LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Blockchain bridges and their classification

Blockchain technology and the crypto ecosystem have evolved rapidly over the last decade. Since the Bitcoin whitepaper was released in 2008, there has been tremendous innovation in the space and we’ve seen widespread adoption.

Blockchain bridges and their classification

Blockchain technology and the crypto ecosystem have evolved rapidly over the last decade. Since the Bitcoin whitepaper was released in 2008, there has been tremendous innovation in the space and we’ve seen widespread adoption. While every year in crypto is unique, 2021 changed the ecosystem in ways that have people questioning where we’re headed in the future. This is because 2021 was the year of the L1s which resulted in many predicting a multi-chain future for crypto as opposed to a winner take all stance that many had prior to the rise of these blockchain ecosystems. However, with an increase in the number and size of different blockchain ecosystems, there came a need for key infrastructure that could connect them. This is where bridges come in.

Here, we will talk about:

What Is A Blockchain Bridge?

Why Do We Have Different Types Of Bridges?

Classification Of Bridges Based On:

How They Work

What They Connect

How They Move Assets

Their Functionality

Let’s dive in!

The Crypto ecosystem has evolved rapidly over the last decade. Since the Bitcoin whitepaper was released in 2008, there has been tremendous innovation in the space and widespread, almost mainstream, adoption. While every year in crypto is unique, 2021 changed the ecosystem in ways that have people interested in crypto’s seemingly limitless future.

2021 was the year of the L1s – which resulted in many predicting a multi-chain future for crypto, as opposed to a winner take all stance that many had prior to the rise of these blockchains. However, with the drastic increase in the number and size of different blockchain ecosystems, there is now a need for key infrastructure to connect them. This is where bridges come in.

Here, we will talk about:

What Is a Blockchain Bridge?

Why Do We Have Different Types Of Bridges?

Classification of Bridges Based on:

How they work

What the connect

How they move assets

Their functionality

Let’s dive in!

What Is A Blockchain Bridge?

Blockchain bridges work similarly to real bridges in the physical world. However, instead of connecting physical locations, blockchain bridges connect two different blockchain networks in crypto. This connection is important because, without a bridge, blockchain networks would remain siloed environments that cannot communicate with each other. This is because each network has its own set of rules and governance mechanisms, due to which their native assets and data are incompatible with the other blockchain. However, with a bridge between two blockchain networks, it becomes possible to transfer crypto assets and arbitrary data between them. Thus, bridges are key for interoperability in the ecosystem and we need them to make different blockchain networks compatible with each other.

Let’s take an example:

Alice has ETH on Ethereum Mainnet and wants to use it on Avalanche. These two chains have their own protocols, rules, communities, and consensus mechanisms and thus, interoperability between them is not possible. In such a case, something needs to go in the middle and offer a way to take information from the Ethereum Mainnet to Avalanche. To do so, Alice would most likely transfer assets via a blockchain bridge in order to securely move the ETH from Ethereum Mainnet to Avalanche. Using the bridge, Alice will be able to convert ETH on Ethereum for wETH on Avalanche.

Why Do We Have Different Types Of Bridges?

Bridges essentially enable communication between different blockchains. And, just like with complex math problems, when you take a look at different bridging solutions in the crypto ecosystem, you will find that there is no one way of enabling communication between blockchains. Bridges have different designs with unique strengths and trade-offs, and thus, there are a plethora of options when it comes to which bridge can be used to communicate between two blockchain networks.

Let’s dig a little deeper into how communication works.

Bridges work by establishing communication channels between two blockchains. In an ideal world, blockchains would just talk to each other but in reality, that’s not possible.

Let’s take an example:

A dApp on Ethereum wants to communicate with a dApp on Solana. Due to the trust boundaries between Ethereum and Solana, they cannot simply talk to each other. These trust boundaries include but are not limited to:

Ethereum and Solana don’t know about each other.

Both can only know what’s happening on their own chain and have no idea what’s going on off-chain.

To both the blockchains, receiving a message from the other is like having an interaction with the outside world that they know nothing about. Hence, trust cannot be established to validate these messages.

Moreover, blockchains can only send messages in one direction. That is to say, there is only one-way communication across a channel. One blockchain can send a message to another on one channel, but there’s no way for the other blockchain to reply on the same channel and confirm that the message has been received.

To establish trust between blockchains and make two-way communication possible, we need something in the middle, something that can bridge the gap between these blockchains. This is where blockchain bridges make it possible to not only transfer messages, data, and resources between different blockchains but also make cross-chain asset transfer. This changes things, as blockchains are no longer limited to one-way communication, as bridges enable them to communicate with other blockchains back and forth.

However, bridges use different mechanisms, or actors, that play the role of verifiers between blockchains to enable communication and overcome the trust boundaries.

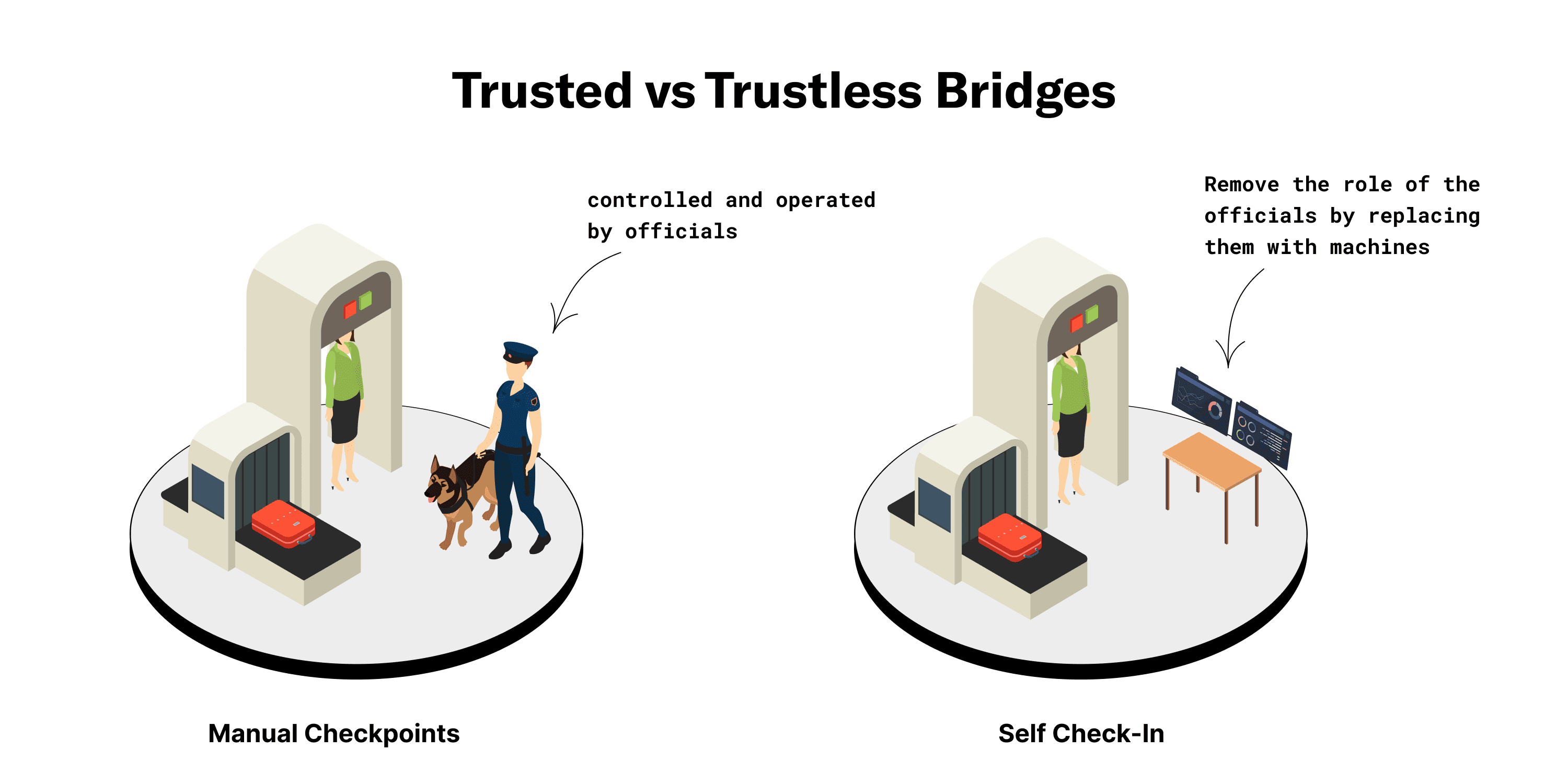

The role of verifiers is the main differentiator between how bridges work. Essentially, some bridges use a trusted system and others use a trustless system of verifiers.

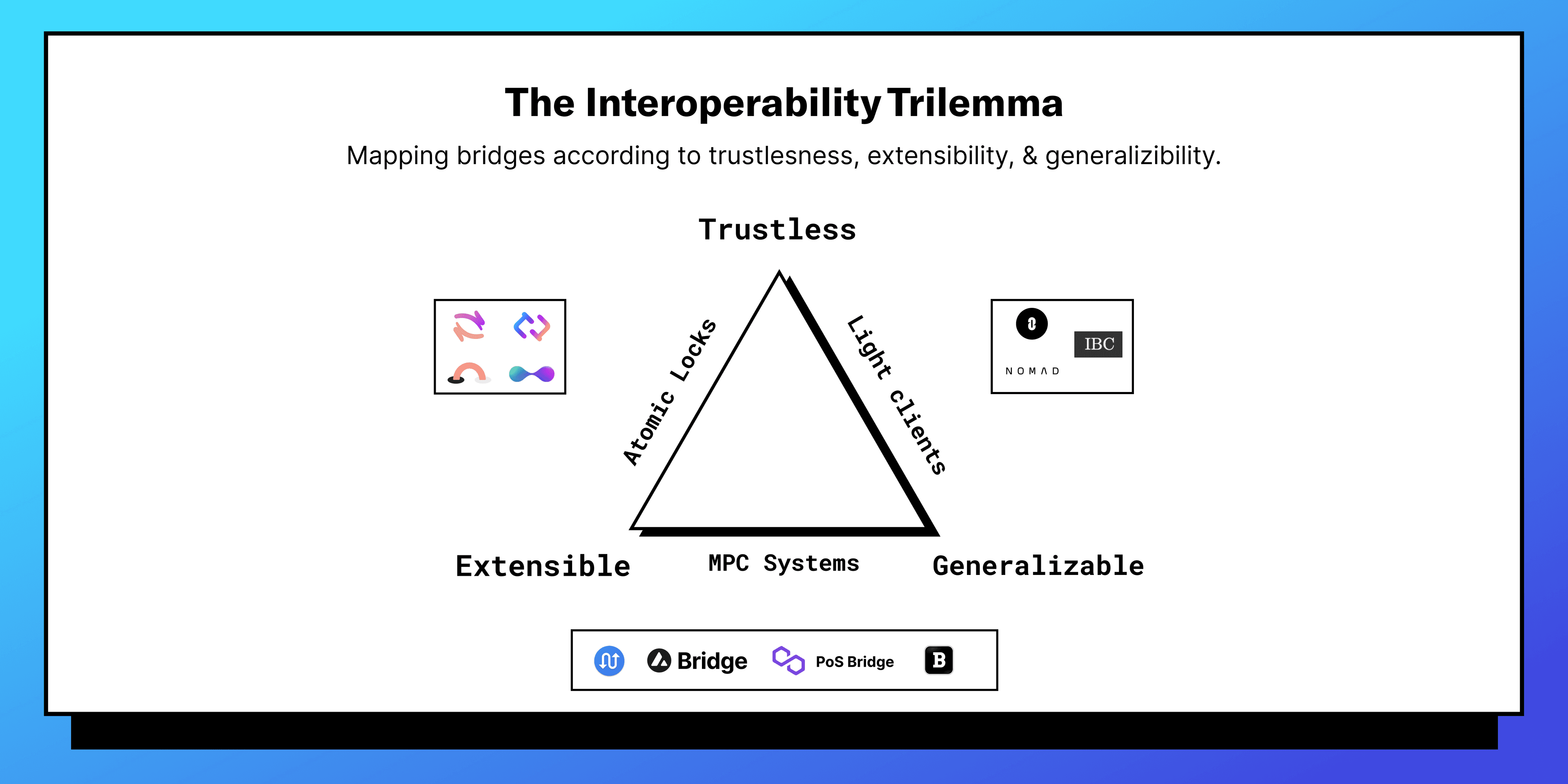

Moreover, we see different types of bridge designs because of the interoperability trilemma in the ecosystem. The interoperability trilemma states that “interoperability protocols or bridges can only have two of the following three properties:

Trustlessness: having equivalent security to the underlying domains.

Extensibility: able to be supported on any domain.

Generalizability: capable of handling arbitrary cross-domain data.”

Also, in his article, Arjun Bhuptani classifies bridges based on how they are verified into natively verified, externally verified, and locally verified systems. Different bridging solutions focus on different factors out of the three mentioned above and have their own strengths and trade-offs. As a result, we get to see varying bridge designs with their own unique value proposition.

The above points explain why we have different bridge designs. But, in general, we see different types of bridges because of what they connect and their main usability. We will further explore this in the “Classification Of Bridges Based On Their Functionality” section.

Classification Of Bridges Based On How They Work

While the purpose of all blockchain bridges is the same, i.e., enabling communication between different blockchains, the way they go about doing so varies. Based on how they work, bridges can generally be classified into:

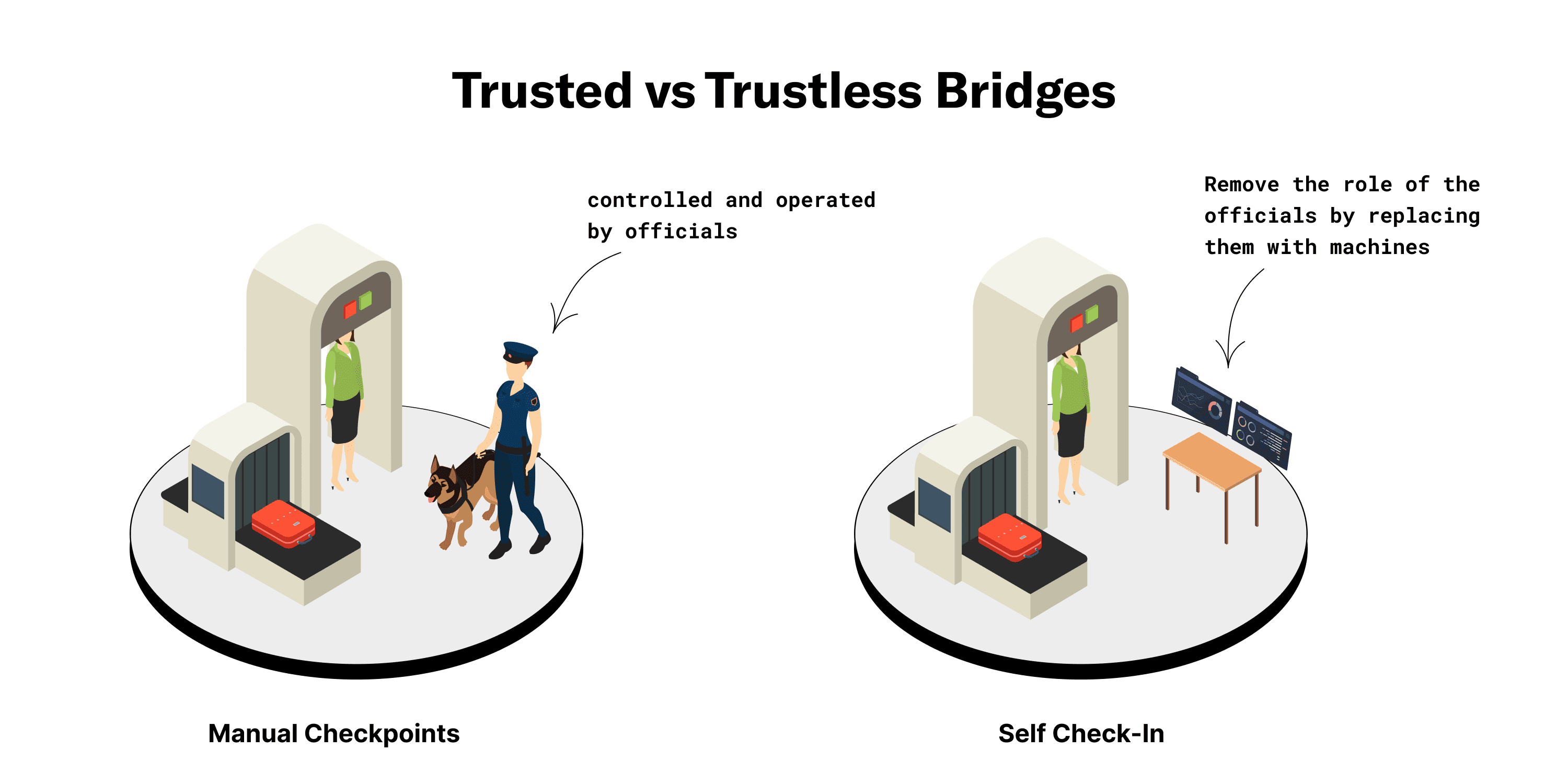

Trusted Bridges —

These bridges use a central authority or federation for their operations. They are called trusted bridges because the users need to trust a third party for using the bridge and hence the safety of their funds. Examples of trusted bridges include Multichain and native bridges like Binance <> Ethereum bridge.

Trustless Bridges —

These bridges remove the role of the trusted third party through the use of smart contracts and algorithms. They are called trustless bridges because they don’t require the users to trust a central authority for using the bridge and hence the security of their funds since they always remain in their custody. Examples of trustless bridges include Connext, cBridge, Hop.

Let’s take an example:

Imagine you’re at the airport security checkpoint. There are two types of checkpoints:

Manual Checkpoints — These are controlled and operated by officials who users have to trust with their personal information and belongings.

Self Check-In — These remove the role of the officials by replacing them with machines and users remain in control of their personal information and belongings.

Manual checkpoints are trusted bridges.

They depend upon a trusted third party, that is to say, the officials for their operations. Users have to give up control of their assets.

Self check-ins are trustless bridges.

They remove the official’s role with technology and enable users to remain in control of their assets.

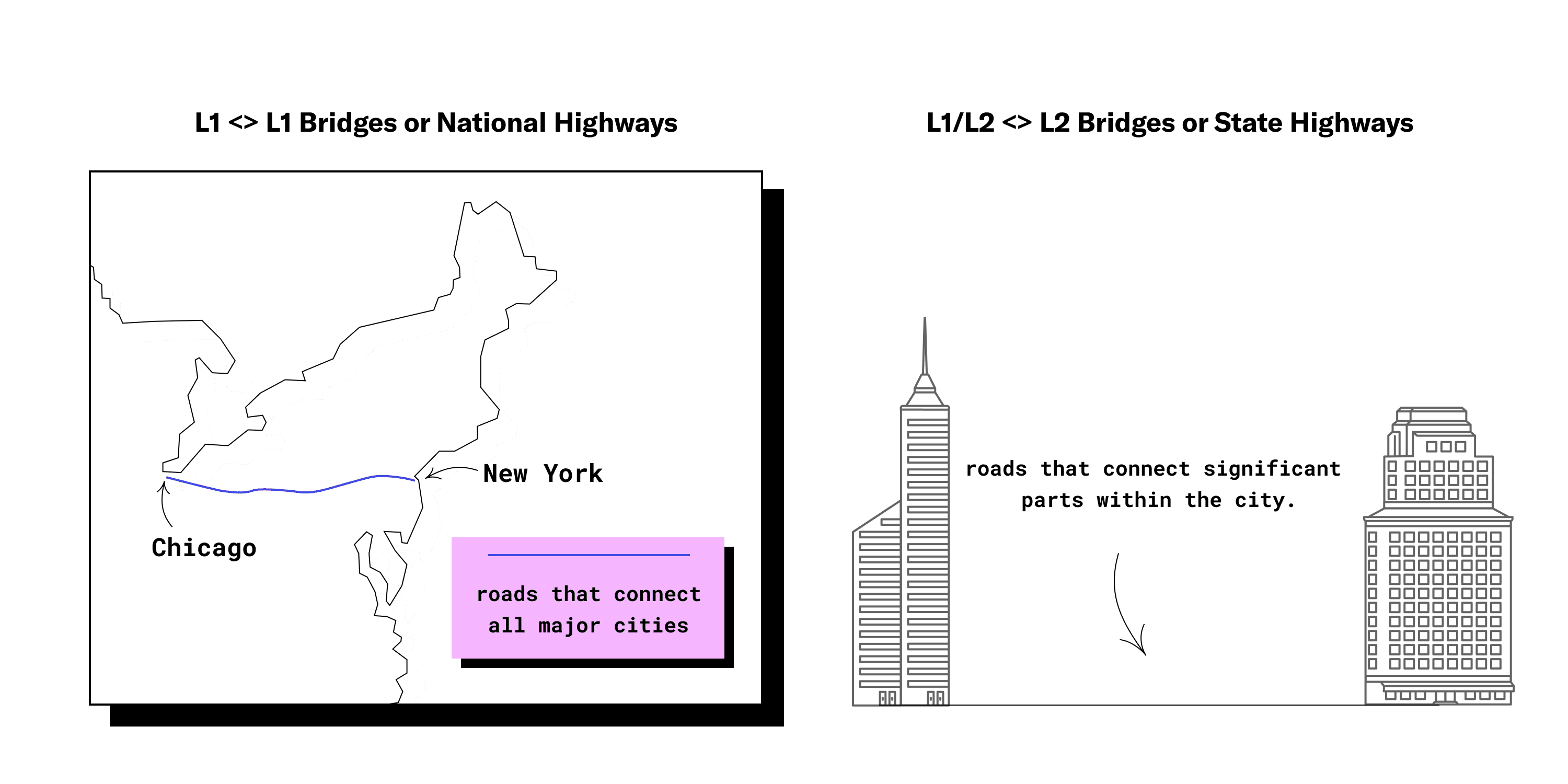

Classification Of Bridges Based On What They Connect

In addition to how they work, bridges can also be classified on the basis of what they connect into the following categories:

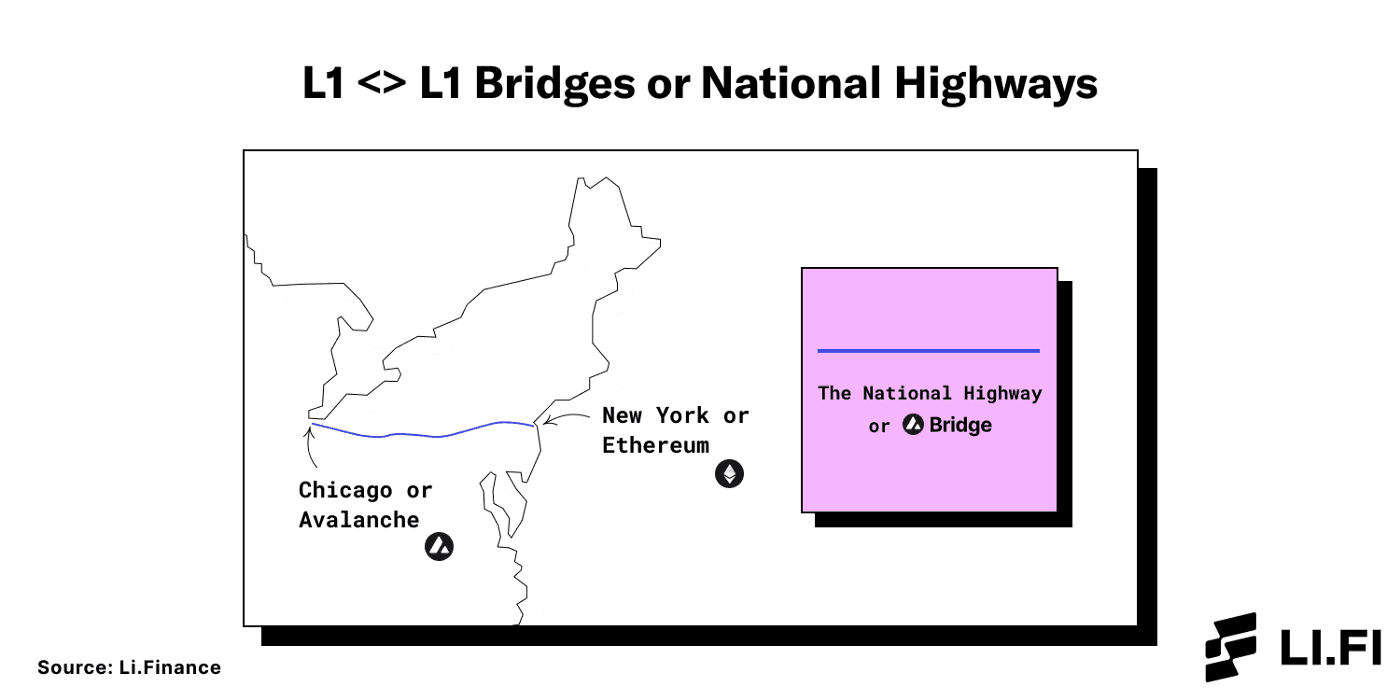

L1 <> L1 Bridges — These bridges connect different L1 blockchains with each other. For example, the

connects Ethereum and Avalanche.

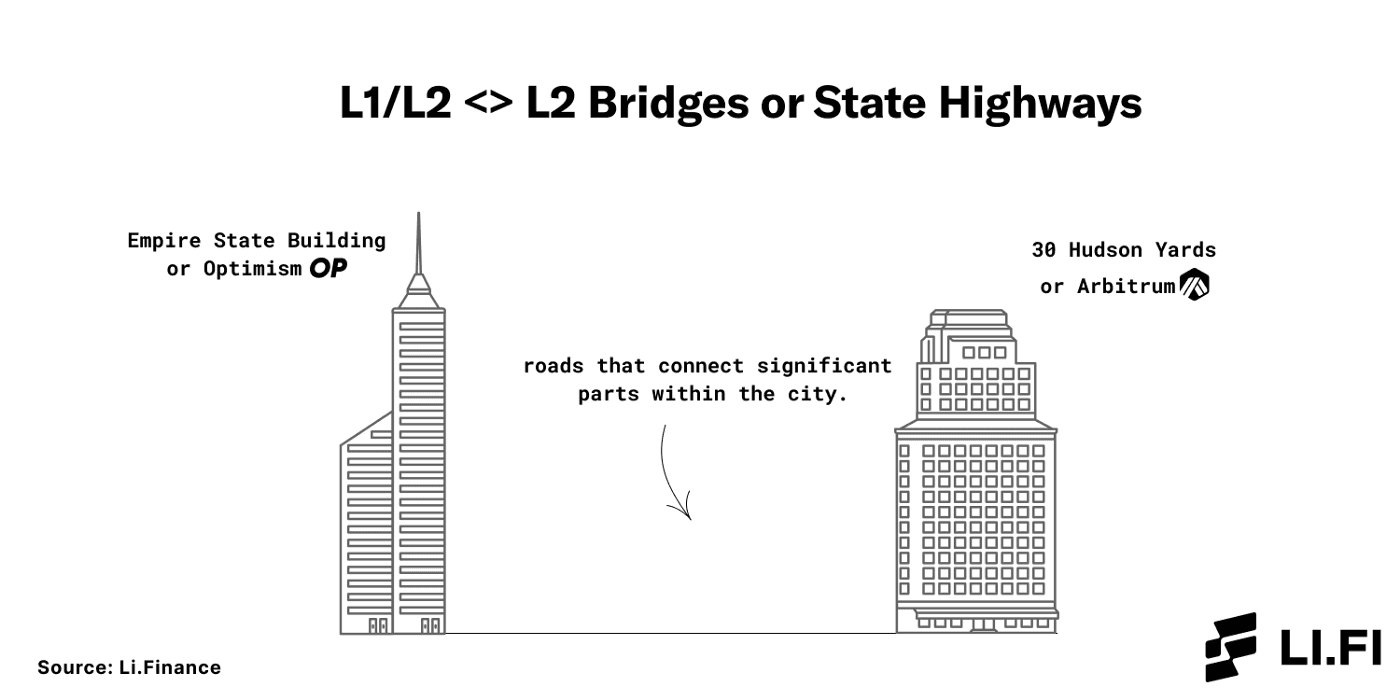

L1/L2 <> L2 Bridges — These bridges connect the Mainnet with different L2 solutions and the L2s with each other. For example, Across is a bridge that connects Ethereum Mainnet to L2s like Arbitrum, Optimism, and

is a bridge that connects different L2s with each other in addition to connecting the Ethereum Mainnet with them.

Let’s take an example:

Building on Haseeb Qureshi’s mental model describing blockchains as cities, we can say that bridges are like roads that connect different cities. Based on what they connect, roads can be classified into the following:

National Highways — These are the roads that connect all major cities.

State Highways — These are the roads that connect significant parts within the city.

National Highways are L1 bridges.

If Ethereum is New York City and Avalanche is Chicago, the Avalanche Bridge (AB) is the National Highway that connects both cities.

State Highways are L2 bridges.

If L2s and rollups like Arbitrum and Optimism are two skyscrapers on Ethereum, that is to say, in New York City, Hop Protocol is the state highway that connects them.

Classification Of Bridges Based On How They Move Assets

Bridges can also be classified based on the mechanism they use to move assets across chains. Generally, based on how they move assets, bridges fall into the following buckets:

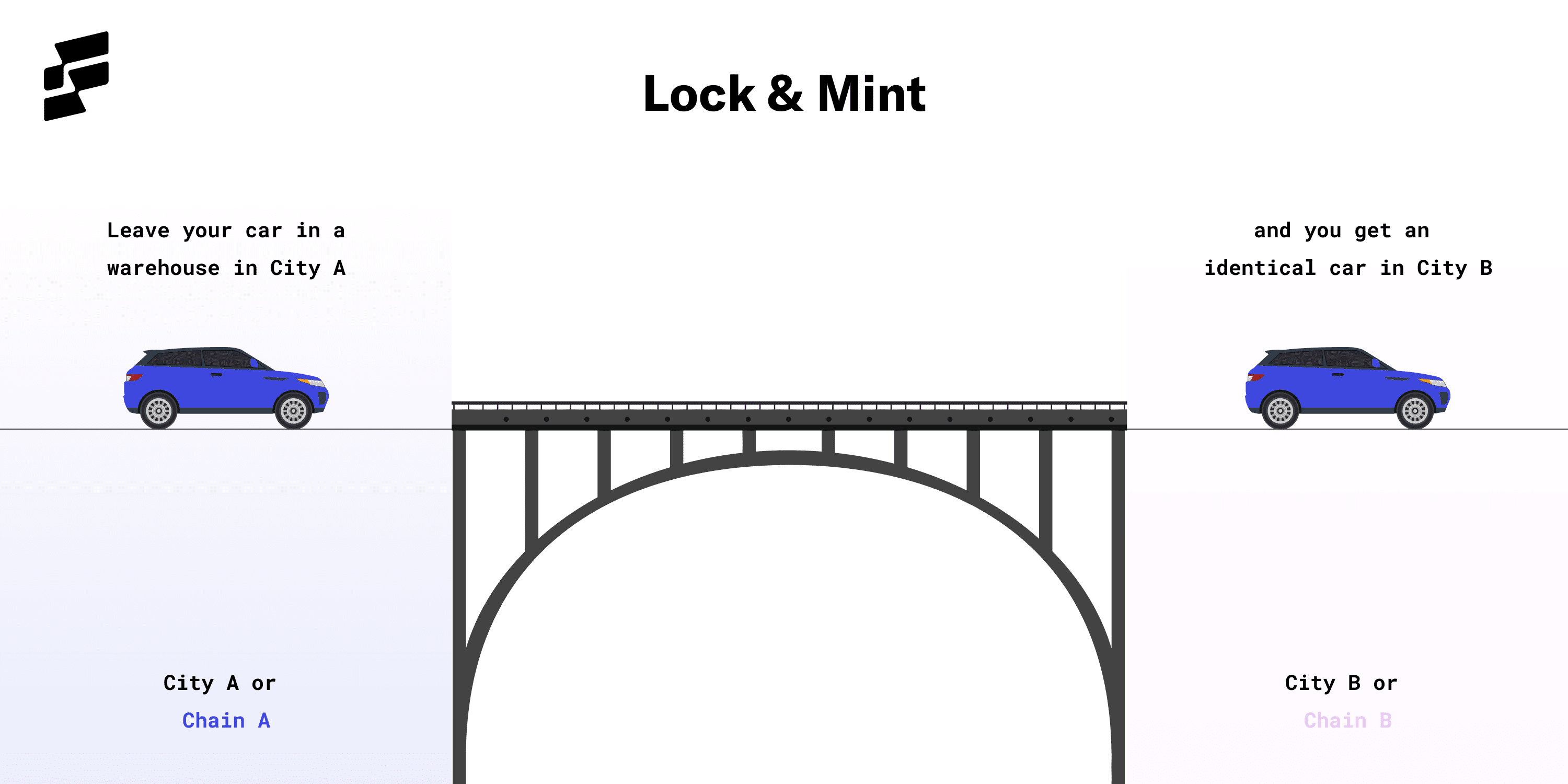

Lock & Mint — These bridges lock assets on the source chain and mint assets on the destination chain. Examples: Polygon PoS bridge, Avalanche Bridge (AB), wrapped BTC, wMonero.

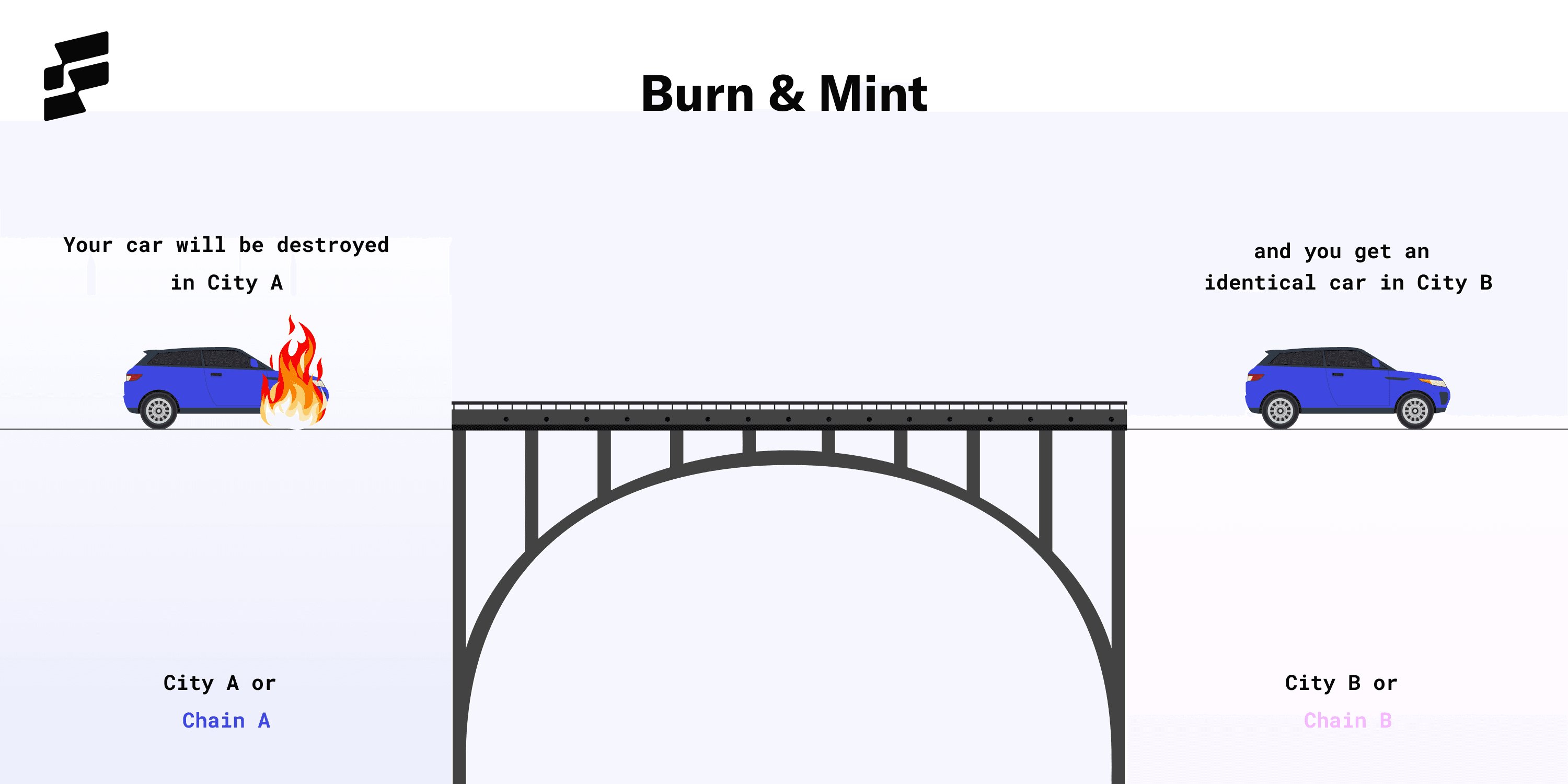

Burn & Mint — These bridges burn assets on the source chain and mint assets on the destination chain. Examples: Hop, Across.

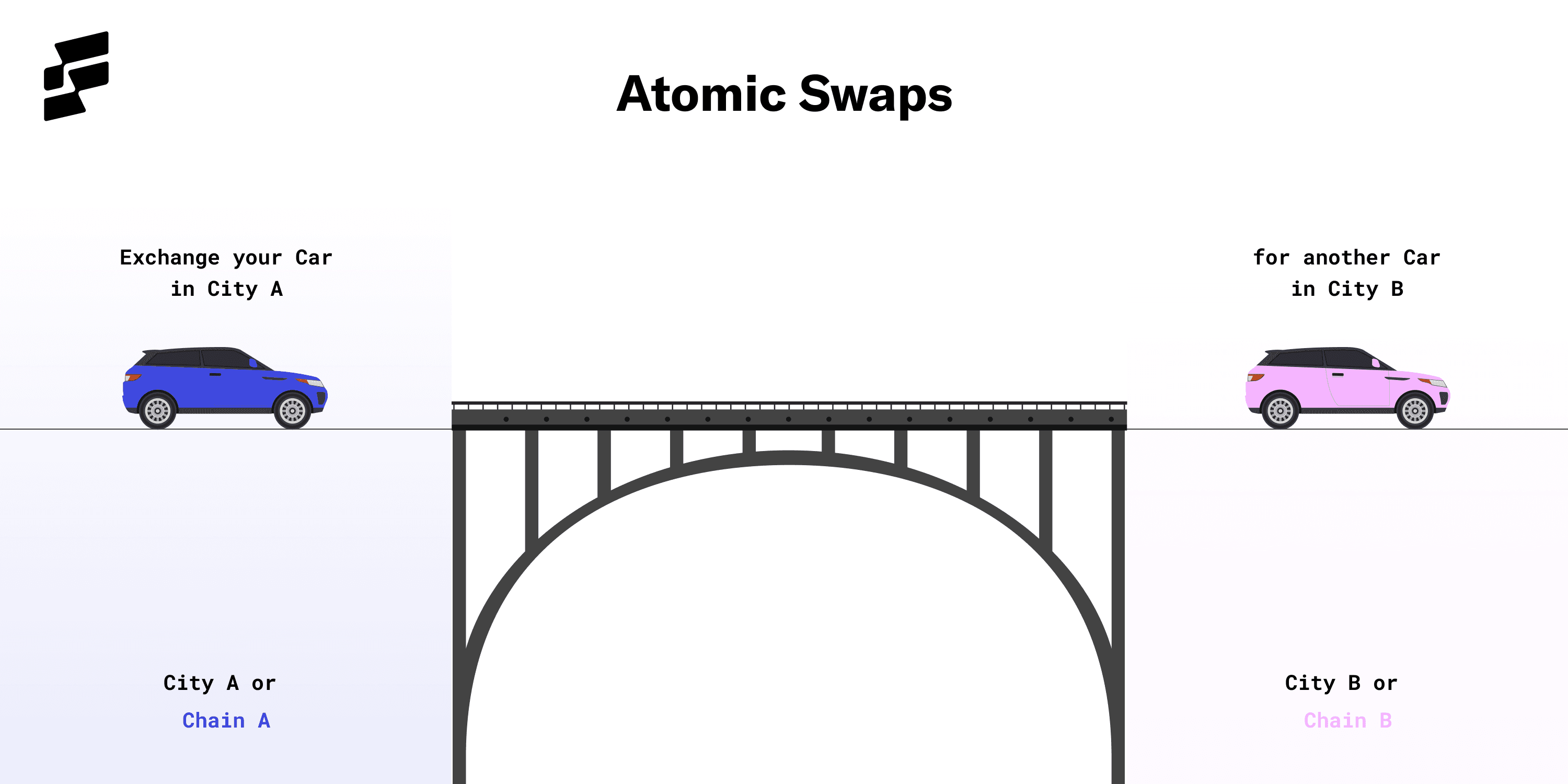

Atomic Swaps — These bridges swap assets on the source chain for assets on the destination chain. Generally, they are more trustless because they rely on self-executing smart contracts for asset swaps and remove the requirement for a trusted third-party necessary in lock & mint or burn & mint mechanisms. Examples: cBridge, Connext.

Let’s take an example.

Imagine you’re traveling in your car from City A to City B which is connected by a bridge. When you reach the bridge, ready to leave City A for City B, you have 3 options to cross the bridge:

Leave your car in a warehouse in City A and in return, you’ll get an identical car in City B. When you return to City A, you can simply return the car you got on arrival and take your original car back. This is similar to the lock and mint mechanism used by bridges.

2. Your car will be destroyed and in return, you will get an identical car in City B. When you return to City A, the same process will be followed again - your car in City B will be destroyed and you will get an identical car in City A. This is similar to the burn and mint mechanism used by bridges

3. Exchange your car in City A for another car in City B. When you want to return to City A, you can follow the same process again - exchange your car in City B for another car in City A. This is similar to the atomic swaps mechanism used by bridges.

Classification Of Bridges Based On Their Function

The classifications mentioned above differentiate between bridges very broadly. But, things can get complicated when we take a closer look into the different bridge types and designs based on how the bridges are used, this to say, their function. Based on their functionality, bridges can be classified into the following:

Chain-To-Chain Bridges — These bridges are mainly designed to support the movement of assets between two blockchains. Generally, it is seen that such bridges use the lock and mint mechanism. Examples: Native bridges such as Polygon’s PoS Bridge, Binance <> Ethereum Bridge, Avalanche Bridge (AB).

Multi-Chain Bridges — These are bridges that work more like an interoperability protocol which can be deployed to any kind of L1 or L2 blockchains. They are designed for transferring assets across multiple blockchains. Examples: Connext, cBridge.

Specialized Bridges — These bridges are focused on specific ecosystems and are designed to support the movement of assets across the focused region. The USP of such bridges is that because of their specialization, they are generally able to enable faster and cheaper cross-chain transactions. Examples: Hop is a rollup-to-rollup bridge that enables the transfer of assets across the Ethereum Mainnet and L2s whereas Across is a bridge that focuses on enabling the quick and cheap transfer of assets from L2 rollups to Ethereum Mainnet.

Wrapped Asset Bridges — These bridges are designed specifically to enable the transfer of non-native assets to different blockchains. They do so by creating wrapped assets on the destination chain that are a representation of the original asset on the source chain. Examples: wrapped BTC, Interlay, wMonero.

Data Specific

Bridges — These are interoperability protocols designed specifically for transferring arbitrary data across multiple blockchains. Generally, these protocols become the base layer of dApps and make it possible for them to achieve cross-chain composability. Examples: Celer’s inter-chain Message Framework, IBC, Nomad, Data Movr.

dApp Specific Bridges — From a purely technical perspective, these are not bridges. But, these are protocols that connect to different blockchains and hence have built an ecosystem that facilitates value to be transferred across blockchains just like bridges. Examples: Thorchain is a decentralized cross-chain AMM that offers cross-chain liquidity features that enable the exchange of assets across blockchain ecosystems. Other examples include Anyswap, Wanchain, and Synapse.

FAQ: Blockchain bridges and their classification

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.