LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Celer’s cBridge — A Deep Dive

All You Need To Know About cBridge

Celer’s cBridge is a multi-chain interoperability platform that can bridge assets and arbitrary messages across 15+ different chains in an instant, low-cost, and secure design. With decentralization at the core of its design and values, Celer is on a mission to bring blockchain adoption to the mainstream and is quickly becoming one of the most widely used bridging solutions in the ecosystem.

In this article, we will cover the following:

cBridge: An Overview

How It Works — Transaction Lifecycle

Bridge Design — Architecture

Transaction Validation Mechanism

Security Model

Incentives

Risks

Supported Chains

Community

Let’s dive in!

cBridge: An Overview

Celer cBridge is a multi-chain interoperability platform that allows users to bridge assets and arbitrary messages in an instant, low-cost, and secure fashion across 15+ different chains. Launched in July 2021, cBridge has expanded its support to a wide range of blockchains, dApps, and cross-chain scenarios.

In addition to bridging crypto assets, Celer Network is spearheading general message passing, and smart contract calls across different chains with its newly launched Inter-chain Message Framework. With the framework, instead of deploying multiple isolated copies of smart contracts on different blockchains, developers can now build inter-chain-native dApps with efficient liquidity utilization, coherent application logic, and shared states. Users of Celer IM-enabled dApps will enjoy the benefits of a diverse multi-blockchain ecosystem with the simplicity of a single-transaction UX, without complicated manual interactions across multiple blockchains.

Celer Inter-chain Message Framework Launched on 01/11/2022 (Source: Celer Network)

Celer Inter-chain Message Framework facilitates the following use cases:

For DEXes — Allows users to swap tokens across multiple chains from just one chain and with only a single transaction.

For Yield Aggregators — Allows users to manage multi-blockchain vaults from a single chain.

For Lending Protocols — Allows users to provide collateral on one chain and borrow assets on a different chain.

For DAO Governance Protocols — Allows unified governance mechanisms without requiring governance tokens to be moved across different chains.

For NFT Marketplaces — Allows a user from one chain to place bids on an auction taking place on a completely different chain.

For Metaverse Games — Allows users to interact seamlessly in the game with virtual items on different chains.

For new kinds of cross-chain asset transfer bridges — Different liquidity models, validation models, or even privacy features can be built and co-exist under the same framework. In fact, cBridge can be seen as an asset bridge built on Celer IM.

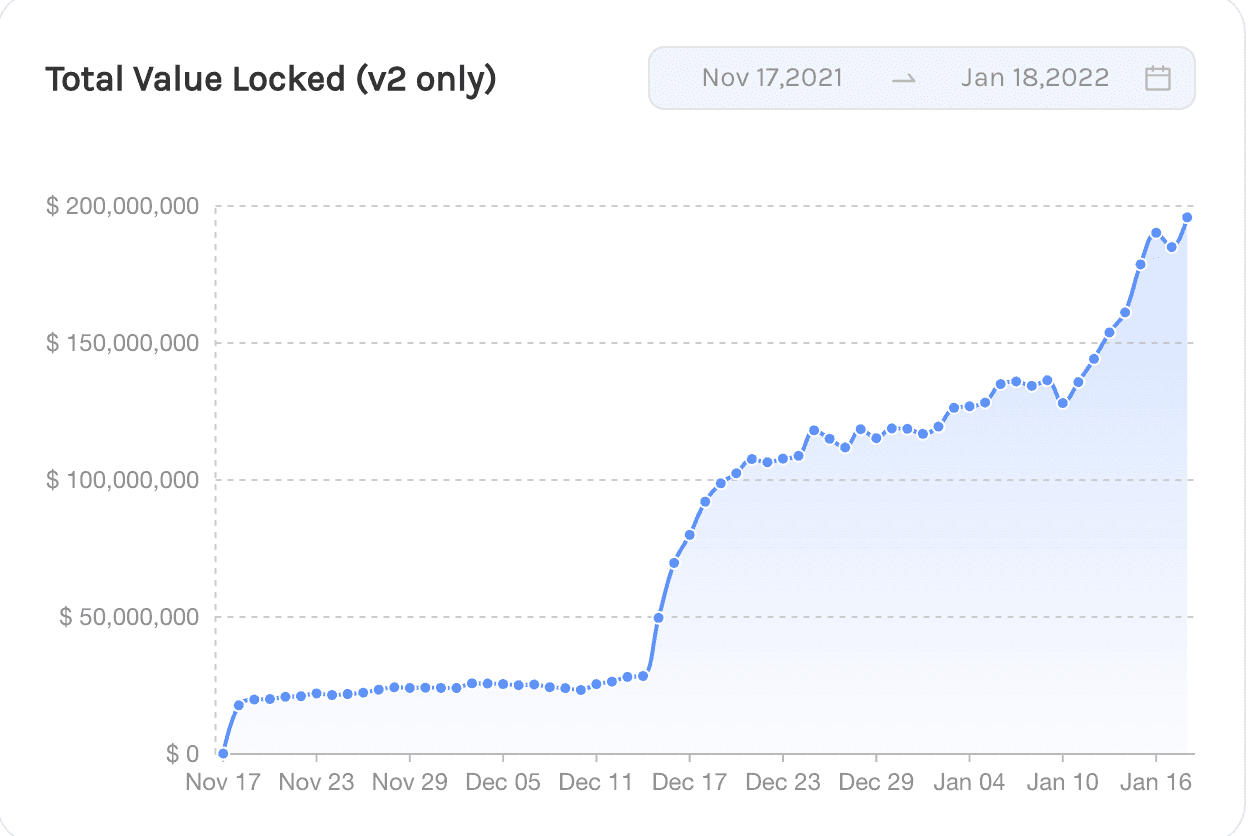

As the asset bridge implementation in the Celer IM framework, cBridge has established itself as one of the most secure bridges in the ecosystem. The cBridge Total Value Locked (TVL) is a testament to the faith of its users.

Total Value Locked (cBridge v2 only) (From Nov 17, 2021 to Jan 18, 2022)

It is also one of the most widely used bridges. As of the time of writing, cBridge has reached $2.2 billion in transactions.

How cBridge Works

With cBridge, there are two major models for asset bridging across chains.

Pool-Based Bridge — This model applies to tokens that have already launched on the target chains while there is no efficient bridging support for the chains (e.g., USDT, USDC, ETH). To enable bridging for the token between chain A and B, cBridge creates two liquidity pools on chain A and chain B respectively. For example, if ETH needs to be transferred from Ethereum L1 to Arbitrum, an ETH liquidity pool needs to be set up on both chains. The bridge rate is dynamically adjusted according to the balances of the two liquidity pools, using the StableSwap pricing curve.

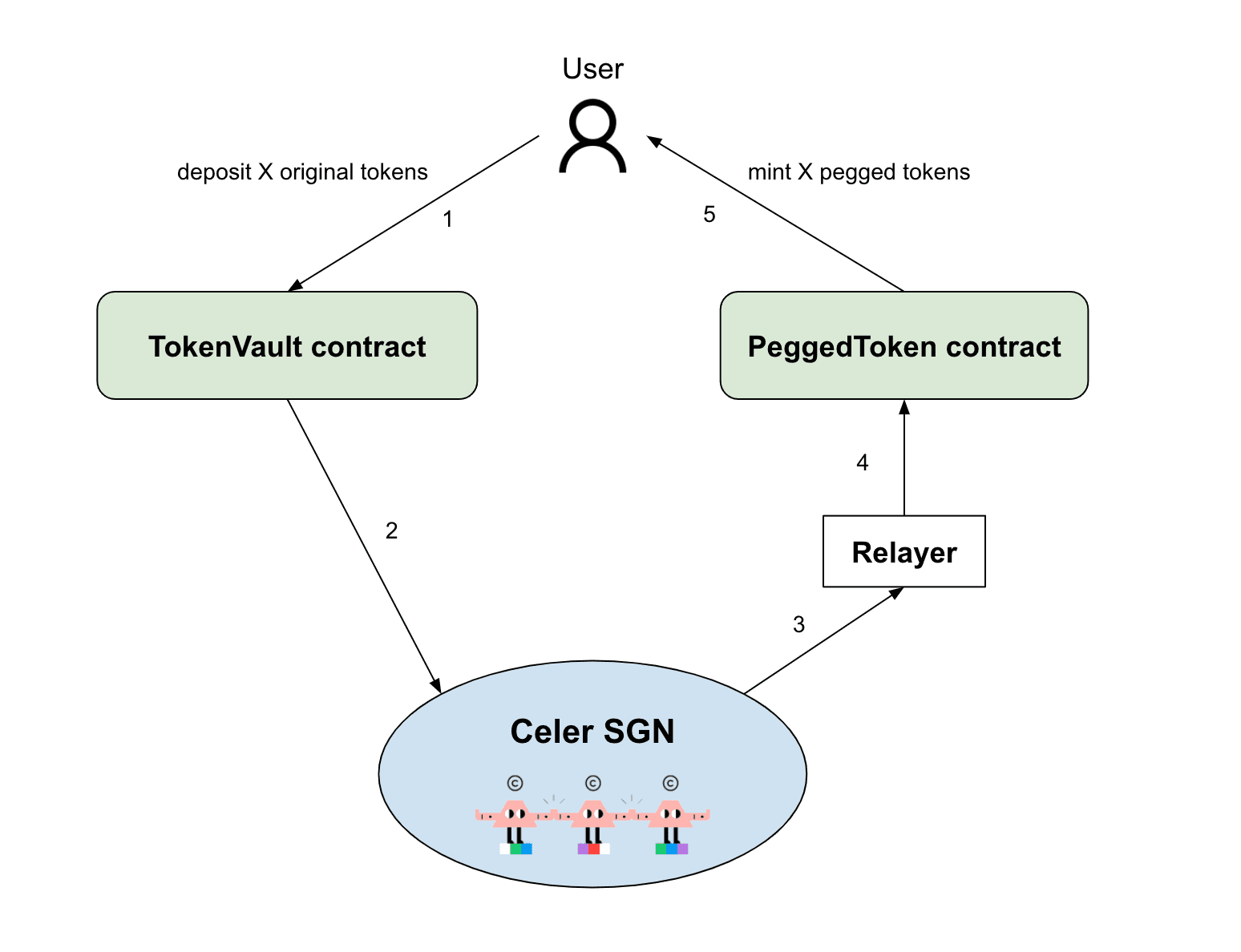

OpenCanonical Token Bridge (Mint & Burn) — This model applies to tokens that have already been generated on chain A (e.g., Ethereum) but not yet on chain B (e.g., BSC), and bridging is needed between chain A and chain B as the dApp grows (e.g., when the dApp decides to launch on chain B).

cBridge will deploy a PeggedToken contract which mints the pegged tokens to the user or burns the pegged tokens on chain B. When a user transfers x tokens from chain A to chain B, x original tokens will be locked on chain A and x pegged tokens will be minted and sent to the user on chain B. Reversely, when a user transfers y tokens from chain B to chain A, y pegged tokens will be burned on chain B, and y original tokens will be sent back to the user on chain A.

What’s different in cBridge’s canonical model is that it incorporates an open standard that can allow multiple minters to mint the same token on the destination chain, with minting power designation and allocation controlled entirely by the project instead of the bridge.

The mint and burn mechanism works in the following manner:

Mint Flow — When a user moves from chain A to chain B, the original token is locked on chain A, and a new pegged token is created and given to the user on chain B. The below figure illustrates the steps for bridging the token from chain A to chain B.

Transfer from chain A to chain B (Mint Flow)

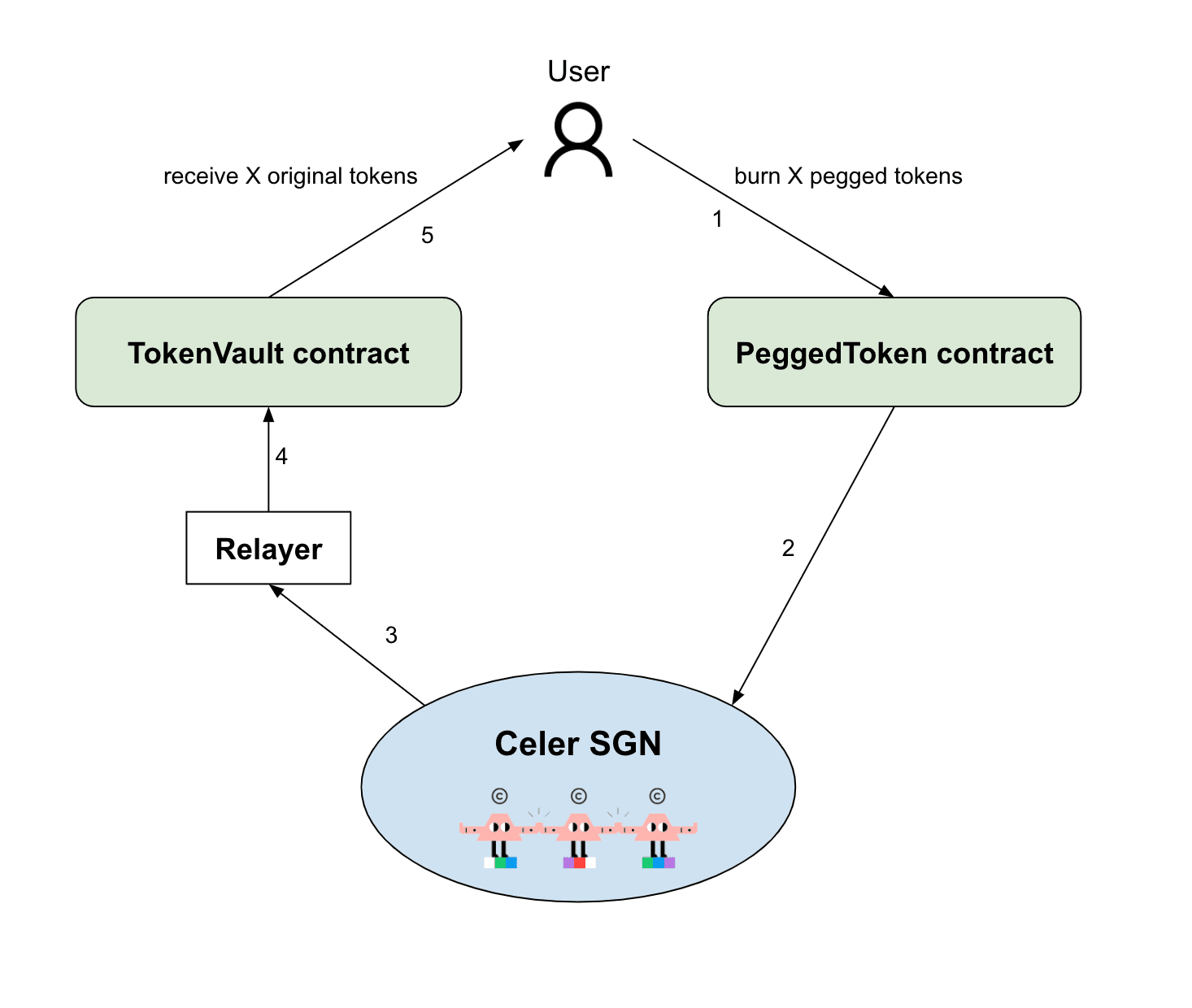

Burn Flow — Reversely, when a user moves from chain B to chain A, the pegged token is burnt on chain B, and an equivalent amount of token is returned to the user on chain A. The below figure illustrates the steps for bridging the pegged tokens from chain B back to chain A.

Transfer from chain B to chain A (Burn Flow)

For executing the mint and burn model, cBridge uses the following contracts:

TokenVault Contract — This contract is deployed on chain A. If pegged tokens are burnt on chain B, the user can deposit the token in this vault and get pegged tokens on chain B or withdraw the token from the vault.

PeggedToken Contract — This contract is deployed on chain B. This contract mints pegged tokens for the user or burns pegged tokens.

Bridge Design — Architecture

The architecture of cBridge has security at the core of its design. Celer State Guardian Network (SGN), the core component in the Celer architecture, is itself a Proof-of-Stake (PoS) blockchain built on Tendermint. SGN uses the same security mechanisms of L1 blockchains like the Cosmos and Polygon PoS chains, with staking and slashing implemented on Ethereum L1 smart contracts.

With inherited PoS security assumptions, SGN serves as the message router between different blockchains, routing messages, and cross-chain fund transfers. Node providers have to stake CELR tokens to join the consensus process of the SGN as a validator. Nodes are incentivized with value capture in the network to function diligently in reaching consensus, storing attestations, and transferring funds. They get slashed when they don’t function as designated or function maliciously. Currently, SGN nodes are all run by renowned institutions like Binance, InfStones, OKEX, Stakewithus, Unaggii, and Stakefish.

State Guardian Network (Source: cBridge Docs)

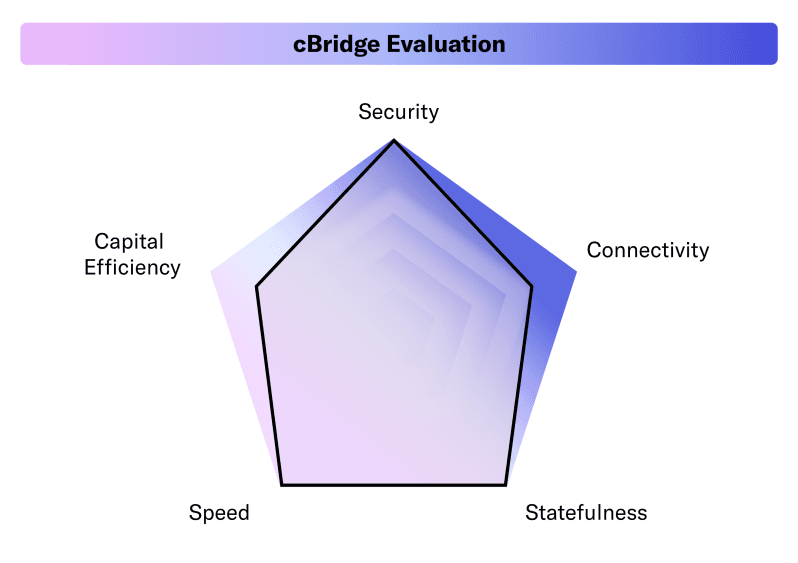

Based on the factors mentioned above, Li.Finance’s evaluation of cBridge’s architecture and design is as follows:

Security — Users are guaranteed secure transfers of their funds through value capture and slashing mechanisms for the nodes. However, cBridge’s design is not trustless because it introduces SGN, a specialized Proof-of-Stake (PoS) chain between the two connected chains. The SGN serves as the message router between different blockchains but also adds the inherited PoS security assumptions. Moreover, since CELR tokens are used as collateral in the system, an assumption is added that capital locked in CELR will always be high enough to secure the system and compensate users. Thus, especially during market downturns, such systems can be vulnerable to attacks.

Speed — cBridge’s bridging models are designed to deliver transfers within minutes. As a Tendermint-based PoS side chain to Ethereum, SGN — the core infrastructure facilitating cross-chain transfers for both the canonical mapping model and the liquidity pool model, reaches consensus faster compared to many layer-1 chains.

Connectivity — cBridge supports a wide range of blockchains including Ethereum, BSC, Avalanche, Fantom, Polygon, Arbitrum, Optimism, Boba, Metis and Oasis. At the time of writing, cBridge supports 19 chains in total. cBridge also supports a variety of tokens including USDT, USDC, BUSD, ETH, METIS, and protocol tokens like LYRA, MCB, DODO, IMX, etc.

Capital Efficiency — cBridge is highly capital efficient as it doesn’t involve any middle token for asset transfers, enabling 100% liquidity utilization theoretically. cBridge smart contracts are also optimized to result in less gas cost. However, the bridge token, i.e, CELR is used as collateral to secure the system. This adds a security assumption related to the price of the token but also makes the system less capital efficient as CELR collateral needs to increase proportionately to the economic throughput facilitated by cBridge.

Statefulness — Celer Inter-chain Message Framework can support general message passing and arbitrary cross-chain function calls, thus ranking it highly for statefulness.

cBridge Evaluation

Transaction Validation Mechanism

SGN serves as the message router between different blockchains, routing messages, and cross-chain fund transfers. SGN value capture and node slashing mechanisms ensure that transactions are validated promptly and properly.

Security

The security design and due diligence from the Celer team minimize the possibility of a loss of funds for users. The cBridge code is open source and its smart contracts have been audited by various reliable sources. The smart contracts have been audited by the following:

The validator nodes’ audits are currently in progress as per the cBridge docs.As a Tendermint-based PoS side chain to Ethereum, SGN’s PoS security assumptions are similar to that of other PoS chains like the Polygon PoS chain. SGN is run by renowned institutions like Binance, InfStones, OKEX, Stakewithus, Unaggii, and Stakefish.Additionally, the cBridge team has also committed $2 million to a cBridge 2.0 bug bounty program on Immunefi, highlighting their commitment to top-tier security researchers and whitehat hackers.

Incentives

cBridge offers the following incentives or rewards to the different participants:

cBridge Nodes — cBridge Nodes earn a portion of the transaction fees while operating via the SGN.

Liquidity Providers — LPs earn the remaining portion of the transaction fees and farming rewards by providing liquidity to the different pools on cBridge

.

Stakers — Staking CELR with the Celer SGN allows users to gain transaction fee earnings and staking rewards without running a node.

More details about liquidity incentives can be found here.

Risks

Interacting with the cBridge has the following risks:

Malicious Actions By Nodes — The liquidity pool will be jeopardized if nodes with more than 2/3 of the total stakes act maliciously. However, as the number of cBridge transactions rises and the overall value acquired by the network grows, it will become increasingly costly for any node to behave maliciously.

Smart Contracts — While cBridge’s smart contracts have been audited by multiple projects, there is still a counterparty risk.

Technology Risks — Given the nature of cBridge’s activities, technology risks that can disrupt cBridge’s operations like software failure, buggy code, human error, spam, and malicious attacks are possible.

All Nodes Go Offline — While this is highly unlikely, in such cases as well, the users’ funds will not be lost. Their transfers will get executed with a delay.

Risks With LP Operations — Providing liquidity in cBridge is not without risk. If there is a substantial liquidity mismatch across chains, users’ liquidity may lose value. This works in the same way as impermanent loss in AMMs.

Supported Chains

cBridge supports the followings chains:Supported Chains — cBridgeCrypto assets supported across these chains include USDT, USDC, BUSD, ETH, METIS, and various protocol tokens (DODO, MCB, IMX, etc).

Team

Celer Network’s development team is led by a group of highly known computer scientists that have a track record of producing large-scale consumer and corporate software. The development team co-founders are highly regarded and have achieved academic excellence from world-renowned institutions like MIT, UC Berkeley, Princeton, and UIUC. cBridge’s core team includes:

Mo Dong — Co-Founder

Junda Liu — Co-Founder

Xiaozhou Li — Co-Founder

Qingkai Liang — Co-Founder

Celer Network has built strategic partnerships with a lot of top-tier projects including Frax, Boba Network, OolongSwap, DODO Dex, MCDEX, Lyra to name a few. You can find out more about Celer’s partnerships here.

Community

You can stay updated with cBridge and its community through the following:

Closing Thoughts

cBridge offers one of the best bridging solutions in the ecosystem. This is because of the following reasons:

Within 6 months of launch, cBridge has seen tremendous growth and the numbers speak for themselves — 15+ different chains, $2.2B in total transaction volume, and $200M in TVL.

The Celer team believes in developing for the long term and has always advocated for decentralization. They have applied their belief in decentralization in the cBridge design as well.

The team believes in promoting the overall development of the ecosystem and continues to extend its support to ecosystem participants. Moreover, Celer is a leading force in the

, which is a testament to their belief in building sustainable solutions for the ecosystem keeping all the participants involved.

At Li.Finance, we share the same values and vision with Celer for the multi-chain ecosystem and building sustainable solutions. We hope to work closely with the team and look forward to developing deeper collaborations to build key infrastructure for the multi-chain future.

FAQ: Celer’s cBridge — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.