Biconomy’s Hyphen — A Deep Dive

All You Need to Know About Biconomy’s Cross-Chain Bridge, Hyphen

Biconomy offers a complete suite of interoperability solutions. Hyphen, Biconomy’s bridging solution is one of the most capital efficient and fastest bridges available to users.

In this article, we will cover the following:

Biconomy: An Overview

Biconomy’s Design

Hyphen’s Architecture

Transaction Validation Mechanism

Security

Incentives

Risks

Supported Chains and Assets

Community

Let’s dive in!

Biconomy: An overview

Biconomy is a suite of protocols that help dApps in providing a great UX to their users. dApp developers can integrate Biconomy through its SDKs and smart contract functions to facilitate meta transactions, which enables them to provide gas-less transactions, accept gas payments in stablecoins, support cross-chain transactions, speed up transactions, and manage transaction queues.

Biconomy’s Hyphen Protocol is the protocol that supports cross-chain transactions and soon plans to support cross-chain contract calls. Mexa is for gasless transactions and Forward is for ERC20 payments.

Biconomy’s Design

Biconomy’s implements the “light clients and relays” approach, which consists of the following:

Trusted Forwarder Contracts — Smart contracts deployed on L1 and L2 Ethereum networks that execute meta transactions on the behalf of dApps whose smart contracts connect to them.

The Biconomy Chain — A decentralized blockchain where Biconomy’s relayers record valid transactions.

Validators — Relayer nodes that watch Biconomy’s L1 and L2 smart contracts for transactions, then document those transactions on the Biconomy chain.

Executors — Relayer nodes that read new transactions written to the Biconomy chain by Validators and execute them on the destination chains where the transactions are intended to be complete.

Delegators — Contributors who delegate $BICO tokens to relayer node operators in exchange for future $BICO proportionate to their stake.

Liquidity Providers — Investors who provide liquidity to Biconomy’s smart contracts to facilitate meta transactions.

dApp Gas Tank — A smart contract developers can deposit funds into, in order to cover or reduce gas fees for their end-users.

In general, transactions are initiated from within smart contracts. These smart contracts connect to Biconomy’s contracts to initiate transactions on other networks. All interactions with Biconomy’s smart contracts are written to the Biconomy chain, where executor relay nodes read new blocks and execute any necessary transactions on other chains.

Here we’ll be covering Biconomy’s cross-chain protocol, Hyphen.

Hyphen’s Architecture

Hyphen enables transfers of Ethereum and stablecoins like USDC between Polygon, Ethereum, and Avalanche. The fees and the speed is better than most bridges out there.

Some transfers happen in under thirty seconds, as their demonstration video shows.

Transfers initiated with Hyphen are executed via the following process:

Funds are deposited — A transfer begins when funds and a destination chain ID are sent to one of Hyphen’s smart contracts deployed across the Ethereum, Polygon, and Avalanche C-Chain main networks.

Watch Towers send a deposit signal — Watch Tower nodes monitor LiquidityPoolManager contracts for deposits, then inform Executor nodes that a transfer has been started and send them the destination chain ID.

Executor nodes initiate transfers on the destination chain — Executor nodes verify the deposit transaction forwarded to them by Watch Tower nodes, then execute transfer transactions on the destination chain.

Rebalancing scripts — Off-chain nodes watch the LiquidityPoolManager contracts and initiate rebalancing whenever liquidity pools become unbalanced by transferring funds from larger liquidity pools to smaller ones.

Each transaction using Hyphen will be charged a LiquidityProvider fee, which is distributed amongst Liquidity Providers, and a transfer transaction fee.

Biconomy also rolled out Hyphen 2.0 recently. Here’s a list of new features on Hyphen:

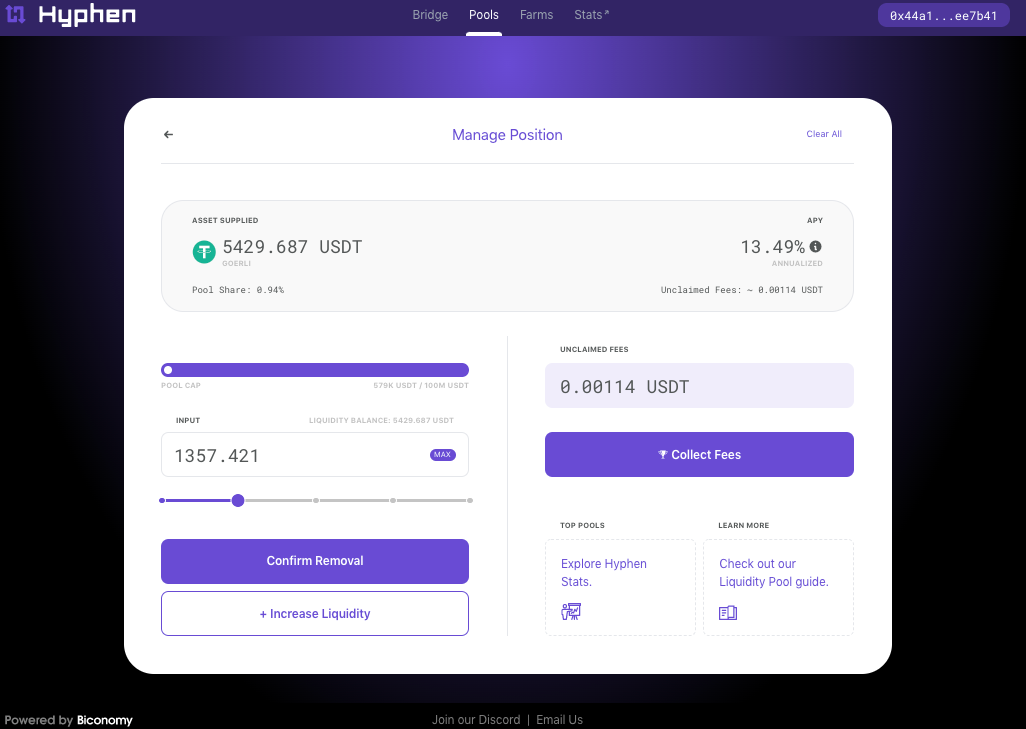

Anyone can become a liquidity provider — Hyphen 2.0 is permissionless and allows anyone to add liquidity up to $10,000 in open pools and facilitate cross-chain transfers. This is made possible by Hyphen’s revamped user-friendly interface enabling Liquidity Providers to earn a portion of Hyphen fees and $BICO rewards.

Earn Fees on Hyphen as an LP

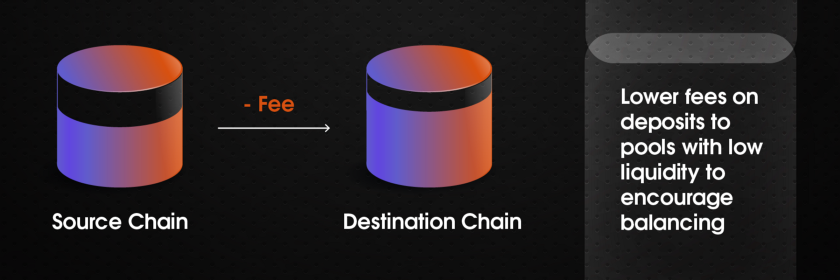

Dynamic Fees — The Biconomy team believes that capital efficiency is the best metric to evaluate the success of a bridge. To make Hyphen’s architecture more capital efficient, the team has introduced a dynamic fee model that allows liquidity pools to be balanced by incentivizing transfers in favor of source chains where liquidity is less than those with abundant liquidity. The team believes that the dynamic fees will enable Hyphen to provide lower cross-chain fees.

Reduced costs with dynamic fees

Arbitrage Opportunities — The introduction of the dynamic fee model will open arbitrage opportunities for Hyphen users. Additionally, Hyphen is also launching an open-source rebalancing bot capable of rebalancing Hyphen pools. These bots can be run by anyone and thus allows users to collect rewards for balancing pools on Hyphen.

Increased chain and asset support — The introduction of dynamic fees and LPs in the Hyphen design enables its architecture to scale. As a result, Hyphen will now be able to add new chains and assets easily. This wasn’t possible in Hyphen’s original architecture.

We can evaluate Biconomy’s architecture according to the following attributes:

Security — Biconomy is crypto-economically secure thanks to its decentralized relayer network and native smart contracts. Assets are transferred, locked, and unlocked based on transactions validated by relayers that are incentivized with $BICO to execute orders honestly. However, Hyphen relies on off-chain servers known as Executor nodes for its operations, making it a trusted solution. Only Executors have the right to transfer funds from the smart contract, anyone who wants to run an Executor node needs to stake collateral higher in value than the amount the funds they can transfer from the smart contract. This disincentivizes the Executors nodes to act in a malicious manner. The details regarding whether the staked collateral is burned or used to reimburse users in case of malicious activities by validators will be released by the Biconomy team in Q2.

Speed — Hyphen drastically improves speeds for transfers from L1 to L2 by maintaining a liquidity pool on all of its supported networks, allowing it to instantly execute transfers as soon as a transaction is initiated.

Connectivity — Biconomy’s chain connectivity through Hyphen is limited to Ethereum, Polygon, and Avalanche C-Chain. Its asset connectivity is also limited, as it only supports ETH, BICO, and a few popular stablecoins such as USDT and USDC. However, with Hyphen 2.0, it is believed that support for new chains and assets will be added more frequently.

Capital efficiency — The Hyphen Protocol is highly capital efficient, as it scans its liquidity pools on all supported networks and executes rebalances

whenever necessary. Funds are automatically transferred between chains to maintain an equal balance. With Hyphen 2.0, it has now become even more capital efficient.

Statefulness — With Biconomy’s relayer network watching for events directly on the chains their smart contracts interact with, Biconomy’s overall protocol is highly stateful — which is good. That means Biconomy is not limited in the information it can share between chains about transactions.

Here’s how we can evaluate Hyphen based on these metrics:

Evaluating Biconomy’s Hyphen

Transaction Validation Mechanism

Biconomy’s transactions are validated by a set of decentralized off-chain relayer nodes that watch for deposits of funds on the source chain of a transaction, then initiate transfers of the equivalent asset on the destination chain.

Biconomy’s relayer network processes transactions on the Biconomy blockchain before executing them on the destination chain. Transactions are written to Biconomy’s chain by relayer nodes, and validators earn $BICO for validating and executing transfers. To become part of this network, one must stake $BICO. Bad actors lose their stake.

The chain’s governance is also decentralized. All $BICO owners have the power to vote on major decisions regarding the network. Governance and staking combine to incentivize all actors to work for the good of the overall network.

Security

Biconomy’s value proposition is in streamlining EVM-compatible currency transactions for dApp developers. The biggest security concerns they face relate to the reliability of their smart contracts, and the level of trust required to make transactions with them.

Smart contract auditing — Because their main products are smart contracts, Biconomy is serious about security. They employ third parties to audit their code regularly, and the audits are publicly available here

.

Meta Transactions — High cryptoeconomic security is ensured for end-users dApps that use Biconomy, thanks to their use of Meta Transactions. Users will never have to use a custodial wallet to authorize meta transactions made with Biconomy.

The Biconomy chain — Biconomy’s relayer network is a decentralized group of servers that process transactions on the Biconomy blockchain before executing them on the destination chain. To keep their incentives in line with the health of the ecosystem, node operators must stake $BICO to join the network. They then pay in $BICO to write information to the chain and earn $BICO for processing transactions. Bad actors lose their stake.

Incentives

Biconomy is in the process of decentralizing its Executor Node relayer network, and this initiative will be powered by $BICO, their ERC20 governance token. Node operators will set up servers that interact with Biconomy’s native blockchain. To write information to the chain requires $BICO, and nodes earn $BICO for processing transactions on the network.

There are other ways to participate in the network as well, all of which are incentivized.

Delegators — $BICO holders can delegate their tokens to node operators and earn $BICO proportional to their stake.

Liquidity Providers — LPs earn a fee from the LiquidityPoolManager contract whenever meta transactions are created with Biconomy. They also earn more $BICO the more liquidity they contribute to the pool.

Node Operators — The node operators ensure the secure and accurate execution of transactions initiated through Biconomy’s smart contracts — their trustworthiness is a major concern for dApp developers and users alike. Biconomy requires operators to stake $BICO before setting up a node. Once their node is on the network, they earn $BICO for doing proper work and lose their stake if they behave inappropriately.

Governance — In the spirit of decentralization, $BICO owners have a vote on key decisions, and the ability to create proposals for improvements to the network.

Risks

As a dApp developer integrating an external tool, your biggest risk is always the reliability of the tool and trustlessness of any protocols the tool implements — but when dApp transactions are also at stake, liquidity becomes another concern. The biggest risks of implementing Biconomy are:

Smart contracts — Though their contracts are audited by multiple third parties, there are always smart contract risks.

External relayers — To execute cross-chain transactions, Biconomy uses its own proprietary relayer nodes, which monitor their smart contracts. This is the most trusted part of their protocol, and if these relayers go down, so will Biconomy’s functionality.

Liquidity protocol — If the liquidity is not there to execute one of their meta transactions, your users will suddenly lose core functionality. Gasless transactions, using tokens to pay for gas, and cross-network value transfers all rely on their liquidity pools. Though they’ve executed well over

3 million transactions and $1 Billion+ in volume to date

, there is still a small risk of liquidity issues.

Supported Chains and Assets

As a bridge between L1 and L2 Ethereum networks, Hyphen supports Polygon and Avalanche, two of the most popular L2 chains.

Through the Hyphen Protocol, users can transfer the following tokens between Ethereum, Polygon, and Avalanche:

USDC

USDT

ETH

BICO

Team

Biconomy’s team consists of builders aiming to push forward the crypto revolution. This includes different coders, crypto-enthusiasts, creatives, designers, all working together to make their goal a reality. Here’s a list of key Biconomy’s co-founders:

Sachin Tomar — CTO

Ahmed Al-Balaghi — CEO

Aniket Jindal — COO

Additionally, Bicionomy’s advisors, community, and users are also integral to their team and ecosystem.

Community

You can stay updated about Biconomy and its community through the following:

Closing Thoughts

Biconomy’s Hyphen offers one of the best bridging solutions in the ecosystem. This is because of the following reasons:

Since its launch, over 17,000 new customers have used Hyphen.

With over $110M in total volume and a TVL of only $8M, Hyphen is one of the most capital-efficient bridges available to users.

Hyphen is also one of the fastest bridges as it has an average transfer time of less than a minute.

Hyphen 2.0 further improves Hyphen’s architecture and design, making it more capital efficient, cheaper, and faster.

We’re excited to integrate Hyphen into LI.FI and offer its features to our users. We believe the vision and values of both teams are aligned towards creating a highly interoperable multi-chain ecosystem. We look forward to working closely with the Biconomy team to build key infrastructure for the multi-chain future.

FAQ: Biconomy’s Hyphen — A Deep Dive

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.