LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Accessing Sui Shouldn’t Be Hard

LI.FI expands to Sui

We’re excited to announce that Sui, one of the most performant L1s in crypto — is now live on LI.FI.

As of writing this, Sui is the 10th largest chain by TVL, locking over $1.2 billion across its DeFi ecosystem. The growth has been significant, and the momentum is still building.

But as this ecosystem matures, so does the need for broader access.

Sui’s performance unlocks new types of applications. What it needs now is a way to connect with users, capital, and liquidity beyond its own walls.

That’s where LI.FI comes in.

This blog breaks down:

What makes Sui architecturally different

What’s already being built in Sui

And how LI.FI’s support unlocks a new layer of connectivity for the network

Let’s get into it.

Sui’s Tech Stack

Sui’s architecture rethinks how data is stored, how transactions are executed, and how users interact with apps. Here’s how it works:

Object-Centric Data Model

Most chains, like Ethereum, use an account-based model. Contracts and balances are stored in accounts, and everything, even a token, is tracked as a number in a mapping. In Sui, everything is treated as an object, whether it’s a token, NFT, or contract. Each object has an owner, a unique ID, and defined access rules. Transactions declare which objects they want to use, and the protocol enforces ownership and permissions at the system level.

This simplifies asset logic for developers and makes it easier to build complex, composable applications. Instead of writing logic to track who owns what or worrying about inconsistent state, that’s built into the chain.

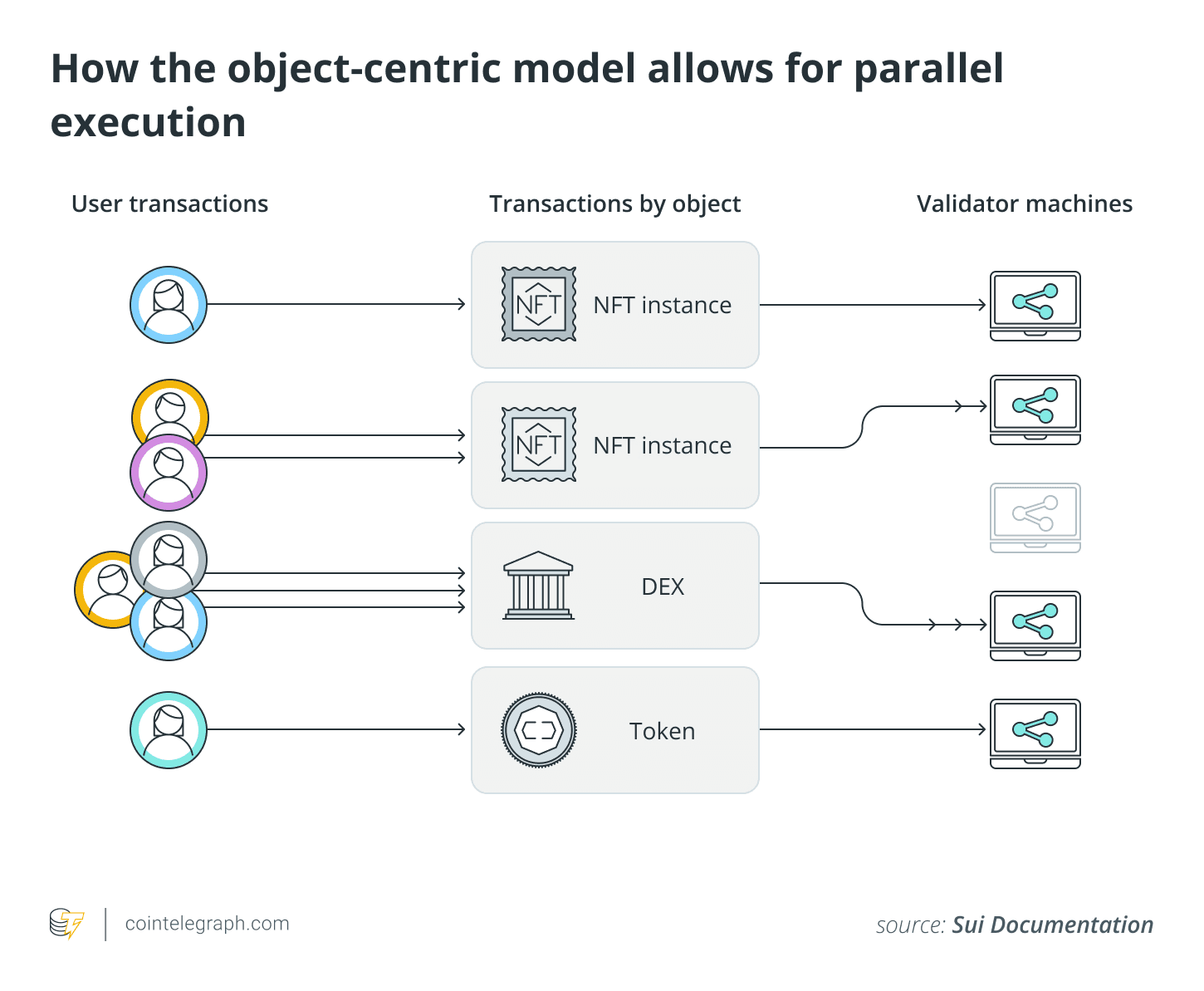

Parallel Execution Engine

Via Gate Learn

On most chains, all transactions are executed one after another, even if they don’t affect the same data. Sui takes advantage of its object model to do things differently. Before executing, Sui checks which objects each transaction touches. If two transactions don’t overlap, they can be safely run at the same time. This allows Sui to process many transactions in parallel, increasing throughput without sacrificing consistency or requiring rollups.

Move Programming Language

Smart contracts on Sui are written in a specialized version of the Move language. Move is resource-orientated, which means assets are treated as owned resources that can’t be copied or accidentally deleted.

When you define an NFT in Move, the language makes sure it’s always accounted for: it has to be moved from one place to another and can't disappear or be duplicated accidentally. This helps developers avoid common bugs like double-spending or forgetting to update balances. Because of this, contracts written in Move are generally safer by default, and developers spend less time writing custom checks to manage asset ownership.

Mysticeti Consensus and Finality

Mysticeti is the system Sui uses to confirm transactions. Instead of having a single validator propose blocks, multiple validators can submit and exchange signed certificates for transactions at the same time. A certified transaction means that enough validators have verified and signed off on it so it can be safely finalized.

Finality happens once more than two-thirds of validators agree on the transaction, which protects against malicious behaviour. Even if some validators go offline or act dishonestly, they can’t finalize conflicting or fake transactions unless they control a majority.

Horizontal Scalability

Many chains scale by adding rollups or splitting into smaller networks, which can create fragmented user experiences and developer complexity. Sui takes a different approach. Its design allows validators to scale by adding more execution threads, called workers, on a single machine. These workers handle different transactions at the same time, as long as the transactions don’t touch the same objects.

This means that as more users and apps join the network, validators can increase their processing power, just like scaling a backend server — without breaking the chain into separate parts.

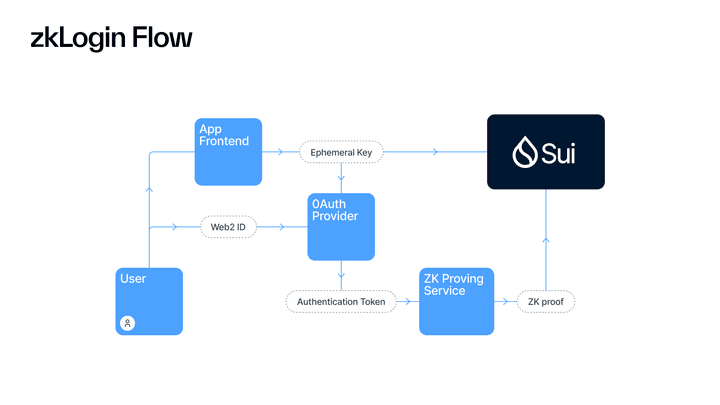

zkLogin and Sponsored Gas

Via Sui Blog

Sui removes two major friction points in onboarding: wallet setup and gas fees.

zkLogin lets users log in using Google, Apple, or other familiar platforms. Instead of creating a wallet manually, they generate a valid on-chain address backed by a zk proof. No one else, including the login provider, can control or impersonate their identity.

Sponsored gas allows apps to cover the user’s transaction fees. This is built into the protocol, so users can interact even if they don’t hold any Sui tokens. Together, these features make the onboarding flow feel closer to a typical web app, while still keeping control with the user.

Together, these components create a developer and user experience that isn’t just incrementally better but is structurally different. Sui offers a base layer where expressiveness, safety, and performance don’t trade off against each other — they’re built in from the start.

Explore the Sui Ecosystem with LI.FI

Sui's ecosystem offers a diverse range of applications across various domains. From lending protocols and DEXs to fully on-chain games and identity services, Sui’s ecosystem is steadily growing.

With LI.FI, users from over 35 chains can now move directly into these apps with their assets and gas ready.

DeFi

Sui has a growing set of DeFi apps across core areas like swapping, lending, and advanced trading.

DEXs

Aftermath Finance: Full trading hub with bridging, staking, and portfolio tools.

Cetus: Concentrated liquidity AMM integrated into most wallets.

Turbos: Lightweight DEX with Uniswap v3-style liquidity ranges.

Lending Protocols

Suilend: Leading lending market by TVL with a simple interface.

Scallop: Supports isolated markets and risk separation.

NAVI Protocol: Lending and staking with broader asset coverage.

Trading

Kriya: Advanced swaps and limit orders powered by DeepBook.

Typus Finance: Vaults for structured yield through option strategies.

Sudo Finance: Synthetic asset trading with leveraged exposure.

NFTs

Sui has an active NFT ecosystem with major collections like Fuddies, SuiFrens, and Gommies, which led early trading volume and brought in active community interest. These collections are primarily traded on Blue Move and TradePort, two marketplaces that support native Sui NFTs.

Blue Move focuses on simple user experience, while TradePort offers multi-chain aggregation. While other marketplaces like DragonSUI have emerged, BlueMove and TradePort remain the primary hubs for Sui's NFT trading.

Native Sui Apps

Sui is already home to apps that extend well beyond financial use cases. From fully on-chain games to identity services.

Cosmocadia: A multiplayer farming and crafting game where all in-game assets are on-chain objects.

Sui 8192: A fully on-chain puzzle game inspired by 2048, where each move is recorded and progress can mint collectible NFTs.

SuiNS: The naming layer for Sui, allowing users to register .Sui domains used across wallets and apps.

Chirp: A DePIN project on Sui focused on IoT connectivity. It lets users scan nearby wireless networks through a mobile app and earn rewards, linking real-world data to on-chain activity.

This is just a small highlight of different projects in Sui. You can visit the Sui Directory for a more detailed overview of active apps across the ecosystem.

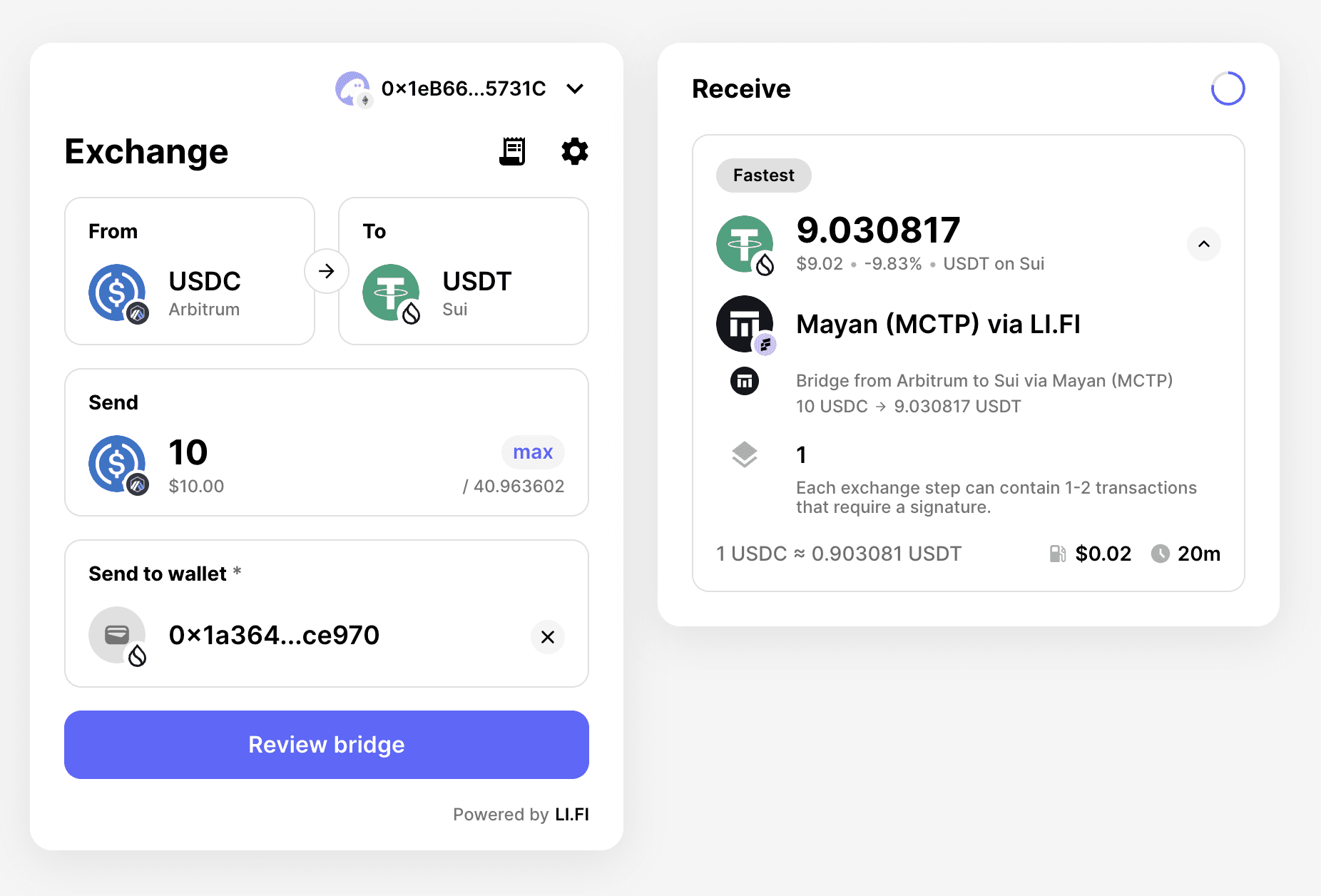

LI.FI Now Supports Sui

Sui is now supported via the LI.FI API, allowing partners to enable both cross-chain and same-chain swaps into Sui. For apps building on Sui, this means users no longer need to come preloaded with Sui or figure out how to bridge manually. They can arrive from other ecosystems and start interacting right away.

Under the hood, we currently support Allbridge and Mayan for bridging, which uses Wormhole for verification.

We've integrated Aftermath for swaps on Sui.

Support is now live through our API in beta for our B2B partners. Rollout across the SDK, Widget, and UI will follow by the end of the month. This is a first step toward making Sui easier to access, and for our partners, it adds a new destination that feels just as connected as any other chain in their stack.

If you're building something on Sui and want your users to get started faster, or if you're thinking about making your chain more accessible, we’d love to chat.

We're here to make it easier to connect across ecosystems, one chain at a time.

FAQ: Accessing Sui Shouldn’t Be Hard

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.