LI.FI has announced a $29M Series A extension, led by Multicoin and CoinFund. Read Here.

Explore Celo By Swapping With LI.FI

LI.FI Interoperability Expands To Celo

Celo is a layer 1 smart-contract platform, focused on the deployment of dApps on mobile devices. The EVM compatible blockchain uses a byzantine fault (BFT) proof of stake consensus which favors consistency of nodes over availability. In this model, consensus can be achieved even with a third of validators being offline or going rogue (though this requires the other 2/3rds of validators to act honestly).

The BFT model is perfect for Celo’s mobile-centric design, as it allows for five second block times and instant finality- meaning that users do not need to wait for more than one block confirmation for a transaction to go through. This is very important, as users are used to mobile transactions being nearly instantaneous in the web2 world. Plumo, the zk-SNARK based system, also drastically decreases the amount of data required to sync to a wallet, because a node does not have to download the entire history of the chain. Another benefit that Celo brings to users is that transaction fees don’t need to be paid in the native asset. Instead, any crypto asset can be used.

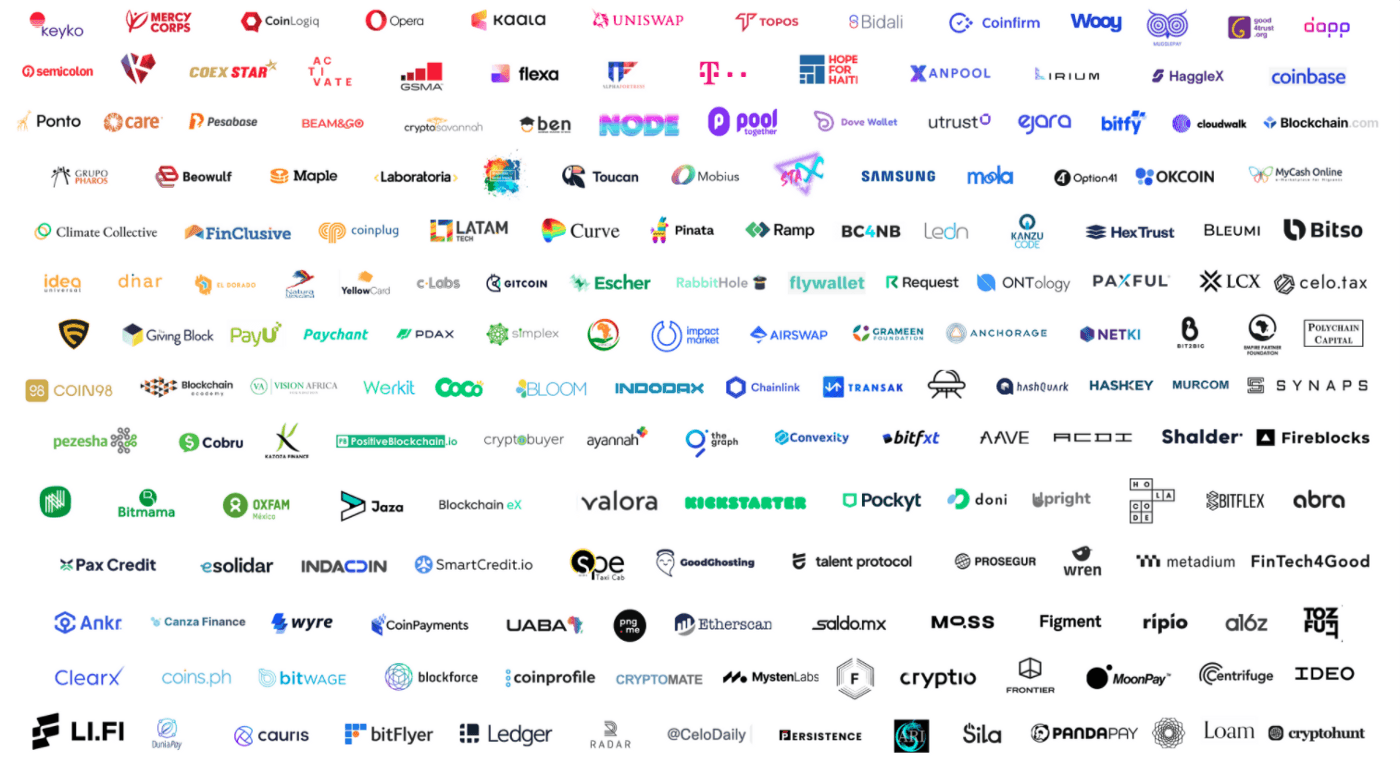

As of 2022, Celo has gone through several fundraising rounds, raising a total of $56.5m from the likes of Coinbase Ventures, Andreessen Horowitz, and Electric Capital. DeFi giants like Aave, Curve, and Sushi have also promoted the usage of Celo by giving out token rewards to users who access their protocol via Celo’s mobile app.

By targeting the mobile segment, Celo is taking a large step forward in web3 mobile customer onboarding. Blockchain ecosystems are still very reliant on desktop users, however mobile devices make up 56% of website traffic.

Since its inception, the iOS and Android-friendly blockchain has attracted many developers, and with a steady growth of around 47% in 2021, there are now more than 180 developers building on Celo. Celo currently has $400 million in total-value locked (TVL) into its ecosystem across X amount of dApps, including web3 behemoths like SushiSwap. With such advancements, it is imperative that liquidity and dApps from other chains follow- allowing this cross-chain communication is exactly our goal at LI.FI.

This article talks about Celo and throws light on some of the most popular dApps in its ecosystem.

Let’s dive in!

Celo Ecosystem Overview

Exploring the Celo Ecosystem

An extremely innovative feature Celo brings to the crypto space is the user-experience for mobile users, which we at LI.FI love! The Valora wallet is a mobile app that allows you to interact with dApps. The public hash of a user’s wallet is also matched with the phone number. This allows people to transact Celo- based tokens directly with their contacts. Another feature made possible is that users can send tokens to contacts before they have even downloaded the wallet itself!

From a security perspective, the Celo network also excels. Not only does Valora instantly prompt you to save your seed phrase at every login, but they also have a thorough multi-factor authentication method for verifying the mobile number initially: A user receives three different SMS codes from three different Celo numbers, minimizing the chances of a bad actor spoofing.

Once users have deposited funds they may easily access a multitude of dApps directly through the Valora wallet. They may connect to simple swap platforms, lending platforms, analytics tools for taxing and tracking, and even some interesting spending features.

Here’s an overview of the most popular dApps on Celo that you can use by swapping with LI.FI today:

Mento.Finance

Decentralized Exchanges (DEXs)

Mento.finance plays a key role for Celos native stablecoin cUSD. The protocol manages the stablecoins peg to by minting and buying CELO through Mento during the overvaluation of cUSD, and vice versa. Users can also exchange their stables to CELO, and the Granda Exchange allows for large exchanges over $500k cUSD to counter slippage. Exchanges such as Sushi and Ubeswap will offer easy access to liquidity for users to swap native and wrapped tokens.

LI.FI offers a simple solution for hopping to and from other EVM compatible chains, as well as helping dApps who integrate LI.FI provide easy access to liquidity for its users on Celo.

Moola Market

Lending Protocols

Users of Celo may access lending protocols such as Moola through the Valora wallet. The platform, with over 30’000 active users, offers incentivizing APRs for stablecoins, as well as the Celo token, making it one of the easiest markets to lend and borrow on mobile. For users who prefer a riskier approach, markets such as Pinnata offer leveraged farming opportunities.

With a growing number of lending options on Celo, users need an easy route to access this liquidity, which we at LI.FI make possible!

Flywallet

Celo spending use cases

Celo is not only designed as a chain for investment and speculation, but also for usage. The layer 1 is built to give users the ability to directly and efficiently spend crypto through a variety of payment applications. Bidali is one example of how users may spend their Celo stablecoins- through the platform customers may buy gift cards from any of their favorite shops.

These stablecoins may also be used for purchasing any flight worldwide using the Flywallet app directly through Valora. With such dApps available, anyone using LI.FI will be able to send tokens to Celo via any-2-any cross-chain swaps and become a part of this innovative way of connecting on-chain and physical uses.

Native Celo dApps

This section is about the amazing dApps built natively on Celo that haven’t been mentioned above. Here’s a list of some of the most widely used native Celo dApps:

Celo Tax — Celo Tax allows you to effortlessly analyze your transaction history in order to provide you with anything you may need for taxes or accounting

ImpactMarket — A decentralized market for donating. ImpactMarket allows you to support alleviating poverty in communities of your choice

Mobius — Mobius provides users with another stablecoin swap, offering wrapped versions of stables including DAI, UST, USDC, etc

Nomspace — Anyone active in the space can create a unique username for the given address using Nomspace!

GoodGhosting — Good Ghosting is a protocol in which user funds are pooled and generate rewards from defi platforms such as Aave and Curve. These rewards are then distributed to users through a gamified manner.

To see a list of all the ambitious projects integrating on Celo, check them out on Celo’s official projects and dApps page.

So, how can users explore the Celo ecosystem?

LI.FI has already integrated the best bridges in the ecosystem, including cBridge and Multichain, enabling users to move their assets to and from the Celo network. As a cross-chain bridge and DEX aggregator, LI.FI can facilitate any-2-any swaps. This means that Celo users can swap any token from the plethora of chains we support to any token available on Celo. LI.FI will route the transaction through a multitude of DEXs and bridges. Here we find the most efficient, cost-effective route from chain to chain. Within just a few clicks users now have access to the Celo ecosystem.

To learn more about Celo, check out:

The future is multi-chain and we strive for more interoperability. We aim to build the multi-chain ecosystem by maintaining good relationships with all the stakeholders. We’re grateful to have Celo in the LI.FI family!

We’ve partnered up with the brightest minds and aim to build the best abstraction and aggregation solution available on the market. If you’re a blockchain network, bridge builder, or dApp developer, come talk to us and let’s work together!

FAQ: Explore Celo By Swapping With LI.FI

Get Started With LI.FI Today

Enjoyed reading our research? To learn more about us:

- Head to our link portal at link3.to

- Read our SDK ‘quick start’ at docs.li.fi

- Subscribe to our newsletter on Substack

- Follow our Telegram Newsletter

- Follow us on X & LinkedIn

Disclaimer: This article is only meant for informational purposes. The projects mentioned in the article are our partners, but we encourage you to do your due diligence before using or buying tokens of any protocol mentioned. This is not financial advice.