the process on the source chain (Chain A) by depositing USDC into a CCTP-integrated dApp and specifying the recipient's wallet address on the target chain.

Part 2 – dApp Burns Native USDC (on Source Chain)

The dApp orchestrates the burning of the designated USDC quantity on the source chain.

Part 3 – Circle Verifies the Burn Event (on Source Chain)

The dApp requests verification from Circle, which is necessary to authorize the minting of the same USDC amount on the destination chain. Circle monitors and confirms the burn event on the source chain.

Part 4 – dApp Mints Native USDC (on Destination Chain)

The dApp proceeds to mint USDC on the destination chain (Chain B), delivering it to the intended recipient's wallet.

Trust Assumptions

CCTP's transaction flow is predicated on certain trust assumptions:

1) Reliance on Circle for Transfer Validation

The legitimacy of a USDC burn on the source chain hinges on Circle's attestation service, which is crucial for greenlighting the minting process on the destination chain. Users' assets are thus safeguarded by Circle's precise validation of each CCTP transaction.

2) Consistent Operational Uptime

CCTP's seamless transaction journey is contingent upon the uninterrupted functionality of Circle's attestation service. Any operational hiccups within Circle could lead to temporary hold-ups or postponements in executing cross-chain transfers via CCTP.

Supported Networks & Adoption

Circle's CCTP is operational on multiple chains, including Arbitrum, Avalanche, Base, Ethereum, Noble, OP Mainnet, Polygon PoS, and the latest addition, Solana.

CCTP compatibility extends to:

Bridge SDKs – Integration is available through various SDKs such as Axelar, Celer, Hyperlane, LI.FI, Router, Wanchain, and Wormhole.

Bridge Apps – Users can access CCTP through bridge applications like cBridge, Wormhole Portal, Voyager, Wanchain, and Jumper.

Wallets – MetaMask, among others, supports CCTP.

Additional Support – A variety of dApps and wallets have also incorporated the SDKs from the aforementioned service providers, further expanding CCTP's support network.

This framework is fundamentally derived from Circle's promotional content for CCTP. In this framework, each tier depends on the underlying layers to furnish critical capabilities.

Resources

You can learn more about Circle’s CCTP through the following resources:

FAQ: Circle's Cross-Chain Transfer Protocol (CCTP) — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.